Home > Comparison > Technology > NOW vs MSTR

The strategic rivalry between ServiceNow, Inc. and Strategy Inc shapes the future of the technology sector’s software application industry. ServiceNow operates as a market-leading enterprise cloud platform focused on workflow automation and IT service management. In contrast, Strategy Inc combines bitcoin treasury management with AI-powered analytics software. This analysis seeks to identify which company’s operational model offers a superior risk-adjusted return for a diversified portfolio in 2026.

Table of contents

Companies Overview

ServiceNow and Strategy Inc stand as pivotal players in enterprise software and digital assets. Both shape their sectors with distinct approaches and growth drivers.

ServiceNow, Inc.: Enterprise Cloud Workflow Leader

ServiceNow dominates the enterprise cloud computing market through its Now platform, automating workflows with AI, machine learning, and robotic process automation. Its core revenue comes from comprehensive IT service management and business operations software. In 2026, ServiceNow strategically focuses on expanding automation and integration capabilities to enhance operational efficiency across diverse industries.

Strategy Inc: Bitcoin Treasury and AI Analytics Pioneer

Strategy Inc operates as a bitcoin treasury company while offering AI-powered enterprise analytics software. Its revenue streams blend digital asset exposure with analytics tools like Strategy One and Mosaic, targeting decision-makers. The company shifted focus in 2026 towards scaling its AI analytics platform alongside maintaining its cryptocurrency investment approach.

Strategic Collision: Similarities & Divergences

ServiceNow emphasizes a closed ecosystem for business process automation, contrasting Strategy’s hybrid model of digital asset management and open AI analytics. Both compete for enterprise IT budgets, but ServiceNow leads in workflow automation while Strategy innovates at the intersection of finance and analytics. Their distinct profiles offer investors exposure to enterprise software resilience versus high-volatility crypto-analytics growth.

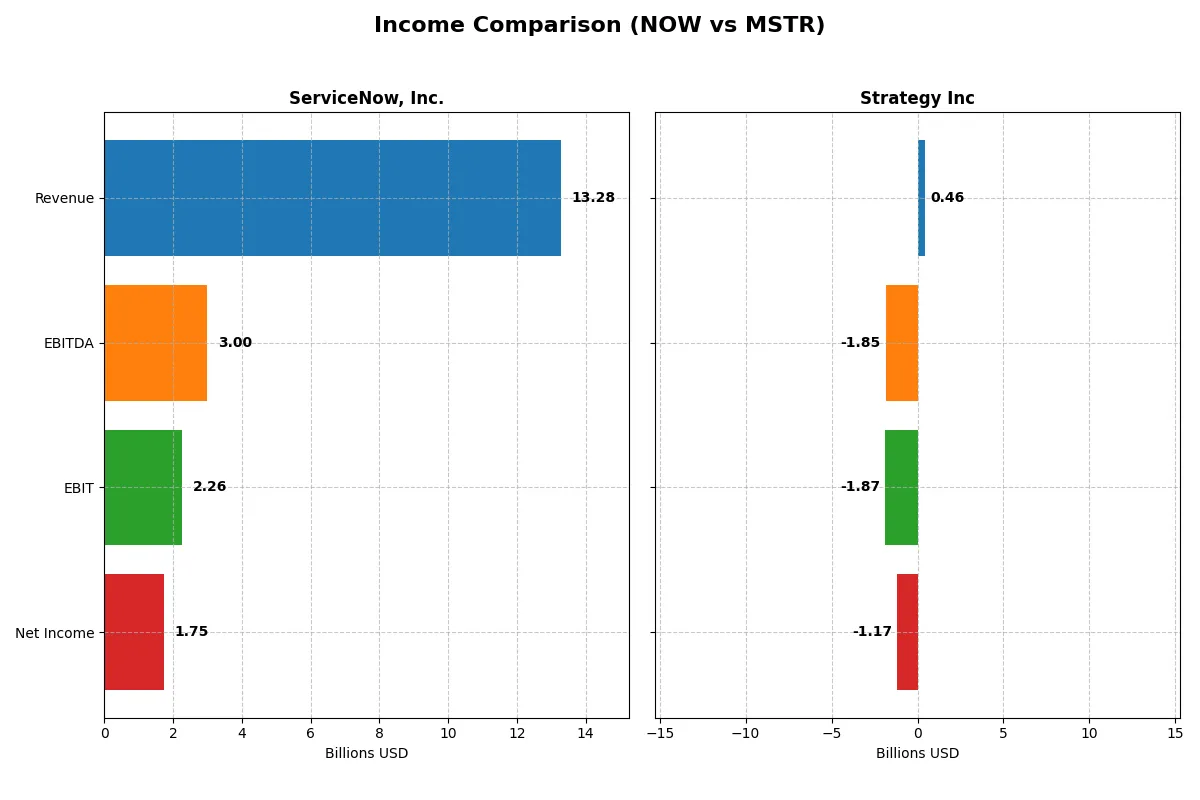

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | ServiceNow, Inc. (NOW) | Strategy Inc (MSTR) |

|---|---|---|

| Revenue | 13.3B | 463M |

| Cost of Revenue | 3.0B | 129M |

| Operating Expenses | 8.5B | 2.2B |

| Gross Profit | 10.3B | 334M |

| EBITDA | 3.0B | -1.85B |

| EBIT | 2.3B | -1.87B |

| Interest Expense | 0 | 62M |

| Net Income | 1.75B | -1.17B |

| EPS | 1.69 | -6.06 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

The following income statement comparison reveals the true operational efficiency and profitability trajectory of two distinct corporate engines.

ServiceNow, Inc. Analysis

ServiceNow’s revenue surged from 5.9B in 2021 to 13.3B in 2025, reflecting strong growth momentum. Gross margins remain robust at 77.5%, while net margins hold firm at 13.2%. In 2025, net income hit 1.75B, driven by efficient cost management and sustained R&D investment, underscoring healthy operating leverage.

Strategy Inc Analysis

Strategy Inc’s revenue declined slightly from 511M in 2021 to 463M in 2024, with gross margin steady at 72%. However, net income swung from a 535M loss in 2021 to a 1.17B loss in 2024, weighed down by high interest expenses and large operating losses. Margin compression and negative EBIT highlight operational challenges.

Growth and Profitability: Robust Expansion vs. Structural Decline

ServiceNow outperforms with consistent revenue and net income growth, favorable margins, and strong operating efficiency. Strategy Inc suffers from shrinking revenues and substantial net losses driven by high costs and interest burdens. For investors, ServiceNow’s profile offers a scalable, profitable growth story, while Strategy Inc’s deteriorating fundamentals warrant caution.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | ServiceNow, Inc. (NOW) | Strategy Inc (MSTR) |

|---|---|---|

| ROE | 13.5% | -6.4% |

| ROIC | 9.0% | -4.4% |

| P/E | 90.9 | -47.8 |

| P/B | 12.3 | 3.1 |

| Current Ratio | 0.95 | 0.71 |

| Quick Ratio | 0.95 | 0.71 |

| D/E (Debt-to-Equity) | 0.25 | 0.40 |

| Debt-to-Assets | 12.3% | 28.1% |

| Interest Coverage | 0 | -29.9 |

| Asset Turnover | 0.51 | 0.018 |

| Fixed Asset Turnover | 4.29 | 5.73 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Ratios serve as a company’s DNA, uncovering hidden risks and operational strengths essential for investment decisions.

ServiceNow, Inc.

ServiceNow shows solid profitability with a 13.48% ROE and a favorable 13.16% net margin. However, its valuation is stretched, with a high P/E of 90.88 and P/B of 12.25. The company retains earnings to fuel R&D, reflecting a growth-driven capital allocation strategy while offering no dividends.

Strategy Inc

Strategy Inc suffers from weak profitability, posting a negative 6.4% ROE and a deeply unfavorable net margin of -251.73%. Despite a low negative P/E signaling distress, its valuation appears less stretched. The firm’s low current and quick ratios indicate liquidity concerns, and it lacks dividend payouts, focusing on internal adjustments rather than shareholder returns.

Premium Valuation vs. Operational Safety

ServiceNow balances operational efficiency and growth despite an expensive valuation, while Strategy Inc struggles on all fronts with poor profitability and liquidity. Investors seeking stability face ServiceNow’s premium profile; those favoring turnaround risk might consider Strategy Inc’s distressed metrics.

Which one offers the Superior Shareholder Reward?

ServiceNow (NOW) and Strategy Inc (MSTR) both eschew dividends, focusing on growth reinvestment. NOW delivers a strong free cash flow of 4.4B with no dividend payout, supporting a disciplined buyback program. MSTR suffers negative free cash flow (-115B in 2024) and operating losses, limiting buybacks. NOW’s robust cash generation and moderate leverage underpin a sustainable distribution model. Conversely, MSTR’s cash-strapped position and negative margins raise red flags. I conclude ServiceNow offers the superior total return profile in 2026, balancing growth and capital return more prudently than Strategy Inc.

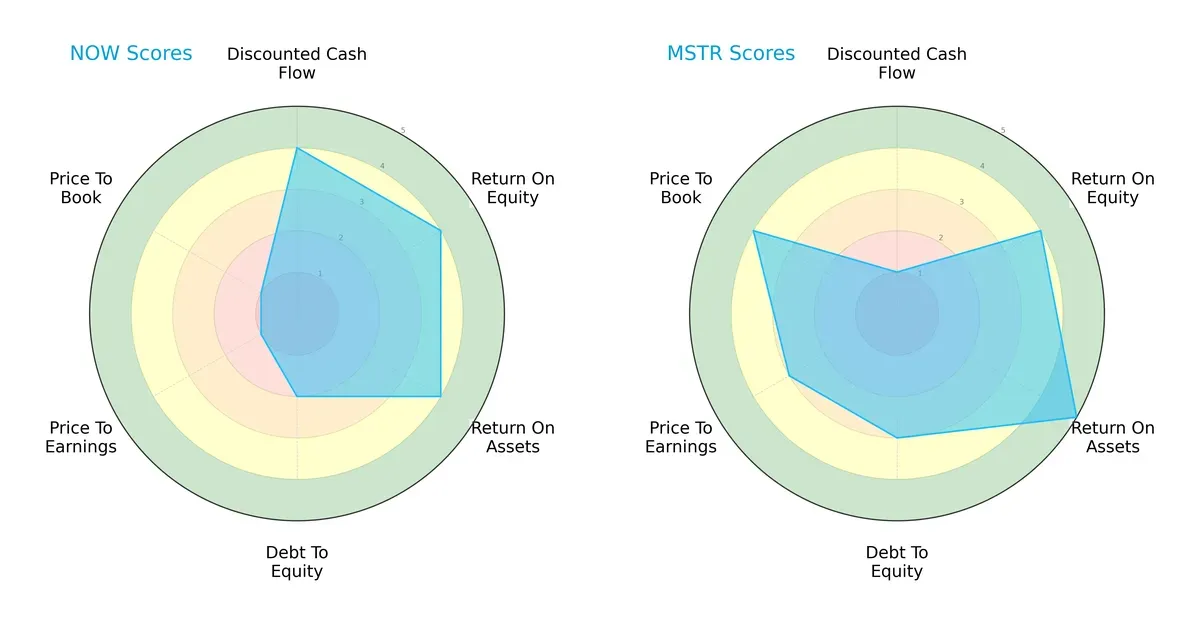

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of ServiceNow, Inc. and Strategy Inc, highlighting their financial strengths and valuation nuances:

ServiceNow exhibits a balanced profile with strong DCF, ROE, and ROA scores but struggles on valuation metrics (PE and PB). Strategy Inc leverages superior asset efficiency and valuation scores but shows a weak discounted cash flow score. ServiceNow’s low debt-to-equity score signals conservative leverage, whereas Strategy Inc assumes moderate debt risk for growth.

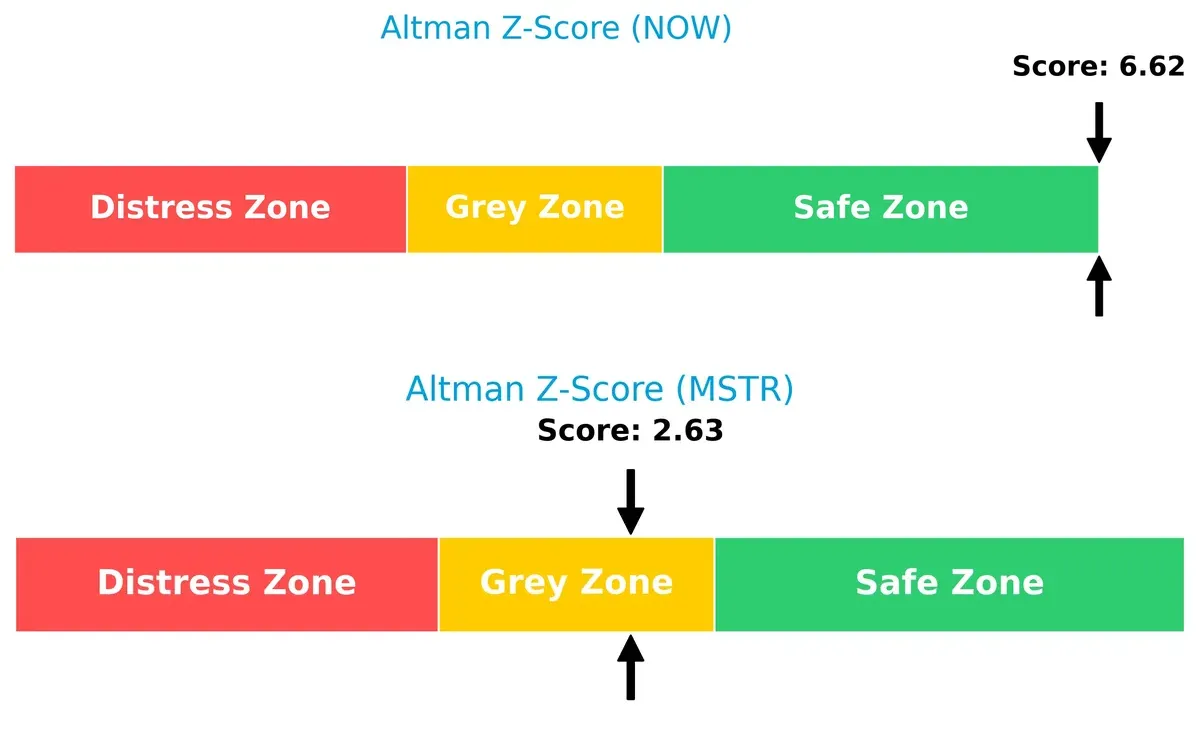

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score gap signals significantly different bankruptcy risks: ServiceNow resides safely above 6.6, while Strategy Inc lingers in the grey zone near 2.6, indicating caution:

Financial Health: Quality of Operations

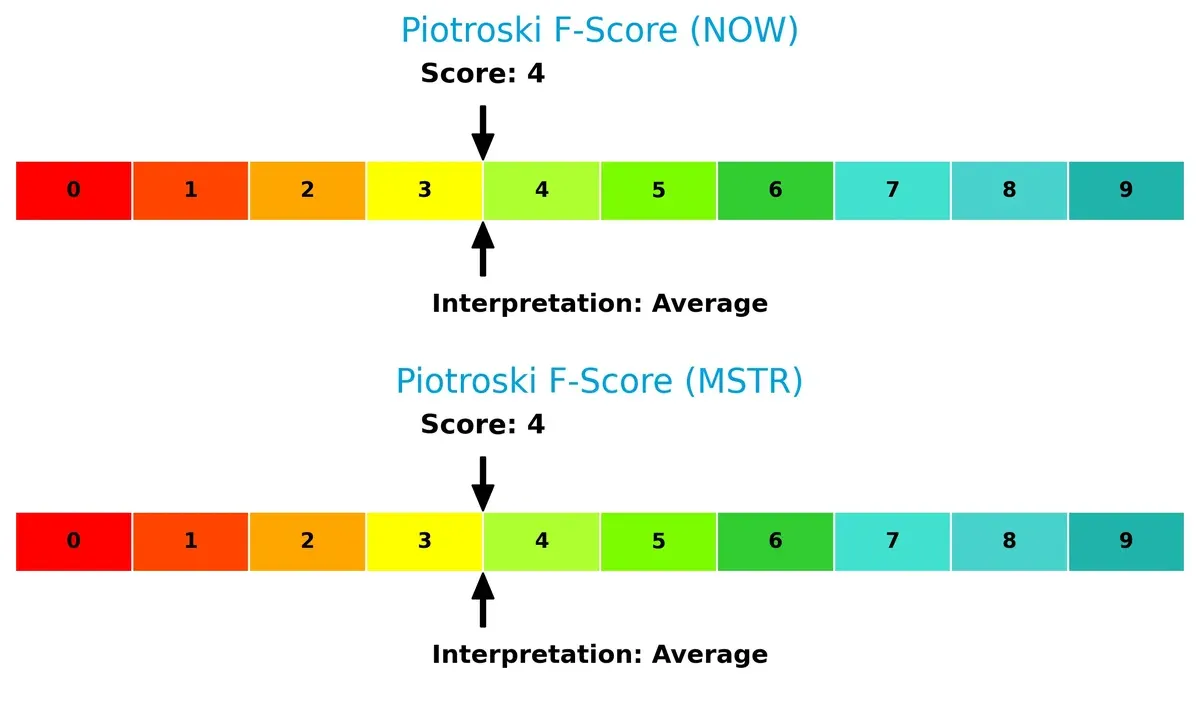

Both companies share an average Piotroski F-Score of 4, signaling moderate internal financial health without major red flags. Neither firm shows peak operational strength:

How are the two companies positioned?

This section dissects the operational DNA of ServiceNow and Strategy Inc by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats and identify which model offers the most resilient competitive advantage today.

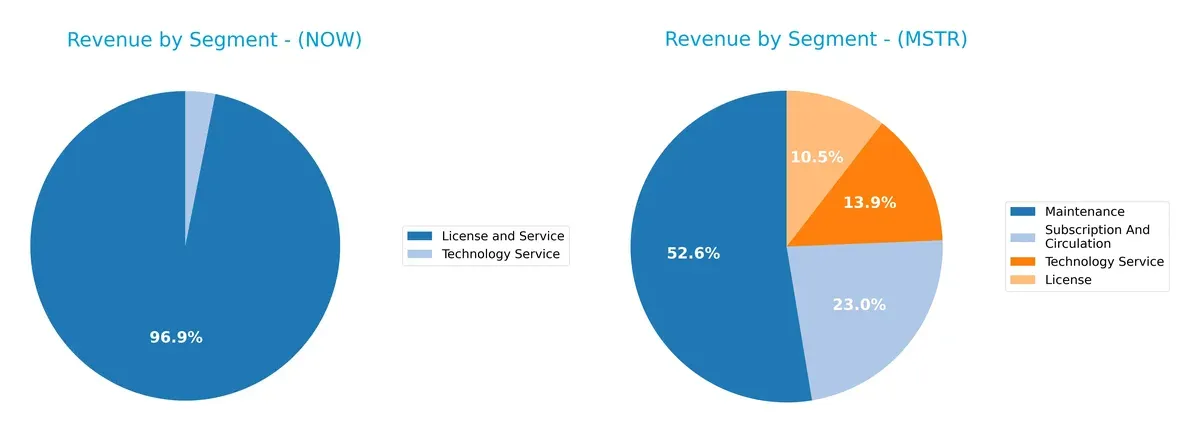

Revenue Segmentation: The Strategic Mix

This comparison dissects how ServiceNow and Strategy Inc diversify their income streams and where their primary sector bets lie:

ServiceNow anchors its revenue with a dominant $12.9B from License and Service, dwarfing its $414M Technology Service segment. Strategy Inc displays a more balanced mix, with $244M Maintenance leading but complemented by License ($49M), Subscription ($107M), and Technology Service ($64M). ServiceNow’s concentration signals reliance on ecosystem lock-in, while Strategy Inc’s spread mitigates concentration risk but may lack infrastructure dominance.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of ServiceNow, Inc. (NOW) and Strategy Inc (MSTR):

NOW Strengths

- Strong profitability with 13.16% net margin

- Favorable debt-to-equity at 0.25

- Global presence with $8.35B revenue in North America and $3.4B in EMEA

- Balanced product revenue exceeding $12.9B

- Favorable fixed asset turnover at 4.29

MSTR Strengths

- Favorable debt ratios with 0.4 debt-to-equity

- Positive fixed asset turnover at 5.73

- Diverse revenue streams including License, Maintenance, Subscription, and Technology Service

- Global revenue presence with $260M in North America and $156M in EMEA

NOW Weaknesses

- Unfavorable valuation multiples: PE 90.88, PB 12.25

- Low current ratio at 0.95 signals liquidity risk

- Zero dividend yield

- Neutral ROE and ROIC close to WACC limit

- Moderate asset turnover at 0.51

MSTR Weaknesses

- Negative profitability metrics: net margin -251.73%, ROE -6.4%, ROIC -4.38%

- High WACC at 16.58%

- Low liquidity ratios at 0.71 current and quick ratio

- Negative interest coverage (-30.23)

- Unfavorable asset turnover at 0.02

- Zero dividend yield

ServiceNow demonstrates robust profitability and global scale but faces valuation and liquidity concerns. Strategy Inc struggles with profitability and liquidity despite a diversified revenue base and favorable asset efficiency. Each company’s financial profile suggests distinct strategic priorities ahead.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat shields long-term profits from relentless competition’s erosion. Without it, sustainable growth is impossible. Let’s examine the moats of ServiceNow and Strategy Inc:

ServiceNow, Inc.: Workflow Automation with Expanding Switching Costs

ServiceNow leverages switching costs embedded in its enterprise cloud platform. Its high gross margin (77.5%) and EBIT margin (17%) reflect margin stability and operational efficiency. In 2026, expanding AI-driven automation deepens its moat by locking in customers and expanding cross-industry reach.

Strategy Inc: Bitcoin Treasury and AI Analytics, a Volatile Moat

Strategy Inc’s moat mixes intangible assets and niche positioning in bitcoin treasury and AI analytics. Unlike ServiceNow, it suffers from declining profitability and negative EBIT margins, signaling a fragile competitive edge. Future AI product launches offer growth but face disruption risks amid volatile crypto exposure.

Workflow Automation vs. Crypto Analytics: Stability Meets Volatility

ServiceNow’s moat is wider and more durable, supported by consistent ROIC growth and strong margins. Strategy Inc’s shrinking ROIC and negative margins expose it to value destruction. ServiceNow is better positioned to defend and expand market share in 2026.

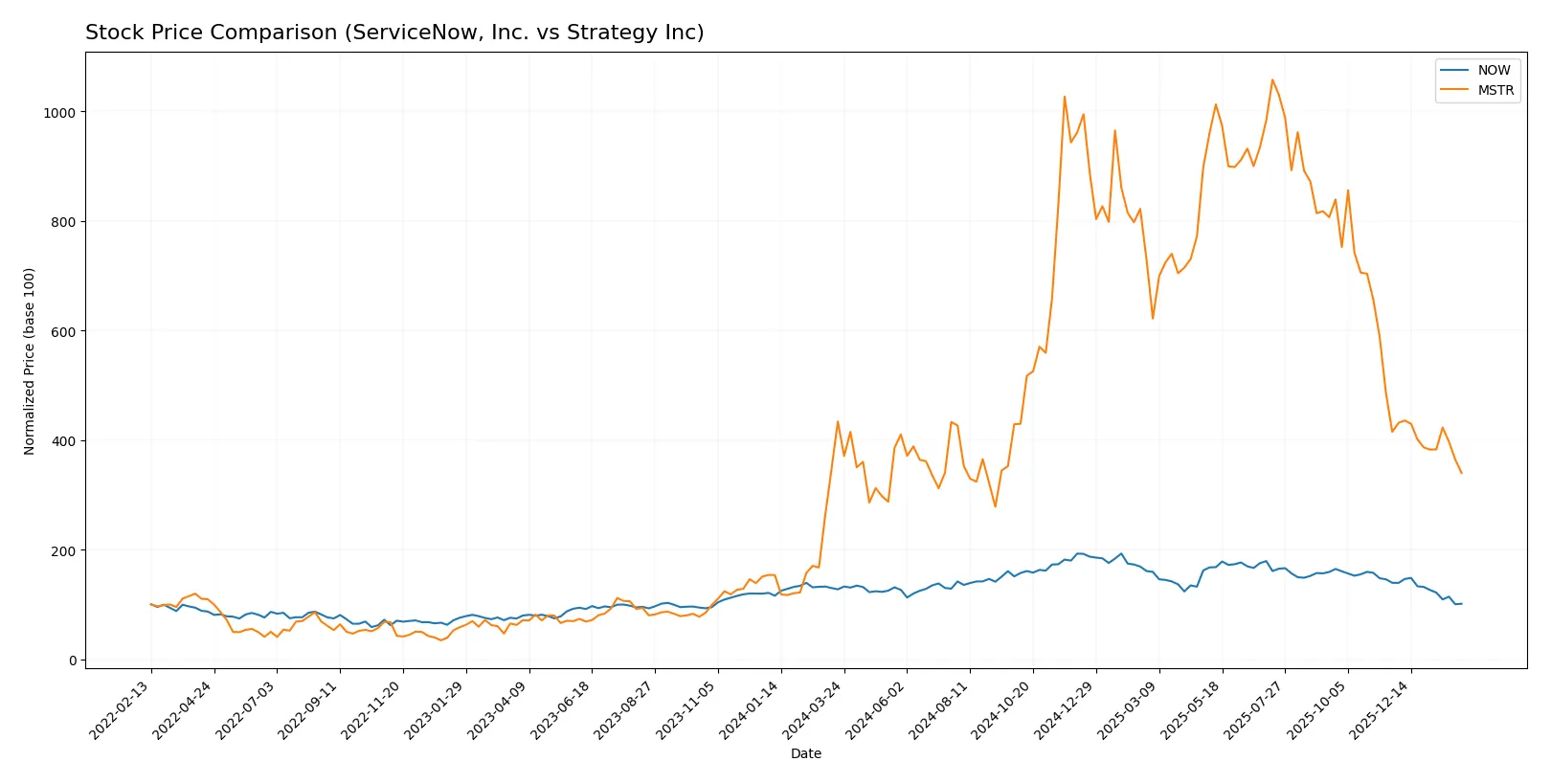

Which stock offers better returns?

Over the past year, both stocks declined significantly, with ServiceNow showing notable deceleration and Strategy Inc experiencing higher volatility but a similar downward trend.

Trend Comparison

ServiceNow, Inc. experienced a bearish trend with a -20.69% price change over 12 months, decelerating and fluctuating between $117.01 and $225.00.

Strategy Inc recorded a -21.66% price decline over the same period, also bearish and decelerating, with a wider price range from $114.30 to $434.58 and higher volatility.

Both stocks trended downward, but ServiceNow’s decline was marginally less severe, delivering slightly better market performance over the past year.

Target Prices

Analysts present a wide but informative range of target prices for ServiceNow, Inc. and Strategy Inc, reflecting divergent views on growth and risk.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| ServiceNow, Inc. | 115 | 1,315 | 440.64 |

| Strategy Inc | 175 | 705 | 433.57 |

The consensus targets for both stocks sit significantly above current prices, indicating strong analyst expectations for upside. ServiceNow’s broad price range signals uncertainty but potential for substantial growth. Strategy Inc shows similarly high targets, though volatility is a key risk factor.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

ServiceNow, Inc. Grades

The table below summarizes recent grades from leading financial institutions for ServiceNow, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-30 |

| Macquarie | Maintain | Neutral | 2026-01-29 |

| Evercore ISI Group | Maintain | Outperform | 2026-01-29 |

| RBC Capital | Maintain | Outperform | 2026-01-29 |

| Keybanc | Maintain | Underweight | 2026-01-29 |

| Needham | Maintain | Buy | 2026-01-29 |

| Stifel | Maintain | Buy | 2026-01-29 |

| BTIG | Maintain | Buy | 2026-01-29 |

| Cantor Fitzgerald | Maintain | Overweight | 2026-01-29 |

| DA Davidson | Maintain | Buy | 2026-01-29 |

Strategy Inc Grades

Below are the recent institutional grades for Strategy Inc:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Maintain | Outperform | 2026-01-16 |

| TD Cowen | Maintain | Buy | 2026-01-15 |

| Citigroup | Maintain | Buy | 2025-12-22 |

| Bernstein | Maintain | Outperform | 2025-12-08 |

| Monness, Crespi, Hardt | Upgrade | Neutral | 2025-11-10 |

| HC Wainwright & Co. | Maintain | Buy | 2025-11-03 |

| Canaccord Genuity | Maintain | Buy | 2025-11-03 |

| BTIG | Maintain | Buy | 2025-10-31 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-10-31 |

| TD Cowen | Maintain | Buy | 2025-10-31 |

Which company has the best grades?

ServiceNow, Inc. holds a broader mix of Buy and Outperform ratings but includes an Underweight grade. Strategy Inc consistently earns Buy and Outperform grades, with fewer negative assessments. Investors may interpret Strategy Inc’s grades as slightly more uniformly positive, potentially implying steadier institutional confidence.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

ServiceNow, Inc.

- Dominates enterprise cloud workflow automation but faces intense tech sector competition.

Strategy Inc

- Operates in volatile bitcoin treasury space and AI analytics, exposed to rapid tech and crypto shifts.

2. Capital Structure & Debt

ServiceNow, Inc.

- Low debt-to-assets at 12.3% signals conservative leverage and strong balance sheet.

Strategy Inc

- Higher leverage at 28.1% debt-to-assets raises financial risk amid negative interest coverage (-30.23).

3. Stock Volatility

ServiceNow, Inc.

- Beta near 1 (0.978) reflects market-level volatility, more stable stock behavior.

Strategy Inc

- Extremely high beta at 3.535 indicates significant stock price swings and higher investor risk.

4. Regulatory & Legal

ServiceNow, Inc.

- Faces standard tech and data privacy regulations across multiple industries globally.

Strategy Inc

- Crypto-related regulatory uncertainty poses systemic risks and compliance challenges worldwide.

5. Supply Chain & Operations

ServiceNow, Inc.

- Robust cloud infrastructure supports operational resilience and scalability.

Strategy Inc

- Operations dependent on cryptocurrency markets and enterprise AI adoption cycles.

6. ESG & Climate Transition

ServiceNow, Inc.

- Increasing focus on governance and sustainable IT solutions aligns with ESG trends.

Strategy Inc

- ESG exposure less clear; crypto involvement may attract scrutiny over energy consumption.

7. Geopolitical Exposure

ServiceNow, Inc.

- Broad global presence but diversified across stable markets reduces geopolitical risk.

Strategy Inc

- Crypto assets and international operations heighten sensitivity to geopolitical tensions.

Which company shows a better risk-adjusted profile?

ServiceNow’s most impactful risk is its stretched valuation with high P/E (90.88) and low liquidity ratios. Strategy Inc confronts severe profitability and liquidity distress, amplified by extreme stock volatility and crypto market dependency. ServiceNow’s conservative leverage and stable Altman Z-score (6.6, safe zone) underpin a stronger risk-adjusted profile. Strategy’s Z-score (2.63, grey zone) and negative margins highlight significant financial fragility. The stark contrast in beta and debt servicing capability justifies greater caution on Strategy Inc.

Final Verdict: Which stock to choose?

ServiceNow’s superpower lies in its steadily improving profitability and robust revenue growth, signaling a maturing but still dynamic platform business. Its main point of vigilance is the stretched valuation multiples, which might pressure returns if growth slows. This stock fits well in an aggressive growth portfolio seeking exposure to cloud workflow innovation.

Strategy Inc’s strategic moat appears rooted in niche market positioning and intellectual property, but financials reveal a troubling value destruction trend and volatile cash flows. Relative to ServiceNow, it offers a riskier profile with less predictable earnings. It could appeal to speculative investors with high risk tolerance seeking turnaround opportunities.

If you prioritize consistent earnings growth and expanding economic value, ServiceNow outshines due to its improving ROIC and solid cash generation. However, if you seek high-risk, high-reward scenarios with potential undervaluation, Strategy Inc offers a speculative play despite deteriorating fundamentals. Both scenarios demand careful risk management given their bearish recent price trends.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of ServiceNow, Inc. and Strategy Inc to enhance your investment decisions: