Home > Analyses > Healthcare > Gilead Sciences, Inc.

Gilead Sciences transforms lives by pioneering therapies that combat some of the world’s most challenging diseases. Its portfolio, anchored by breakthrough HIV and liver disease treatments, defines industry standards for innovation and efficacy. The company’s expanding pipeline in oncology and cell therapy further cements its role as a biopharma powerhouse. As Gilead navigates a competitive landscape, I ask: do its robust fundamentals still support its premium valuation and growth ambitions?

Table of contents

Business Model & Company Overview

Gilead Sciences, Inc., founded in 1987 and headquartered in Foster City, California, dominates the biopharmaceutical sector with a focus on unmet medical needs. Its portfolio forms a cohesive ecosystem addressing HIV/AIDS, liver diseases, oncology, and infectious diseases. The company leverages innovative therapies like Biktarvy and Veklury to maintain leadership in global healthcare innovation.

Gilead’s revenue engine balances patented pharmaceuticals with recurring demand from chronic disease treatments. Its expansive footprint spans the Americas, Europe, and Asia, enabling robust market penetration. This strategic global presence, combined with a diverse product mix, underpins a durable economic moat based on innovation and scale in life-saving medicines.

Financial Performance & Fundamental Metrics

I analyze Gilead Sciences’ income statement, key financial ratios, and dividend payout policy to assess its operational efficiency and shareholder value creation.

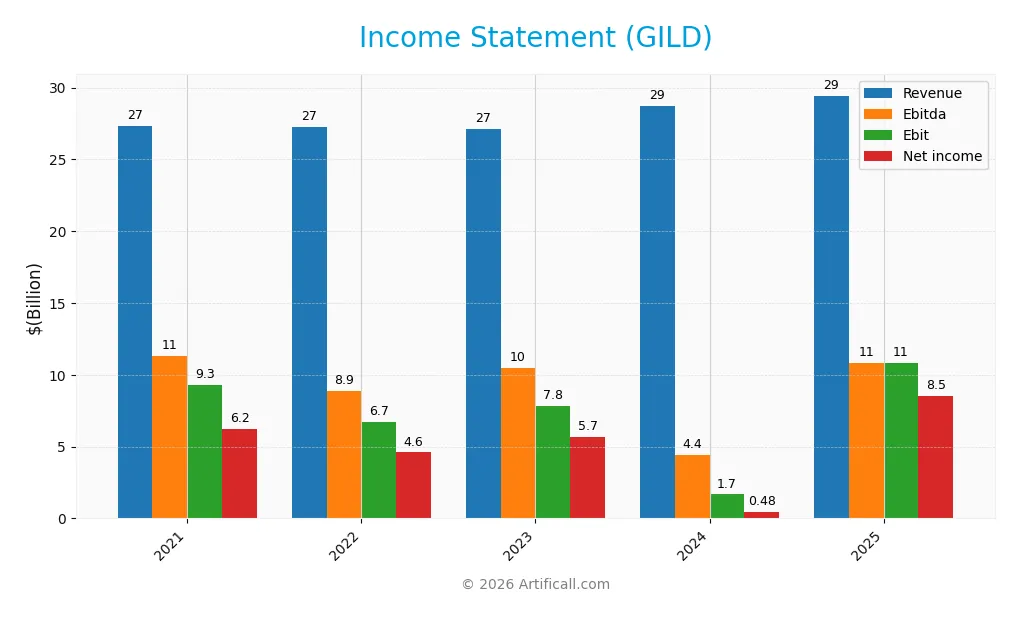

Income Statement

The table below summarizes Gilead Sciences, Inc.’s key income statement items over the past five fiscal years, reflecting revenue, expenses, and profitability metrics.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 27.3B | 27.3B | 27.1B | 28.8B | 29.4B |

