Making your trading system easily for the Prorealtime platform

You want to develop a trading system, and you have already spent a lot of time without reaching expected success?

This template will help you to achieve it, and this is why :

- This template includes all the features necessary for the operation of a trading system.

- You simply have to insert an entry point into the template.

- The template is preconfigured to maximize profits and reduce risks.

Three complete trading bots are included in the package!

€299,00

Description

1. Save precious time

Most of the time, the trading systems contain the same features. Use a complete template allows saving many development time. You will fastly create new trading systems.

In addition, the template is preconfigured in its time unit. Thus you will immediately see if a strategy is reliable.

2. Decrease risks

Traders often overlook risks, whereas risk management is the cornerstone of trading. Sooner or later, the risks end up occurring and when it happens, the cost of loss can be terrible. A trading system with a wrong setting could destroy all its previous gains while only some sessions.

I specifically designed this template to reduce risks and prevent me from significant losses.

3. Increase your chances of gains

The profits of a trading system depend on the success rate and the risk-reward ratio. The template is set up to preserve a success rate greater than 50% with an expected gain higher than the risk of loss.

4. Find a trading strategy

Powerful tools allowing strategy research are included in this package. These tools will help you to find a trading strategy quickly.

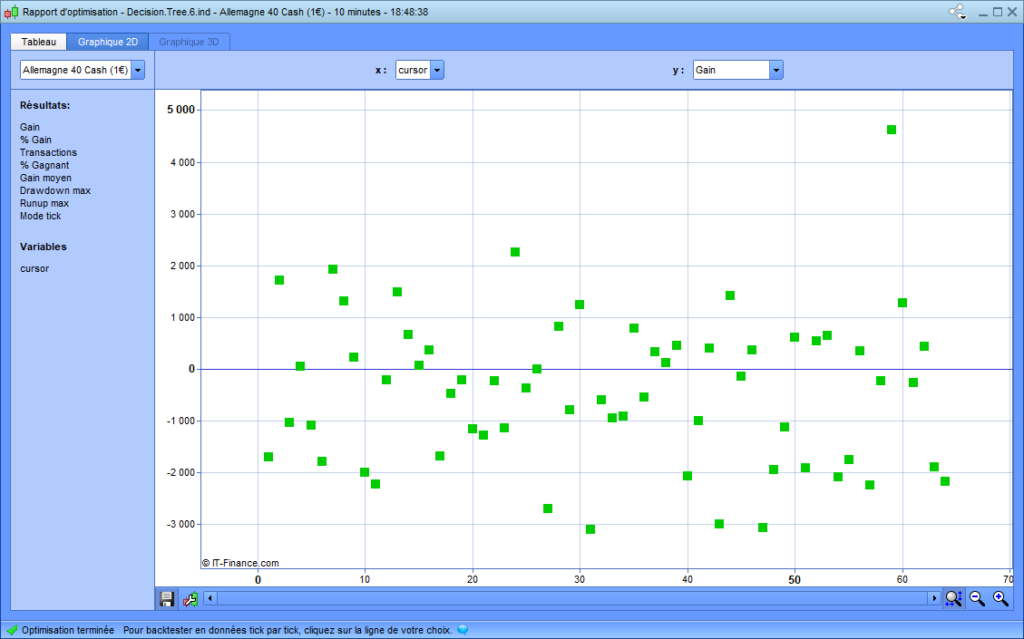

Decision trees

This set of algorithms will allow you to find the technical configuration giving the best return. You will test all the possibilities until six technical indicators.

Cross finder

The cross finder is an algorithm designed to fastly find the best moving average crossing on an asset in a time unit. You will easily find the moving average crossing that gives you the best return.

5. Three complete trading systems

I added three complete automated trading systems working on the DAX in the « 10-minutes » time frame to facilitate your understanding.

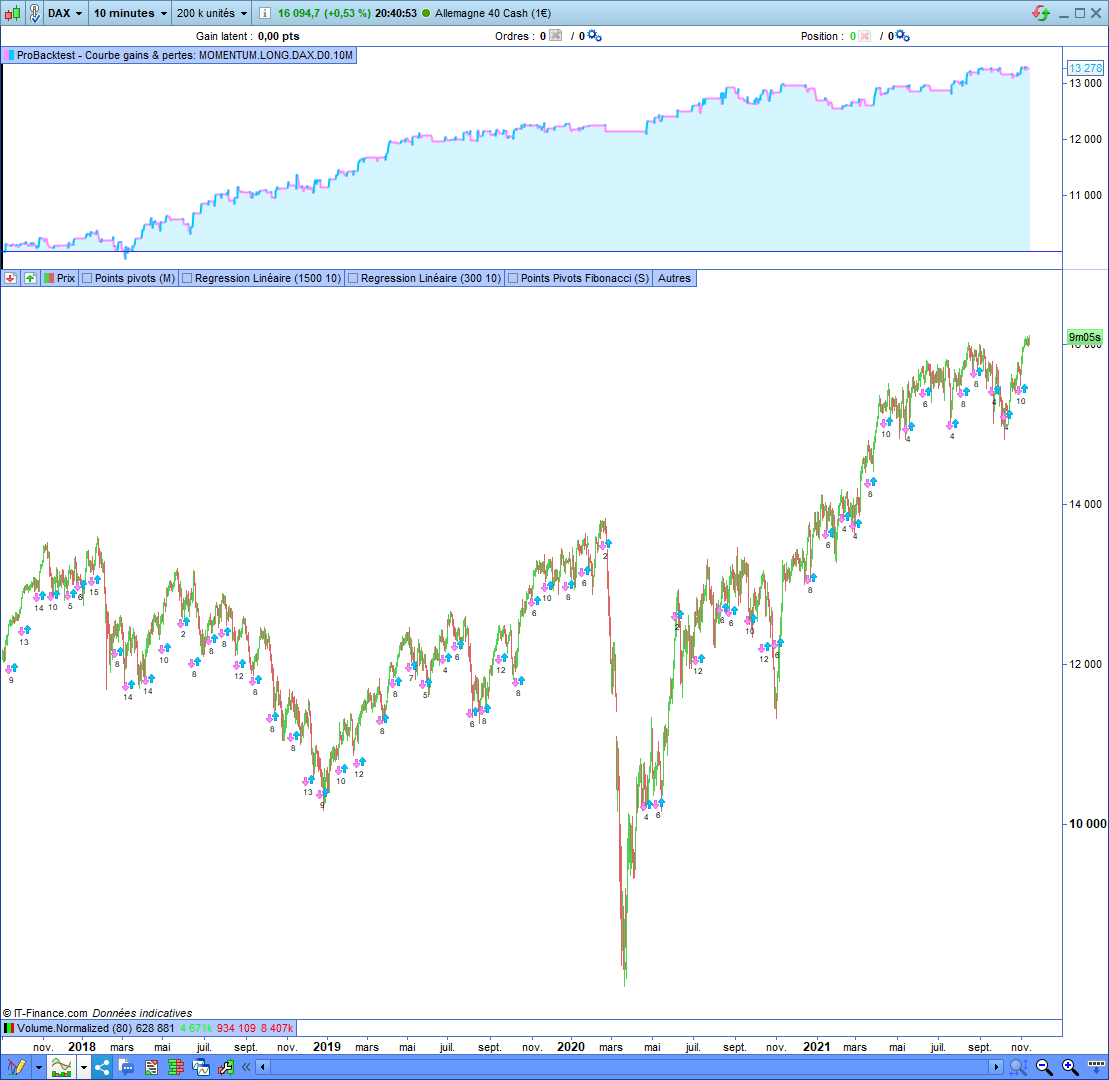

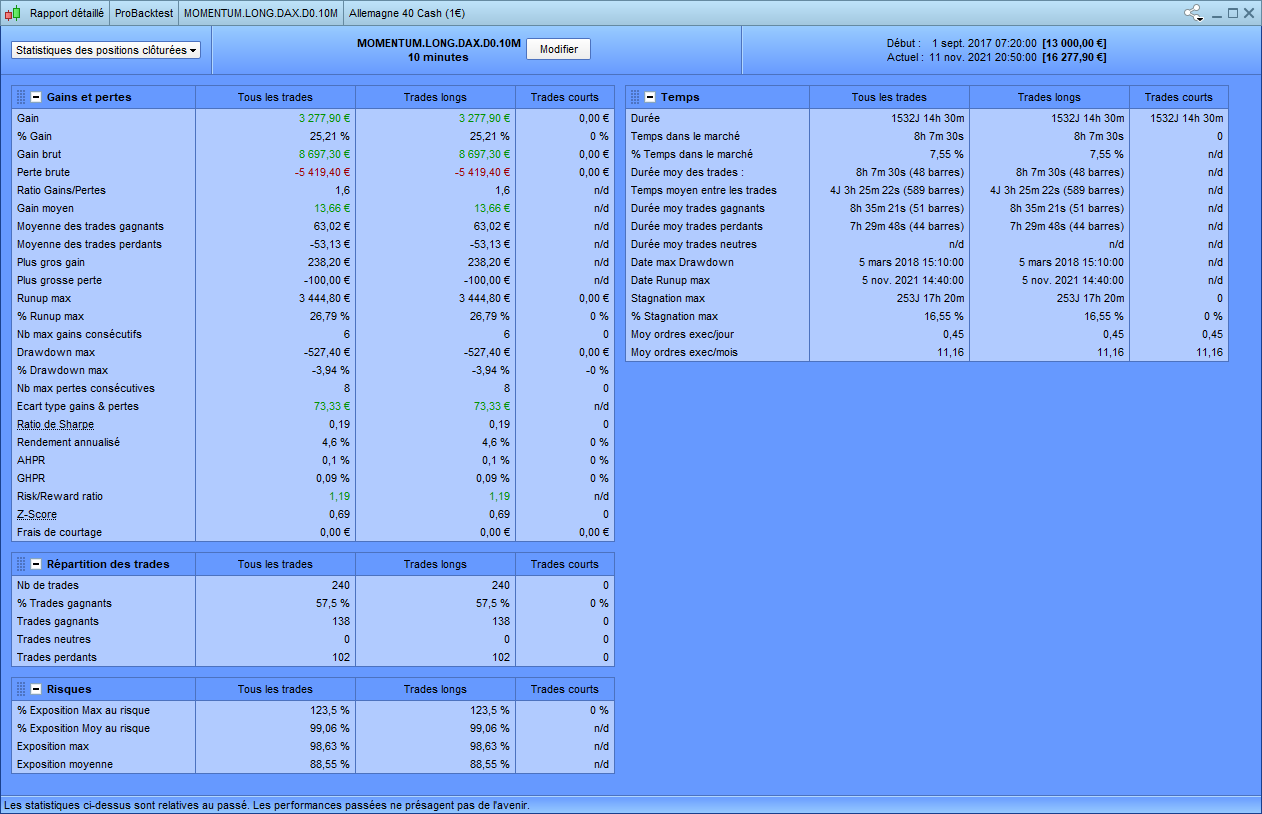

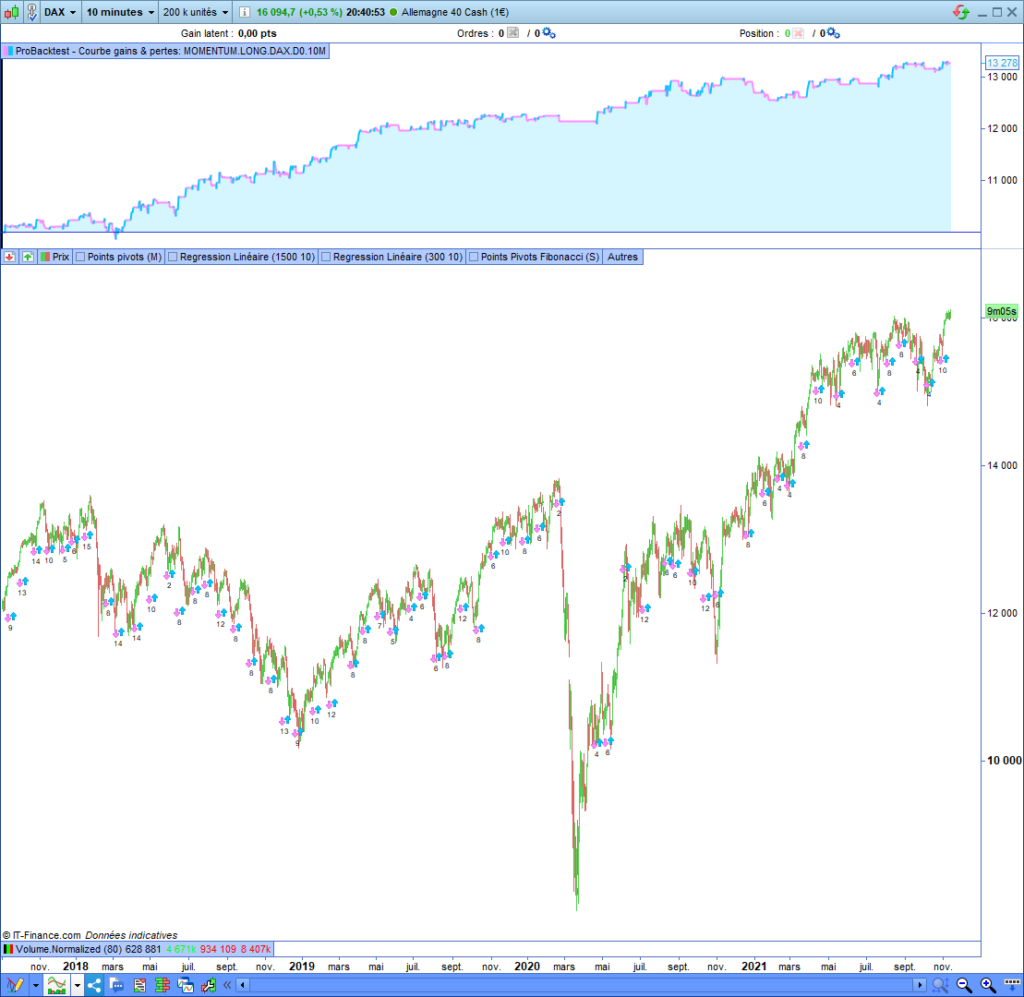

1. Momentum strategy

Equity curve of the momentum strategy

Entry opening example of the momentum strategy

2. Moving Average crossover strategy

Equity curve of the moving average strategy

3. Technical bounce strategy

Equity curve of the technical bounce strategy

Double bottom indicator

I give you two chartist indicators capable of recognizing the double bottom figure on 10 and 13 candles in all timeframes:

I give you two chartist indicators capable of recognizing the double bottom figure on 10 and 13 candles in all timeframes:

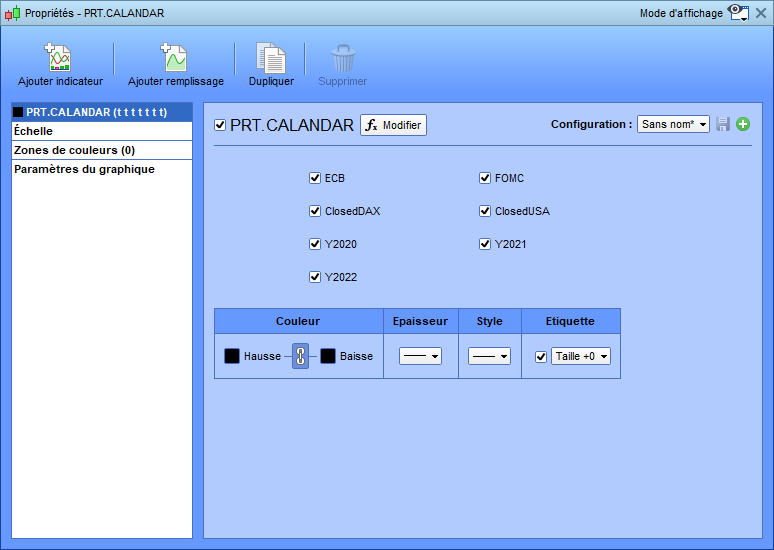

Market Calendar indicator

I will also give you the PRT CALENDAR. It is a market calendar indicator providing the FMOC and ECB meeting schedule and the holidays for the USA and the German market.

I will also give you the PRT CALENDAR. It is a market calendar indicator providing the FMOC and ECB meeting schedule and the holidays for the USA and the German market.

Included features in the template

|

Features |

Description |

| Market calendar | Never miss not open an entry during a market holiday thanks to the implementation of a market calendar. (2021 ECB and FOMC schedules are included) |

| Time specifications | Open an entry only when the market is open and close at the market closing thanks to time conditions. Avoid the risk with the wintertime and the summertime decalage between Europe and the USA. |

| Number of entry openings | Improve your money management by defining the maximum number of entries by day. |

| Stop loss and target setting | Control the risk of the system thanks to stop-loss and target. |

| Profit securing algorithm | The template implements a smart algorithm that will secure the latent profit to protect you against a fall of the market. |

| Trend detection | The template can recognize the market trend and will never open an entry in a bear market. |

| High volatility protection | If the market volatility is too high, the template will not open a position. This feature protects you against false signals and slippage risks. |

| Build a position | The whole system is configured to allow you to build a position on several candles. This particularity gives you the possibility to obtain a better price and smooth your global position’s price. Besides, your final position will have several stop-loss and target prices. That decreases the risk of stop hunting. |

| Rounded price algorithm | The template knows the next hundred and the next fifty prices. If your position has sufficient latent profit, the system will begin to secure your gain when the price touches a rounded price. |

| Management of the variables | After each important treatment, the system reinitializes all the variables to avoid unexpected behaviors. |

| Emergency stop of the system | You have the choice to activate the emergency stop of the system if certain conditions are completed. For example, you can stop the system if your strategy loses too much money or if the market’s volatility is extremely high. |

Included products in the package

| Product types | Product name |

| Template | TEMPLATE.LONG.DAY.DAX.D0.v1.itf

FAQ_and_Documentation_Artificall.pdf FAQ_et_Documentation_Template_Artificall.FR |

| Decision trees | Decision.Tree.3.Indicators.itf

Decision.Tree.4.Indicators.itf Decision.Tree.5.Indicators.itf Decision.Tree.6.Indicators.itf Decision_Trees_Documentation_Artificall.pdf |

| Cross Finder | CROSS.FINDER.LONG.itf

CROSS.FINDER.SHORT.itf Cross_Finder_Documentation_Artificall.pdf |

| Complete trading system examples | MOMENTUM.LONG.DAX.D0.10M.itf

CROSS.LONG.DAY.DAX.10m.D0.itf REBOUND.LONG.DAX.10m.itf |

| Double bottom indicators | W10.ARTIFICALL.itf

W13.ARTIFICALL.itf |

| PRT CALENDAR | PRT.CALANDAR.itf |

Important notes

The template is optimized to operate the DAX30 for a “2 minutes” time frame. If you want to operate another time frame or asset, you will have to apply some modifications.

The template is optimized to operate the DAX30 for a “2 minutes” time frame. If you want to operate another time frame or asset, you will have to apply some modifications.

I started automated trading using Prorealtime in 2016, and this template is the result of many years of work. I improved its efficiency and its robustness day by day. Today, I consider that this template is complete and efficient. I use it on my trading accound.

| Secure payment | Installation support | Free updating | Expertise |

|

|

|

|

|