Mettler-Toledo International Inc. (MTD) and RadNet, Inc. (RDNT) both operate in the medical diagnostics and research sector, yet their approaches differ significantly. MTD focuses on manufacturing precision instruments and analytical solutions, while RadNet specializes in outpatient diagnostic imaging services and AI-driven technologies. Comparing these companies reveals insights into innovation strategies and market positioning, helping investors identify which stock offers the most compelling growth potential. Let’s explore which company stands out for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Mettler-Toledo International Inc. and RadNet, Inc. by providing an overview of these two companies and their main differences.

Mettler-Toledo International Inc. Overview

Mettler-Toledo International Inc. operates globally in the medical diagnostics and research industry, specializing in precision instruments and services. The company’s portfolio includes laboratory instruments, industrial weighing solutions, and retail weighing technologies. Serving diverse sectors such as life sciences, food and beverage, and transportation, Mettler-Toledo maintains a strong market presence with 16,000 employees and a $30.3B market cap.

RadNet, Inc. Overview

RadNet, Inc. provides outpatient diagnostic imaging services across the United States, offering a range of modalities including MRI, CT, and mammography. The company also develops specialized computerized systems and AI solutions to support diagnostic imaging. Headquartered in Los Angeles, RadNet operates 347 centers and employs 11,000 staff, with a market capitalization of $6.0B, focusing on enhancing radiology through technology.

Key similarities and differences

Both companies operate in the healthcare sector, specifically within medical diagnostics and research, but their business models differ significantly. Mettler-Toledo focuses on manufacturing precision instruments and software for various industries, while RadNet delivers outpatient imaging services and diagnostic technology solutions. Mettler-Toledo’s global footprint contrasts with RadNet’s US-centric service network, highlighting differing operational scales and market approaches.

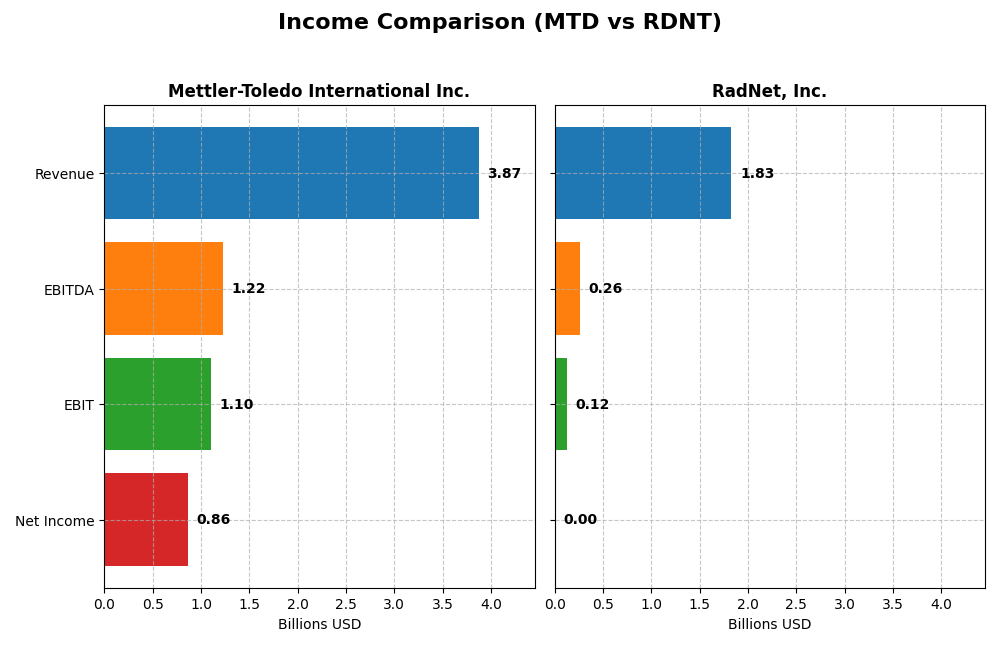

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for Mettler-Toledo International Inc. and RadNet, Inc. for the fiscal year 2024.

| Metric | Mettler-Toledo International Inc. | RadNet, Inc. |

|---|---|---|

| Market Cap | 30.3B USD | 6.0B USD |

| Revenue | 3.87B USD | 1.83B USD |

| EBITDA | 1.22B USD | 263M USD |

| EBIT | 1.10B USD | 125M USD |

| Net Income | 863M USD | 2.79M USD |

| EPS | 40.67 USD | 0.038 USD |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Mettler-Toledo International Inc.