| Cost of Revenue | 6.6B | 5.7B | 6.5B | 6.3B | 3.9B |

| Operating Expenses | 10.8B | 14.3B | 13.0B | 20.8B | 13.7B |

| Gross Profit | 20.7B | 21.6B | 20.6B | 22.5B | 25.5B |

| EBITDA | 11.3B | 8.9B | 10.5B | 4.4B | 10.8B |

| EBIT | 9.3B | 6.7B | 7.8B | 1.7B | 10.8B |

| Interest Expense | 1.0B | 0.9B | 0.9B | 1.0B | 1.0B |

| Net Income | 6.2B | 4.6B | 5.7B | 0.5B | 8.5B |

| EPS | 4.96 | 3.66 | 4.54 | 0.38 | 6.84 |

| Filing Date | 2022-02-23 | 2023-02-22 | 2024-02-23 | 2025-02-28 | 2026-02-10 |

Income Statement Evolution

Gilead Sciences’ revenue grew modestly by 2.4% in 2025, slightly slowing compared to the 7.8% overall growth since 2021. Despite this, gross profit increased 13.4%, reflecting improved cost management. Margins strengthened notably, with net margin rising 26.8% over the period, signaling enhanced profitability and operational efficiency.

Is the Income Statement Favorable?

The 2025 income statement shows strong fundamentals. Gilead achieved an 86.7% gross margin and a 36.8% EBIT margin, both favorable versus industry norms. Net margin reached 28.9%, supported by controlled interest expenses at 3.5% of revenue. Earnings per share surged 1684%, reflecting exceptional bottom-line improvement. Overall, the income profile is clearly favorable.

Financial Ratios

The following table presents key financial ratios for Gilead Sciences, Inc. across fiscal years 2021 to 2025, reflecting profitability, valuation, liquidity, leverage, efficiency, and dividend metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 22.8% | 16.8% | 20.9% | 1.7% | 28.9% |

| ROE | 29.5% | 21.6% | 24.8% | 2.5% | 0% |

| ROIC | 12.8% | 10.6% | 11.8% | 2.4% | 0% |

| P/E | 14.7 | 23.5 | 17.8 | 240.0 | 17.9 |

| P/B | 4.33 | 5.07 | 4.43 | 5.96 | 0 |

| Current Ratio | 1.27 | 1.29 | 1.43 | 1.60 | 0 |

| Quick Ratio | 1.13 | 1.15 | 1.27 | 1.45 | 0 |

| D/E | 1.27 | 1.19 | 1.09 | 1.38 | 0 |

| Debt-to-Assets | 39.3% | 39.9% | 40.2% | 45.3% | 0% |

| Interest Coverage | 9.91 | 7.84 | 8.06 | 1.70 | 11.5 |

| Asset Turnover | 0.40 | 0.43 | 0.44 | 0.49 | 0 |

| Fixed Asset Turnover | 5.33 | 4.98 | 5.10 | 5.31 | 0 |

| Dividend Yield | 3.95% | 3.44% | 3.77% | 3.40% | 2.57% |

Evolution of Financial Ratios

Gilead Sciences’ profitability showed a marked improvement by 2025, with net profit margin rising from 1.7% in 2024 to 28.9%. However, key liquidity ratios like current and quick ratios declined to zero in 2025, indicating worsening short-term financial health. Debt-to-equity ratio improved from 1.38 in 2024 to zero, signaling reduced leverage.

Are the Financial Ratios Favorable?

In 2025, profitability and dividend yield ratios are favorable, with a 28.9% net margin and 2.57% dividend yield. Interest coverage at 10.57 also supports financial stability. However, liquidity and efficiency ratios remain unfavorable or unavailable, hindering a full assessment. Overall, the ratio profile is neutral, reflecting mixed signals on financial health and operational efficiency.

Shareholder Return Policy

Gilead Sciences maintains a consistent dividend, with a 2025 payout ratio near 46%, yielding 2.57% annually. Dividends are well-covered by free cash flow, supported by a dividend and capex coverage ratio above 2.5. The company also engages in share buybacks, balancing capital return.

This disciplined approach aligns with sustainable shareholder value creation. Coverage metrics indicate distributions remain within cash generation limits, reducing risk of unsustainable payouts or excessive buybacks. Gilead’s policy reflects prudent capital allocation amid stable profitability and cash flow.

Score analysis

The following radar chart illustrates Gilead Sciences’ key financial metric scores for a comprehensive performance overview:

Gilead scores very favorably on return on equity and assets, indicating strong profitability. However, its debt-to-equity and price-to-book ratios are very unfavorable, signaling potential leverage and valuation concerns. Other metrics show moderate to favorable standings.

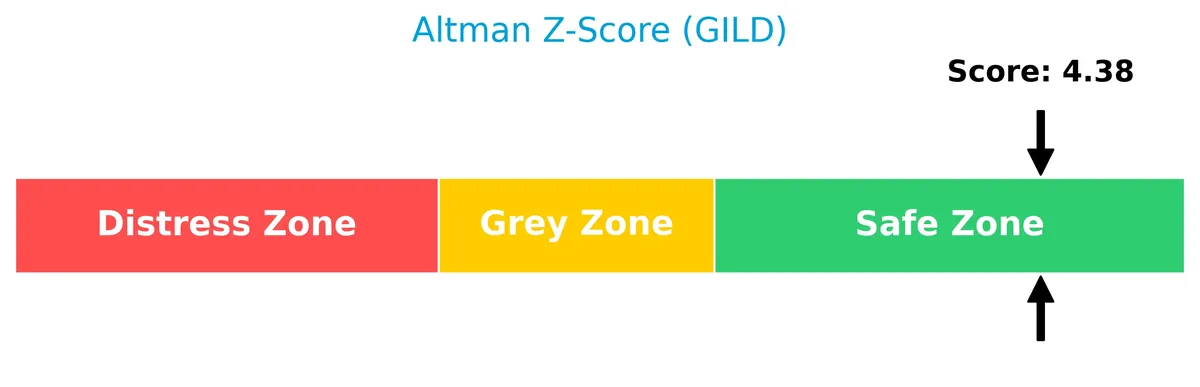

Analysis of the company’s bankruptcy risk

Gilead Sciences’ Altman Z-Score places it comfortably in the safe zone, reflecting a low bankruptcy risk:

Is the company in good financial health?

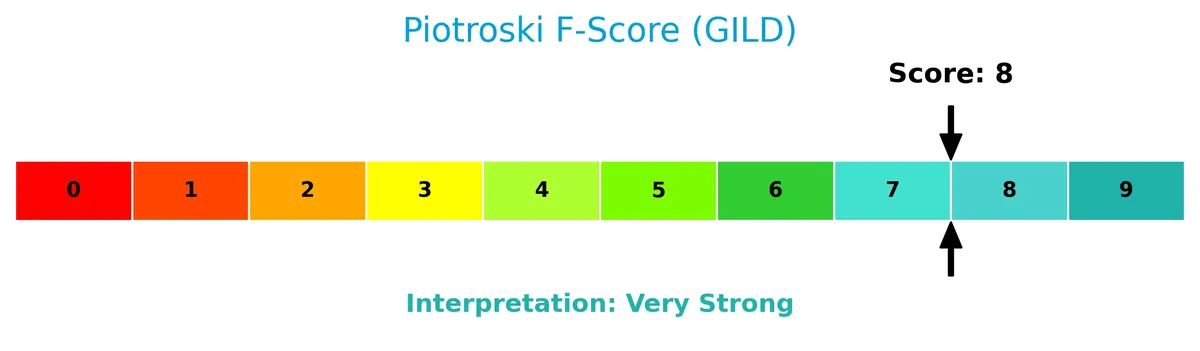

The Piotroski Score diagram highlights Gilead’s financial strength and operational efficiency:

With a very strong Piotroski score of 8, Gilead demonstrates robust financial health, suggesting effective management and solid fundamentals.

