Home > Analyses > Real Estate > Extra Space Storage Inc.

Extra Space Storage Inc. transforms how millions manage space, providing secure and accessible storage solutions that simplify everyday life. As the second largest self-storage owner and largest manager in the U.S., Extra Space leads with a vast network of nearly 2,000 facilities and a reputation for operational excellence and innovation in the REIT industrial sector. As we explore its current performance, the key question remains: does Extra Space’s strong market position and growth outlook still justify its premium valuation?

Table of contents

Business Model & Company Overview

Extra Space Storage Inc., founded in 2004 and headquartered in Salt Lake City, Utah, stands as the second largest self-storage owner and operator in the US. With 1,906 stores across 40 states, Washington D.C., and Puerto Rico, it offers a cohesive ecosystem of secure storage solutions, including boat, RV, and business storage. The company’s portfolio comprises approximately 1.4M units and 147.5M square feet of rentable space, reflecting its core mission to provide convenient and reliable storage options nationwide.

The company’s revenue engine balances its self-administered, self-managed REIT model with a dominant presence in the US market, leveraging its scale to optimize operational efficiency. With over 8,000 employees, Extra Space Storage operates in a critical segment of real estate, capitalizing on recurring rental income from diverse storage units. Its competitive advantage lies in its extensive footprint and management expertise, securing a durable economic moat in the evolving self-storage industry.

Financial Performance & Fundamental Metrics

This section reviews Extra Space Storage Inc.’s income statement, key financial ratios, and dividend payout policy to provide a clear view of its fundamental strength.

Income Statement

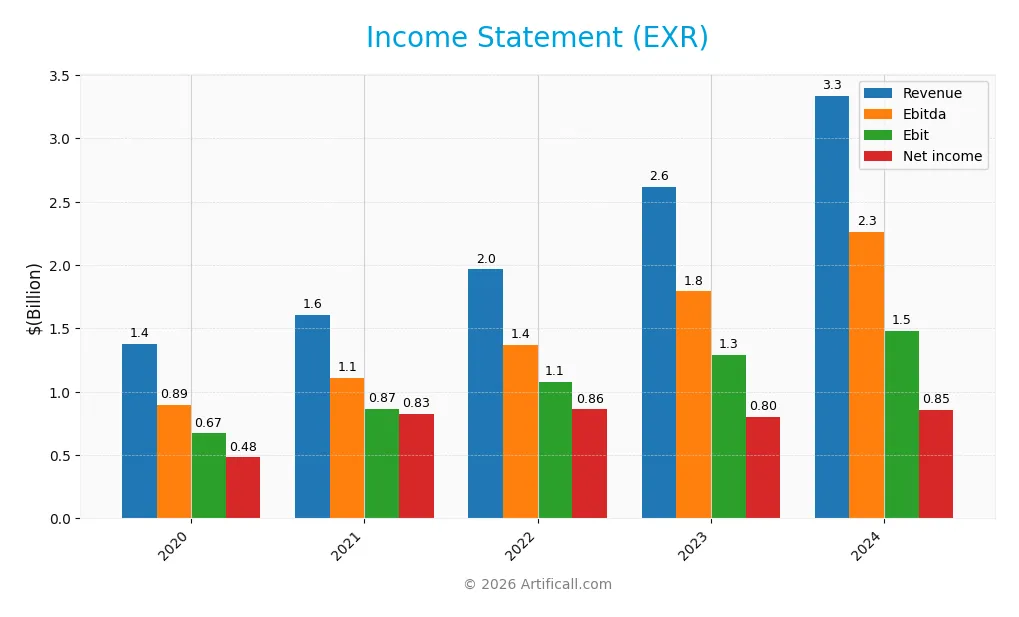

The table below summarizes Extra Space Storage Inc.’s key income statement figures for the fiscal years 2020 through 2024.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 1.38B | 1.61B | 1.97B | 2.62B | 3.34B |

| Cost of Revenue | 359M | 379M | 423M | 594M | 791M |

| Operating Expenses | 354M | 254M | 492M | 851M | 1.22B |

| Gross Profit | 1.02B | 1.23B | 1.54B | 2.02B | 2.55B |

| EBITDA | 895M | 1.11B | 1.37B | 1.79B | 2.26B |

| EBIT | 670M | 868M | 1.08B | 1.29B | 1.48B |

| Interest Expense | 172M | 166M | 219M | 438M | 595M |

| Net Income | 482M | 827M | 861M | 801M | 854M |

| EPS | 3.71 | 6.20 | 6.41 | 4.74 | 4.03 |

| Filing Date | 2021-02-26 | 2022-02-28 | 2023-02-28 | 2024-02-29 | 2025-02-28 |

Income Statement Evolution

From 2020 to 2024, Extra Space Storage Inc. experienced strong revenue growth of 142%, with net income rising 77%. Despite this expansion, net margin declined by nearly 27%, indicating margin pressure. Gross and EBIT margins remained favorable at 76.3% and 44.4%, respectively, showing stable operational efficiency. However, interest expense increased to 17.8% of revenue, an unfavorable trend impacting profitability.

Is the Income Statement Favorable?

The 2024 fiscal year shows generally favorable fundamentals with a 27.6% revenue growth and a 14.7% EBIT increase, supporting strong operational performance. Net margin fell by 16.6%, and EPS declined by 15%, reflecting some profitability challenges. Interest costs remain elevated relative to revenue, which is unfavorable. Overall, the income statement is predominantly positive, with 64% of key metrics rated favorable, indicating solid but cautious financial health.

Financial Ratios

The table below presents key financial ratios of Extra Space Storage Inc. (EXR) for the fiscal years 2020 through 2024, providing a clear view of profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 35% | 51% | 44% | 31% | 26% |

| ROE | 19% | 27% | 26% | 6% | 6% |

| ROIC | 7.0% | 9.3% | 8.6% | 4.2% | 4.5% |

| P/E | 31.2 | 36.5 | 22.9 | 33.8 | 37.0 |

| P/B | 5.9 | 9.7 | 6.1 | 1.9 | 2.3 |

| Current Ratio | 0.37 | 0.83 | 0.67 | 0.85 | 0.93 |

| Quick Ratio | 0.37 | 0.83 | 0.67 | 0.85 | 0.93 |

| D/E | 2.36 | 1.99 | 2.32 | 0.78 | 0.93 |

| Debt-to-Assets | 64% | 59% | 62% | 41% | 45% |

| Interest Coverage | 3.9 | 5.9 | 4.8 | 2.7 | 2.2 |

| Asset Turnover | 0.15 | 0.15 | 0.16 | 0.10 | 0.12 |

| Fixed Asset Turnover | 5.5 | 6.3 | 7.4 | 9.5 | 4.5 |

| Dividend Yield | 3.1% | 2.0% | 4.1% | 3.9% | 4.3% |

Evolution of Financial Ratios

Over the period from 2020 to 2024, Extra Space Storage Inc. saw a decline in Return on Equity (ROE), dropping from around 19% in 2020 to just above 6% in 2024. The Current Ratio improved moderately from 0.37 in 2020 to 0.93 in 2024, indicating better short-term liquidity. Meanwhile, the Debt-to-Equity Ratio decreased significantly from roughly 2.36 in 2020 to 0.93 in 2024, reflecting reduced leverage and a shift towards a more balanced capital structure. Profitability margins generally softened over the years.

Are the Financial Ratios Favorable?

In 2024, profitability as measured by net margin was favorable at 25.61%, yet ROE and Return on Invested Capital (ROIC) were unfavorable at 6.13% and 4.49%, respectively, indicating challenges in generating returns. Liquidity ratios such as the Current Ratio were unfavorable at 0.93, while the Quick Ratio was neutral. Leverage metrics, including Debt-to-Equity and Debt-to-Assets ratios, were mostly neutral. Efficiency showed mixed signals with an unfavorable Asset Turnover but favorable Fixed Asset Turnover. Market valuation ratios like Price-to-Earnings were unfavorable, while Dividend Yield was favorable at 4.34%, contributing to a slightly unfavorable overall ratio profile.

Shareholder Return Policy

Extra Space Storage Inc. maintains a consistent dividend payment with a payout ratio above 100%, reaching 161% in 2024 and a dividend yield around 4.3%. The company covers dividends and capital expenditures with operating cash flow, while share buybacks are also part of its return strategy.

This high payout ratio suggests distributions may exceed net income, posing sustainability risks if free cash flow declines. However, the combination of dividends and buybacks aims to enhance shareholder value, though the elevated payout ratio warrants cautious monitoring for long-term stability.

Score analysis

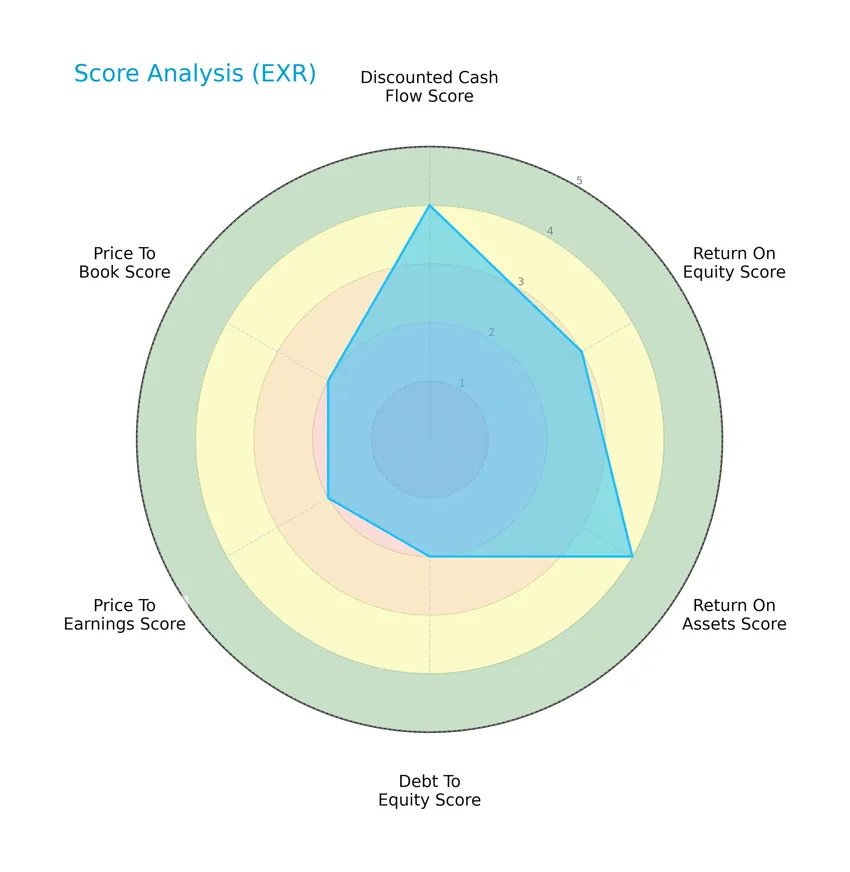

The following radar chart presents a comprehensive view of Extra Space Storage Inc.’s key financial scores:

The company shows favorable scores in discounted cash flow (4) and return on assets (4), with moderate performance in return on equity (3), debt to equity (2), price to earnings (2), and price to book (2), reflecting a mixed financial profile.

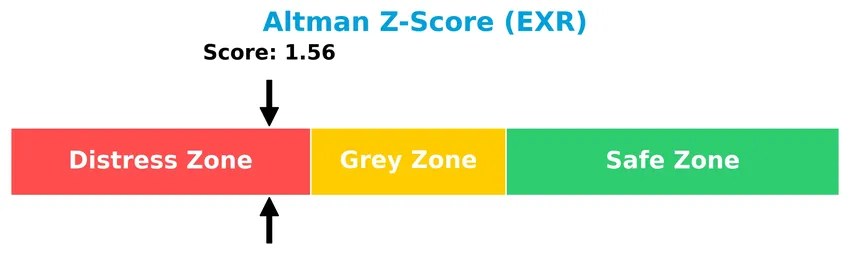

Analysis of the company’s bankruptcy risk

Extra Space Storage Inc.’s Altman Z-Score places it in the distress zone, indicating a high probability of financial distress and elevated bankruptcy risk:

Is the company in good financial health?

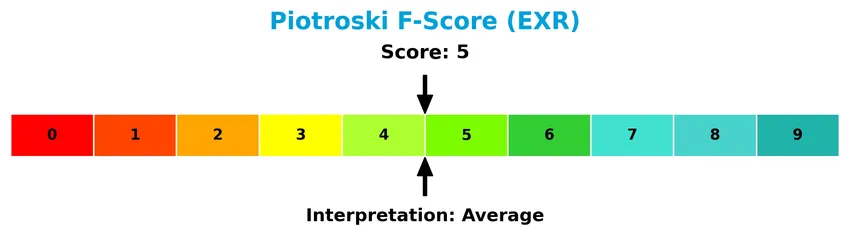

The Piotroski Score diagram provides insight into the company’s overall financial health and strength:

With a Piotroski Score of 5, Extra Space Storage Inc. demonstrates average financial health, suggesting moderate strength but not a particularly strong position in terms of profitability, leverage, liquidity, and operational efficiency.

Competitive Landscape & Sector Positioning

This sector analysis will examine Extra Space Storage Inc.’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether Extra Space Storage Inc. holds a competitive advantage within the self-storage REIT industry.

Strategic Positioning

Extra Space Storage Inc. has a concentrated product portfolio focused primarily on self-storage operations, which generated $2.8B in revenue in 2024, complemented by tenant reinsurance at $333M. Geographically, it operates 1,906 stores across 40 US states, Washington D.C., and Puerto Rico, emphasizing a broad but domestic market exposure.

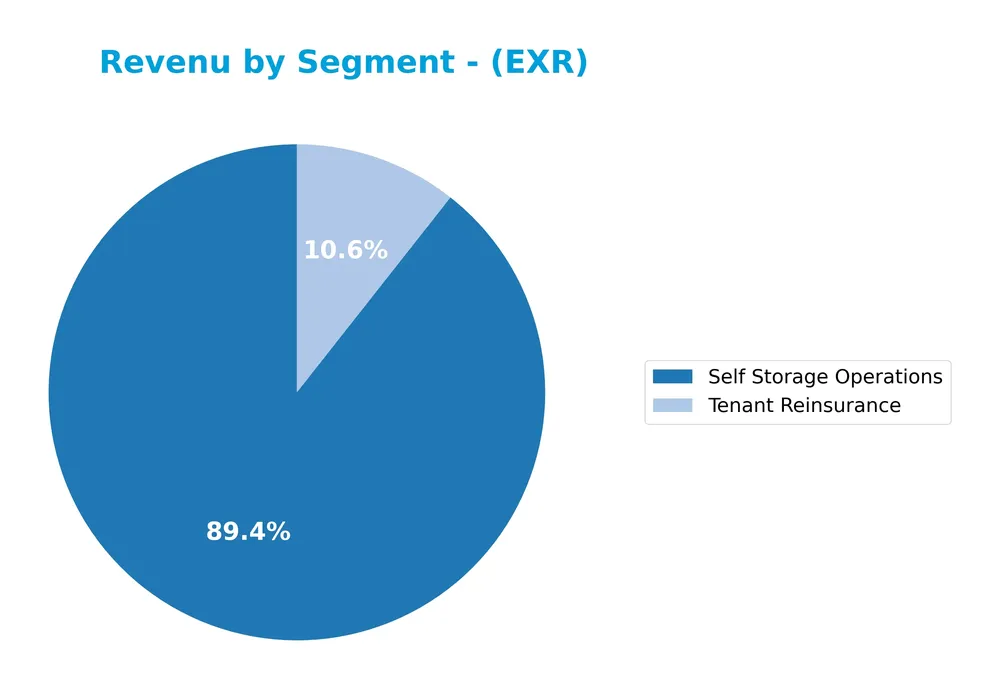

Revenue by Segment

This pie chart illustrates Extra Space Storage Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting the relative contribution of each business area.

The dominant revenue driver for Extra Space Storage remains its Self Storage Operations, which reached $2.8B in 2024, showing strong and consistent growth over recent years. Tenant Reinsurance, while significantly smaller at $333M, also expanded steadily. The company’s revenue concentration in self storage suggests a focused business model, with the most recent year indicating healthy acceleration in the core segment, supporting a stable growth outlook.

Key Products & Brands

The following table outlines the key products and brands offered by Extra Space Storage Inc.:

| Product | Description |

|---|---|

| Self Storage Operations | Provides approximately 1.4M storage units across 1,906 stores in 40 states, Washington D.C., and Puerto Rico. |

| Tenant Reinsurance | Insurance products offered to tenants renting storage units, generating supplementary revenue. |

Extra Space Storage’s core business centers on self-storage unit rentals, supported by tenant reinsurance services, contributing to diversified revenue streams in the self-storage industry.

Main Competitors

There are 3 competitors in the sector, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Prologis, Inc. | 120B |

| Public Storage | 45.3B |

| Extra Space Storage Inc. | 27.8B |

Extra Space Storage Inc. ranks 3rd among its competitors, holding about 25.1% of the market cap of the leader, Prologis, Inc. The company is positioned below both the average market cap of the top 10 competitors (64.3B) and the median market cap in the sector (45.3B). It maintains a significant distance of +50.97% from its closest competitor above, Public Storage.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does EXR have a competitive advantage?

Extra Space Storage Inc. does not currently present a competitive advantage, as its ROIC is below WACC by 3.64%, indicating value destruction and declining profitability over the 2020-2024 period. The company’s overall moat status is very unfavorable, reflecting inefficiencies in capital use despite favorable income statement metrics.

Looking ahead, Extra Space Storage could explore growth opportunities by leveraging its extensive portfolio of 1,906 self-storage stores across 40 states, including niche markets like boat, RV, and business storage. Expansion into underpenetrated markets or enhancement of service offerings may provide avenues for future value creation.

SWOT Analysis

This SWOT analysis highlights Extra Space Storage Inc.’s key internal and external factors to inform strategic investment decisions.

Strengths

- strong market position as 2nd largest U.S. self-storage operator

- solid gross margin at 76.3%

- attractive dividend yield of 4.34%

Weaknesses

- declining ROIC and profitability trend

- unfavorable interest expense at 17.8%

- below-average liquidity ratios

Opportunities

- growing demand for self-storage due to urbanization

- expansion into new geographic markets

- increasing business and specialty storage segments

Threats

- rising interest rates increasing debt costs

- intense industry competition

- economic downturn reducing discretionary storage spending

Overall, Extra Space Storage benefits from robust market scale and profitability but faces headwinds from declining returns and financial leverage. Strategic focus should be on improving operational efficiency and managing debt while capitalizing on expanding storage demand.

Stock Price Action Analysis

The following weekly chart illustrates Extra Space Storage Inc. (EXR) stock price movements over the past 100 weeks, highlighting key price fluctuations and trend shifts:

Trend Analysis

Over the past 12 months, EXR’s stock price declined by 1.28%, indicating a bearish trend. The price range varied between a high of 180.41 and a low of 129.56, with an acceleration in the downward movement. The overall volatility, measured by a 12.46 standard deviation, suggests notable price fluctuations during this period.

Volume Analysis

Trading volumes over the last three months show a decreasing trend, with total activity slightly seller-driven as sellers accounted for 53.35% of recent volume. This marginal seller dominance and declining volume suggest cautious investor sentiment and reduced market participation during this timeframe.

Target Prices

The consensus target price for Extra Space Storage Inc. (EXR) reflects moderate upside potential.

| Target High | Target Low | Consensus |

|---|---|---|

| 164 | 143 | 149.38 |

Analysts expect the stock to trade between $143 and $164, with a consensus around $149, indicating cautious optimism in its near-term valuation.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section presents an overview of analyst ratings and consumer feedback related to Extra Space Storage Inc. (EXR).

Stock Grades

Here is a summary of the latest verified stock grades for Extra Space Storage Inc. from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Hold | 2026-01-20 |

| Mizuho | Maintain | Outperform | 2026-01-12 |

| Scotiabank | Downgrade | Sector Perform | 2026-01-08 |

| UBS | Maintain | Buy | 2026-01-08 |

| Truist Securities | Maintain | Hold | 2025-12-16 |

| Mizuho | Maintain | Outperform | 2025-12-05 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-05 |

| RBC Capital | Maintain | Sector Perform | 2025-11-07 |

| Evercore ISI Group | Maintain | In Line | 2025-11-03 |

| Evercore ISI Group | Maintain | In Line | 2025-10-03 |

The overall trend shows a mix of Hold and Outperform ratings, with a notable downgrade by Scotiabank to Sector Perform. Consensus leans toward a Hold, reflecting cautious optimism among analysts.

Consumer Opinions

Consumer sentiment about Extra Space Storage Inc. (EXR) reflects a mix of satisfaction with convenience and concerns over pricing and customer service.

| Positive Reviews | Negative Reviews |

|---|---|

| “Facilities are clean and well-maintained.” | “Customer service response times can be slow.” |

| “Easy online reservation process.” | “Prices are higher compared to competitors.” |

| “Convenient locations near my home.” | “Limited availability during peak seasons.” |

Overall, consumers appreciate Extra Space Storage’s cleanliness and accessibility but frequently note elevated costs and occasional customer service delays as areas for improvement.

Risk Analysis

Below is a summary table highlighting key risks relevant to Extra Space Storage Inc. (EXR) for informed investment decision-making:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score at 1.56 indicates distress zone, risk of financial instability | High | High |

| Profitability | Unfavorable ROE (6.13%) and ROIC (4.49%) may limit growth potential | Medium | Medium |

| Valuation | Elevated P/E ratio (37.03) suggests potential overvaluation | Medium | Medium |

| Liquidity | Current ratio below 1 (0.93) signals tight short-term liquidity | Medium | Medium |

| Market Volatility | Beta of 1.273 implies higher sensitivity to market swings | Medium | Medium |

| Debt Levels | Moderate debt-to-equity ratio and interest coverage indicate manageable debt | Medium | Medium |

The most pressing risk is EXR’s financial fragility, as indicated by its Altman Z-Score in the distress zone, signaling potential bankruptcy risk. Combined with a moderate Piotroski score of 5, investors should exercise caution and monitor liquidity and profitability trends carefully.

Should You Buy Extra Space Storage Inc.?

Extra Space Storage Inc. appears to be facing declining profitability and a deteriorating competitive moat, suggesting value destruction. Despite a substantial leverage profile and liquidity challenges, its overall B rating reflects moderate operational efficiency, indicating a cautious, balanced financial stance.

Strength & Efficiency Pillars

Extra Space Storage Inc. exhibits solid profitability with a net margin of 25.61% and a robust gross margin of 76.31%, underscoring strong operational efficiency. The company maintains favorable fixed asset turnover at 4.51, enhancing asset utilization. Its Piotroski Score of 5 indicates average financial health, while the Altman Z-Score of 1.56 places it in the distress zone, flagging caution in financial stability. Despite a weighted average cost of capital (WACC) at 8.13%, the return on invested capital (ROIC) stands at 4.49%, signaling that the company is currently shedding value rather than creating it.

Weaknesses and Drawbacks

Valuation metrics present notable concerns, with a high price-to-earnings (P/E) ratio of 37.03 suggesting a premium valuation that may limit upside potential. The price-to-book (P/B) ratio of 2.27 is moderate but paired with a current ratio below 1 at 0.93, indicating potential liquidity constraints. Leverage metrics remain neutral, yet the interest expense ratio at 17.83% is unfavorable, burdening profitability. Market dynamics reveal a slightly seller-dominant environment, with buyers comprising only 46.65% of recent volume, which may exert short-term downward pressure on the stock.

Our Verdict about Extra Space Storage Inc.

The long-term fundamental profile of Extra Space Storage Inc. could be considered mixed to unfavorable due to its value destruction and financial distress signals. Despite this, recent market behavior shows some positive price momentum with a 6.26% gain. However, the slightly seller-dominant trend in the short term suggests that, despite long-term challenges, investors might adopt a cautious wait-and-see approach for a more favorable entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Extra Space Storage Inc. Announces Tax Reporting Information for 2025 Distributions – PR Newswire (Jan 22, 2026)

- Extra Space Storage Inc (NYSE:EXR) Receives Consensus Recommendation of “Hold” from Brokerages – MarketBeat (Jan 24, 2026)

- Extra Space Storage Inc. Announces Date of Earnings Release and Conference Call to Discuss 4th Quarter and Year-End 2025 Results – Yahoo Finance (Jan 20, 2026)

- Extra Space Storage’s quarterly earnings preview: What you need to know – MSN (Jan 21, 2026)

- Extra Space Storage CEO Joe Margolis Wins Glassdoor Employees’ Choice Award – Nareit (Jan 20, 2026)

For more information about Extra Space Storage Inc., please visit the official website: extraspace.com