Investors seeking opportunities in the medical diagnostics sector often weigh companies with strong innovation and market presence. Waters Corporation (WAT) and RadNet, Inc. (RDNT) both operate within Medical – Diagnostics & Research, yet focus on distinct niches: analytical instruments versus outpatient imaging services. Their strategies in technology and service expansion make this comparison insightful. In this article, I will help you determine which company offers the more compelling investment potential.

Table of contents

Companies Overview

I will begin the comparison between Waters Corporation and RadNet, Inc. by providing an overview of these two companies and their main differences.

Waters Corporation Overview

Waters Corporation is a specialty measurement company focused on providing analytical workflow solutions across Asia, the Americas, and Europe. It operates two segments, Waters and TA, designing and servicing high and ultra-performance liquid chromatography and mass spectrometry systems. Its products support drug discovery, clinical trial testing, nutritional safety, and environmental analysis, serving pharmaceutical, life science, and industrial customers globally.

RadNet, Inc. Overview

RadNet, Inc. delivers outpatient diagnostic imaging services in the United States through a network of 347 centers. Its offerings include MRI, CT, PET, mammography, ultrasound, and radiology services, alongside developing computerized systems and AI suites to improve diagnostic imaging interpretation. The company primarily serves healthcare providers with advanced imaging and technology solutions, headquartered in Los Angeles, California.

Key similarities and differences

Both companies operate in the medical diagnostics and research sector, catering to healthcare-related fields with technological solutions. Waters focuses on analytical instrumentation and software for laboratory research and industrial applications worldwide, while RadNet emphasizes outpatient imaging services and AI-enhanced diagnostics in the U.S. market. Their business models differ in that Waters manufactures and sells scientific instruments, whereas RadNet provides clinical services and imaging technology systems.

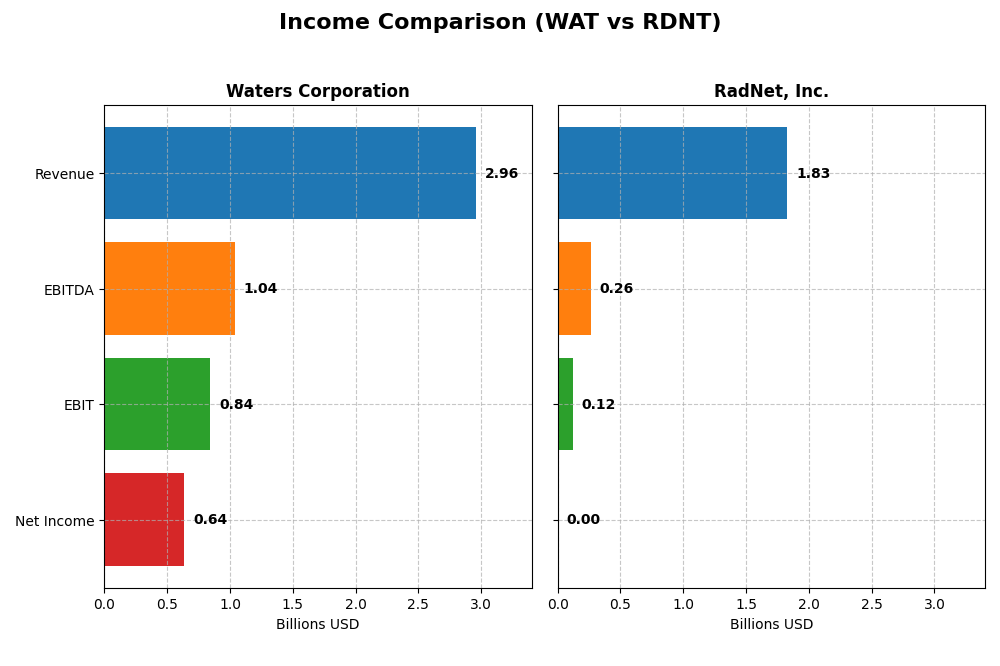

Income Statement Comparison

Below is a side-by-side comparison of the latest full-year income statement metrics for Waters Corporation and RadNet, Inc., providing a clear view of their financial performance in 2024.

| Metric | Waters Corporation (WAT) | RadNet, Inc. (RDNT) |

|---|---|---|

| Market Cap | 23.6B | 6.0B |

| Revenue | 2.96B | 1.83B |

| EBITDA | 1.04B | 263M |

| EBIT | 845M | 125M |

| Net Income | 638M | 2.79M |

| EPS | 10.75 | 0.038 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Waters Corporation

Waters Corporation’s revenue grew modestly by 0.07% in 2024, reaching $2.96B, with net income slightly declining to $638M. Gross and net margins remain strong but showed slight deterioration, with a net margin of 21.56%. Despite slower growth, operating efficiency improved, reflected in favorable expense control and stable EBIT margin near 28.55%.

RadNet, Inc.

RadNet’s revenue increased significantly by 13.18% in 2024 to $1.83B, while net income fell sharply to $2.8M from $3M. Margins remain thin, with a gross margin of 13.62% and net margin close to zero, indicating tight profitability. The year saw strong revenue and EBIT growth but compressed net margin and EPS, signaling margin pressure despite top-line gains.

Which one has the stronger fundamentals?

Waters Corporation exhibits stronger fundamentals with consistently high margins and stable profitability, though growth slowed in the latest year. RadNet shows impressive revenue and net income growth over five years but struggles with low margins and recent net income decline. Waters’s solid margin profile contrasts with RadNet’s margin challenges, defining their fundamental differences.

Financial Ratios Comparison

The table below presents the most recent key financial ratios for Waters Corporation and RadNet, Inc., facilitating a straightforward comparison of their financial health and market valuation.

| Ratios | Waters Corporation (WAT) | RadNet, Inc. (RDNT) |

|---|---|---|

| ROE | 34.9% | 0.31% |

| ROIC | 18.4% | 3.1% |

| P/E | 34.5 | 1826.3 |

| P/B | 12.0 | 5.7 |

| Current Ratio | 2.11 | 2.12 |

| Quick Ratio | 1.51 | 2.12 |

| D/E | 0.93 | 1.92 |

| Debt-to-Assets | 37.4% | 52.6% |

| Interest Coverage | 9.21 | 1.31 |

| Asset Turnover | 0.65 | 0.56 |

| Fixed Asset Turnover | 4.08 | 1.37 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Waters Corporation

Waters Corporation displays strong profitability ratios with a net margin of 21.56% and a return on equity of 34.88%, signaling efficient management and good earnings generation. Liquidity ratios are favorable, supporting short-term financial stability, though valuation ratios like P/E (34.51) and P/B (12.04) are less attractive. The company does not pay dividends, likely prioritizing reinvestment and growth, as indicated by zero dividend yield and last dividend.

RadNet, Inc.

RadNet shows weak profitability metrics, with a net margin of 0.15% and return on equity near zero at 0.31%, suggesting limited profit generation. Liquidity ratios are favorable, but high debt ratios and low interest coverage raise financial risk concerns. RadNet also does not pay dividends, reflecting either reinvestment needs or a possible turnaround phase amid ongoing financial challenges.

Which one has the best ratios?

Comparing both, Waters Corporation has a more favorable ratio profile, with stronger profitability and liquidity indicators despite some valuation concerns. RadNet’s ratios reflect financial stress and weaker returns, with a higher proportion of unfavorable ratios. Therefore, Waters exhibits a stronger financial stance based on the provided quantitative metrics.

Strategic Positioning

This section compares the strategic positioning of Waters Corporation and RadNet, Inc., focusing on market position, key segments, and exposure to technological disruption:

Waters Corporation

- Leading specialty measurement company with moderate competition in diagnostics and research.

- Diverse segments: chromatography instruments, consumables, thermal analysis, and software.

- Exposure through advanced analytical instruments and software supporting drug discovery and environmental testing.

RadNet, Inc.

- Outpatient diagnostic imaging provider with intense competition and regional presence.

- Concentrated in diagnostic imaging services and AI-enhanced radiology software.

- Exposure via AI suites for cancer detection and computerized imaging systems.

Waters Corporation vs RadNet, Inc. Positioning

Waters Corporation adopts a diversified approach across multiple analytical and diagnostic technologies, providing broad exposure to various scientific sectors. RadNet, Inc. focuses on concentrated outpatient imaging and AI software development, leveraging technology to enhance diagnostic accuracy but with narrower segment diversity.

Which has the best competitive advantage?

Waters Corporation demonstrates a slightly favorable moat with value creation despite declining profitability, indicating a moderate competitive advantage. RadNet, Inc. shows a slightly unfavorable moat, shedding value but improving profitability, reflecting weaker competitive positioning.

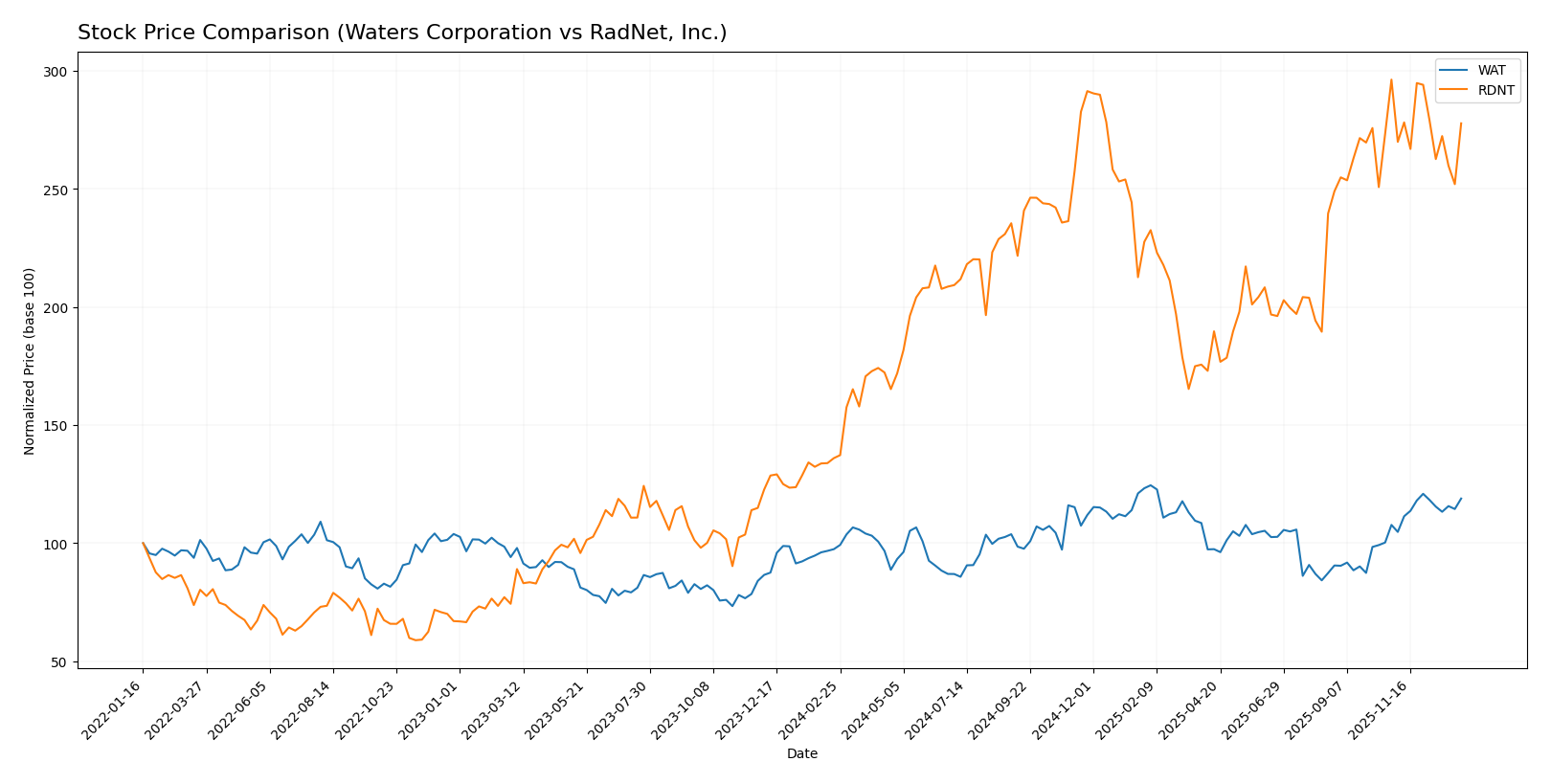

Stock Comparison

The stock price chart over the past 12 months highlights significant upward momentum for both Waters Corporation and RadNet, Inc., with Waters showing accelerating gains and RadNet exhibiting strong overall growth but recent deceleration.

Trend Analysis

Waters Corporation’s stock showed a 22.0% price increase over the past year, reflecting a bullish trend with acceleration. The price fluctuated between 281.2 and 415.48, supported by a 33.33 standard deviation.

RadNet, Inc. experienced a 104.23% price rise over the same period, indicating a bullish trend but with deceleration. The stock ranged from 38.29 to 83.41, with lower volatility at 11.02 standard deviation.

Comparing both stocks, RadNet delivered the highest market performance with over 100% growth, despite recent declines, while Waters showed steadier acceleration and higher volatility.

Target Prices

Analysts present a confident target price consensus for Waters Corporation and RadNet, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Waters Corporation | 480 | 315 | 406.86 |

| RadNet, Inc. | 95 | 90 | 92.25 |

The target consensus for Waters Corporation suggests modest upside potential versus its current price of 396.75 USD, while RadNet’s consensus target is notably above its current price of 78.20 USD, indicating room for growth according to analysts.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Waters Corporation and RadNet, Inc.:

Rating Comparison

Waters Corporation Rating

- Rating: B+ indicating a very favorable status.

- Discounted Cash Flow Score: 4, considered favorable.

- ROE Score: 5, very favorable reflecting strong profit generation.

- ROA Score: 5, very favorable showing efficient asset use.

- Debt To Equity Score: 1, very unfavorable indicating higher financial risk.

- Overall Score: 3, moderate financial standing.

RadNet, Inc. Rating

- Rating: D+ with a very unfavorable status.

- Discounted Cash Flow Score: 1, very unfavorable.

- ROE Score: 1, very unfavorable indicating weak profitability.

- ROA Score: 1, very unfavorable showing poor asset utilization.

- Debt To Equity Score: 1, very unfavorable indicating similar financial risk.

- Overall Score: 1, very unfavorable financial standing.

Which one is the best rated?

Based strictly on the provided data, Waters Corporation is better rated overall with a B+ rating, higher DCF, ROE, and ROA scores, despite a weak debt-to-equity score. RadNet has uniformly very unfavorable scores and a D+ rating.

Scores Comparison

Here is the comparison of the Altman Z-Score and Piotroski Score for Waters Corporation and RadNet, Inc.:

Waters Corporation Scores

- Altman Z-Score: 9.73, in the safe zone, indicating low bankruptcy risk.

- Piotroski Score: 6, average financial strength and investment quality.

RadNet, Inc. Scores

- Altman Z-Score: 2.16, in the grey zone, indicating moderate bankruptcy risk.

- Piotroski Score: 2, very weak financial strength and poor investment quality.

Which company has the best scores?

Waters Corporation shows a significantly higher Altman Z-Score and a stronger Piotroski Score than RadNet, indicating better financial stability and overall financial health based on the provided data.

Grades Comparison

Here is a comparison of the recent grades issued by reputable grading companies for Waters Corporation and RadNet, Inc.:

Waters Corporation Grades

This table lists the latest grades from recognized financial institutions for Waters Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2025-12-15 |

| Wolfe Research | Upgrade | Outperform | 2025-12-10 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-05 |

| TD Cowen | Maintain | Hold | 2025-11-05 |

| JP Morgan | Maintain | Neutral | 2025-10-09 |

| Wells Fargo | Maintain | Equal Weight | 2025-08-05 |

| Deutsche Bank | Maintain | Hold | 2025-08-05 |

| Jefferies | Maintain | Buy | 2025-08-04 |

| Baird | Maintain | Outperform | 2025-07-16 |

| Wells Fargo | Downgrade | Equal Weight | 2025-07-15 |

The overall trend for Waters Corporation indicates a stable rating mostly around “Equal Weight” or “Hold,” with occasional upgrades to “Outperform” and “Buy.”

RadNet, Inc. Grades

Below are the recent grades from established grading firms for RadNet, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B. Riley Securities | Maintain | Buy | 2025-12-01 |

| Barclays | Maintain | Overweight | 2025-11-13 |

| Truist Securities | Maintain | Buy | 2025-11-12 |

| Truist Securities | Maintain | Buy | 2025-09-03 |

| Barclays | Maintain | Overweight | 2025-09-03 |

| Raymond James | Maintain | Strong Buy | 2025-08-13 |

| Truist Securities | Maintain | Buy | 2025-04-11 |

| Barclays | Maintain | Overweight | 2025-03-24 |

| Raymond James | Upgrade | Strong Buy | 2025-03-05 |

| Barclays | Maintain | Overweight | 2025-01-22 |

RadNet shows a consistent pattern of positive ratings, predominantly “Buy,” “Overweight,” and “Strong Buy,” with no downgrades reported recently.

Which company has the best grades?

RadNet, Inc. has received consistently stronger grades than Waters Corporation, with numerous “Buy” and “Strong Buy” ratings compared to Waters’ predominantly “Hold” and “Equal Weight.” This suggests RadNet is viewed more favorably by analysts, potentially indicating higher growth expectations or lower perceived risk for investors.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses between Waters Corporation (WAT) and RadNet, Inc. (RDNT), based on the latest financial and operational data.

| Criterion | Waters Corporation (WAT) | RadNet, Inc. (RDNT) |

|---|---|---|

| Diversification | Broad product segments including instruments and services, balancing recurring consumables and system sales | Revenue mainly from commercial insurance and patient services; less product diversification |

| Profitability | High profitability with 21.56% net margin and 34.88% ROE; strong ROIC at 18.43% | Very low profitability; net margin near 0.15%, ROE 0.31%, and ROIC 3.14% |

| Innovation | Strong innovation in analytical instruments and service systems; maintains competitive advantage | Limited innovation focus, mostly healthcare service oriented |

| Global presence | Significant global footprint with diversified markets for instruments and services | Primarily US-focused healthcare services network |

| Market Share | Leading position in analytical instrument market with steady revenue growth | Regional player in radiology and healthcare services with fragmented market |

Waters Corporation demonstrates strength in profitability, innovation, and global diversification but faces a declining ROIC trend, suggesting cautious monitoring. RadNet shows improving ROIC but remains unprofitable overall, with concentrated exposure and weaker financial metrics. Investors should weigh Waters’ stability and innovation against RadNet’s growth potential amid profitability challenges.

Risk Analysis

The table below summarizes key risks for Waters Corporation (WAT) and RadNet, Inc. (RDNT) based on their most recent financial and operational data from 2024.

| Metric | Waters Corporation (WAT) | RadNet, Inc. (RDNT) |

|---|---|---|

| Market Risk | Moderate (Beta 1.16) | High (Beta 1.51) |

| Debt level | Moderate (Debt/Equity 0.93) | High (Debt/Equity 1.92) |

| Regulatory Risk | Moderate (Healthcare industry) | Moderate (Healthcare industry) |

| Operational Risk | Low (Strong asset turnover) | Moderate (Lower asset turnover) |

| Environmental Risk | Low to Moderate | Low to Moderate |

| Geopolitical Risk | Low (Primarily US/EU exposure) | Low (Primarily US exposure) |

Waters Corporation exhibits moderate market and debt risks but benefits from strong profitability and financial stability, reflected in a safe Altman Z-score and favorable ratings. RadNet faces higher financial leverage, lower profitability, and a grey-zone Altman Z-score, making it more vulnerable to operational and financial risks. Debt load and interest coverage remain the most impactful risks for RadNet.

Which Stock to Choose?

Waters Corporation shows a favorable income evolution with solid profitability and a strong return on equity of 34.88%. Its debt levels are moderate, reflected in a neutral debt-to-equity ratio, and its overall rating is very favorable with a B+ score.

RadNet, Inc. exhibits significant revenue growth but low profitability, with a net margin of only 0.15% and a high debt-to-equity ratio indicating financial risk. Its rating is very unfavorable, marked by a D+ score and weak financial ratios.

For investors, Waters Corporation might appear more suitable for those prioritizing quality and stable profitability, while RadNet could be interpreted as a growth opportunity with higher risk due to its financial challenges and lower rating.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Waters Corporation and RadNet, Inc. to enhance your investment decisions: