Hello and welcome to Artificall. 😀

My name is Vivien. I’m a trader and software developer. I’ve been programming indicators and screeners for over seven years on the Prorealtime platform.

I share my knowledge in the learning section. You’ll discover trading strategies and tips for success.

I created indicators and screeners to help you seize the best market opportunities. They will give you buy and sell signals with exit conditions.

➡️ You’ll have everything you need to trade all types of markets. 😉

Discover Profitable Strategies for Prorealtime

Finding a profitable trading strategy is challenging. It requires a lot of work. However, it is the key to your success. I regularly publish articles on strategies that I consider profitable enough. This will help you find the right one for you:

Building a robust trader bot step-by-step

I wrote this book to help you design your trading system using Prorealtime

As a first step, I provide you with the theoretical and conceptual basis you need to develop trading algorithms. Then, step-by-step, I will lead you in programming your trading bot. After that, a chapter about the backtest analysis will explain how to reduce the risk of overfitting.

Find the most profitable trading opportunities

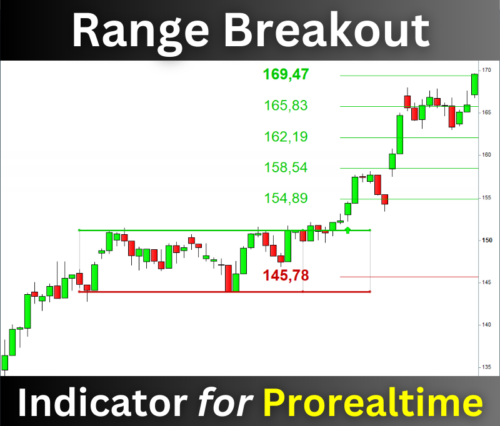

The Ultimate Breaker will help you trade the most profitable patterns. It detects the breakouts of the best figures, often followed by explosive price movements.

The indicator displays signals, targets, and stoploss. It works with all the assets in any time unit.