Finally, winning in the past using a trading bot is easy. Finding a winning strategy from three technical indicators and good optimization in a backtest is pretty simple. The problem is we want to win in the future. And here, things are more complicated. In this post, I will present how to make money in the future using a trader bot. I will show you how to find the “fair optimization” that gives you the best chance to win in the future with a trader bot working on the Prorealtime platform.

Example of an automated trading strategy

To illustrate this point, I chose the example of a moving average crossing strategy. It is a straightforward trading strategy, but that will help you better understand the concept I will describe. You must run it on the DAX40 within a ’10-minute’ timeframe.

Description of the trading strategy

My chosen strategy will open a long entry when the moving average in 100 periods crosses over the moving average in 300 periods.

I generated this trading strategy using the “Cross Finder” algorithm included in the Prorealtime template available in my shop. This algorithm allows us to test all the moving average crossings quickly. The results are then sorted in ascending order depending on their performances.

Source code of the entry openings

The following source code is runnable on the Prorealtime platform. It will open a long entry when the moving average on 100 periods crosses over the moving average on 300 periods. It will be active only during the cash market session, that is to say, from 09h00 until 21h30. All the opened entries will be automatically closed at 21h30 anyway.

// Strategy-test for the Dax 40 in a 10 minutes timeframe

DEFPARAM CUMULATEORDERS = false // only one trade in the same time

DEFPARAM FLATBEFORE = 090000 // avoide entry opening before this hour

DEFPARAM FLATAFTER = 213000 // close entry at this hour

//--------------------------------------------------------------------------

// ENTRY POINT

// Strategy of Moving average crossing

// MOVING AVERAGES

MM100 = average[100](close)

MM300 = average[300](close)

// Moving average crossing condition

conditionMovingAverage = MM100 CROSSES OVER MM300

//--------------------------------------------------------------------------

// OPEN A LONG ENTRY

IF NOT LongOnMarket AND conditionMovingAverage THEN

PSTOPLOSS = //...

PTARGET = //...

SET STOP pLOSS PSTOPLOSS

SET TARGET pPROFIT PTARGET

BUY 1 CONTRACT AT MARKET

ENDIF

How to optimize an automated trading strategy?

The optimizer of the variables

The Prorealtime platform provides several optimization tools. It is notably the case of the “optimizer of the variables”. This tool will compute all the combinations of the values you want to test about a specific variable. Then, depending on the performance, it will sort the obtained results in ascending order.

Optimization sequence

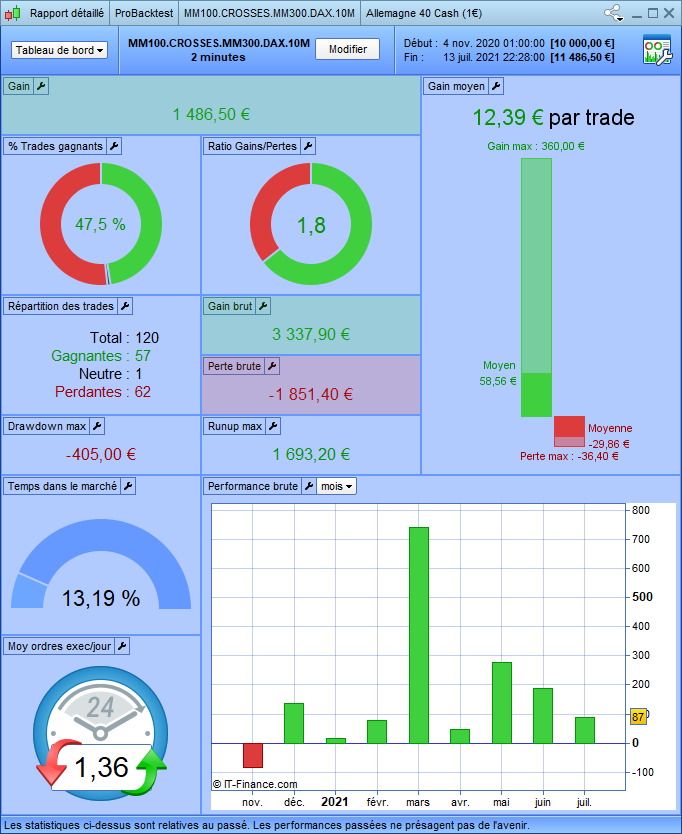

I divided the test period into two equal samples for the purpose of this study. The first period will run from November 04, 2020, until July 13, 2021. The second period will run from July 13, 2021, until December 01, 2021. I will optimize the stop loss and the target during the first period. I will call this period “IS”, meaning “In the Sample”. Then I will check this optimization during the second period. I will call this period the “OOS” meaning “Out Of the Sample”.

| Starting date | Ending date | |

| In the Sample | 11/04/2020 | 07/13/2021 |

| Out Of the Sample | 07/13/2021 | 12/01/2021 |

I created this division to validate the efficiency of an optimization model. To process this validation, I will optimize the strategy during the optimization period, the IS, and then run this strategy on the OOS test period. If the performance between the two periods is significantly different, the model is probably inefficient.

Stop-loss and target optimization

Now, I will naively run the optimizer of the variables on the stop-loss and the target. First, I will optimize the stop-loss positioning and the target. I will select the stop-loss and target values that give the best return during the “In the Sample” period and verify this setting on the “Out Of the sample” period.

Optimization of the stop-loss

To optimize the stop-loss, I need to execute the optimizer of the variables on the “PSTOPLOSS” variable. This variable sets the position of the stop-loss in points. For example, suppose the value of the PSTOPLOSS variable is 20. In that case, the trading system will place all the stop-losses 20 points under the position price immediately after the long entry opening.

Stop-loss optimization preparation

I commented out the code line allowing the PSTOPLOSS variable assignment because it is precisely the business of the optimizer. The optimizer of the variables will sequentially modify the value of the PSTOPLOSS variable.

I also removed the target code line from the source code to allow the optimizer to optimize the stop-loss independently.

The “FLATAFTER” parameter will close the entries that remain opened at 21h30 anyway.

DEFPARAM CUMULATEORDERS = false // only one trade in the same time

DEFPARAM FLATBEFORE = 090000 // avoide entry opening before this hour

DEFPARAM FLATAFTER = 213000 // close entry at this hour

//--------------------------------------------------------------------------

// ENTRY POINT

// Strategy of Moving average crossing

// MOVING AVERAGES

MM100 = average[100](close)

MM300 = average[300](close)

// Moving average crossing condition

conditionMovingAverage = MM100 CROSSES OVER MM300

//--------------------------------------------------------------------------

// OPEN A LONG ENTRY

IF NOT LongOnMarket AND conditionMovingAverage THEN

// PSTOPLOSS = //...

// PTARGET = //...

SET STOP pLOSS PSTOPLOSS

// SET TARGET pPROFIT PTARGET

BUY 1 CONTRACT AT MARKET

ENDIF

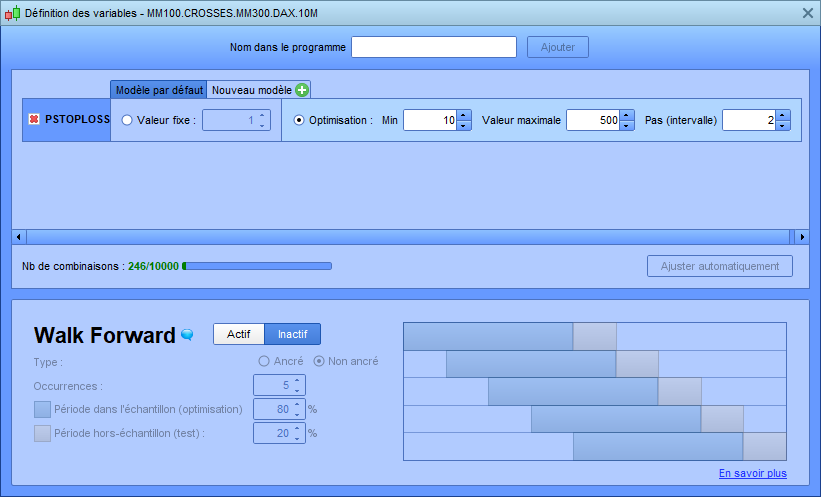

Configuration of the optimizer for the stop-loss

I set the minimum value at ten points, the maximum value at 500 points, and a step of two points. The optimizer will try the 246 combinations of stop-loss from 10 to 500 by two points. The optimizer will place a stop-loss at 10 points, then at 12 points, then at 14 until 500, and relaunch the backtest each time.

Result of the stop-loss optimization

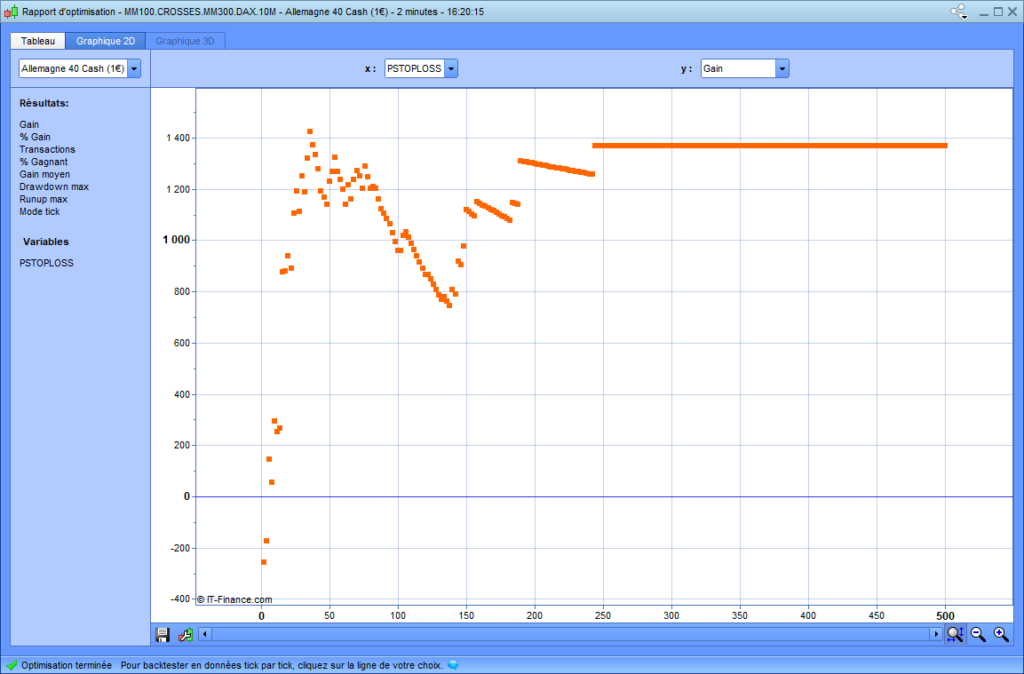

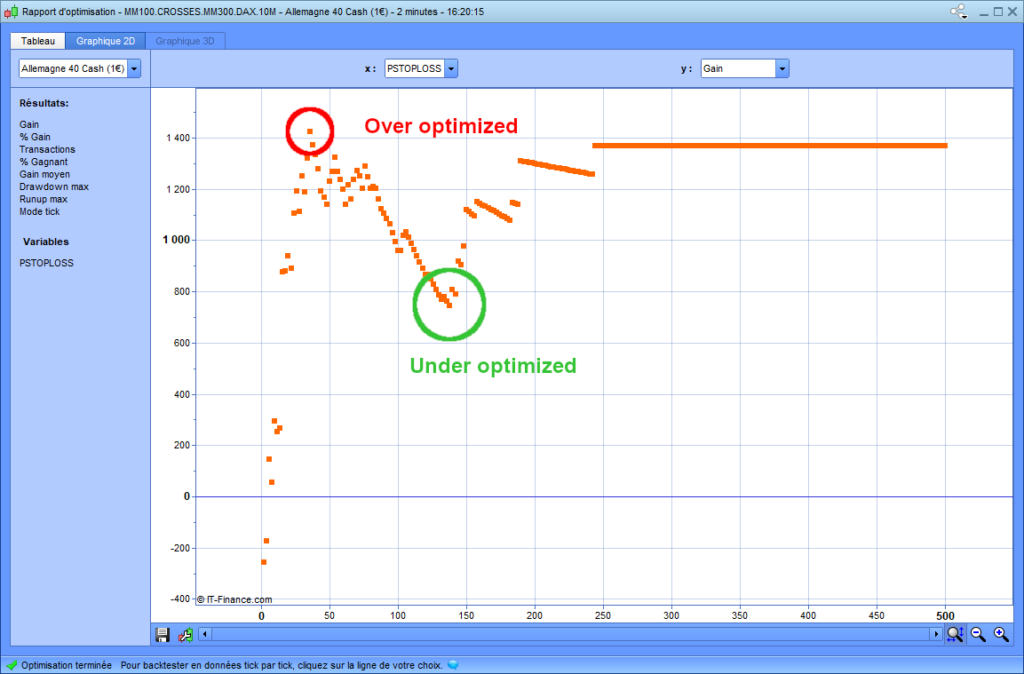

The following graph shows the result of the stop-loss positioning optimization:

The abscissa axis represents the tested values for the stop-loss, and the ordinate axis represents the trading system performance depending on the stop-loss values. According to the previous outcome, a stop-loss at 36 points gives the best performance, with a gain of 1400 points during the test period. Thus, I naively set the PSTOPLOSS variable at 36 points in the source code of the trading strategy.

//--------------------------------------------------------------------------

// OPEN A LONG ENTRY

IF NOT LongOnMarket AND conditionMovingAverage THEN

PSTOPLOSS = 36

// PTARGET = //...

SET STOP pLOSS PSTOPLOSS

// SET TARGET pPROFIT PTARGET

BUY 1 CONTRACT AT MARKET

ENDIF

Optimization of the target

The optimization of the target is the same process as stop-loss. I need to open the optimizer of the variable again and set the same test for the “PTARGET” variable.

Target optimization preparation

I commented that the code line allows the “PTARGET” variable because the optimizer will try several values. This time I keep the stop-loss code line with the value I found before, which is 36 points.

DEFPARAM CUMULATEORDERS = false // only one trade in the same time

DEFPARAM FLATBEFORE = 090000 // avoide entry opening before this hour

DEFPARAM FLATAFTER = 213000 // close entry at this hour

//--------------------------------------------------------------------------

// ENTRY POINT

// Strategy of Moving average crossing

// MOVING AVERAGES

MM100 = average[100](close)

MM300 = average[300](close)

// Moving average crossing condition

conditionMovingAverage = MM100 CROSSES OVER MM300

//--------------------------------------------------------------------------

// OPEN A LONG ENTRY

IF NOT LongOnMarket AND conditionMovingAverage THEN

PSTOPLOSS = 36

// PTARGET = //...

