Home > Comparison > Technology > NOW vs SOUN

The strategic rivalry between ServiceNow, Inc. and SoundHound AI, Inc. shapes the evolving landscape of enterprise software applications. ServiceNow operates as a capital-intensive cloud platform leader specializing in workflow automation across multiple industries. In contrast, SoundHound AI focuses on high-growth conversational AI solutions with a nimble operational footprint. This analysis seeks to determine which company’s trajectory offers superior risk-adjusted returns for a diversified portfolio navigating the technology sector’s dynamic environment.

Table of contents

Companies Overview

ServiceNow and SoundHound AI both drive innovation in enterprise software with distinct approaches to automation and AI.

ServiceNow, Inc.: Enterprise Workflow Automation Leader

ServiceNow dominates the enterprise cloud computing market with its Now platform, which delivers workflow automation, AI, machine learning, and IT service management. Its core revenue comes from extensive enterprise subscriptions across industries like healthcare and finance. In 2026, ServiceNow focused on expanding automation through strategic partnerships and enhancing its AI-driven service delivery.

SoundHound AI, Inc.: Conversational AI Innovator

SoundHound AI specializes in developing voice AI platforms that enable businesses to build conversational assistants. Its Houndify platform generates revenue by licensing speech recognition and natural language tools to various industries. The company’s 2026 strategy emphasized refining voice AI capabilities to enhance customer engagement and integration flexibility.

Strategic Collision: Similarities & Divergences

Both firms operate in the software application space but pursue contrasting philosophies. ServiceNow builds a closed ecosystem centered on workflow automation and enterprise IT management. SoundHound AI offers an open platform focused on voice AI integration. Their primary battleground is automation—ServiceNow in enterprise workflows, SoundHound in conversational interfaces. Investors face divergent profiles: ServiceNow’s scale and stability versus SoundHound’s high beta and growth potential.

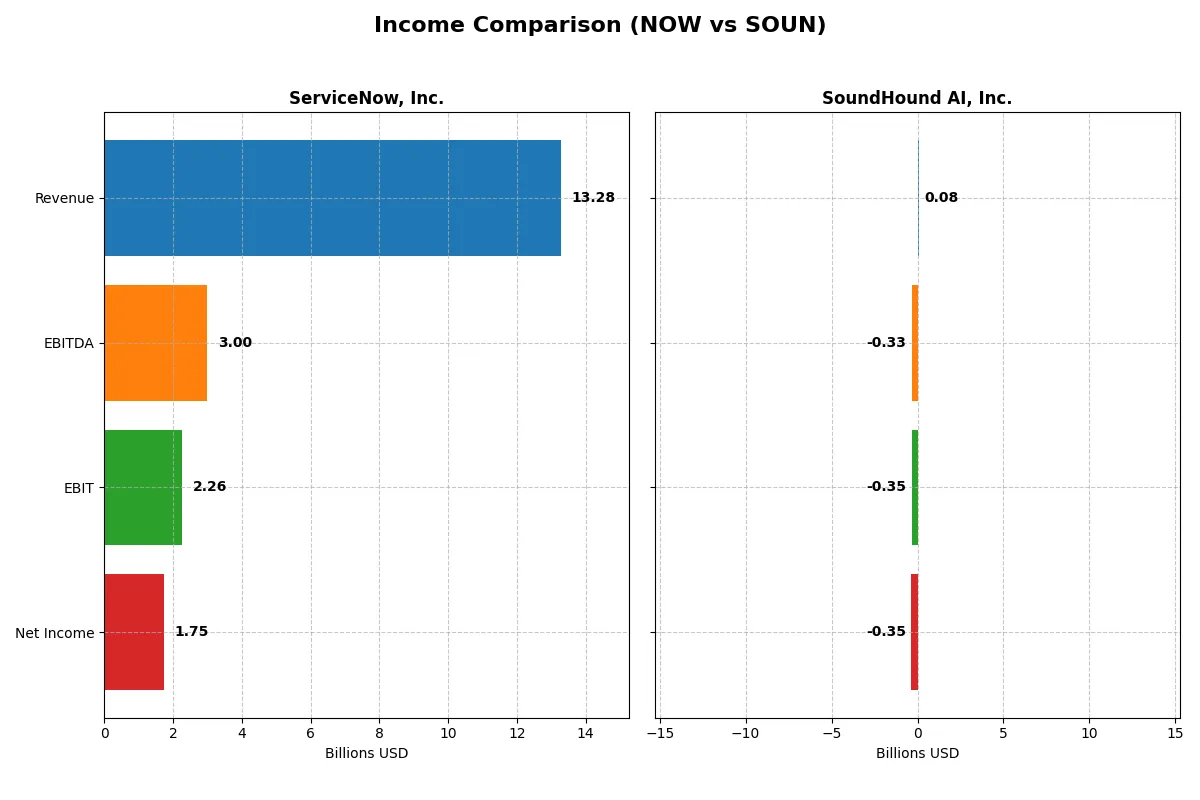

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | ServiceNow, Inc. (NOW) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| Revenue | 13.3B | 85M |

| Cost of Revenue | 3B | 43M |

| Operating Expenses | 8.5B | 383M |

| Gross Profit | 10.3B | 41M |

| EBITDA | 3B | -329M |

| EBIT | 2.3B | -348M |

| Interest Expense | 0 | 12M |

| Net Income | 1.75B | -351M |

| EPS | 1.69 | -1.04 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals the true efficiency and profitability of two distinct corporate engines in the evolving tech landscape.

ServiceNow, Inc. Analysis

ServiceNow’s revenue surged from 5.9B in 2021 to 13.3B in 2025, with net income rising from 230M to 1.75B. Gross margin remains robust at 77.5%, and net margin steadily improved to 13.2%. The 2025 figures highlight strong operational leverage and healthy margin expansion, underpinned by disciplined expense control and growing earnings per share.

SoundHound AI, Inc. Analysis

SoundHound AI’s revenue climbed from 13M in 2020 to 85M in 2024, yet it remains unprofitable with a net loss of 351M in 2024. Gross margin improved to 48.9%, but EBIT and net margins are deeply negative at -410% and -414%, reflecting high operating expenses and interest costs. Despite strong revenue growth, losses widened, signaling ongoing challenges in scaling efficiently.

Verdict: Profitability Excellence vs. Growth at a Cost

ServiceNow clearly outperforms with high and expanding margins alongside substantial profit growth, demonstrating operational efficiency and capital discipline. SoundHound AI exhibits impressive top-line momentum but suffers from persistent losses and poor cost management. Investors seeking sustainable profitability will find ServiceNow’s profile more attractive.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | ServiceNow, Inc. (NOW) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| ROE | 13.48% | -191.99% |

| ROIC | 8.98% | -68.13% |

| P/E | 90.9 | -19.1 |

| P/B | 12.25 | 36.76 |

| Current Ratio | 0.95 | 3.77 |

| Quick Ratio | 0.95 | 3.77 |

| D/E | 0.25 | 0.02 |

| Debt-to-Assets | 12.3% | 0.8% |

| Interest Coverage | 0 | -28.1 |

| Asset Turnover | 0.51 | 0.15 |

| Fixed Asset Turnover | 4.29 | 14.28 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Ratios act as a company’s DNA, revealing hidden operational strengths and risks essential for assessing investment quality.

ServiceNow, Inc.

ServiceNow delivers solid profitability with a 13.48% ROE and a favorable 13.16% net margin. However, its valuation is stretched, with a high P/E of 90.88 and a P/B of 12.25. The company reinvests heavily in R&D, foregoing dividends to fuel growth, while maintaining a conservative debt profile and strong interest coverage.

SoundHound AI, Inc.

SoundHound suffers from severe profitability issues, posting a negative ROE of -191.99% and a net margin below zero. Its valuation appears distorted with a negative P/E but a steep P/B of 36.76, signaling market skepticism. Despite a robust current ratio, the company’s weak asset turnover and negative cash flow highlight significant operational challenges, with no dividend payout.

Premium Valuation vs. Operational Safety

ServiceNow balances operational efficiency and growth investment despite a premium valuation. In contrast, SoundHound’s unfavorable profitability and cash flow metrics expose high risk. The former suits investors prioritizing steady growth, while the latter fits those willing to tolerate volatility for speculative upside.

Which one offers the Superior Shareholder Reward?

ServiceNow (NOW) delivers superior shareholder rewards compared to SoundHound AI (SOUN). NOW pays no dividends but boasts strong free cash flow (4.4B) and sustains significant buybacks, supporting long-term value. SOUN, meanwhile, pays no dividends, generates negative cash flow, and carries high leverage, undermining distribution sustainability. I favor NOW’s disciplined capital allocation and robust cash generation for total return in 2026.

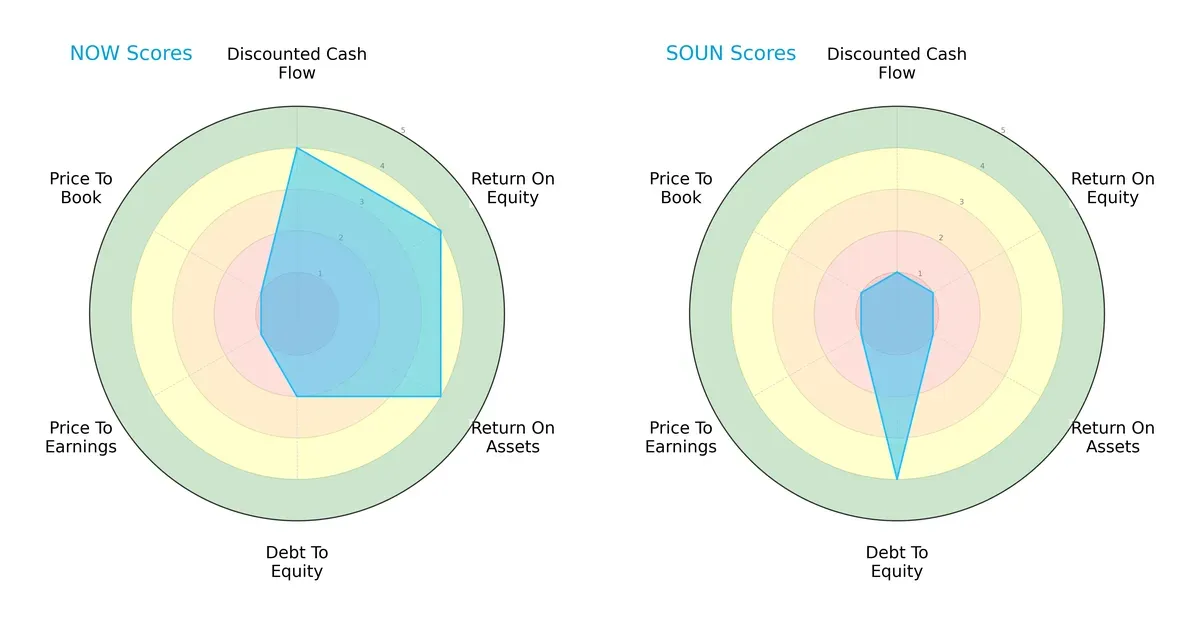

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of ServiceNow, Inc. and SoundHound AI, Inc., highlighting their core financial strengths and vulnerabilities:

ServiceNow exhibits a balanced profile with strong DCF, ROE, and ROA scores, reflecting efficient capital use and profitability. However, its moderate debt-to-equity score signals some leverage risk. SoundHound AI leans heavily on a low debt-to-equity score, indicating financial conservatism, but suffers from weak profitability and valuation metrics. ServiceNow’s diversified strengths contrast with SoundHound’s reliance on low leverage.

—

Bankruptcy Risk: Solvency Showdown

ServiceNow’s Altman Z-Score of 6.62 surpasses SoundHound AI’s 4.79, both safely above distress thresholds, but ServiceNow’s higher score signals superior long-term survival prospects in this cycle:

—

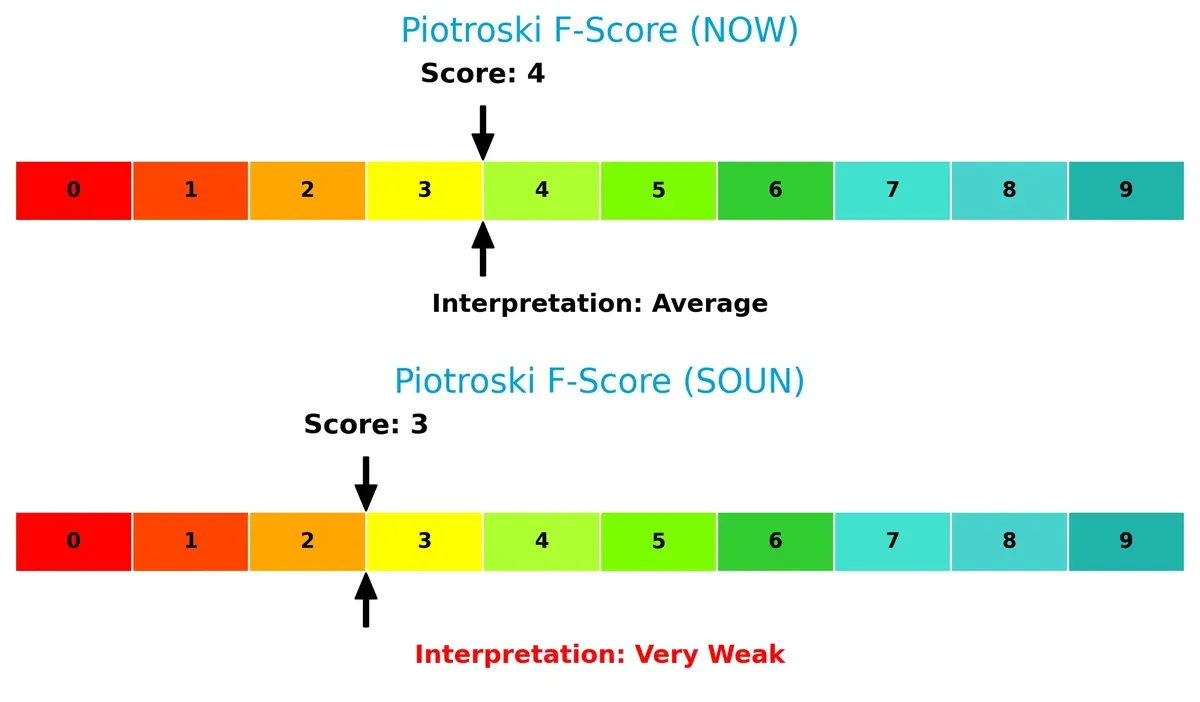

Financial Health: Quality of Operations

ServiceNow’s Piotroski F-Score of 4 reflects moderate financial health, outperforming SoundHound AI’s weaker score of 3, which raises red flags about internal operational metrics and potential value risks:

How are the two companies positioned?

This section dissects the operational DNA of ServiceNow and SoundHound by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats and identify which offers the most resilient, sustainable competitive advantage today.

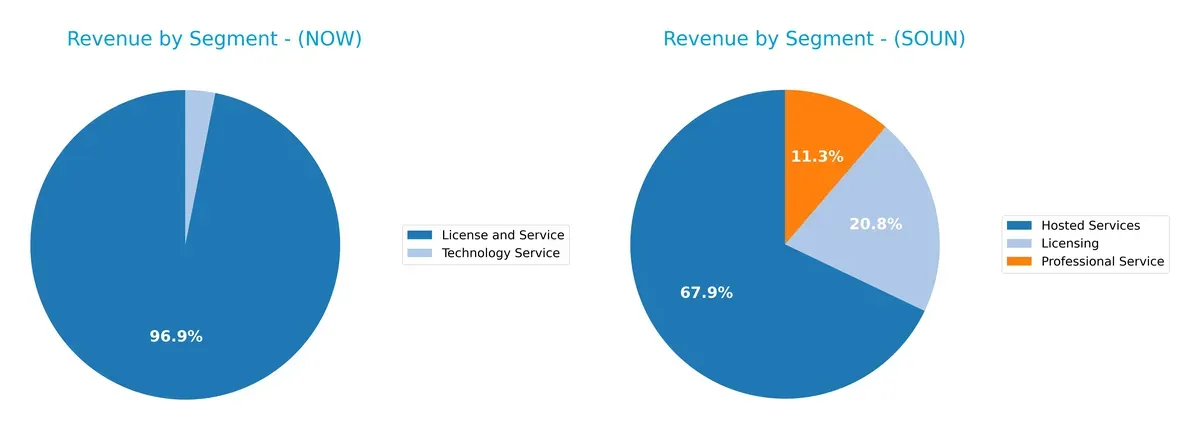

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how ServiceNow, Inc. and SoundHound AI, Inc. diversify their income streams and where their primary sector bets lie:

ServiceNow dwarfs SoundHound with $12.9B in License and Service revenue, anchoring its growth on digital workflow products. SoundHound’s $57M Hosted Services lead its modest mix. ServiceNow’s focus signals infrastructure dominance and ecosystem lock-in, while SoundHound’s diversified but small segments imply early-stage growth with concentration risk. The contrast highlights ServiceNow’s scale advantage against SoundHound’s nascent revenue base.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of ServiceNow and SoundHound AI based on diversification, profitability, financial metrics, innovation, global presence, and market share:

ServiceNow Strengths

- Strong and growing revenues in License and Service segments

- Favorable net margin at 13.16%

- Low debt-to-assets at 12.3% indicating prudent leverage

- High fixed asset turnover at 4.29

- Global presence with significant sales in North America, EMEA, and Asia Pacific

- Consistent profitability metrics

SoundHound AI Strengths

- Favorable quick ratio at 3.77 reflecting solid liquidity

- Very low debt levels with debt-to-assets at 0.79%

- High fixed asset turnover at 14.28 indicating efficient asset use

- Presence in diverse international markets including US, Korea, France, Japan

- Favorable PE ratio despite negative earnings reflecting growth expectations

ServiceNow Weaknesses

- Unfavorable valuation multiples with PE at 90.88 and PB at 12.25

- Current ratio below 1 at 0.95 signaling liquidity risk

- No dividend yield

- Neutral ROE and ROIC only slightly above WACC indicating limited economic profit

- Moderate asset turnover at 0.51

SoundHound AI Weaknesses

- Large negative profitability with net margin at -414% and ROE at -192%

- Very high WACC at 17.81% increasing capital costs

- Negative interest coverage

- Unfavorable asset turnover at 0.15

- Unfavorable PB at 36.76

- No dividend yield

ServiceNow enjoys steady profitability, global diversification, and solid financial health but faces valuation and liquidity concerns. SoundHound AI shows liquidity strength and efficient asset use but struggles with severe profitability and high capital costs, impacting its economic viability. These factors shape each company’s strategic priorities going forward.

The Moat Duel: Analyzing Competitive Defensibility

Structural moats protect long-term profits from relentless competition erosion. Only a durable competitive advantage ensures sustained value creation:

ServiceNow, Inc.: Workflow Automation Switching Costs

I see ServiceNow’s moat rooted in high switching costs. Its strong gross margin (77.5%) and steady EBIT margin (17%) reflect pricing power and margin stability. Expanding into AI and new verticals in 2026 should deepen this moat.

SoundHound AI, Inc.: Emerging Voice AI Innovation

SoundHound’s moat arises from proprietary voice AI technology, contrasting ServiceNow’s entrenched platform. Despite sizable revenue growth (85% last year), it suffers negative margins and value destruction. Scaling product adoption and market reach in 2026 remains critical.

Enterprise Workflow Lock-In vs. AI Innovation Potential

ServiceNow holds the wider moat with proven margin strength and rising ROIC, signaling effective capital use. SoundHound shows growth but still destroys value, making ServiceNow better equipped to defend market share.

Which stock offers better returns?

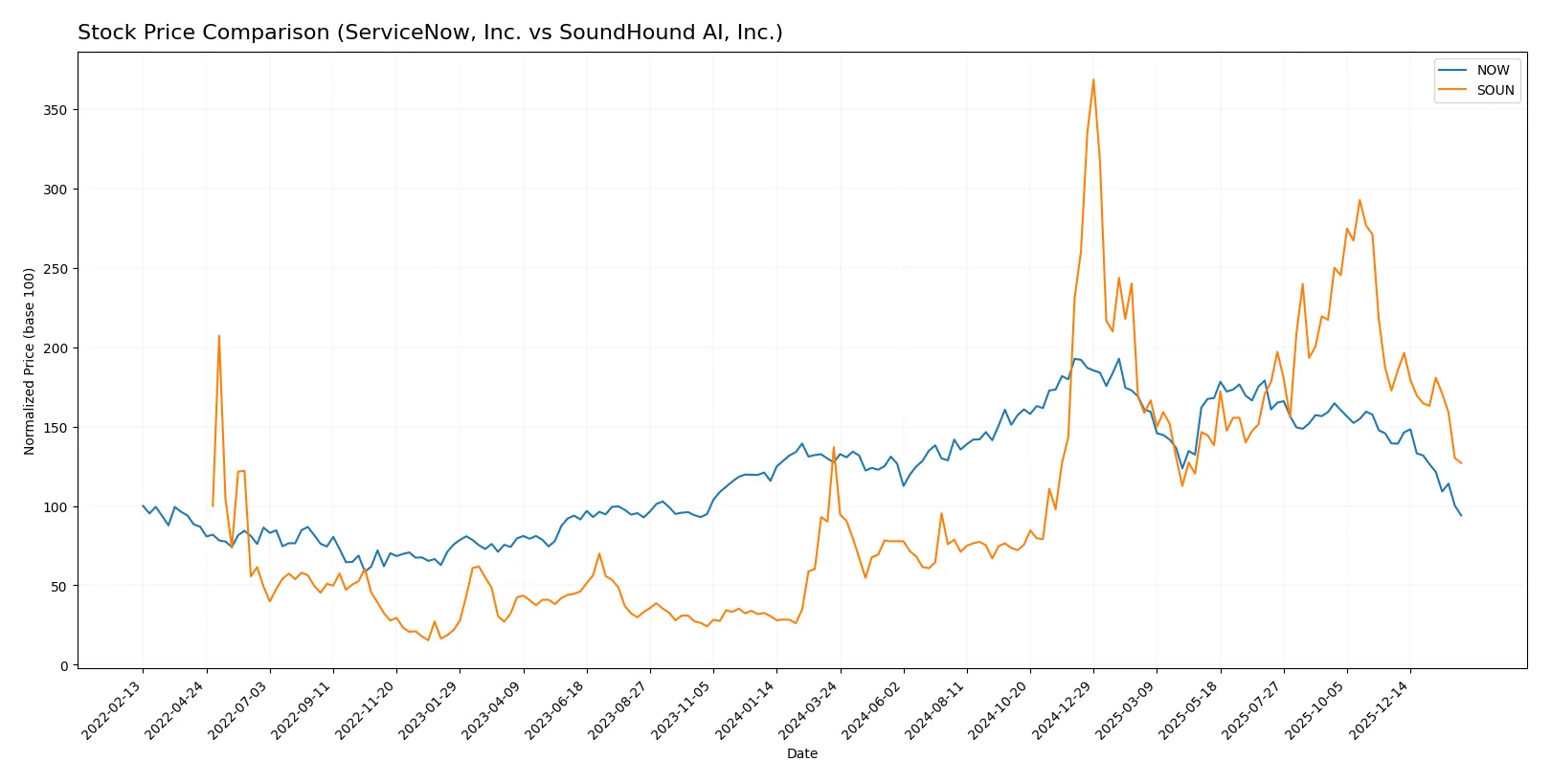

The past year saw both ServiceNow, Inc. and SoundHound AI, Inc. experience declining stock prices, with notable volatility and seller dominance in recent trading sessions.

Trend Comparison

ServiceNow, Inc. shows a bearish trend with a -26.22% price decline over the past 12 months. The trend decelerates, with high volatility (std dev 25.07) and a recent sharper drop of -32.53%.

SoundHound AI, Inc. also follows a bearish trend, falling -7.3% over 12 months, with deceleration and lower volatility (std dev 4.59). The recent period shows a -26.38% decline, indicating accelerated weakness.

ServiceNow’s larger price drop contrasts with SoundHound’s milder annual loss, but recent sharp declines narrow this gap. ServiceNow’s performance is weaker overall.

Target Prices

Analysts present a wide range of target prices, reflecting differing views on growth and valuation.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| ServiceNow, Inc. | 115 | 1315 | 440.64 |

| SoundHound AI, Inc. | 11 | 15 | 13.33 |

ServiceNow’s consensus target at 440.64 greatly exceeds its current 109.77 price, indicating bullish expectations despite recent weakness. SoundHound’s target consensus at 13.33 also sits above its 8.26 price, suggesting upside potential amid volatility.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following tables summarize recent grades from reputable institutions for both companies:

ServiceNow, Inc. Grades

This table displays the latest grades and actions from well-known grading firms for ServiceNow, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-30 |

| Evercore ISI Group | Maintain | Outperform | 2026-01-29 |

| Macquarie | Maintain | Neutral | 2026-01-29 |

| BTIG | Maintain | Buy | 2026-01-29 |

| RBC Capital | Maintain | Outperform | 2026-01-29 |

| Keybanc | Maintain | Underweight | 2026-01-29 |

| Stifel | Maintain | Buy | 2026-01-29 |

| DA Davidson | Maintain | Buy | 2026-01-29 |

| Cantor Fitzgerald | Maintain | Overweight | 2026-01-29 |

| Needham | Maintain | Buy | 2026-01-29 |

SoundHound AI, Inc. Grades

This table shows recent grades and rating changes from recognized grading companies for SoundHound AI, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Cantor Fitzgerald | Upgrade | Overweight | 2025-12-12 |

| DA Davidson | Maintain | Buy | 2025-11-18 |

| Piper Sandler | Maintain | Neutral | 2025-11-07 |

| HC Wainwright & Co. | Maintain | Buy | 2025-10-16 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-17 |

| Wedbush | Maintain | Outperform | 2025-09-11 |

| DA Davidson | Maintain | Buy | 2025-09-10 |

| Ladenburg Thalmann | Upgrade | Buy | 2025-08-11 |

| Wedbush | Maintain | Outperform | 2025-08-08 |

Which company has the best grades?

ServiceNow, Inc. holds a broader consensus of Buy and Outperform ratings from major firms, despite one Underweight. SoundHound AI, Inc. shows a mix of Buy and Outperform grades but includes Neutral ratings. Investors may perceive ServiceNow as having stronger institutional support, potentially reflecting greater confidence in its outlook.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

ServiceNow, Inc.

- Established leader in enterprise cloud software with strong customer base and diverse product suite.

SoundHound AI, Inc.

- Emerging player focused on voice AI; faces intense competition from tech giants and niche startups.

2. Capital Structure & Debt

ServiceNow, Inc.

- Conservative leverage with D/E ratio of 0.25; manageable debt and strong interest coverage.

SoundHound AI, Inc.

- Minimal debt load (D/E 0.02) but negative interest coverage signals operational cash flow challenges.

3. Stock Volatility

ServiceNow, Inc.

- Beta near 1 (0.978) indicating market-level volatility and relative stability.

SoundHound AI, Inc.

- High beta (2.876) reveals significant stock price swings and higher investor risk.

4. Regulatory & Legal

ServiceNow, Inc.

- Operates globally with compliance frameworks; risks include data privacy and antitrust scrutiny.

SoundHound AI, Inc.

- Faces evolving AI regulations; regulatory uncertainties may impact product deployment and market access.

5. Supply Chain & Operations

ServiceNow, Inc.

- Robust cloud infrastructure and diversified service delivery mitigate operational disruptions.

SoundHound AI, Inc.

- Smaller scale and reliance on third-party cloud providers may expose it to operational bottlenecks.

6. ESG & Climate Transition

ServiceNow, Inc.

- Increasing ESG initiatives with focus on sustainability and governance; well-positioned for climate risks.

SoundHound AI, Inc.

- Early-stage ESG policies; less mature climate risk management could affect stakeholder trust.

7. Geopolitical Exposure

ServiceNow, Inc.

- Global footprint exposes it to geopolitical tensions but diversified markets reduce single-country risk.

SoundHound AI, Inc.

- Concentrated US market exposure limits geopolitical risk but reduces international growth opportunities.

Which company shows a better risk-adjusted profile?

ServiceNow’s established market position, prudent capital structure, and balanced risk profile offer superior risk-adjusted stability. SoundHound struggles with extreme stock volatility, weak profitability, and operational risks. ServiceNow’s Altman Z-score of 6.6 confirms solid financial health versus SoundHound’s lower 4.8. SoundHound’s negative net margin and high beta heighten my concern over its resilience amid market volatility.

Final Verdict: Which stock to choose?

ServiceNow, Inc. (NOW) excels as a cash-generating powerhouse with steadily improving profitability and a growing return on invested capital. Its main point of vigilance remains a tight liquidity position, reflected in a current ratio below 1. NOW suits investors targeting aggressive growth with a tolerance for valuation premium.

SoundHound AI, Inc. (SOUN) offers promise through its strategic moat in voice AI technology and a strong liquidity buffer. However, it currently struggles with value destruction and weak profitability metrics. SOUN fits investors who pursue high-risk, innovative plays with a focus on long-term growth potential and capital preservation.

If you prioritize stable cash flow and proven profitability, ServiceNow outshines as the compelling choice due to its operational efficiency and value creation momentum. However, if you seek speculative growth with a technology edge and can accept heightened financial risk, SoundHound could offer superior upside despite its current challenges.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of ServiceNow, Inc. and SoundHound AI, Inc. to enhance your investment decisions: