Verint Systems Inc. transforms how businesses engage with their customers, redefining the standards of customer interaction across industries. As a trailblazer in the software infrastructure sector, Verint provides cutting-edge solutions that enhance customer experience and operational efficiency. With innovative offerings like AI-driven customer engagement tools and robust analytics, the company has earned a solid reputation for quality and reliability. As we dive into the investment analysis, we must consider whether Verint’s fundamentals justify its current market valuation and future growth prospects.

Table of contents

Company Description

Verint Systems Inc. is a prominent player in the Software – Infrastructure sector, specializing in customer engagement solutions globally. Founded in 1994 and headquartered in Melville, NY, Verint offers a suite of applications designed to enhance customer interactions, including tools for forecasting, analytics, and AI-driven conversation management. With a market cap of approximately $1.22B and a workforce of around 3,800 employees, the company operates primarily in North America. Verint’s strategic focus on innovation in customer experience management positions it as a significant influencer in shaping industry standards and enhancing operational efficiency for businesses worldwide.

Fundamental Analysis

In this section, I will conduct a fundamental analysis of Verint Systems Inc., focusing on its income statement, financial ratios, and dividend payout policy.

Income Statement

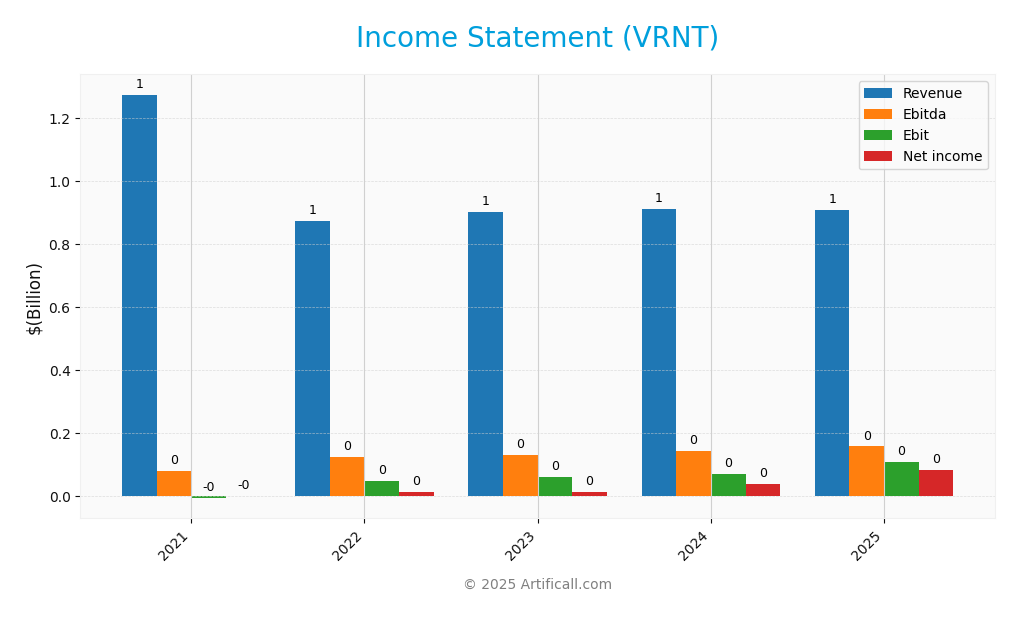

Below is the income statement for Verint Systems Inc. (VRNT) over the last five fiscal years, providing insights into the company’s financial performance.

| Income Statement Metrics | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Revenue | 1.27B | 874.51M | 902.25M | 910.39M | 909.19M |

| Cost of Revenue | 415.59M | 298.57M | 295.07M | 277.11M | 261.14M |

| Operating Expenses | 749.41M | 529.09M | 549.82M | 565.09M | 541.66M |

| Gross Profit | 858.11M | 575.94M | 607.18M | 633.28M | 648.05M |

| EBITDA | 79.15M | 125.28M | 130.60M | 143.09M | 158.01M |

| EBIT | -6.23M | 49.83M | 62.64M | 71.61M | 108.48M |

| Interest Expense | 39.80M | 10.32M | 7.88M | 10.33M | 10.13M |

| Net Income | -0.11M | 14.41M | 14.90M | 38.61M | 82.27M |

| EPS | -0.0016 | 0.22 | 0.23 | 0.28 | 1.05 |

| Filing Date | 2021-03-31 | 2022-03-29 | 2023-03-29 | 2024-03-27 | 2025-03-26 |

Over the five-year period, Verint Systems has shown a trend of fluctuating revenues, peaking in 2024 at $910.39M before slightly declining to $909.19M in 2025. Notably, net income surged from $38.61M in 2024 to $82.27M in 2025, indicating improved profitability and operational efficiency. The gross profit margin has remained relatively stable, suggesting effective cost management in line with revenue adjustments. The increase in EBITDA signals stronger operational performance, marking 2025 as a year of significant recovery and growth compared to previous years.

Financial Ratios

Below is a summary of key financial ratios for Verint Systems Inc. (VRNT) over the last five fiscal years.

| Ratio | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | -0.00008 | 0.0165 | 0.0165 | 0.0424 | 0.0905 |

| ROE | -0.00007 | 0.0104 | 0.0115 | 0.0305 | 0.0622 |

| ROIC | 0.0268 | 0.0097 | 0.0089 | 0.0258 | 0.0479 |

| WACC | N/A | N/A | N/A | N/A | N/A |

| P/E | -47168.20 | 233.59 | 166.51 | 49.21 | 19.17 |

| P/B | 3.43 | 2.42 | 1.92 | 1.50 | 1.19 |

| Current Ratio | 1.10 | 1.37 | 1.32 | 1.37 | 1.12 |

| Quick Ratio | 1.08 | 1.36 | 1.29 | 1.34 | 1.09 |

| D/E | 0.59 | 0.33 | 0.35 | 0.36 | 0.34 |

| Debt-to-Assets | 0.27 | 0.20 | 0.20 | 0.20 | 0.20 |

| Interest Coverage | 1.41 | 4.54 | 7.28 | 6.99 | 10.50 |

| Asset Turnover | 0.39 | 0.37 | 0.39 | 0.41 | 0.40 |

| Fixed Asset Turnover | 6.53 | 8.79 | 8.81 | 11.70 | 11.96 |

| Dividend Yield | 0.00031 | 0.00382 | 0.00838 | 0.01095 | 0.01273 |

Interpretation of Financial Ratios

In the most recent fiscal year (2025), VRNT’s net margin improved significantly to 9.05%, indicating stronger profitability. The return on equity (ROE) of 6.22% is modest but reflects a positive trend. However, the P/E ratio of 19.17 suggests a more reasonable valuation compared to the previous years, which were excessively high. The debt metrics are stable, but the company should maintain cautious financial management to sustain growth.

Evolution of Financial Ratios

Over the past five years, VRNT’s financial ratios have shown gradual improvement, particularly in profitability and efficiency metrics. The net margin and ROE have notably increased, while the P/E ratio has adjusted to more sustainable levels, indicating a positive shift in the company’s financial health and market perception.

Distribution Policy

Verint Systems Inc. (VRNT) has adopted a conservative distribution policy, offering a dividend of $0.32 per share, translating to an annual yield of approximately 1.27%. The payout ratio stands at 24.4%, indicating a sustainable distribution backed by healthy free cash flow. Additionally, the company engages in share buybacks, reflecting confidence in its stock valuation. This balanced approach supports long-term value creation for shareholders, although vigilance regarding potential market fluctuations is advisable.

Sector Analysis

Verint Systems Inc. operates within the Software – Infrastructure sector, focusing on customer engagement solutions. Its competitive advantages include innovative applications, strong analytics capabilities, and a diverse product portfolio that positions it well against key competitors.

Strategic Positioning

Verint Systems Inc. (VRNT) holds a competitive position in the Software – Infrastructure industry, with a market cap of approximately $1.22B. Its offerings in customer engagement solutions, particularly in areas like forecasting, quality compliance, and conversational AI, have garnered a notable market share. However, the company faces increasing competitive pressure from agile tech startups and established players introducing disruptive technologies. The current market dynamics necessitate continuous innovation to retain its edge amidst rapid technological advancements and evolving customer expectations.

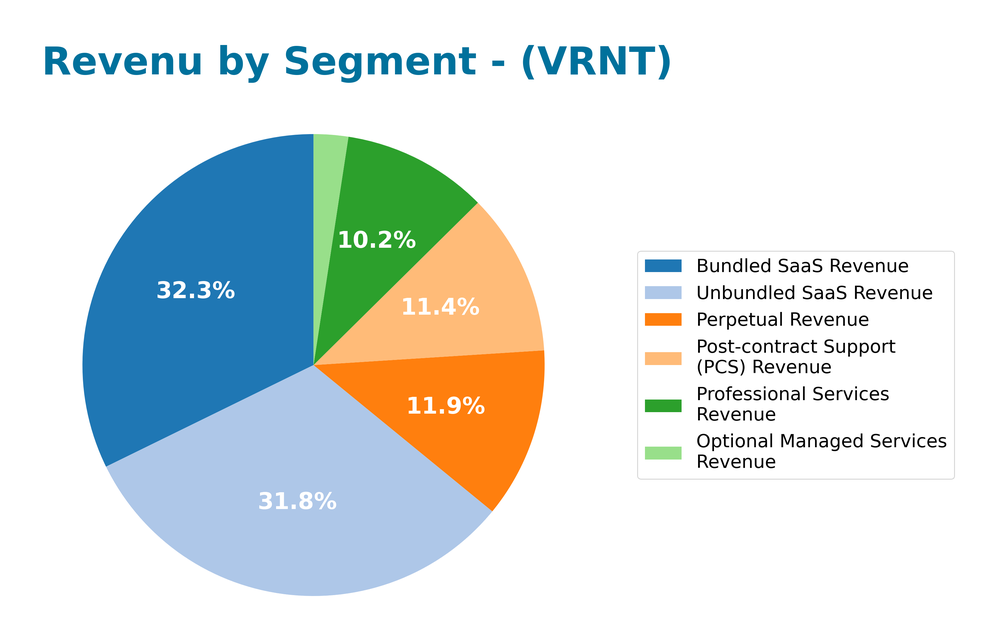

Revenue by Segment

The following chart illustrates Verint Systems Inc.’s revenue distribution by segment for the fiscal year 2025, showcasing the financial performance across various business lines.

In FY 2025, Verint’s revenue segments show a balanced contribution, with Unbundled SaaS Revenue leading at 289.4M, followed closely by Bundled SaaS Revenue at 293.2M and Post-contract Support at 103.5M. Notably, the Professional Services segment experienced a decline to 92.5M from previous periods, indicating potential pressure on margins in this area. Overall, while SaaS revenues continue to drive growth, the shift in Professional Services could present risks if not addressed, especially given the competitive landscape.

Key Products

Below is a table outlining some of the key products offered by Verint Systems Inc., which provide essential customer engagement solutions.

| Product | Description |

|---|---|

| Forecasting and Scheduling | An application that helps organizations predict workload requirements and manage staff scheduling to meet customer demands. |

| Quality and Compliance | Utilizes automation and analytics to ensure customer interactions meet quality standards across various service channels. |

| Interaction Insights | Extracts valuable insights from both structured and unstructured customer interactions to enhance service delivery. |

| Real-Time Work | Supports workforce activities in real-time, enabling employees to respond promptly to customer needs. |

| Engagement Channels | A platform for managing customer interactions across various mediums, including messaging, social media, email, and voice. |

| Conversational AI | An intelligent virtual assistant that facilitates human-like conversations, enhancing customer support across all channels. |

| Engagement Orchestration | Improves operational efficiency and customer satisfaction by streamlining workflows and processes for service teams. |

| Knowledge Management | Provides tools for agents to access and share information, ensuring high-quality customer service. |

| Experience Management | Collects and analyzes customer experience data to help businesses understand and improve customer satisfaction. |

| Customer Engagement Cloud | A comprehensive platform that integrates various customer engagement tools and services for businesses of all sizes. |

These products are designed to enhance customer engagement and operational efficiency, making Verint a key player in the software infrastructure industry.

Main Competitors

No verified competitors were identified from available data. Verint Systems Inc. has an estimated market share in the customer engagement solutions sector, positioning itself as a significant player in the technology industry. The company primarily operates in the U.S. market and focuses on providing advanced software applications that enhance customer interactions and workforce efficiency.

Competitive Advantages

Verint Systems Inc. (VRNT) holds a strong position in the customer engagement solutions market, underpinned by a diverse portfolio of applications that enhance workforce efficiency and customer satisfaction. The company’s focus on innovative technologies, such as Conversational AI and Engagement Orchestration, positions it well for future growth. As businesses increasingly prioritize customer experience, Verint’s ability to analyze and optimize interactions presents substantial opportunities. Expanding into emerging markets and introducing new cloud-based services further enhances its competitive edge, ensuring resilience in a dynamic industry landscape.

SWOT Analysis

The following SWOT analysis provides insight into Verint Systems Inc.’s strategic position.

Strengths

- Strong market presence

- Innovative product offerings

- Solid customer engagement solutions

Weaknesses

- Dependence on specific market segments

- Limited global reach

- High competition in the software industry

Opportunities

- Growing demand for AI solutions

- Expansion into new markets

- Increasing focus on customer experience

Threats

- Rapid technological changes

- Economic fluctuations

- Intense competition

Overall, Verint Systems Inc. has a robust foundation with significant strengths and opportunities. However, attention must be paid to its weaknesses and external threats to ensure sustainable growth and competitive advantage.

Stock Analysis

In this report, I will analyze the stock price movements of Verint Systems Inc. (VRNT) over the past year, highlighting key price dynamics and trading behavior.

Trend Analysis

Over the past year, Verint Systems Inc. has experienced a percentage change of -24.92%. This indicates a bearish trend, suggesting a decline in stock value. The stock has seen notable highs at $36.78 and lows at $15.20, with the trend exhibiting acceleration. The standard deviation of 5.52 indicates that the stock has experienced significant volatility during this timeframe.

Volume Analysis

In the last three months, trading volumes have totaled approximately 550M shares, with buyer volume at 246M and seller volume at 303M. The trading activity appears to be slightly seller-driven, as indicated by the 40.8% buyer dominance. Additionally, the volume trend is increasing, which may suggest heightened market participation and investor sentiment leaning towards selling pressure.

Analyst Opinions

Recent analyst recommendations for Verint Systems Inc. (VRNT) indicate a consensus rating of “Buy.” Analysts have highlighted the company’s strong discounted cash flow score of 4 and solid return on assets score of 4 as key strengths. Notably, the overall score stands at 3, with some concern regarding its debt-to-equity ratio, which scored a 2. This suggests cautious optimism; analysts such as those from the investment firm have recognized the potential for growth despite some challenges. Overall, the sentiment leans positively for investors considering VRNT in their portfolios.

Stock Grades

Verint Systems Inc. (VRNT) has recently seen a series of stock grade adjustments from various reputable analysts. Here’s a summary of the latest grades:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Downgrade | Sector Perform | 2025-08-26 |

| Needham | Downgrade | Hold | 2025-08-25 |

| Rosenblatt | Downgrade | Neutral | 2025-08-25 |

| Needham | Maintain | Buy | 2025-06-05 |

| Wedbush | Maintain | Outperform | 2025-06-05 |

| Needham | Maintain | Buy | 2025-04-25 |

| Wedbush | Maintain | Outperform | 2025-03-28 |

| Needham | Maintain | Buy | 2025-03-27 |

| RBC Capital | Maintain | Outperform | 2025-03-27 |

| Evercore ISI Group | Maintain | In Line | 2025-03-27 |

The overall trend shows a shift towards caution, with multiple downgrades in recent weeks. This may reflect broader market concerns or specific challenges faced by Verint Systems, suggesting that investors should approach this stock with due diligence.

Target Prices

The consensus target price for Verint Systems Inc. (VRNT) is optimistic, reflecting a stable outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 20.5 | 20.5 | 20.5 |

Overall, analysts expect the stock to maintain a solid performance, with a unified target price indicating confidence in its value.

Consumer Opinions

Consumer sentiment around Verint Systems Inc. (VRNT) reveals a mix of satisfaction and areas for improvement, reflecting the diverse experiences of users.

| Positive Reviews | Negative Reviews |

|---|---|

| Excellent customer support and responsiveness | Software updates often lead to bugs |

| Robust analytics capabilities | High learning curve for new users |

| Reliable performance under high demand | Pricing perceived as on the higher side |

Overall, consumer feedback indicates that while Verint’s customer support and analytics tools are highly praised, customers frequently express concerns about software reliability and pricing.

Risk Analysis

In evaluating Verint Systems Inc. (VRNT), it’s essential to consider the following risks that could impact investment decisions.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in the tech sector can affect stock price. | High | High |

| Regulatory Risk | Changes in data privacy laws may impact operations. | Medium | High |

| Competitive Risk | Intense competition in the analytics market. | High | Medium |

| Operational Risk | Risks associated with software failures or breaches. | Medium | High |

| Economic Risk | Global economic downturns can affect client budgets. | Medium | Medium |

The most significant risks for VRNT appear to be market and regulatory risks, given the evolving landscape of technology and data compliance requirements.

Should You Buy Verint Systems Inc.?

Verint Systems Inc. shows a positive net margin of 9.05%, indicating profitability. The company’s total debt stands at 448.43M, which suggests a moderate level of financial leverage. Over the recent fiscal years, the fundamentals have shown some volatility but have generally improved. The current rating for Verint is B+.

Favorable signals include a positive net margin of 9.05%, return on invested capital (ROIC) at 4.79%, and a weighted average cost of capital (WACC) of 8.56%. However, there are no other favorable signals as ROIC is below WACC, indicating value destruction. Unfavorable signals include a long-term trend that is bearish with a price change percentage of -24.92% and recent seller volume exceeding buyer volume, suggesting a lack of buying interest.

In conclusion, the current indicators may suggest that it would be preferable to wait for more favorable conditions, particularly given the negative long-term trend and the recent dominance of sellers over buyers. Additionally, the high beta of 1.431 indicates potential volatility, which could further complicate the investment decision.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Verint Systems Inc (VRNT) Q1 2026 Earnings Call Highlights: Strong AI Growth and Strategic Wins … – Yahoo Finance (Jun 05, 2025)

- VRNT Stock Alert: Halper Sadeh LLC Is Investigating Whether the Sale of Verint Systems Inc. Is Fair to Shareholders – Business Wire (Aug 25, 2025)

- Verint Systems (VRNT) Q2 Earnings and Revenues Beat Estimates – Nasdaq (Sep 02, 2025)

- Why We’re Not Concerned About Verint Systems Inc.’s (NASDAQ:VRNT) Share Price – simplywall.st (Jul 15, 2025)

- Thoma Bravo nears $2B deal for Verint Systems – Bloomberg (VRNT:NASDAQ) – Seeking Alpha (Aug 24, 2025)

For more information about Verint Systems Inc., please visit the official website: verint.com