SET STOP pLOSS PSTOPLOSS

SET TARGET pPROFIT PTARGET

BUY 1 CONTRACT AT MARKET

ENDIF

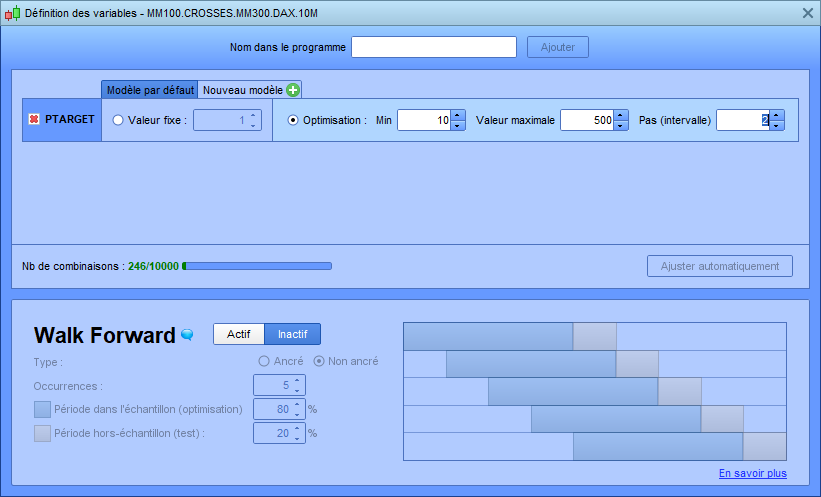

Configuration of the optimizer for the target

I defined the same configuration as the stop-loss optimization. I set the minimum value at ten points, the maximum value at 500 points, and a step of two points. The optimizer will try the 246 combinations from 10 to 500 by two points.

Result of the target optimization

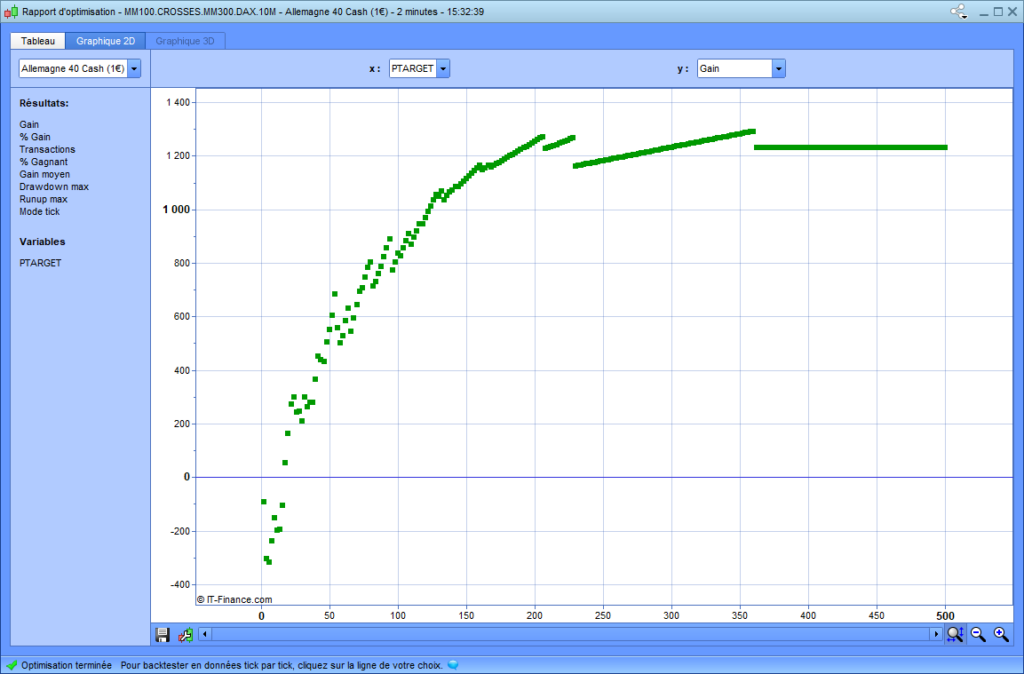

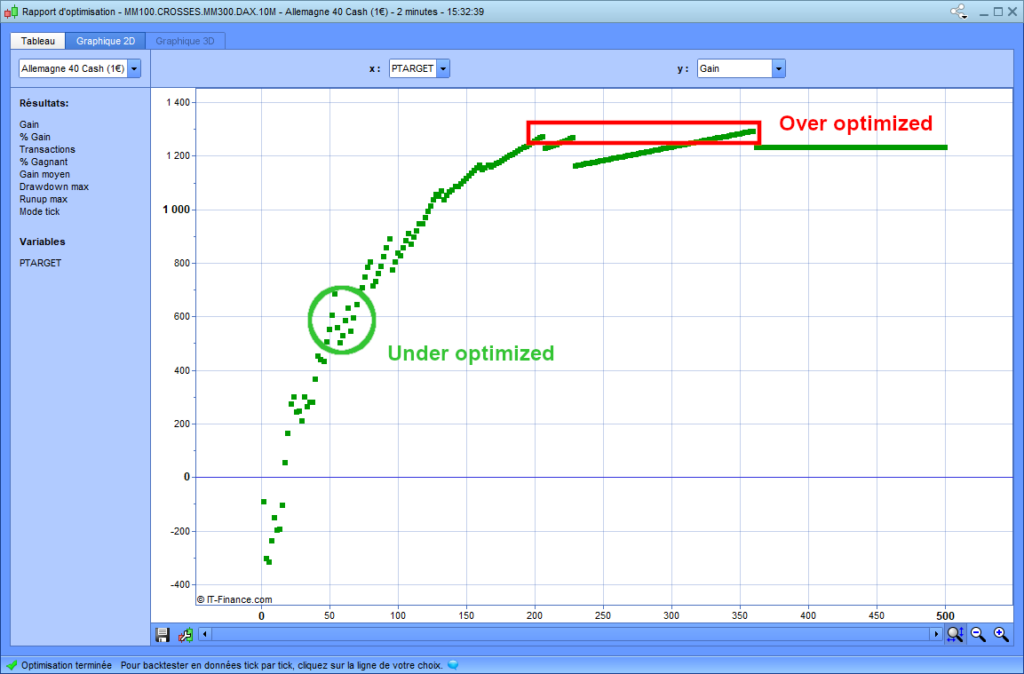

The following graph shows the result of the target positioning optimization:

Regarding the result obtained by the optimizer of the variable on the test period, the best value of the target is 360 points. This value gives 1200 points of return. Thus, I will naively choose this value for the target in my trading strategy.

Overfitted configuration of the strategy

This is the code source of the trading strategy that I naively optimized the stop-loss and target positioning. This configuration is probably over-optimized. I will run this strategy in the IS period to see the result.

//--------------------------------------------------------------------------

// *** OVERFITTED STRATEGY EXAMPLE – DO NOT RUN ON A REAL ACCOUNT *** //

// * ACADEMICAL PURPOSE * //

// MM100.CROSSES.MM300.DAX.10M

// THIS STRATEGY MUST BE RUN ON THE DAX INDEX WITH A "10-minutes" TIMEFRAME

//--------------------------------------------------------------------------

DEFPARAM CUMULATEORDERS = false // only one trade in the same time

DEFPARAM FLATBEFORE = 090000 // avoide entry opening before this hour

DEFPARAM FLATAFTER = 213000 // close entry at this hour

//--------------------------------------------------------------------------

// ENTRY POINT

// Strategy of Moving average crossing

// MOVING AVERAGES

MM100=average[100](close)

MM300=average[300](close)

// Moving average crossing condition

conditionMovingAverage = MM100 CROSSES OVER MM300

//--------------------------------------------------------------------------

// OPEN A LONG ENTRY

IF NOT LongOnMarket AND conditionMovingAverage THEN

// Overfitted setting

PSTOPLOSS = 36

PTARGET = 360

SET STOP pLOSS PSTOPLOSS

SET TARGET pPROFIT PTARGET

BUY 1 CONTRACT AT MARKET

ENDIF

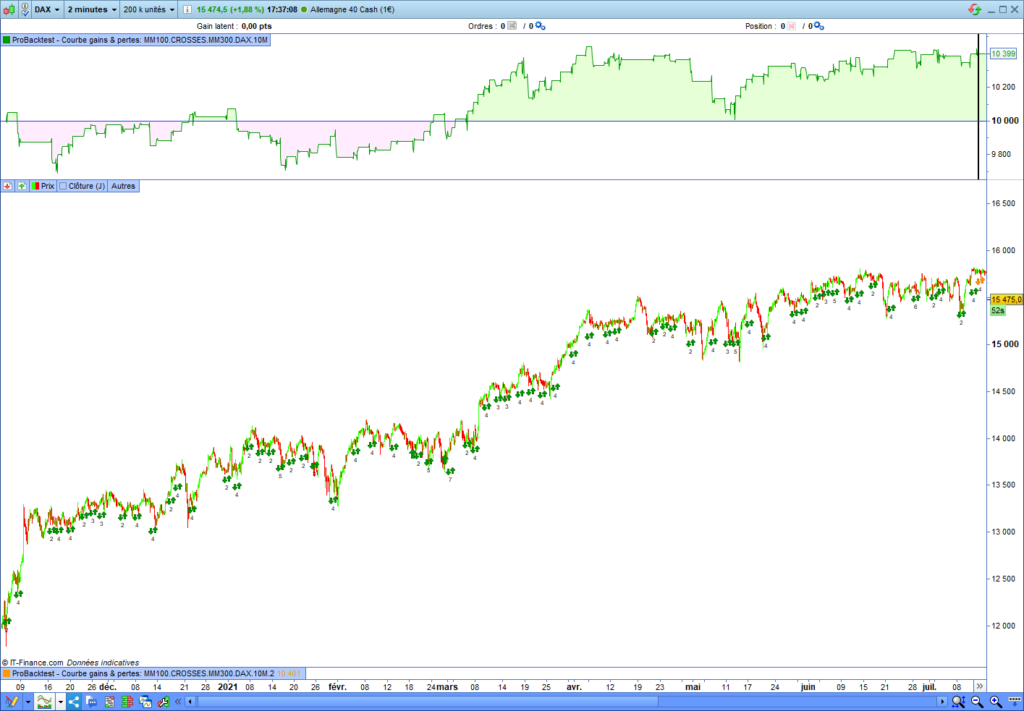

Result of the overfitted backtest

The optimization of the stop-loss and target that I proceeded with gave me a performance of 14.86% during the test period. The success rate of this strategy is 47.5%, the drawdown is four times lower than the runup, and the risk/reward ratio is 1.8. In other words, the result of this backtest does not show any lack or problem. It even looks perfectly acceptable!

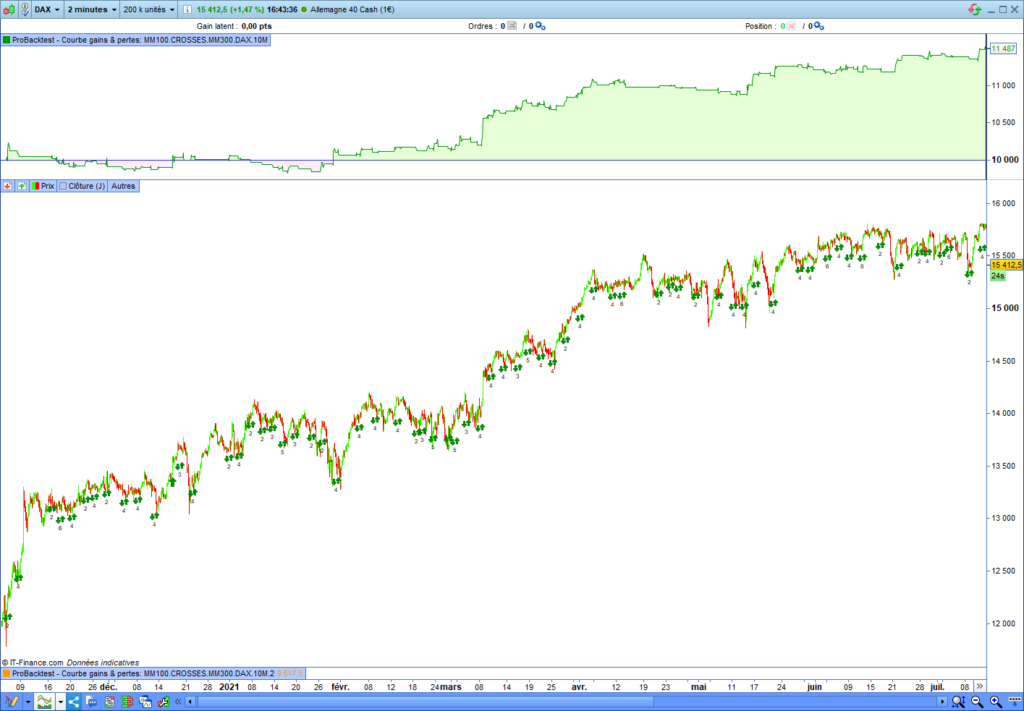

Equity curve of the overfitted backtest

The equity curve is imperfect and does not show an eventual overfitting problem. In short, this strategy is acceptable and looks ready to launch on a real trading account. [IRONY]

Now, I will compare the performance of this strategy run on the IS period with the result on the OOS period.

Win in the past but lose in the future

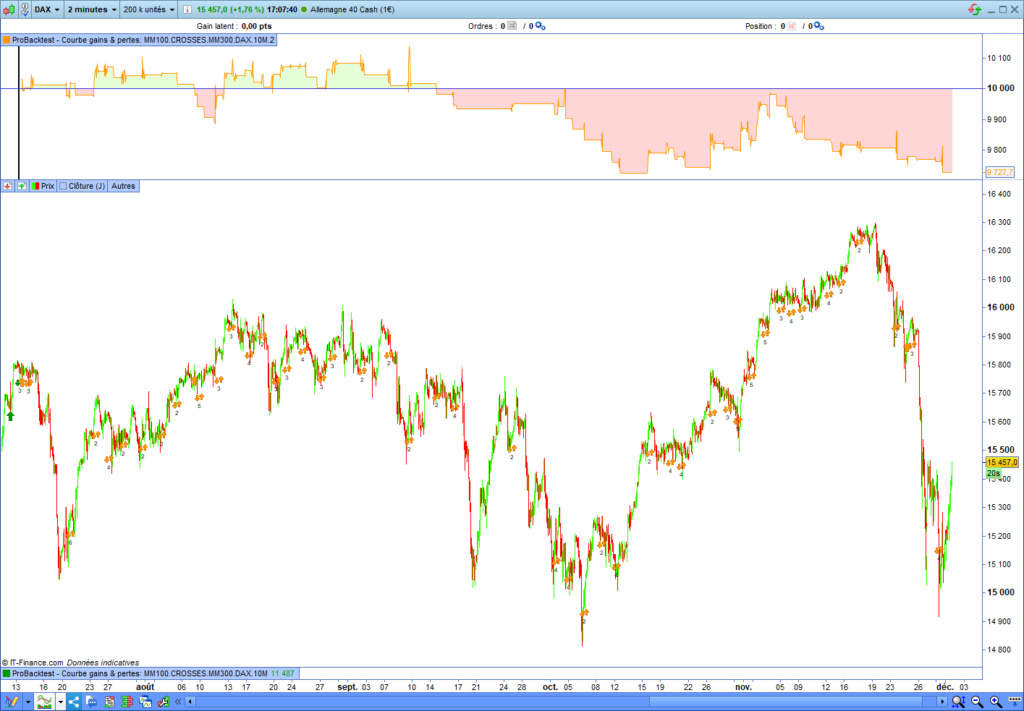

I will run this fantastic trading strategy during the OOS period, that is to say, from July 13, 2021, until December 01, 2021, to validate its efficiency.

Out of the sample validation

Here is the result of the strategy applied during the OOS period:

This wonderful trading system takes a trashing during the OOS period, to no one’s surprise. Unfortunately, it is the tragic fate of many trading systems.

How to find the fair optimization of a trading system?

When I started automatic trading, I optimized my trading system randomly, incrementally correcting losses after losses. I had fallen into the overfitting trap: I always won in the past but never in the future. It took a lot of time and tests to understand how to win in the future with a trading system. The method I have found is counterintuitive, and you may find it difficult to accept.

I will explain how to process to find the fair optimization of a trading strategy. That is to say, finding an optimization that will win in the future.

Deteriorate the equity curve of the backtest

Over the many optimization tests of trading systems that I made, I realized an amazing phenomenon: the more a backtest is winning in the past, the more it will lose.

Out of curiosity, I have had fun deteriorating the equity curve of a backtest and modifying the configuration of the strategy. What a surprise! This poor strategy in the past had become winning in the future. At this time, I realized the underfitting principle. I understood it is better to voluntarily under-optimize a trading system instead of achieving the correct optimization. (The correct optimization is supposed to be a point at the center between under-fitting and over-fitting)

Under-optimize the stop-loss and the target

I will voluntarily under-optimize the stop-loss and target positioning in my automated trading system. Later, I will compare the behavior of this trading bot between the IS and the OOS. As a reminder, at the beginning of this study, I chose the stop-loss and target positioning that gave the best performance during the IS period. This configuration was lost during the OOS period.

To under-optimize the stop-loss and the target, I will choose the value for which the performance is two times lower than the best possible choice. The best performance of the stop-loss position gave a return of 1400 points. Thus, I will select the value for which the performance is nearest 700 points. The best performance of the target position gave a return of 1200 points. Thus, I will select the value for which the performance is nearest 600 points.

Under-optimize the stop-loss position

The following graph shows the optimizer result executed on the stop-loss variable. The over-optimized values are circled in red (at the top of the chart). They perform best during the IS period but lose the OOS period. The under-optimized values are circled in green (at the bottom of the chart). Their performance during the IS backtest is two times lower than the over-optimized values:

I will choose one of the green-circled values and restart an OOS backtest to see the performance of this trading system. However, I will also under-optimize the target before launching the backtest.

Under-optimize the target position

The following graph shows the optimizer result executed on the target variable. The over-optimized values are circled in red (at the top of the chart). They perform best during the IS period but lose the OOS period. The under-optimized values are circled in green (at the bottom of the chart). Their performance during the IS backtest is two times lower than the over-optimized values:

I will choose one of the green-circled values and restart an OOS backtest to see the performance of this trading system.

Result of the under-optimized backtest

I will run a backtest with under-optimized values for the stop-loss and target. First, I will run the backtest on the IS period, and later, I will run the backtest on the IS period.

Source code of the under-fitted trading system

//--------------------------------------------------------------------------

// *** UNDER-OPTIMIZED STRATEGY *** //

// * ACADEMICAL PURPOSE * //

// MM100.CROSSES.MM300.DAX.10M

// AUTOR: Vivien Schmitt

// https://artificall.com

// DATE : 2021/12/01

// THIS STRATEGY MUST BE RUN ON THE DAX INDEX WITH A "10-minutes" TIMEFRAME

//--------------------------------------------------------------------------

DEFPARAM CUMULATEORDERS = false // only one trade in the same time

DEFPARAM FLATBEFORE = 090000 // avoide entry opening before this hour

DEFPARAM FLATAFTER = 213000 // close entry at this hour

//--------------------------------------------------------------------------

// ENTRY POINT

// Strategy of Moving average crossing

// MOVING AVERAGES

MM100=average[100](close)

MM300=average[300](close)

// Moving average crossing condition

conditionMovingAverage = MM100 CROSSES OVER MM300

//--------------------------------------------------------------------------

// OPEN A LONG ENTRY

IF NOT LongOnMarket AND conditionMovingAverage THEN

// Overfitted setting

PSTOPLOSS = 125

PTARGET = 50

SET STOP pLOSS PSTOPLOSS

SET TARGET pPROFIT PTARGET

BUY 1 CONTRACT AT MARKET

ENDIF

Performance of the under-optimized trading system

Here is the result of the trading system having under-fitted stop-loss and target:

Validation of the optimization in the future

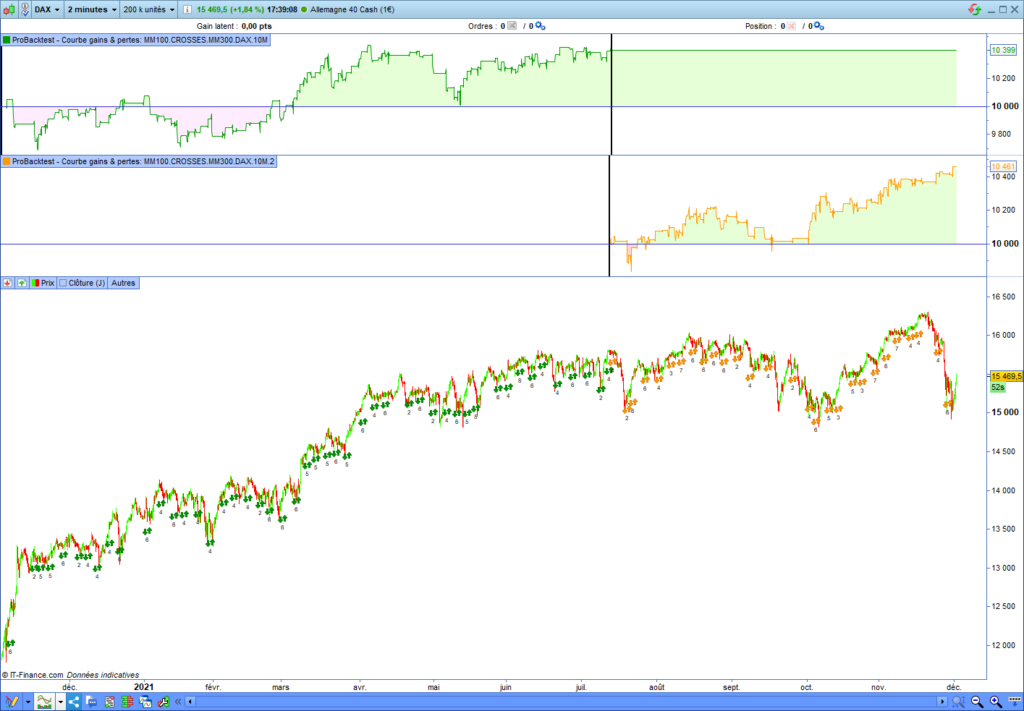

I will compare the performance of this trader robot between the IS and the OOS. I will run a backtest on the IS period and another on the OOS period on the same chart to process this comparison.

IS and OOS performance comparison

The following chart compares the performance between the IS and the OOS backtest. The IS backtest result is on the top of the chart, and the OOS result is below.

This time, the performance of the OOS backtest is positive. This under-optimized configuration is winning in the future. That confirms that an under-optimized trading system has more chance to succeed.

The limitations of the under-optimization model

As with all financial studies and all mathematical models, there are some lacks and limitations. I will present the most important to you.

Risk management accordance

An under-optimized setting is always in keeping with your personal risk management rules. In this example, the final under-fitted values do not correspond with my risk management rules. The “target/stop-loss” ratio is lower than one (50/125<1), and I do not accept it. I respect the risk management rule saying that the target must be greater than the stop-loss. Thus I can validate the previous trading system nether run it on my real account.

Definition of an “under-optimized” value

The choice of under-optimized values is not perfectly established. In this example, I chose the values for which their returns were two times lower than the highest performance during the IS backtest. This choice is relatively arbitrary and may not be the best choice.

What parameters need to be under-optimized?

I apply this model to the stop-loss and the target to support my arguments about the under-optimization duty. I cannot guarantee that it would be possible to under-fit all the trading system parameters. And I don’t know if under-optimizing all the features would be profitable.

Optimization models

Several mathematical models, like the WalkFarward or the Gradient Descent, allow trading system optimization. As I write this, I have not found a perfect model that works each time. Each model has possibilities and limitations.

Under-optimization key points

- The more a trading system wins in the past, the more it risks losing in the future.

- An under-optimized trading system has more chances to win in the future. They perform relatively poorly during the “In the Sample” period but give a positive return during the “Out Of the Sample” period.

- The definition of under-optimization is subjective. Sometimes, the choice can be difficult because of missing values.

- Unfortunately, perfect mathematical or machine learning models do not exist. They give only a probability of success.

Range Breakout Indicator for Prorealtime [FREE]

The Range Breaker will help you seize the best trading opportunities. It detects range breakouts, which are often followed by explosive movements. Thanks to this indicator, you will never miss a breakout again.

credit image: https://www.maxpixel.net/Mystery-Youth-Magic-Girl-The-Silence-Beauty-Ruda-4716922

Great content! Keep up the good work!

Pingback: Validate an automated trading strategy thanks to stress tests

Pingback: Evaluate the robustness of an automated trading strategy at first glance