Competitive Landscape & Sector Positioning

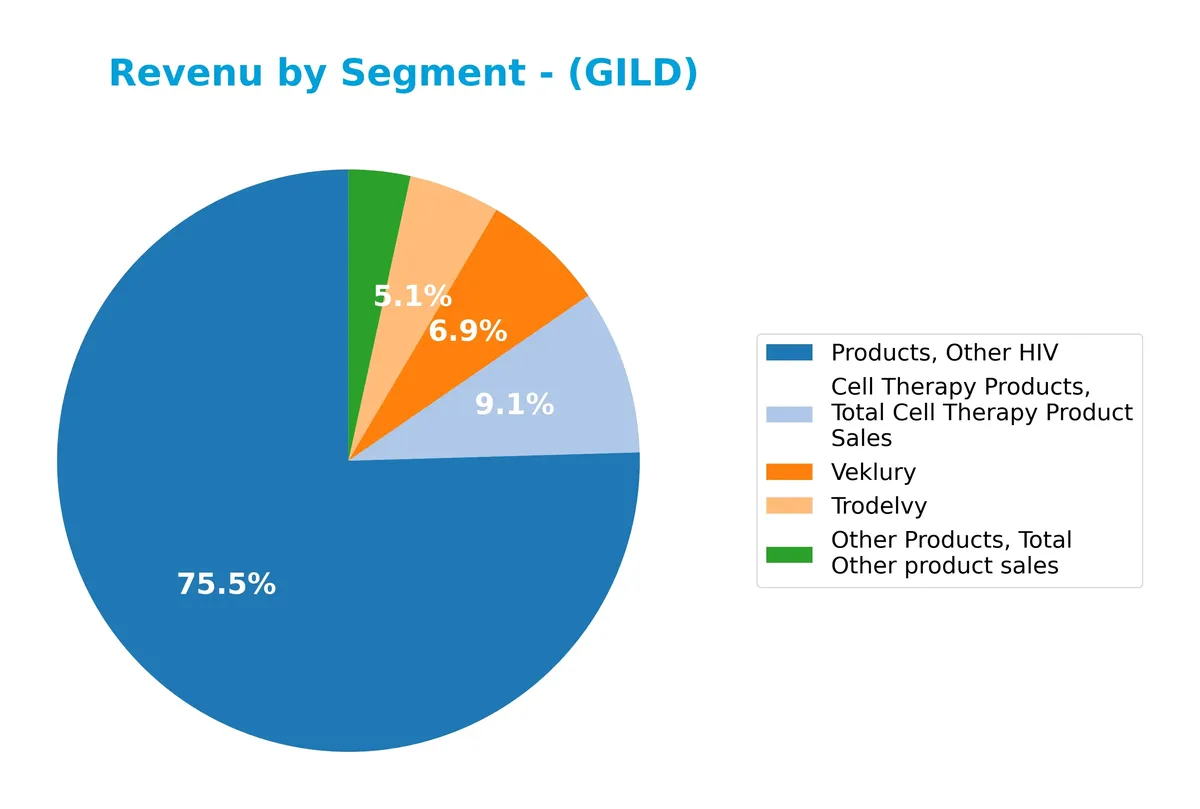

This sector analysis covers Gilead Sciences, Inc.’s strategic positioning, revenue by segment, key products, and main competitors. I will examine whether Gilead holds a competitive advantage over its peers in the drug manufacturing industry.

Strategic Positioning

Gilead Sciences concentrates heavily on HIV and antiviral treatments, with $19.6B in 2024 HIV product sales and $4.6B from Europe and $20.6B from the US. The firm diversifies into cell therapy and oncology, but the US remains its dominant geographic market.

Revenue by Segment

This pie chart illustrates Gilead Sciences’ revenue distribution by product segment for the fiscal year 2024, highlighting the major contributors to the company’s top-line performance.

In 2024, the HIV segment remains the dominant revenue driver with $19.6B, reflecting steady demand. Cell Therapy products grew to $2.4B, showing strong expansion. Veklury sales declined to $1.8B, indicating pressure after peak pandemic demand. Trodelvy surged to $1.3B, signaling successful oncology growth. Other Products contribute modestly at $890M, showing stable but limited impact. The portfolio balance points to moderate concentration risk in HIV and emerging oncology.

Key Products & Brands

The table below outlines Gilead Sciences’ principal products and brand descriptions across therapy areas:

| Product | Description |

|---|---|

| Biktarvy, Genvoya, Descovy | HIV/AIDS treatment regimens among the company’s core antiviral portfolio. |

| Odefsey, Truvada, Complera/Eviplera, Stribild, Atripla | Additional HIV/AIDS therapies with longstanding market presence. |

| Veklury | Intravenous injection for treating COVID-19, a key recent therapeutic. |

| Epclusa, Harvoni, Vosevi, Vemlidy, Viread | Treatments targeting liver diseases including hepatitis B and C. |

| Yescarta, Tecartus, Trodelvy, Zydelig | Products for hematology, oncology, and cell therapy indications. |

| Letairis | Oral drug for pulmonary arterial hypertension. |

| Ranexa | Oral formulation for chronic angina management. |

| AmBisome | Liposomal antifungal for serious invasive infections. |

Gilead’s portfolio spans antiviral, oncology, and specialty therapies. HIV/AIDS treatments remain foundational, complemented by growth in cell therapy and COVID-19 products. The firm balances legacy and innovative drugs addressing diverse unmet medical needs.

Main Competitors

The sector includes 10 main competitors, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Eli Lilly and Company | 970B |

| Johnson & Johnson | 500B |

| AbbVie Inc. | 405B |

| AstraZeneca PLC | 285B |

| Merck & Co., Inc. | 268B |

| Amgen Inc. | 176B |

| Gilead Sciences, Inc. | 151B |

| Pfizer Inc. | 143B |

| Bristol-Myers Squibb Company | 109B |

| Biogen Inc. | 26B |

Gilead Sciences ranks 7th among its competitors, holding about 20% of the market cap of the leader, Eli Lilly. It trades below both the average market cap of the top 10 (303B) and the sector median (222B). The company sits approximately 8.7% below its next closest rival, Amgen, illustrating a moderate gap in scale.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Gilead Sciences, Inc. have a competitive advantage?

Gilead Sciences shows strong profitability metrics with a gross margin of 87% and net margin near 29%, indicating operational efficiency. However, its return on invested capital trend is declining, and ROIC compared to WACC is unavailable, limiting clarity on moat strength.

The company leverages a broad product portfolio across HIV, liver diseases, oncology, and cell therapy markets. Collaborations with multiple biotech firms suggest potential growth avenues through innovation and geographic expansion, particularly in Europe and international markets.

SWOT Analysis

This analysis highlights Gilead Sciences’ key internal and external factors to inform strategic decisions.

Strengths

- strong gross margin at 86.7%

- robust EBIT margin at 36.7%

- very strong Piotroski score of 8

Weaknesses

- declining ROIC trend signals weakening capital efficiency

- unfavorable liquidity ratios (current and quick ratio at 0)

- low price-to-book ratio indicating potential undervaluation or asset concerns

Opportunities

- growth in international markets, especially Europe and other regions

- expanding oncology and cell therapy portfolio

- collaboration agreements with major pharma players

Threats

- intense competition in biopharma sector

- regulatory risks in multiple jurisdictions

- reliance on key drugs facing patent cliffs

Gilead’s solid profitability and strong financial health contrast with challenges in liquidity and capital returns. The company must leverage global expansion and R&D partnerships while managing competitive and regulatory pressures.

Stock Price Action Analysis

The weekly stock chart below displays Gilead Sciences, Inc. (GILD) price movements over the past 12 months, highlighting key volatility and trend shifts:

Trend Analysis

GILD’s stock gained 114.57% over the past year, reflecting a strong bullish trend with accelerating momentum. The price ranged between 64.27 and 155.8, showing notable volatility (std. dev. 21.44). Recent weeks confirm continued strength with a 23.81% rise and a positive slope of 2.87.

Volume Analysis

Over the last three months, trading volume increased and was clearly buyer-driven. Buyers accounted for 64.54% of activity, signaling strong investor demand and rising market participation supporting the uptrend.

Target Prices

Analysts set a clear target consensus for Gilead Sciences, reflecting confidence in its growth potential.

| Target Low | Target High | Consensus |

|---|---|---|

| 105 | 177 | 154.2 |

The target range from 105 to 177 indicates moderate upside, with a consensus price of 154.2 suggesting positive market expectations.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback, providing insight into Gilead Sciences, Inc.’s market perception.

Stock Grades

The following table presents the latest verified stock grades from recognized financial institutions for Gilead Sciences, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2026-02-11 |

| Wells Fargo | Maintain | Overweight | 2026-02-11 |

| Cantor Fitzgerald | Maintain | Overweight | 2026-02-11 |

| Scotiabank | Maintain | Sector Outperform | 2026-02-11 |

| Truist Securities | Maintain | Buy | 2026-02-11 |

| Truist Securities | Maintain | Buy | 2026-01-27 |

| Citigroup | Maintain | Buy | 2026-01-27 |

| UBS | Maintain | Buy | 2026-01-26 |

| Morgan Stanley | Maintain | Overweight | 2026-01-13 |

| Citigroup | Maintain | Buy | 2026-01-07 |

The consensus reflects a strong buy bias with 37 buy ratings versus only one sell, underscoring steady confidence across top-tier analysts. Most firms maintain positive outlooks, favoring accumulation over caution.

Consumer Opinions

Gilead Sciences, Inc. draws mixed consumer reactions, reflecting its complex role in healthcare innovation.

| Positive Reviews | Negative Reviews |

|---|---|

| Effective antiviral treatments improve lives. | High drug prices limit accessibility for many. |

| Strong commitment to advancing medical research. | Customer service response times are slow. |

| Wide range of specialty medications available. | Some side effects reported with key drugs. |

Overall, consumers praise Gilead’s innovation and treatment efficacy. However, affordability and customer service remain persistent concerns, potentially affecting patient satisfaction and long-term loyalty.

Risk Analysis

Below is a summary table outlining key risks for Gilead Sciences, Inc. based on recent financial and operational data:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Low current and quick ratios indicate liquidity constraints. | Medium | High |

| Profitability | ROE and ROIC at zero signal inefficiencies despite net margin. | Medium | Medium |

| Leverage | Favorable debt-to-equity but very unfavorable debt-to-book. | Low | Medium |

| Market Volatility | Low beta (0.39) suggests limited stock price sensitivity. | Low | Low |

| Pipeline & Competition | Dependence on a few key drugs risks revenue concentration. | Medium | High |

| Regulatory Risks | Drug approvals and patent cliffs could disrupt growth. | Medium | High |

Liquidity issues stand out as the most pressing risk due to unfavorable current and quick ratios. Although Gilead enjoys a strong Altman Z-Score (4.38, safe zone) and a very strong Piotroski score (8), the zero ROE and ROIC raise concerns about capital efficiency. Recent drug patent expirations and intensifying competition exacerbate revenue risks. Investors must weigh these factors carefully against the favorable dividend yield and stable market position.

Should You Buy Gilead Sciences, Inc.?

Gilead Sciences appears to be a profitable company with improving operational efficiency and a very strong Piotroski Score. Despite a declining ROIC trend and a challenging leverage profile, its Altman Z-Score suggests a safe financial position. The overall B+ rating could be seen as favorable for investors seeking moderate risk exposure.

Strength & Efficiency Pillars

Gilead Sciences, Inc. shows robust operational efficiency with a gross margin of 86.69% and a net margin of 28.9%, signaling strong profitability. The company’s EBIT margin stands at 36.75%, reflecting effective cost management. Despite unavailable ROIC and WACC data, the Altman Z-Score of 4.38 firmly places Gilead in the safe zone, supporting financial stability. The Piotroski Score of 8 confirms very strong financial health, reinforcing the company’s operational resilience and value creation potential.

Weaknesses and Drawbacks

While Gilead’s Altman Z-Score indicates safety, certain valuation and leverage metrics raise caution. The price-to-earnings ratio at 17.94 is moderate but the price-to-book metric is unavailable, limiting valuation clarity. Leverage appears favorable with a low debt-to-equity ratio and solid interest coverage of 10.57, yet liquidity metrics such as current and quick ratios are unfavorable, potentially signaling short-term funding constraints. These factors warrant vigilance despite strong operational results.

Our Final Verdict about Gilead Sciences, Inc.

Gilead Sciences may appear fundamentally sound with strong profitability and financial health scores. The bullish overall price trend, coupled with buyer dominance at 64.54% recently, suggests positive market sentiment. However, moderate valuation and liquidity concerns recommend a cautious approach. Investors might consider waiting for clearer signals or improved liquidity before committing significant capital, especially given the mixed ratio profile.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Gilead Sciences, Inc. (NASDAQ:GILD) to Issue Dividend Increase – $0.82 Per Share – MarketBeat (Feb 11, 2026)

- Gilead Sciences Stock Surges to Record Highs Amid Bull Notes – Schaeffer’s Investment Research (Feb 11, 2026)

- GILD: Wells Fargo Raises Price Target for Gilead Sciences | GILD Stock News – GuruFocus (Feb 11, 2026)

- Gilead Sciences (GILD) Q4 2025 adj. earnings decline, despite higher revenues – AlphaStreet News (Feb 11, 2026)

- GILD’s Q4 Earnings Beat Estimates, HIV and Liver Disease Drugs Power Sales – Yahoo Finance (Feb 11, 2026)

For more information about Gilead Sciences, Inc., please visit the official website: gilead.com