Home > Analyses > Technology > CoreWeave, Inc. Class A Common Stock

CoreWeave, Inc. is reshaping the cloud infrastructure landscape by powering the next generation of AI and compute-intensive workloads. Renowned for its cutting-edge GPU and CPU compute solutions, CoreWeave supports industries from visual effects to AI model training with unmatched scalability and speed. As a rapidly growing player in software infrastructure, its innovative platform has gained significant market traction. The question now is whether CoreWeave’s strong fundamentals can sustain its impressive valuation and fuel future growth in an increasingly competitive sector.

Table of contents

Business Model & Company Overview

CoreWeave, Inc., founded in 2017 and headquartered in Livingston, New Jersey, operates a robust cloud platform designed to accelerate and scale GenAI workloads. Its core business integrates GPU and CPU compute, storage, networking, and managed services into a unified ecosystem that supports AI model training, inference, VFX, and rendering. Since its IPO in March 2025, CoreWeave has quickly established itself as a key player within the Software – Infrastructure industry.

The company’s revenue engine balances hardware provision with a growing portfolio of virtual and bare metal servers and recurring managed services. CoreWeave strategically serves enterprises across the Americas, Europe, and Asia, leveraging its specialized infrastructure to meet global demand. Its competitive advantage lies in building tailored compute solutions that power the next wave of AI innovation, positioning it as a formidable force shaping the future of cloud-based AI infrastructure.

Financial Performance & Fundamental Metrics

In this section, I analyze CoreWeave, Inc. Class A Common Stock’s income statement, key financial ratios, and dividend payout policy to assess its fundamental strength.

Income Statement

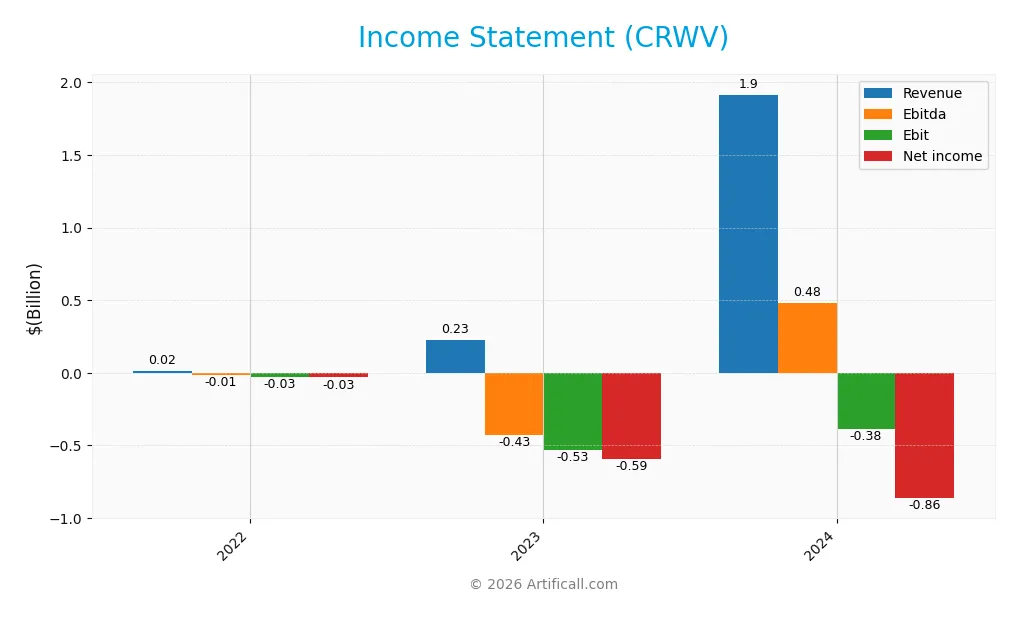

The table below presents CoreWeave, Inc. Class A Common Stock’s key income statement figures for fiscal years 2022 through 2024, reported in USD.

| 2022 | 2023 | 2024 | |

|---|---|---|---|

| Revenue | 15.8M | 229M | 1.92B |

| Cost of Revenue | 12.1M | 68.8M | 493M |

| Operating Expenses | 26.6M | 175M | 1.10B |

| Gross Profit | 3.7M | 160M | 1.42B |

| EBITDA | -13.9M | -426M | 480M |

| EBIT | -25.6M | -530M | -383M |

| Interest Expense | 9.4M | 28.4M | 361M |

| Net Income | -31.1M | -594M | -863M |

| EPS | -0.077 | -1.47 | -2.33 |

| Filing Date | 2022-12-31 | 2023-12-31 | 2024-12-31 |

Income Statement Evolution

CoreWeave’s revenue exhibited a substantial increase from $15.8M in 2022 to $1.92B in 2024, reflecting strong growth momentum, especially between 2023 and 2024. Despite this, net income remained negative, worsening from -$31.1M in 2022 to -$863.4M in 2024, with net margins consistently unfavorable. Gross margins improved to a favorable 74.24% by 2024, while EBIT margins stayed negative at -20.02%.

Is the Income Statement Favorable?

In 2024, CoreWeave showed robust top-line growth with a revenue increase of 736.64% year-over-year, supported by a favorable gross profit growth of 787.89%. Operating expenses grew proportionally but were offset by significant other expenses and interest costs driving the company to a negative net margin of -45.08%. Despite a positive operating income of $324M, the bottom line was adversely affected, resulting in a diluted EPS of -$2.33. Overall, fundamentals reflect a mixed but generally favorable growth profile with profitability challenges.

Financial Ratios

The following table summarizes key financial ratios for CoreWeave, Inc. Class A Common Stock (CRWV) over the last three fiscal years, illustrating profitability, efficiency, liquidity, leverage, and dividend metrics:

| Ratios | 2022 | 2023 | 2024 |

|---|---|---|---|

| Net Margin | -196% | -259% | -451% |

| ROE | 0 | 1.0% | 2.1% |

| ROIC | 0 | -0.3% | 2.1% |

| P/E | -520 | -27.2 | -18.7 |

| P/B | 0 | -27.1 | -39.1 |

| Current Ratio | 0 | 0.50 | 0.39 |

| Quick Ratio | 0 | 0.50 | 0.39 |

| D/E | 0 | -3.35 | -25.7 |

| Debt-to-Assets | 0 | 40.2% | 59.6% |

| Interest Coverage | -2.42 | -0.51 | 0.90 |

| Asset Turnover | 0 | 0.046 | 0.11 |

| Fixed Asset Turnover | 0 | 0.058 | 0.13 |

| Dividend Yield | 0 | 0 | 0.36% |

Evolution of Financial Ratios

Between 2022 and 2024, CoreWeave’s Return on Equity (ROE) improved substantially, reaching 2.09% in 2024 from zero in 2022, indicating a positive trend in profitability. However, the Current Ratio declined to 0.39 by 2024, reflecting reduced liquidity. The Debt-to-Equity Ratio remained negative and favorable, showing a unique capital structure but with a rising Debt-to-Assets ratio at 59.56%, signaling increased leverage.

Are the Financial Ratios Favorable?

In 2024, CoreWeave’s profitability ratios are mixed: ROE is favorable, but net margin and return on invested capital are unfavorable. Liquidity ratios such as Current and Quick Ratios are below 1, indicating potential short-term financial stress. Efficiency ratios like Asset Turnover are low, and leverage ratios show high debt levels with an unfavorable Debt-to-Assets ratio and negative Interest Coverage. Overall, 71.43% of key ratios are unfavorable, suggesting cautious interpretation of financial health.

Shareholder Return Policy

CoreWeave, Inc. does pay a dividend, with a dividend per share of approximately $0.14 in 2024 and a modest yield near 0.36%. However, the payout ratio is negative and free cash flow per share is deeply negative at -$14.7, indicating dividends are not covered by cash flow.

The company’s negative net income and high debt levels suggest risk in sustaining distributions. There is no explicit mention of share buybacks, which could otherwise supplement shareholder returns. Overall, the current policy appears challenged in supporting sustainable long-term value creation given the financial strain.

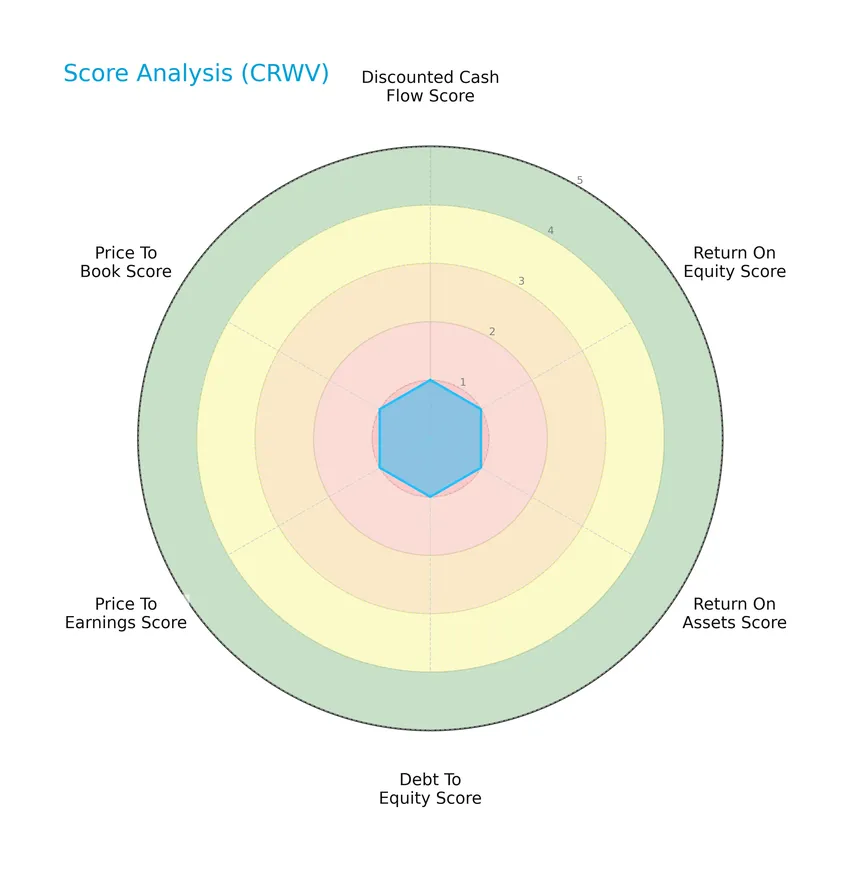

Score analysis

The following radar chart presents an overview of CoreWeave, Inc. Class A Common Stock’s key financial scores:

All evaluated metrics, including discounted cash flow, return on equity, return on assets, debt to equity, price to earnings, and price to book ratios, are rated very unfavorable with a score of 1 each, indicating significant financial challenges across these fundamental valuation and performance measures.

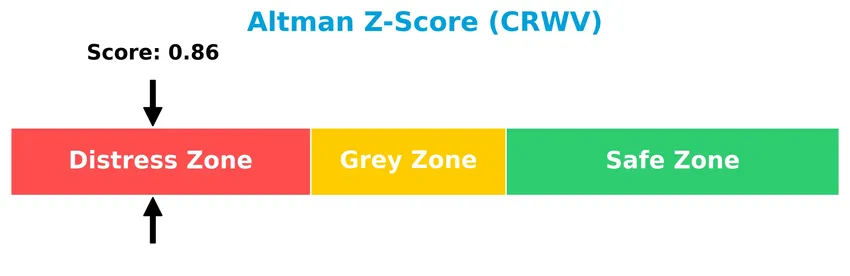

Analysis of the company’s bankruptcy risk

CoreWeave’s Altman Z-Score places it firmly in the distress zone, indicating a high risk of bankruptcy and financial instability:

Is the company in good financial health?

The Piotroski Score diagram below illustrates the company’s financial health based on nine accounting criteria:

With a Piotroski Score of 3, CoreWeave is categorized as very weak financially, suggesting limited strength in profitability, leverage, liquidity, and operational efficiency metrics.

Competitive Landscape & Sector Positioning

This section will analyze CoreWeave, Inc.’s strategic position within the technology sector, focusing on its revenue segments, key products, and main competitors. I will also assess whether CoreWeave holds any competitive advantages over its rivals in the software infrastructure industry.

Strategic Positioning

CoreWeave, Inc. focuses on a concentrated product portfolio within software infrastructure, specializing in cloud platform services for GenAI workloads, including GPU and CPU compute, storage, and networking. It operates primarily from the US, maintaining a targeted technological niche without explicit geographic diversification.

Key Products & Brands

The table below outlines CoreWeave, Inc.’s key products and brand offerings focused on cloud infrastructure and AI support:

| Product | Description |

|---|---|

| GPU Compute | High-performance GPU resources for compute-intensive workloads. |

| CPU Compute | Scalable CPU compute services for varied enterprise needs. |

| Storage Services | Data storage solutions integrated within the cloud platform. |

| Networking Services | Network infrastructure supporting connectivity and data transfer. |

| Managed Services | End-to-end management of cloud resources and infrastructure. |

| Virtual and Bare Metal Servers | Options for virtualized and dedicated physical servers. |

| Fleet Lifecycle Controller | Platform tool for managing the lifecycle of server fleets. |

| Node Lifecycle Controller | Tool for overseeing individual compute node life cycles. |

| Tensorizer | Specialized platform component, likely related to AI workload optimization. |

| Observability | Monitoring and analytics services for cloud infrastructure performance. |

| VFX and Rendering Services | Cloud services tailored for visual effects and rendering workloads. |

| AI Model Training | Infrastructure supporting training of artificial intelligence models. |

| AI Inference | Services enabling AI model deployment and real-time inference. |

| Mission Control | Centralized platform for managing and orchestrating cloud operations and AI workloads. |

CoreWeave’s product suite combines advanced compute infrastructure with specialized AI and rendering services, supported by management and lifecycle tools designed to optimize enterprise cloud workloads.

Main Competitors

There are 32 competitors in the Technology sector for CoreWeave, Inc. Class A Common Stock, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Microsoft Corporation | 3.52T |

| Oracle Corporation | 553B |

| Palantir Technologies Inc. | 383B |

| Adobe Inc. | 140B |

| Palo Alto Networks, Inc. | 120B |

| CrowdStrike Holdings, Inc. | 113B |

| Synopsys, Inc. | 92B |

| Cloudflare, Inc. | 69B |

| Fortinet, Inc. | 59B |

| Block, Inc. | 40B |

CoreWeave ranks 11th among 32 competitors in the Software – Infrastructure industry. Its market cap is only 1.32% of the leader, Microsoft, reflecting a much smaller scale. The company is below the average market cap of the top 10 competitors (508B) but remains above the sector median of 18.8B. The 14.55% gap to the next competitor above highlights a moderate distance from its closest rival.

Does CRWV have a competitive advantage?

CoreWeave, Inc. (CRWV) currently does not present a competitive advantage as it is shedding value with a negative ROIC compared to WACC and an overall unfavorable moat status. Despite favorable revenue and gross profit growth, its profitability metrics such as EBIT and net margin remain negative, indicating challenges in generating sustainable economic profits.

Looking ahead, CoreWeave is positioned to capitalize on opportunities in scaling and accelerating GenAI workloads with its cloud platform, including GPU and CPU compute services, AI model training, and observability tools. These offerings may open new markets and growth avenues, but the company must improve operational efficiency to translate growth into lasting value creation.

Comparisons with competitors

Check out how we compare the company to its competitors:

SWOT Analysis

This SWOT analysis identifies CoreWeave, Inc.’s key internal and external factors to inform strategic investment decisions.

Strengths

- Rapid revenue growth (736.64% in 1 year)

- Strong gross margin (74.24%)

- High ROE (208.77%)

Weaknesses

- Negative net margin (-45.08%)

- High financial leverage (debt to assets 59.56%)

- Poor liquidity ratios (current ratio 0.39)

Opportunities

- Growing GenAI and cloud infrastructure demand

- Expansion in AI model training and VFX rendering

- Potential market leadership in GPU compute services

Threats

- High beta (21.65) indicating volatility

- Risk of financial distress (Altman Z-Score 0.86)

- Intense competition in cloud infrastructure sector

CoreWeave shows impressive growth and operational strengths but struggles with profitability and financial stability. Investors should weigh its growth potential against risks from high leverage and market volatility when considering position sizing and risk management.

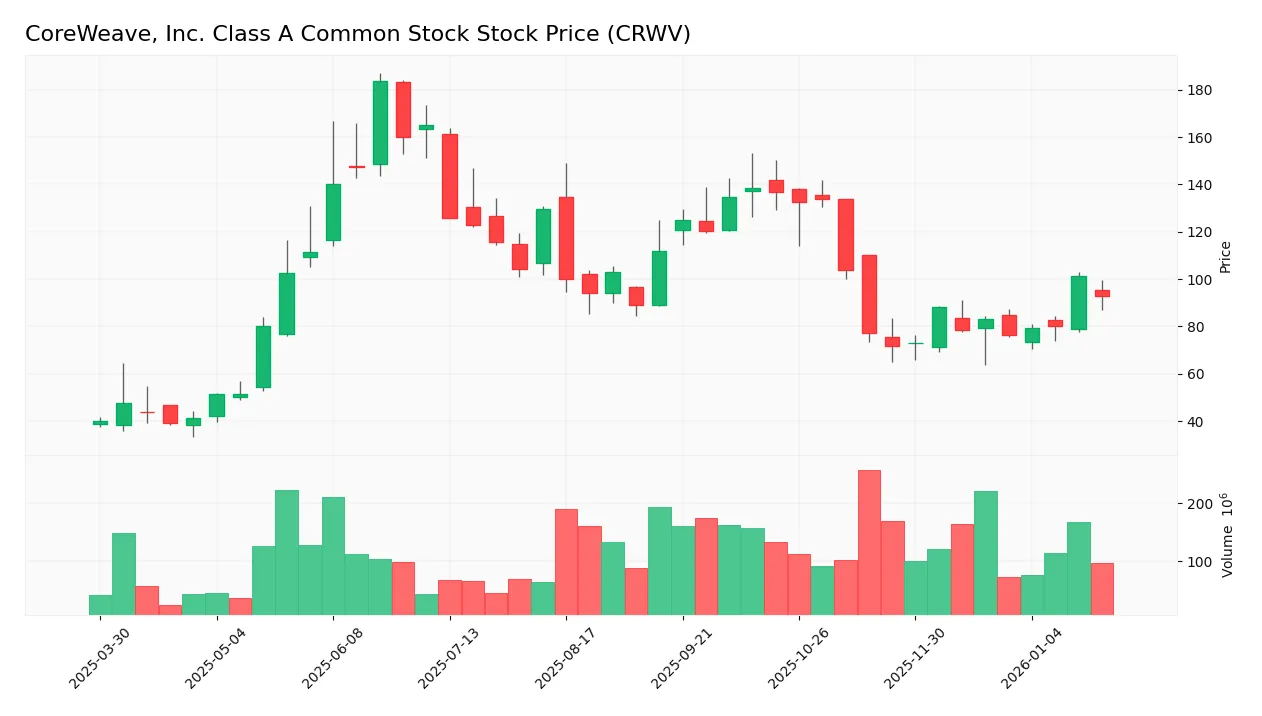

Stock Price Action Analysis

The following weekly stock chart illustrates CoreWeave, Inc. Class A Common Stock (CRWV) price movements and volatility over the past 12 months:

Trend Analysis

Over the past 12 months, CRWV’s stock price increased by 132.45%, indicating a strong bullish trend. The price showed acceleration with a high volatility level, reflected by a 35.29 standard deviation, ranging from $39.09 to $183.58. However, in the recent 2.5-month period, the price declined 10.6%, showing a mild negative slope but still within a volatile range.

Volume Analysis

In the last three months, trading volume has increased with seller volume slightly exceeding buyer volume, resulting in a neutral buyer dominance of 48.14%. This suggests balanced investor sentiment and active market participation without a clear directional bias.

Target Prices

The consensus target prices for CoreWeave, Inc. Class A Common Stock indicate a moderately optimistic outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 175 | 68 | 115.79 |

Analysts expect CoreWeave’s share price to trade broadly between 68 and 175, with a consensus near 116, reflecting cautious optimism about the stock’s growth potential.

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback regarding CoreWeave, Inc. Class A Common Stock (CRWV).

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Stock Grades

The following table presents the latest verified grades for CoreWeave, Inc. Class A Common Stock from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2026-01-12 |

| Wells Fargo | Maintain | Overweight | 2026-01-08 |

| DA Davidson | Upgrade | Neutral | 2026-01-05 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| Goldman Sachs | Maintain | Neutral | 2025-11-17 |

| Loop Capital | Maintain | Buy | 2025-11-12 |

| Barclays | Maintain | Equal Weight | 2025-11-12 |

| HC Wainwright & Co. | Maintain | Buy | 2025-11-12 |

| Wells Fargo | Maintain | Overweight | 2025-11-12 |

| Jefferies | Maintain | Buy | 2025-11-11 |

Overall, the grades indicate a generally positive sentiment with multiple buy and overweight ratings, while some firms maintain neutral or equal weight positions, reflecting a balanced investor outlook on CoreWeave’s stock.

Consumer Opinions

Consumer sentiment around CoreWeave, Inc. Class A Common Stock (CRWV) reflects a mix of enthusiasm for its innovative technology and some concerns about customer support.

| Positive Reviews | Negative Reviews |

|---|---|

| “CoreWeave’s GPU cloud solutions significantly boosted our processing speed.” | “Customer service response times have been slower than expected.” |

| “The platform’s scalability perfectly fits our growing data needs.” | “Pricing can be a bit steep for smaller businesses.” |

| “Excellent integration capabilities with existing workflows.” | “Occasional downtime has disrupted our projects.” |

Overall, consumers appreciate CoreWeave’s advanced technology and scalability but often cite customer support delays and pricing as areas needing improvement.

Risk Analysis

The following table summarizes the main risks CoreWeave, Inc. faces, highlighting their likelihood and potential impact on investors:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Extremely high beta (21.65) indicates volatile stock price and market risk. | High | High |

| Profitability | Negative net margin (-45.08%) and weak ROIC (2.08%) show operational losses. | High | High |

| Liquidity | Very low current and quick ratios (0.39) suggest possible short-term liquidity issues. | Medium | Medium |

| Leverage | High debt-to-assets ratio (59.56%) and negative interest coverage (-1.06) indicate financial stress. | High | High |

| Bankruptcy Risk | Altman Z-Score (0.86) places the company in distress zone, signaling bankruptcy risk. | High | High |

| Financial Strength | Piotroski Score of 3 reflects very weak financial health and poor fundamentals. | High | Medium |

| Market Valuation | Negative P/E and P/B ratios complicate valuation and investor confidence. | Medium | Medium |

CoreWeave’s risks are heavily weighted towards financial distress and volatility. The distress zone Altman Z-Score and high leverage highlight a significant bankruptcy risk, while the extreme beta suggests sharp stock price swings. Investors should exercise caution and manage exposure carefully given these factors.

Should You Buy CoreWeave, Inc. Class A Common Stock?

CoreWeave appears to be navigating significant financial distress with very weak operational efficiency and an unfavorable competitive moat, suggesting value destruction. Despite a challenging leverage profile, the overall rating could be seen as D+, indicating a cautious analytical interpretation.

Strength & Efficiency Pillars

CoreWeave, Inc. Class A Common Stock exhibits some promising profitability signals, notably a robust return on equity of 208.77%, reflecting strong shareholder value generation. The gross margin stands at an impressive 74.24%, indicating solid operational efficiency in revenue retention. However, the return on invested capital (ROIC) is only 2.08%, significantly trailing the weighted average cost of capital (WACC) at 83.49%, signaling that the company is not a value creator but rather shedding value. Financial health is concerning, with an Altman Z-Score of 0.86 placing CoreWeave in the distress zone, and a Piotroski score of 3 indicating very weak fundamentals.

Weaknesses and Drawbacks

CoreWeave faces multiple financial and market pressures that warrant caution. The current ratio of 0.39 and quick ratio of 0.39 suggest liquidity risks, raising concerns about the company’s ability to meet short-term obligations. Debt metrics are mixed: a negative debt-to-equity ratio (-25.68) is favorable, but a high debt-to-assets ratio of 59.56% and negative interest coverage (-1.06) highlight leverage challenges. Valuation metrics, surprisingly, appear favorable due to negative P/E (-18.73) and P/B (-39.11) ratios, reflecting losses rather than typical valuation premiums. Recent seller dominance in the market, with buyers accounting for only 48.14%, adds short-term headwinds despite a longer-term bullish trend.

Our Verdict about CoreWeave, Inc. Class A Common Stock

The long-term fundamental profile of CoreWeave may appear unfavorable given its financial distress indicators and value destruction. Despite a bullish overall stock trend with a 132.45% price increase, recent market behavior reveals a slight seller dominance and a 10.6% price decline in the last quarter. Therefore, despite underlying growth potential, recent market pressure suggests a wait-and-see approach for a better entry point to mitigate risk exposure.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Coreweave CSO Venturo sells $25.8 million in shares – Investing.com (Jan 24, 2026)

- CoreWeave (CRWV) Shares Pull Back Tuesday: What Investors Are Watching – Benzinga (Jan 13, 2026)

- Coreweave’s McBee sells $12.5 million in class a common stock – Investing.com (Jan 23, 2026)

- Coreweave’s McBee sells $784k in class a common stock – Investing.com (Jan 14, 2026)

- Coreweave’s McBee Brannin sells $700k in class a common stock – Investing.com (Jan 07, 2026)

For more information about CoreWeave, Inc. Class A Common Stock, please visit the official website: coreweave.com