In the ever-evolving landscape of software applications, two companies stand out: ServiceNow, Inc. (NOW) and monday.com Ltd. (MNDY). Both are pioneering solutions in the technology sector, focusing on enhancing operational efficiency through innovative software. While ServiceNow specializes in enterprise cloud computing for workflow automation, monday.com offers a visual work operating system tailored for project management. This article will dissect their strengths and strategies to help you identify the more compelling investment opportunity.

Table of contents

Company Overview

ServiceNow, Inc. Overview

ServiceNow, Inc. is a leading provider of enterprise cloud computing solutions that focus on automating and managing services for businesses globally. Founded in 2004 and headquartered in Santa Clara, California, the company offers a comprehensive suite of applications including IT service management, performance analytics, and workflow automation. With a market capitalization of approximately $171B, ServiceNow is well-positioned in the software application industry, serving a diverse clientele across sectors such as healthcare, finance, and government. Under the leadership of CEO William R. McDermott, the company continues to innovate, particularly through strategic partnerships aimed at enhancing process automation for its clients.

monday.com Ltd. Overview

monday.com Ltd. is an emerging player in the cloud-based software market, specializing in customizable work management solutions. Established in 2012 and based in Tel Aviv, Israel, the company offers a visual Work OS that allows organizations to create tailored applications and manage workflows effectively. With a market cap of about $7.56B, monday.com serves a varied clientele, including businesses and educational institutions, providing tools for project management, CRM, and more. CEO Eran Zinman leads the company in its mission to streamline operations through modular and adaptable software solutions.

Key Similarities and Differences

Both ServiceNow and monday.com operate within the software application industry, focusing on enhancing business efficiency through cloud-based solutions. However, their business models differ significantly; ServiceNow primarily targets large enterprises with complex IT needs, while monday.com appeals to a broader audience, including smaller organizations, with its user-friendly and modular work management tools.

Income Statement Comparison

Below is a comparison of the income statements for ServiceNow, Inc. and monday.com Ltd., highlighting their financial performance for the most recent fiscal year.

| Metric | ServiceNow, Inc. | monday.com Ltd. |

|---|---|---|

| Revenue | 10.98B | 972M |

| EBITDA | 2.23B | 58M |

| EBIT | 1.76B | 40M |

| Net Income | 1.43B | 32M |

| EPS | 6.92 | 0.65 |

Interpretation of Income Statement

In the latest fiscal year, ServiceNow showcased strong revenue growth of approximately 22% from the previous year, resulting in a substantial net income of 1.43B. The EBITDA margin remained stable, indicating efficient operational management. Conversely, monday.com experienced a revenue increase of 33%, yet it reported a modest net income of 32M, reflecting ongoing investments in growth. While ServiceNow’s margins proved resilient, monday.com’s path to profitability remains a focus as it continues to scale. Overall, ServiceNow’s performance is robust, while monday.com shows potential for future improvement with strategic execution.

Financial Ratios Comparison

Below is a comparative table showing the most recent revenue and key financial ratios for ServiceNow, Inc. (NOW) and monday.com Ltd. (MNDY):

| Metric | [Company A: NOW] | [Company B: MNDY] |

|---|---|---|

| ROE | 14.83% | 3.14% |

| ROIC | 9.22% | -1.73% |

| P/E | 153.13 | – |

| P/B | 22.71 | 11.41 |

| Current Ratio | 1.10 | 2.66 |

| Quick Ratio | 1.10 | 2.66 |

| D/E | 0.24 | 0.10 |

| Debt-to-Assets | 0.11 | 0.05 |

| Interest Coverage | 59.30 | – |

| Asset Turnover | 0.54 | 0.57 |

| Fixed Asset Turnover | 4.47 | 7.13 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

In examining the financial ratios, ServiceNow demonstrates a stronger return on equity (ROE) and return on invested capital (ROIC) compared to monday.com, indicating better efficiency in generating profits from equity and capital. However, monday.com has superior liquidity ratios (current and quick ratios) suggesting better short-term financial health. Notably, the high P/E ratio for ServiceNow reflects its premium valuation, which may imply risk if growth expectations are not met. A cautious approach is advised when considering these investments.

Dividend and Shareholder Returns

ServiceNow, Inc. (NOW) does not pay dividends, focusing instead on reinvestment for growth, which aligns with its high growth phase. The absence of dividends is justified by its commitment to R&D and strategic acquisitions. Furthermore, the company engages in share buybacks, which may enhance shareholder value over time.

Conversely, monday.com Ltd. (MNDY) also refrains from paying dividends, prioritizing reinvestment to support its expansion. Like NOW, it undertakes share buybacks, indicating a potential strategy for long-term value creation. Both companies’ approaches reflect their growth-oriented strategies, suggesting that their lack of dividends could ultimately benefit shareholders in the long run.

Strategic Positioning

ServiceNow, Inc. (NOW) commands a substantial market share in the enterprise cloud computing sector, driven by its comprehensive platform for workflow automation and IT service management. With a market capitalization of 171.3B, it faces competitive pressure from monday.com Ltd. (MNDY), which offers a versatile Work OS for project management and collaboration. MNDY’s market cap stands at 7.6B, indicating a growing presence. Both companies must navigate technological disruptions to maintain their market positions and adapt to evolving customer needs.

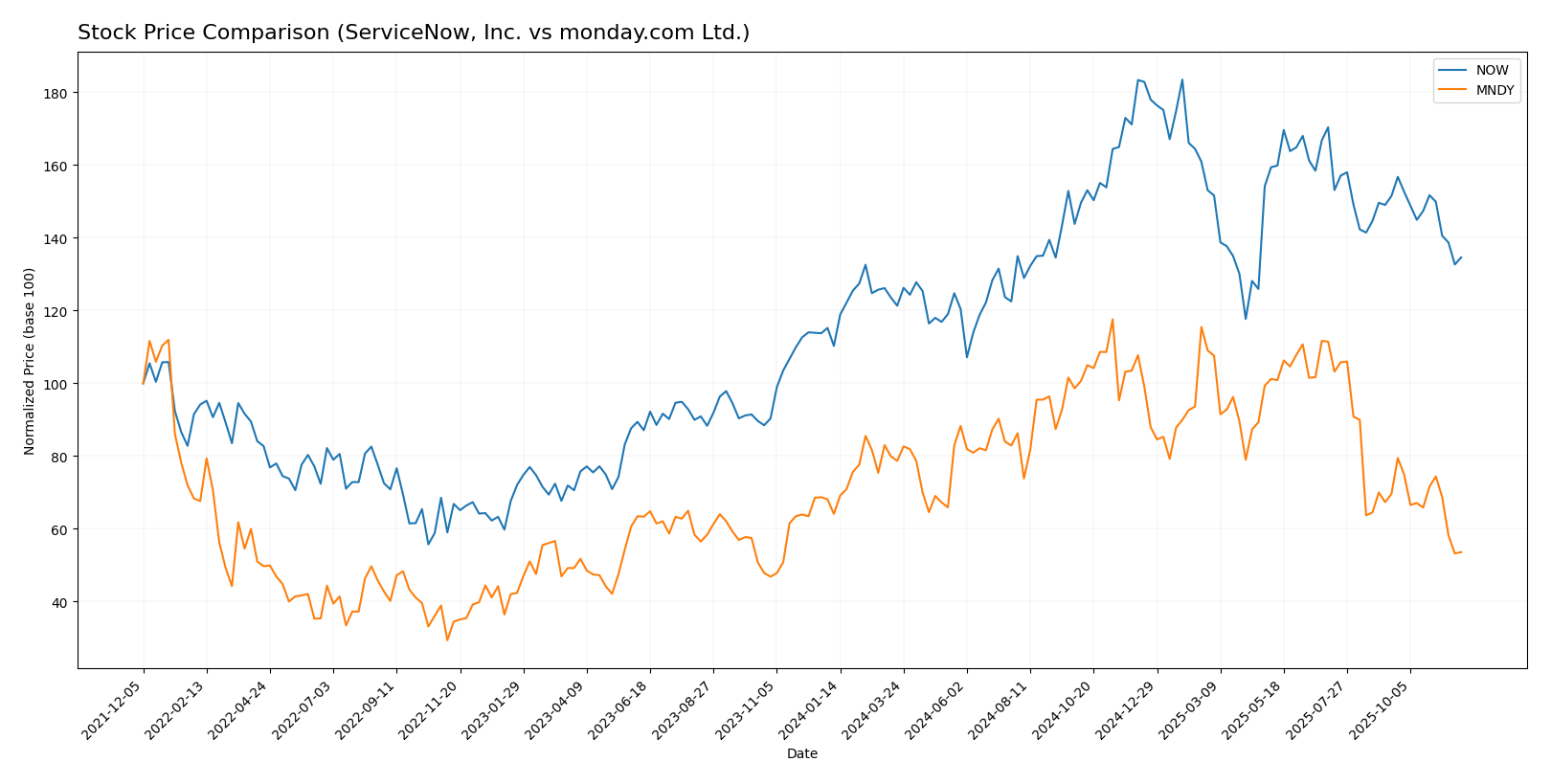

Stock Comparison

In analyzing the weekly stock price movements of ServiceNow, Inc. (NOW) and monday.com Ltd. (MNDY), we observe significant fluctuations, highlighting the dynamic trading environment over the past year.

Trend Analysis

ServiceNow, Inc. (NOW) Over the past year, NOW has experienced a price change of +22.06%. This positive variation indicates a bullish trend. However, it is important to note that the recent trend analysis reflects a decline of -11.16% from September 14, 2025, to November 30, 2025, suggesting a deceleration in momentum. The highest price recorded was 1124.98, while the lowest was 656.93, with a standard deviation of 116.38 indicating moderate volatility.

monday.com Ltd. (MNDY) In contrast, MNDY has seen a price decrease of -16.41% over the same timeframe, establishing a bearish trend. The recent trend analysis shows a more pronounced decline of -23.01% from September 14, 2025, to November 30, 2025, also indicating deceleration. The stock reached a high of 324.31 and a low of 146.85, with a standard deviation of 41.62, reflecting lower volatility compared to NOW.

In summary, while NOW shows potential for recovery from its recent downturn, MNDY faces ongoing challenges, which investors should consider when evaluating their portfolios.

Analyst Opinions

Recent analyst assessments for ServiceNow, Inc. (NOW) and monday.com Ltd. (MNDY) indicate a consensus rating of “Buy” for both companies. Analysts have highlighted their strong discounted cash flow scores and solid return on assets, with both firms receiving an overall score of 3. Analysts emphasize the growth potential in the cloud software sector, which supports their positive outlook. Notably, firms like Morgan Stanley and Goldman Sachs have reiterated their confidence in these stocks, reflecting a bullish sentiment in the current market landscape.

Stock Grades

I have analyzed the latest stock grades for two companies, ServiceNow, Inc. (NOW) and monday.com Ltd. (MNDY), as provided by reputable grading firms.

ServiceNow, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | maintain | Overweight | 2025-10-30 |

| Canaccord Genuity | maintain | Buy | 2025-10-30 |

| TD Cowen | maintain | Buy | 2025-10-30 |

| UBS | maintain | Buy | 2025-10-30 |

| Wells Fargo | maintain | Overweight | 2025-10-30 |

| Barclays | maintain | Overweight | 2025-10-30 |

| Citigroup | maintain | Buy | 2025-10-30 |

| UBS | maintain | Buy | 2025-10-14 |

| Morgan Stanley | upgrade | Overweight | 2025-09-24 |

| JMP Securities | maintain | Market Outperform | 2025-08-04 |

monday.com Ltd. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | maintain | Neutral | 2025-11-11 |

| Piper Sandler | maintain | Overweight | 2025-11-11 |

| Morgan Stanley | maintain | Overweight | 2025-11-11 |

| Jefferies | maintain | Buy | 2025-11-11 |

| Citigroup | maintain | Buy | 2025-11-11 |

| Barclays | maintain | Overweight | 2025-11-11 |

| UBS | maintain | Neutral | 2025-11-11 |

| JP Morgan | maintain | Overweight | 2025-11-11 |

| Wells Fargo | maintain | Overweight | 2025-11-11 |

| DA Davidson | maintain | Buy | 2025-11-11 |

Overall, both companies have received consistent grades, with multiple firms maintaining their positive outlooks. ServiceNow shows a strong performance with a majority “Overweight” rating, while monday.com also maintains several “Overweight” grades, indicating strong potential for growth.

Target Prices

ServiceNow, Inc. (NOW) and monday.com Ltd. (MNDY) have reliable target price data from analysts, indicating a consensus outlook for both companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| ServiceNow, Inc. | 1315 | 860 | 1172.71 |

| monday.com Ltd. | 365 | 202 | 293.78 |

For ServiceNow, the consensus target price of 1172.71 suggests a significant upside potential compared to its current price of 825.31. In contrast, monday.com’s consensus target of 293.78 indicates a favorable outlook, given its current price of 147.78. Overall, analysts appear optimistic about the growth prospects for both companies.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of ServiceNow, Inc. (NOW) and monday.com Ltd. (MNDY) based on the most recent data.

| Criterion | ServiceNow, Inc. (NOW) | monday.com Ltd. (MNDY) |

|---|---|---|

| Diversification | High | Moderate |

| Profitability | Strong (Net Margin: 13%) | Weak (Net Margin: 3.3%) |

| Innovation | High | Moderate |

| Global presence | Strong | Moderate |

| Market Share | Leading | Emerging |

| Debt level | Low (Debt/Equity: 0.24) | Very Low (Debt/Equity: 0.10) |

Key takeaways indicate that ServiceNow demonstrates robust profitability and a strong market position, while monday.com, although innovative, faces challenges in profitability and market share. Understanding these factors can guide your investment decisions effectively.

Risk Analysis

In the table below, I present a summary of the key risks associated with ServiceNow, Inc. and monday.com Ltd. for the current fiscal year.

| Metric | ServiceNow, Inc. | monday.com Ltd. |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Low | Moderate |

| Operational Risk | Moderate | High |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate | Moderate |

Both companies face significant market and operational risks, especially monday.com, which has shown volatility in its financial performance. The software industry, where both operate, is susceptible to rapid market changes and regulatory scrutiny, making risk management critical.

Which one to choose?

When comparing ServiceNow (NOW) and monday.com (MNDY), both companies have shown strong fundamentals, but they exhibit distinct characteristics. ServiceNow has a higher gross profit margin of 79.18% compared to monday.com’s 89.33%, indicating greater efficiency in revenue generation. However, ServiceNow’s net income per share is significantly higher at $6.92 versus monday.com’s $0.65, which reflects its profitability and financial health.

ServiceNow’s stock trend is bullish with a recent price change of +22.06%, while monday.com is in a bearish trend, down -16.41%. Analyst ratings for both companies are similar, maintaining a grade of B, but ServiceNow’s overall score slightly edges out with better return on equity and asset metrics.

Investors focusing on growth might find ServiceNow more appealing due to its profitability and bullish trend, while those seeking value may consider monday.com, which has a lower price-to-earnings ratio despite its current challenges.

Risks include competition and market dependence, particularly for monday.com, which is facing a significant valuation challenge.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of ServiceNow, Inc. and monday.com Ltd. to enhance your investment decisions: