The Trade Desk, Inc. (TTD) and SoundHound AI, Inc. (SOUN) are two dynamic players in the software application industry, each driving innovation in digital advertising and voice AI technologies. While TTD excels in data-driven advertising platforms, SOUN pioneers conversational AI solutions, creating intriguing market overlap in tech-driven customer engagement. This article will explore their strengths and risks to determine which company offers a more compelling investment opportunity for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between The Trade Desk and SoundHound AI by providing an overview of these two companies and their main differences.

The Trade Desk Overview

The Trade Desk, Inc. is a technology company operating a self-service cloud platform that enables buyers to create, manage, and optimize data-driven digital advertising campaigns. Serving advertising agencies and related service providers, it supports various ad formats across devices such as computers, mobiles, and connected TVs. Founded in 2009 and headquartered in Ventura, California, The Trade Desk is a key player in the software application industry with a market cap of $17.3B.

SoundHound AI Overview

SoundHound AI, Inc. develops voice AI platforms designed to help businesses deliver conversational experiences. Its flagship Houndify platform offers tools including speech recognition, natural language processing, and embedded voice solutions to build custom voice assistants. Headquartered in Santa Clara, California, and founded more recently, SoundHound AI operates in the software application sector with a market cap of approximately $4.7B.

Key similarities and differences

Both companies operate in the technology sector within the software application industry, focusing on innovative platforms that enable customers to engage digitally—The Trade Desk in digital advertising and SoundHound AI in voice AI. They differ in scale and maturity: The Trade Desk is larger with over 3,500 employees and a longer market presence, whereas SoundHound AI is smaller with 842 employees and a narrower focus on voice technology solutions.

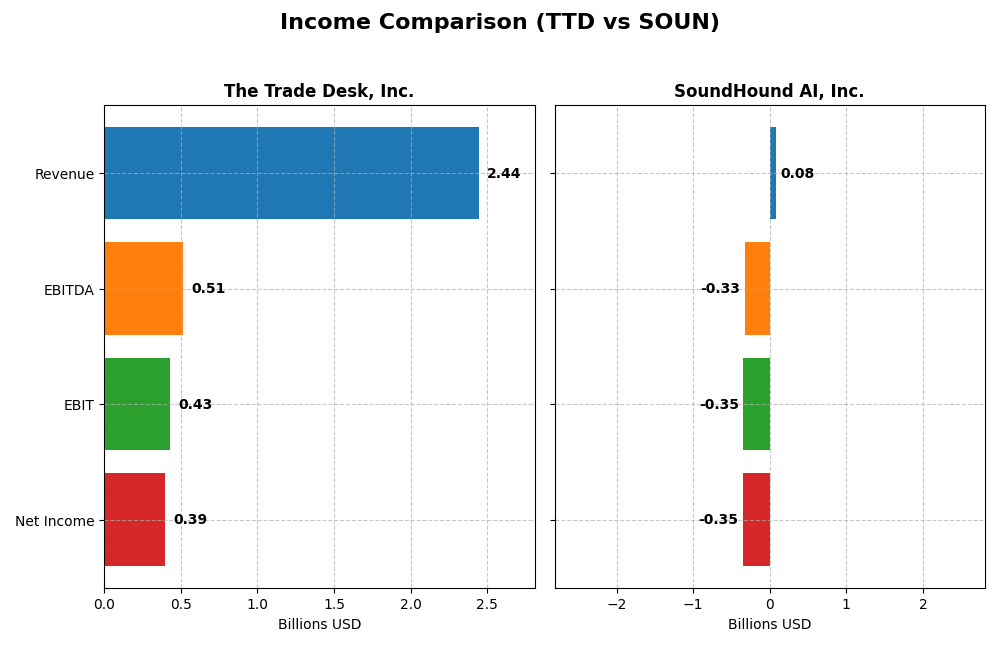

Income Statement Comparison

This table compares key income statement metrics for The Trade Desk, Inc. and SoundHound AI, Inc. for the fiscal year 2024, providing a clear view of their financial performance.

| Metric | The Trade Desk, Inc. (TTD) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| Market Cap | 17.3B | 4.7B |

| Revenue | 2.44B | 85M |

| EBITDA | 515M | -329M |

| EBIT | 427M | -348M |

| Net Income | 393M | -351M |

| EPS | 0.80 | -1.04 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

The Trade Desk, Inc.

The Trade Desk’s revenue showed strong growth from 2020 to 2024, increasing from $836M to $2.44B, while net income rose from $242M to $393M. Gross and EBIT margins remained robust, with gross margin at 80.7% and EBIT margin at 17.5% in 2024. The latest year’s performance featured accelerated EBIT growth of 113% and EPS growth of 117%, indicating improving profitability.

SoundHound AI, Inc.

SoundHound AI experienced significant revenue growth from $13M in 2020 to $85M in 2024, an increase of over 550%. However, net income remained negative, deteriorating to a loss of $351M in 2024. Margins reflect substantial losses, with EBIT and net margins at -411% and -414%, respectively. The most recent year showed worsening net margin and EPS, despite favorable revenue expansion.

Which one has the stronger fundamentals?

The Trade Desk demonstrates stronger fundamentals with consistent profitability, favorable margins, and positive income growth. SoundHound AI, while growing revenue rapidly, suffers significant losses and unfavorable profitability metrics. The Trade Desk’s stable margins and improving earnings contrast with SoundHound’s persistent net losses, indicating a more solid income statement foundation for The Trade Desk.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for The Trade Desk, Inc. (TTD) and SoundHound AI, Inc. (SOUN) for the fiscal year 2024, enabling a clear view of their recent financial performance metrics.

| Ratios | The Trade Desk, Inc. (TTD) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| ROE | 13.3% | -191.9% |

| ROIC | 10.0% | -68.1% |

| P/E | 146.8 | -19.1 |

| P/B | 19.6 | 36.8 |

| Current Ratio | 1.86 | 3.77 |

| Quick Ratio | 1.86 | 3.77 |

| D/E | 0.11 | 0.02 |

| Debt-to-Assets | 5.1% | 0.8% |

| Interest Coverage | 0 | -28.1 |

| Asset Turnover | 0.40 | 0.15 |

| Fixed Asset Turnover | 5.17 | 14.28 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

The Trade Desk, Inc.

The Trade Desk shows a generally favorable ratio profile with strong liquidity (current ratio 1.86) and low leverage (debt-to-equity 0.11). Profitability is decent with a net margin of 16.08% and a neutral return on equity at 13.33%. However, valuation metrics like PE (146.77) and PB (19.56) appear stretched. The company does not pay dividends, likely focusing on reinvestment and growth.

SoundHound AI, Inc.

SoundHound AI displays mostly unfavorable ratios, with a negative net margin (-414.06%) and negative returns on equity (-191.99%) and invested capital (-68.13%). While liquidity is strong (current ratio 3.77) and leverage low (debt-to-equity 0.02), profitability and interest coverage are poor. The firm pays no dividends, consistent with a high-growth or reinvestment phase.

Which one has the best ratios?

Based on the evaluations, The Trade Desk has a more favorable ratio set, with solid profitability, liquidity, and manageable leverage, despite high valuation multiples. SoundHound AI’s ratios reflect financial stress and negative profitability, resulting in an unfavorable overall assessment.

Strategic Positioning

This section compares the strategic positioning of The Trade Desk, Inc. and SoundHound AI, Inc., including their market position, key segments, and exposure to technological disruption:

The Trade Desk, Inc.

- Leading digital advertising platform facing competitive pressure in software applications.

- Focuses on self-service cloud platform for data-driven digital advertising across multiple formats.

- Moderate exposure to disruption, operating in evolving digital ad tech but with established platform.

SoundHound AI, Inc.

- Smaller AI voice platform with higher beta, competing in conversational AI solutions.

- Revenue driven by hosted services, licensing, and professional services in AI voice technology.

- High exposure to disruption through innovative voice AI and conversational technology.

The Trade Desk, Inc. vs SoundHound AI, Inc. Positioning

The Trade Desk has a diversified digital advertising platform serving multiple ad formats, while SoundHound AI concentrates on voice AI solutions with growing hosted services. Trade Desk operates at scale, SoundHound shows faster segment growth but smaller size.

Which has the best competitive advantage?

Both companies are currently shedding value with slightly unfavorable moat ratings. However, SoundHound AI shows improving profitability trends, while The Trade Desk’s profitability is declining, indicating differing trajectories in competitive positioning.

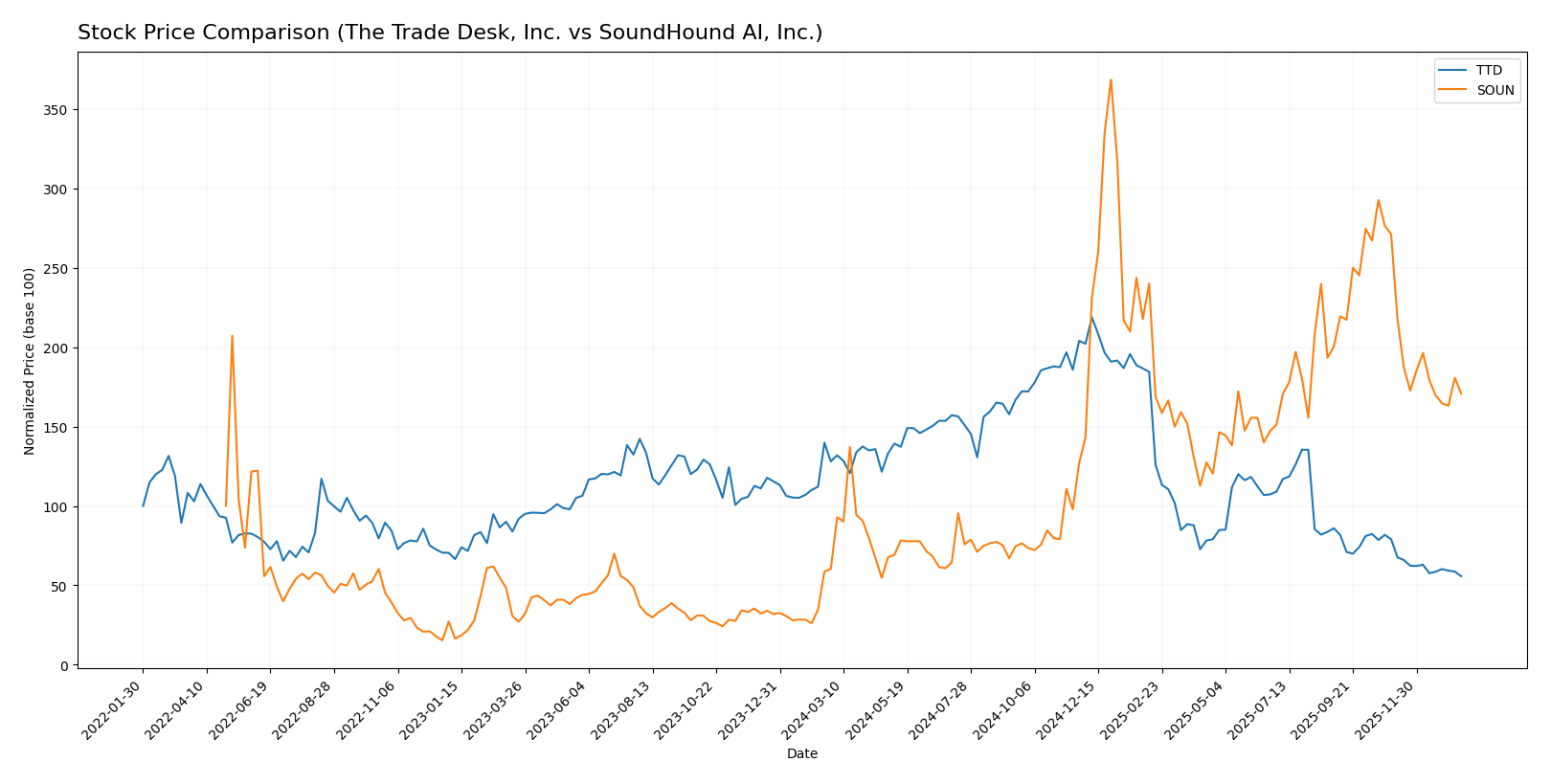

Stock Comparison

The stock price chart highlights significant divergences in price trajectories and trading dynamics between The Trade Desk, Inc. and SoundHound AI, Inc. over the past 12 months, reflecting contrasting market momentum and investor behavior.

Trend Analysis

The Trade Desk, Inc. experienced a bearish trend over the past year, with a 56.43% price decline and decelerating downward momentum, reaching a high of 139.11 and a low of 35.48, accompanied by high volatility (std deviation 28.36).

SoundHound AI, Inc. showed a bullish trend over the same period, with a 183.16% increase but decelerating gains, peaking at 23.95 and bottoming at 3.55, with relatively low volatility (std deviation 4.66).

Comparing both stocks, SoundHound AI, Inc. delivered the highest market performance, significantly outperforming The Trade Desk, Inc. despite both showing recent downward trends.

Target Prices

The current consensus target prices reflect cautious optimism among analysts for these technology companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| The Trade Desk, Inc. | 98 | 39 | 56.73 |

| SoundHound AI, Inc. | 15 | 11 | 13.33 |

Analysts expect The Trade Desk’s stock to appreciate significantly from its current price of 35.48, while SoundHound AI shows moderate upside potential from 11.1. Both stocks present opportunities but require careful risk assessment.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for The Trade Desk, Inc. and SoundHound AI, Inc.:

Rating Comparison

The Trade Desk, Inc. Rating

- Rating: B, classified as Very Favorable by analysts

- Discounted Cash Flow Score: 4, indicating Favorable

- ROE Score: 4, showing Favorable profitability

- ROA Score: 4, demonstrating Favorable asset usage

- Debt To Equity Score: 3, a Moderate financial risk

SoundHound AI, Inc. Rating

- Rating: C-, also noted as Very Favorable in classification

- Discounted Cash Flow Score: 1, rated Very Unfavorable

- ROE Score: 1, marked Very Unfavorable

- ROA Score: 1, considered Very Unfavorable

- Debt To Equity Score: 4, indicating Favorable risk level

Which one is the best rated?

Based strictly on the provided data, The Trade Desk, Inc. holds superior ratings and financial scores compared to SoundHound AI, Inc. It outperforms in discounted cash flow, ROE, ROA, and has a moderate debt-to-equity risk, making it better rated overall.

Scores Comparison

The scores comparison between The Trade Desk, Inc. and SoundHound AI, Inc. is as follows:

TTD Scores

- Altman Z-Score: 4.3, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 5, reflecting average financial strength.

SOUN Scores

- Altman Z-Score: 6.6, firmly in safe zone, very low bankruptcy risk.

- Piotroski Score: 3, indicating very weak financial strength.

Which company has the best scores?

SoundHound AI has a higher Altman Z-Score, suggesting stronger financial stability regarding bankruptcy risk. However, The Trade Desk shows a better Piotroski Score, indicating comparatively stronger overall financial health.

Grades Comparison

Here is a detailed comparison of the latest grades assigned to The Trade Desk, Inc. and SoundHound AI, Inc.:

The Trade Desk, Inc. Grades

This table summarizes recent grades from established financial institutions for The Trade Desk, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-01-13 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-12 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-01-08 |

| Wolfe Research | Maintain | Outperform | 2026-01-06 |

| Guggenheim | Maintain | Buy | 2026-01-05 |

| Jefferies | Maintain | Hold | 2025-12-11 |

| Wedbush | Maintain | Neutral | 2025-12-08 |

| DA Davidson | Maintain | Buy | 2025-11-10 |

| Truist Securities | Maintain | Buy | 2025-11-07 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-07 |

Overall, The Trade Desk shows a stable grade pattern, predominantly favoring Buy and Equal Weight ratings, indicating moderate confidence with some positive outlooks.

SoundHound AI, Inc. Grades

The following table lists recent grades from recognized financial firms for SoundHound AI, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Cantor Fitzgerald | Upgrade | Overweight | 2025-12-12 |

| DA Davidson | Maintain | Buy | 2025-11-18 |

| Piper Sandler | Maintain | Neutral | 2025-11-07 |

| HC Wainwright & Co. | Maintain | Buy | 2025-10-16 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-17 |

| Wedbush | Maintain | Outperform | 2025-09-11 |

| DA Davidson | Maintain | Buy | 2025-09-10 |

| Ladenburg Thalmann | Upgrade | Buy | 2025-08-11 |

| Wedbush | Maintain | Outperform | 2025-08-08 |

SoundHound AI presents a generally positive grading trend, with multiple Buy and Outperform ratings and recent upgrades, signaling growing analyst confidence.

Which company has the best grades?

Comparing both, The Trade Desk holds a larger number of Buy ratings but also several Neutral and Equal Weight grades, reflecting a cautious stance. SoundHound AI features fewer total ratings but a higher proportion of upgrades and Outperform grades, suggesting a more optimistic analyst view. Investors might interpret these differences as varied confidence levels and potential risk-return profiles between the two companies.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for The Trade Desk, Inc. (TTD) and SoundHound AI, Inc. (SOUN), based on their latest financial and operational data.

| Criterion | The Trade Desk, Inc. (TTD) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| Diversification | Moderate, focused on digital advertising platforms | Increasing diversification with Hosted Services growing significantly |

| Profitability | Favorable net margin (16.08%), positive ROIC (10.02%) | Negative net margin (-414.06%), negative ROIC (-68.13%) but improving |

| Innovation | Stable innovation, supported by favorable fixed asset turnover (5.17) | High innovation potential with growing revenue in hosted services |

| Global presence | Strong global advertising reach | Emerging global presence, mostly growing in hosted/licensing services |

| Market Share | Established in digital ad tech space, premium valuation (high PE and PB) | Smaller market share, early-stage growth, high valuation multiples |

Key takeaways: The Trade Desk shows solid profitability and operational efficiency but faces valuation concerns. SoundHound AI is still unprofitable but demonstrates robust revenue growth and improving profitability trends, suggesting potential upside with higher risk.

Risk Analysis

Below is a comparison table highlighting key risks for The Trade Desk, Inc. (TTD) and SoundHound AI, Inc. (SOUN) based on their latest 2024 data.

| Metric | The Trade Desk, Inc. (TTD) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| Market Risk | Moderate (Beta 1.1) | High (Beta 2.9) |

| Debt level | Low (Debt/Equity 0.11) | Very Low (Debt/Equity 0.02) |

| Regulatory Risk | Moderate | Moderate |

| Operational Risk | Low | High (Negative profit margins) |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate | Moderate |

The most impactful risk for SOUN is its high market volatility and significant operational losses, posing a high risk for investors. TTD shows more financial stability with low debt and favorable operational metrics but faces moderate market and regulatory risks.

Which Stock to Choose?

The Trade Desk, Inc. (TTD) exhibits favorable income growth with a 25.63% revenue increase in 2024 and solid profitability metrics, including a 16.08% net margin. Its financial ratios largely appear favorable, supported by low debt levels and a strong current ratio. The company holds a very favorable overall rating but shows a slightly unfavorable MOAT due to declining ROIC relative to WACC.

SoundHound AI, Inc. (SOUN) shows strong revenue growth of 84.62% in 2024 but suffers from negative profitability, with a -414.06% net margin and unfavorable financial ratios overall. Its debt levels remain low, and liquidity ratios are mixed. Despite a very favorable rating classification, its MOAT is slightly unfavorable, indicating value destruction though with improving profitability trends.

Investors with a risk-tolerant or growth-oriented profile might find SoundHound AI’s revenue expansion appealing despite weak profitability, while those prioritizing financial stability and quality could view The Trade Desk’s stronger income statement and more balanced financial ratios as favorable. The contrasting MOAT evaluations and rating nuances suggest that each stock’s appeal depends significantly on individual investment objectives.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of The Trade Desk, Inc. and SoundHound AI, Inc. to enhance your investment decisions: