In the fast-evolving tech landscape, two companies stand out: Snowflake Inc. and Informatica Inc. Both are key players in the data management software industry, yet they adopt distinct approaches to innovation and market strategy. Snowflake focuses on a cloud-based data platform that empowers businesses to harness their data effectively, while Informatica emphasizes comprehensive data integration and governance solutions across diverse environments. Join me as we explore which of these companies presents the most compelling investment opportunity today.

Table of contents

Company Overview

Snowflake Inc. Overview

Snowflake Inc. operates a cloud-based data platform that serves both domestic and international markets. Founded in 2012 and based in Bozeman, Montana, Snowflake aims to provide organizations with a unified source of truth for their data. By enabling businesses to consolidate data, the platform supports data-driven insights and applications, facilitating a wide range of analytical capabilities. As a leader in the software application industry, Snowflake has positioned itself at the forefront of the data revolution, attracting a diverse clientele across various sectors. The company’s focus on innovation and scalability has made it a preferred choice for businesses looking to leverage cloud technologies for data management and analytics.

Informatica Inc. Overview

Informatica Inc., established in 1993 and headquartered in Redwood City, California, specializes in data management solutions powered by artificial intelligence. The company provides a comprehensive platform that connects and manages data across multi-cloud and hybrid systems, catering to enterprise-scale needs. Informatica’s suite of products includes data integration, data quality, master data management, and governance tools, making it a vital partner for businesses seeking to enhance data integrity and compliance. With a strong emphasis on unifying data to drive operational efficiency and analytics, Informatica plays a crucial role in helping organizations navigate the complexities of data management.

Key similarities between Snowflake and Informatica include their focus on data management and a commitment to leveraging cloud technologies. However, their business models differ; Snowflake specializes in providing a data platform for analytics, while Informatica emphasizes a broader range of data management solutions, including data integration and governance.

Income Statement Comparison

The table below compares the income statements of Snowflake Inc. and Informatica Inc. for the most recent fiscal years, providing a snapshot of their financial performance.

| Metric | Snowflake Inc. (2025) | Informatica Inc. (2024) |

|---|---|---|

| Revenue | 3.63B | 1.64B |

| EBITDA | -1.10B | 338M |

| EBIT | -1.28B | 199M |

| Net Income | -1.29B | 9.93M |

| EPS | -3.86 | 0.03 |

Interpretation of Income Statement

In 2025, Snowflake Inc. reported a significant increase in revenue to 3.63B, up from 2.81B in 2024, indicating robust growth. However, the company continued to experience substantial net losses, with a net income of -1.29B, illustrating ongoing challenges in profitability. In contrast, Informatica Inc. maintained a stable growth trajectory, with revenue of 1.64B and a return to profitability, achieving a net income of 9.93M. This performance highlights a marked difference in operational efficiency and margin management between the two companies.

Financial Ratios Comparison

The following table presents a comparative analysis of key financial ratios for Snowflake Inc. (SNOW) and Informatica Inc. (INFA) based on the most recent data available.

| Metric | SNOW | INFA |

|---|---|---|

| ROE | -42.86% | 0.43% |

| ROIC | -25.32% | 0.56% |

| P/E | -46.97 | -65.39 |

| P/B | 20.13 | 3.70 |

| Current Ratio | 1.75 | 1.66 |

| Quick Ratio | 1.75 | 1.66 |

| D/E | 0.90 | 0.85 |

| Debt-to-Assets | 29.72% | 36.28% |

| Interest Coverage | -527.73 | 0.22 |

| Asset Turnover | 0.40 | 0.31 |

| Fixed Asset Turnover | 5.53 | 7.70 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

The analysis shows that SNOW is struggling with negative returns on equity and invested capital, indicating inefficiencies in generating profits. In contrast, INFA displays modest profitability metrics and a more stable debt profile. Nevertheless, both companies exhibit no dividends, reflecting a focus on growth rather than returning cash to shareholders. Investors should be cautious given the high valuation ratios, especially for SNOW, which could signal overvaluation risks.

Dividend and Shareholder Returns

Snowflake Inc. (SNOW) does not pay dividends, opting instead to reinvest its earnings for growth during its high-growth phase. This strategy aligns with long-term shareholder value creation, although it carries risks associated with sustained negative net income. Notably, SNOW engages in share buybacks, which can enhance shareholder value if executed judiciously.

Informatica Inc. (INFA) also refrains from paying dividends, reflecting a focus on reinvestment and innovation. While INFA has a nominal dividend payout ratio, its share buyback initiatives suggest a commitment to returning value to shareholders. Both companies prioritize growth, but investors should be cautious of the potential risks in maintaining this trajectory without consistent profitability.

Strategic Positioning

Snowflake Inc. (SNOW) holds a significant share in the cloud data platform market, driven by its innovative Data Cloud, which caters to a diverse array of industries. With a market cap of $82.9B, it faces competitive pressure primarily from Informatica Inc. (INFA), which specializes in data integration and management with a market cap of $7.5B. Both companies must continuously adapt to technological disruptions and evolving customer demands to maintain their positions in this rapidly changing sector.

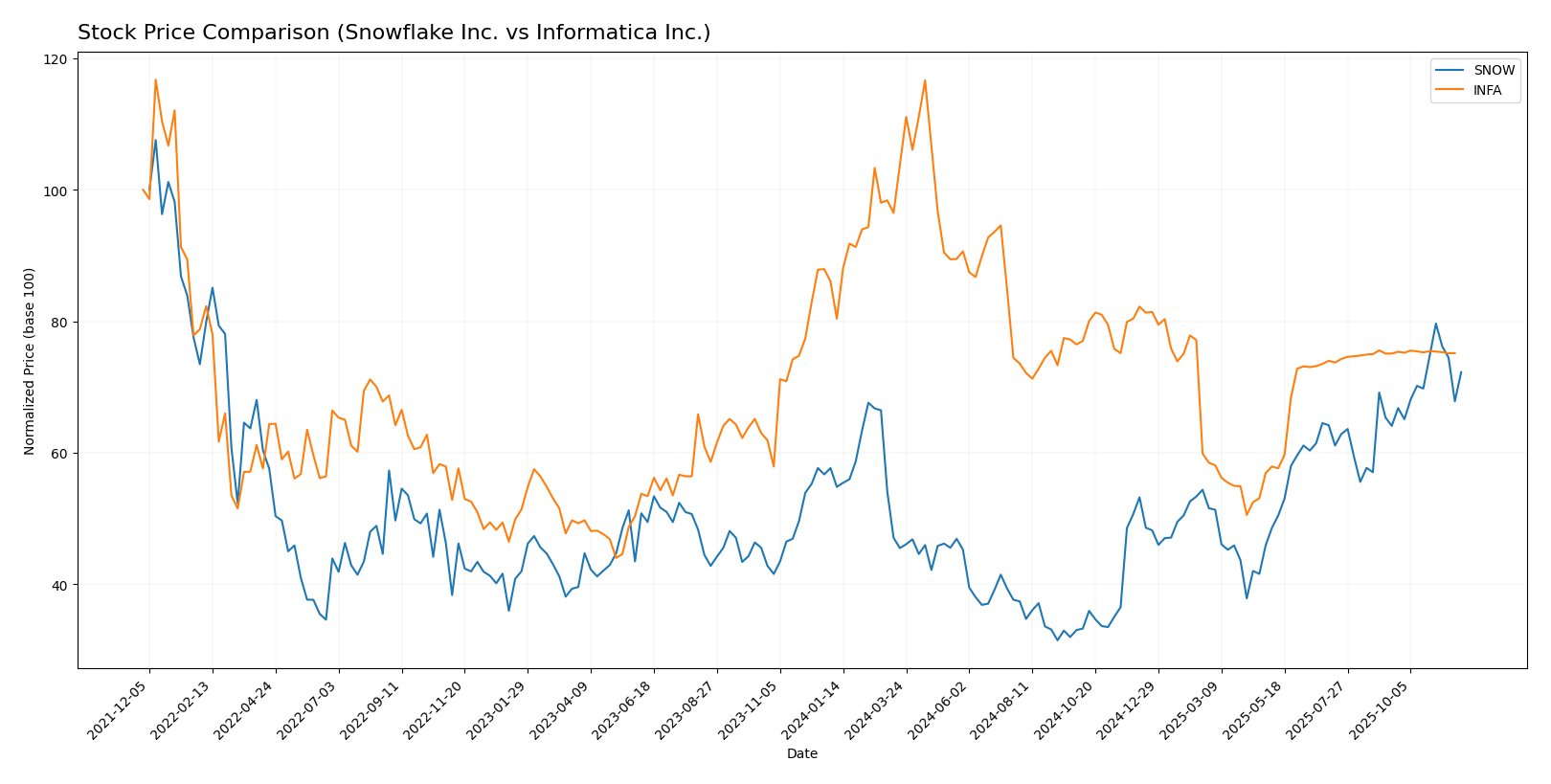

Stock Comparison

In this section, I will analyze the weekly stock price movements and trading dynamics of Snowflake Inc. (SNOW) and Informatica Inc. (INFA) over the past year, highlighting key price changes and trends.

Trend Analysis

Snowflake Inc. (SNOW) has experienced a significant bullish trend over the past year, with a percentage change of +31.83%. This upward movement indicates acceleration in the stock’s performance, as reflected in its highest price of 274.88 and lowest price of 108.56. The recent trend from September 14, 2025, to November 30, 2025, shows a price change of +12.73%, further affirming the bullish sentiment in the stock. The standard deviation of 15.74 suggests moderate volatility during this period, signaling some fluctuations in trading activity.

Informatica Inc. (INFA), on the other hand, has experienced a bearish trend with a percentage change of -12.68% over the past year. The trend has also accelerated downwards, with notable highs at 38.48 and lows at 16.67. In the recent analysis from September 7, 2025, to November 23, 2025, the stock’s price change was almost neutral at +0.08%, indicating a lack of significant movement in the short term. The standard deviation of 0.05 reflects very low volatility, suggesting stable but weak trading conditions.

In summary, while SNOW shows strong bullish signals with notable acceleration, INFA faces challenges with a bearish trend, albeit with minimal recent changes. Careful consideration of these dynamics is essential for making informed investment decisions.

Analyst Opinions

Recent analyst recommendations for Snowflake Inc. (SNOW) indicate a cautious stance, with a rating of C- from analysts. The main concerns include low scores in return on equity and debt to equity, suggesting potential financial instability. Analysts emphasize the need for improved financial metrics before considering a buy. Currently, there are no recent recommendations for Informatica Inc. (INFA). Overall, the consensus for Snowflake is to hold, reflecting a wait-and-see approach amidst ongoing financial scrutiny.

Stock Grades

In this section, I present the latest stock ratings for Snowflake Inc. and Informatica Inc. from recognized grading companies.

Snowflake Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | maintain | Outperform | 2025-11-17 |

| B of A Securities | maintain | Buy | 2025-11-17 |

| BTIG | maintain | Buy | 2025-11-12 |

| JMP Securities | maintain | Market Outperform | 2025-10-28 |

| Wedbush | maintain | Outperform | 2025-10-20 |

| Rosenblatt | maintain | Buy | 2025-10-17 |

| UBS | maintain | Buy | 2025-10-08 |

| Macquarie | maintain | Neutral | 2025-08-28 |

| Scotiabank | maintain | Sector Outperform | 2025-08-28 |

| Mizuho | maintain | Outperform | 2025-08-28 |

Informatica Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Guggenheim | downgrade | Neutral | 2025-08-07 |

| UBS | maintain | Neutral | 2025-08-07 |

| Baird | maintain | Neutral | 2025-05-28 |

| JP Morgan | downgrade | Neutral | 2025-05-28 |

| RBC Capital | maintain | Sector Perform | 2025-05-28 |

| Wolfe Research | downgrade | Peer Perform | 2025-05-28 |

| Wells Fargo | maintain | Equal Weight | 2025-05-28 |

| Truist Securities | downgrade | Hold | 2025-05-28 |

| RBC Capital | maintain | Sector Perform | 2025-05-27 |

| UBS | maintain | Neutral | 2025-05-16 |

Overall, Snowflake Inc. continues to receive strong ratings from multiple grading companies, indicating consistent confidence in its performance. In contrast, Informatica Inc. has experienced several downgrades, suggesting a cautious outlook among analysts.

Target Prices

Reliable target price data is available for both Snowflake Inc. (SNOW) and Informatica Inc. (INFA), reflecting the consensus expectations from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Snowflake Inc. | 325 | 221 | 276.46 |

| Informatica Inc. | 27 | 25 | 26 |

The target consensus for Snowflake Inc. suggests an expected upside from the current price of 249.05, indicating bullish sentiment among analysts. Meanwhile, Informatica Inc.’s consensus aligns closely with its current price of 24.79, signaling a stable outlook.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of Snowflake Inc. (SNOW) and Informatica Inc. (INFA).

| Criterion | Snowflake Inc. | Informatica Inc. |

|---|---|---|

| Diversification | High (Cloud Data Platform) | Moderate (Data Management Products) |

| Profitability | Negative margins (2025) | Positive margins (2024) |

| Innovation | Strong (AI and Data Solutions) | Good (AI-Powered Data Management) |

| Global presence | Strong (International) | Moderate (US-focused) |

| Market Share | Growing (Cloud Data Market) | Stable (Data Management) |

| Debt level | Manageable (Debt to Equity: 0.895) | Higher (Debt to Equity: 0.806) |

In summary, while Snowflake demonstrates strong innovation and growth potential in the cloud data market, it faces profitability challenges. Conversely, Informatica shows better profitability and manageable debt, though it lacks the same level of innovation and global presence.

Risk Analysis

The following table outlines key risks associated with Snowflake Inc. (SNOW) and Informatica Inc. (INFA):

| Metric | Snowflake Inc. | Informatica Inc. |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | High |

| Operational Risk | High | Moderate |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | Moderate |

Both companies face considerable market and operational risks due to their reliance on technology and data services. Recent trends highlight the need for robust regulatory compliance, particularly for Informatica, as it navigates complex data privacy laws.

Which one to choose?

When comparing Snowflake Inc. (SNOW) and Informatica Inc. (INFA), it’s evident that both companies face distinct challenges. Snowflake showcases a high gross profit margin of 66.5% but struggles with profitability, reflected in negative net and operating margins. Its stock trend is currently bullish, with a price increase of 31.83% over the past year. Conversely, Informatica, although having a lower gross profit margin of 80.1%, has demonstrated a bearish trend, with a price decline of 12.68% recently.

Based on fundamentals, Snowflake’s growth potential may appeal to growth-focused investors, while Informatica’s higher gross margin could attract those seeking stability. However, both companies face risks such as market competition and valuation concerns.

Recommendation: Investors focused on growth may prefer Snowflake, while those prioritizing stability should consider Informatica.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Snowflake Inc. and Informatica Inc. to enhance your investment decisions: