In today’s fast-evolving tech landscape, The Trade Desk, Inc. (TTD) and Pegasystems Inc. (PEGA) stand out as leaders in the software application industry. Both companies drive innovation through cloud-based platforms, targeting digital advertising and enterprise software solutions. Their overlapping markets and strategic focus on automation and data-driven insights make them compelling comparables. Join me as we analyze which company offers the most promising investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between The Trade Desk, Inc. and Pegasystems Inc. by providing an overview of these two companies and their main differences.

The Trade Desk Overview

The Trade Desk, Inc. operates a self-service cloud-based platform that enables buyers to create, manage, and optimize data-driven digital advertising campaigns across multiple formats and channels. Founded in 2009 and headquartered in Ventura, California, it serves advertising agencies and other service providers globally. The company is positioned as a technology leader in digital advertising software, with a market cap of $17.3B and 3,522 employees.

Pegasystems Overview

Pegasystems Inc. develops and supports enterprise software applications, including the Pega Platform and Pega Infinity for customer engagement and digital process automation. Incorporated in 1983 and based in Waltham, Massachusetts, Pegasystems caters to industries like financial services and healthcare. It has a market cap of $8.9B and employs 5,443 people, marketing its products via direct sales and technology partnerships.

Key similarities and differences

Both companies operate in the software application industry within the technology sector and trade on NASDAQ. The Trade Desk focuses on digital advertising technology, while Pegasystems specializes in enterprise software for customer engagement and automation. Pegasystems serves a broader range of industries, whereas The Trade Desk targets advertising agencies. The Trade Desk has a larger market cap but fewer employees compared to Pegasystems.

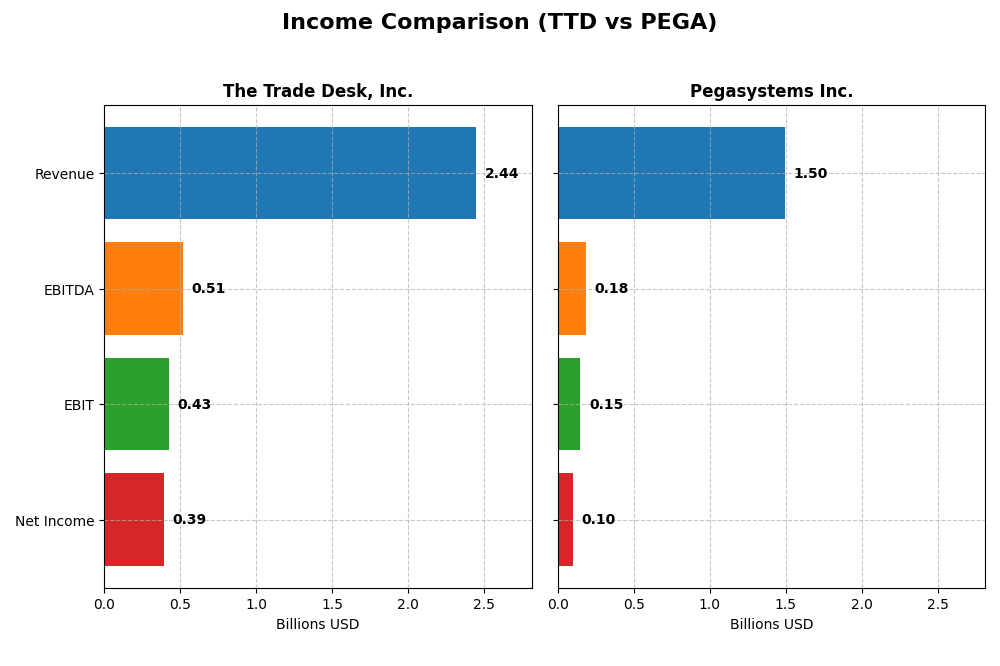

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for The Trade Desk, Inc. and Pegasystems Inc. for the fiscal year 2024.

| Metric | The Trade Desk, Inc. | Pegasystems Inc. |

|---|---|---|

| Market Cap | 17.3B | 8.9B |

| Revenue | 2.44B | 1.50B |

| EBITDA | 515M | 185M |

| EBIT | 427M | 149M |

| Net Income | 393M | 99M |

| EPS | 0.80 | 0.58 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

The Trade Desk, Inc.

The Trade Desk has demonstrated strong revenue growth, rising from $836M in 2020 to $2.44B in 2024, with net income increasing from $242M to $393M over the same period. Margins remain robust, with a gross margin above 80%, and a favorable net margin of 16.1% in 2024. The latest year showed a significant acceleration in revenue and net income growth, with EPS more than doubling, reflecting improved operational efficiency.

Pegasystems Inc.

Pegasystems’ revenue grew steadily from $1.02B in 2020 to $1.50B in 2024, while net income turned positive after earlier losses, reaching $99M in 2024. Gross margins remain solid near 74%, though EBIT margins are moderate at about 10%. The most recent year saw modest revenue growth of 4.5%, but net income and EPS rose sharply, indicating improved profitability and margin expansion after prior restructuring.

Which one has the stronger fundamentals?

The Trade Desk exhibits stronger fundamentals with higher revenue and net income growth rates, superior margins, and consistent profitability. Pegasystems shows positive momentum with a return to profitability and margin improvements but at lower scale and growth rates. Both companies have favorable income evaluations, though The Trade Desk’s margin and growth metrics present a more robust financial profile overall.

Financial Ratios Comparison

The table below compares key financial ratios for The Trade Desk, Inc. (TTD) and Pegasystems Inc. (PEGA) based on their most recent fiscal year data from 2024.

| Ratios | The Trade Desk, Inc. (TTD) | Pegasystems Inc. (PEGA) |

|---|---|---|

| ROE | 13.3% | 16.9% |

| ROIC | 10.0% | 7.4% |

| P/E | 147x | 80x |

| P/B | 19.6x | 13.6x |

| Current Ratio | 1.86 | 1.23 |

| Quick Ratio | 1.86 | 1.23 |

| D/E (Debt-to-Equity) | 0.11 | 0.94 |

| Debt-to-Assets | 5.1% | 31.1% |

| Interest Coverage | 0 (not available) | 18.1x |

| Asset Turnover | 0.40 | 0.85 |

| Fixed Asset Turnover | 5.17 | 14.36 |

| Payout Ratio | 0% | 10.3% |

| Dividend Yield | 0% | 0.13% |

Interpretation of the Ratios

The Trade Desk, Inc.

The Trade Desk shows a generally favorable ratio profile, with strong net margin at 16.08% and return on invested capital of 10.02%, indicating solid profitability and capital efficiency. However, high price-to-earnings (146.77) and price-to-book (19.56) ratios suggest valuation concerns. The company does not pay dividends, reflecting a reinvestment strategy likely aimed at growth.

Pegasystems Inc.

Pegasystems displays a mixed ratio set with a favorable return on equity of 16.94%, but a more neutral net margin at 6.63% and return on invested capital of 7.4%. Its moderate current ratio (1.23) and debt levels suggest balanced liquidity and leverage. The company pays a small dividend with a 0.13% yield, implying some shareholder returns while maintaining cautious distribution.

Which one has the best ratios?

The Trade Desk holds a more favorable overall ratio assessment with 57.14% favorable indicators versus Pegasystems’ 28.57%. While The Trade Desk’s valuation metrics seem stretched, its profitability and liquidity ratios are stronger. Pegasystems presents a more conservative but less compelling profitability profile, with a slightly favorable global ratio opinion.

Strategic Positioning

This section compares the strategic positioning of The Trade Desk, Inc. and Pegasystems Inc., focusing on market position, key segments, and exposure to technological disruption:

The Trade Desk, Inc.

- Leading in digital advertising technology, facing high competition in software applications.

- Focuses on data-driven digital advertising across multiple ad formats and devices.

- Operates a cloud-based platform with exposure to evolving ad tech but no explicit disruption noted.

Pegasystems Inc.

- Established in enterprise software with competitive pressure in multiple global markets.

- Diverse revenue from cloud, consulting, maintenance, subscription licenses, and perpetual licenses.

- Offers cloud and automation software, adapting through digital process automation and customer engagement.

The Trade Desk, Inc. vs Pegasystems Inc. Positioning

The Trade Desk concentrates on digital advertising technology with a specialized platform, while Pegasystems maintains a diversified software portfolio serving multiple industries globally. This difference reflects a focused versus broad approach in market reach and business drivers.

Which has the best competitive advantage?

Both companies are classified as slightly unfavorable in moat evaluation, with The Trade Desk showing declining profitability and Pegasystems improving profitability despite shedding value. Neither currently demonstrates a strong sustainable competitive advantage based on ROIC versus WACC.

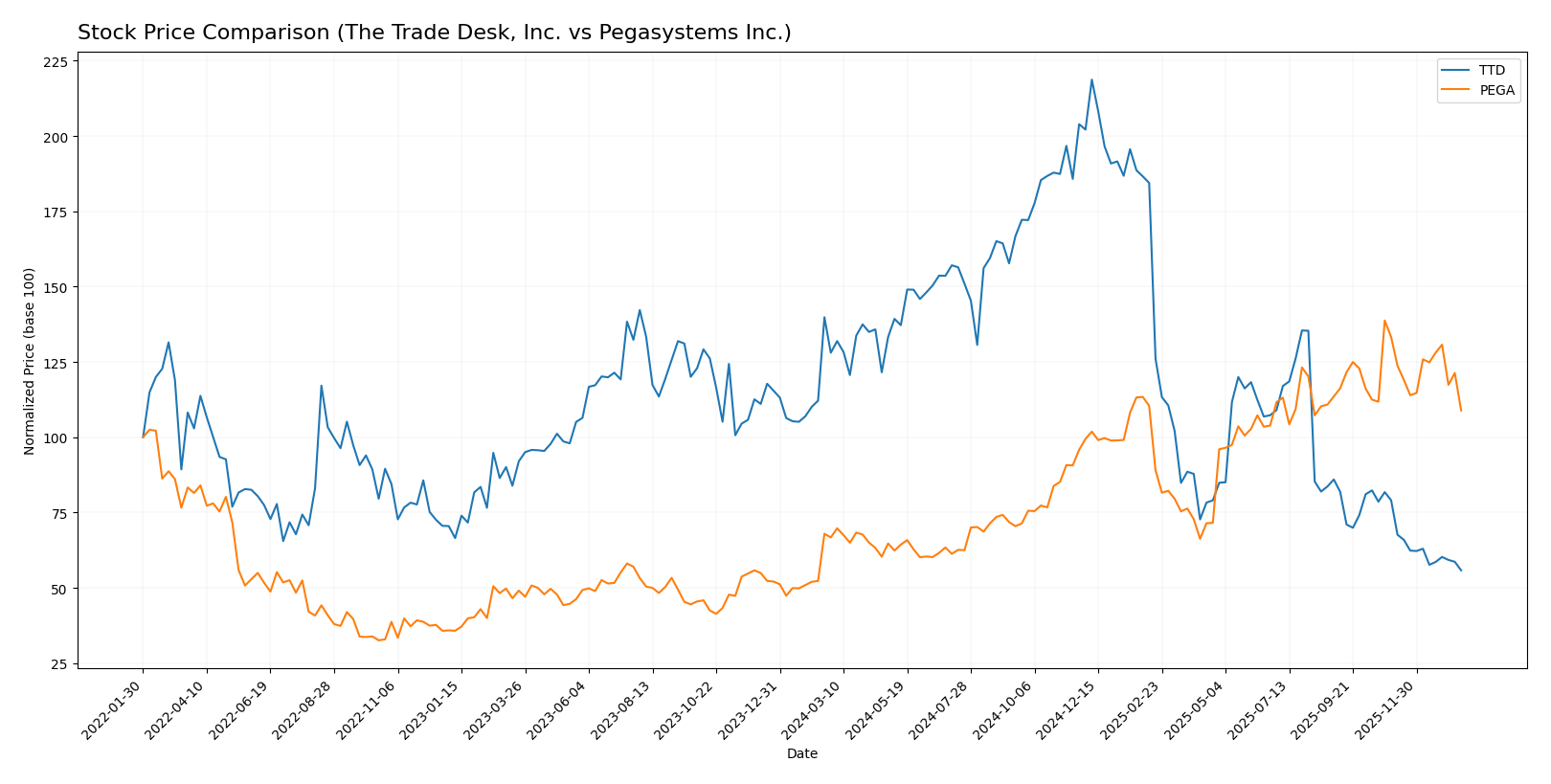

Stock Comparison

The stock price movements of The Trade Desk, Inc. and Pegasystems Inc. over the past year reveal contrasting trends, with significant declines for The Trade Desk and notable gains for Pegasystems, alongside shifting trading volumes and market dynamics.

Trend Analysis

The Trade Desk, Inc. experienced a bearish trend over the past 12 months, with a price decline of 56.43%, showing deceleration and high volatility (std deviation 28.36). The stock ranged between 139.11 and 35.48.

Pegasystems Inc. showed a bullish trend over the same period, gaining 63.18%, but with decelerating momentum and moderate volatility (std deviation 10.77). Prices fluctuated from 28.73 to 66.27.

Comparing both stocks, Pegasystems delivered the highest market performance with a strong positive return, while The Trade Desk faced substantial losses despite both showing decelerating trends recently.

Target Prices

Here is the current consensus on target prices from verified analysts for The Trade Desk, Inc. and Pegasystems Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| The Trade Desk, Inc. | 98 | 39 | 56.73 |

| Pegasystems Inc. | 80 | 67 | 74 |

Analysts see The Trade Desk’s stock price (currently 35.48 USD) as undervalued with a wide target range, suggesting potential upside. Pegasystems trades below its consensus target of 74 USD, indicating moderate growth expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for The Trade Desk, Inc. (TTD) and Pegasystems Inc. (PEGA):

Rating Comparison

TTD Rating

- Rating: B, considered very favorable by analysts.

- Discounted Cash Flow Score: 4, indicating a favorable valuation outlook.

- ROE Score: 4, showing favorable profit generation from equity.

- ROA Score: 4, reflecting favorable asset utilization efficiency.

- Debt To Equity Score: 3, reflecting moderate financial risk.

- Overall Score: 3, rated as moderate overall financial strength.

PEGA Rating

- Rating: B+, considered very favorable by analysts.

- Discounted Cash Flow Score: 3, indicating a moderate valuation outlook.

- ROE Score: 5, showing very favorable profit generation from equity.

- ROA Score: 5, reflecting very favorable asset utilization efficiency.

- Debt To Equity Score: 3, reflecting moderate financial risk.

- Overall Score: 3, rated as moderate overall financial strength.

Which one is the best rated?

Based on the provided data, PEGA holds a slightly higher rating of B+ compared to TTD’s B. PEGA also scores better on ROE and ROA, while both share similar overall and debt-to-equity scores, indicating PEGA is marginally better rated.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for The Trade Desk and Pegasystems:

The Trade Desk Scores

- Altman Z-Score: 4.3, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 5, reflecting an average financial strength.

Pegasystems Scores

- Altman Z-Score: 10.3, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 8, reflecting very strong financial strength.

Which company has the best scores?

Pegasystems has the highest Altman Z-Score and a very strong Piotroski Score, indicating stronger financial health compared to The Trade Desk, which has a safe but lower Z-Score and an average Piotroski Score.

Grades Comparison

Here is a comparison of recent grades assigned to The Trade Desk, Inc. and Pegasystems Inc. by established grading companies:

The Trade Desk, Inc. Grades

The following table reports the latest grades from recognized financial institutions for The Trade Desk, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-01-13 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-12 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-01-08 |

| Wolfe Research | Maintain | Outperform | 2026-01-06 |

| Guggenheim | Maintain | Buy | 2026-01-05 |

| Jefferies | Maintain | Hold | 2025-12-11 |

| Wedbush | Maintain | Neutral | 2025-12-08 |

| DA Davidson | Maintain | Buy | 2025-11-10 |

| Truist Securities | Maintain | Buy | 2025-11-07 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-07 |

The Trade Desk shows a mixed but generally positive trend with multiple buy and outperform grades, balanced by several equal weight and neutral ratings.

Pegasystems Inc. Grades

The following table summarizes recent grades from credible financial analysts for Pegasystems Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2025-12-05 |

| Wedbush | Maintain | Outperform | 2025-10-23 |

| RBC Capital | Maintain | Outperform | 2025-10-23 |

| Barclays | Maintain | Equal Weight | 2025-10-23 |

| Rosenblatt | Maintain | Buy | 2025-10-23 |

| DA Davidson | Upgrade | Buy | 2025-10-22 |

| Rosenblatt | Maintain | Buy | 2025-10-15 |

| Rosenblatt | Maintain | Buy | 2025-07-24 |

| DA Davidson | Maintain | Neutral | 2025-07-24 |

| Wedbush | Maintain | Outperform | 2025-07-24 |

Pegasystems’ ratings reveal a generally stronger consensus with a majority of buy, outperform, and overweight grades, indicating analyst confidence.

Which company has the best grades?

Both companies hold a consensus “Buy” rating, but Pegasystems Inc. has a comparatively higher number of outperform and overweight grades, suggesting stronger analyst conviction. This disparity may impact investor sentiment by implying a potentially more favorable outlook on Pegasystems relative to The Trade Desk.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for The Trade Desk, Inc. (TTD) and Pegasystems Inc. (PEGA) based on their most recent financial and strategic data.

| Criterion | The Trade Desk, Inc. (TTD) | Pegasystems Inc. (PEGA) |

|---|---|---|

| Diversification | Moderate; focused on programmatic advertising | High; diverse software segments including Cloud, Consulting, Maintenance |

| Profitability | Favorable net margin (16.08%) but declining ROIC trend; slightly unfavorable moat | Moderate net margin (6.63%), increasing ROIC trend; slightly unfavorable moat |

| Innovation | Strong in digital advertising technology; high fixed asset turnover (5.17) | Strong cloud and subscription growth; significant investment in Pega Cloud (>$1.1B revenue) |

| Global presence | Well-established in digital ad markets globally | Global software presence with expanding cloud services |

| Market Share | Strong in programmatic ad buying but facing margin pressure | Growing market share in cloud software and subscription services |

Key takeaways: TTD excels in profitability and operational efficiency but faces challenges in sustaining value creation with a declining ROIC trend. PEGA shows diversified revenue streams and improving profitability, driven by cloud growth, yet it is still recovering value. Both companies present investment opportunities with differing risk profiles.

Risk Analysis

Below is a comparative table of key risks associated with The Trade Desk, Inc. (TTD) and Pegasystems Inc. (PEGA) based on the most recent data available for 2024-2026.

| Metric | The Trade Desk, Inc. (TTD) | Pegasystems Inc. (PEGA) |

|---|---|---|

| Market Risk | High beta 1.105; volatile share price range (35.23-126.2) | Moderate beta 1.084; share price range (29.83-68.1) |

| Debt level | Low debt-to-equity (0.11), low debt-to-assets (5.11%) | Higher debt-to-equity (0.94), debt-to-assets 31.09% |

| Regulatory Risk | Moderate, US and international digital advertising regulations | Moderate, global software compliance and data privacy laws |

| Operational Risk | Platform reliability and competition in ad tech space | Integration of diverse software products globally |

| Environmental Risk | Low direct exposure | Low direct exposure |

| Geopolitical Risk | Exposure to international markets with some geopolitical tensions | Broad global presence with possible regional risks |

The most impactful risks for both companies are market volatility and regulatory changes. TTD’s high valuation multiples and volatile price range may increase market risk, while PEGA’s higher debt level requires monitoring for financial stability. Both operate in highly regulated tech sectors with evolving privacy laws, which could affect growth and compliance costs.

Which Stock to Choose?

The Trade Desk, Inc. (TTD) displays a strong income evolution with 25.63% revenue growth in 2024 and a favorable global income statement evaluation of 92.86%. Its financial ratios are mostly favorable, including a 16.08% net margin and solid liquidity, supported by low debt levels and a very favorable B rating. However, its economic moat shows a slightly unfavorable status, indicating declining ROIC and value shedding.

Pegasystems Inc. (PEGA) shows moderate income growth of 4.51% in 2024 but a favorable overall income statement evaluation of 78.57%. Financial ratios are mixed, with a favorable 16.94% ROE but neutral debt metrics and a slightly favorable B+ rating. Its moat evaluation also signals value destruction, though ROIC trend is improving, suggesting increasing profitability.

Investors focused on strong income growth and favorable financial ratios might find TTD appealing, while those valuing improving profitability and a stronger return on equity could consider PEGA. The choice could depend on whether one prioritizes growth momentum or an improving economic moat with moderate income gains.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of The Trade Desk, Inc. and Pegasystems Inc. to enhance your investment decisions: