In today’s fast-paced investment landscape, selecting the right company to add to your portfolio is crucial. This analysis compares Roper Technologies, Inc. (ROP) and ServiceTitan, Inc. (TTAN), two companies that operate within overlapping sectors—industrial machinery and software application. Both firms are known for their innovative solutions, making them intriguing options for investors. Join me as we explore which of these companies presents the most compelling investment opportunity.

Table of contents

Company Overview

Roper Technologies, Inc. Overview

Roper Technologies, Inc. is a leading diversified technology company that designs and develops a wide range of software and engineered products. Headquartered in Sarasota, Florida, Roper operates in the industrial machinery sector, focusing on sectors such as diagnostics, financial management, and cloud-based solutions. With a market capitalization of approximately $48B, the company serves various industries, including healthcare and insurance, offering innovative solutions like data analytics and precision instruments. Roper’s commitment to technological advancement positions it as a key player in the industrial landscape.

ServiceTitan, Inc. Overview

ServiceTitan, Inc. specializes in software solutions for field service management, primarily targeting the residential and commercial service industries. Founded in 2008 and headquartered in Glendale, California, ServiceTitan is rapidly growing within the software application sector, boasting a market cap of around $8.3B. The company provides tools that streamline operations for service providers, enhancing efficiency and customer service. With a focus on innovation, ServiceTitan is establishing itself as a vital partner for service businesses looking to leverage technology for growth.

Key similarities and differences in their business models include Roper’s broad focus on various industrial solutions and services, contrasting with ServiceTitan’s specialized approach to field service management software. While both companies leverage technology for operational efficiency, Roper’s diversification offers a wider market reach compared to ServiceTitan’s targeted niche.

Income Statement Comparison

The following table presents a comparative income statement for Roper Technologies, Inc. (ROP) and ServiceTitan, Inc. (TTAN) for the most recent fiscal year.

| Metric | Roper Technologies (ROP) | ServiceTitan (TTAN) |

|---|---|---|

| Revenue | 7.04B | 771.88M |

| EBITDA | 3.04B | -141.04M |

| EBIT | 2.23B | -221.26M |

| Net Income | 1.55B | -359.73M |

| EPS | 14.47 | -8.53 |

Interpretation of Income Statement

In the most recent fiscal year, Roper Technologies (ROP) demonstrated robust growth with a revenue increase to 7.04B, resulting in a net income of 1.55B, reflecting strong operational efficiency. Conversely, ServiceTitan (TTAN) reported revenues of 771.88M but incurred a significant net loss of 359.73M, indicating challenges in managing costs relative to revenue. ROP’s EBITDA margin has improved, while TTAN’s negative margins suggest a need for strategic adjustments to enhance profitability. Overall, ROP’s performance highlights its market strength, whereas TTAN’s results underscore the importance of addressing operational inefficiencies.

Financial Ratios Comparison

The following table provides a recent comparison of key financial ratios for Roper Technologies, Inc. (ROP) and ServiceTitan, Inc. (TTAN).

| Metric | ROP | TTAN |

|---|---|---|

| ROE | 8.21% | -16.44% |

| ROIC | 5.50% | -14.25% |

| P/E | 35.94 | N/A |

| P/B | 2.95 | 2.98 |

| Current Ratio | 0.40 | 3.74 |

| Quick Ratio | 0.37 | 3.74 |

| D/E | 0.41 | 0.11 |

| Debt-to-Assets | 24.48% | 9.35% |

| Interest Coverage | 7.70 | -14.82 |

| Asset Turnover | 0.22 | 0.44 |

| Fixed Asset Turnover | 47.02 | 9.57 |

| Payout Ratio | 20.78% | N/A |

| Dividend Yield | 0.58% | 0% |

Interpretation of Financial Ratios

ROP exhibits strong profitability with a positive ROE and ROIC, indicating effective use of equity and investment capital. However, TTAN shows concerning negative profitability metrics and high leverage risks, reflected in its low interest coverage and high debt-to-assets ratio. The stark contrast in current and quick ratios highlights ROP’s liquidity challenges compared to TTAN’s robust liquidity position. Investors should exercise caution when considering TTAN due to its negative financial performance.

Dividend and Shareholder Returns

Roper Technologies, Inc. (ROP) offers a dividend with a payout ratio of 21%, yielding 0.58% annually. The company has consistently increased its dividend, supported by strong free cash flow, though risks include potential market downturns affecting sustainability. In contrast, ServiceTitan, Inc. (TTAN) does not pay dividends, focusing instead on reinvestment for growth. This strategy aligns with their high-growth phase, although they do engage in share buybacks. Both approaches can support long-term shareholder value, albeit through different paths.

Strategic Positioning

Roper Technologies (ROP) commands a substantial market share in the industrial machinery sector, leveraging its diverse portfolio of software and engineered solutions to sustain its competitive edge. With a market cap of 48B, it faces moderate competitive pressure from emerging technologies and established players. In contrast, ServiceTitan (TTAN) operates within the software application industry, focusing on field service management with a market cap of 8.3B, navigating a landscape marked by rapid technological disruption and increasing demand for efficiency. Both companies must adapt to evolving market dynamics to maintain their positions.

Stock Comparison

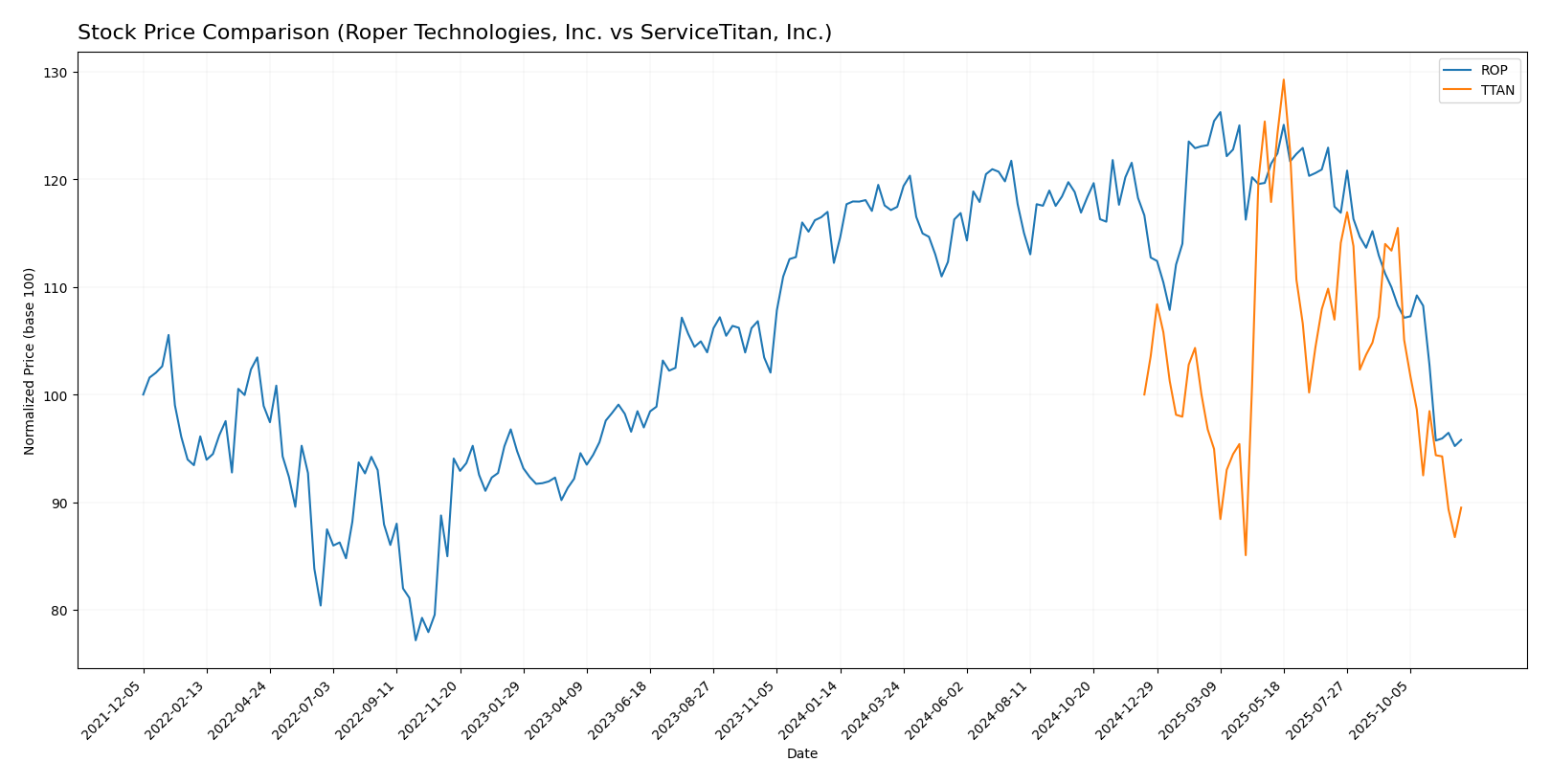

In this analysis, I will review the stock price movements of Roper Technologies, Inc. (ROP) and ServiceTitan, Inc. (TTAN) over the past year, highlighting key price dynamics and trading behaviors.

Trend Analysis

Roper Technologies, Inc. (ROP)

Over the past year, ROP’s stock has experienced a price change of -14.66%, indicating a bearish trend. The stock has shown notable deceleration in its downward movement, with the highest price recorded at 588.38 and the lowest at 443.75. The standard deviation of 30.17 suggests a significant level of volatility in its price action.

In the recent trend from September 14, 2025, to November 30, 2025, the stock has further declined by -12.9%, with a trend slope of -7.35. The standard deviation during this period is 28.07, reinforcing the presence of volatility.

ServiceTitan, Inc. (TTAN)

For TTAN, the price change over the past year stands at -10.51%, also reflecting a bearish trend. The trend has decelerated, with the stock reaching a high of 129.26 and a low of 85.07. The standard deviation of 10.28 indicates lower volatility compared to ROP.

In the recent period from September 14, 2025, to November 30, 2025, TTAN’s stock saw a more pronounced decline of -21.06%, with a trend slope of -2.36 and a standard deviation of 8.83, which is consistent with the overall bearish sentiment.

In conclusion, both ROP and TTAN currently exhibit bearish trends with significant declines over the past year, suggesting caution for potential investors looking to enter these stocks.

Analyst Opinions

Recent analyst recommendations for Roper Technologies, Inc. (ROP) indicate a consensus rating of “Buy” with a solid B+ score. Analysts highlight its strong performance in discounted cash flow and return on assets, making it an attractive investment. In contrast, ServiceTitan, Inc. (TTAN) has garnered a “Sell” consensus with a C- rating. Analysts point to its weak performance in key financial metrics, particularly return on equity and return on assets, as reasons for caution. Overall, I suggest focusing on ROP for potential growth while being cautious with TTAN.

Stock Grades

In this section, I’ll present the latest stock grades for Roper Technologies, Inc. (ROP) and ServiceTitan, Inc. (TTAN). These grades are sourced from reputable grading companies, providing insight into the current sentiment around these stocks.

Roper Technologies, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | downgrade | Sector Perform | 2025-10-27 |

| Barclays | maintain | Underweight | 2025-10-27 |

| TD Cowen | maintain | Buy | 2025-10-24 |

| Raymond James | maintain | Strong Buy | 2025-10-24 |

| RBC Capital | maintain | Outperform | 2025-10-24 |

| Jefferies | maintain | Buy | 2025-10-24 |

| Mizuho | maintain | Neutral | 2025-10-17 |

| JP Morgan | downgrade | Underweight | 2025-10-15 |

| Barclays | maintain | Underweight | 2025-10-01 |

| Truist Securities | maintain | Buy | 2025-07-22 |

ServiceTitan, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BMO Capital | maintain | Outperform | 2025-11-20 |

| Wells Fargo | maintain | Overweight | 2025-09-19 |

| Stifel | maintain | Buy | 2025-09-19 |

| Canaccord Genuity | maintain | Buy | 2025-09-19 |

| Piper Sandler | maintain | Overweight | 2025-09-19 |

| Citigroup | maintain | Neutral | 2025-09-09 |

| Piper Sandler | maintain | Overweight | 2025-09-05 |

| Needham | maintain | Buy | 2025-09-05 |

| Morgan Stanley | maintain | Equal Weight | 2025-09-05 |

| Truist Securities | maintain | Buy | 2025-09-05 |

Overall, ROP shows mixed sentiments with some downgrades, particularly from RBC Capital and JP Morgan, while maintaining strong ratings from firms like Raymond James and TD Cowen. In contrast, TTAN remains solidly rated with several firms maintaining their positive outlook, indicating a generally favorable sentiment among analysts.

Target Prices

The current consensus target prices for Roper Technologies, Inc. and ServiceTitan, Inc. indicate optimistic future valuations based on analyst expectations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Roper Technologies, Inc. | 650 | 506 | 574.2 |

| ServiceTitan, Inc. | 145 | 115 | 132.57 |

For Roper Technologies, the consensus target price of 574.2 suggests a potential upside from the current price of 446.41. Meanwhile, ServiceTitan’s consensus of 132.57 also reflects optimism compared to its current price of 89.49.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Roper Technologies, Inc. (ROP) and ServiceTitan, Inc. (TTAN), based on the most recent financial data.

| Criterion | Roper Technologies, Inc. (ROP) | ServiceTitan, Inc. (TTAN) |

|---|---|---|

| Diversification | High across various sectors | Focused on field service |

| Profitability | Strong with a net margin of 22% | Negative margins |

| Innovation | Advanced engineering solutions | Growing software platform |

| Global presence | Significant international reach | Primarily US market |

| Market Share | Established leader in industrial tools | Emerging player |

| Debt level | Moderate (Debt-to-Equity: 0.41) | Low (Debt-to-Equity: 0.11) |

Key takeaways indicate that Roper Technologies has a robust profitability and diversification profile, while ServiceTitan continues to develop but currently faces profitability challenges. Understanding these aspects can guide investment decisions effectively.

Risk Analysis

In the following table, I present a risk analysis for two companies, Roper Technologies, Inc. and ServiceTitan, Inc., highlighting various risk metrics that could impact their performance.

| Metric | Roper Technologies, Inc. | ServiceTitan, Inc. |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Low | Moderate |

| Operational Risk | Low | High |

| Environmental Risk | Moderate | Low |

| Geopolitical Risk | Low | Moderate |

In synthesizing the risks, I find that ServiceTitan faces high operational and market risks, driven by its negative profit margins and the competitive software landscape. Meanwhile, Roper Technologies exhibits more stability, although it still faces moderate market risks due to macroeconomic factors.

Which one to choose?

When comparing Roper Technologies, Inc. (ROP) and ServiceTitan, Inc. (TTAN), ROP appears more favorable based on its solid fundamentals. ROP has a market cap of $55.7B, a gross profit margin of 69.3%, and a net profit margin of 22.0%. In contrast, TTAN, with a market cap of $4.3B, shows concerning financial health with negative profit margins and a C- rating from analysts. ROP’s stock trend is currently bearish, with a price change of -14.66% over the past year, while TTAN’s trend is also bearish at -10.51%.

For growth-focused investors, ROP may be the better choice due to its stronger fundamentals. However, those seeking speculative opportunities might consider TTAN, keeping in mind its current financial instability. Specific risks include industry competition and valuation concerns.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Roper Technologies, Inc. and ServiceTitan, Inc. to enhance your investment decisions: