The opening range breakout is one of the most known trading strategies. That consists of opening an entry after the price of an asset crosses a key level. A breakout is often followed by a significant price movement, giving considerable potential for profit. In this post, I will show you how to exploit range breakouts to win on the market. I will provide you with an indicator, a trading system, and a screener working on the Prorealtime platform.

- What is a breakout?

- What are the best assets to trade range breakings?

- How to recognize a range using an indicator?

- Opening range breakout indicator

- Opening range breakout trading system

- Backtest of the opening range breakout strategy

- Risks of the opening range breakout strategy

- Opening range breakout screener

- Opening Range breakout summary

- Range Breakout Indicator for Prorealtime [FREE]

What is a breakout?

A breakout occurs when the price of an asset, such as a stock or an index, breaks a critical level. These key levels can be support or resistance. An increase in transaction volume often follows a breakout, which can indicate the beginning of a long-term trend or price acceleration.

Several factors, like economic news, a company publication, a political event, or a change in market sentiment, can trigger a breakout.

A breakout can be bullish or bearish. It is bullish when the price breaches the resistance, giving a long opportunity. It can be bearish when the price breaks the support, providing a sell-sort opportunity.

Bullish breakout example

Here is an example of a bullish breakout on the S&P 500. The uptrend accelerated after the resistance had been broken:

Bearish breakout example

Here is an example of a bearish breakout on the S&P 500. The downtrend accelerated after the price had broken down the support:

The different types of price levels

The breaking of numerous price level types can trigger a significant market movement. Here is the list of the main price level types that you can exploit in a breakout strategy:

- Range’s support and resistance

- Chartist’s pivot points

- Bullish and bearish oblique

- Previous or historical highest and lowest

- Bollinger bands

- Volume profile point of control

Other key prices allow breakout trading. Globally, each price level, such as support or resistance, can be used in a breakout strategy.

In this post, I decided to focus on range breakout. I will show you how to trade the range support or resistance breaking. I may abord trading of others key prices later.

What are the best assets to trade range breakings?

You can trade the breakouts on indexes, stocks, or any forex pair. However, trade breakouts on assets with some properties will be more profitable. Here are the two most important:

- The long-term trend must be evident. The long-term uptrend is necessary to buy the bullish breakouts, and the long-term downtrend is necessary to sell the bearish breakouts short.

- The breakout trading strategy is more profitable on volatile assets. The expected profits are higher, but the risk of losses is also higher.

How to recognize a range using an indicator?

It is easy to identify a range with the naked eye but complex with an indicator. There is no perfect indicator that can detect a range. I will present you with an algorithm capable of recognizing most of the market’s ranges. The idea consists of calculating the distance between the median price and the closing price of each candle on the range length. The distance will be low if the candles are regrouped around the median, which would indicate a range in this period.

We can consider three steps to solve this range recognition algorithm:

This range indicator will have two parameters: length of the range and distance from the median.

Range recognition algorithm

Here are the three range recognition steps. All source codes I will provide work on the Prorealtime platform.

1. Median price calculation

The first step consists of calculating the median price over the period corresponding to the length of the range we want to recognize. You will begin by putting the close prices in an Array. Then, you will have to sort the prices in an ascending order. The value in the middle of the table will correspond to the median price.

