In a world increasingly reliant on connectivity, Silicon Laboratories Inc. revolutionizes how we interact with technology daily. As a frontrunner in the semiconductor industry, Silicon Labs excels with its innovative analog-intensive mixed-signal solutions that power everything from smart homes to medical devices. With a reputation for quality and cutting-edge design, I find myself questioning whether the company’s promising growth trajectory and robust fundamentals still justify its current market valuation.

Table of contents

Company Description

Silicon Laboratories Inc. (NASDAQ: SLAB), founded in 1996 and headquartered in Austin, Texas, is a leading fabless semiconductor company specializing in analog-intensive mixed-signal solutions. With a market cap of approximately $4B, Silicon Labs develops innovative wireless microcontrollers and sensor products that address a wide array of Internet of Things (IoT) applications, such as connected home devices, industrial automation, and medical instrumentation. Operating primarily in the U.S. and China, the company leverages a diverse sales strategy that includes direct sales and a network of distributors. Through its commitment to innovation and robust ecosystem, Silicon Laboratories plays a pivotal role in advancing the semiconductor industry, particularly in the burgeoning IoT space.

Fundamental Analysis

In this section, I will analyze Silicon Laboratories Inc.’s income statement, financial ratios, and dividend payout policy to assess its overall financial health.

Income Statement

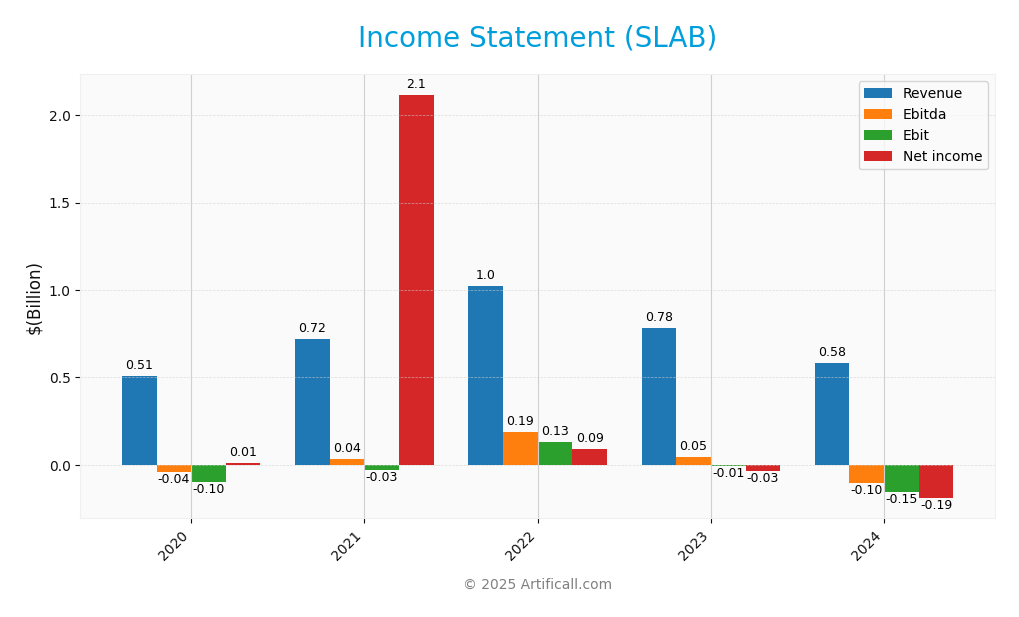

Below is the Income Statement for Silicon Laboratories Inc. (SLAB), illustrating the company’s financial performance over the last five fiscal years.

| Item | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 511M | 721M | 1.024B | 782M | 584M |

| Cost of Revenue | 216M | 295M | 382M | 322M | 272M |

| Operating Expenses | 402M | 458M | 523M | 485M | 478M |

| Gross Profit | 295M | 425M | 643M | 460M | 312M |

| EBITDA | -39M | 35M | 190M | 46M | -105M |

| EBIT | -98M | -27M | 133M | -5M | -154M |

| Interest Expense | 34M | 31M | 7M | 6M | 1M |

| Net Income | 12M | 2.118B | 91M | -34M | -191M |

| EPS | 0.29 | 49.44 | 2.61 | -1.09 | -5.93 |

| Filing Date | 2021-02-03 | 2022-02-02 | 2023-02-01 | 2024-02-20 | 2025-02-04 |

Interpretation of Income Statement

Over the analyzed period, we can observe a significant decline in both Revenue and Net Income, particularly from 2022 to 2024. Revenue decreased from 1.024B in 2022 to just 584M in 2024, indicating a challenging market environment. The Net Income trend reflects this downturn, transitioning from a profit of 91M in 2022 to a loss of 191M in 2024. Margins have also been under pressure; Gross Profit has decreased, resulting in negative EBITDA and EBIT in the latest fiscal year, signaling operational inefficiencies. Overall, SLAB’s performance in 2024 highlights the necessity for strategic adjustments to regain profitability.

Financial Ratios

The following table presents key financial ratios for Silicon Laboratories Inc. (SLAB) over recent fiscal years.

| Metrics | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 1.41% | -9.93% | 8.93% | -4.41% | -32.69% |

| ROE | 1.04% | -3.24% | 6.51% | -2.86% | -17.69% |

| ROIC | 1.70% | -1.22% | 4.18% | -3.17% | -18.15% |

| P/E | 444.84 | -123.47 | 52.08 | -121.88 | -21.53 |

| P/B | 4.65 | 3.99 | 3.39 | 3.48 | 3.81 |

| Current Ratio | 3.43 | 3.35 | 7.87 | 4.51 | 6.15 |

| Quick Ratio | 3.20 | 3.27 | 7.33 | 3.32 | 5.07 |

| D/E | 0.47 | 0.20 | 0.38 | 0.05 | 0.01 |

| Debt-to-Assets | 28.26% | 15.23% | 24.41% | 4.49% | 1.27% |

| Interest Coverage | 1.12 | -0.87 | 17.74 | -4.35 | -126.33 |

| Asset Turnover | 0.44 | 0.24 | 0.47 | 0.54 | 0.48 |

| Fixed Asset Turnover | 6.36 | 4.92 | 6.74 | 5.36 | 4.42 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

Analyzing Silicon Laboratories Inc. (SLAB), I observe several key financial ratios that reflect its current health. The liquidity ratios are robust, with a current ratio of 6.15 and a quick ratio of 5.07, indicating strong short-term financial stability. However, profitability ratios are concerning; the net profit margin stands at -32.69%, suggesting ongoing operational challenges. The solvency ratio is negative at -0.998, highlighting potential financial risk. Despite a strong cash ratio of 2.88, the debt to equity ratio is low at 0.014, showing limited reliance on debt. Overall, while liquidity appears strong, profitability issues warrant caution for potential investors.

Evolution of Financial Ratios

Over the past five years, SLAB’s financial ratios have shown a concerning trend. The current ratio has fluctuated, peaking at 7.87 in 2022, while profitability ratios have declined significantly, with the net profit margin dropping from 8.93% in 2022 to -32.69% in 2024, indicating deteriorating operational performance.

Distribution Policy

Silicon Laboratories Inc. (SLAB) does not pay dividends, reflecting its ongoing reinvestment strategy aimed at fostering high growth and innovation. The company is in a phase prioritizing research and development, which can be essential for long-term value creation. Additionally, SLAB has engaged in share buybacks, indicating a commitment to returning capital to shareholders. However, the absence of dividends may raise concerns about sustainability and risk management, especially given its negative net income. Overall, this distribution approach aligns with a growth-focused strategy but requires careful monitoring of financial health.

Sector Analysis

Silicon Laboratories Inc. operates in the semiconductor industry, specializing in analog-intensive mixed-signal solutions, with a strong focus on IoT applications and a competitive edge through innovation and diverse product offerings.

Strategic Positioning

Silicon Laboratories Inc. (SLAB) holds a competitive position in the semiconductor industry, focusing on analog-intensive mixed-signal solutions. With a market cap of approximately $4B, the company faces significant competitive pressure, particularly from larger players in the IoT sector. As of now, SLAB has carved out a niche in wireless microcontrollers and sensor products, critical for applications ranging from smart home devices to industrial automation. However, ongoing technological disruptions and rapid advancements in the semiconductor space necessitate continual innovation and adaptation to maintain market share.

Revenue by Segment

The pie chart below illustrates the revenue distribution by segment for Silicon Laboratories Inc. (SLAB) over the fiscal years 2022 to 2024.

In recent years, the “Industrial & Commercial” segment has shown a downward trend, with revenues decreasing from 573M in 2022 to 339M in 2024. This decline indicates a potential shift in demand or increased competition in this area. The previous segments, such as “Infrastructure” and “Internet of Things,” are not represented in the latest data, highlighting a narrowing focus. The most recent year’s performance underscores a significant contraction, raising concerns about margin pressures and the need for strategic pivots to revive growth in this segment.

Key Products

Silicon Laboratories Inc. offers a range of innovative products tailored for various applications in the semiconductor industry. Below is a table highlighting some of their key products:

| Product | Description |

|---|---|

| Wireless Microcontrollers | These are low-power, highly integrated microcontrollers designed for IoT applications, enabling seamless wireless connectivity. |

| Sensor Products | Silicon Labs provides advanced sensor solutions that are essential for smart home and industrial applications, enhancing automation and control. |

| Smart Lighting Solutions | Innovative solutions that enable energy-efficient lighting systems, integrated with sensors and connectivity features for smart environments. |

| Smart Metering Devices | These devices facilitate real-time monitoring and management of energy consumption, crucial for utilities and consumers alike. |

| Asset Tracking Solutions | Products designed to optimize the tracking and management of assets in various industries, improving efficiency and reducing losses. |

These products reflect Silicon Laboratories’ commitment to delivering high-quality, cutting-edge technology for a diverse set of applications.

Main Competitors

No verified competitors were identified from available data. However, Silicon Laboratories Inc. (SLAB) operates within the semiconductor industry, focusing on analog-intensive mixed-signal solutions. The company is estimated to hold a notable market share in the IoT sector, which encompasses various applications such as connected home devices, industrial automation, and medical instrumentation.

Competitive Advantages

Silicon Laboratories Inc. (SLAB) holds a strong competitive position in the semiconductor industry, particularly in analog-intensive mixed-signal solutions. Its innovative wireless microcontrollers and sensor products cater to a diverse array of applications within the Internet of Things (IoT) sector, including smart home devices and industrial automation. The company’s commitment to R&D allows for the continuous introduction of new products, which enhances its market reach. Looking ahead, opportunities in emerging markets and advancements in smart technologies position SLAB to capitalize on future growth, making it an attractive option for investors seeking long-term value.

SWOT Analysis

This SWOT analysis aims to evaluate the internal and external factors influencing Silicon Laboratories Inc. (SLAB) as a potential investment.

Strengths

- Strong market position in semiconductors

- Diverse product portfolio

- Innovative technology focus

Weaknesses

- Limited dividend history

- Dependence on specific markets

- High competition in the industry

Opportunities

- Growth in IoT applications

- Expansion into emerging markets

- Strategic partnerships for innovation

Threats

- Economic downturns affecting demand

- Rapid technological changes

- Supply chain vulnerabilities

In summary, Silicon Laboratories Inc. possesses a robust market position and innovative capabilities, presenting promising growth opportunities. However, potential investors should remain cautious of the competitive landscape and market dependencies that may impact performance.

Stock Analysis

Over the past year, Silicon Laboratories Inc. (SLAB) has exhibited notable stock price movements, characterized by a bullish trend despite recent fluctuations. The trading dynamics reveal a complex interplay between buyers and sellers, impacting the overall investor sentiment.

Trend Analysis

Analyzing the stock’s performance over the last 12 months, SLAB has experienced a percentage change of +1.55%. This indicates a bullish trend, although it is important to note that the trend is currently in a state of deceleration. The stock has reached notable highs of 155.33 and lows of 89.82, with a standard deviation of 13.72 suggesting moderate volatility. This combination of factors reflects a market that is stabilizing but not without its recent challenges.

Volume Analysis

In the last three months, the total trading volume for SLAB has been 199.7M, with buyer volume at 98.9M and seller volume at 99.6M. The volume trend is decreasing, and the activity appears seller-driven, as indicated by a buyer dominance percentage of only 49.52%. This suggests a cautious investor sentiment, with a current market environment leaning more towards selling pressure rather than buying enthusiasm.

Analyst Opinions

Recent analyst recommendations for Silicon Laboratories Inc. (SLAB) indicate a consensus sell rating. Analysts have assigned a C- rating, highlighting concerns regarding weak return on equity and assets, alongside a high debt-to-equity ratio. Analysts suggest that the company’s current valuation might not justify its growth potential, leading to a cautious outlook. Given these factors, I recommend investors closely monitor SLAB’s performance and consider alternative opportunities in the market.

Stock Grades

The latest stock ratings for Silicon Laboratories Inc. (SLAB) indicate a consistent outlook from various reputable grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Susquehanna | Maintain | Neutral | 2025-08-06 |

| Morgan Stanley | Maintain | Equal Weight | 2025-08-06 |

| Barclays | Maintain | Equal Weight | 2025-08-05 |

| Susquehanna | Maintain | Neutral | 2025-07-22 |

| Stifel | Maintain | Buy | 2025-07-18 |

| Keybanc | Maintain | Overweight | 2025-07-08 |

| Benchmark | Maintain | Buy | 2025-05-27 |

| Needham | Maintain | Buy | 2025-05-14 |

| Benchmark | Maintain | Buy | 2025-05-14 |

| Susquehanna | Maintain | Neutral | 2025-05-14 |

Overall, the trend in grades for SLAB shows a mix of “Buy” and “Neutral” ratings, with a few “Overweight” assessments. This suggests a cautious but steady sentiment among analysts, indicating that while some firms are optimistic, others maintain a more conservative outlook.

Target Prices

Analysts have reached a consensus regarding Silicon Laboratories Inc. (SLAB) target prices.

| Target High | Target Low | Consensus |

|---|---|---|

| 165 | 130 | 147.5 |

Overall, the target prices suggest that analysts expect moderate growth potential for SLAB, with a consensus indicating a well-balanced outlook.

Consumer Opinions

Consumer sentiment about Silicon Laboratories Inc. (SLAB) reflects a mixed bag of experiences, showcasing both commendable strengths and notable areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| Excellent product reliability and support | High pricing compared to competitors |

| Innovative technology and features | Issues with customer service responsiveness |

| Strong performance in IoT applications | Some products have a steep learning curve |

| User-friendly interface | Occasional delivery delays |

Overall, consumer feedback indicates that while SLAB excels in product reliability and innovation, there are concerns regarding pricing and customer service responsiveness that could impact user satisfaction.

Risk Analysis

In this section, I will outline the key risks associated with investing in Silicon Laboratories Inc. (SLAB), highlighting their probability and potential impact.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Volatility in semiconductor demand affecting sales | High | High |

| Regulatory Risk | Changes in trade policies impacting export capabilities | Medium | High |

| Technological Risk | Rapid advancements by competitors outpacing innovation | High | Medium |

| Supply Chain Risk | Disruptions in semiconductor supply due to geopolitical factors | Medium | High |

Given the current landscape, the most pressing risks for SLAB include high market volatility and supply chain disruptions, both of which could significantly affect the company’s performance and stock value.

Should You Buy Silicon Laboratories Inc.?

Silicon Laboratories Inc. (SLAB) is currently experiencing a challenging profitability phase with a negative net margin of -0.3269, which indicates ongoing losses. The company maintains a low debt level, with a debt-to-equity ratio of 0.0144, reflecting a solid financial position. Over recent years, the fundamentals have shown volatility, particularly with a substantial drop in revenue from 1.02B in 2022 to 634M in 2025. The company currently holds a rating of C-.

Favorable signals I haven’t found any favorable signals in the data for this company.

Unfavorable signals Silicon Laboratories Inc. is facing significant challenges, including a negative net margin of -0.3269, which indicates ongoing losses. The recent seller volume exceeds the buyer volume, suggesting that selling pressure is greater than buying interest. The stock’s recent trend is negative, with a price change of -8.47%, indicating a bearish sentiment.

Conclusion Given the unfavorable signals, it might be more prudent to wait for more favorable conditions before considering an investment in Silicon Laboratories Inc.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Silicon Laboratories, Inc. $SLAB Shares Sold by Universal Beteiligungs und Servicegesellschaft mbH – MarketBeat (Nov 24, 2025)

- A Fresh Look at Silicon Labs (SLAB) Valuation Following Recent Momentum Shift – Yahoo Finance (Nov 22, 2025)

- Silicon Labs to Participate at Upcoming Investor Conferences – PR Newswire (Nov 18, 2025)

- Silicon Labs (SLAB): Is There Untapped Value After the Recent Share Price Pullback? – simplywall.st (Nov 19, 2025)

- Silicon Labs (NASDAQ: SLAB) to Join 3 Investor Conferences with Webcast in 2025 – Stock Titan (Nov 18, 2025)

For more information about Silicon Laboratories Inc., please visit the official website: silabs.com