Home > Analyses > Technology > Monolithic Power Systems, Inc.

Monolithic Power Systems powers the unseen heart of today’s electronics, enabling everything from sleek laptops to advanced automotive systems. As a semiconductor innovator, MPWR crafts cutting-edge DC-DC integrated circuits that manage energy efficiently across diverse markets. Its reputation for quality and technological leadership sets it apart in a fiercely competitive industry. The critical question now: does Monolithic Power’s robust innovation pipeline and market reach justify its lofty valuation and future growth prospects?

Table of contents

Business Model & Company Overview

Monolithic Power Systems, Inc., founded in 1997 and headquartered in Kirkland, Washington, leads the semiconductor industry with a focus on power electronics solutions. Its core business integrates DC to DC ICs and lighting control ICs into a unified ecosystem powering computing, automotive, industrial, and consumer markets. This cohesive mission drives innovation across portable devices, infotainment, and medical equipment, defining its dominant market position.

The company’s revenue engine blends hardware IC sales with strategic relationships across global markets, including China, Taiwan, Europe, South Korea, and the US. It leverages third-party distributors and direct OEM engagements to sustain growth. Monolithic Power Systems’ strong foothold and product integration create a durable economic moat, shaping the future of power management in electronics.

Financial Performance & Fundamental Metrics

I analyze Monolithic Power Systems, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder value.

Income Statement

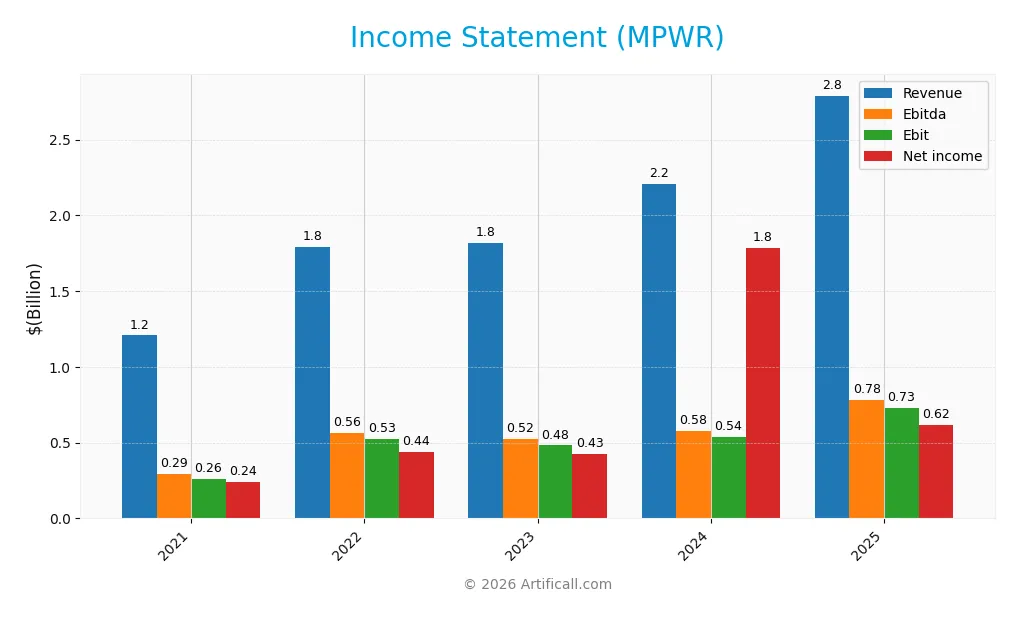

The table below summarizes Monolithic Power Systems, Inc.’s key income statement figures over the past five fiscal years.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 1.21B | 1.79B | 1.82B | 2.21B | 2.79B |

| Cost of Revenue | 522M | 746M | 800M | 986M | 1.25B |

| Operating Expenses | 423M | 522M | 539M | 682M | 811M |

| Gross Profit | 685M | 1.05B | 1.02B | 1.22B | 1.54B |

| EBITDA | 291M | 564M | 522M | 576M | 780M |

| EBIT | 262M | 527M | 482M | 539M | 729M |

| Interest Expense | 0 | 0 | 0 | 0 | 0 |

| Net Income | 242M | 438M | 427M | 1.79B | 616M |

| EPS | 5.28 | 9.37 | 8.98 | 36.76 | 12.82 |

| Filing Date | 2022-02-25 | 2023-02-24 | 2024-02-29 | 2025-03-03 | 2026-02-05 |

Income Statement Evolution

Monolithic Power Systems, Inc. (MPWR) recorded a strong revenue increase of 26.4% from 2024 to 2025, continuing a 131% rise since 2021. Gross profit expanded in line with revenue, maintaining a favorable gross margin near 55%. EBIT margin improved to 26.1%, reflecting disciplined cost control despite rising operating expenses. Net margin, however, declined sharply in the latest year.

Is the Income Statement Favorable?

In 2025, MPWR showed robust operating income growth of 35%, with operating leverage supporting margin expansion. Interest expenses remained nil, enhancing profitability. Yet net income and EPS dropped significantly due to an unusual income tax expense reported in 2025, impacting net margin negatively. Despite this anomaly, fundamentals remain generally favorable, supported by solid top-line growth, stable margins, and effective expense management.

Financial Ratios

The following table presents key financial ratios for Monolithic Power Systems, Inc. (MPWR) over the past five fiscal years, showing profitability, valuation, liquidity, leverage, efficiency, and dividend metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 20.0% | 24.4% | 23.5% | 80.9% | 22.1% |

| ROE | 19.5% | 26.2% | 20.8% | 56.8% | 16.6% |

| ROIC | 17.2% | 24.5% | 18.5% | 16.2% | 14.9% |

| P/E | 93.5 | 37.8 | 70.3 | 16.1 | 70.7 |

| P/B | 18.2 | 9.9 | 14.6 | 9.1 | 11.7 |

| Current Ratio | 5.0 | 5.4 | 7.7 | 5.3 | 5.9 |

| Quick Ratio | 3.8 | 3.7 | 6.1 | 3.9 | 4.4 |

| D/E | 0 | 0.001 | 0.003 | 0.005 | 0 |

| Debt-to-Assets | 0 | 0.001 | 0.002 | 0.004 | 0 |

| Interest Coverage | 0 | 0 | 0 | 0 | 0 |

| Asset Turnover | 0.76 | 0.87 | 0.75 | 0.61 | 0.65 |

| Fixed Asset Turnover | 3.3 | 5.0 | 4.9 | 4.2 | 4.4 |

| Dividend Yield | 0.48% | 0.83% | 0.62% | 0.84% | 0.65% |

Note: Interest coverage ratio is reported as zero for all years, indicating no reported interest expense or coverage data. The unusually high 2024 net margin and ROE suggest possible data anomalies or extraordinary items.

Evolution of Financial Ratios

Monolithic Power Systems’ ROE showed an overall upward trend, reaching 16.55% in 2025. The current ratio fluctuated but ended high at 5.91, signaling increased liquidity. Debt-to-equity remained at zero, indicating no financial leverage. Profitability margins stayed stable or improved slightly, with net margin around 22%, reflecting consistent operational efficiency.

Are the Financial Ratios Favorable?

In 2025, MPWR’s profitability ratios, including ROE (16.55%) and net margin (22.07%), are favorable, outperforming typical sector benchmarks. Liquidity is mixed; the quick ratio (4.38) is strong, but the current ratio (5.91) is considered unfavorable due to potential inefficient asset use. Leverage is minimal with zero debt, supporting financial stability. Valuation multiples like P/E (70.69) and P/B (11.7) appear stretched, posing valuation risks. Overall, the financial ratios lean favorable with cautious notes on valuation and liquidity.

Shareholder Return Policy

Monolithic Power Systems, Inc. pays dividends with a payout ratio averaging around 40-46% over recent years. Dividend per share has steadily increased from $2.39 in 2021 to $5.93 in 2025, with a modest yield near 0.65%. Share buybacks are not explicitly reported.

The dividend distribution appears supported by solid profitability and free cash flow, aligning with sustainable long-term value creation. However, the elevated payout ratio approaching 46% in 2025 warrants monitoring to avoid pressure on cash reserves amid market fluctuations.