Mettler-Toledo shows steady revenue growth from 2020 to 2024, increasing from $3.1B to $3.87B, with net income rising from $603M to $863M. Margins remain strong and mostly stable, with a gross margin of 58.17% and net margin of 22.29% in 2024. The latest year saw slower revenue growth (2.22%) but improved net margin and EPS growth, reflecting operational efficiency.

RadNet, Inc.

RadNet’s revenue grew significantly from $1.07B in 2020 to $1.83B in 2024, with net income turning positive and rising to $2.8M in 2024 from a loss in 2020. Margins are lower and more volatile, with a 13.62% gross margin and a very slim net margin of 0.15% in 2024. The most recent year showed strong revenue and EBIT growth but declining net margin and EPS, indicating margin pressures.

Which one has the stronger fundamentals?

Mettler-Toledo exhibits consistently higher and more stable margins, with favorable net income and EPS growth over the period, despite a slight slowdown in revenue growth recently. RadNet shows robust revenue expansion and net income improvements but struggles with very thin margins and negative EPS growth in the latest year. Overall, Mettler-Toledo’s fundamentals appear stronger and more resilient.

Financial Ratios Comparison

This table presents the most recent key financial ratios for Mettler-Toledo International Inc. (MTD) and RadNet, Inc. (RDNT) as of fiscal year 2024, enabling a clear side-by-side comparison.

| Ratios | Mettler-Toledo International Inc. (MTD) | RadNet, Inc. (RDNT) |

|---|---|---|

| ROE | -6.80% | 0.31% |

| ROIC | 41.06% | 3.14% |

| P/E | 30.09 | 1826.32 |

| P/B | -204.66 | 5.65 |

| Current Ratio | 1.02 | 2.12 |

| Quick Ratio | 0.73 | 2.12 |

| D/E (Debt-to-Equity) | -16.79 | 1.92 |

| Debt-to-Assets | 65.77% | 52.60% |

| Interest Coverage | 15.10 | 1.31 |

| Asset Turnover | 1.20 | 0.56 |

| Fixed Asset Turnover | 5.03 | 1.37 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

Mettler-Toledo International Inc.

Mettler-Toledo shows a mixed ratio profile with favorable net margin (22.29%), ROIC (41.06%), and asset turnover, but an unfavorable ROE (-680.23%) and PE ratio (30.09). The debt-to-equity is strong, while debt-to-assets and quick ratio present concerns. The company does not pay dividends, focusing on reinvestment and operational efficiency.

RadNet, Inc.

RadNet’s ratios largely appear weak, with unfavorable net margin (0.15%), ROE (0.31%), and ROIC (3.14%). Liquidity ratios are favorable, but high debt-to-equity (1.92), debt-to-assets (52.6%), and low interest coverage (1.56) indicate financial strain. RadNet does not distribute dividends, likely prioritizing growth and managing debt challenges.

Which one has the best ratios?

Mettler-Toledo’s ratios are slightly favorable overall, showing stronger profitability and capital efficiency despite some leverage concerns. RadNet’s profile is more unfavorable, with weaker profitability and financial health metrics. Thus, Mettler-Toledo demonstrates a more robust ratio set compared to RadNet.

Strategic Positioning

This section compares the strategic positioning of Mettler-Toledo International Inc. (MTD) and RadNet, Inc. (RDNT) including market position, key segments, and exposure to technological disruption:

Mettler-Toledo International Inc.

- Large market cap near 30B with moderate competitive pressure in medical diagnostics.

- Diverse segments: industrial, laboratory, and retail products driving growth and revenue stability.

- Exposure focused on precision instruments and analytical technologies with indirect digital integration.

RadNet, Inc.

- Smaller market cap about 6B with notable competitive pressure in outpatient imaging services.

- Concentrated on outpatient diagnostic imaging and related AI software enhancing radiology services.

- Direct exposure to AI suites for image interpretation and computerized diagnostic imaging systems.

Mettler-Toledo International Inc. vs RadNet, Inc. Positioning

MTD pursues a diversified approach across multiple product lines and geographies, offering industrial and laboratory instruments. RDNT concentrates on outpatient imaging services and AI diagnostic software, reflecting a narrower but tech-driven focus. Diversification supports MTD’s stability, while RDNT’s specialization targets innovation in diagnostics.

Which has the best competitive advantage?

MTD holds a very favorable economic moat with strong value creation and growing ROIC, indicating durable competitive advantages. RDNT’s moat is slightly unfavorable despite growing profitability, suggesting weaker sustainable competitive advantage.

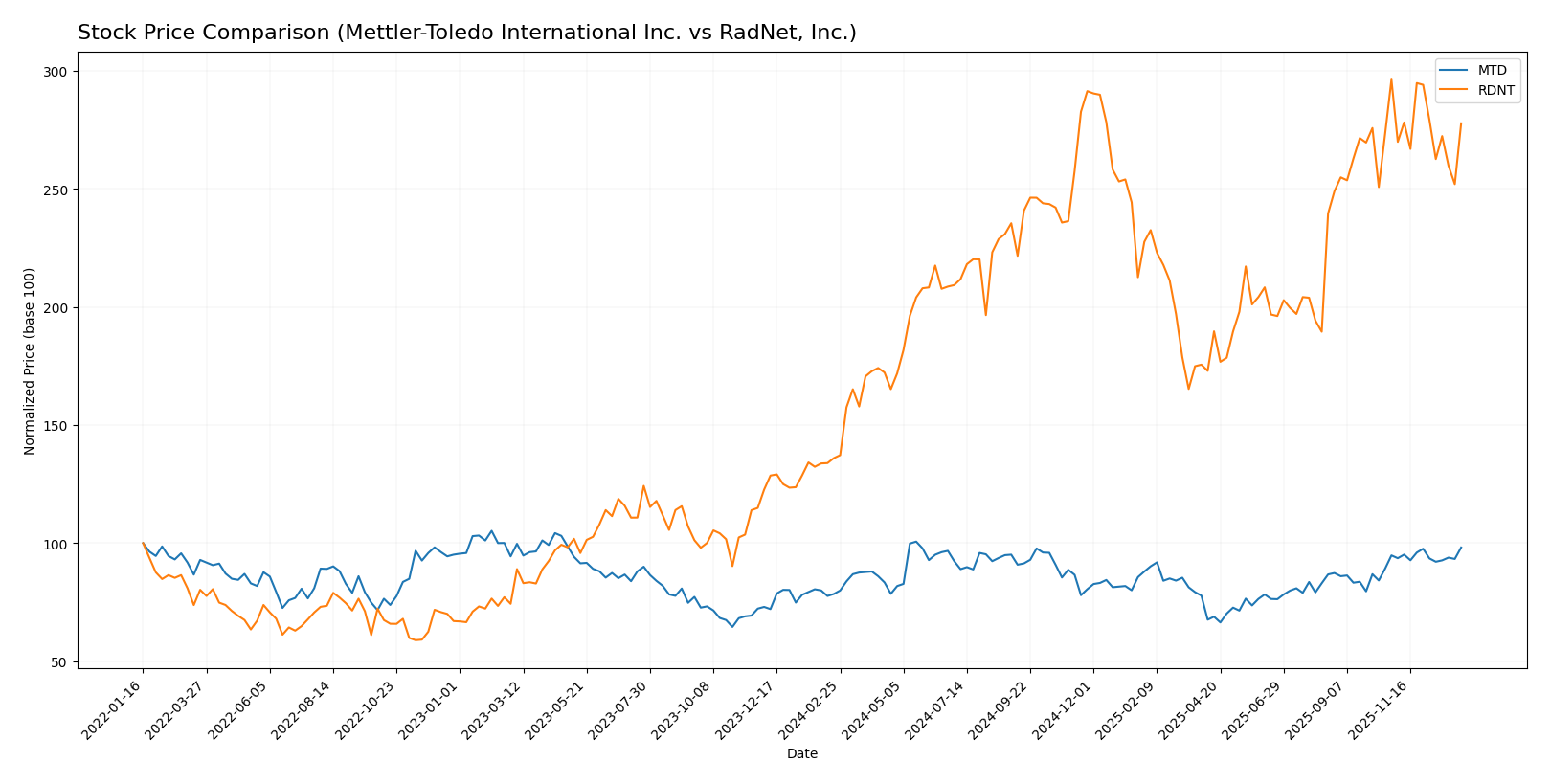

Stock Comparison

The stock price chart over the past year illustrates significant bullish momentum for both Mettler-Toledo International Inc. (MTD) and RadNet, Inc. (RDNT), with notable differences in acceleration and volatility patterns shaping their trading dynamics.

Trend Analysis

Mettler-Toledo International Inc. (MTD) showed a 25.07% price increase over the past 12 months, indicating a bullish trend with accelerating momentum and high volatility, reaching a peak price of 1522.75 and a low of 1004.96.

RadNet, Inc. (RDNT) experienced a 104.23% price increase over the same period, also bullish but with decelerating momentum and lower volatility, achieving a high of 83.41 and a low of 38.29.

Comparing the two, RDNT delivered the highest market performance during the analyzed year, outperforming MTD in overall price appreciation despite recent downward pressure.

Target Prices

The current analyst consensus indicates optimistic target prices for both Mettler-Toledo International Inc. and RadNet, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Mettler-Toledo International Inc. | 1600 | 1400 | 1504.17 |

| RadNet, Inc. | 95 | 90 | 92.25 |

Analysts expect Mettler-Toledo’s stock price to slightly appreciate from its current 1485.12 USD, while RadNet shows a target consensus well above its present 78.2 USD, indicating potential upside for both stocks.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Mettler-Toledo International Inc. and RadNet, Inc.:

Rating Comparison

MTD Rating

- Rating: C+ indicating a very favorable status.

- Discounted Cash Flow Score: 3, moderate valuation.

- ROE Score: 1, very unfavorable efficiency.

- ROA Score: 5, very favorable asset utilization.

- Debt To Equity Score: 1, very unfavorable risk.

- Overall Score: 2, moderate financial standing.

RDNT Rating

- Rating: D+ indicating a very favorable status.

- Discounted Cash Flow Score: 1, very unfavorable.

- ROE Score: 1, very unfavorable efficiency.

- ROA Score: 1, very unfavorable asset utilization.

- Debt To Equity Score: 1, very unfavorable risk.

- Overall Score: 1, very unfavorable standing.

Which one is the best rated?

Based on the provided data, MTD holds a higher overall rating (C+) and better scores in discounted cash flow and return on assets compared to RDNT’s lower ratings and consistently unfavorable financial scores.

Scores Comparison

Here is the comparison of the Altman Z-Score and Piotroski Score for both companies:

MTD Scores

- Altman Z-Score: 6.88, indicating a safe financial zone and low bankruptcy risk.

- Piotroski Score: 8, reflecting very strong financial health and value potential.

RDNT Scores

- Altman Z-Score: 2.16, in a grey zone with moderate bankruptcy risk.

- Piotroski Score: 2, indicating very weak financial strength and investment quality.

Which company has the best scores?

MTD shows stronger financial stability with a high Altman Z-Score in the safe zone and a very strong Piotroski Score. RDNT’s scores suggest higher risk and weaker financial health based on the provided data.

Grades Comparison

Here is a comparison of the latest grades issued by reputable grading companies for Mettler-Toledo International Inc. and RadNet, Inc.:

Mettler-Toledo International Inc. Grades

This table summarizes recent grades and actions from major grading firms for Mettler-Toledo International Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2025-12-15 |

| Barclays | Maintain | Overweight | 2025-12-15 |

| Citigroup | Maintain | Buy | 2025-11-10 |

| Barclays | Maintain | Overweight | 2025-11-10 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-10 |

| Stifel | Maintain | Buy | 2025-11-10 |

| JP Morgan | Maintain | Neutral | 2025-10-09 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-07 |

| Barclays | Maintain | Overweight | 2025-10-02 |

| B of A Securities | Maintain | Neutral | 2025-09-22 |

Overall, Mettler-Toledo’s grades indicate a stable outlook, with a mix of Buy, Overweight, and Neutral ratings maintained by various firms.

RadNet, Inc. Grades

This table presents the recent grades and actions by recognized grading companies for RadNet, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B. Riley Securities | Maintain | Buy | 2025-12-01 |

| Barclays | Maintain | Overweight | 2025-11-13 |

| Truist Securities | Maintain | Buy | 2025-11-12 |

| Truist Securities | Maintain | Buy | 2025-09-03 |

| Barclays | Maintain | Overweight | 2025-09-03 |

| Raymond James | Maintain | Strong Buy | 2025-08-13 |

| Truist Securities | Maintain | Buy | 2025-04-11 |

| Barclays | Maintain | Overweight | 2025-03-24 |

| Raymond James | Upgrade | Strong Buy | 2025-03-05 |

| Barclays | Maintain | Overweight | 2025-01-22 |

RadNet’s grades show a generally positive and improving trend, with multiple Buy and Overweight ratings, including upgrades to Strong Buy by Raymond James.

Which company has the best grades?

RadNet, Inc. has received stronger grades overall, including several Strong Buy ratings and upgrades, compared to Mettler-Toledo’s more cautious Hold and Equal Weight consensus. This suggests RadNet may be viewed more favorably by analysts, potentially impacting investor confidence and portfolio positioning.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Mettler-Toledo International Inc. (MTD) and RadNet, Inc. (RDNT) based on their recent financial performance, market position, and operational metrics.

| Criterion | Mettler-Toledo International Inc. (MTD) | RadNet, Inc. (RDNT) |

|---|---|---|

| Diversification | Strong product diversification across industrial (1.49B), laboratory (2.19B), and retail (196M) segments | Moderate diversification mainly in healthcare services and insurance segments |

| Profitability | High profitability with 22.3% net margin, ROIC 41.1%, creating strong value | Very low net margin (0.15%), ROIC 3.14%, currently destroying value |

| Innovation | Demonstrates durable competitive advantage with growing ROIC, supporting innovation and growth | Profitability improving but still unfavorable; innovation impact unclear |

| Global presence | Established global footprint with diversified industrial and lab equipment markets | Primarily US-focused healthcare services, limiting global reach |

| Market Share | Leading player in precision instruments with consistent revenue growth | Competing in fragmented healthcare imaging market with smaller market share |

Key takeaways: Mettler-Toledo exhibits robust financial health, strong diversification, and a durable moat with high returns and innovation capability. RadNet shows improving profitability but remains challenged by low margins, limited diversification, and less global exposure, signaling higher risk for investors.

Risk Analysis

Below is a comparative table outlining key risks for Mettler-Toledo International Inc. (MTD) and RadNet, Inc. (RDNT) based on the latest financial and operational data from 2024.

| Metric | Mettler-Toledo International Inc. (MTD) | RadNet, Inc. (RDNT) |

|---|---|---|

| Market Risk | Beta 1.42 indicates moderate volatility | Beta 1.51 indicates higher volatility |

| Debt level | Debt-to-assets 65.8% (unfavorable) | Debt-to-assets 52.6% (unfavorable) |

| Regulatory Risk | Moderate, due to healthcare sector | Moderate, outpatient imaging services subject to healthcare regulations |

| Operational Risk | Low, strong operational metrics | Moderate, lower asset turnover and efficiency |

| Environmental Risk | Low, precision instrument manufacturing | Moderate, imaging centers’ energy and compliance impact |

| Geopolitical Risk | Low, global diversified operations | Low, primarily US-focused operations |

The most impactful risks involve Mettler-Toledo’s relatively high debt-to-assets ratio and RadNet’s operational inefficiencies combined with high debt levels. RadNet’s financial fragility is underscored by its weak Altman Z-score (grey zone) and low Piotroski score, signaling heightened bankruptcy risk compared to Mettler-Toledo’s safer financial position. Investors should carefully monitor debt management and operational improvements in both companies to mitigate downside risk.

Which Stock to Choose?

Mettler-Toledo International Inc. (MTD) shows a favorable income statement with strong gross and net margins, positive revenue and earnings growth, and a very favorable economic moat indicating durable competitive advantage. Its financial ratios are slightly favorable overall, with strengths in asset turnover and interest coverage despite some unfavorable measures like return on equity and debt ratios. The company holds a very favorable rating with moderate overall scores and demonstrates financial stability supported by a safe zone Altman Z-Score and a very strong Piotroski Score.

RadNet, Inc. (RDNT) presents a favorable income growth trend but with weaker profitability margins and a less efficient use of capital. Its financial ratios are predominantly unfavorable, including low returns, high debt levels, and poor interest coverage. The company’s economic moat is slightly unfavorable, suggesting value destruction despite improving profitability. RDNT’s rating is very unfavorable with weak financial scores, and its Altman Z-Score places it in the grey zone with a very weak Piotroski Score indicating financial fragility.

Investors focused on stable profitability and durable competitive advantages might find Mettler-Toledo’s profile more favorable, while those with a tolerance for higher risk and interest in growth potential could view RadNet’s improving metrics and recent revenue gains as a sign of possible future upside. The choice could depend on balancing preference for financial strength against appetite for growth opportunities.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Mettler-Toledo International Inc. and RadNet, Inc. to enhance your investment decisions: