QUALCOMM Incorporated and SkyWater Technology, Inc. are two key players in the semiconductor industry, each with unique approaches to innovation and market presence. QUALCOMM is a global leader in wireless technologies and intellectual property licensing, while SkyWater specializes in advanced semiconductor manufacturing services. Their shared industry focus but differing strategies make this comparison compelling for investors seeking growth potential and stability. Let’s explore which company presents the most interesting investment opportunity today.

Table of contents

Companies Overview

I will begin the comparison between QUALCOMM and SkyWater Technology by providing an overview of these two companies and their main differences.

QUALCOMM Overview

QUALCOMM Incorporated focuses on developing and commercializing foundational wireless technologies globally. It operates through three segments: Qualcomm CDMA Technologies, Qualcomm Technology Licensing, and Qualcomm Strategic Initiatives. The company develops integrated circuits and system software for 3G/4G/5G communication, licenses intellectual property for wireless products, and invests in early-stage tech companies. Founded in 1985, QUALCOMM is headquartered in San Diego, CA, with 49K employees.

SkyWater Technology Overview

SkyWater Technology, Inc. provides semiconductor development and manufacturing services, including engineering and process development. It supports customers in sectors like aerospace, defense, automotive, bio-health, and industrial IoT. Established in 2017 and based in Bloomington, MN, SkyWater operates with 702 employees. The company offers manufacturing for silicon-based analog, mixed-signal, power discrete, MEMS, and rad-hard integrated circuits.

Key similarities and differences

Both QUALCOMM and SkyWater operate in the semiconductor industry and serve technology sectors; however, QUALCOMM emphasizes wireless communication technologies and intellectual property licensing, while SkyWater focuses on semiconductor manufacturing and co-development services. QUALCOMM has a significantly larger market cap and workforce, with a broad scope including investments in emerging tech, whereas SkyWater is a smaller, specialized manufacturer catering to diverse industrial applications.

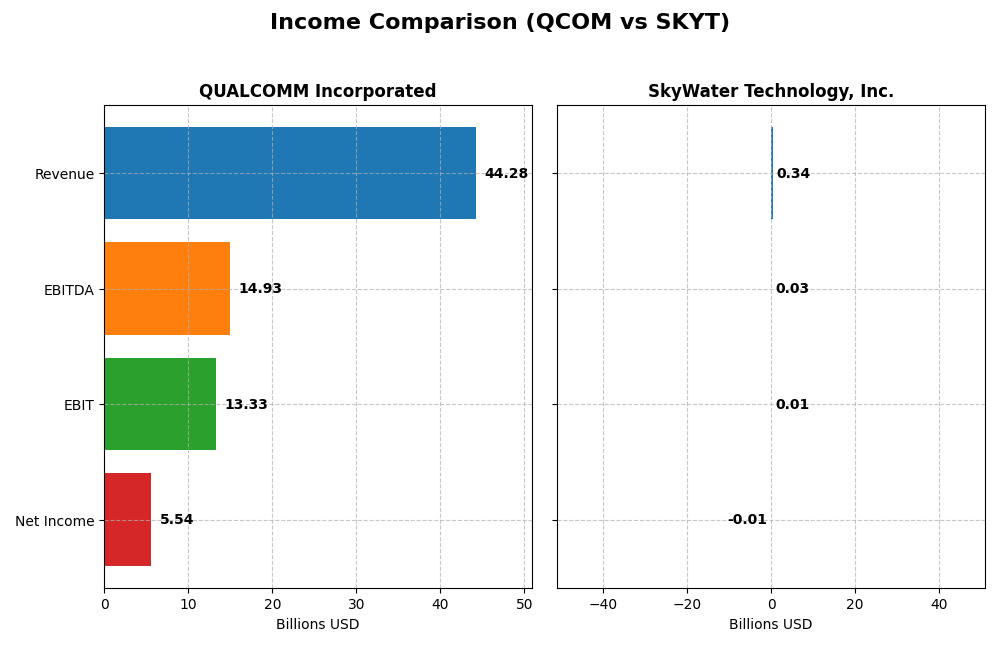

Income Statement Comparison

The table below compares the most recent fiscal year income statement figures of QUALCOMM Incorporated and SkyWater Technology, Inc., highlighting key financial metrics for both companies.

| Metric | QUALCOMM Incorporated | SkyWater Technology, Inc. |

|---|---|---|

| Market Cap | 175.2B | 1.57B |

| Revenue | 44.28B | 342M |

| EBITDA | 14.93B | 25.25M |

| EBIT | 13.33B | 6.56M |

| Net Income | 5.54B | -6.79M |

| EPS | 5.06 | -0.14 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

QUALCOMM Incorporated

QUALCOMM’s revenue showed a steady increase from $33.6B in 2021 to $44.3B in 2025, reflecting a 31.9% growth over five years. Net income, however, declined from $9.0B in 2021 to $5.5B in 2025, indicating a downward trend in profitability. Margins remained strong, with a gross margin of 55.4% and an EBIT margin above 30% in 2025, though net margin fell sharply in the latest year.

SkyWater Technology, Inc.

SkyWater’s revenue rose significantly from $140M in 2020 to $342M in 2024, a growth of 143.7%. Net income losses narrowed from -$20M in 2020 to -$6.8M in 2024, showing improving profitability trends. Gross margin improved to 20.3% in 2024, while EBIT margin remained low at 1.9%. The company exhibited positive momentum with better margin and earnings growth in the most recent year.

Which one has the stronger fundamentals?

QUALCOMM demonstrates stronger absolute revenues and profitability with high gross and EBIT margins, but its net income and margin have deteriorated recently. SkyWater shows rapid growth and improving margins from a smaller base, with reduced losses and positive earnings growth. QUALCOMM’s larger scale contrasts with SkyWater’s promising growth trajectory and margin improvements, reflecting differing fundamental strengths.

Financial Ratios Comparison

The table below compares key financial ratios for QUALCOMM Incorporated (QCOM) and SkyWater Technology, Inc. (SKYT) based on their most recent fiscal year data.

| Ratios | QUALCOMM Incorporated (2025) | SkyWater Technology, Inc. (2024) |

|---|---|---|

| ROE | 26.13% | -11.79% |

| ROIC | 13.19% | 3.40% |

| P/E | 32.70 | -100.26 |

| P/B | 8.54 | 11.82 |

| Current Ratio | 2.82 | 0.86 |

| Quick Ratio | 2.10 | 0.76 |

| D/E (Debt-to-Equity) | 0.70 | 1.33 |

| Debt-to-Assets | 29.54% | 24.46% |

| Interest Coverage | 18.61 | 0.74 |

| Asset Turnover | 0.88 | 1.09 |

| Fixed Asset Turnover | 9.44 | 2.07 |

| Payout ratio | 68.67% | 0% |

| Dividend yield | 2.10% | 0% |

Interpretation of the Ratios

QUALCOMM Incorporated

QUALCOMM shows mostly strong financial ratios with favorable net margin at 12.51%, ROE at 26.13%, and ROIC at 13.19%, indicating good profitability and efficiency. Liquidity ratios are solid, and debt levels remain manageable. However, valuation metrics like PE of 32.7 and PB of 8.54 appear less attractive. The company pays dividends, yielding 2.1%, supported by steady payout coverage and share buybacks, suggesting reliable shareholder returns without obvious risks.

SkyWater Technology, Inc.

SkyWater’s ratios reveal weaknesses with negative net margin (-1.98%) and ROE (-11.79%), reflecting losses and operational challenges. Liquidity ratios are below 1, raising concerns about short-term financial health. Debt levels and interest coverage indicate financial strain. The company does not pay dividends, likely due to ongoing reinvestment and growth phase priorities, with no share buybacks reported, emphasizing focus on development over distributions.

Which one has the best ratios?

Based on the evaluations, QUALCOMM exhibits a predominantly favorable ratio profile with strong profitability, liquidity, and dividend support, whereas SkyWater struggles with unfavorable profitability, liquidity, and coverage ratios. Therefore, QUALCOMM holds the advantage in financial stability and shareholder returns, while SkyWater faces significant ratio-related challenges.

Strategic Positioning

This section compares the strategic positioning of QUALCOMM and SkyWater Technology, focusing on market position, key segments, and exposure to technological disruption:

QUALCOMM

- Leading global wireless technology developer with large market cap and competitive pressure.

- Diversified segments: QCT chips, QTL patent licensing, and QSI early-stage tech investments.

- Invests in emerging technologies like 5G, AI, automotive, and IoT, adapting to wireless disruptions.

SkyWater Technology

- Smaller semiconductor manufacturer with niche focus, facing higher volatility and competitive pressure.

- Concentrated on semiconductor manufacturing and engineering services for defense, automotive, and IoT.

- Provides specialized silicon-based analog and mixed-signal semiconductor services with moderate disruption risk.

QUALCOMM vs SkyWater Technology Positioning

QUALCOMM has a diversified strategy spanning semiconductor chips, licensing, and tech investments, offering multiple revenue streams. SkyWater focuses on manufacturing services in specific industries, which may limit scale but allows specialization. Diversification versus concentration defines their strategic contrast.

Which has the best competitive advantage?

QUALCOMM holds a slightly favorable moat by creating value despite declining profitability, indicating a more sustainable competitive advantage. SkyWater has a slightly unfavorable moat, shedding value but showing improving profitability trends.

Stock Comparison

The stock price chart highlights significant upward momentum for SkyWater Technology, Inc. (SKYT) with strong gains and accelerating growth, while QUALCOMM Incorporated (QCOM) shows moderate overall gains but recent price declines suggesting mixed trading dynamics.

Trend Analysis

QUALCOMM Incorporated’s stock exhibited a bullish trend over the past year, gaining 5.7% with accelerating momentum, despite a recent 9.48% decline signaling short-term deceleration in price direction.

SkyWater Technology, Inc. displayed a robust bullish trend with a 245.48% increase over the last year, accelerating sharply and maintaining strong buyer dominance during the recent 87.85% rally.

Comparatively, SkyWater Technology outperformed QUALCOMM by a wide margin, delivering the highest market performance and stronger price acceleration over the analyzed 12-month period.

Target Prices

The current target price consensus for these semiconductor companies reflects a mixed outlook from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| QUALCOMM Incorporated | 210 | 165 | 185.71 |

| SkyWater Technology, Inc. | 25 | 25 | 25 |

For QUALCOMM, analysts expect the stock to appreciate from its current price of $163.60 to a consensus target of $185.71, indicating moderate upside potential. SkyWater Technology’s target at $25 is below its current price of $32.82, suggesting a more cautious or bearish outlook from analysts.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for QUALCOMM Incorporated and SkyWater Technology, Inc.:

Rating Comparison

QCOM Rating

- Rated B+ with a very favorable status overall.

- Discounted Cash Flow score is 4, considered favorable for future cash flows.

- Return on Equity score is 5, very favorable for profit generation efficiency.

- Return on Assets score is 5, very favorable for asset utilization.

- Debt to Equity score is 1, very unfavorable, indicating high financial risk.

SKYT Rating

- Rated B+ with a very favorable status overall.

- Discounted Cash Flow score is 1, indicating a very unfavorable valuation.

- Return on Equity score is 5, very favorable for profit generation efficiency.

- Return on Assets score is 5, very favorable for asset utilization.

- Debt to Equity score is 1, very unfavorable, indicating high financial risk.

Which one is the best rated?

Both QCOM and SKYT hold the same overall B+ rating with identical ROE and ROA scores. However, QCOM exhibits a significantly better discounted cash flow score, suggesting a more favorable valuation outlook compared to SKYT.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for QUALCOMM and SkyWater Technology:

QUALCOMM Scores

- Altman Z-Score: 6.37, indicating a safe zone status.

- Piotroski Score: 7, classified as strong financial health.

SkyWater Technology Scores

- Altman Z-Score: 2.20, indicating a grey zone status.

- Piotroski Score: 5, classified as average financial health.

Which company has the best scores?

QUALCOMM shows stronger financial stability with a safe zone Altman Z-Score and a strong Piotroski Score of 7. SkyWater Technology’s scores indicate moderate risk with a grey zone Altman Z-Score and average Piotroski Score of 5.

Grades Comparison

Here is a detailed comparison of the latest grades and ratings for QUALCOMM Incorporated and SkyWater Technology, Inc.:

QUALCOMM Incorporated Grades

The table below shows recent grades from reputable financial institutions for QUALCOMM Incorporated.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Downgrade | Neutral | 2026-01-09 |

| Rosenblatt | Maintain | Buy | 2025-11-06 |

| B of A Securities | Maintain | Buy | 2025-11-06 |

| Mizuho | Maintain | Outperform | 2025-11-06 |

| Wells Fargo | Maintain | Underweight | 2025-11-06 |

| Piper Sandler | Maintain | Overweight | 2025-11-06 |

| UBS | Maintain | Neutral | 2025-11-06 |

| JP Morgan | Maintain | Overweight | 2025-11-04 |

| Citigroup | Maintain | Neutral | 2025-10-28 |

| Rosenblatt | Maintain | Buy | 2025-10-28 |

QUALCOMM’s grades show a mixed but generally positive trend, with several “Buy” and “Outperform” ratings, balanced by some “Neutral” and “Underweight” assessments.

SkyWater Technology, Inc. Grades

Presented below are recent grades from recognized grading firms for SkyWater Technology, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2025-11-06 |

| Piper Sandler | Maintain | Overweight | 2025-11-06 |

| TD Cowen | Maintain | Buy | 2025-11-06 |

| Needham | Maintain | Buy | 2025-08-07 |

| Needham | Maintain | Buy | 2025-05-08 |

| Needham | Maintain | Buy | 2025-02-27 |

| Needham | Maintain | Buy | 2024-11-11 |

| Piper Sandler | Maintain | Overweight | 2024-10-25 |

| Piper Sandler | Maintain | Overweight | 2024-08-08 |

| Needham | Maintain | Buy | 2024-05-09 |

SkyWater Technology consistently holds “Buy” and “Overweight” ratings, reflecting a stable positive outlook by its graders.

Which company has the best grades?

Both QUALCOMM and SkyWater Technology have a consensus rating of “Buy,” but QUALCOMM displays a broader range of opinions including some downgrades and neutral stances, while SkyWater’s grades are uniformly positive. This suggests SkyWater may be viewed with more consistent confidence by analysts, which could influence investor sentiment and risk perception accordingly.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for QUALCOMM Incorporated (QCOM) and SkyWater Technology, Inc. (SKYT) based on the most recent financial and operational data.

| Criterion | QUALCOMM Incorporated (QCOM) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Diversification | Strong product segmentation: chipsets (QCT $38.4B) and licensing (QTL $5.6B) | Focused on advanced technology and wafer services with revenues around $270M in 2024, less diversified |

| Profitability | Favorable net margin (12.5%), ROE (26.1%), ROIC (13.2%) | Negative net margin (-2.0%), negative ROE (-11.8%), low ROIC (3.4%) |

| Innovation | Consistent investment in chipset technology and licensing | Growing ROIC trend indicates improving innovation and operations |

| Global presence | Established global footprint with diverse client base | Smaller scale, niche market with wafer fabs primarily in the US |

| Market Share | Large market share in mobile and wireless chipsets | Smaller player in semiconductor manufacturing services |

Key takeaways: QUALCOMM demonstrates strong profitability, diversified revenue streams, and a solid global presence, though its ROIC shows a declining trend. SkyWater, while currently less profitable and smaller in scale, shows improving operational efficiency with growing ROIC, signaling potential for future growth but with higher risk.

Risk Analysis

Below is a comparison table summarizing key risks for QUALCOMM Incorporated (QCOM) and SkyWater Technology, Inc. (SKYT) based on the most recent data available.

| Metric | QUALCOMM Incorporated (QCOM) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Market Risk | Moderate (Beta 1.21) | High (Beta 3.49) |

| Debt Level | Moderate (D/E 0.7, Debt to Assets 29.5%) | High (D/E 1.33, Debt to Assets 24.5%) |

| Regulatory Risk | Moderate (Tech patents/licensing exposure) | Moderate (Defense and aerospace contracts) |

| Operational Risk | Low (Large scale, diversified operations) | High (Small company, manufacturing scale-up risks) |

| Environmental Risk | Moderate (Industry-wide semiconductor impact) | Moderate (Manufacturing environmental compliance) |

| Geopolitical Risk | Moderate (Global supply chains, US tech regulations) | Moderate (Defense sector exposure, US-based) |

I note that SkyWater’s high market volatility (beta 3.49) and elevated debt levels increase its financial risk compared to QUALCOMM. QUALCOMM’s extensive patent portfolio and licensing revenue offer some buffer against operational and regulatory risks, but geopolitical tensions affecting global tech supply chains remain a concern for both. SkyWater’s smaller scale and concentration in manufacturing expose it to higher operational risk, especially in scaling production and managing costs. Investors should weigh these factors carefully, prioritizing risk mitigation and diversification in their portfolios.

Which Stock to Choose?

QUALCOMM Incorporated (QCOM) shows favorable income growth with a 13.66% revenue increase in 2025, strong profitability metrics, and a solid balance sheet indicated by a 2.82 current ratio and low net debt to EBITDA of 0.62. Its overall financial ratios are mostly favorable, supported by a very favorable rating and a safe-zone Altman Z-Score.

SkyWater Technology, Inc. (SKYT) demonstrates strong revenue growth of 19.39% in 2024 and improving profitability, though its net margin remains negative. Its financial ratios are predominantly unfavorable, with liquidity ratios below 1 and higher debt levels. The company holds a moderate rating, a grey-zone Altman Z-Score, and an average Piotroski score, reflecting some financial risk.

For investors prioritizing stability and efficient capital use, QUALCOMM’s favorable financial health and value-creating moat might appear more attractive. Conversely, those with a higher risk tolerance, seeking growth potential, may find SkyWater’s accelerating revenue and improving profitability indicative of emerging opportunities, despite its financial challenges.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of QUALCOMM Incorporated and SkyWater Technology, Inc. to enhance your investment decisions: