Knowing what to buy during a bear market is very hard. All the assets decrease, even those considered a safe haven like gold. In an increasing rate paradigm, government bonds like the US Treasury fall! Despite this global sense of gloom, there are opportunities to seize if you remain vigilant. In this post, I will present the ETFs I buy during a bear market in a long-term way.

What is an ETF?

ETF means “Exchange Traded Fund.” An ETF is a financial derivative that allows you to purchase a basket of stocks simultaneously. ETFs are regulated products overseen by market authorities such as the SEC or ESMA. These financial products are designed for long-term investment purposes. You can trade them from any broker.

What should you consider before buying ETFs?

Numerous articles explain how to choose an ETF and what details to consider. Most of the time, these posts focus on annual fees or performance compared to a benchmark.

I do not attach much importance to these details. What matters most is the composition of the ETF. I mean the included stocks and in what proportion. The second property I watch is the geographical exposure of the ETF. I want to know which countries most of ETF’s stocks are listed in.

The prudence rules to respect before buying a bear market

While in a bear or highly volatile market, you should be particularly vigilant about the assets you own or wish to buy from a long-term perspective. When a market crash occurs, unexpected opportunities appear, but tolerating a significant latent loss is psychologically challenging. You should go cautiously on this.

The following four rules could help you to better invest:

- The first rule is not to open a too big entry once. It is better to build a position incrementally.

- The second is to space your entry openings because we never know how many times the market will decrease.

- The third will be to choose defensive assets, meaning companies having solid fundamentals.

- The fourth rule is to favor low-beta assets, which is often the case with defensive stocks.

For further information, I published a post titled ’10 Rules for Buying the Dip Safely,’ in which I provide a comprehensive technical solution.

My three favorite ETFs that I buy during a bear market

My three preferred ETFs are the only ones that correspond to the previous prudential rules. It is the “iShares STOXX Europe 600 Personal & Household Goods“, the “iShares MSCI World Consumer Staples“, and the “iShares STOXX Europe 600 Food & Beverage“.

Composition of the ETFs

The composition of an ETF is certainly the first feature you should consider before making a decision. You will find this information on the official site of the ETF provider in the “Holdings” section. The holdings of an ETF make its strength and determine its behavior during troubled periods. I will expose the first ten companies of the Personal & Household, Consumer Staples, and Food & Beverage ETFs.

iShares STOXX Europe 600 Personal & Household Goods

The Fund seeks to track the performance of an index composed of companies from the European Personal and Household Goods sector.

| Companies | Proportion |

|---|---|

| LVMH MOET HENNESSY LOUIS VUITT | 19,08% |

| UNILEVER PLC ORD | 13,42% |

| L OREAL S.A. | 9,87% |

| BRITISH AMERICAN TOBACCO ORD | 9,76% |

| CIE FINANCIERE RICHEMONT AG ZUG ORD | 6,78% |

| RECKITT BNCSR GRP ORD | 6,35% |

| HERMES INTL ORD | 4,92% |

| KERING SA | 4,31% |

| ADIDAS ORD | 3,94% |

| IMPERIAL BRANDS PLC ORD | 2,17% |

iShares MSCI World Consumer Staples

The iShares MSCI World Consumer Staples Sector UCITS ETF USD (Dist) aims to track the MSCI World Consumer Staples index, which in turn tracks the consumer staples sector across developed markets worldwide.

| Companies | Proportion |

|---|---|

| PROCTER & GAMBLE | 9.04% |

| NESTLE SA | 7.50% |

| COSTCO WHOLESALE CORP | 6.24% |

| WALMART INC | 6.21% |

| COCA-COLA | 5.94% |

| PEPSICO INC | 5.82% |

| PHILIP MORRIS INTERNATIONAL INC | 3.58% |

| UNILEVER PLC | 3.03% |

| LOREAL SA | 2.62% |

| MONDELEZ INTERNATIONAL INC CLASS A | 2.35% |

iShares STOXX Europe 600 Food & Beverage

The Fund seeks to track the performance of an index composed of companies from the European food and beverage sector.

| Compagnies | Proportion |

|---|---|

| NESTLE SA ORD | 29,82% |

| DIAGEO ORD | 15,78% |

| ANHEUSER-BUSCH INBEV SA/NV ORD | 8,84% |

| PERNOD-RICARD ORD | 7,23% |

| GROUPE DANONE ORD | 6,74% |

| KONINKLIJKE DSM ORD | 5,04% |

| HEINEKEN ORD | 4,04% |

| KERRY GROUP ORD | 2,97% |

| LINDT SPRUENGLI ORD | 2,24% |

| MOWI ASA ORD | 2,21% |

Geographical exposure

Here are the geographical exposures of the « iShares STOXX Europe 600 Personal & Household Goods » and the « iShares STOXX Europe 600 Food & Beverage » ETFs:

iShares STOXX Europe 600 Personal & Household Goods

| Countries | Proportion |

|---|---|

| France | 39,45% |

| Grande-Bretagne | 36,40% |

| Suisse | 7,61% |

| Allemagne | 7,56% |

iShares MSCI World Consumer Staples

| Countries | Proportion |

|---|---|

| United States | 59.79% |

| United Kingdom | 10.67% |

| Switzerland | 8.60% |

| Japan | 5.24% |

| France | 4.78% |

iShares STOXX Europe 600 Food & Beverage

| Countries | Proportion |

|---|---|

| Suisse | 34,18% |

| Grande-Bretagne | 18,30% |

| France | 14,72% |

| Pays-Bas | 11,01% |

A low five-year beta

Here is the beta of these ETFs compared to the S&P 500 index. The following betas are calculated on the last five years:

| ETF | Beta 5Y |

|---|---|

| iShares STOXX Europe 600 Personal & Household Goods | 0,9 |

| iShares MSCI World Consumer Staples | 0.74 |

| iShares STOXX Europe 600 Food & Beverage | 0,7 |

Summary

I consider these three ETFs to be the most suitable for building a long-term portfolio during a bear market. Most stocks that make up the “Personal & Household Goods”, “MSCI World Consumer Staples”, and the “Food & Beverage” are defensive values. They always survived the stock-market storms. The geographical exposure is distributed between the United States and the wealthiest European countries, which enhances security. The 5Y-beta is lower than one, which reduces the risk. However, it would help if you always stayed prudent during a bear market. It would be best if you did not open a position that is too big. Nobody knows how much a bear market will decrease.

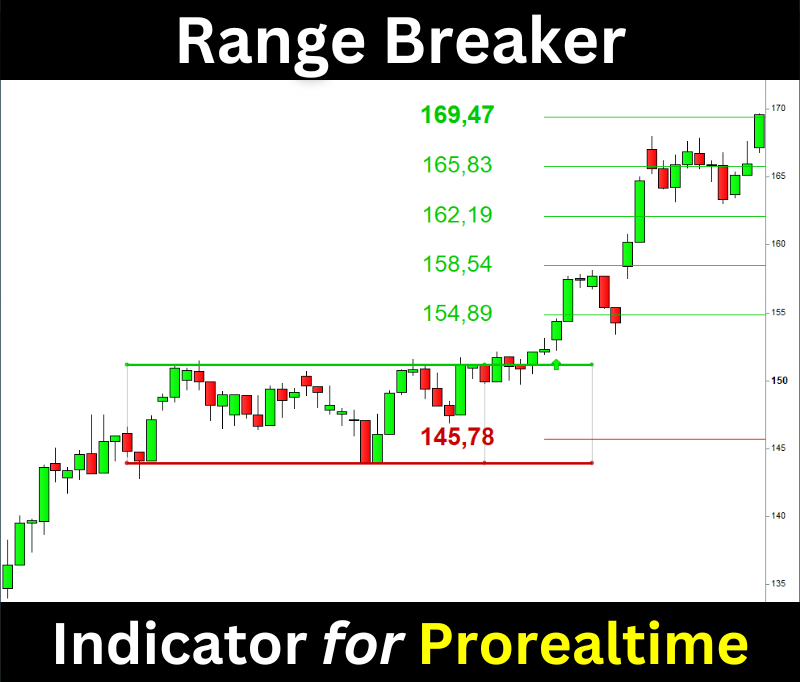

Range Breakout Indicator for Prorealtime

The Range Breaker will help you trade the Range Breakouts on Prorealtime. It displays the ranges, breakout signals, and target prices on your chart.

Credit images:

https://www.pexels.com/photo/assorted-color-umbrellas-1486861/

https://www.pexels.com/photo/letter-tiles-arranged-in-text-stay-home-on-table-4200746/