Home > Analyses > Healthcare > Danaher Corporation

Danaher Corporation transforms healthcare and industry with precision instruments that drive breakthroughs in diagnostics, life sciences, and environmental solutions. Its flagship technologies in genomics, clinical diagnostics, and water quality shape critical decisions in labs and hospitals worldwide. Renowned for relentless innovation and operational excellence, Danaher commands a durable competitive moat. As valuations expand, I ask: do Danaher’s fundamentals continue to justify its premium amid evolving market dynamics?

Table of contents

Business Model & Company Overview

Danaher Corporation, founded in 1969 and based in Washington, DC, commands a leading position in the Medical – Diagnostics & Research industry. It operates a cohesive ecosystem across Life Sciences, Diagnostics, and Environmental & Applied Solutions, delivering advanced instruments and consumables that serve medical, industrial, and research sectors worldwide. Its diverse portfolio integrates cutting-edge technologies to support healthcare and scientific innovation.

The company’s revenue engine balances sales of hardware, consumables, software, and recurring services, with strong exposure across the Americas, Europe, and Asia. Danaher generates value from clinical instruments, genomics tools, and environmental testing systems, reflecting a broad, resilient business model. Its enduring economic moat lies in proprietary technologies and high switching costs, cementing its role as a future shaper of diagnostics and life sciences markets.

Financial Performance & Fundamental Metrics

I will analyze Danaher Corporation’s income statement, key financial ratios, and dividend payout policy to assess its operational efficiency and shareholder returns.

Income Statement

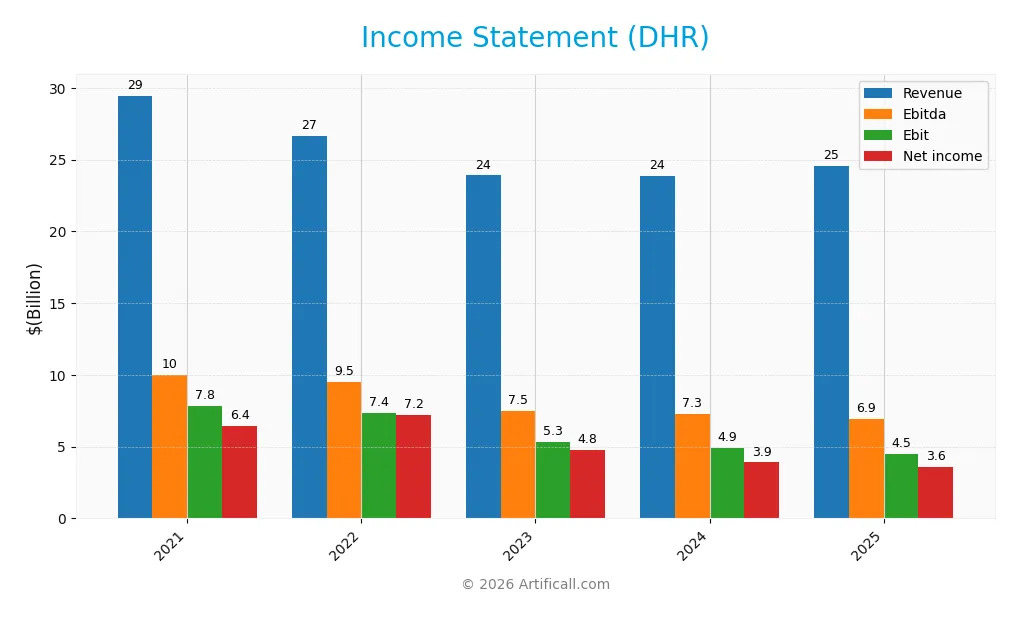

The table below summarizes Danaher Corporation’s key income statement metrics over the past five fiscal years, reflecting its operational performance and profitability trends.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 29.45B | 26.64B | 23.89B | 23.88B | 24.57B |

| Cost of Revenue | 11.50B | 10.46B | 9.86B | 9.67B | 9.60B |

| Operating Expenses | 9.90B | 8.65B | 8.76B | 9.02B | 9.83B |

| Gross Profit | 17.95B | 16.19B | 14.03B | 14.21B | 14.97B |

| EBITDA | 10.01B | 9.49B | 7.50B | 7.28B | 6.95B |

| EBIT | 7.84B | 7.35B | 5.33B | 4.92B | 4.50B |

| Interest Expense | 241M | 207M | 289M | 278M | 265M |

| Net Income | 6.43B | 7.21B | 4.76B | 3.90B | 3.61B |

| EPS | 8.77 | 9.80 | 6.44 | 5.33 | 5.07 |

| Filing Date | 2022-02-23 | 2023-02-22 | 2024-02-21 | 2025-02-20 | 2026-01-28 |

Income Statement Evolution

Danaher’s revenue declined 16.6% from 2021 to 2025, with a slight 2.9% increase from 2024 to 2025. Net income fell sharply by 43.8% over the period, reflecting margin pressure. Gross margin remained favorable at 60.9%, but EBIT and net margins both contracted, indicating rising costs and less efficient profitability.

Is the Income Statement Favorable?

In 2025, Danaher reported a 14.7% net margin and 18.3% EBIT margin, both favorable compared to industry standards. However, the company experienced negative growth in EBIT (-8.7%) and net margin (-9.9%) year-over-year. Despite strong gross margins and controlled interest expenses, declining earnings per share (-4.7%) signal weakening fundamentals overall.

Financial Ratios

The table below presents key financial ratios for Danaher Corporation (DHR) over the past five fiscal years, providing insight into profitability, efficiency, liquidity, leverage, and shareholder returns:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 22% | 27% | 20% | 16% | 15% |

| ROE | 14.2% | 14.4% | 8.9% | 7.9% | 6.9% |

| ROIC | 8.9% | 8.7% | 5.7% | 6.1% | 5.7% |

| P/E | 32.4 | 23.7 | 35.8 | 43.0 | 44.8 |

| P/B | 4.61 | 3.41 | 3.19 | 3.39 | 3.08 |

| Current Ratio | 1.43 | 1.89 | 1.68 | 1.40 | 1.87 |

| Quick Ratio | 1.09 | 1.56 | 1.37 | 1.05 | 1.51 |

| D/E | 0.52 | 0.41 | 0.37 | 0.35 | 0.35 |

| Debt-to-Assets | 28.0% | 24.4% | 23.1% | 22.1% | 22.1% |

| Interest Coverage | 33.4x | 36.4x | 18.3x | 18.6x | 19.4x |

| Asset Turnover | 0.35 | 0.32 | 0.28 | 0.31 | 0.29 |

| Fixed Asset Turnover | 6.10 | 5.80 | 4.26 | 3.93 | 4.44 |

| Dividend Yield | 0.36% | 0.48% | 0.48% | 0.46% | 0.54% |

Evolution of Financial Ratios

Return on Equity (ROE) declined steadily from 14.3% in 2022 to 6.9% in 2025, indicating weakening profitability. The Current Ratio improved from 1.43 in 2021 to 1.87 in 2025, reflecting enhanced liquidity. Debt-to-Equity Ratio decreased from 0.52 in 2021 to 0.35 in 2025, showing reduced leverage and a more conservative capital structure.

Are the Financial Ratios Fovorable?

In 2025, liquidity ratios remain strong with a Current Ratio of 1.87 and Quick Ratio of 1.51, signaling solid short-term financial health. Debt metrics are favorable, including Debt-to-Equity at 0.35 and Debt-to-Assets at 22%. Profitability is mixed: net margin is favorable at 14.7%, but ROE and asset turnover are weak. Market valuation ratios such as P/E of 44.8 and P/B of 3.08 appear elevated, suggesting caution despite an overall favorable financial profile.

Shareholder Return Policy

Danaher maintains a dividend payout ratio near 24%, with a steady dividend per share growth reaching $1.24 in 2025. The dividend yield remains modest at 0.54%, supported by share buybacks and a dividend coverage ratio exceeding 3x free cash flow plus capex.

This disciplined distribution policy balances returning capital with reinvestment needs. The coverage indicates sustainability, mitigating risks of excessive payouts or buybacks. Overall, Danaher’s approach supports steady, long-term shareholder value creation through prudent capital allocation.

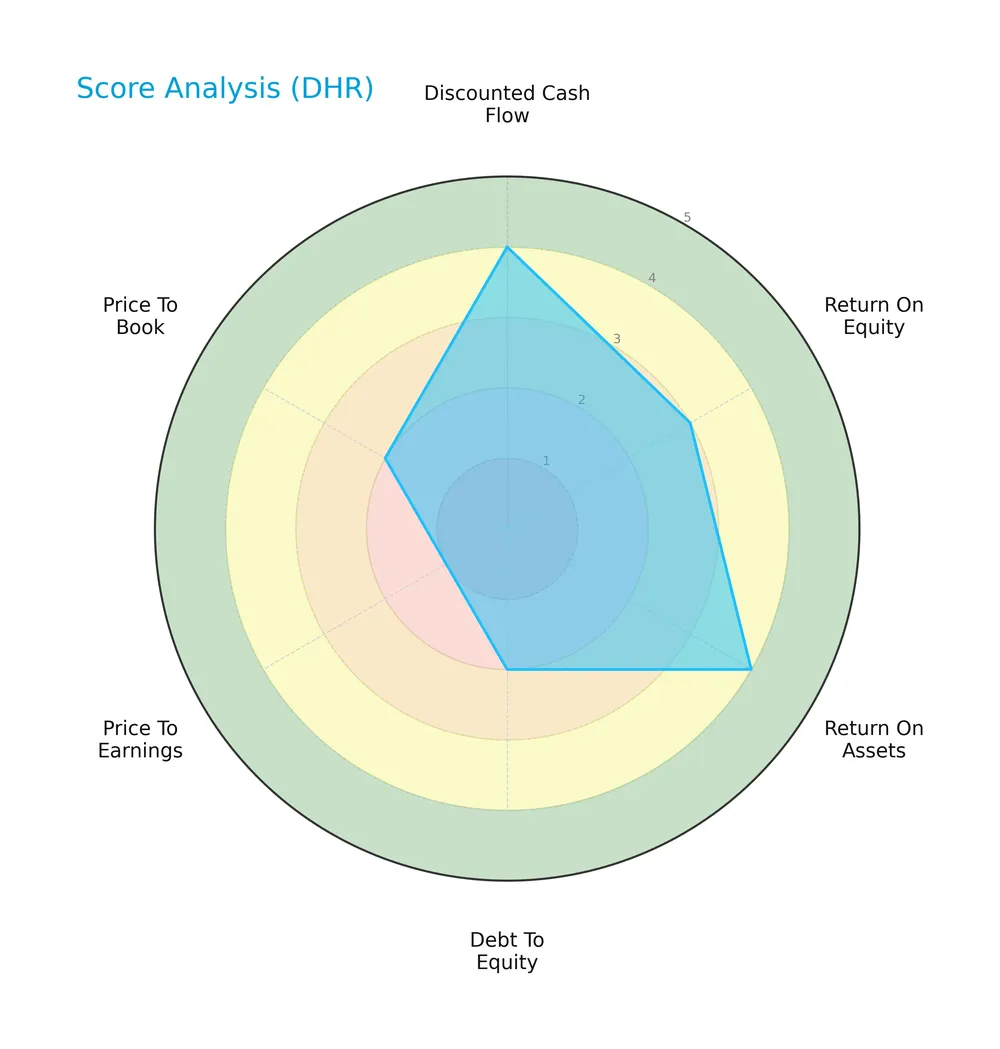

Score analysis

The radar chart below illustrates Danaher Corporation’s key financial scores across multiple valuation and performance metrics:

Danaher shows strength in discounted cash flow and return on assets, scoring favorably at 4 each. Return on equity is moderate at 3. Debt to equity and price to book ratios are moderate, while price to earnings remains very unfavorable at 1, indicating valuation concerns.

Analysis of the company’s bankruptcy risk

Danaher’s Altman Z-Score positions the company comfortably in the safe zone, signaling low bankruptcy risk and financial stability:

Is the company in good financial health?

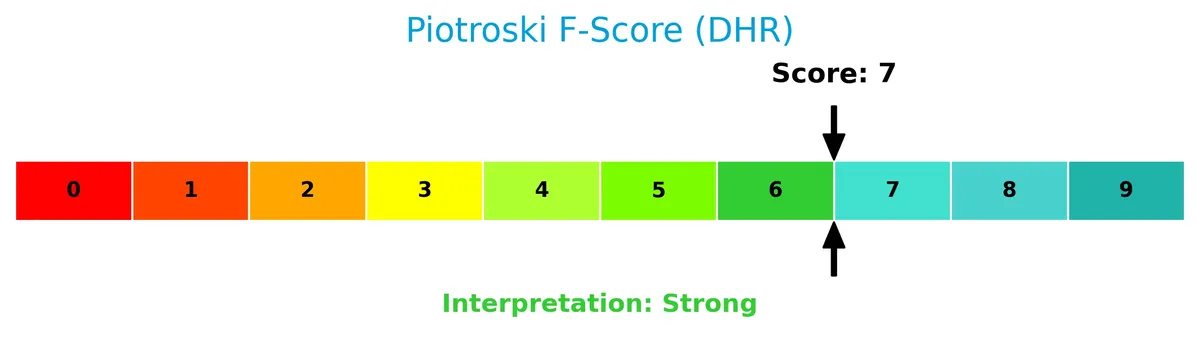

The Piotroski Score diagram below reflects Danaher’s solid financial health with a score of 7, categorized as strong:

A Piotroski score of 7 suggests robust profitability, efficiency, and leverage metrics, highlighting the company’s sound financial condition and operational strength.

Competitive Landscape & Sector Positioning

This section analyzes Danaher Corporation’s strategic positioning within the healthcare sector and its revenue distribution by segment. I will review its key products, main competitors, and competitive advantages. The analysis aims to determine whether Danaher holds a sustainable competitive advantage over peers.

Strategic Positioning

Danaher Corporation operates a diversified portfolio spanning Life Sciences, Diagnostics, and Environmental & Applied Solutions. Its revenue is well-distributed geographically, with significant exposure in North America (9.9B), other developed markets (11.1B), and China (2.8B), reflecting broad global reach.

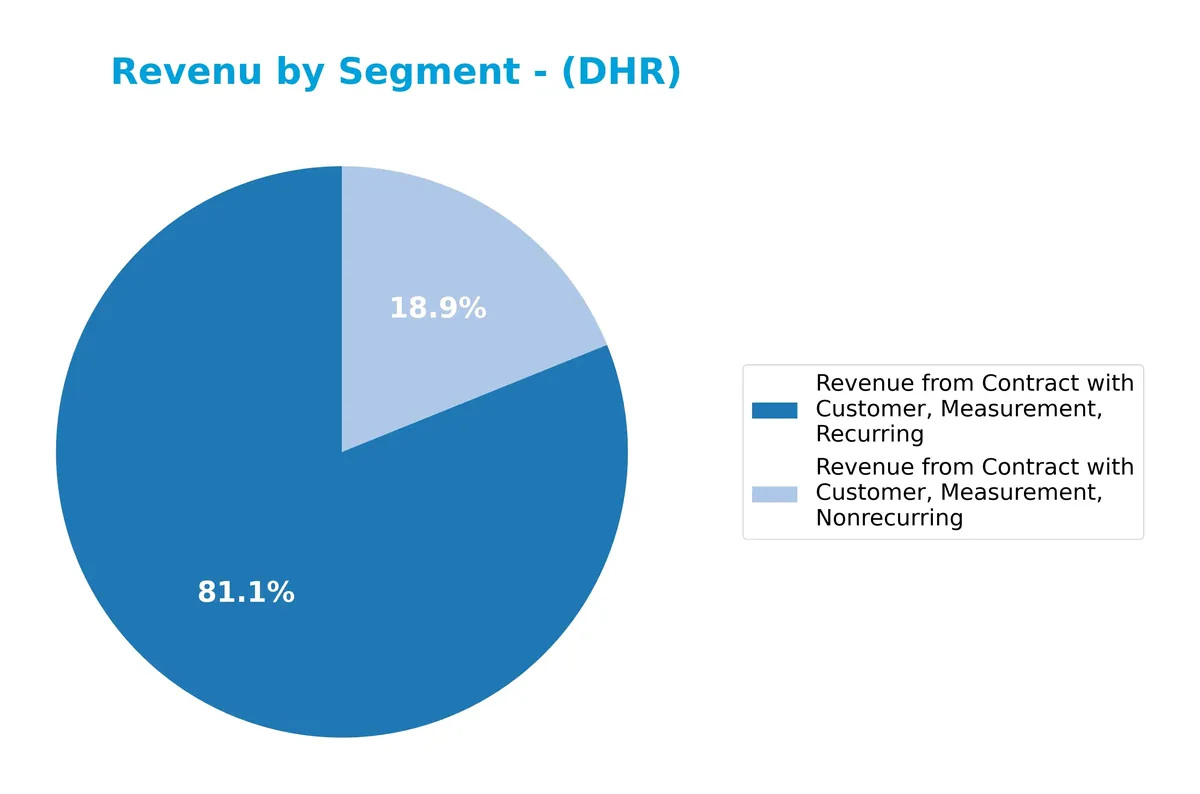

Revenue by Segment

This pie chart illustrates Danaher Corporation’s revenue distribution by segment for the fiscal year 2024, highlighting recurring and nonrecurring measurement revenues.

In 2024, recurring measurement revenue dominates with $19.4B, reflecting Danaher’s strong, stable customer contracts. Nonrecurring measurement revenue fell to $4.5B, down from prior years, signaling a slowdown in one-time sales. The shift towards recurring revenue underlines a strategic focus on predictable cash flows, reducing volatility risks. This concentration on recurring streams enhances Danaher’s moat and supports resilient growth despite cyclical pressures.

Key Products & Brands

The table below outlines Danaher Corporation’s primary products and brands across its key business segments:

| Product | Description |

|---|---|

| Life Sciences | Mass spectrometers, flow cytometry, genomics, lab automation, centrifugation, microscopes, consumables, gene and cell therapy tools. |

| Diagnostics | Chemistry, immunoassay, microbiology, hematology, molecular, acute care, pathology diagnostics products, instruments, reagents, software. |

| Environmental & Applied Solutions | Instruments, consumables, software, disinfection systems for water analysis, treatment, packaging design, printing, coding, traceability. |

Danaher’s portfolio spans advanced life sciences tools, comprehensive diagnostic systems, and environmental solutions. These segments serve healthcare, research, industrial, and environmental markets worldwide.

Main Competitors

Danaher Corporation faces 11 competitors in the Healthcare sector. The table lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Thermo Fisher Scientific Inc. | 225B |

| Danaher Corporation | 165B |

| IDEXX Laboratories, Inc. | 53.5B |

| Agilent Technologies, Inc. | 39.1B |

| IQVIA Holdings Inc. | 38.4B |

| Mettler-Toledo International Inc. | 28.8B |

| Waters Corporation | 22.7B |

| Quest Diagnostics Incorporated | 19.4B |

| Revvity, Inc. | 11.6B |

| Charles River Laboratories International, Inc. | 10B |

Danaher ranks 2nd among its competitors with a market cap at 68% of the leader, Thermo Fisher Scientific. It sits well above both the average market cap of the top 10 (61.3B) and the sector median (28.8B). The company enjoys a 46.78% premium over its closest rival, highlighting a strong competitive position in the Medical Diagnostics & Research industry.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Danaher have a competitive advantage?

Danaher currently lacks a competitive advantage, as it shows a very unfavorable moat with declining ROIC and returns below its cost of capital. The company is destroying value through decreasing profitability over 2021-2025.

Looking ahead, Danaher’s diversified segments in Life Sciences, Diagnostics, and Environmental & Applied Solutions offer exposure to evolving markets and innovative products. Growth opportunities exist in genomics, bioprocess technologies, and global diagnostics expansion.

SWOT Analysis

This SWOT analysis identifies Danaher Corporation’s key internal and external factors to guide strategic decisions.

Strengths

- strong gross margin at 61%

- diversified segments in Life Sciences and Diagnostics

- solid liquidity ratios (current 1.87, quick 1.51)

Weaknesses

- declining revenue and net income over 5 years

- ROIC below WACC, indicating value destruction

- high P/E of 44.8 signals overvaluation risk

Opportunities

- growth potential in emerging markets like China

- expansion in bioprocess and gene therapy sectors

- innovation in lab automation and diagnostics

Threats

- intense competition in medical diagnostics

- regulatory and reimbursement pressures

- macroeconomic slowdown impacting capital spending

Danaher’s strengths in margins and diversification are offset by troubling profitability trends and valuation concerns. Strategic focus must harness growth markets and innovation while addressing operational efficiency to restore value creation.

Stock Price Action Analysis

The following weekly stock chart illustrates Danaher Corporation’s price movements over the past 100 weeks:

Trend Analysis

Over the past 12 months, Danaher’s stock declined by 13.1%, indicating a bearish trend with accelerating downward momentum. The price ranged from a high of 276.75 to a low of 181.77, showing significant volatility with a standard deviation of 26.52. Recent three-month decline of 4.69% continues this negative trajectory.

Volume Analysis

Trading volume has increased overall, with buyers slightly dominating at 52.61% historically. However, in the recent three months, sellers gained control, accounting for 66% of volume, suggesting growing bearish sentiment and heightened selling pressure among investors.

Target Prices

The consensus target price for Danaher Corporation (DHR) reflects confident analyst expectations.

| Target Low | Target High | Consensus |

|---|---|---|

| 220 | 270 | 252.33 |

Analysts project a solid upside potential with targets ranging from 220 to 270, indicating positive market sentiment.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

I present an overview of analyst grades and consumer feedback reflecting Danaher Corporation’s current market perception and reputation.

Stock Grades

Here are the latest verified grades for Danaher Corporation from respected financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2026-01-29 |

| Jefferies | Maintain | Buy | 2026-01-29 |

| TD Cowen | Maintain | Buy | 2026-01-07 |

| Guggenheim | Maintain | Buy | 2026-01-05 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-15 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-23 |

| TD Cowen | Maintain | Buy | 2025-10-22 |

| Barclays | Maintain | Overweight | 2025-10-22 |

| Rothschild & Co | Downgrade | Neutral | 2025-10-08 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-07 |

The overall trend shows broad confidence in Danaher, with most firms maintaining Buy or Overweight ratings. Only Rothschild & Co shifted down to Neutral, signaling a modest caution among analysts.

Consumer Opinions

Danaher Corporation consistently earns praise for its innovation and product quality, yet some clients express concerns over service responsiveness.

| Positive Reviews | Negative Reviews |

|---|---|

| “Products are reliable and technologically advanced.” | “Customer support can be slow during peak times.” |

| “Danaher’s innovations have improved our workflow.” | “Pricing feels higher compared to competitors.” |

| “Strong focus on quality control and consistency.” | “Occasional delays in delivery affect project timelines.” |

Overall, consumers appreciate Danaher’s technological leadership and product reliability. However, recurring issues with customer service speed and pricing warrant attention to maintain satisfaction.

Risk Analysis

Below is a concise overview of Danaher Corporation’s key risks, assessing their likelihood and potential impact on performance:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation Risk | Elevated P/E of 44.8 suggests the stock trades at a premium, increasing correction risk. | Medium | High |

| Profitability Risk | Return on Equity at 6.88% trails WACC of 7.83%, signaling challenges in generating excess returns. | Medium | Medium |

| Market Volatility | Beta of 0.958 indicates sensitivity slightly below market, exposing shares to sector swings. | Medium | Medium |

| Operational Risk | Asset turnover ratio of 0.29 is low, hinting at inefficient asset utilization versus peers. | Medium | Medium |

| Dividend Risk | Dividend yield at 0.54% is low, limiting income appeal and signaling cautious capital allocation. | Low | Low |

I see valuation risk as the most pressing. Historically, high P/E stocks in healthcare face sharp corrections during economic slowdowns. Danaher’s ROE below WACC weakens its moat, limiting long-term value creation. Operational inefficiencies demand monitoring. The company’s Altman Z-score of 4.36 reassures on bankruptcy risk, but investors must remain vigilant about macro shifts and execution risks.

Should You Buy Danaher Corporation?

Danaher’s analytical profile appears to be mixed. Despite robust profitability and strong operational efficiency, its competitive moat seems very unfavorable, signaling value destruction. The leverage profile is moderate but manageable. Overall, a B rating suggests a cautiously favorable investment case.

Strength & Efficiency Pillars

Danaher Corporation shows solid profitability with a net margin of 14.71% and an interest expense ratio of just 1.08%, supporting strong operating efficiency. Its Altman Z-Score of 4.36 places it firmly in the safe zone, indicating financial stability. The Piotroski Score of 7 further confirms robust financial health. While ROIC at 5.72% slightly trails WACC at 7.83%, the company maintains favorable leverage metrics, including a debt-to-equity ratio of 0.35, underscoring prudent capital structure management.

Weaknesses and Drawbacks

Several valuation and growth metrics highlight risks. Danaher’s P/E ratio stands at a high 44.8, signaling a premium valuation that may pressure future returns. The price-to-book ratio of 3.08 also appears elevated relative to sector norms. Recent revenue growth is weak at 2.9%, while net income declined sharply by 43.8% over the last five years. The recent seller dominance at 65.94% volume signals near-term market pressure. Additionally, return on equity at 6.88% remains below expectations, reflecting challenges in generating shareholder value.

Our Verdict about Danaher Corporation

Danaher presents a fundamentally mixed profile with strong financial health but clear value erosion, as ROIC fails to exceed WACC. Despite its safe financial footing and operational efficiency, the recent bearish trend and seller dominance suggest caution. The long-term fundamentals may appear favorable, but short-term market dynamics could warrant a wait-and-see approach before entering at current elevated valuations.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Bessemer Group Inc. Raises Position in Danaher Corporation $DHR – MarketBeat (Feb 05, 2026)

- Danaher Corporation (DHR): A Bull Case Theory – Yahoo Finance UK (Feb 04, 2026)

- Danaher: The Worst Should Be Over, But Valuation Is Still Tight (Rating Downgrade) (DHR) – Seeking Alpha (Feb 04, 2026)

- Danaher Corporation (DHR) Growth Potential: Analysts See 21% Upside Amid Strong Diagnostics & Research Focus – DirectorsTalk Interviews (Feb 02, 2026)

- ABN AMRO Bank N.V. Makes New $7.27 Million Investment in Danaher Corporation $DHR – MarketBeat (Feb 05, 2026)

For more information about Danaher Corporation, please visit the official website: danaher.com