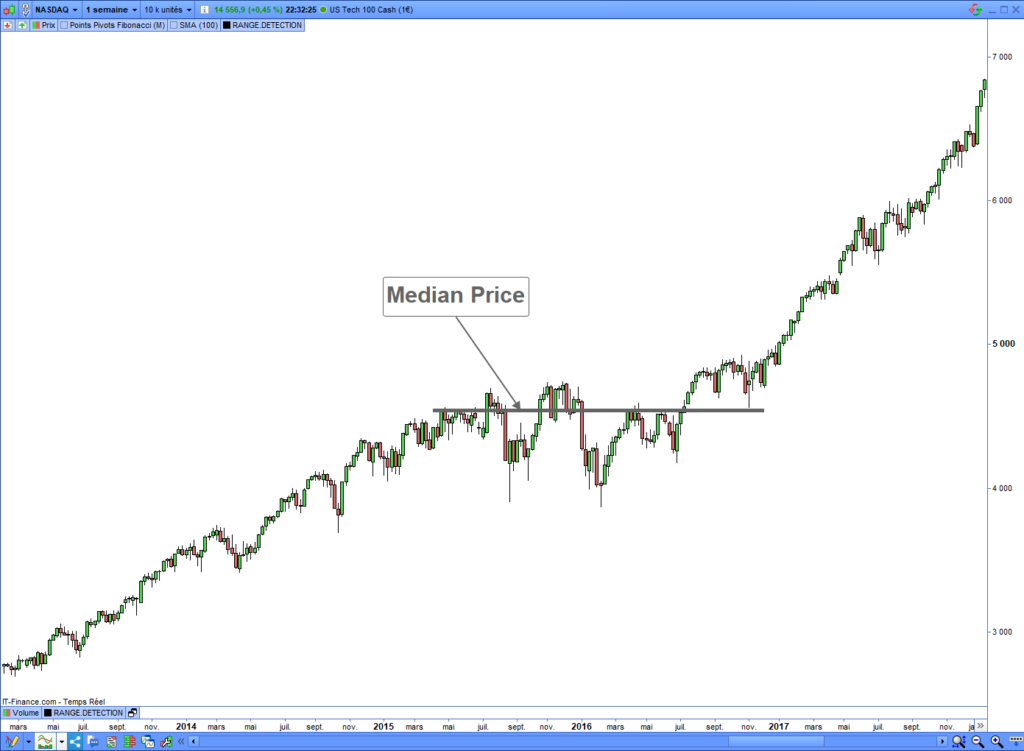

The following chart shows the candle dispersion around the median price along the range length:

Median price indicator

The following code computes and prints the median price on the 100 last candles. You must create an indicator on the Prorealtime platform and copy/paste the code to run it:

defparam drawonlastbaronly=true

//------------------------------------------------------//

// * MEDIAN PRICE INDICATOR * * //

//------------------------------------------------------//

// Range length

rangeLength = 100

// MEDIANE CALCULATION

// 1.1 Put prices in the table

FOR i = 0 TO rangeLength - 1 DO

$closeTab[i] = close[i]

NEXT

// 1.2 Ascending sort

Arraysort($closeTab, ascend)

// 1.3 Median price extraction

midValue = rangeLength / 2

roundedMidValue = FLOOR(rangeLength / 2)

IF midValue = roundedMidValue THEN

// even number

Mediane = ($closeTab[roundedMidValue] + $closeTab[roundedMidValue + 1]) / 2

ELSE

// odd number

Mediane = $closeTab[midValue]

ENDIF

// Median price printing

DRAWSEGMENT(barindex-rangeLength, Mediane, barindex, Mediane) coloured(0,0,0)

RETURN2. Distance calculation

The second step is calculating the average distance between the median price and the closing price of each candle. When the market ranges, the candles are regrouped in a lateral canal. The more the candles are regrouped around the median, the lower the average distance. A low distance will indicate a range occurring.

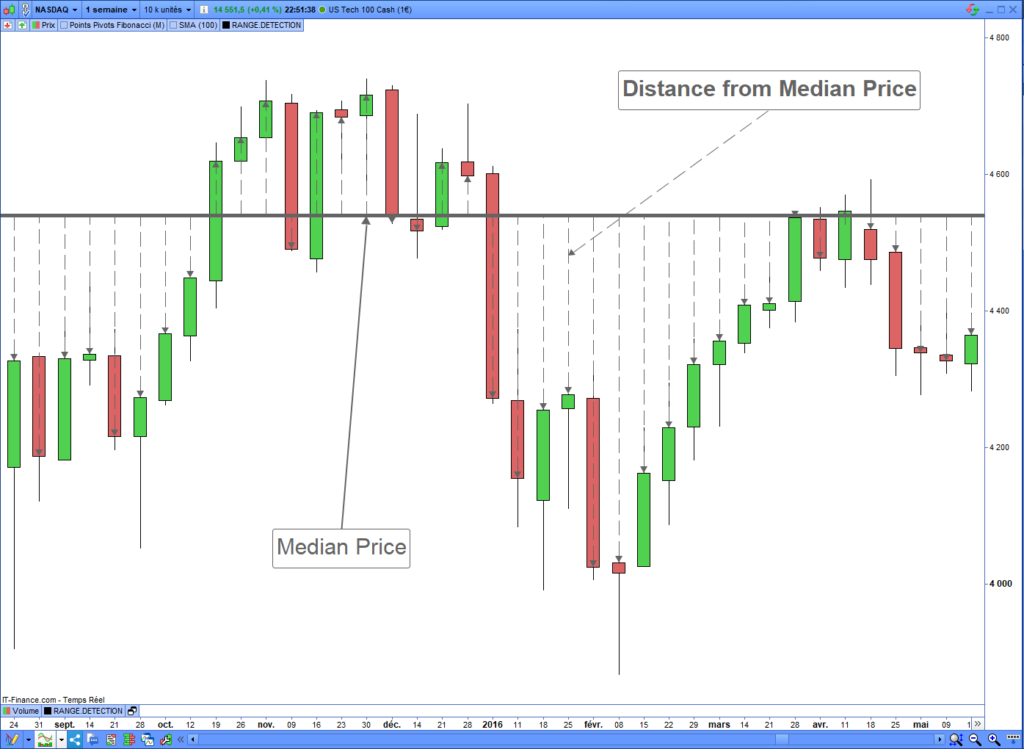

The following chart shows the distances between the median price and the closing prices of each candle:

Distance from median indicator

The following code will calculate the average distance between the closing prices and the median price along the length of the range we want to recognize:

defparam drawonlastbaronly=true

//------------------------------------------------------//

// * DISTANCE FROM MEDIAN PRICE INDICATOR * * //

//------------------------------------------------------//

// Range length

rangeLength = 100

// MEDIANE CALCULATION

// 1.1 Put prices in the table

FOR i = 0 TO rangeLength - 1 DO

$closeTab[i] = close[i]

NEXT

// 1.2 Ascending sort

Arraysort($closeTab, ascend)

// 1.3 Median price extraction

midValue = rangeLength / 2

roundedMidValue = FLOOR(rangeLength / 2)

IF midValue = roundedMidValue THEN

// even number

Mediane = ($closeTab[roundedMidValue] + $closeTab[roundedMidValue + 1]) / 2

ELSE

// odd number

Mediane = $closeTab[midValue]

ENDIF

// * DISTANCE CALCULATION * //

distanceSquare = 0

FOR i = 0 to rangeLength - 1 DO

distanceSquare = distanceSquare + SQUARE(close[i] - Mediane)

i=i+1

NEXT

distance = SQRT(distanceSquare / rangeLength) / close

RETURN distanceDistance from median example

Here is an example of the distance calculation between the median and the closing price on the Nasdaq in the weekly timeframe. You can see the distance reducing when the last 100 candles have shaped a range:

3. The distance filter

The last step consists of filtering the market part having a low distance from the median price. A low distance will indicate a range occurring. You have to define a threshold below which you consider the candles shaped as a range. I defined a threshold of 0.05 in the following code:

ONCE threshold = 0.05

RANGEDETECTED = 0

IF distance <= threshold THEN

RANGEDETECTED = 1

ELSE

RANGEDETECTED = 0

ENDIF

// Signal smoothing

SMOOTHEDRANGE = average[5](RANGEDETECTED)

SMOOTHEDRANGEDETECTED = 0

IF SMOOTHEDRANGE > 0 THEN

SMOOTHEDRANGEDETECTED = 1

ELSE

SMOOTHEDRANGEDETECTED = 0

ENDIF

In the previous code, I smoothed the range detection signal averaging on five periods. That enhanced the quality of the signal, reducing false signals.

Code of the range indicator

The following source code recognizes ranges on the market. You can run it on the Prorealtime platform. I set 100 as the range length and 0.05 as the detection threshold. You will adapt the length and the threshold depending on your needs. This configuration works well on indexes and ETFs in daily and weekly timeframes:

//------------------------------------------------------//

// * RANGE DETECTION PROREALTIME INDICATOR * * //

//------------------------------------------------------//

// Vivien Schmitt

// https://artificall.com

//------------------------------------------------------//

//------------------------------------------------------//

// * PARAMETERS

//------------------------------------------------------//

ONCE rangeLength = 100

ONCE threshold = 0.05 //0.02

//------------------------------------------------------//

// * MEDIANE CALCULATION

//------------------------------------------------------//

// 1.1 Put prices in the table

FOR i = 0 TO rangeLength - 1 DO

$closeTab[i] = close[i]

NEXT

// 1.2 Ascending sort

Arraysort($closeTab, ascend)

// 1.3 Median price extraction

midValue = rangeLength / 2

roundedMidValue = FLOOR(rangeLength / 2)

IF midValue = roundedMidValue THEN

// even number

Mediane = ($closeTab[roundedMidValue] + $closeTab[roundedMidValue + 1]) / 2

ELSE

// odd number

Mediane = $closeTab[midValue]

ENDIF

//------------------------------------------------------//

// * DISTANCE CALCULATION

//------------------------------------------------------//

distanceSquare = 0

FOR i = 0 to rangeLength - 1 DO

distanceSquare = distanceSquare + SQUARE(close[i] - Mediane)

i=i+1

NEXT

standardDeviation = STD[rangeLength]

distance = SQRT(distanceSquare / rangeLength) / close

//------------------------------------------------------//

// * RANGE DETECTION

//------------------------------------------------------//

RANGEDETECTED = 0

IF distance <= threshold THEN

RANGEDETECTED = 1

ELSE

RANGEDETECTED = 0

ENDIF

// Signal smoothing

SMOOTHEDRANGE = average[5](RANGEDETECTED)

SMOOTHEDRANGEDETECTED = 0

IF SMOOTHEDRANGE > 0 THEN

SMOOTHEDRANGEDETECTED = 1

ELSE

SMOOTHEDRANGEDETECTED = 0

ENDIF

RETURN SMOOTHEDRANGEDETECTEDRange detection example

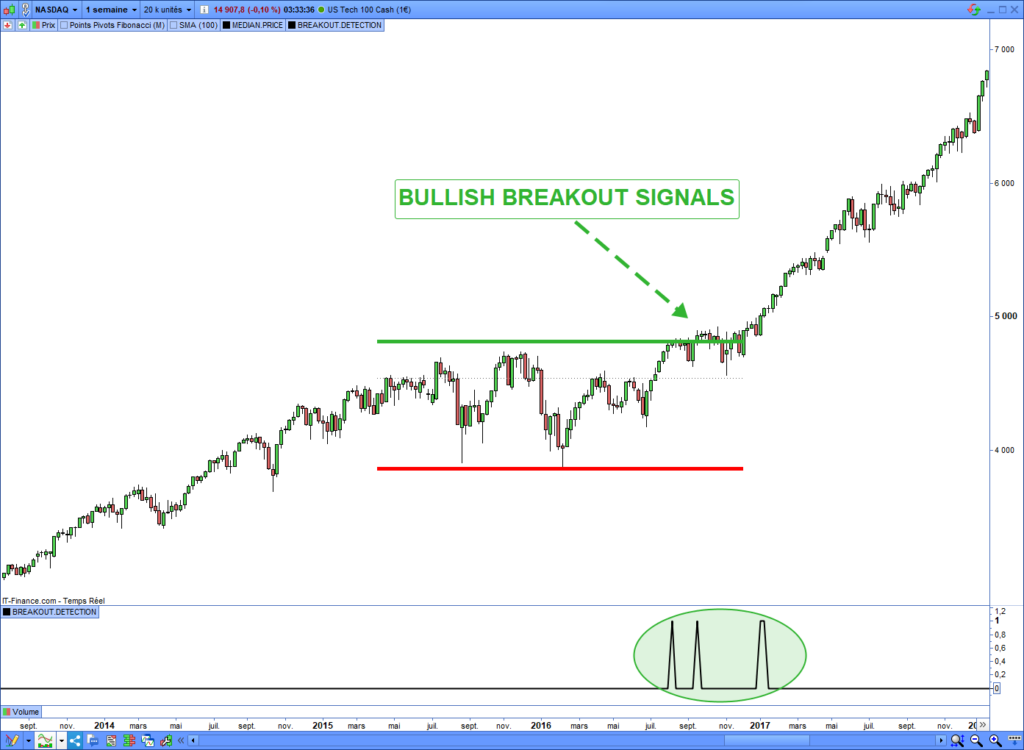

The following chart shows an example of range detection in the Nasdaq in weekly time units. The range indicator returns 1 when the algorithm detects a range on the last 100 candles:

Opening range breakout indicator

The breakout happens when the price overhead closes the highest or below the lowest of the range. The market could start a durable price movement after this event. The breakouts provide a buying or sell shorting signal.

The following chart shows the highest and the lowest of the range:

Highest and lowest breakouts

Detecting a breakout needs to know the range’s highest and lowest. Then, you will send a signal after the price overhead closes the highest or below closes the lowest. The following source code will send 1 in case of a bullish breakout and -1 in case of a bearish breakout:

//------------------------------------------------------//

// * BREAKOUT SIGNAL

//------------------------------------------------------//

// Highest and lowest price

highestPrice = highest[rangeLength](high)

lowestPrice = lowest[rangeLength](low)

BREAKOUT = 0

IF close > highestPrice[1] THEN

BREAKOUT = 1

ELSIF close < lowestPrice[1] THEN

BREAKOUT = -1

ENDIF

RETURN BREAKOUTNow, you must join the breakout with the range detection signal.

Code of the opening range breakout indicator

Here is the indicator’s source code, allowing the detection of bullish and bearish range breakouts. This indicator works on the Prorealtime platform:

//------------------------------------------------------//

// * OPENING RANGE BREAKOUT SIGNAL * * //

//------------------------------------------------------//

// Vivien Schmitt

// https://artificall.com

//------------------------------------------------------//

//------------------------------------------------------//

// * PARAMETERS

//------------------------------------------------------//

ONCE rangeLength = 100

ONCE threshold = 0.05 //0.02

//------------------------------------------------------//

// * MEDIANE CALCULATION

//------------------------------------------------------//

// 1.1 Put prices in the table

FOR i = 0 TO rangeLength - 1 DO

$closeTab[i] = close[i]

NEXT

// 1.2 Ascending sort

Arraysort($closeTab, ascend)

// 1.3 Median price extraction

midValue = rangeLength / 2

roundedMidValue = FLOOR(rangeLength / 2)

IF midValue = roundedMidValue THEN

// even number

Mediane = ($closeTab[roundedMidValue] + $closeTab[roundedMidValue + 1]) / 2

ELSE

// odd number

Mediane = $closeTab[midValue]

ENDIF

//------------------------------------------------------//

// * DISTANCE CALCULATION

//------------------------------------------------------//

// 2 Calculate distance from the median

distanceSquare = 0

FOR i = 0 to rangeLength - 1 DO

distanceSquare = distanceSquare + SQUARE(close[i] - Mediane)

i=i+1

NEXT

distance = SQRT(distanceSquare / rangeLength) / close

//------------------------------------------------------//

// * RANGE DETECTION

//------------------------------------------------------//

// 3.1 Detecting of the low distance

RANGEDETECTED = 0

IF distance <= threshold THEN

RANGEDETECTED = 1

ELSE

RANGEDETECTED = 0

ENDIF

// 3.2 Signal smoothing

SMOOTHEDRANGE = average[5](RANGEDETECTED)

SMOOTHEDRANGEDETECTED = 0

IF SMOOTHEDRANGE > 0 THEN

SMOOTHEDRANGEDETECTED = 1

ELSE

SMOOTHEDRANGEDETECTED = 0

ENDIF

//------------------------------------------------------//

// * RANGE BREAKOUT

//------------------------------------------------------//

// 4.1 Highest and lowest price

highestPrice = highest[rangeLength](high)

lowestPrice = lowest[rangeLength](low)

// 4.2 Detect if the price breaks support or resistance

BREAKOUT = 0

IF close > highestPrice[1] THEN

BREAKOUT = 1

ELSIF close < lowestPrice[1] THEN

BREAKOUT = -1

ENDIF

//------------------------------------------------------//

// * OPENING RANGE BREAKOUT SIGNAL

//------------------------------------------------------//

// 5 Range detection and breakout signal merging

RANGEBREAKOUT = 0

IF SMOOTHEDRANGEDETECTED = 1 AND BREAKOUT = 1 THEN

RANGEBREAKOUT = 1

ELSIF SMOOTHEDRANGEDETECTED = 1 AND BREAKOUT = -1 THEN

RANGEBREAKOUT = -1

ENDIF

RETURN RANGEBREAKOUTExample of a range breakout detection

Here is an example of a bullish range breakout signal that occurred on the Nasdaq in a weekly timeframe:

Opening range breakout trading system

You can use the indicator code I presented to trade the range breakouts automatically on the Prorealtime platform. You only have to open a long entry after a bullish breakout and a short entry after a bearish breakout.

Code of the opening range breakout trading system

Here is the source code of the range breakout automated strategy. This trading system will open long entries after bullish breakouts and short entries after bearish breakouts:

//------------------------------------------------------//

// * OPENING RANGE BREAKOUT TRADING SYSTEM * * //

//------------------------------------------------------//

// Vivien Schmitt

// https://artificall.com

//------------------------------------------------------//

//------------------------------------------------------//

// * PARAMETERS

//------------------------------------------------------//

ONCE rangeLength = 100

ONCE threshold = 0.05 //0.02

//------------------------------------------------------//

// * MEDIANE CALCULATION

//------------------------------------------------------//

// 1.1 Put prices in the table

FOR i = 0 TO rangeLength - 1 DO

$closeTab[i] = close[i]

NEXT

// 1.2 Ascending sort

Arraysort($closeTab, ascend)

// 1.3 Median price extraction

midValue = rangeLength / 2

roundedMidValue = FLOOR(rangeLength / 2)

IF midValue = roundedMidValue THEN

// even number

Mediane = ($closeTab[roundedMidValue] + $closeTab[roundedMidValue + 1]) / 2

ELSE

// odd number

Mediane = $closeTab[midValue]

ENDIF

//------------------------------------------------------//

// * DISTANCE CALCULATION

//------------------------------------------------------//

// 2 Calculate distance from the median

distanceSquare = 0

FOR i = 0 to rangeLength - 1 DO

distanceSquare = distanceSquare + SQUARE(close[i] - Mediane)

i=i+1

NEXT

distance = SQRT(distanceSquare / rangeLength) / close

//------------------------------------------------------//

// * RANGE DETECTION

//------------------------------------------------------//

// 3.1 Detecting of the low distance

RANGEDETECTED = 0

IF distance <= threshold THEN

RANGEDETECTED = 1

ELSE

RANGEDETECTED = 0

ENDIF

// 3.2 Signal smoothing

SMOOTHEDRANGE = average[5](RANGEDETECTED)

SMOOTHEDRANGEDETECTED = 0

IF SMOOTHEDRANGE > 0 THEN

SMOOTHEDRANGEDETECTED = 1

ELSE

SMOOTHEDRANGEDETECTED = 0

ENDIF

//------------------------------------------------------//

// * RANGE BREAKOUT

//------------------------------------------------------//

// 4.1 Highest and lowest price

highestPrice = highest[rangeLength](high)

lowestPrice = lowest[rangeLength](low)

// 4.2 Detect if the price breaks support or resistance

BREAKOUT = 0

IF close > highestPrice[1] THEN

BREAKOUT = 1

ELSIF close < lowestPrice[1] THEN

BREAKOUT = -1

ENDIF

//------------------------------------------------------//

// * OPENING RANGE BREAKOUT SIGNAL

//------------------------------------------------------//

// 5 Range detection and breakout signal merging

RANGEBREAKOUT = 0

IF SMOOTHEDRANGEDETECTED = 1 AND BREAKOUT = 1 THEN

RANGEBREAKOUT = 1

ELSIF SMOOTHEDRANGEDETECTED = 1 AND BREAKOUT = -1 THEN

RANGEBREAKOUT = -1

ENDIF

//------------------------------------------------------//

// * ENTRY OPENNING & CLOSING * * //

//------------------------------------------------------//

// Strategy

LongBreakout = 1

ShortBreakout = 1

// Position size

capitalByEntry = 10000

numberOfContracts = max(1, floor(capitalByEntry / close))

// Stoploss & Targer

longStopLoss = 10

longTarget = longStopLoss * 3

shortStopLoss = 5

shortTarget = shortStopLoss * 3

// Conditions pour ouvrir une position acheteuse

IF NOT LongOnMarket AND LongBreakout AND RANGEBREAKOUT = 1 THEN

BUY numberOfContracts CONTRACTS AT MARKET

SET STOP %LOSS longStopLoss

SET TARGET %PROFIT longTarget

ENDIF

// Conditions pour ouvrir une position en vente à découvert

IF NOT ShortOnMarket AND ShortBreakout AND RANGEBREAKOUT = -1 THEN

SELLSHORT numberOfContracts CONTRACTS AT MARKET

SET STOP %LOSS shortStopLoss

SET TARGET %PROFIT shortTarget

ENDIF

Example of an opening range breakout entry

The following chart shows the automated entry opening after the bullish breakout of the highest range resistance:

Backtest of the opening range breakout strategy

I will backtest the range breakout automated strategy with several assets on the Prorealtime platform. I will run the trading system on the Nasdaq, the DAX40, and the EUR/USD forex pair.

Backtest of the range breakout bot on the Nasdaq

Here is the backtest of the range breakout strategy on the Nasdaq in the daily timeframe. Regarding the bullish bias of the Nasdaq, I activated only the bullish breakout signals. The trading system will only open long entries:

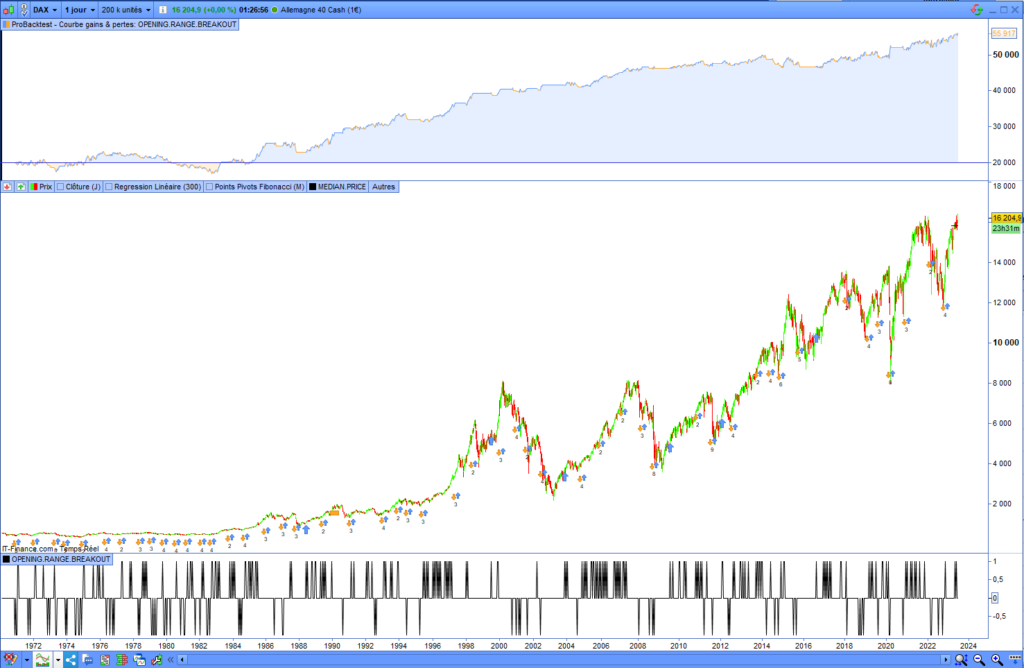

Backtest of the range breakout bot on the Dax 40

Here is the backtest of the range breakout strategy on the DAX40 in the daily timeframe. This time, I activated both bullish and bearish breakout signals. The trading system will open long and short entries:

Backtest of the range breakout bot on the EUR/USD

Here is the backtest of the range breakout strategy on the USD/EUR forex pair in the daily timeframe. The trading system will open long and short entries. I defined only one contract by entry opening:

Risks of the opening range breakout strategy

Like most trading strategies, range breakout trading contains risks. The particularity of this strategy is that you will open entries in a highly volatile market. That increases the number of false signals occurring and stops loss executions.

In a volatile market, it is essential to control your risk exposure. To reduce potential losses, you should not open leveraged entries. In addition, you should not place the stop loss too near the entry price. This will reduce the risk of the stop-loss execution.

Opening range breakout screener

The Prorealtime platform gives the possibility to program screeners. You can use the source code of the range breakout indicator to build a screener and find opening range breakout opportunities on stocks and ETFs.

Code of the opening range breakout screener

Here is the source code of the range breakout screener runnable on the Prorealtime platform:

//------------------------------------------------------//

// * OPENING RANGE BREAKOUT SCREENER * * //

//------------------------------------------------------//

// Vivien Schmitt

// https://artificall.com

//------------------------------------------------------//

//------------------------------------------------------//

// * PARAMETERS

//------------------------------------------------------//

ONCE rangeLength = 100

ONCE threshold = 0.05 //0.02

//------------------------------------------------------//

// * MEDIANE CALCULATION

//------------------------------------------------------//

// 1.1 Put prices in the table

FOR i = 0 TO rangeLength - 1 DO

$closeTab[i] = close[i]

NEXT

// 1.2 Ascending sort

Arraysort($closeTab, ascend)

// 1.3 Median price extraction

midValue = rangeLength / 2

roundedMidValue = FLOOR(rangeLength / 2)

IF midValue = roundedMidValue THEN

// even number

Mediane = ($closeTab[roundedMidValue] + $closeTab[roundedMidValue + 1]) / 2

ELSE

// odd number

Mediane = $closeTab[midValue]

ENDIF

//------------------------------------------------------//

// * DISTANCE CALCULATION

//------------------------------------------------------//

// 2 Calculate distance from the median

distanceSquare = 0

FOR i = 0 to rangeLength - 1 DO

distanceSquare = distanceSquare + SQUARE(close[i] - Mediane)

i=i+1

NEXT

distance = SQRT(distanceSquare / rangeLength) / close

//------------------------------------------------------//

// * RANGE DETECTION

//------------------------------------------------------//

// 3.1 Detecting of the low distance

RANGEDETECTED = 0

IF distance <= threshold THEN

RANGEDETECTED = 1

ELSE

RANGEDETECTED = 0

ENDIF

// 3.2 Signal smoothing

SMOOTHEDRANGE = average[5](RANGEDETECTED)

SMOOTHEDRANGEDETECTED = 0

IF SMOOTHEDRANGE > 0 THEN

SMOOTHEDRANGEDETECTED = 1

ELSE

SMOOTHEDRANGEDETECTED = 0

ENDIF

//------------------------------------------------------//

// * RANGE BREAKOUT

//------------------------------------------------------//

// 4.1 Highest and lowest price

highestPrice = highest[rangeLength](high)

lowestPrice = lowest[rangeLength](low)

// 4.2 Detect if the price breaks support or resistance

BREAKOUT = 0

IF close > highestPrice[1] THEN

BREAKOUT = 1

ELSIF close < lowestPrice[1] THEN

BREAKOUT = -1

ENDIF

//------------------------------------------------------//

// * OPENING RANGE BREAKOUT SIGNAL

//------------------------------------------------------//

// 5 Range detection and breakout signal merging

RANGEBREAKOUT = 0

IF SMOOTHEDRANGEDETECTED = 1 AND BREAKOUT = 1 THEN

RANGEBREAKOUT = 1

ELSIF SMOOTHEDRANGEDETECTED = 1 AND BREAKOUT = -1 THEN

RANGEBREAKOUT = 1

ENDIF

//------------------------------------------------------//

// *** SCREENER ***//

//------------------------------------------------------//

SCREENER [RANGEBREAKOUT](BREAKOUT as "RANGE BREAKOUT")Range breakout screener example

Here is the result of the opening range breakout screener run on the Prorealtime platform. The screener will return 1 for the bullish breakouts and -1 for the bearish breakouts:

Opening Range breakout summary

1. A breakout is a break of a key-level price. A significant price movement often follows it in the breaking direction.

2. You can trade the breakout on any asset, such as stocks, ETFs, and Futures or CFD contracts.

3. The opening range breakout strategy works in all timeframes, but it is more profitable to take swing trading signals and hold the position for several days or weeks.

4. Breakout trading is a risky strategy because of high volatility during the signal’s occurrence.

Range Breakout Indicator for Prorealtime [FREE]

The Range Breaker will help you seize the best trading opportunities. It detects range breakouts, which are often followed by explosive movements. Thanks to this indicator, you will never miss a breakout again.

Pingback: Improving your trading performances using Divergences

Bonsoir,

Super ton travail,

Meilleurs vœux pour 2024.

Cordialement

Bonjour Philippe,

Merci beaucoup, je vous souhaite une très bonne année 2024 😊

A bientôt