Download the eBook for Free

Coding a trading bot is hard to achieve. The Seven Pillars guide covers everything you need to know to build a winning trader bot. You will find codes with clear explanations.

Discover the Seven Pillars to Building a Winning Trader Bot

I am dedicated to helping traders like you achieve success in the markets. With expert insights into the Prorealtime platform, you can build a trader bot that is designed to deliver consistent, profitable trades. The Seven Pillars guide covers everything you need to know to build a winning trader bot, including:

1. DEFINE A MARKET & ECONOMIC CALENDAR

If you do not define time management rules, your trading system will open too many entries and take a series of losses. You will need to determine precisely when our bot can operate the market or stay inactive.

Setting the period by the hour and day while your trader bot could find an opportunity on the market is essential.

You will learn how to manage the temporality of an automated trading system.

You will learn how to manage the temporality of an automated trading system.

2. IMPLEMENT MONEY MANAGEMENT

An automated trading system with a wrong configuration could open a succession of entries until a fall in a margin call. Implementing safety features into your bot to decrease financial risks and defining the position sizing is imperative.

You will learn how to set the number of entries your trading system will open.

You will learn how to set the number of entries your trading system will open.

3. MEASURE THE MARKET TREND

The market trend can be bullish or bearish regarding a period and a timeframe. For example, 100 periods with a 1-minute timeframe or 20 periods with a daily timeframe.

The without-trend market is challenging to describe cause there is often a succession of small bull and bear markets.

You will compare moving averages with linear regressions to discover the best way to determine the market trend.

You will compare moving averages with linear regressions to discover the best way to determine the market trend.

4. MARKET VOLATILITY PERCEPTION

Volatility is the parameter that best expresses the risk of an asset at a given moment. The measure of the volatility is straightforward, thanks to the standard deviation. The highly volatile markets are often difficult to trade. Thus it is preferable to avoid them.

You will learn how to measure market volatility to avoid too volatile markets.

You will learn how to measure market volatility to avoid too volatile markets.

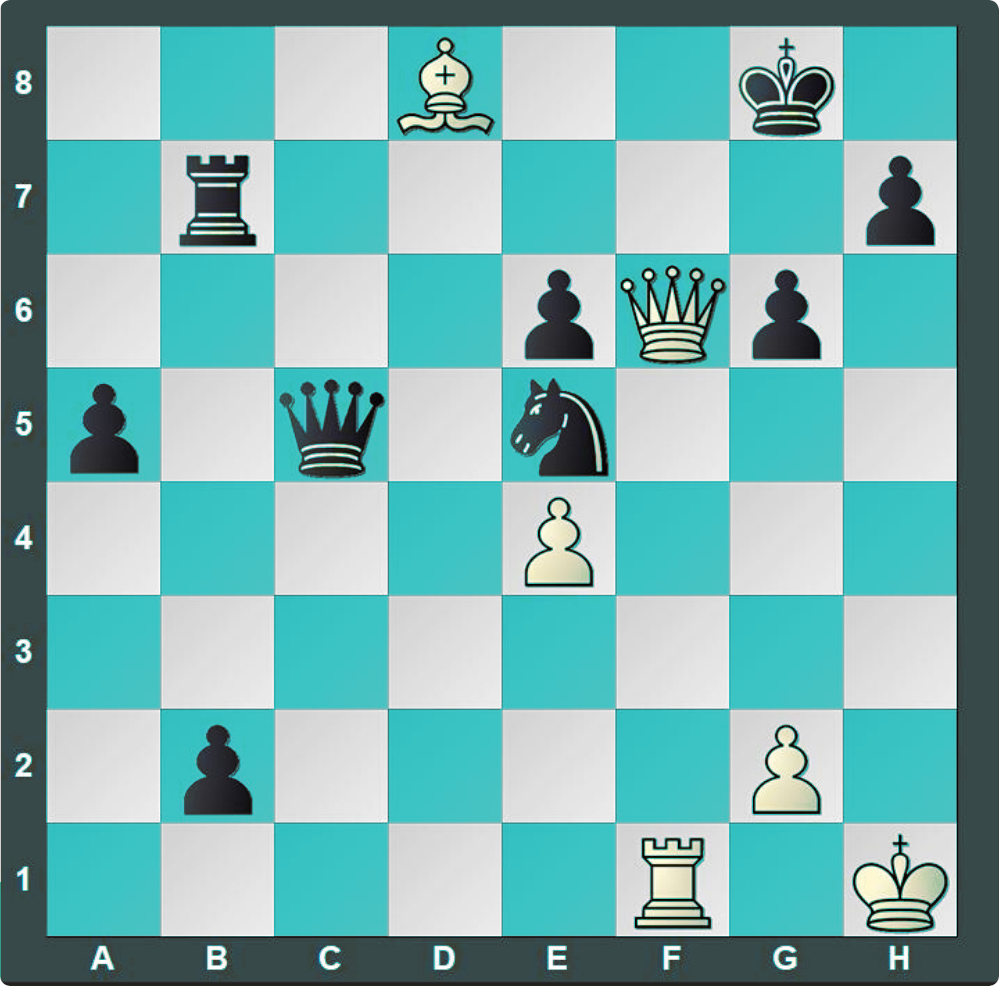

5. STOP LOSS AND TARGET POSITIONING

The stop loss and target setting are significant parts of my trading style. The tactical approach focuses on profits and losses management.

Each closed entry would give profits strictly greater than losses, and their success rate would be greater than 50%.

You will learn how to determine the best stop loss and target position.

You will learn how to determine the best stop loss and target position.

6. PROFITS SECURING

For the sake of robustness, a strategy must be equipped with a profit-securing mechanism. This mechanism’s purpose is automatically place a sell-stop order when the latent profits are greater than a certain level.

In this way, if the price is felt before reaching the initial target, the opened position will stay a winner. (except if there is a gap or a flash crash)

You will learn the way to secure your latent profits using a profit-securing mechanism.

You will learn the way to secure your latent profits using a profit-securing mechanism.

7. TARGET OVERWRITING

We often see reflux when the market touches a ‘resistance’ as a price ending by 100 or a monthly pivot. This reflux is sometimes profound, and at times, the market trend goes in a reversal direction.

If your target is placed a little above a significant price level, you should eventually replace it with this considerable price to close your entry before the reversal.

You will learn how to replace a target with resistance.

You will learn how to replace a target with resistance.

I created this free guide to help you to develop your automated trading system working on Prorealtime.

If you have any questions, don’t hesitate to contact me 🙂