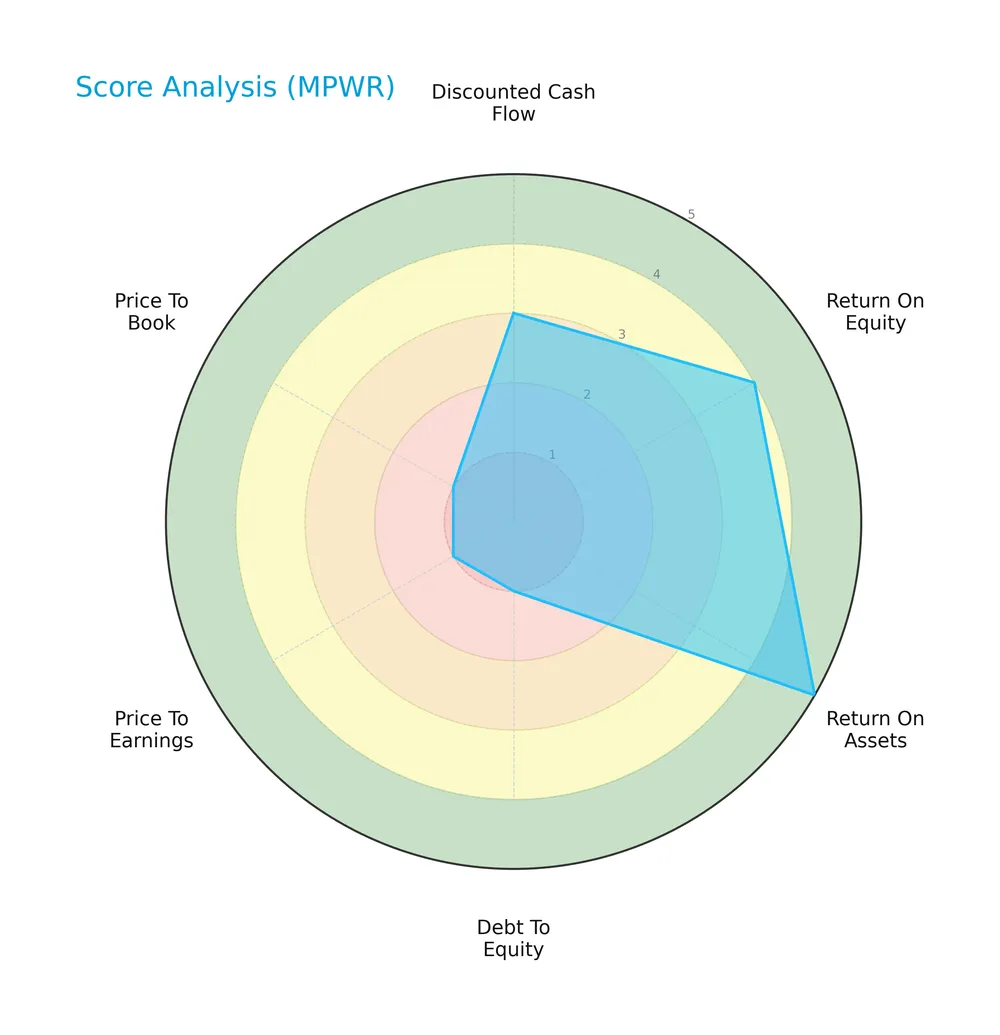

Score analysis

Here is a radar chart illustrating Monolithic Power Systems’ key financial scores across multiple valuation and performance metrics:

The company shows moderate discounted cash flow and overall scores, with favorable returns on equity and very favorable returns on assets. However, debt-to-equity, price-to-earnings, and price-to-book ratios score very unfavorably, indicating valuation and leverage concerns.

