Twilio Inc. and SoundHound AI, Inc. are two innovative companies shaping the future of digital communication and voice technology. Twilio, a cloud communications leader, empowers developers to build customer engagement solutions, while SoundHound AI focuses on advanced voice AI platforms. Both operate at the intersection of software and communication services, making their strategies and growth potential highly relevant for investors. In this article, I will help you uncover which company offers the most compelling investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between Twilio Inc. and SoundHound AI, Inc. by providing an overview of these two companies and their main differences.

Twilio Inc. Overview

Twilio Inc. offers a cloud communications platform that helps developers build, scale, and operate customer engagement within software applications worldwide. Founded in 2008 and headquartered in San Francisco, Twilio provides APIs enabling voice, messaging, video, and email integration. The company operates in the Communication Services sector with a market cap of approximately 21.2B USD.

SoundHound AI, Inc. Overview

SoundHound AI, Inc. develops an independent voice AI platform designed to enable businesses to deliver conversational experiences. Its flagship product, Houndify, includes tools like speech recognition and natural language understanding. Headquartered in Santa Clara and founded more recently, SoundHound operates in the Technology sector with a market cap near 4.45B USD.

Key similarities and differences

Both companies focus on software solutions that enhance user interaction—Twilio through communication APIs and SoundHound via voice AI platforms. Twilio serves a broader customer engagement market with a larger scale and workforce, while SoundHound specializes in voice AI technology with a smaller employee base. Their business models converge on software innovation but differ in technology focus and market capitalization.

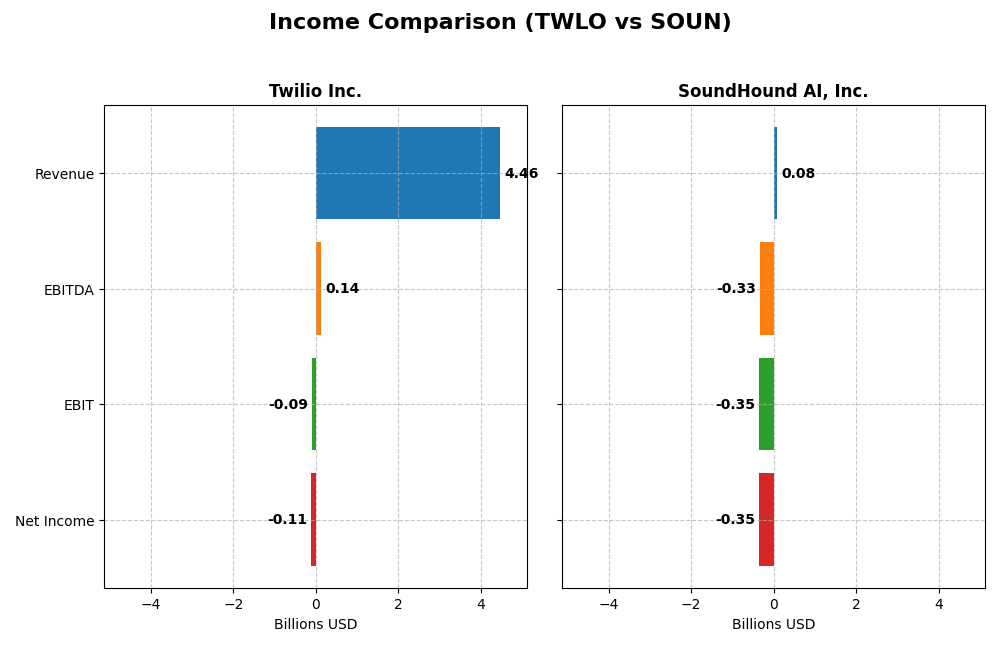

Income Statement Comparison

The table below compares key income statement metrics for Twilio Inc. and SoundHound AI, Inc. for the fiscal year 2024, providing a snapshot of their financial performance.

| Metric | Twilio Inc. (TWLO) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| Market Cap | 21.2B | 4.45B |

| Revenue | 4.46B | 85M |

| EBITDA | 136M | -329M |

| EBIT | -89M | -348M |

| Net Income | -109M | -351M |

| EPS | -0.66 | -1.04 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Twilio Inc.

Twilio’s revenue has steadily increased from $1.76B in 2020 to $4.46B in 2024, showing a strong growth trend. Despite consistent gross margins around 50%, net income remains negative, though losses narrowed to -$109M in 2024 from -$1.26B in 2022. The latest year shows improved profitability with a 7.3% revenue rise and better net margin, signaling positive operational progress.

SoundHound AI, Inc.

SoundHound’s revenue surged significantly from $13M in 2020 to $85M in 2024, marking robust growth. The gross margin stayed favorable near 49%, but net income remains deeply negative, at -$351M in 2024, reflecting high operating expenses and interest costs. The recent year showed strong revenue growth but worsening EBIT and net margin, indicating profitability challenges amid expansion.

Which one has the stronger fundamentals?

Twilio demonstrates stronger fundamentals with consistent revenue growth, a stable gross margin, and improving net income and earnings per share, despite ongoing losses. SoundHound shows impressive top-line growth but suffers from high expenses and negative net margins, weakening its overall financial health. Twilio’s income statement presents a more favorable outlook based on margin stability and reduced losses.

Financial Ratios Comparison

Below is a comparison of key financial ratios for Twilio Inc. (TWLO) and SoundHound AI, Inc. (SOUN) based on their most recent fiscal year data as of 2024.

| Ratios | Twilio Inc. (TWLO) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| ROE | -1.38% | -191.99% |

| ROIC | -0.55% | -68.13% |

| P/E | -163.92 | -19.15 |

| P/B | 2.25 | 36.76 |

| Current Ratio | 4.20 | 3.77 |

| Quick Ratio | 4.20 | 3.77 |

| D/E | 0.14 | 0.02 |

| Debt-to-Assets | 11.25% | 0.79% |

| Interest Coverage | 0 | -28.05 |

| Asset Turnover | 0.45 | 0.15 |

| Fixed Asset Turnover | 18.24 | 14.28 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Twilio Inc.

Twilio’s ratios present a mixed picture with 35.7% favorable and 50% unfavorable indicators, leading to a slightly unfavorable overall assessment. Key weaknesses include negative net margin (-2.45%) and return on equity (-1.38%), alongside a high current ratio (4.2) flagged as unfavorable. The company does not pay dividends, consistent with its reinvestment and growth strategy.

SoundHound AI, Inc.

SoundHound shows a more unfavorable profile, with 64.3% of ratios negative and 0% neutral, reflecting significant profitability challenges. Notably, its net margin stands at -414%, and return on equity is deeply negative at -192%. The company also does not pay dividends, likely prioritizing R&D and expansion given its high beta and industry focus.

Which one has the best ratios?

Between the two, Twilio holds a relatively better ratio profile, showing fewer unfavorable metrics and a slightly unfavorable overall rating. SoundHound’s ratios are more severely negative, with substantial losses and weaker operational efficiency, resulting in a distinctly unfavorable evaluation.

Strategic Positioning

This section compares the strategic positioning of Twilio Inc. and SoundHound AI, Inc. including market position, key segments, and exposure to technological disruption:

Twilio Inc.

- Large market cap of 21B with competitive pressure in communication services industry.

- Focuses on cloud communications platform enabling customer engagement via APIs including voice, messaging, video, and email.

- Moderate exposure to technological disruption through evolving communication APIs and cloud services.

SoundHound AI, Inc.

- Smaller market cap of 4.5B, operating in software application sector with high beta.

- Develops voice AI platform offering conversational tools like speech recognition and natural language understanding.

- High exposure to technological disruption with voice AI innovations impacting multiple industries.

Twilio Inc. vs SoundHound AI, Inc. Positioning

Twilio leverages a diversified communications platform serving broad engagement needs, while SoundHound AI concentrates on voice AI applications. Twilio’s larger scale supports broad market reach; SoundHound’s niche focus targets emerging conversational AI trends but with smaller scale.

Which has the best competitive advantage?

Both companies have slightly unfavorable MOAT evaluations, indicating value destruction despite growing profitability. Twilio’s higher market cap and diversification suggest a more stable position, but neither currently demonstrates a strong sustainable competitive advantage.

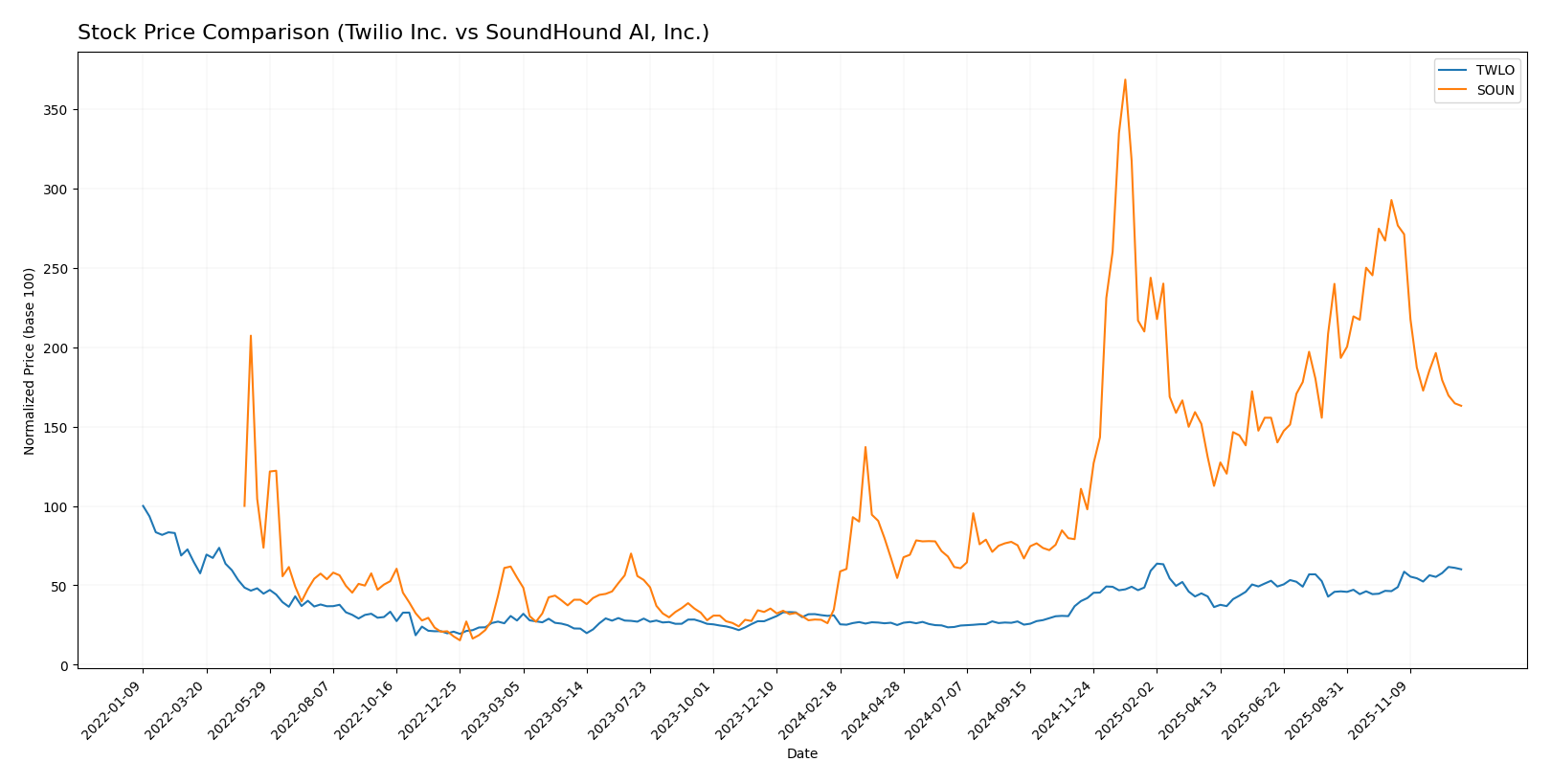

Stock Comparison

The past year has seen significant price movements for Twilio Inc. and SoundHound AI, with Twilio showing steady acceleration in growth while SoundHound experienced a sharp overall increase but recent deceleration and volatility in trading dynamics.

Trend Analysis

Twilio Inc. (TWLO) exhibited a strong bullish trend over the past 12 months with a 93.24% price increase, marked by acceleration and a high volatility level with a standard deviation of 28.13. The stock reached a high of 146.58 and a low of 54.24.

SoundHound AI, Inc. (SOUN) showed an even more pronounced bullish trend with a 369.03% price increase over the same period but with deceleration and lower volatility (std deviation 4.74). The stock hit a high of 23.95 and a low of 2.26.

Comparing the two, SoundHound AI delivered the highest market performance over the past year despite recent price declines, outperforming Twilio in cumulative returns but showing greater recent volatility and seller dominance.

Target Prices

The current analyst consensus presents a clear outlook on target prices for Twilio Inc. and SoundHound AI, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Twilio Inc. | 165 | 120 | 148 |

| SoundHound AI, Inc. | 17 | 15 | 16 |

Analysts expect Twilio’s stock to appreciate moderately above its current price of 138.36 USD, while SoundHound AI shows potential to rise significantly from 10.6 USD, reflecting generally bullish sentiment.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Twilio Inc. and SoundHound AI, Inc.:

Rating Comparison

TWLO Rating

- Rating: C+; status: Very Favorable

- Discounted Cash Flow Score: 2, Moderate valuation indication

- ROE Score: 2, Moderate efficiency in generating profit from equity

- ROA Score: 2, Moderate asset utilization effectiveness

- Debt To Equity Score: 3, Moderate financial risk

- Overall Score: 2, Moderate overall financial standing

SOUN Rating

- Rating: C-; status: Very Favorable

- Discounted Cash Flow Score: 1, Very Unfavorable valuation indication

- ROE Score: 1, Very Unfavorable efficiency in generating profit from equity

- ROA Score: 1, Very Unfavorable asset utilization effectiveness

- Debt To Equity Score: 4, Favorable low financial risk

- Overall Score: 1, Very Unfavorable overall financial standing

Which one is the best rated?

Twilio holds a higher overall score and better ratings for discounted cash flow, ROE, and ROA, indicating stronger financial metrics. SoundHound shows a favorable debt-to-equity score but lower marks elsewhere, making Twilio the better rated based solely on these data.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Twilio Inc. and SoundHound AI, Inc.:

Twilio Inc. Scores

- Altman Z-Score: 6.29, indicating a safe zone, low bankruptcy risk.

- Piotroski Score: 6, classified as average financial strength.

SoundHound AI, Inc. Scores

- Altman Z-Score: 5.59, also in the safe zone, low bankruptcy risk.

- Piotroski Score: 3, classified as very weak financial strength.

Which company has the best scores?

Twilio shows a higher Altman Z-Score and a better Piotroski Score compared to SoundHound. Twilio’s scores suggest stronger financial stability and average financial health, whereas SoundHound’s Piotroski Score indicates very weak financial strength.

Grades Comparison

Here is a comparison of the latest grades assigned by reputable grading companies for Twilio Inc. and SoundHound AI, Inc.:

Twilio Inc. Grades

The following table lists recent grades from credible grading firms for Twilio Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citizens | Maintain | Market Outperform | 2025-12-30 |

| TD Cowen | Maintain | Hold | 2025-10-31 |

| Wells Fargo | Maintain | Overweight | 2025-10-31 |

| Stifel | Maintain | Hold | 2025-10-31 |

| Piper Sandler | Maintain | Overweight | 2025-10-31 |

| Rosenblatt | Maintain | Buy | 2025-10-31 |

| UBS | Maintain | Buy | 2025-10-31 |

| Mizuho | Maintain | Outperform | 2025-10-31 |

| JP Morgan | Maintain | Overweight | 2025-10-31 |

| Needham | Maintain | Buy | 2025-10-31 |

Twilio’s grades mostly range from Hold to Buy, with multiple firms maintaining positive ratings such as Buy, Outperform, and Overweight.

SoundHound AI, Inc. Grades

Below is a summary of recent grades from recognized grading companies for SoundHound AI, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Cantor Fitzgerald | Upgrade | Overweight | 2025-12-12 |

| DA Davidson | Maintain | Buy | 2025-11-18 |

| Piper Sandler | Maintain | Neutral | 2025-11-07 |

| HC Wainwright & Co. | Maintain | Buy | 2025-10-16 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-17 |

| Wedbush | Maintain | Outperform | 2025-09-11 |

| DA Davidson | Maintain | Buy | 2025-09-10 |

| Ladenburg Thalmann | Upgrade | Buy | 2025-08-11 |

| Wedbush | Maintain | Outperform | 2025-08-08 |

| Piper Sandler | Downgrade | Neutral | 2025-07-14 |

SoundHound’s grades show a mix from Neutral to Buy and Outperform, with recent upgrades to Overweight and Buy, indicating an improving outlook from some firms.

Which company has the best grades?

Comparing both companies, Twilio Inc. has a stronger consensus of Buy and Outperform ratings, while SoundHound AI displays a wider range including Neutral but also recent upgrades. Investors might view Twilio’s more consistent positive ratings as reflecting a steadier analyst confidence.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Twilio Inc. (TWLO) and SoundHound AI, Inc. (SOUN) based on the most recent data available.

| Criterion | Twilio Inc. (TWLO) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| Diversification | Primarily focused on communications; limited diversification | Offers hosted services, licensing, and professional services; better segment variety |

| Profitability | Currently unprofitable with negative net margin (-2.45%) and ROIC (-0.55%) but improving ROIC trend | Deeply unprofitable with steep negative net margin (-414.06%) and ROIC (-68.13%), though ROIC is growing |

| Innovation | Strong innovation in cloud communications with high fixed asset turnover (18.24) | Innovative in AI voice and speech recognition but high valuation multiples (PB 36.76) raise concerns |

| Global presence | Substantial global reach in communications sector | Smaller scale, more niche in AI voice technology with limited global footprint |

| Market Share | Large communications market share with $4.16B revenue in 2024 | Smaller market share with $57.25M revenue in 2024 |

Key takeaways: Both companies are currently value destroyers with unprofitable operations but show improving profitability trends. Twilio benefits from larger scale and stronger global presence, while SoundHound offers more diversified product lines within AI but faces greater financial challenges. Investors should weigh growth potential against ongoing profitability risks.

Risk Analysis

Below is a comparison of key risk factors for Twilio Inc. (TWLO) and SoundHound AI, Inc. (SOUN) as of 2024:

| Metric | Twilio Inc. (TWLO) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| Market Risk | Beta 1.32, moderate volatility | Beta 2.84, high volatility |

| Debt level | Low debt-to-equity 0.14, favorable | Very low debt-to-equity 0.02, favorable |

| Regulatory Risk | Moderate, US and global data privacy regulations | Moderate, technology sector regulations |

| Operational Risk | Moderate, scaling cloud infrastructure | High, early-stage AI platform development |

| Environmental Risk | Low, limited direct impact | Low, limited direct impact |

| Geopolitical Risk | Moderate, global market exposure | Moderate, US-based with international clients |

The most impactful risks are market volatility and operational challenges. SoundHound’s high beta indicates greater price swings, increasing investor risk. Both companies maintain low debt, limiting financial risk. Twilio faces moderate regulatory and operational risks tied to its cloud communications platform, while SoundHound’s early-stage AI technology poses higher operational uncertainty. Investors should weigh volatility and execution risks carefully.

Which Stock to Choose?

Twilio Inc. (TWLO) shows a favorable income evolution with 78.57% positive income statement indicators, including a 153% revenue growth over five years, despite slightly unfavorable profitability and some unfavorable financial ratios. Its debt levels are moderate and its rating is very favorable (C+).

SoundHound AI, Inc. (SOUN) exhibits unfavorable income statement trends with 57.14% negative indicators, including net income decline over the period, and predominantly unfavorable financial ratios. Debt is low, but its rating stands at C- with more financial weaknesses than TWLO.

For risk-averse investors prioritizing financial stability and consistent profitability, TWLO might appear more favorable given its stronger rating and improving income metrics. Conversely, growth-oriented investors accepting higher volatility could find SOUN’s rapid revenue expansion and bullish long-term price trend of interest despite its financial challenges.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Twilio Inc. and SoundHound AI, Inc. to enhance your investment decisions: