I think buying the dip is one of the most challenging strategies. It requires a great deal of caution. When I buy the dip in the stock market, sometimes I am right, and sometimes I am wrong. I made costly mistakes, but I had taken excellent deals. I will show you how to buy the dip from long-term investment and give you the source code of my signal system working on the Prorealtime platform.

Description of the buy-the-dip strategy

The strategy I will present is what I do with my money. I developed this strategy after many years of tests and observations. I am not saying that my approach is the best, but it gave me profitable returns.

My buy-the-dip strategy consists of four stages:

- Choosing adapted assets

- Macroeconomic analysis

- Technical analysis

- Building a position

These steps allow me to decide when to start buying the dip and if I can continue. They help me to shape my entry openings and stay rational. I leave no room for emotions during a bear market.

I. Choosing adapted assets to buy the dip

As I previously explained in the “What ETFs to buy during a bear market?” post, certain assets are more adapted to buy a bear market.

It would be best if you gave preference to these three categories of assets for buying the dip:

- The main indexes like the S&P 500, the Dow Jones, or the Euro Stocks 50.

- The defensive ETFs with low-beta, like “Personal & Household Goods” or “Consumer Staples”.

- The stocks have excellent fundamentals like Procter & Gamble or Colgate-Palmolive.

In this post, I chose to operate the Dow Jones to build a position in a dip. I would warn against buying the dip on the high-volatile or bad-fundamentals assets. I experienced this acutely in the oil companies I described here: “How did I lose 10 000$ in five minutes?“.

II. Macroeconomic analysis

Before buying the dip, I try to understand why the market is falling and what macroeconomic data I need to watch to make an investment decision.

Identify the bear market root cause

Buying the dip means buying a bear market. A bear market has two dimensions: its duration and its depth. The first thing I do is to identify why the market falls. I try to know if the reason will persist in the long term or be episodic. Then, I evaluate the severity of this event. This stage is crucial because it will help me decide whether to start a position construction.

If the cause of the bear market is transient, I will rapidly begin to build a position. If it is persistent, I prefer to wait several quarters. If the severity of the situation is low, I will start buying the market after it touches the first main support. I prefer to wait until the market bounces on lower support if the severity is high.

Summary table depending on the type of events:

| Short duration | Long duration | |

|---|---|---|

| LOW SEVERITY | Buying the firsts supports | Wait one quarter |

| HIGH SEVERITY | Buying the third/four supports | Wait several quarters |

What are the key macroeconomic indicators to watch?

There are numerous macroeconomics data. You will be flooded with information if you try to analyze all indicators. You have to focus on the indicators that most impact the market. These key indicators change over time, depending on the economic paradigm. In the past, investors monitored the Michigan Consumer Sentiment Index and the employment rate most. The most critical macroeconomic indicators today are inflation and FED benchmark interest rates.

What is inflation?

As mentioned by Jean-Claude Trichet, former of the European Central Bank, we can synthesize inflation by the variation of the unit cost of production. The unit cost of production is the total expenses incurred by a company to produce a certain quantity of goods or services and then divide the total amount by the quantity produced. This unit cost integrates all a company spends to produce a good or deliver a service like wages, raw materials, and energy.

Monitoring the sensitive assets to inflation

Certain assets are sensitive to inflation. That is the case with agricultural raw materials, precious and semi-precious metals like gold and silver, and energy like oil. The price of these assets tends to increase during inflationist periods and decrease during deflationist periods.

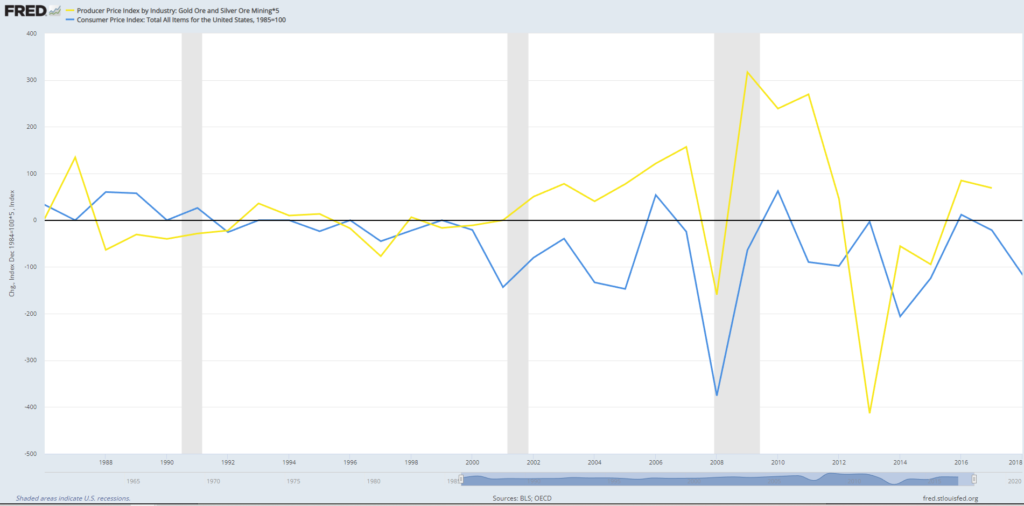

The following chart shows the gold & silver industry prices and the consumer price index. The macroeconomic data are updated monthly or quarterly. But the gold and silver price is available in real-time. You can watch the gold price to monitor inflation:

Example of a macroeconomic analysis

Here is the last macroeconomic analysis I made for the second 2022 quarter.

Unit labor cost

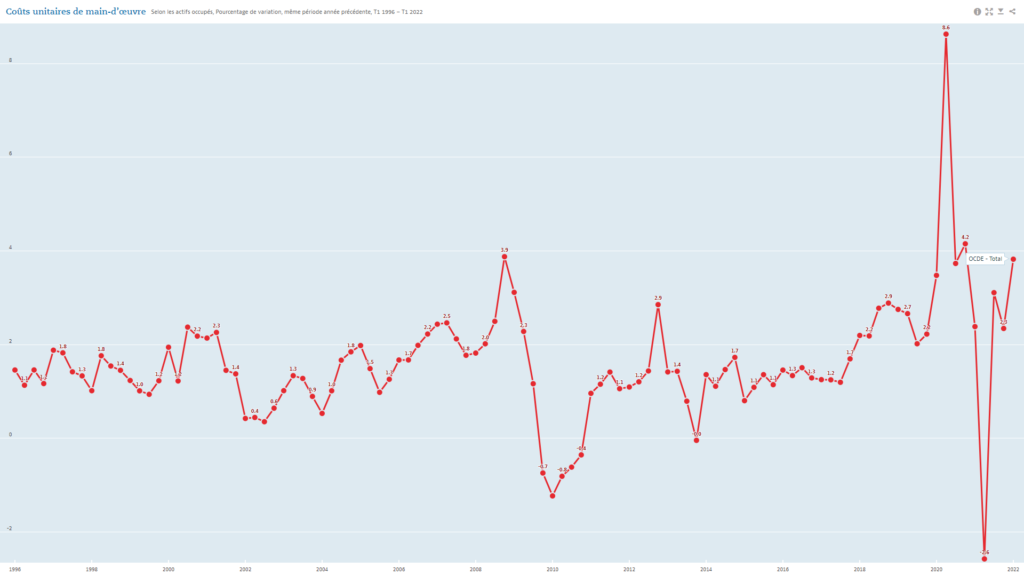

You can monitor the unit labor cost on the OECD website: https://data.oecd.org/fr/lprdty/couts-unitaires-de-main-d-uvre.htm

The following graphic shows the unit labor cost from 1996 until 2022. The pandemic crisis caused unprecedented instability in labor costs. The current level (2022-Q2) is slightly higher than the pre-crisis level:

Gold price

The gold price appears to have started a bearish trend since April 2022, which is deflationist:

Oil price

Each economic situation is particular. In the current period, the oil price variation strongly impacted inflation. Watching this asset is essential to know if the inflation peak is passed.

The peak in the oil price appears to be over, and the price has decreased since June 2022:

Wheat price

The wheat price has strongly decreased since its Mai 2022 peak:

Macroeconomic summary for the 2022-Q2

- The price increase, exacerbated by the Ukraine war, triggered the stock market collapse at the beginning of 2022. Inflation is the root cause of the market decline.

- Since the second quarter of 2022, gold, silver, oil, and wheat prices have significantly declined. It seems that some American companies intend to dismiss employees in the next quarter.

Regarding these observations, I consider that the inflation peak is passed. Then I activated my buy-the-dip strategy I will present to you in the technical analysis paragraph. However, I stay prudential because the war in Ukraine is not finished.

III. Technical analysis

It is unnecessary to process a deeply technical investment analysis from a long-term perspective. However, ignoring what the market was doing in a buy-the-dip case would be dangerous. It is essential to watch what the market is doing globally and identify the most important supports.

Defining the best time unit

As I exposed in the “10 golden rules for buying the dip” post, the most reliable time units to buy the dip are weekly and monthly. They allow better identification of the global trend and main supports. These time units are insensitive to the market noise, which helps avoid false buying and selling signals.

Identifying the main supports

I primarily use the Fibonacci monthly pivots and the historically highest and lowest to localize the main supports. The pivot points are price levels corresponding to critical supports and resistances. The market is often reactive to these price levels. They can be calculated in all-time units, but the monthly time unit is perfectly adapted to the buy-the-dip strategy.

Pivot points calculation

Pivot = ( H + B + C ) / 3

R3 = Pivot + 1.000 x ( H – L )

R2 = Pivot + 0.618 x ( H – L )

R1 = Pivot + 0.382 x ( H – L )

S1 = Pivot - 0.382 x ( H – L )

S2 = Pivot - 0.618 x ( H – L )

S3 = Pivot - 1.000 x ( H – L )

In the previous formula, H corresponds to the highest, B to the lowest, and C to the close.

Source code for the pivot points calculation

The following source code is executable on the Prorealtime platform :

//------------------------------------------------------//

// * FIBONACCI PIVOT POINTS * //

Once lastMonthBarIndex = 0

Once monthlyHigh = undefined

Once monthlyLow = undefined

Once monthlyPivot = undefined

Once monthlyR1 = undefined

Once monthlyS1 = undefined

Once monthlyR2 = undefined

Once monthlyS2 = undefined

Once monthlyR3 = undefined

Once monthlyS3 = undefined

If Month<>Month[1] then

duration = BarIndex - lastMonthBarIndex

IF duration <= 0 THEN

duration = 1

ENDIF

monthlyHigh = Highest[duration](High)[1]

monthlyLow = Lowest[duration](Low)[1]

lastMonthBarIndex = BarIndex

monthlyPivot = (monthlyHigh + monthlyLow + Close[1]) / 3

// FIBONACCI SUPPORTS

monthlyS1 = monthlyPivot - .382 * (monthlyHigh - monthlyLow)

monthlyS2 = monthlyPivot - .618 * (monthlyHigh - monthlyLow)

monthlyS3 = monthlyPivot - 1 * (monthlyHigh - monthlyLow)

EndifMonthly pivot on the Dow Jones

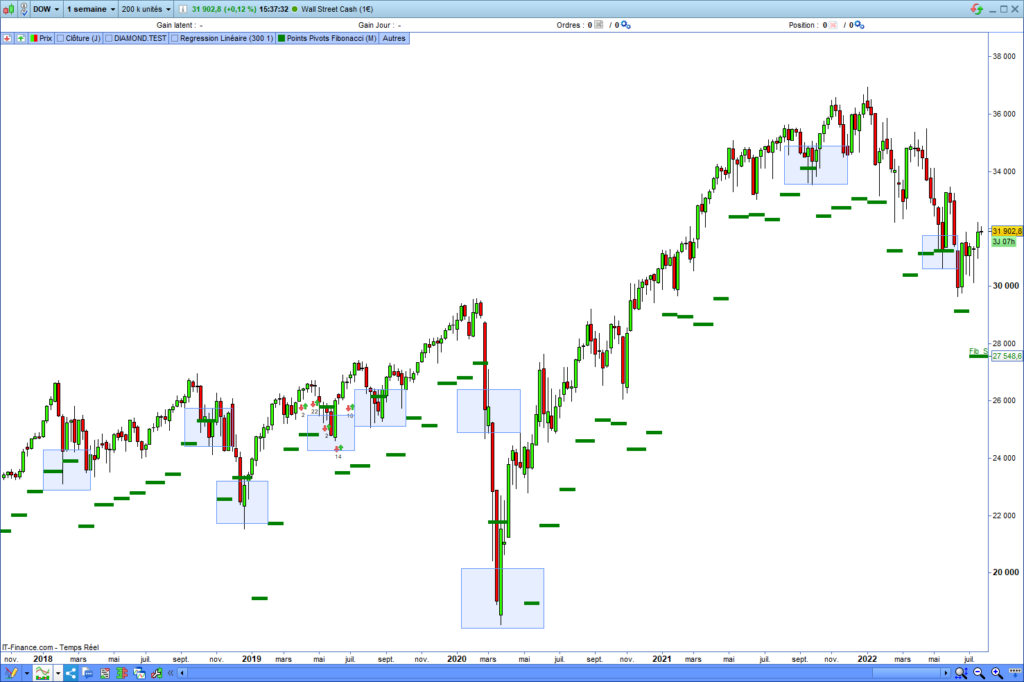

The following chart shows the area where the price closes under the thirty monthly support:

Buying conditions under the support

Now I will create the condition to open an entry under the monthly pivots. The following source code checks the price closes under the third monthly pivot :

conditionPivotFibo = close =< monthlyS3Evaluating the falling force

I never open an entry if the market too brutally crosses support. When the market is strongly bearish, it breaks most of the supports. Although this is a posteriori obvious, it is hard to predict where the market will bounce. Implementing a volatility indicator into your strategy is an excellent way to avoid opening a position during a significant drop. It is sufficient to wait until the market calms before opening an entry.

Volatility checking source code

You have to ensure the market has not broken the support too brutally. Numerous technical indicators can measure volatility. One of the most straightforward is the Bollinger bands. It draws inferior and superior bands around the price. These bands are standard deviations. The crossing of these bands expresses an increase in abnormal volatility.

The following source code checks the price does not cross these bands before opening an entry:

// * BOLLINGER BANDS * //

dev = 2 //quantity of deviation

avg = average[20](close) //mean

BollingUp = avg + std[20](close)*dev //Bollinger Up value

BollingDown = avg - std[20](close)*dev //Bollinger Up value

conditionVolatility = close < BollingUp AND close > BollingDownIV. Buy the dip signal system

I am going to present to you a backtest of a buy-the-dip strategy. This strategy is purely technical. It will give you buying signals during the dips without macroeconomic states. You will have to process this verification before opening a position. The source code of this signal system is runnable on the Prorealtime platform. It works like an indicator.

Source code of my buy-the-dip strategy

The technical conditions I use to buy the dip are simple: I open an entry only if the price closes under monthly support and the volatility is not excessive. The following source code sends a buying signal if the price closes under the third monthly pivot and if the price has not broken the Bollinger bands:

//------------------------------------------------------//

// *** BUY TH DIP STRATEGY ***

//------------------------------------------------------//

// Signal initialization

SIGNAL = 0

//------------------------------------------------------//

// * BOLLINGER BANDS * //

dev = 2 //quantity of deviation

avg = average[20](close) //mean

BollingUp = avg + std[20](close)*dev //Bollinger Up value

BollingDown = avg - std[20](close)*dev //Bollinger Up value

conditionVolatility = close < BollingUp AND close > BollingDown

//------------------------------------------------------//

// * FIBONACCI PIVOT POINTS * //

Once lastMonthBarIndex = 0

Once monthlyHigh = undefined

Once monthlyLow = undefined

Once monthlyPivot = undefined

Once monthlyR1 = undefined

Once monthlyS1 = undefined

Once monthlyR2 = undefined

Once monthlyS2 = undefined

Once monthlyR3 = undefined

Once monthlyS3 = undefined

If Month<>Month[1] then

duration = BarIndex - lastMonthBarIndex

IF duration <= 0 THEN

duration = 1

ENDIF

monthlyHigh = Highest[duration](High)[1]

monthlyLow = Lowest[duration](Low)[1]

lastMonthBarIndex = BarIndex

monthlyPivot = (monthlyHigh + monthlyLow + Close[1]) / 3

// FIBONACCI SUPPORTS

monthlyS1 = monthlyPivot - .382 * (monthlyHigh - monthlyLow)

monthlyS2 = monthlyPivot - .618 * (monthlyHigh - monthlyLow)

monthlyS3 = monthlyPivot - 1 * (monthlyHigh - monthlyLow)

Endif

//conditionPivotFibo = close =< monthlyS2

conditionPivotFibo = close =< monthlyS3

//------------------------------------------------------//

// *** ENTRY OPENING **//

IF conditionVolatility AND conditionPivotFibo THEN

SIGNAL = 1

ENDIF

RETURN SIGNAL AS "BUYTHEDIP"Buy the dip strategy backtesting

The following chart shows the dip openings on the Dow Jones index:

Buy the dip strategy analysis

This purely technical buy-the-dip strategy works as expected. It gives buying signals when the market breaks a monthly pivot if the volatility is not excessive.

If you run the previous source code for an extended period, you will see that the strategy opened up too soon during the 2008 crash. I seriously studied this problem with many trading strategies. I never find a technical indicator capable of predicting a market crash. Outside the Corona crash, which was particularly violent, it is impossible to differentiate a dip from the start of a market crash. That is why I integrated the macroeconomic analysis into my strategy.

V. Building a position during a dip

I use this buy-the-dip strategy like a signal system. I start to build a position in a dip only if the macroeconomic and technical are met. I discretionary decide whether to take the buying signal or not. Sometimes I leave a bit of time before opening an entry. I will buy the dip if the market and macroeconomics are still valid. If the conditions deteriorate, I will stop to buy the market. That allows me to manage my risk exposure depending on the evolution of the situation. I fixed the entry size, habitually between 500€ and 1000€. The maximum size of my position is around 10000€ by assets. I prefer to take time to build a position before completing a line. Depending on the asset, I open new entries each month or quarter.

I am building a position on the Euro stocks 50, the “Personal & Household Goods” and the “Consumer Staples” ETFs. I did not take all the signals sent by my system for some weeks. On the following chart, the blue line corresponds to my entry price on the Personal & Household Goods ETF:

Buy the dip Summary

Buying the dip needs to be prudent. Here is the synthesis of the stages of buying the dip:

- Evaluating the severity of the bear market cause.

- Identify the main supports and wait for a decrease in market volatility.

- Focusing on main indexes or defensive assets.

- Building a position progressively, depending on the evolution of the market.

Range Breakout Indicator for Prorealtime [FREE]

The Range Breaker will help you seize the best trading opportunities. It detects range breakouts, which are often followed by explosive movements. Thanks to this indicator, you will never miss a breakout again.

Pingback: The 10 golden rules for buying the dip

Pingback: How to benefit from the pullbacks on the market?