Home > Comparison > Consumer Cyclical > MBLY vs AMBA

The strategic rivalry between Mobileye Global Inc. and Ambarella, Inc. shapes the future of automotive technology and semiconductor innovation. Mobileye excels as a consumer cyclical firm specializing in advanced driver assistance, while Ambarella operates as a technology company focused on semiconductor video solutions. This analysis probes their contrasting models—integrated ADAS versus chip design—to identify which path offers superior risk-adjusted returns for diversified portfolios navigating this dynamic sector.

Table of contents

Companies Overview

Mobileye and Ambarella both play pivotal roles in advancing automotive and imaging technologies, driving innovation in their respective niches.

Mobileye Global Inc.: Leader in Autonomous Driving Systems

Mobileye is a pioneer in advanced driver assistance systems (ADAS) and autonomous driving technologies. It generates revenue primarily through its safety-focused software solutions that detect road users and provide real-time alerts. In 2026, Mobileye emphasizes scaling its cloud-enhanced driver assist and Level 4 autonomous driving platforms, aiming to integrate advanced navigation and over-the-air updates globally.

Ambarella, Inc.: Specialist in Video Processing Semiconductors

Ambarella focuses on semiconductor solutions for high-definition video and AI-powered vision processing. Its system-on-a-chip designs serve automotive cameras, security systems, and consumer electronics. The company’s 2026 strategy concentrates on expanding applications in autonomous vehicle cameras and industrial robotics, leveraging its expertise in low-power, integrated video compression and AI algorithms.

Strategic Collision: Similarities & Divergences

Both firms target the automotive tech space but diverge in approach: Mobileye delivers software-driven safety and autonomy, while Ambarella supplies critical semiconductor hardware. Their competition centers on autonomous vehicle sensing and driver assistance markets. Mobileye’s software dominance contrasts with Ambarella’s hardware specialization, defining distinct risk and growth profiles for investors navigating this evolving sector.

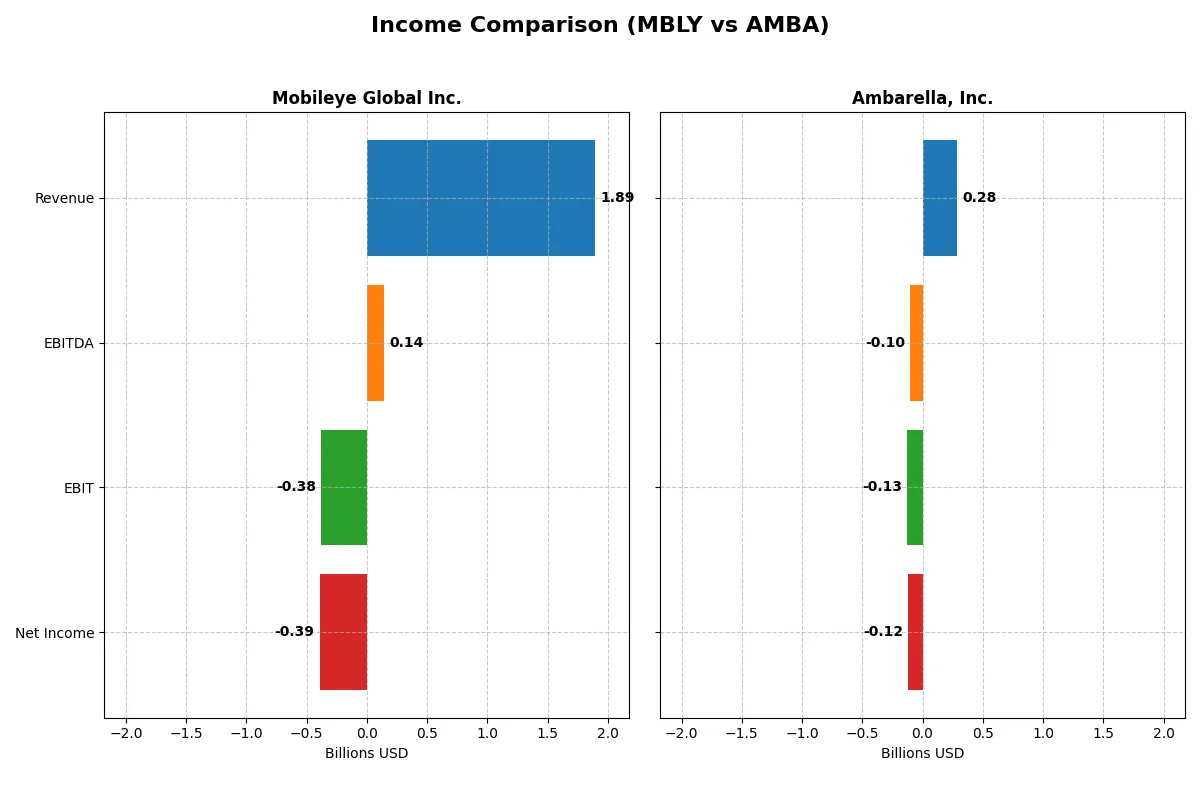

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Mobileye Global Inc. (MBLY) | Ambarella, Inc. (AMBA) |

|---|---|---|

| Revenue | 1.89B | 285M |

| Cost of Revenue | 990M | 113M |

| Operating Expenses | 1.34B | 299M |

| Gross Profit | 904M | 172M |

| EBITDA | 140M | -101M |

| EBIT | -377M | -127M |

| Interest Expense | 0 | 0 |

| Net Income | -392M | -117M |

| EPS | -0.48 | -2.84 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company runs the more efficient and sustainable corporate engine in a competitive market.

Mobileye Global Inc. Analysis

Mobileye grew revenue steadily, reaching 1.89B in 2025, up 14.5% from 2024. Despite positive gross margin near 48%, net income remains negative at -392M, reflecting margin pressure. The company’s improving EBIT margin and 88% net margin growth over one year signal a recovery in operational efficiency.

Ambarella, Inc. Analysis

Ambarella expanded revenue by 25.8% to 285M in 2025, showing strong top-line momentum. Its gross margin stands at a robust 60.5%, yet net income is deeply negative at -117M, with a net margin of -41.1%. EBIT improved moderately, but heavy losses indicate ongoing challenges in translating revenue into profits.

Margin Strength vs. Revenue Momentum

Mobileye’s larger revenue base and rapid EBIT margin improvement contrast with Ambarella’s higher gross margin but smaller scale and deeper net losses. Mobileye shows a clearer path to profitability with better margin recovery. For investors, Mobileye’s profile offers more potential stability, while Ambarella remains a higher-risk growth story.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Mobileye Global Inc. (MBLY) | Ambarella, Inc. (AMBA) |

|---|---|---|

| ROE | -3.3% | -20.9% |

| ROIC | -3.6% | -22.0% |

| P/E | -21.6 | -27.1 |

| P/B | 0.71 | 5.64 |

| Current Ratio | 6.1 | 2.6 |

| Quick Ratio | 5.3 | 2.4 |

| D/E | 0 | 0.009 |

| Debt-to-Assets | 0 | 0.008 |

| Interest Coverage | 0 | 0 |

| Asset Turnover | 0.15 | 0.41 |

| Fixed Asset Turnover | 4.00 | 19.96 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Ratios serve as a company’s financial DNA, exposing hidden risks and revealing operational strengths critical to investor insight.

Mobileye Global Inc.

Mobileye displays weak profitability with a negative ROE of -3.3% and net margin at -20.7%, signaling operational challenges. Valuation metrics suggest Mobileye trades cheaply, with a favorable P/E at -21.61 and a low P/B of 0.71. The firm reinvests heavily in R&D, supporting future growth rather than paying dividends.

Ambarella, Inc.

Ambarella suffers deeper profitability issues, with ROE at -20.86% and net margin of -41.12%, reflecting significant losses. Its valuation appears stretched, marked by a high P/B of 5.64 despite a favorable negative P/E of -27.05. Ambarella also forgoes dividends, channeling capital into intensive R&D and product development.

Valuation Discipline vs. Profitability Struggles

Mobileye balances a more attractive valuation against moderate profitability risks, while Ambarella faces severe losses with a less supportive valuation. Investors prioritizing valuation discipline may find Mobileye’s profile more aligned with risk management, whereas Ambarella suits those focused on aggressive growth despite financial headwinds.

Which one offers the Superior Shareholder Reward?

I see Mobileye (MBLY) and Ambarella (AMBA) both skip dividends, focusing on reinvestment and buybacks. MBLY’s payout ratio is zero, with no dividends paid, mirroring AMBA’s approach. MBLY’s free cash flow per share is $0.64, higher than AMBA’s $0.57, signaling stronger cash generation. MBLY maintains a robust buyback program, enhancing shareholder value sustainably, while AMBA’s capital allocation appears less efficient, with weaker operating cash flow coverage at 0.28 versus MBLY’s 1.48. MBLY’s strategic reinvestment and disciplined buybacks offer a more sustainable total return profile in 2026. I consider Mobileye the superior choice for shareholder reward.

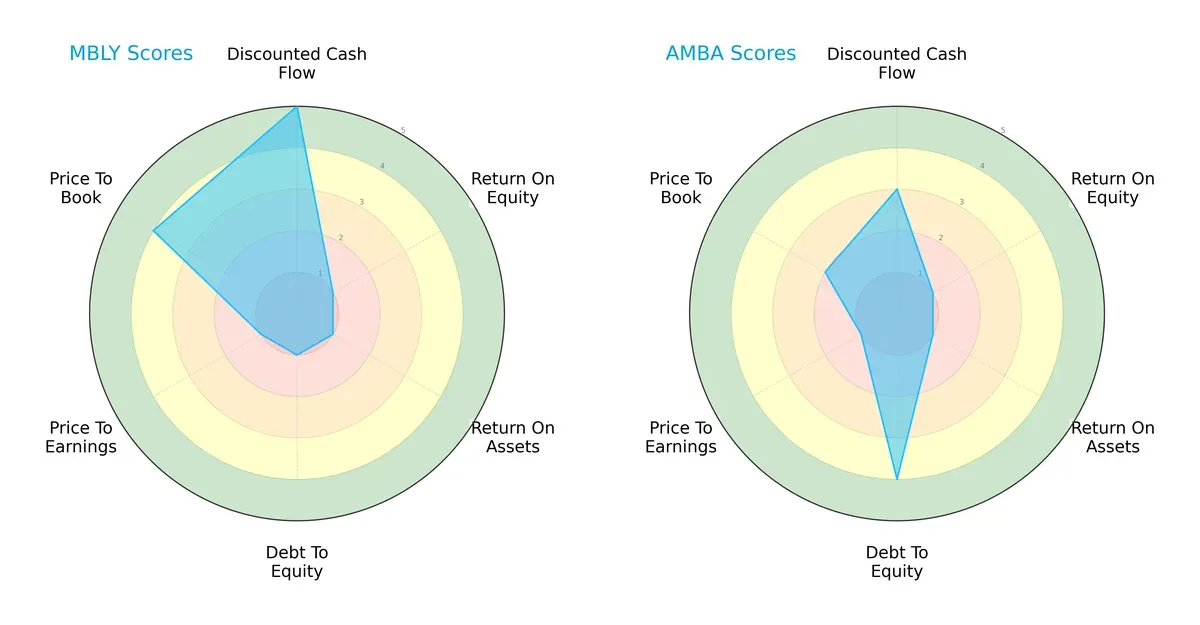

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Mobileye Global Inc. and Ambarella, Inc., highlighting their financial strengths and vulnerabilities:

Mobileye leads with a very favorable discounted cash flow score (5 vs. 3), signaling stronger future cash flow expectations. Ambarella holds the edge in debt-to-equity (4 vs. 1), reflecting a more conservative capital structure. Both firms struggle with returns (ROE and ROA scores at 1), indicating operational challenges. Mobileye’s favorable price-to-book ratio (4 vs. 2) suggests better market valuation balance, while Ambarella’s valuation metrics remain moderate to unfavorable. Overall, Mobileye offers a more nuanced profile driven by valuation and cash flow, whereas Ambarella relies heavily on its financial leverage advantage.

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score delta between Mobileye (7.42) and Ambarella (10.14) confirms both firms reside well within the safe zone, signaling robust solvency and low bankruptcy risk in this cycle:

Financial Health: Quality of Operations

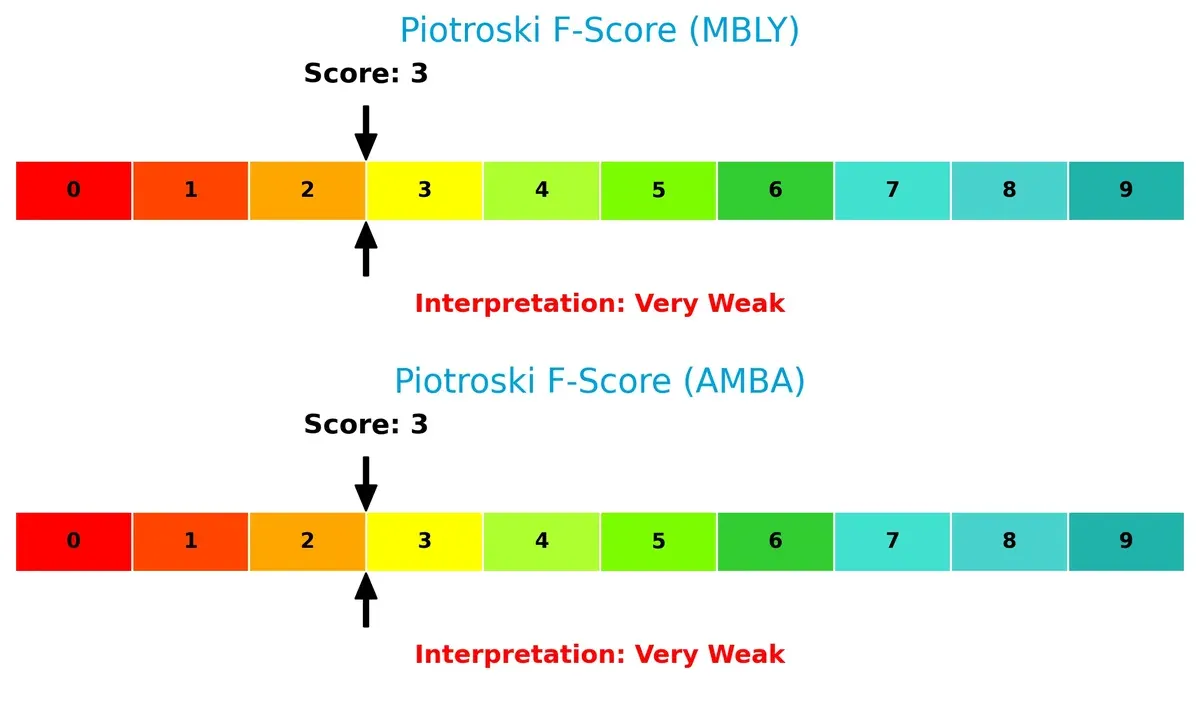

Both Mobileye and Ambarella score a weak 3 on the Piotroski F-Score, flagging concerns about their internal financial health and operational efficiency relative to industry expectations. This low score warns investors of potential red flags in profitability, liquidity, or leverage metrics that merit close monitoring:

How are the two companies positioned?

This section dissects the operational DNA of Mobileye and Ambarella by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats and identify which business model delivers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Mobileye Global Inc. and Ambarella, Inc. diversify their income streams and reveals their primary sector bets:

Mobileye relies heavily on its Mobileye segment, generating $1.61B in 2024 and anchoring its revenue mix. The other segments contribute only $41M, indicating high concentration risk. Ambarella lacks available data, preventing a direct comparison. Mobileye’s dominance in one segment signals a strong ecosystem lock-in but raises vulnerability to shifts in that market. Diversification remains a key area for strategic expansion.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Mobileye Global Inc. and Ambarella, Inc.:

Mobileye Strengths

- Strong global presence with diversified revenues across US, China, Europe, Korea

- Favorable fixed asset turnover at 4.0 indicating efficient asset use

- Low debt levels with zero debt-to-assets ratio

- Favorable price-to-earnings and price-to-book ratios imply market confidence

Ambarella Strengths

- Favorable current and quick ratios reflect good liquidity

- Very high fixed asset turnover at 19.96 shows excellent asset efficiency

- Low but positive debt-to-assets ratio supports prudent leverage

- Favorable price-to-earnings ratio despite challenges

Mobileye Weaknesses

- Negative profitability with net margin -20.7% and negative ROE and ROIC

- Extremely high current ratio (6.1) indicates inefficient asset management

- Zero interest coverage raises solvency concerns

- Declining revenues in key markets like China and US from 2023 to 2024

Ambarella Weaknesses

- Deeply negative profitability with net margin -41.12% and ROIC -21.96%

- Unfavorable weighted average cost of capital at 12.99% increases capital costs

- High price-to-book ratio at 5.64 suggests possible overvaluation risk

- Negative interest coverage and unfavorable asset turnover hint at operational issues

Overall, Mobileye shows strengths in global diversification and asset management but struggles with profitability and working capital efficiency. Ambarella faces deeper profitability and capital cost challenges despite strong liquidity and asset turnover. Both companies must address operational inefficiencies to improve financial health and support strategic growth.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competition erosion:

Mobileye Global Inc.: Advanced Driver Assistance Network Effects

Mobileye leverages network effects through vast data from millions of vehicles, stabilizing gross margins near 48%. Yet, its declining ROIC signals looming pressure on profitability by 2026.

Ambarella, Inc.: Semiconductor Integration Cost Advantage

Ambarella’s moat stems from its integrated AI video processing chips, delivering a superior 60.5% gross margin. However, a steeper ROIC decline warns of value erosion despite revenue growth potential in automotive and industrial segments.

Verdict: Network Effects vs. Cost-Driven Innovation

Both firms face deteriorating ROIC, but Mobileye’s extensive data-driven ecosystem creates a wider moat than Ambarella’s cost advantage. Mobileye is better positioned to defend market share through scalable intelligence integration.

Which stock offers better returns?

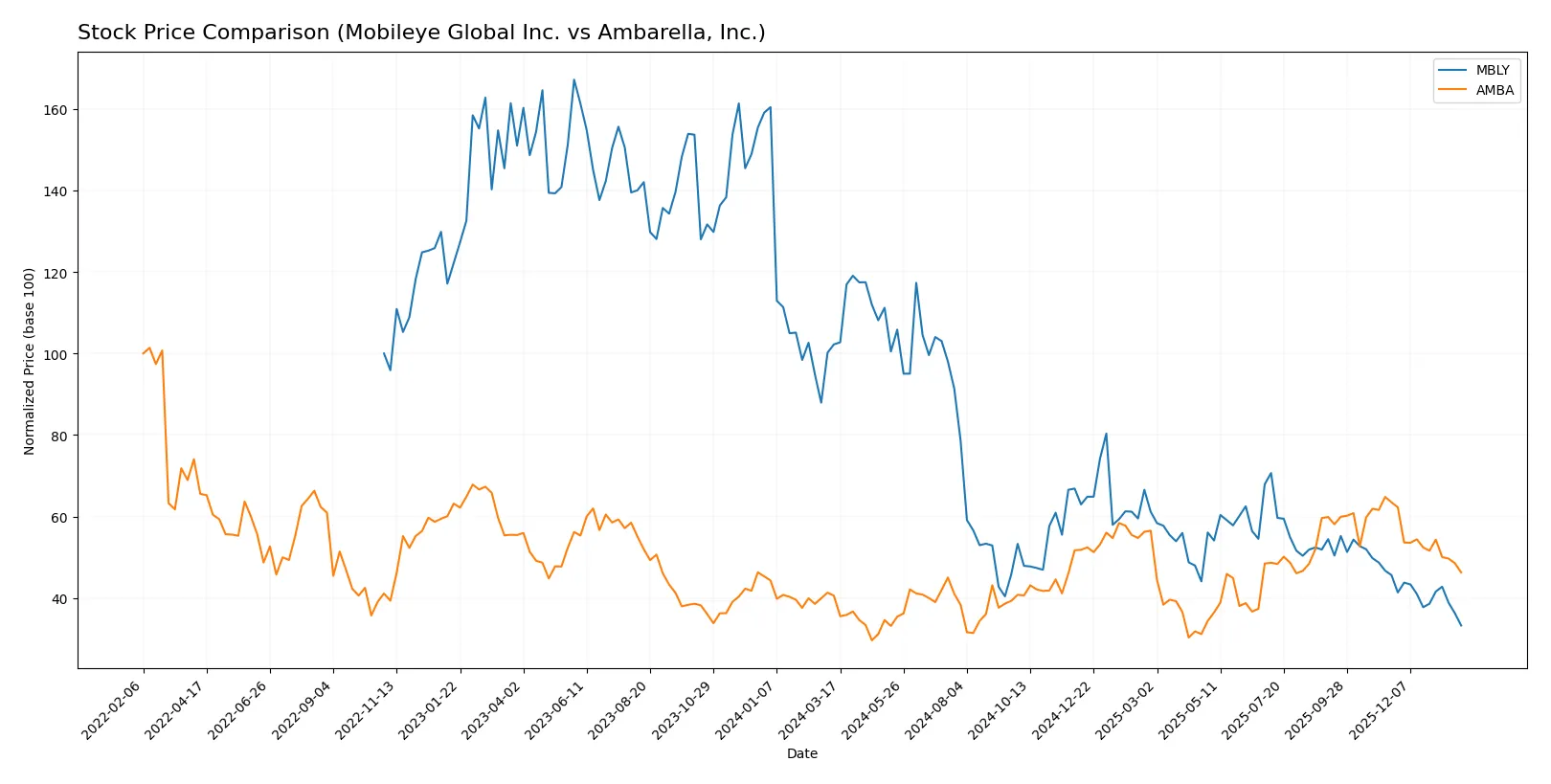

The stock prices of Mobileye Global Inc. and Ambarella, Inc. show contrasting dynamics over the past year, with Mobileye experiencing a sharp decline and Ambarella demonstrating moderate gains before recent weakening.

Trend Comparison

Mobileye Global Inc.’s stock fell 67.46% over the past 12 months, marking a bearish trend with decelerating losses and a volatility measure of 6.13. The price peaked at 32.15 and bottomed at 8.98.

Ambarella, Inc. posted a 14.09% gain over the same period, reflecting a bullish but decelerating trend. Its volatility was higher at 12.79, with prices ranging between 40.99 and 89.67.

Both stocks declined sharply in recent months, but Ambarella’s positive full-year return outperformed Mobileye’s significant loss, delivering stronger market performance overall.

Target Prices

Analysts present a cautious to optimistic outlook across Mobileye Global Inc. and Ambarella, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Mobileye Global Inc. | 11 | 28 | 16.71 |

| Ambarella, Inc. | 80 | 115 | 97.5 |

Mobileye’s consensus target sits nearly double its current $8.98 price, signaling potential upside amid emerging ADAS growth. Ambarella’s $97.5 target exceeds its $64.04 share price by over 50%, reflecting strong confidence in its semiconductor innovation.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here is a summary of recent grades given by recognized financial institutions for both companies:

Mobileye Global Inc. Grades

The table below shows the latest grades issued by established grading companies for Mobileye Global Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Tigress Financial | Maintain | Buy | 2026-01-29 |

| RBC Capital | Maintain | Sector Perform | 2026-01-23 |

| Needham | Maintain | Buy | 2026-01-23 |

| UBS | Maintain | Neutral | 2026-01-23 |

| Canaccord Genuity | Maintain | Buy | 2026-01-23 |

| Morgan Stanley | Maintain | Equal Weight | 2026-01-23 |

| Wells Fargo | Maintain | Overweight | 2026-01-23 |

| HSBC | Downgrade | Hold | 2026-01-23 |

| UBS | Maintain | Neutral | 2026-01-14 |

| Wolfe Research | Downgrade | Peer Perform | 2026-01-12 |

Ambarella, Inc. Grades

Below is a list of recent ratings by reliable grading firms for Ambarella, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | Maintain | Buy | 2025-11-26 |

| Needham | Maintain | Buy | 2025-11-26 |

| B of A Securities | Maintain | Neutral | 2025-11-26 |

| Rosenblatt | Maintain | Buy | 2025-11-26 |

| Rosenblatt | Maintain | Buy | 2025-11-24 |

| Oppenheimer | Maintain | Perform | 2025-08-29 |

| B of A Securities | Maintain | Neutral | 2025-08-29 |

| Needham | Maintain | Buy | 2025-08-29 |

| Rosenblatt | Maintain | Buy | 2025-08-29 |

| Morgan Stanley | Maintain | Overweight | 2025-08-29 |

Which company has the best grades?

Mobileye Global Inc. exhibits a broader range of grades, mostly Buy and Neutral with a few downgrades. Ambarella, Inc. consistently receives Buy and Neutral ratings with no recent downgrades. Ambarella’s steadier positive outlook may signal lower analyst uncertainty and more stable investor sentiment.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing Mobileye Global Inc. and Ambarella, Inc. in the 2026 market environment:

1. Market & Competition

Mobileye Global Inc.

- Dominates ADAS and autonomous driving, but faces fierce competition in automotive tech.

Ambarella, Inc.

- Operates in semiconductors with diverse video processing products, encountering intense rivalry and rapid innovation.

2. Capital Structure & Debt

Mobileye Global Inc.

- Zero debt position, strong balance sheet, but low interest coverage flags risk in earnings sustainability.

Ambarella, Inc.

- Minimal debt, solid current ratios, but interest coverage remains zero, raising caution on operational profits.

3. Stock Volatility

Mobileye Global Inc.

- Low beta (0.56) suggests lower volatility and defensive stance amid market swings.

Ambarella, Inc.

- High beta (1.95) indicates significant stock price swings, raising risk for investors.

4. Regulatory & Legal

Mobileye Global Inc.

- Exposure to evolving automotive safety regulations globally could increase compliance costs.

Ambarella, Inc.

- Semiconductor industry faces regulatory scrutiny on exports and technology controls, impacting growth.

5. Supply Chain & Operations

Mobileye Global Inc.

- Relies heavily on global semiconductor supply chains, vulnerable to disruptions and geopolitical tensions.

Ambarella, Inc.

- Semiconductor manufacturing and component sourcing remain exposed to operational bottlenecks and cost inflation.

6. ESG & Climate Transition

Mobileye Global Inc.

- Automotive focus aligns with green mobility trends but must accelerate ESG disclosures and carbon footprint management.

Ambarella, Inc.

- Faces pressure to improve sustainability metrics in semiconductor production and supply chain.

7. Geopolitical Exposure

Mobileye Global Inc.

- Headquartered in Israel, geopolitical tensions pose operational and market risks.

Ambarella, Inc.

- Based in the U.S., benefits from stable environment but exposed to trade tensions affecting semiconductor exports.

Which company shows a better risk-adjusted profile?

Mobileye’s largest risk lies in market competition and regulatory compliance in a fast-evolving automotive sector. Ambarella faces high stock volatility and weaker profitability amid semiconductor industry pressures. Mobileye’s low beta and zero debt underpin a more conservative risk profile. Ambarella’s higher operating leverage and geopolitical trade risks create greater uncertainty. The recent sharp disparity in net margins (Mobileye at -20.7%, Ambarella at -41.1%) underscores Ambarella’s elevated financial risk. Overall, Mobileye shows a better risk-adjusted profile thanks to stronger balance sheet stability and lower market volatility.

Final Verdict: Which stock to choose?

Mobileye Global Inc. (MBLY) stands out as a cash flow generator with robust free cash flow to equity and a strong liquidity cushion. Its core strength is in operational efficiency, driven by focused R&D investment. The main point of vigilance remains its persistent value destruction and declining returns on capital. It suits aggressive growth portfolios willing to tolerate volatility for future innovation payoff.

Ambarella, Inc. (AMBA) offers a strategic moat through its specialized video processing technology, supporting recurring revenue streams. Its comparatively stronger balance sheet and conservative leverage provide a safer profile amid industry turbulence. AMBA fits well in Growth at a Reasonable Price (GARP) portfolios seeking moderate risk with exposure to niche tech markets.

If you prioritize dynamic cash generation and breakthrough R&D momentum, Mobileye outshines due to its operational cash conversion strength despite current profitability challenges. However, if you seek better financial stability and a defensible market niche, Ambarella offers superior risk control and strategic positioning. Both companies carry notable risks tied to profitability and capital efficiency, requiring careful investor alignment with risk tolerance.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Mobileye Global Inc. and Ambarella, Inc. to enhance your investment decisions: