In the fast-paced semiconductor industry, NVIDIA Corporation (NVDA) and QUALCOMM Incorporated (QCOM) stand out as formidable players, each driving innovation and shaping the future of technology. Both companies are intricately linked through their focus on high-performance computing and wireless technology, yet they pursue distinct strategies in their respective markets. In this article, I will analyze these two giants to help you identify which company presents the most compelling investment opportunity for your portfolio.

Table of contents

Company Overview

NVIDIA Corporation Overview

NVIDIA Corporation (NVDA) is a leading designer and manufacturer of graphics processing units (GPUs) and other computing solutions, primarily for gaming, professional visualization, data centers, and automotive markets. Founded in 1993 and headquartered in Santa Clara, California, NVIDIA’s mission focuses on driving innovation in artificial intelligence (AI) and multi-dimensional graphics. The company is well-known for its GeForce line of gaming GPUs and has expanded its portfolio to include advanced data center platforms and automotive AI solutions. With a market capitalization of approximately $4.36T, NVIDIA stands as a dominant player in the semiconductor industry, continually pushing the boundaries of technology.

QUALCOMM Incorporated Overview

QUALCOMM Incorporated (QCOM), established in 1985 and based in San Diego, California, specializes in developing foundational technologies for the wireless industry. The company operates through segments that include Qualcomm CDMA Technologies, Qualcomm Technology Licensing, and Qualcomm Strategic Initiatives. Its mission encompasses delivering cutting-edge integrated circuits and system software for communication devices across various technologies, including 3G, 4G, and 5G. With a market cap of around $175B, QUALCOMM plays a crucial role in advancing mobile connectivity and innovation within the telecommunications space.

Key Similarities and Differences

Both NVIDIA and QUALCOMM operate within the semiconductor industry, focusing on advanced technology solutions. However, while NVIDIA primarily emphasizes graphics and AI computing, QUALCOMM centers on wireless communication technologies and licensing. This distinction highlights their unique contributions to the tech landscape, catering to different market needs and consumer segments.

Income Statement Comparison

The following table provides a concise comparison of the most recent income statements for NVIDIA Corporation (NVDA) and QUALCOMM Incorporated (QCOM), focusing on key metrics such as revenue and net income.

| Metric | NVDA | QCOM |

|---|---|---|

| Revenue | 130.5B | 44.3B |

| EBITDA | 86.1B | 14.9B |

| EBIT | 84.3B | 13.3B |

| Net Income | 72.9B | 5.5B |

| EPS | 2.97 | 5.06 |

Interpretation of Income Statement

In the most recent year, NVIDIA demonstrated significant growth, achieving a revenue of 130.5B, up from 60.9B the previous year, indicating strong demand for its products. Net income rose sharply to 72.9B, reflecting robust operational efficiency and margins. Meanwhile, QUALCOMM also saw growth, with revenue climbing to 44.3B; however, its net income of 5.5B suggests narrower margins. Both companies exhibit solid performance, but NVIDIA’s explosive growth and superior profitability metrics clearly position it ahead in the current competitive landscape.

Financial Ratios Comparison

The following table provides a comparative analysis of the most recent financial ratios for NVIDIA Corporation (NVDA) and QUALCOMM Incorporated (QCOM).

| Metric | NVDA | QCOM |

|---|---|---|

| ROE | 92% | 26% |

| ROIC | 75% | 13% |

| P/E | 40 | 18 |

| P/B | 37 | 8 |

| Current Ratio | 4.44 | 2.82 |

| Quick Ratio | 3.88 | 2.10 |

| D/E | 0.13 | 0.70 |

| Debt-to-Assets | 9% | 30% |

| Interest Coverage | 330 | 19 |

| Asset Turnover | 1.17 | 0.88 |

| Fixed Asset Turnover | 16.16 | 9.44 |

| Payout ratio | 1.14% | 36% |

| Dividend yield | 0.03% | 1.94% |

Interpretation of Financial Ratios

From the analysis, NVDA exhibits significantly higher profitability metrics (ROE and ROIC) compared to QCOM, indicating superior efficiency in generating returns. The lower debt ratios for NVDA suggest a stronger balance sheet and less financial risk. However, QCOM’s higher dividend yield may be attractive for income-focused investors. Overall, while NVDA shows robust growth potential, QCOM presents a more conservative investment approach with stable dividends, albeit at a lower growth trajectory.

Dividend and Shareholder Returns

NVIDIA (NVDA) has a modest dividend yield of 0.03% with a payout ratio of only 1.14%, indicating a strong capacity for reinvestment. While it does engage in share buybacks, the low dividend suggests a focus on growth rather than immediate shareholder returns. In contrast, QUALCOMM (QCOM) offers a more substantial dividend yield of 2.10% with a payout ratio of 68.67%, reflecting a balanced approach to shareholder returns and growth. This distribution strategy supports sustainable long-term value creation for both companies.

Strategic Positioning

NVIDIA (NVDA) commands a significant market share in the semiconductor industry, particularly in graphics processing units (GPUs) required for gaming and AI applications. With a market cap of approximately 4.36T, NVIDIA faces competitive pressure from companies like Qualcomm (QCOM), which has a market cap of around 175B and focuses on wireless communication technologies. Both companies are navigating technological disruptions, including advancements in AI and 5G, which influence their strategic positioning and product offerings. As these sectors evolve, ongoing innovation and adaptation will be crucial for maintaining competitiveness.

Stock Comparison

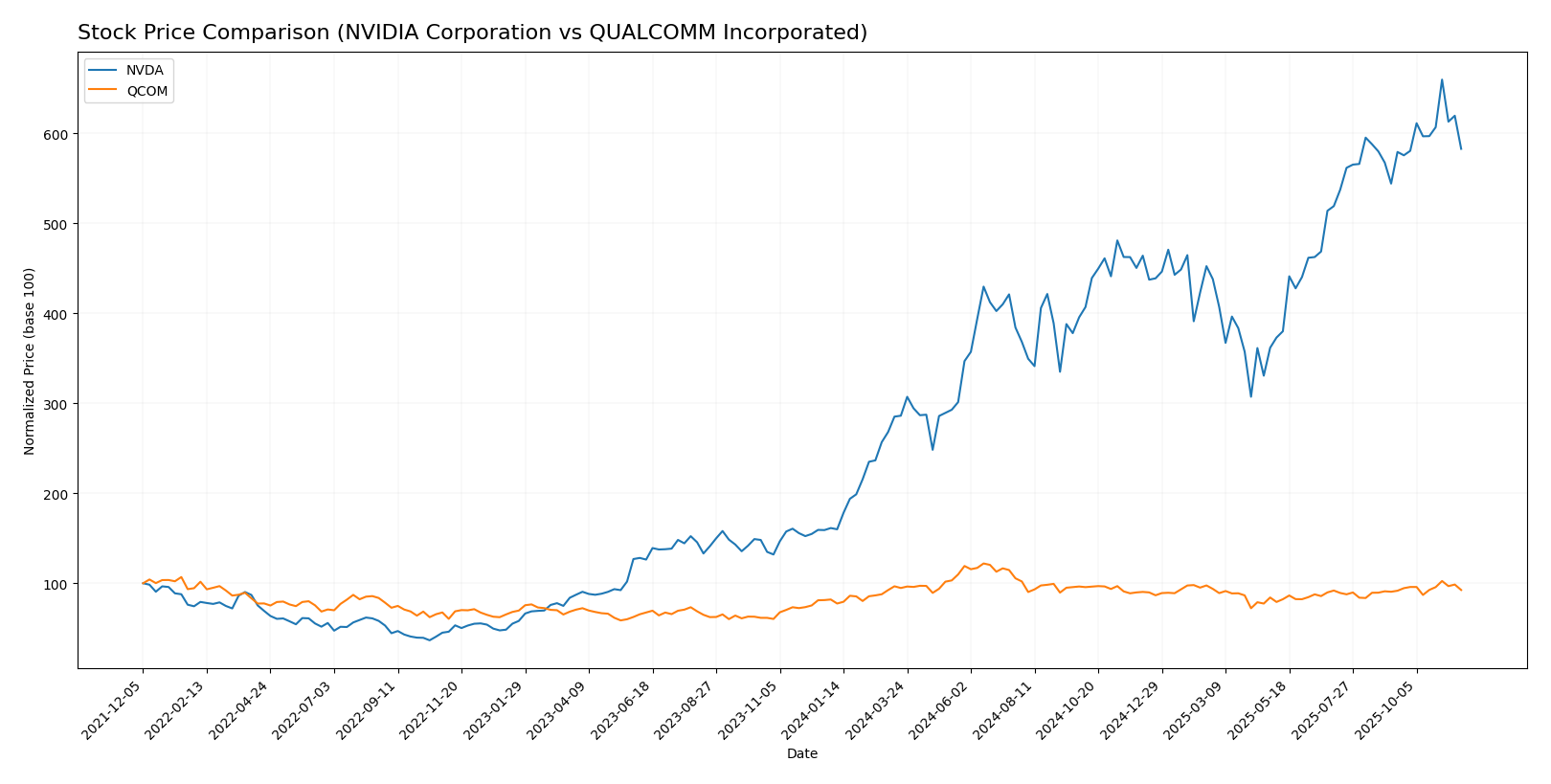

In analyzing the weekly stock price movements for NVIDIA Corporation (NVDA) and QUALCOMM Incorporated (QCOM), I have observed significant price dynamics over the past year, highlighting both companies’ strong bullish trends and notable price fluctuations.

Trend Analysis

For NVIDIA Corporation (NVDA), the stock has shown a remarkable price change of 261.23% over the past year. This substantial increase indicates a clear bullish trend, further supported by an acceleration in price movement. The stock has experienced notable highs, reaching $202.49, and lows at $49.10, with a standard deviation of 35.52, suggesting a higher level of volatility in its price movements. Recently, from September 7, 2025, to November 23, 2025, NVDA has seen a modest price increase of 7.1%, reflecting continued upward momentum, albeit with a standard deviation of 8.42, indicating some fluctuations in the recent trend.

In the case of QUALCOMM Incorporated (QCOM), the stock has achieved a 12.91% price increase over the past year, marking a bullish trend as well. The price range has varied significantly, with highs at $215.33 and lows at $127.46, and a standard deviation of 16.88, indicating moderate volatility. Over the recent period from September 7, 2025, to November 23, 2025, QCOM experienced a slight price change of 2.16%, which, while positive, reflects a relatively stable phase with a standard deviation of 6.8.

Analyst Opinions

Recent analyst recommendations for NVIDIA (NVDA) and QUALCOMM (QCOM) indicate a consensus rating of “B+,” suggesting a hold position. Analysts highlight NVDA’s strong return on equity and assets, despite lower scores in price-to-earnings and price-to-book ratios. Similarly, QCOM benefits from high efficiency metrics but faces challenges with its debt-to-equity ratio. Notable analysts, including those from well-known firms, emphasize caution in the current market environment while recognizing growth potential. Overall, both stocks are viewed as solid holds for investors looking to manage risk effectively.

Stock Grades

In this section, I will present the most recent stock grades for two prominent companies: NVIDIA Corporation (NVDA) and QUALCOMM Incorporated (QCOM).

NVIDIA Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Melius Research | maintain | Buy | 2025-11-20 |

| Argus Research | maintain | Buy | 2025-11-20 |

| Benchmark | maintain | Buy | 2025-11-20 |

| Keybanc | maintain | Overweight | 2025-11-20 |

| Rosenblatt | maintain | Buy | 2025-11-20 |

| JP Morgan | maintain | Overweight | 2025-11-20 |

| Deutsche Bank | maintain | Hold | 2025-11-20 |

| Citigroup | maintain | Buy | 2025-11-20 |

| Cantor Fitzgerald | maintain | Overweight | 2025-11-20 |

| Barclays | maintain | Overweight | 2025-11-20 |

QUALCOMM Incorporated Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | maintain | Buy | 2025-11-06 |

