Home > Comparison > Technology > MSFT vs GDDY

The strategic rivalry between Microsoft Corporation and GoDaddy Inc. shapes the dynamics of the software infrastructure sector. Microsoft operates as a diversified technology behemoth with a cloud and productivity focus. GoDaddy specializes in cloud-based services for digital identity and small businesses, emphasizing web hosting and online marketing. This analysis explores their contrasting growth models to identify which company offers a superior risk-adjusted return for diversified portfolios.

Table of contents

Companies Overview

Microsoft Corporation and GoDaddy Inc. both hold pivotal roles in the software infrastructure sector, shaping digital ecosystems in distinct ways.

Microsoft Corporation: Global Software Infrastructure Powerhouse

Microsoft dominates the software infrastructure market through diverse segments: Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. It generates revenue by licensing software like Office 365 and Azure cloud services. In 2026, Microsoft focuses on expanding its cloud platform and AI-driven enterprise solutions to deepen market penetration and enhance ecosystem integration.

GoDaddy Inc.: Digital Identity and Web Services Leader

GoDaddy specializes in cloud-based technology products centered on domain registration and website hosting. Its core revenue comes from hosting services, marketing tools, and security products tailored for small businesses and individuals. In 2026, GoDaddy emphasizes improving its managed hosting and e-commerce solutions to capture growing demand for online business presence and digital marketing.

Strategic Collision: Similarities & Divergences

Both companies operate in software infrastructure but diverge in scale and focus. Microsoft pursues a broad enterprise ecosystem with cloud and productivity software, while GoDaddy targets entrepreneurs and SMBs with domain and hosting services. Their primary battleground lies in cloud offerings and customer engagement tools. Microsoft’s vast market position contrasts with GoDaddy’s niche specialization, defining distinct risk and growth profiles.

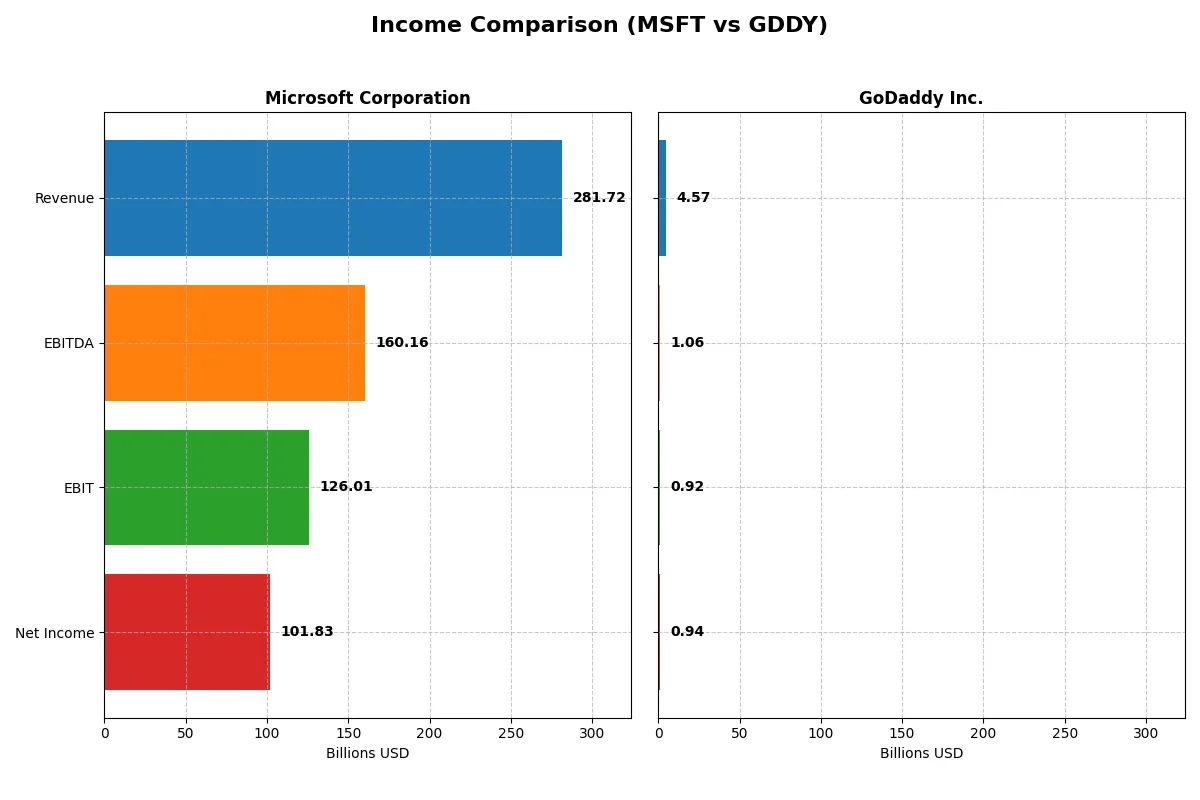

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Microsoft Corporation (MSFT) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Revenue | 282B | 4.57B |

| Cost of Revenue | 87.8B | 1.65B |

| Operating Expenses | 65.4B | 2.03B |

| Gross Profit | 194B | 2.92B |

| EBITDA | 160B | 1.06B |

| EBIT | 126B | 924M |

| Interest Expense | 2.39B | 158M |

| Net Income | 102B | 937M |

| EPS | 13.7 | 6.63 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals how efficiently Microsoft and GoDaddy convert revenue into profits and sustain margin strength.

Microsoft Corporation Analysis

Microsoft’s revenue soared from 168B in 2021 to 282B in 2025, driving net income from 61B to 102B. Gross margin remains robust at 68.8%, while net margin holds a strong 36.2%. In 2025, Microsoft sustained efficient expense control, growing EBIT by nearly 14%, underscoring solid operational momentum.

GoDaddy Inc. Analysis

GoDaddy’s revenue expanded moderately from 3.3B in 2020 to 4.6B in 2024, with net income rising impressively from -495M to 937M. The company maintains a healthy gross margin of 63.9% and a net margin near 20.5%. Despite a recent EPS drop, 2024 saw strong EBIT growth of 58%, signaling improving operating efficiency.

Margin Dominance vs. Growth Resilience

Microsoft clearly leads with superior scale and margin dominance, delivering consistent profitability and margin stability above industry averages. GoDaddy excels in rapid earnings recovery and strong EBIT growth but operates with thinner margins. Investors favor Microsoft’s blend of size and margin strength, while GoDaddy appeals to those seeking high-growth turnaround potential.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Microsoft Corporation (MSFT) | GoDaddy Inc. (GDDY) |

|---|---|---|

| ROE | 29.6% | 135.4% |

| ROIC | 22.0% | 16.0% |

| P/E | 36.3 | 29.8 |

| P/B | 10.8 | 40.3 |

| Current Ratio | 1.35 | 0.72 |

| Quick Ratio | 1.35 | 0.72 |

| D/E | 0.18 | 5.63 |

| Debt-to-Assets | 9.8% | 47.3% |

| Interest Coverage | 53.9 | 5.64 |

| Asset Turnover | 0.46 | 0.56 |

| Fixed Asset Turnover | 1.23 | 22.22 |

| Payout ratio | 23.6% | 0% |

| Dividend yield | 0.65% | 0% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, unveiling hidden risks and operational strengths essential for informed investing.

Microsoft Corporation

Microsoft exhibits strong profitability with a 29.65% ROE and a robust 36.15% net margin, signaling operational excellence. However, its valuation appears stretched, with a high P/E of 36.31 and P/B of 10.76. The company maintains prudent capital allocation, returning value via modest dividends and reinvesting heavily in R&D for sustained growth.

GoDaddy Inc.

GoDaddy shows an exceptional 135.37% ROE and a healthy 20.49% net margin, indicating efficient use of equity. Despite a lower P/E of 29.76, its P/B ratio is notably high at 40.28, suggesting valuation concerns. The firm carries heavy debt (D/E 5.63) and no dividend, focusing on growth investments and managing operational leverage cautiously.

Premium Valuation vs. Growth Leverage

Microsoft balances strong profitability with a premium valuation and moderate leverage, offering stability and steady returns. GoDaddy’s high ROE contrasts with financial risk from high debt and weak liquidity. Investors seeking operational safety may prefer Microsoft, while those favoring aggressive growth might consider GoDaddy’s riskier profile.

Which one offers the Superior Shareholder Reward?

I observe Microsoft pays a consistent dividend with a 0.65% yield and a sustainable 24% payout ratio, supported by robust free cash flow of $9.6B. GoDaddy offers no dividends, reinvesting nearly all free cash flow ($8.9B) into growth. Microsoft also executes sizable buybacks, driving total shareholder returns. GoDaddy’s heavy debt (debt-to-equity above 5) and weak current ratio (0.72) raise red flags on distribution sustainability. I conclude Microsoft offers the superior, more reliable shareholder reward in 2026.

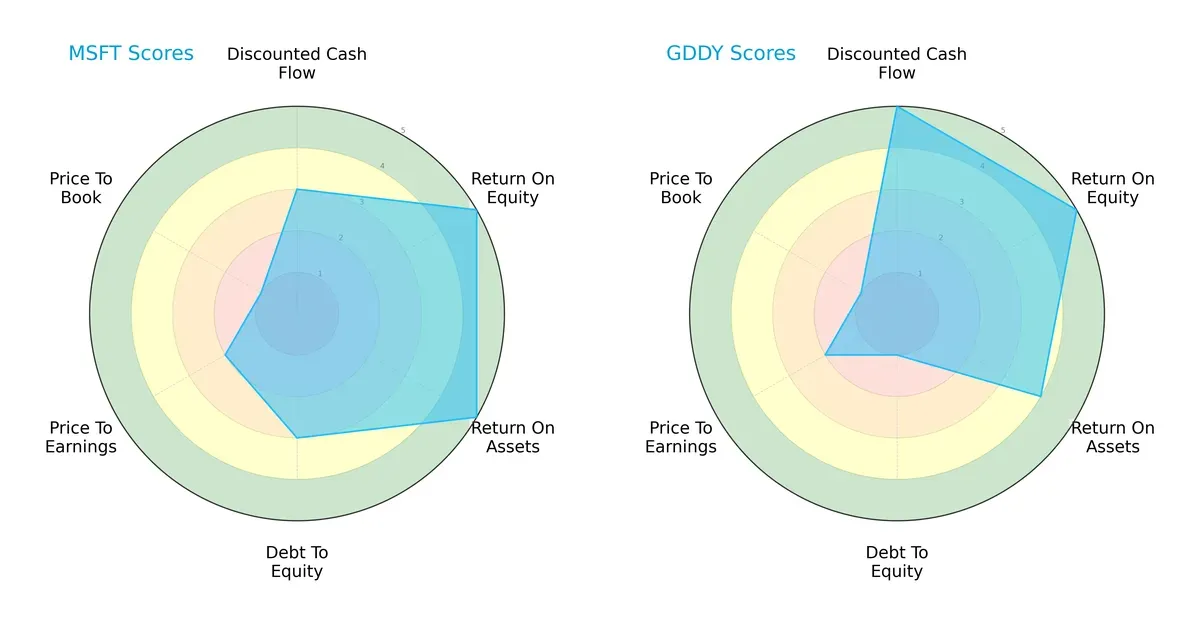

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Microsoft Corporation and GoDaddy Inc., highlighting their financial strengths and vulnerabilities:

Microsoft shows balanced strengths with very favorable ROE and ROA scores, and moderate DCF and debt-to-equity positions. GoDaddy leverages a strong DCF score and comparable ROE but suffers from a weak debt-to-equity profile. Microsoft’s profile is more balanced, while GoDaddy relies heavily on cash flow projections.

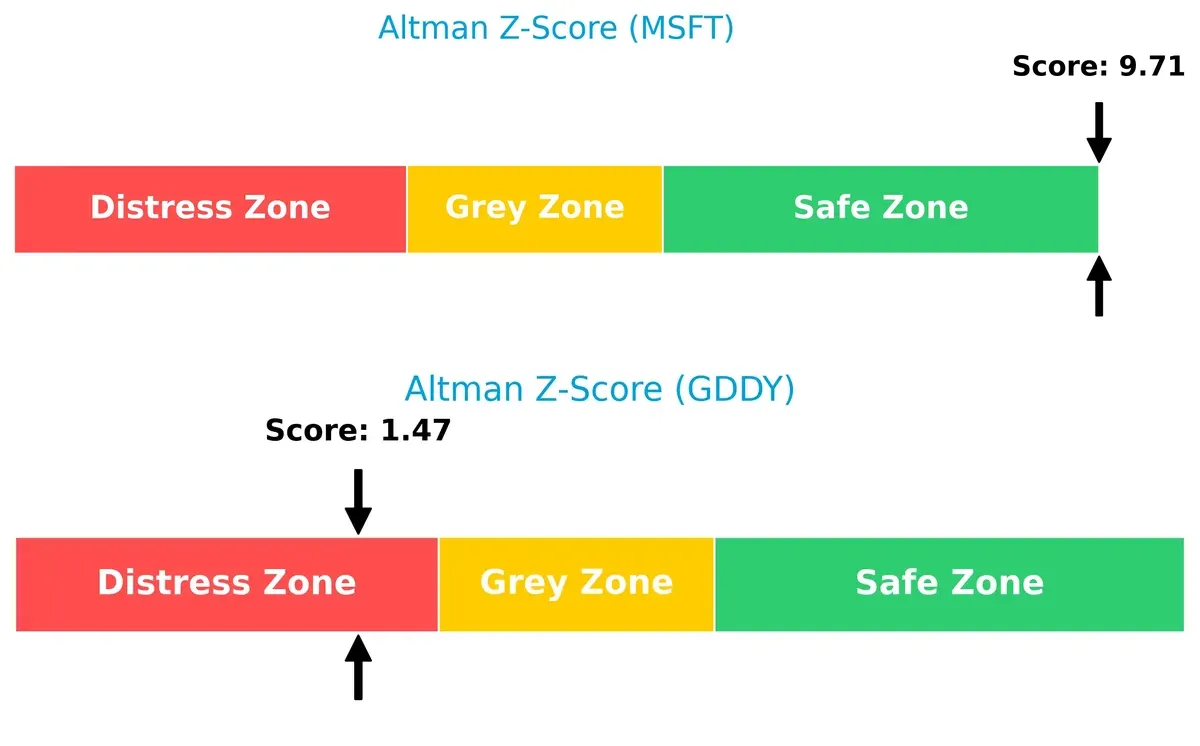

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score gap is stark: Microsoft scores 9.7, safely in the “safe zone,” while GoDaddy scores 1.47, signaling distress risk. This suggests Microsoft is well-positioned to endure economic cycles, unlike GoDaddy, which faces heightened bankruptcy risk:

Financial Health: Quality of Operations

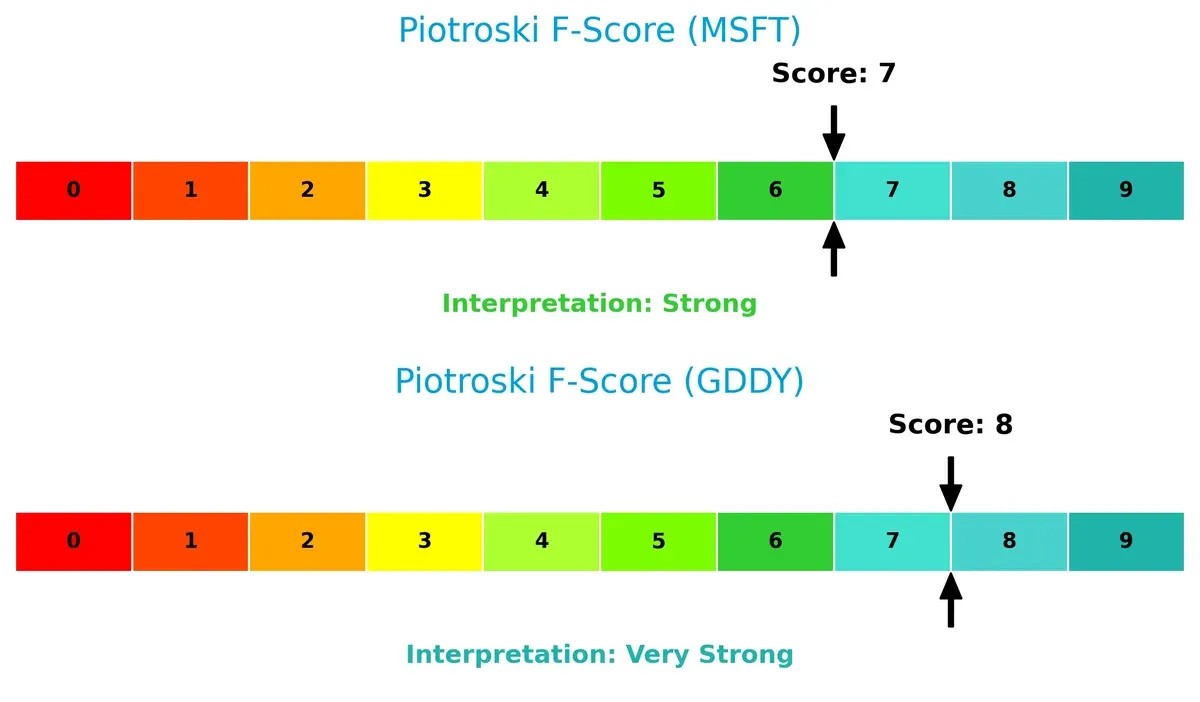

GoDaddy’s Piotroski F-Score of 8 indicates very strong financial health, surpassing Microsoft’s strong but lower score of 7. Despite solvency concerns, GoDaddy’s internal operations and profitability metrics remain robust:

How are the two companies positioned?

This section dissects the operational DNA of Microsoft and GoDaddy by comparing their revenue distribution across segments and analyzing internal strengths and weaknesses. The goal is to confront their economic moats to identify which business model delivers the most resilient and sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

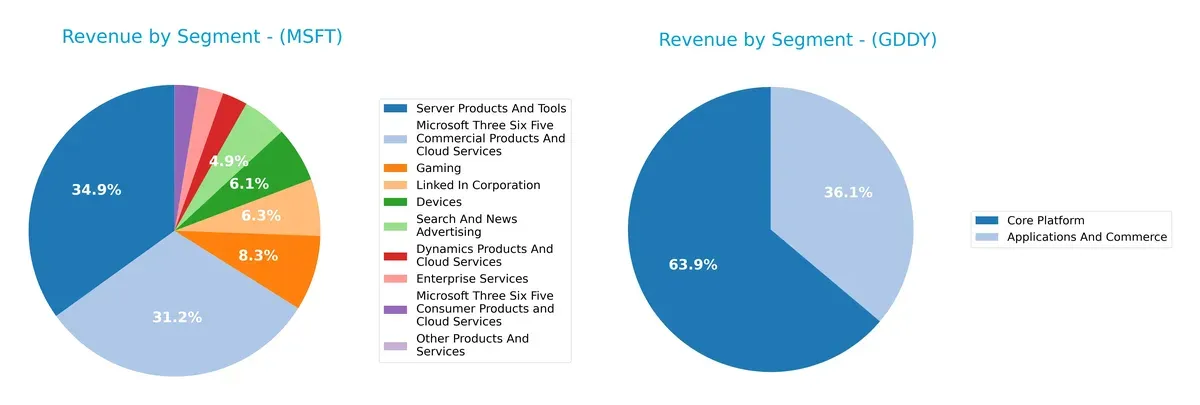

This revenue comparison dissects how Microsoft Corporation and GoDaddy Inc. diversify their income streams and where their primary sector bets lie:

Microsoft’s revenue dwarfs GoDaddy’s, anchored by broad segments like Server Products ($98.4B) and Microsoft 365 Commercial ($87.8B). Microsoft boasts a highly diversified portfolio spanning gaming, advertising, devices, and cloud services, reducing concentration risk. In contrast, GoDaddy relies heavily on Core Platform ($2.92B) and Applications & Commerce ($1.65B), reflecting a narrower focus. Microsoft’s ecosystem lock-in and infrastructure dominance offer robust strategic moats, while GoDaddy faces higher exposure to its core offerings.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Microsoft Corporation and GoDaddy Inc.:

Microsoft Corporation Strengths

- Diverse revenue streams across cloud, enterprise, gaming, and devices

- Strong global presence with over $137B non-US revenue in 2025

- High profitability with 36.15% net margin and 29.65% ROE

- Favorable capital structure with low debt and strong interest coverage

- Innovation backed by sustained growth in cloud and productivity segments

GoDaddy Inc. Strengths

- Favorable ROE of 135.37% and positive net margin of 20.49%

- Strong fixed asset turnover indicating efficient asset use

- Favorable WACC at 7.37%, supporting capital efficiency

- Focused product segments with growing core platform and commerce revenues

- Solid interest coverage despite higher leverage

Microsoft Corporation Weaknesses

- High valuation multiples, PE at 36.31 and PB at 10.76, may limit upside

- Asset turnover at 0.46 is relatively low, indicating less efficient asset use

- Dividend yield is low at 0.65%, less attractive for income investors

- Current ratio is only neutral at 1.35, limiting short-term liquidity buffer

GoDaddy Inc. Weaknesses

- Weak liquidity ratios with current and quick ratios at 0.72, signaling potential short-term risks

- High debt-to-equity ratio of 5.63 signals elevated financial leverage

- High PB ratio at 40.28 suggests overvaluation concerns

- Dividend yield is zero, not supporting income-focused investors

Microsoft’s breadth across multiple segments and strong profitability underline its market dominance. GoDaddy’s high ROE and asset efficiency show operational strengths but are counterbalanced by weaker liquidity and higher financial risk.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only true defense against long-term profit erosion from competition. Here’s how Microsoft and GoDaddy stack up:

Microsoft Corporation: Ecosystem Lock-in with Intangible Assets

Microsoft’s competitive advantage stems from its vast ecosystem of software, cloud services, and enterprise solutions. This moat shows in its strong 44.7% EBIT margin and consistent value creation with ROIC 13.3% above WACC, despite a slight declining trend. In 2026, expanding Azure and AI integration may deepen this moat but requires vigilance against cloud competitors.

GoDaddy Inc.: Customer Switching Costs in SMB Digital Identity

GoDaddy’s moat lies in customer switching costs tied to domain registration and hosting services. Unlike Microsoft’s diversified ecosystem, GoDaddy leverages SMB-focused products with improving ROIC and a robust growth trend (+147%). Its 20.2% EBIT margin signals room for margin expansion. Growth in marketing tools and e-commerce can fortify its position in 2026.

Ecosystem Lock-in vs. Switching Costs: Who Holds the Stronger Moat?

Microsoft possesses a wider moat driven by a diversified ecosystem and higher profitability metrics. However, GoDaddy’s rapidly improving ROIC trend shows a deepening competitive advantage in a niche market. Microsoft remains better equipped to defend market share against large-scale disruptions, while GoDaddy’s moat depends on sustaining customer loyalty in a crowded SMB space.

Which stock offers better returns?

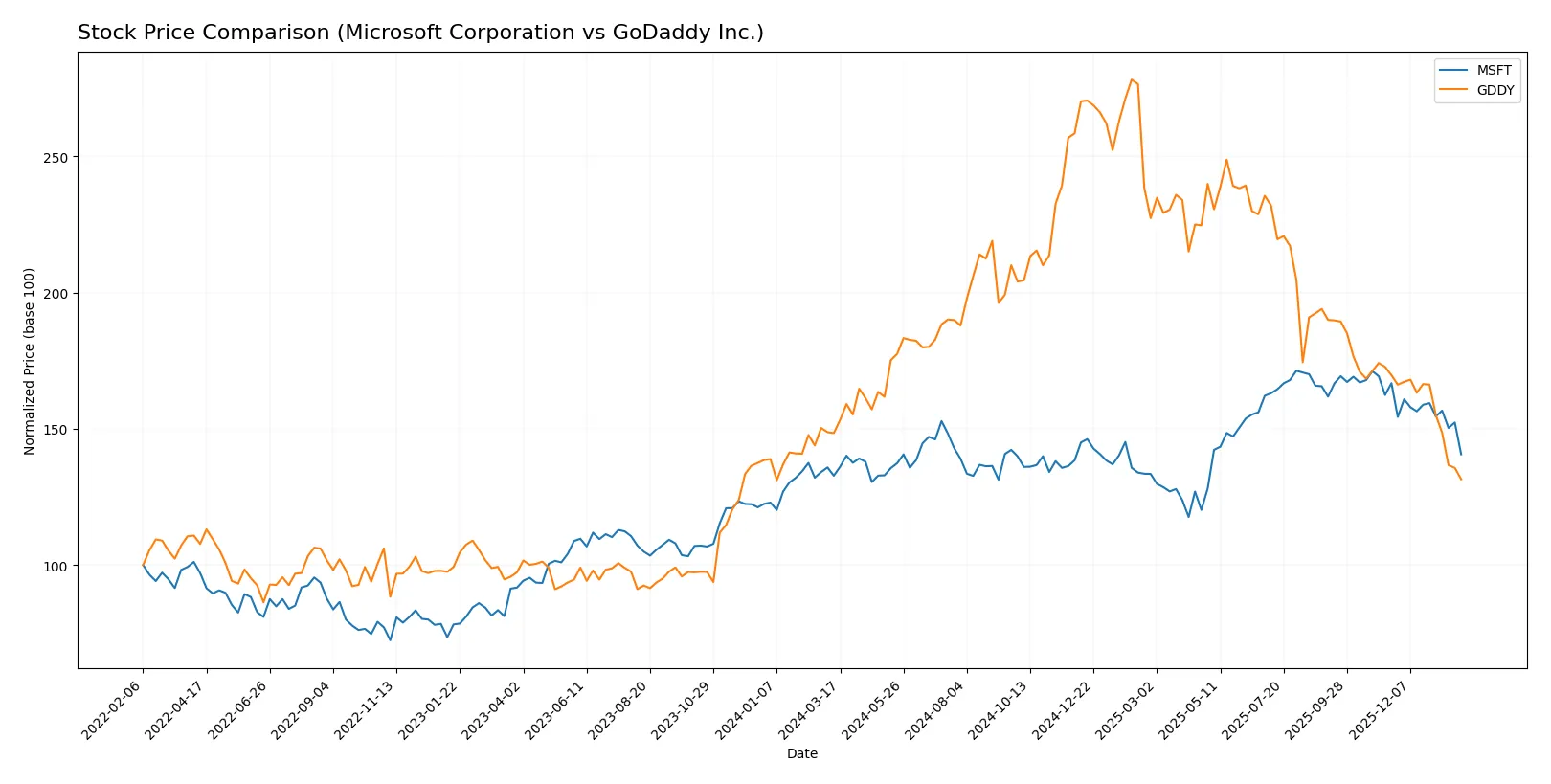

The past 12 months show Microsoft’s stock rising steadily before a recent sharp decline, while GoDaddy’s price trended downward with accelerating losses toward year-end.

Trend Comparison

Microsoft’s stock rose 5.93% over the past year, showing a bullish trend but with decelerating momentum. The price ranged from 359.84 to 524.11, indicating notable volatility.

GoDaddy’s stock fell 11.41%, confirming a bearish trend with deceleration. Its price fluctuated between 100.52 and 212.65, reflecting moderate volatility over the same period.

Microsoft outperformed GoDaddy, delivering the highest market returns despite a recent downturn, while GoDaddy’s stock showed sustained negative performance.

Target Prices

Analysts show a bullish consensus for both Microsoft Corporation and GoDaddy Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Microsoft Corporation | 450 | 675 | 600.04 |

| GoDaddy Inc. | 70 | 182 | 143.33 |

Microsoft’s consensus target of 600 significantly exceeds its current 430 price, signaling strong growth expectations. GoDaddy’s 143 consensus also suggests upside potential versus its 100 current price.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Microsoft Corporation Grades

The table below shows recent grades from major financial institutions for Microsoft Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-30 |

| Scotiabank | Maintain | Sector Outperform | 2026-01-29 |

| Wells Fargo | Maintain | Overweight | 2026-01-29 |

| RBC Capital | Maintain | Outperform | 2026-01-29 |

| Stifel | Maintain | Buy | 2026-01-29 |

| Evercore ISI Group | Maintain | Outperform | 2026-01-29 |

| Keybanc | Maintain | Overweight | 2026-01-29 |

| Piper Sandler | Maintain | Overweight | 2026-01-29 |

| DA Davidson | Maintain | Buy | 2026-01-29 |

| Cantor Fitzgerald | Maintain | Overweight | 2026-01-29 |

GoDaddy Inc. Grades

Here are the latest institutional grades for GoDaddy Inc. from recognized analysts.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-01-15 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-01-08 |

| Jefferies | Maintain | Hold | 2026-01-05 |

| Evercore ISI Group | Maintain | In Line | 2025-10-31 |

| Benchmark | Maintain | Buy | 2025-10-31 |

| JP Morgan | Maintain | Overweight | 2025-10-31 |

| B. Riley Securities | Maintain | Buy | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Citigroup | Maintain | Buy | 2025-10-31 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-06 |

Which company has the best grades?

Microsoft consistently receives higher-tier grades like Buy, Outperform, and Overweight. GoDaddy’s ratings range mostly from Hold to Buy. Microsoft’s stronger grades suggest more institutional confidence, potentially influencing investor sentiment and capital flows.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Microsoft Corporation

- Dominates enterprise software and cloud with diverse segments, but faces intensifying cloud competition from AWS and Google.

GoDaddy Inc.

- Focuses on SMB cloud services and domain registration, struggling with scale and competitive pressure from larger cloud providers.

2. Capital Structure & Debt

Microsoft Corporation

- Maintains low debt-to-equity (0.18) and strong interest coverage (52.8), indicating robust financial stability.

GoDaddy Inc.

- Exhibits high debt-to-equity (5.63) and weaker interest coverage (5.8), raising financial risk concerns.

3. Stock Volatility

Microsoft Corporation

- Beta at 1.07 reflects moderate market volatility typical for large tech firms.

GoDaddy Inc.

- Slightly lower beta (0.95) suggests less sensitivity to market swings but possibly less liquidity.

4. Regulatory & Legal

Microsoft Corporation

- Faces scrutiny over antitrust and data privacy globally due to size and market influence.

GoDaddy Inc.

- Regulatory risks are lower but could increase with expansion of payment and hosting services.

5. Supply Chain & Operations

Microsoft Corporation

- Complex global supply chain for hardware (Surface, Xbox) with some exposure to component shortages.

GoDaddy Inc.

- Relies heavily on cloud infrastructure providers and third-party vendors, exposing it to operational risks.

6. ESG & Climate Transition

Microsoft Corporation

- Strong ESG initiatives and investment in sustainable cloud infrastructure improve resilience and brand.

GoDaddy Inc.

- ESG efforts less prominent, possibly lagging in climate transition readiness for a tech firm.

7. Geopolitical Exposure

Microsoft Corporation

- Global footprint exposes it to geopolitical tensions impacting cloud and software licensing.

GoDaddy Inc.

- Primarily US-focused but expanding internationally, which could increase geopolitical risks.

Which company shows a better risk-adjusted profile?

Microsoft’s strongest risk is regulatory scrutiny and market competition in cloud. GoDaddy’s primary risk is its leveraged capital structure, increasing financial vulnerability. Microsoft’s low debt, high interest coverage, and safe-zone Altman Z-score demonstrate superior risk management. GoDaddy’s distressed Altman Z-score and high debt-to-equity ratio raise red flags. Despite moderate stock volatility, Microsoft’s diversified business and strong balance sheet yield a better risk-adjusted profile in 2026.

Final Verdict: Which stock to choose?

Microsoft’s superpower lies in its unmatched scale and efficient capital deployment, consistently generating high returns well above its cost of capital. Its slight decline in ROIC signals a need for vigilance on margin pressure. It fits portfolios targeting stable, long-term growth with moderate risk tolerance.

GoDaddy’s strategic moat stems from its niche dominance in domain services and recurring revenue streams, supported by a rising ROIC trend. However, its heavier debt load and weaker liquidity present a safety trade-off compared to Microsoft. It suits investors looking for GARP opportunities with a tolerance for operational leverage.

If you prioritize resilient cash generation and proven scale, Microsoft is the compelling choice due to its stable profitability and financial strength. However, if you seek higher growth potential supported by a durable competitive advantage, GoDaddy offers superior momentum but with elevated financial risk. Both present distinct analytical scenarios depending on your portfolio’s risk profile and growth expectations.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Microsoft Corporation and GoDaddy Inc. to enhance your investment decisions: