Home > Analyses > Industrials > Xylem Inc.

Xylem Inc. powers the vital flow of water that sustains communities and industries worldwide. As a global leader in water technology, it engineers advanced pumps, treatment systems, and smart analytics that ensure clean, reliable water management. Renowned for innovation and operational excellence, Xylem shapes how cities and businesses tackle water challenges. The key question now: do its solid fundamentals and growth prospects still justify its premium market valuation in 2026?

Table of contents

Business Model & Company Overview

Xylem Inc., founded in 2011 and headquartered in Rye Brook, New York, dominates the industrial machinery sector with a focus on water and wastewater solutions. Its cohesive ecosystem spans Water Infrastructure, Applied Water, and Measurement & Control Solutions, delivering engineered products and services that address critical water challenges globally. Xylem’s portfolio integrates pumps, controls, filtration, and smart metering under renowned brands like Flygt and Goulds Water Technology, reinforcing its competitive advantage in water management.

Xylem’s revenue engine balances hardware sales with growing software and service offerings, including cloud analytics and remote monitoring, across the Americas, Europe, and Asia Pacific. This diversified model enhances recurring revenue streams and customer stickiness. The company’s extensive direct sales and distributor networks amplify global reach. I recognize Xylem’s robust economic moat in combining advanced technology with essential infrastructure, positioning it as a key player shaping the future of water management.

Financial Performance & Fundamental Metrics

I analyze Xylem Inc.’s income statement, key financial ratios, and dividend payout policy to assess its operational efficiency and shareholder value creation.

Income Statement

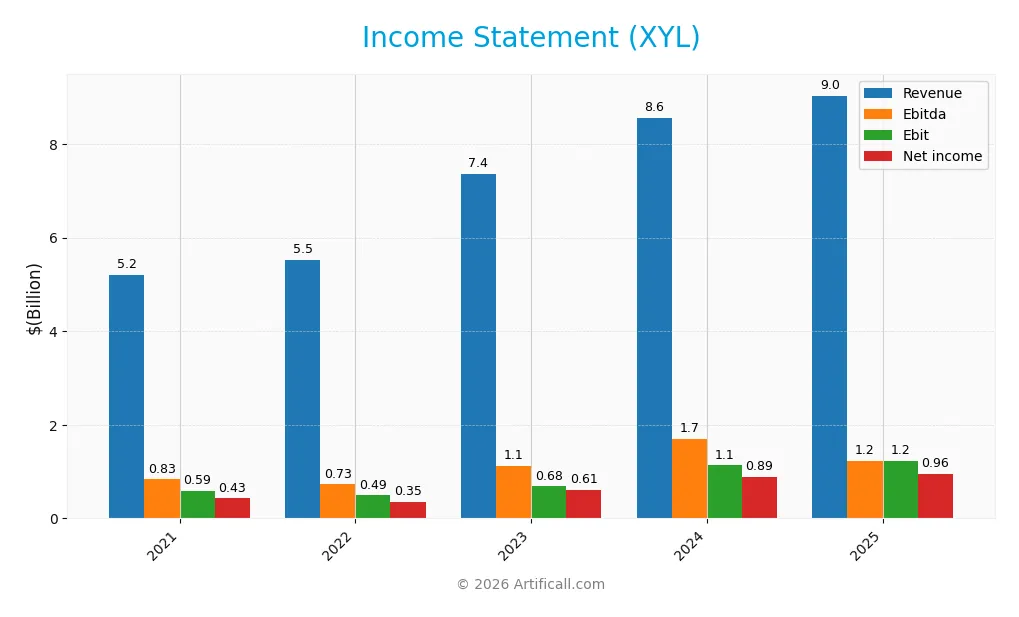

The table below summarizes Xylem Inc.’s key income statement figures from 2021 through 2025, reflecting revenue growth and profitability trends.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 5.2B | 5.5B | 7.4B | 8.6B | 9.0B |

| Cost of Revenue | 3.2B | 3.4B | 4.6B | 5.4B | 5.6B |

| Operating Expenses | 1.4B | 1.5B | 2.1B | 2.2B | 2.3B |

| Gross Profit | 2.0B | 2.1B | 2.7B | 3.2B | 3.5B |

| EBITDA | 832M | 726M | 1.1B | 1.7B | 1.2B |

| EBIT | 587M | 490M | 684M | 1.1B | 1.2B |

| Interest Expense | 76M | 50M | 49M | 44M | 29M |

| Net Income | 427M | 355M | 609M | 890M | 957M |

| EPS | 2.37 | 1.97 | 2.81 | 3.67 | 3.93 |

| Filing Date | 2022-02-25 | 2023-02-24 | 2024-02-28 | 2025-03-03 | 2026-02-10 |

Income Statement Evolution

Xylem Inc. posted steady revenue growth, increasing 74% from 2021 to 2025, with a 5.5% rise in the last year alone. Net income more than doubled over the period, reflecting strong margin expansion. Gross margin improved to 38.5%, while net margin reached 10.6%, signaling enhanced profitability and operational efficiency.

Is the Income Statement Favorable?

In 2025, fundamentals appear favorable. EBIT margin stood at a healthy 13.5%, supported by disciplined operating expenses growing in line with revenue. Interest expense remained low at 0.32% of revenue, and EPS rose 7.4%, demonstrating effective capital allocation and earnings quality. Overall, income statement metrics indicate solid financial health.

Financial Ratios

This table summarizes key financial ratios for Xylem Inc. (XYL) over the fiscal years 2021 to 2025, providing a clear view of profitability, liquidity, valuation, and leverage metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 8.2% | 6.4% | 8.3% | 10.4% | 10.6% |

| ROE | 13.3% | 10.2% | 6.0% | 8.4% | 8.3% |

| ROIC | 7.0% | 7.8% | 4.5% | 5.8% | 6.4% |

| P/E | 50.6 | 56.1 | 40.7 | 31.6 | 34.6 |

| P/B | 6.7 | 5.7 | 2.4 | 2.6 | 2.9 |

| Current Ratio | 2.27 | 1.89 | 1.76 | 1.75 | 1.63 |

| Quick Ratio | 1.77 | 1.39 | 1.30 | 1.33 | 1.28 |

| D/E | 0.78 | 0.56 | 0.24 | 0.20 | 0.17 |

| Debt-to-Assets | 30.3% | 24.5% | 14.8% | 12.9% | 11.0% |

| Interest Coverage | 7.7x | 12.4x | 13.3x | 22.9x | 42.2x |

| Asset Turnover | 0.63 | 0.69 | 0.46 | 0.52 | 0.51 |

| Fixed Asset Turnover | 8.07 | 8.77 | 6.30 | 7.43 | 7.80 |

| Dividend Yield | 0.94% | 1.09% | 1.20% | 1.24% | 1.18% |

Evolution of Financial Ratios

From 2021 to 2025, Xylem Inc.’s Return on Equity (ROE) declined from 13.27% to 8.34%, indicating weakening profitability. The Current Ratio steadily decreased from 2.27 to 1.62, showing reduced liquidity but remaining above 1. The Debt-to-Equity Ratio improved significantly, falling from 0.78 to 0.17, reflecting lower financial leverage and enhanced balance sheet stability.

Are the Financial Ratios Fovorable?

In 2025, profitability shows mixed signals: net margin at 10.59% is favorable, but ROE at 8.34% is unfavorable, below the typical market benchmark near 15%. Liquidity ratios, including a current ratio of 1.62 and quick ratio of 1.28, are favorable, supporting short-term solvency. Leverage remains conservative with a debt-to-equity of 0.17 and interest coverage above 42x, both favorable. Efficiency ratios like asset turnover are neutral, while valuation metrics such as P/E at 34.64 are unfavorable, reflecting high market expectations. Overall, the ratios are slightly favorable but warrant cautious interpretation.

Shareholder Return Policy

Xylem Inc. maintains a consistent dividend payout ratio around 40-50%, with a dividend yield near 1.2%. Dividend payments are covered by free cash flow, supported by moderate share buybacks, indicating balanced capital allocation.

This policy reflects a steady income approach without risking cash flow sustainability. The combination of dividends and buybacks suggests a commitment to long-term shareholder value while preserving financial flexibility.

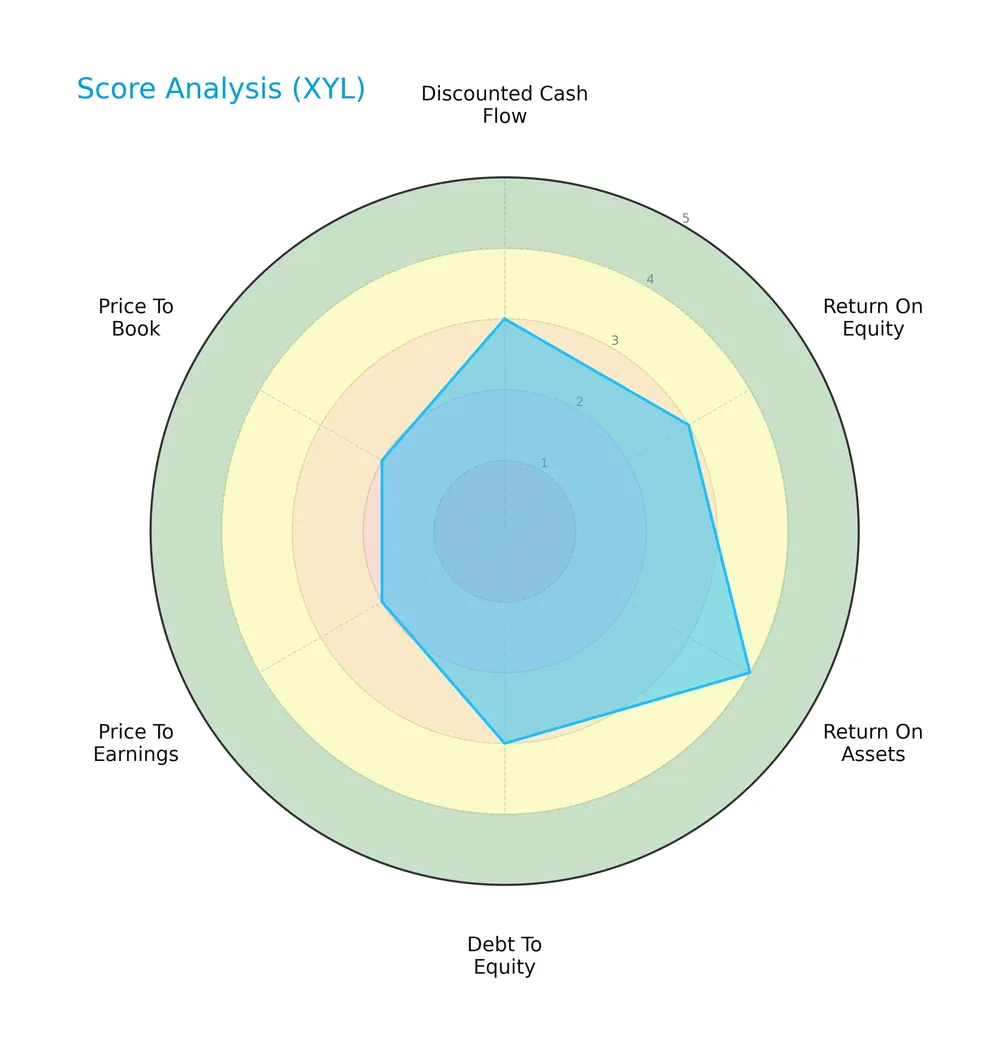

Score analysis

Here is a radar chart illustrating Xylem Inc.’s key financial scores across valuation, profitability, and leverage metrics:

Xylem shows moderate scores on discounted cash flow, return on equity, and debt to equity. Return on assets stands out favorably. However, valuation metrics price-to-earnings and price-to-book appear unfavorable, indicating potential market pricing concerns.

Analysis of the company’s bankruptcy risk

Xylem’s Altman Z-Score firmly places it in the safe zone, signaling low bankruptcy risk and financial stability:

Is the company in good financial health?

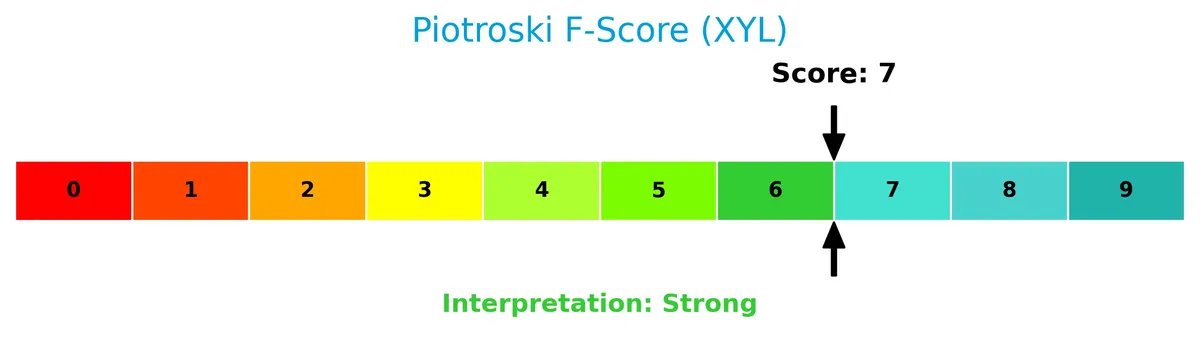

The Piotroski Score diagram highlights Xylem’s strong financial health status based on nine fundamental criteria:

With a score of 7, Xylem demonstrates solid profitability, liquidity, and operational efficiency, reflecting a robust financial condition overall.

Competitive Landscape & Sector Positioning

This analysis explores Xylem Inc.’s strategic positioning and revenue streams within the industrial machinery sector. It reviews key products and identifies main competitors shaping the market landscape. I will assess whether Xylem holds a competitive advantage over its peers in this industry.

Strategic Positioning

Xylem Inc. maintains a diversified product portfolio across Water Infrastructure, Applied Water, and Measurement & Control Solutions segments. Geographically, it is heavily concentrated in the US, generating over $4.8B in 2024, supplemented by significant revenue from Europe and Asia Pacific regions.

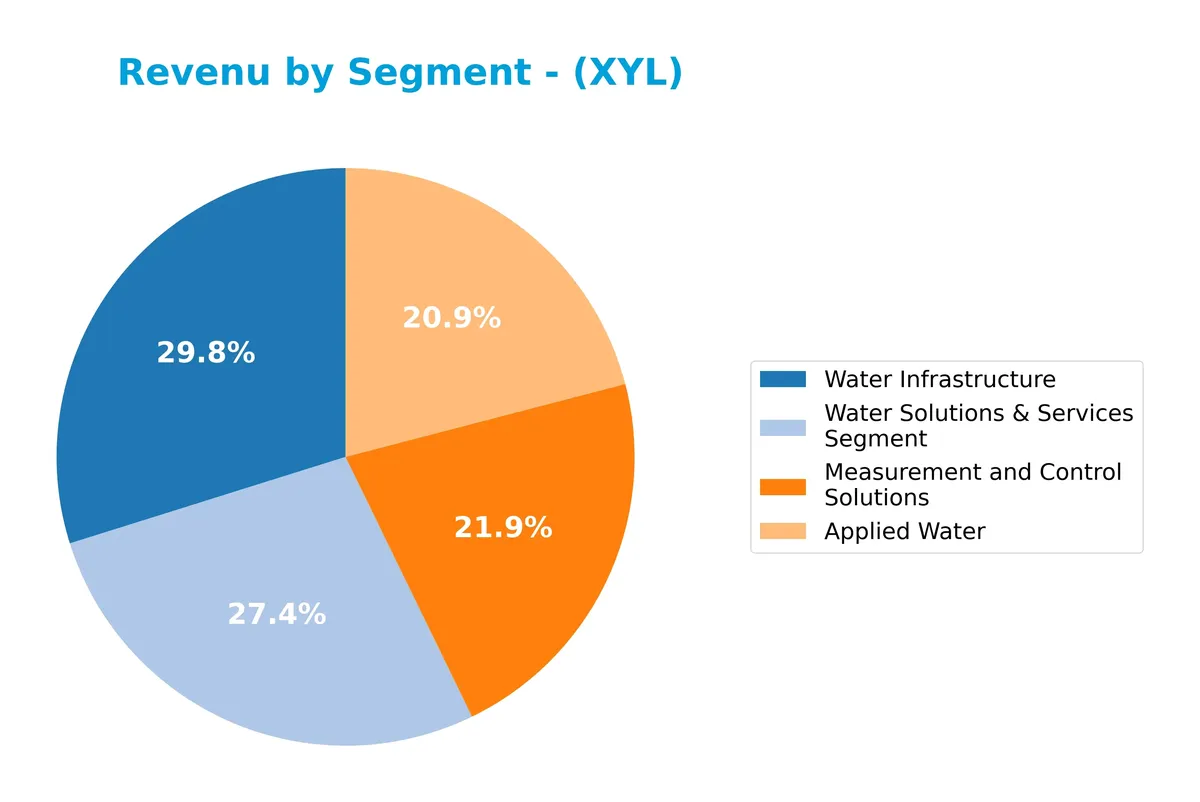

Revenue by Segment

This pie chart illustrates Xylem Inc.’s revenue distribution by segment for the fiscal year ending December 31, 2024, highlighting the company’s business composition.

Water Infrastructure remains the largest revenue driver at 2.56B, followed closely by Water Solutions & Services at 2.34B, and Measurement and Control Solutions at 1.87B. Applied Water contributes 1.79B. The 2024 data shows a more balanced revenue mix compared to previous years, with Water Solutions & Services emerging as a notable new segment alongside steady growth in Measurement and Control Solutions.

Key Products & Brands

Xylem Inc. offers engineered water solutions through distinct product lines and renowned brand names:

| Product | Description |

|---|---|

| Water Infrastructure | Pumps, controls, filtration, disinfection, and biological treatment equipment; brands include Flygt, Godwin, Wedeco, Sanitaire, Leopold, Xylem Vue. |

| Applied Water | Pumps, valves, heat exchangers, controls, and dispensing systems for residential, commercial, and industrial use; brands include Goulds Water Technology, Bell & Gossett, A-C Fire Pump, Standard Xchange, Lowara, Jabsco, Flojet, Xylem Vue. |

| Measurement & Control Solutions | Smart meters, networked communication devices, measurement and control technologies, software, and services; brands include Pure, Sensus, Smith Blair, WTW, Xylem Vue, YSI. |

Xylem’s diverse product range spans water transport, treatment, and monitoring, supported by a portfolio of well-established brands across multiple global markets.

Main Competitors

Xylem Inc. competes with 24 companies in Industrials; here are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Eaton Corporation plc | 127B |

| Parker-Hannifin Corporation | 114.2B |

| Howmet Aerospace Inc. | 85.2B |

| Emerson Electric Co. | 76.3B |

| Illinois Tool Works Inc. | 73B |

| Cummins Inc. | 71.9B |

| AMETEK, Inc. | 48.3B |

| Roper Technologies, Inc. | 46.8B |

| Rockwell Automation, Inc. | 44.8B |

| Symbotic Inc. | 35.9B |

Xylem ranks 12th among 24 competitors, with a market cap roughly 25% of Eaton Corporation’s. It stands below both the average market cap of the top 10 competitors (72.4B) and the sector median (32.4B). The company maintains an 11.16% market cap gap versus its closest superior rival, highlighting a moderate distance from the immediate competition.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Xylem Inc. have a competitive advantage?

Xylem Inc. does not present a competitive advantage, as its return on invested capital (ROIC) remains below its weighted average cost of capital (WACC), signaling value destruction. The company’s declining ROIC trend further confirms weakening profitability and inefficient capital use.

Looking ahead, Xylem’s diversified segments in Water Infrastructure, Applied Water, and Measurement & Control Solutions offer growth potential through smart meters, cloud-based analytics, and international market expansion. These opportunities could support future value creation if operational efficiency improves.

SWOT Analysis

This SWOT analysis highlights Xylem Inc.’s key internal and external factors shaping its strategic outlook.

Strengths

- strong brand portfolio

- diversified global presence

- favorable profit margins

Weaknesses

- declining ROIC indicating value destruction

- below-industry ROE

- high P/E ratio signals possible overvaluation

Opportunities

- growing water infrastructure demand

- expansion in Asia Pacific markets

- innovation in smart water technologies

Threats

- intense industry competition

- regulatory changes in water management

- economic sensitivity affecting industrial spending

Xylem’s solid brand and profitability provide a stable platform, yet its declining ROIC warns of operational inefficiencies. The company must leverage growth in emerging markets and technology advancements while mitigating competitive and regulatory risks.

Stock Price Action Analysis

The weekly stock chart below illustrates Xylem Inc.’s price fluctuations over the last 12 months:

Trend Analysis

Over the past 12 months, XYL’s stock price declined by 0.22%, indicating a neutral trend given the threshold is ±2%. The price showed deceleration despite a high volatility of 9.59. The highest price reached 151.31, the lowest 104.6, reflecting a broad trading range.

Volume Analysis

Over the last three months, trading volume is increasing with buyers accounting for 50.13%, indicating neutral buyer behavior. This balance suggests cautious market participation with no clear dominance by buyers or sellers.

Target Prices

Analysts show a bullish consensus for Xylem Inc., reflecting solid confidence in its growth prospects.

| Target Low | Target High | Consensus |

|---|---|---|

| 150 | 178 | 169.67 |

The target prices reveal a robust range, with a consensus near 170, signaling positive analyst expectations for XYL’s stock performance.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines analyst ratings and consumer feedback to provide a comprehensive view of Xylem Inc.’s market perception.

Stock Grades

Here are the recent verified analyst grades for Xylem Inc., reflecting their current stance on the stock:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-01-07 |

| Mizuho | Maintain | Neutral | 2026-01-05 |

| TD Cowen | Maintain | Hold | 2025-12-05 |

| UBS | Maintain | Buy | 2025-11-06 |

| RBC Capital | Maintain | Outperform | 2025-10-29 |

| Stifel | Maintain | Buy | 2025-10-29 |

| Citigroup | Maintain | Buy | 2025-10-29 |

| Barclays | Maintain | Overweight | 2025-10-29 |

| Citigroup | Maintain | Buy | 2025-10-09 |

| Mizuho | Maintain | Neutral | 2025-09-12 |

The grades consistently show a stable outlook, with multiple buy and overweight ratings balanced by neutral and hold positions. This mix indicates cautious optimism among analysts, with no recent downgrades or upgrades disrupting the status quo.

Consumer Opinions

Consumer sentiment around Xylem Inc. reflects a mix of admiration for its innovation and concerns about service consistency.

| Positive Reviews | Negative Reviews |

|---|---|

| “Xylem’s products are reliable and efficient, especially in water management solutions.” | “Customer support response times are slower than expected.” |

| “Impressive technology that truly helps with sustainable water use.” | “Installation process can be complicated without professional help.” |

| “Strong commitment to environmental responsibility resonates well with my values.” | “Pricing feels premium compared to competitors with similar offerings.” |

Overall, consumers praise Xylem’s cutting-edge technology and sustainability focus. However, recurring issues with customer support and pricing temper enthusiasm.

Risk Analysis

Key risks facing Xylem Inc. span operational, financial, and market factors, each with distinct probabilities and impacts:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | The stock shows a beta of 1.16, indicating higher sensitivity to market swings than the S&P 500. | Medium | Medium |

| Valuation Risk | The price-to-earnings ratio at 34.6 is elevated versus industrial peers, suggesting overvaluation. | High | High |

| Profitability | Return on equity (8.3%) lags behind WACC (8.8%), signaling potential value destruction. | Medium | Medium |

| Operational Risk | Supply chain disruptions could affect manufacturing and servicing of water infrastructure. | Medium | High |

| Debt and Liquidity | Favorable debt ratios and strong interest coverage reduce default risk, but liquidity must be monitored. | Low | Low |

| Dividend Pressure | A modest 1.18% yield limits appeal to income-focused investors amid rising rates. | Low | Low |

The most concerning risks are Xylem’s high valuation and operational challenges from supply chain issues. Despite a safe Altman Z-Score (4.44) signaling strong financial health, the unfavorable ROE versus WACC warns of potential inefficiencies. Market volatility also poses a moderate threat given the stock’s beta above 1. I advise close monitoring of profitability trends and cost management to mitigate these risks.

Should You Buy Xylem Inc.?

Xylem Inc. appears to be in a safe zone for bankruptcy risk, with strong earnings quality but declining operational efficiency eroding its competitive moat. Despite manageable leverage, its overall B rating suggests moderate value creation yet notable valuation headwinds.

Strength & Efficiency Pillars

Xylem Inc. shows strong operational margins with a gross margin of 38.46% and a net margin of 10.59%, both favorable signals of efficient cost management. Interest expense remains low at 0.32%, supporting profitability. However, the return on invested capital (ROIC) at 6.42% falls short of the weighted average cost of capital (WACC) at 8.84%, indicating the company is currently destroying value. Despite this, the Altman Z-Score of 4.44 places Xylem firmly in the safe zone, reflecting solid financial stability.

Weaknesses and Drawbacks

Xylem’s valuation appears stretched, with a high price-to-earnings ratio of 34.64 signaling a premium that may limit upside. The price-to-book ratio at 2.89 is neutral but warrants watchfulness. Return on equity is weak at 8.34%, which may disappoint investors seeking strong capital returns. While leverage metrics like debt-to-equity at 0.17 and current ratio at 1.62 are favorable, the bearish overall stock trend and recent price decline of -8.35% suggest market pressure and potential short-term headwinds.

Our Final Verdict about Xylem Inc.

The company’s long-term fundamentals show operational strength and financial safety, yet value destruction indicated by ROIC below WACC tempers enthusiasm. Despite a strong Piotroski score of 7 and a safe Altman Z-Score, the bearish price trend and premium valuation suggest caution. Xylem might appear attractive for investors focused on stability but could warrant a wait-and-see approach for a more compelling entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Xylem Inc (XYL) Q4 2025 Earnings Call Highlights: Record Revenue and Strategic Transformation – GuruFocus (Feb 10, 2026)

- Xylem shares slide after cautious 2026 outlook (XYL:NYSE) – Seeking Alpha (Feb 10, 2026)

- Xylem Inc. (NYSE:XYL) Declares Quarterly Dividend of $0.43 – MarketBeat (Feb 10, 2026)

- Why Xylem (XYL) Stock Is Down Today – Yahoo Finance (Feb 10, 2026)

- How Do Investors Really Feel About Xylem Inc? – Benzinga (Feb 10, 2026)

For more information about Xylem Inc., please visit the official website: xylem.com