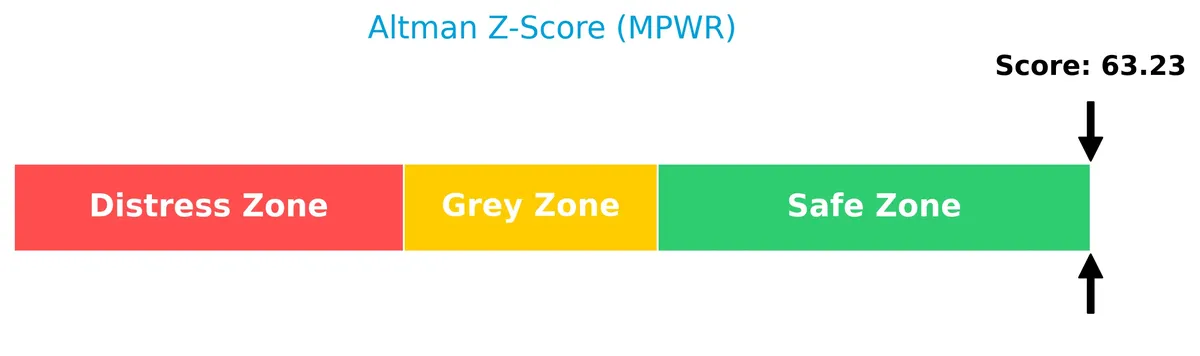

Analysis of the company’s bankruptcy risk

Monolithic Power Systems’ Altman Z-Score places it firmly in the safe zone, signaling a very low bankruptcy risk at this time:

Is the company in good financial health?

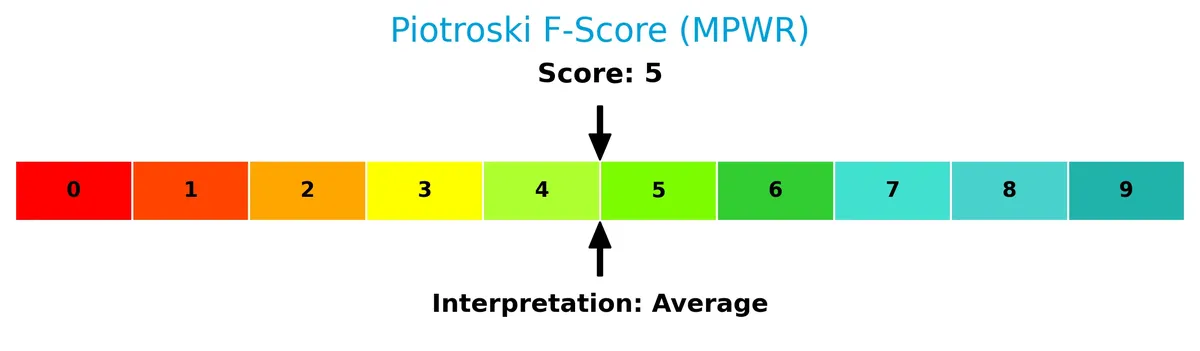

The Piotroski diagram below shows an average score, reflecting moderate financial strength without clear signs of either weakness or exceptional robustness:

A Piotroski Score of 5 suggests the company exhibits balanced fundamentals, neither particularly strong nor weak, indicating a middle-ground financial health profile.

Competitive Landscape & Sector Positioning

This sector analysis examines Monolithic Power Systems, Inc.’s strategic positioning, revenue segments, and key products. I will assess whether the company holds a competitive advantage against its peers in the semiconductor industry.

Strategic Positioning

Monolithic Power Systems concentrates on semiconductor power electronics, with DC to DC products generating $1.72B in 2023 and lighting control products $102M. Its geographic exposure is diverse, heavily weighted in China ($1.18B in 2024) and Taiwan ($578M), with substantial presence in Korea, Europe, Japan, Southeast Asia, and the US.

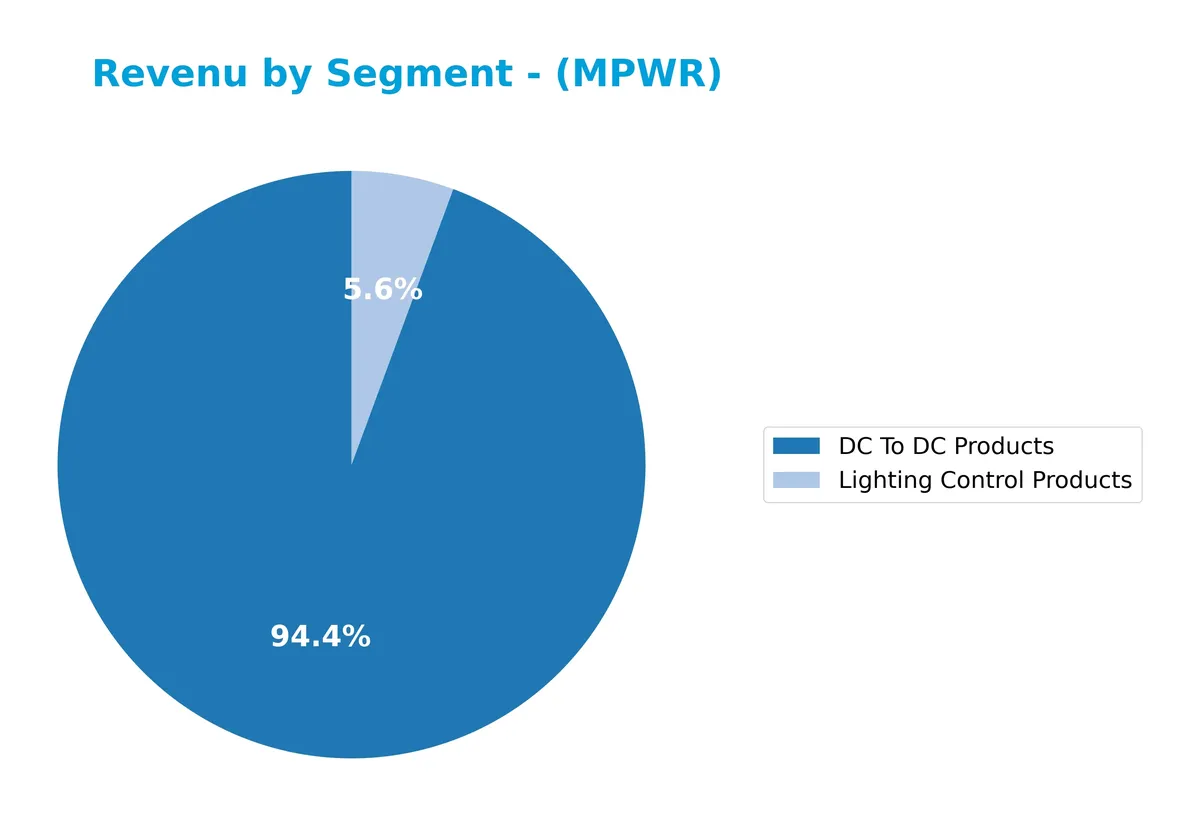

Revenue by Segment

This pie chart illustrates Monolithic Power Systems, Inc.’s revenue distribution by product segment for the fiscal year 2023.

The dominant segment is DC To DC Products, generating $1.72B in 2023, showing steady growth from $1.70B in 2022. Lighting Control Products remain a minor contributor at $102M but also grew slightly. Historically, DC To DC Products drive the business, reflecting Monolithic’s moat in power management solutions. The 2023 data shows continued acceleration without concentration risk, given consistent, balanced segment expansion.

Key Products & Brands

The table below details Monolithic Power Systems’ primary products and their roles in power electronics solutions:

| Product | Description |

|---|---|

| DC To DC Products | Integrated circuits converting and controlling voltages in devices like computers and medical equipment. |

| Lighting Control Products | ICs managing backlighting for LCD panels in notebooks, monitors, car navigation, TVs, and general illumination. |

Monolithic Power Systems focuses on DC to DC converters and lighting control ICs. These products serve diverse markets, including computing, automotive, and industrial sectors. The company’s growth reflects steady demand for efficient power management solutions.

Main Competitors

Monolithic Power Systems, Inc. faces 38 competitors in the Semiconductors industry; here are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| NVIDIA Corporation | 4.6T |

| Broadcom Inc. | 1.6T |

| Taiwan Semiconductor Manufacturing Company Limited | 1.6T |

| ASML Holding N.V. | 415B |

| Advanced Micro Devices, Inc. | 363B |

| Micron Technology, Inc. | 353B |

| Lam Research Corporation | 232B |

| Applied Materials, Inc. | 214B |

| QUALCOMM Incorporated | 185B |

| Intel Corporation | 173B |

Monolithic Power Systems ranks 17th among 38 competitors. Its market cap is 1.28% of the leader NVIDIA’s 4.6T valuation. The company stands below the average market cap of the top 10 leaders (975B) but above the sector median of 31B. It is approximately 5.5% smaller than the next competitor above in rank, indicating a narrow gap with immediate rivals.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does MPWR have a competitive advantage?

Monolithic Power Systems presents a competitive advantage by consistently creating value, with ROIC exceeding WACC by 4.3%. However, its profitability shows a declining trend, which may signal future challenges.

Looking ahead, MPWR benefits from diverse semiconductor applications across computing, automotive, and industrial markets. Expansion in China and Taiwan, along with new power electronics solutions, offer growth opportunities.

SWOT Analysis

This SWOT analysis highlights Monolithic Power Systems, Inc.’s key strategic factors shaping its competitive position.

Strengths

- Strong gross margin at 55%

- High EBIT margin of 26%

- Zero debt and excellent interest coverage

Weaknesses

- Very high P/E of 70.7

- Elevated P/B at 11.7

- Declining ROIC trend signals profitability pressure

Opportunities

- Expanding semiconductor demand in China and Taiwan

- Growth potential in automotive and industrial sectors

- Increasing adoption of power management ICs

Threats

- Intense competition in semiconductor industry

- Geopolitical risks affecting supply chain

- High valuation exposes stock to correction

Monolithic Power Systems exhibits robust profitability and balance sheet strength. However, rising valuation multiples and a declining ROIC trend require cautious monitoring. The firm’s strategy should leverage growth in Asian markets while safeguarding margins amid competitive and geopolitical challenges.

Stock Price Action Analysis

The weekly chart below summarizes Monolithic Power Systems, Inc. (MPWR) stock price movements over the past 12 months:

Trend Analysis

Over the past 12 months, MPWR’s stock price rose by 79.02%, indicating a strong bullish trend with accelerating momentum. The price ranged from a low of 477.39 to a high of 1229.82, showing significant volatility reflected by a 150.74 standard deviation.

Volume Analysis

Trading volume is increasing, with buyers accounting for 52.57% overall. In the recent three months, buyer dominance strengthened to 57.17%, suggesting buyer-driven activity and growing investor participation in MPWR shares.

Target Prices

Analysts project a robust upside for Monolithic Power Systems, Inc., reflecting strong confidence in its growth prospects.

| Target Low | Target High | Consensus |

|---|---|---|

| 1200 | 1500 | 1313.71 |

The target range between 1200 and 1500 indicates bullish sentiment. The consensus price near 1314 suggests solid upside potential relative to current levels.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines analyst ratings and consumer feedback regarding Monolithic Power Systems, Inc. (MPWR) to provide balanced insights.

Stock Grades

Here is the latest verified grade data from leading equity research firms for Monolithic Power Systems, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Rosenblatt | Maintain | Neutral | 2026-02-06 |

| Truist Securities | Maintain | Buy | 2026-02-06 |

| Wells Fargo | Maintain | Overweight | 2026-02-06 |

| Keybanc | Maintain | Overweight | 2026-02-06 |

| Needham | Maintain | Buy | 2026-02-06 |

| Stifel | Maintain | Buy | 2026-02-04 |

| Wells Fargo | Maintain | Overweight | 2026-01-26 |

| Wells Fargo | Upgrade | Overweight | 2026-01-15 |

| Truist Securities | Maintain | Buy | 2025-12-19 |

| Citigroup | Maintain | Buy | 2025-11-03 |

The consensus reflects a strong buy bias, with most firms maintaining Buy or Overweight ratings. Wells Fargo notably upgraded its rating earlier this year, signaling growing confidence in the stock’s outlook.

Consumer Opinions

Monolithic Power Systems, Inc. (MPWR) earns praise for innovation but faces customer concerns over pricing and support.

| Positive Reviews | Negative Reviews |

|---|---|

| “Exceptional power efficiency in their chips.” | “Customer service response times are slow.” |

| “Products consistently improve device battery life.” | “Pricing is higher than competitors’ offerings.” |

| “Strong reliability in high-performance applications.” | “Limited availability of some product lines.” |

Consumers frequently applaud MPWR’s technical excellence and product reliability. However, recurring complaints about customer service and pricing suggest areas for improvement in client relations and market competitiveness.

Risk Analysis

Below is a summary table outlining key risks for Monolithic Power Systems, Inc. (MPWR):

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation Risk | High P/E (70.7) and P/B (11.7) ratios suggest overvaluation risk. | High | High |

| Market Volatility | Beta of 1.455 indicates above-market price swings. | High | Medium |

| Dividend Yield | Low yield at 0.65% may deter income-focused investors. | Medium | Low |

| Liquidity | Elevated current ratio (5.91) signals inefficient asset use. | Medium | Medium |

| Debt Risk | Zero debt minimizes financial risk but limits leverage flexibility. | Low | Low |

| Profitability | Strong net margin (22.07%) and ROIC (14.93%) support resilience. | Low | Low |

| Financial Health | Altman Z-score (63.23) places company safely away from distress. | Low | Low |

Valuation risk stands out as the most significant threat given MPWR’s stretched multiples relative to sector averages. The stock’s elevated beta further exposes investors to sharp market movements. Despite these, robust profitability and a clean balance sheet provide a solid buffer. Prudence dictates close monitoring of market sentiment and valuation trends.

Should You Buy Monolithic Power Systems, Inc.?

Monolithic Power Systems appears to be delivering robust value creation with a slightly favorable competitive moat despite declining profitability. Its leverage profile might raise caution, reflected in a very unfavorable debt-to-equity score. Overall, the company’s financial health suggests a B- rating.

Strength & Efficiency Pillars

Monolithic Power Systems, Inc. exhibits robust profitability with a net margin of 22.07% and a return on equity (ROE) of 16.55%. The return on invested capital (ROIC) stands at a strong 14.93%, exceeding the weighted average cost of capital (WACC) of 10.63%. This clearly positions the company as a value creator. Its interest expense is negligible at 0.0%, reflecting operational efficiency. Despite a declining ROIC trend, the firm sustains favorable gross and EBIT margins of 55.18% and 26.11%, respectively, underscoring solid operational performance.

Weaknesses and Drawbacks

The company’s valuation metrics raise caution. A high price-to-earnings (P/E) ratio of 70.69 and price-to-book (P/B) of 11.7 suggest an expensive premium, potentially limiting upside. The current ratio is unusually high at 5.91, which may indicate inefficient capital deployment rather than liquidity strength. Although debt-to-equity is zero, the low Piotroski score of 5 signals average financial health. Dividend yield is weak at 0.65%, which might deter income-focused investors. These factors could pressure the stock despite its underlying fundamentals.

Our Final Verdict about Monolithic Power Systems, Inc.

Monolithic Power Systems presents a fundamentally sound profile with strong profitability and clear value creation. The overall bullish price trend, coupled with slightly buyer-dominant recent volume at 57.17%, suggests positive market sentiment. However, elevated valuation multiples and average financial strength imply prudence. This profile might appear attractive for long-term exposure but suggests a cautious approach for investors seeking an optimal entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Monolithic Power Systems (MPWR) Stock Trades Up, Here Is Why – Finviz (Feb 06, 2026)

- Monolithic Power Systems (MPWR) Shares Rise, Here’s the Reason – Bitget (Feb 06, 2026)

- Needham Raises Monolithic Power Systems (MPWR) Price Target to $ – GuruFocus (Feb 06, 2026)

- Monolithic Power Systems (NASDAQ:MPWR) Q4: Beats on revenue but inventory levels increase – MSN (Feb 06, 2026)

- Monolithic Power Systems Beats Estimates, Hikes Dividend – Investor’s Business Daily (Feb 05, 2026)

For more information about Monolithic Power Systems, Inc., please visit the official website: monolithicpower.com