| Piper Sandler | maintain | Overweight | 2025-11-06 |

| Wells Fargo | maintain | Underweight | 2025-11-06 |

| UBS | maintain | Neutral | 2025-11-06 |

| Rosenblatt | maintain | Buy | 2025-11-06 |

| Mizuho | maintain | Outperform | 2025-11-06 |

| JP Morgan | maintain | Overweight | 2025-11-04 |

| Rosenblatt | maintain | Buy | 2025-10-28 |

| Citigroup | maintain | Neutral | 2025-10-28 |

| UBS | maintain | Neutral | 2025-10-27 |

The overall trend for NVIDIA indicates a strong consensus among analysts with multiple “Buy” and “Overweight” ratings, suggesting confidence in the company’s future performance. In contrast, QUALCOMM presents a mixed picture with a balance of “Buy,” “Overweight,” and “Underweight” ratings, indicating varying opinions on its market position.

Target Prices

The consensus target prices for NVIDIA Corporation (NVDA) and QUALCOMM Incorporated (QCOM) reflect analysts’ expectations for future performance.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| NVIDIA Corporation | 352 | 200 | 261.77 |

| QUALCOMM Incorporated | 210 | 165 | 190 |

For NVIDIA, the consensus target price of 261.77 indicates a potential upside from its current price of 178.88. Similarly, QUALCOMM’s target consensus of 190 suggests a favorable outlook compared to its current price of 163.30.

Strengths and Weaknesses

In the following table, I compare the strengths and weaknesses of NVIDIA Corporation (NVDA) and QUALCOMM Incorporated (QCOM) based on their recent performance metrics and market positioning.

| Criterion | NVIDIA Corporation (NVDA) | QUALCOMM Incorporated (QCOM) |

|---|---|---|

| Diversification | High (Gaming, AI, Automotive) | Moderate (Wireless tech) |

| Profitability | Strong (Net Profit Margin: 55.8%) | Moderate (Net Profit Margin: 12.5%) |

| Innovation | High (Leading in AI and GPUs) | Moderate (Focus on 5G and IoT) |

| Global presence | Extensive (Global operations) | Strong (Focus on wireless tech) |

| Market Share | Dominant in GPUs | Strong in mobile chipsets |

| Debt level | Low (Debt-to-Equity: 0.13) | High (Debt-to-Equity: 0.70) |

Key takeaways: NVIDIA shows stronger profitability, innovation, and diversification compared to QUALCOMM. However, QUALCOMM maintains a solid market presence in wireless technologies, despite higher debt levels. Investors should weigh these factors carefully when considering positions in either company.

Risk Analysis

In this section, I provide a concise overview of the key risks associated with NVIDIA Corporation (NVDA) and QUALCOMM Incorporated (QCOM).

| Metric | NVIDIA Corporation (NVDA) | QUALCOMM Incorporated (QCOM) |

|---|---|---|

| Market Risk | High (Beta: 2.269) | Moderate (Beta: 1.208) |

| Regulatory Risk | Moderate | High |

| Operational Risk | Low | Moderate |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

Both companies face significant market risk due to high volatility, especially NVIDIA with a beta of 2.269. Furthermore, regulatory and geopolitical challenges can impact their operations, particularly as global tensions rise and regulations tighten in the technology sector.

Which one to choose?

When comparing NVIDIA Corporation (NVDA) and QUALCOMM Incorporated (QCOM), both companies present strong fundamentals, but their profiles cater to different investor preferences. NVDA boasts a robust market cap of 2.91T and impressive profit margins (net margin at 55.8%), reflecting a bullish stock trend with a significant price change of 261.23% over the past year. Analysts rate NVDA at B+, with a focus on growth potential, but a high P/E ratio of 39.9 indicates a premium valuation.

On the other hand, QCOM, with a market cap of 181.17B, has a lower P/E ratio of 32.7 and a strong dividend yield of 2.1%, appealing to income-focused investors. Its bullish price trend shows a 12.91% increase, indicating stable performance.

Investors focused on growth may prefer NVDA, while those prioritizing stability and dividends may favor QCOM. However, both companies face risks from competition and market dependence in their respective sectors.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of NVIDIA Corporation and QUALCOMM Incorporated to enhance your investment decisions: