Home > Comparison > Technology > AAPL vs MSFT The strategic rivalry between Apple Inc. and Microsoft Corporation shapes the evolving landscape of the global technology sector. Apple operates as...

View Full Comparison600+ Companies Analyzed | Full S&P 500 Coverage | 100% Data-Driven Insights | ProRealTime Indicators

Identify Market Opportunities

We’ve analyzed the entire S&P 500 and Nasdaq-100. Deep-dive company analyses and comparisons:

Unlock the Wide MOAT List

Join our community of data-driven investors to access the complete MOAT stocks list for free.

The Artificall Advantage: Where AI Meets Human Expertise

Artificall bridges the gap between institutional data and individual investors. We combine rigorous fundamental research with a proprietary RAG AI. Our technology processes thousands of SEC filings in real-time to eliminate bias and deliver objective insights. Master the S&P 500 and Nasdaq-100 with our data-driven tools. Evaluate company fundamentals in minutes and make well-informed investment decisions.

Deep-Dive Analyses

Company Comparisons

Market News

ProRealTime Indicators

Featured Analyses

Apple 2026: The Mastery of Capital and Durable Advantage

Is Microsoft a Slightly Favorable Moat Amid Declining ROIC? 2026 Review

NVIDIA 2026: The Mastery of a Very Favorable Moat

Featured Comparisons

NVIDIA vs QUALCOMM: Which Semiconductors Offer More Growth?

NVIDIA Corporation and QUALCOMM Incorporated stand as two titans within the semiconductor industry, each driving innovation in overlapping markets like AI, wireless communication, and advanced computing. NVIDIA’s focus on graphics,...

View Full ComparisonSynopsys vs Cadence: Evaluating Growth and Risks for Investors

In the fast-evolving world of electronic design automation, two industry leaders stand out: Synopsys, Inc. (SNPS) and Cadence Design Systems, Inc. (CDNS). Both companies specialize in advanced software solutions that...

View Full ComparisonMarket News: Data-Driven Insights

Stay ahead of the curve with curated financial updates. We focus on news that directly impacts stock prices. Our RAG AI filters out the noise to deliver only the most relevant data. Understand the “why” behind market moves in real-time.

Deckers Outdoor Shares Jump 15% on Quarterly Results: What’s Next?

Deckers Outdoor shares surged sharply following the release of its quarterly results, reflecting a strong market reaction that contrasts with the apparel sector’s inherent volatility. This rise raises a critical...

Access the newsMicrosoft Shares Drop 12% Post-Results: What Went Wrong?

Microsoft’s stock price fell sharply despite its status as a technology leader, creating a stark contrast between its market value and investor reaction. The core question is why the company’s...

Access the newsUnitedHealth Shares Drop 20% Today: What Investors Must Know

UnitedHealth’s stock price has plunged nearly 20% today, despite its status as a leading diversified healthcare company with significant market presence. This sharp decline raises critical questions about the factors...

Access the newsOptimize Your Entries with our Prorealtime Indicators

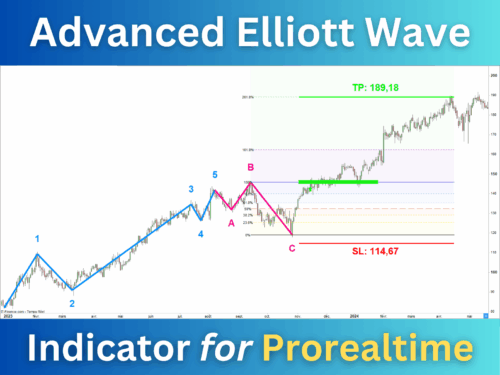

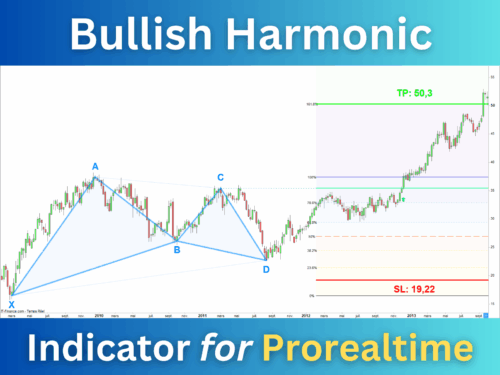

Finding opportunities in the markets is often time-consuming and challenging. That is why I designed my indicators for demanding traders who want clarity, timing, and efficiency. They display all the information you need to make a decision: visual analysis, signals, and exit conditions. Whether you’re a swing trader or an investor, beginner or experienced, they will help you better approach the financial markets:

A few words about me

Leveraging years of experience as a banking software developer, I transitioned to a self-employed post-lockdown. After mastering ProRealTime indicators, I developed a proprietary Retrieval-Augmented Generation AI (RAG) for fundamental research.

Today, I provide expert company comparisons and analyses to empower investors with data-driven decision-making