Finding a trading strategy can be challenging and time-consuming due to the numerous possibilities. However, I discovered a way to quickly find a trading strategy thanks to decision trees and the MFE/MAE ratio on the Prorealtime platform. I hope this post will help you save a lot of time in your trading strategies research.

What is a decision tree?

Decision tree definition

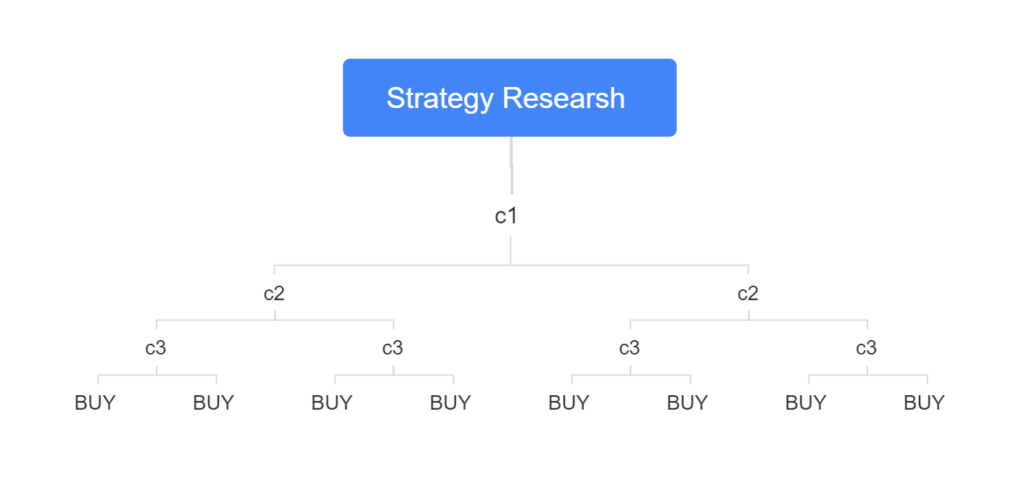

Decision trees are a category of trees used in data exploration and business intelligence. They give a hierarchical representation of data in the form of sequences of decisions.

The decision trees will help you compute all possible combinations of conditions that allow an entry opening.

There are three categories of nodes on a decision tree: the root node, the internal nodes, and the leaves.

Root node

The root node is the highest node of the decision tree. It is the gateway of a tree.

Internal nodes

The internal nodes begin just under the root node. All these nodes have child nodes that can be another internal node or a leaf.

Leaf nodes

These nodes have no children. They correspond to a final decision. Each leaf is a decision representing a possible combination that we want to test.

Decision tree modeling

We will design the modeling of the decision tree from the set of possible values that we will test :

On the above decision tree, you have to imagine that you are focused on a non-leaf node :

- To test a TRUE condition, go down one floor toward the right.

- If you want to test a false condition, you go down one floor toward the left.

For example, all the left conditions on the decision tree (c1, c2, and c3) represent all false conditions: “NOT c1 AND NOT c2 AND NOT c3”.

The leaf nodes represent the decision that we will make. Since we search long entry points, the decision that we will make is “BUY”.

Find an entry point from technical indicators

You can use decision trees for modeling the possible values of a global entry opening condition. This condition will be defined from a set of technical indicators.

Principal technical indicators

There are four principal categories of technical indicators: trend, momentum, volume, and volatility.

| TREND | MOMENTUM | VOLUME | VOLATILITY |

|---|---|---|---|

| Moving averages Exponential moving average (EMA) Moving average Convergence divergence (MACD) Parabolic stop and reverse (Parabolic SAR) Linear regression Polynomial regression | Stochastic momentum Index (SMI) Commodity channel index (CCI) Relative strength index (RSI) | Volume Chaikin oscillator Onbalance volume (OBV) Volume rate of change | Bollinger bands Average true range Standard deviation Standard error |

For example, I randomly chose three technical indicators from I defined three intermediate conditions :

// Definition of unitary conditions to test

c1 = RSI[14] > 30

c2 = MACD [12,26,9] > 0

c3 = LinearRegressionSlope[10](close) > 0

We will test all the possibilities of these three conditions (c1, c2, and c3) in a global entry opening condition :

conditionDecisionTree = c1 AND NOT c2 AND c3Truth table

Turn the decision tree into a truth matrix

We can represent the set of possibilities the decision tree gives in a truth matrix. In the following table, the “0” value represents “FALSE” and the “1” value represents “TRUE” :

| c1 | c2 | c3 |

|---|---|---|

| 0 | 0 | 0 |

| 0 | 0 | 1 |

| 0 | 1 | 0 |

| 0 | 1 | 1 |

| 1 | 0 | 0 |

| 1 | 0 | 1 |

| 1 | 1 | 0 |

| 1 | 1 | 1 |

Translation of the truth table into runnable code

It is easy to translate the truth table into Prorealtime code. We have to replace “0” with “NOT condition” and “1” with “condition”.

| c1 | c2 | c3 |

|---|---|---|

| NOT c1 | NOT c2 | NOT c3 |

| NOT c1 | NOT c2 | C3 |

| NOT c1 | c2 | NOT c3 |

| NOT c1 | c2 | c3 |

| c1 | NOT c2 | NOT c3 |

| c1 | NOT c2 | C3 |

| c1 | c2 | NOT c3 |

| c1 | c2 | C3 |

Now we can easily build all the conditions that we want to test.

Build the conditions of the trading system

To build all the conditions, inserting the “AND” keyword between each condition from the truth table is sufficient. In this way, we will obtain the global condition allowing entry opening :

conditionDecisionTree = NOT c1 AND NOT c2 AND NOT c3

conditionDecisionTree = NOT c1 AND NOT c2 AND C3

conditionDecisionTree = NOT c1 AND c2 AND NOT c3

conditionDecisionTree = NOT c1 AND c2 AND c3

conditionDecisionTree = c1 AND NOT c2 AND NOT c3

conditionDecisionTree = c1 AND NOT c2 AND C3

conditionDecisionTree = c1 AND c2 AND NOT c3

conditionDecisionTree = c1 AND c2 AND C3

We can successfully test each possibility to observe whether one of the combinations presents an arbitrage opportunity.

For that, we have to define a cursor with a value beginning from 1 to 8. We will use this cursor in the condition “if cursor=x then” to test each “conditionDecisionTree “ possibility :

IF cursor=1 THEN

conditionDecisionTree = NOT c1 AND NOT c2 AND NOT c3

ENDIF

On the page below, I provide you with the complete source code to find a strategy using three technical indicators.

Long trading strategy research

To begin, I will only try to buy each condition previously given to see if the three chosen technical indicators are efficient for a long strategy.

Code to research a long trading strategy

DEFPARAM CUMULATEORDERS = false

DEFPARAM FLATBEFORE = 090000

DEFPARAM FLATAFTER = 213000

// Définition des conditions unitaires à tester

c1 = RSI[14] > 30

c2 = MACD [12,26,9] > 0

c3 = LinearRegressionSlope[10](close) > 0

// Parcourir l'arbre de décision

IF cursor=1 THEN

conditionDecisionTree = NOT c1 AND NOT c2 AND NOT c3

ENDIF

IF cursor=2 THEN

conditionDecisionTree = NOT c1 AND NOT c2 AND C3

ENDIF

IF cursor=3 THEN

conditionDecisionTree = NOT c1 AND c2 AND NOT c3

ENDIF

IF cursor=4 THEN

conditionDecisionTree = NOT c1 AND c2 AND c3

ENDIF

IF cursor=5 THEN

conditionDecisionTree = c1 AND NOT c2 AND NOT c3

ENDIF

IF cursor=6 THEN

conditionDecisionTree = c1 AND NOT c2 AND C3

ENDIF

IF cursor=7 THEN

conditionDecisionTree = c1 AND c2 AND NOT c3

ENDIF

IF cursor=8 THEN

conditionDecisionTree = c1 AND c2 AND C3

ENDIF

// Ouvrir une position

IF NOT LongOnMarket AND conditionDecisionTree THEN

BUY 1 CONTRACT AT MARKET

ENDIF

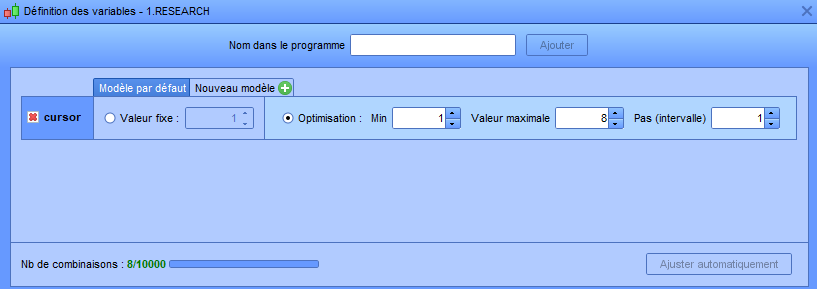

Long Trading strategy test running

To run a test, you have to create a new automated trading system on the Prorealtime platform and copy-paste the previous code source.

After that, you have to open the optimizer of the variables. I present to you this functionality in the chapter “Optimizer of the variables” of my book. This tool allows you to test a range of values of a variable.

We will run the optimizer of the variables on the “cursor” variable varying its value from 1 to 8. Thus, we can cover all possible cases of the global condition “conditionDecisionTree “.

Now we can run the test like a normal strategy.

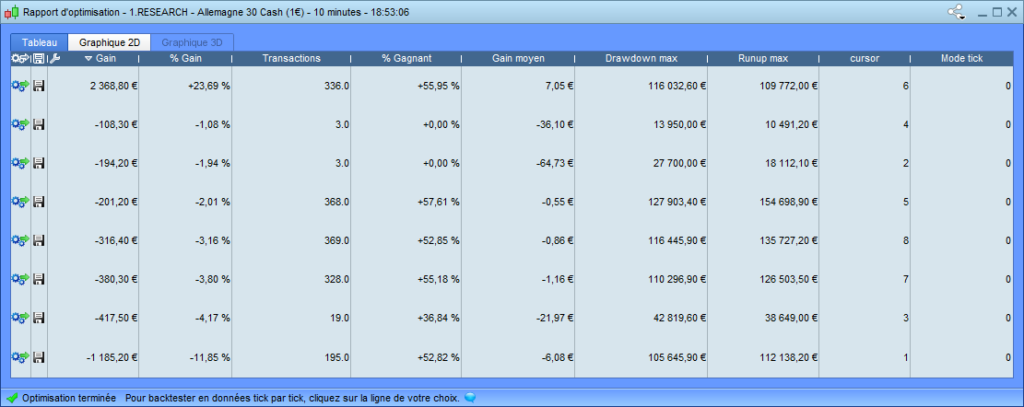

Interpretation of the result

Having launched the process, the optimizer of the variables prints the result for each value of the “cursor” variable corresponding to each tested combination.

The optimizer will naturally sort the result by performance :

The MFE / MAE ratio

Estimate the profitability of a strategy

As I mentioned in the chapter “Tactic and strategy meshing” of my book, the performance of a strategy depends on the entry, stop, and target positioning.

We will utilize the MFE, the MAE, and the average MFE/MAE to address this issue. These three indicators are available on the Prorealtime platform.

Max Favorable Execution

The MFE corresponds to the most significant latent gain, while the position. The average MFE is the average of the MFE of the backtested strategy. This is the average of the maximal latent profits of the strategy.

Max Adverse Execution

The MAE corresponds to the most significant latent loss, while the position. The average MAE is the average of the MAE of the backtested strategy. This is the average of the maximal latent losses of the strategy.

The average MFE / MAE indicator

The average MFE / MAE prints the MFE and the MAE on a graphic bar.

The MFE / MAE ratio

MFE / MAE ratio = MFE / MAE

You can easily validate the efficiency of an entry point thanks to the MFE / MAE ratio. If the MFE / MAE ratio is greater than 1, the average of latent profits is greater than the average of latent losses.

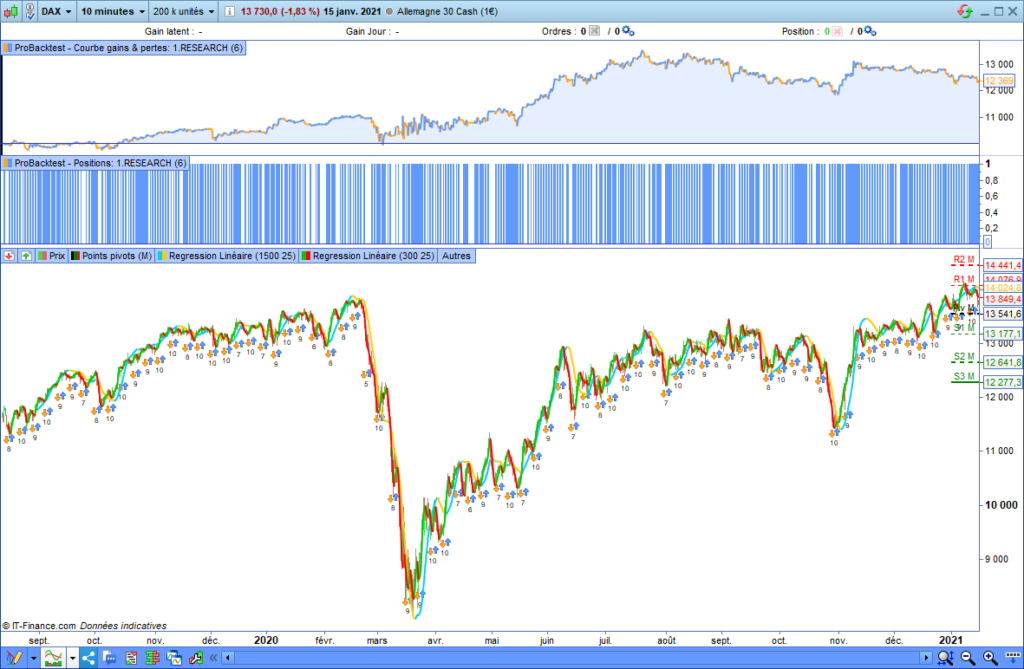

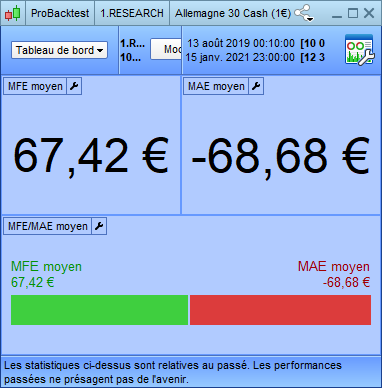

Backtest interpretation

To simplify the test result reading, I created a specific report that only contains the MFA, the MAE, and the average MFE / MAE indicators:

To create a specific report, you have to click on the tool key on the top right of the default report:

Then click on the green cross button to create a new report:

After that, you have to name and save the new model.

We can observe that despite the performance of 23.69%, the MFE is lower than the MAE.

MFE / MAE ratio:

MFE / MAE ratio = 67.42 / 68.68

MFE / MAE ratio = 0.98

The MFE/MAE ratio is lower than 1; thus, the tested combination is not effective.

However, the fact that the MFE and the MAE are close gives us hope that we will eventually have the opportunity to create a profitable automated trading system. Besides, we should try to see if latent profits appear before latent losses. We should also analyze each entry point of this strategy.

Short trading strategy Research

Because the MFE / MAE ratio is lower than 1, I will remake the previous research process on the three technical indicators that I presented at the beginning of this chapter for a short-selling strategy.

For that, I will replace the “BUY” instruction with “SELLSHORT” in the source code :

// Open a short entry

IF NOT ShortOnMarket AND conditionDecisionTree THEN

SELLSHORT 1 CONTRACT AT MARKET

ENDIF

Note about source code

You may be remarked that I also replaced the “NOT LongOnMarket” instruction with “NOT ShortOnMarket”. I will explain this instruction later in my book’s chapter, “Position status of your system”.

Remember that this instruction disallows a new short entry opening if the system has already opened a short entry and has not closed it.

You can view the source code research on the page below, which includes a brief entry from the three technical indicators I selected at the beginning of this chapter.

Code to research a short trading strategy

DEFPARAM CUMULATEORDERS = false

DEFPARAM FLATBEFORE = 090000

DEFPARAM FLATAFTER = 213000

// Définition des conditions unitaires à tester

c1 = RSI[14] > 30

c2 = MACD [12,26,9] > 0

c3 = LinearRegressionSlope[10](close) > 0

// Parcourir l'arbre de décision

IF cursor=1 THEN

conditionDecisionTree = NOT c1 AND NOT c2 AND NOT c3

ENDIF

IF cursor=2 THEN

conditionDecisionTree = NOT c1 AND NOT c2 AND C3

ENDIF

IF cursor=3 THEN

conditionDecisionTree = NOT c1 AND c2 AND NOT c3

ENDIF

IF cursor=4 THEN

conditionDecisionTree = NOT c1 AND c2 AND c3

ENDIF

IF cursor=5 THEN

conditionDecisionTree = c1 AND NOT c2 AND NOT c3

ENDIF

IF cursor=6 THEN

conditionDecisionTree = c1 AND NOT c2 AND C3

ENDIF

IF cursor=7 THEN

conditionDecisionTree = c1 AND c2 AND NOT c3

ENDIF

IF cursor=8 THEN

conditionDecisionTree = c1 AND c2 AND C3

ENDIF

// Ouvrir une position courte

IF NOT ShortOnMarket AND conditionDecisionTree THEN

SELLSHORT 1 CONTRACT AT MARKET

ENDIF

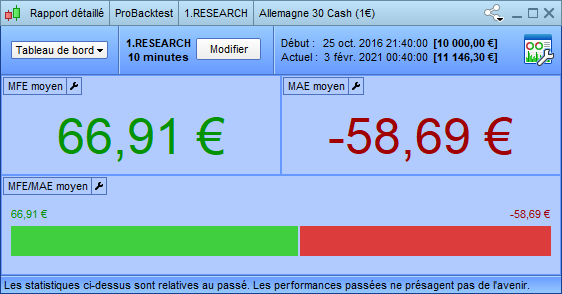

Running and interpretation of the results of the short strategy

The running of this test is like the previous long test.

The optimizer of the variables selected for the first combination for the cursor value is 1. The performance of this combination is 11.46%.

This combination corresponds to the following condition :

conditionDecisionTree = NOT c1 AND NOT c2 AND NOT c3This result is interesting, even if the performance is only 11.46% on the period, the MFE / MAE ratio is more positive than the initial long strategy :

We can eventually conclude that the three initially selected conditions give a better potential for a return to a sell-shorting strategy than a long strategy.

Strategy research summary

- The decision tree data structure can help you represent all combinations of technical indicators.

- The MFE / MAE ratio is a good indicator of whether an entry point is exploitable quickly.

- The MFE / MAE ratio should be greater than 1 to validate the earnings potential of a strategy.

- If the MFE / MAE ratio of a long strategy is lower than 1, then the MFE / MAE ratio should be greater than 1 if you short these same entries.

To go further

Find a trading strategy from more technical indicators

In my book on automated trading, I provide codes to find a strategy using four and five technical indicators.

Sources

- Decision tree: https://en.wikipedia.org/wiki/Decision_tree

- Combinations and Permutations: https://www.mathsisfun.com/combinatorics/combinations-permutations.html

- Trading strategy papers: https://www.academia.edu/Documents/in/Trading_Strategies

Primary image source: https://www.maxpixel.net/Experiment-Flat-Laboratory-Chemistry-Science-5379250

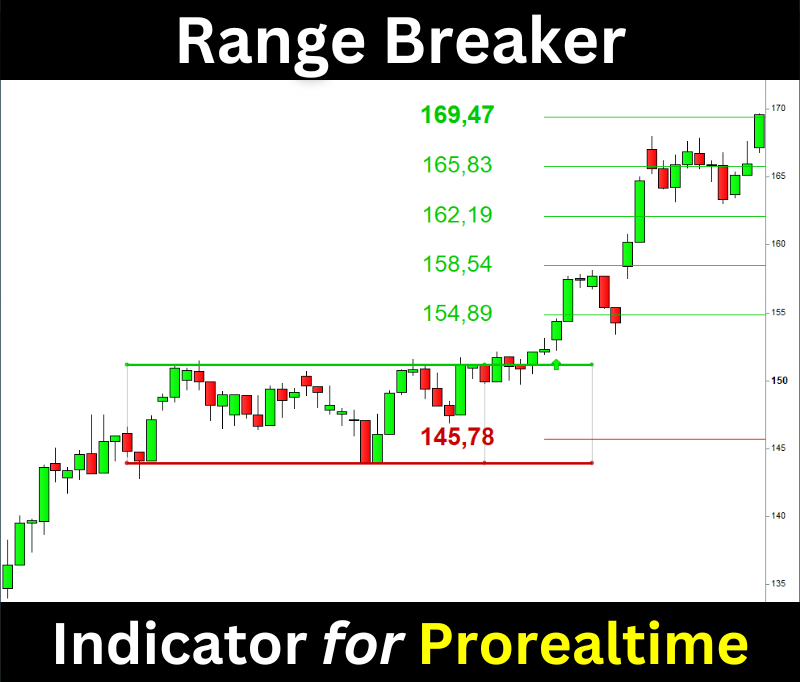

Range Breakout Indicator for Prorealtime

The Range Breaker will help you trade the Range Breakouts on Prorealtime. It displays the ranges, breakout signals, and target prices on your chart.