In the rapidly evolving healthcare information services sector, GE HealthCare Technologies Inc. (GEHC) and Tempus AI, Inc. (TEM) stand out as influential players driving innovation. GEHC focuses on advanced medical imaging and diagnostic solutions, while Tempus AI pioneers data-driven precision medicine through AI-powered diagnostics and analytics. This comparison explores their market positions and growth strategies to help you identify which company holds the greatest potential for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between GE HealthCare Technologies Inc. and Tempus AI, Inc. by providing an overview of these two companies and their main differences.

GEHC Overview

GE HealthCare Technologies Inc. focuses on developing, manufacturing, and marketing products and digital solutions for diagnosis, treatment, and patient monitoring worldwide. Operating through four segments—Imaging, Ultrasound, Patient Care Solutions, and Pharmaceutical Diagnostics—GEHC offers a broad portfolio including CT, MR imaging, ultrasound, medical devices, and diagnostic agents. The company is headquartered in Chicago and employs 53,000 people.

TEM Overview

Tempus AI, Inc. is a healthcare technology company specializing in next-generation sequencing diagnostics, molecular genotyping, and pathology testing. It provides data analytics, clinical trial matching services, and algorithmic oncology tests through platforms like Insights, Trials, Hub, and Lens. Based in Chicago, TEM employs approximately 2,400 staff and collaborates with pharmaceutical and biotech firms to advance therapeutic programs in oncology.

Key similarities and differences

Both companies operate in the healthcare information services sector and are headquartered in Chicago, offering innovative solutions to improve patient care. GEHC has a diversified product portfolio across imaging and patient care devices with a large workforce, while TEM focuses primarily on molecular diagnostics, data analytics, and clinical trial services with a smaller team. GEHC’s business model centers on hardware and diagnostic agents, whereas TEM emphasizes software platforms and data-driven services.

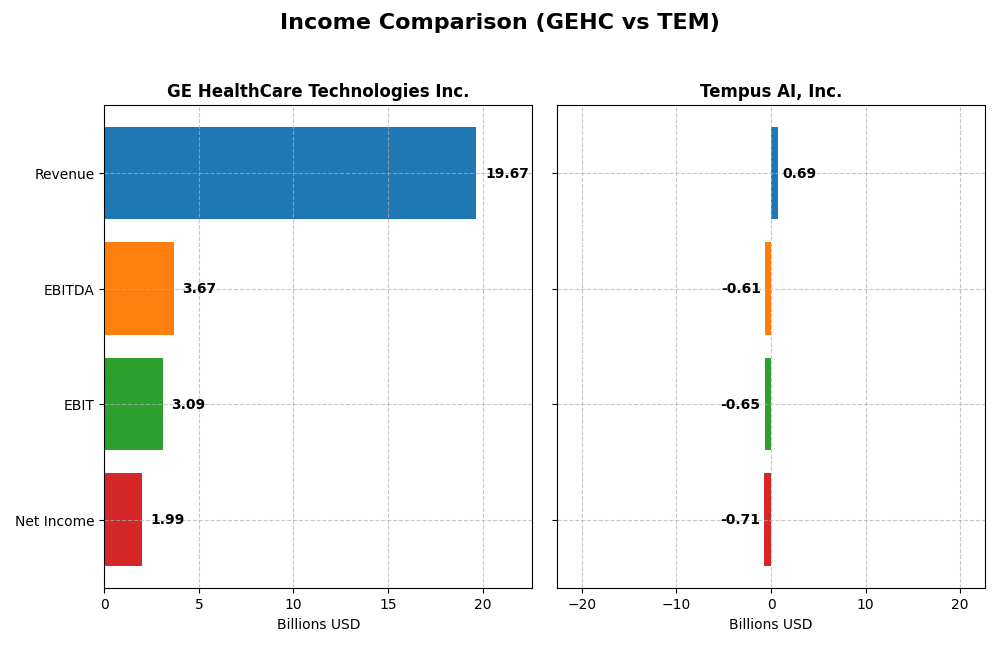

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for GE HealthCare Technologies Inc. and Tempus AI, Inc. for the fiscal year 2024.

| Metric | GE HealthCare Technologies Inc. | Tempus AI, Inc. |

|---|---|---|

| Market Cap | 39.9B | 11.4B |

| Revenue | 19.7B | 693M |

| EBITDA | 3.67B | -610M |

| EBIT | 3.09B | -648M |

| Net Income | 1.99B | -706M |

| EPS | 4.37 | -4.60 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

GE HealthCare Technologies Inc.

GEHC’s revenue showed steady growth from $17.16B in 2020 to $19.67B in 2024, reflecting a 14.61% increase overall. Net income, however, declined significantly over the period, with a notable dip to $1.99B in 2024 from $13.85B in 2020, influenced by discontinued operations in earlier years. Margins remained favorable, with a recent net margin of 10.13%, and 2024 saw improved EBIT and net margin growth despite slower revenue growth.

Tempus AI, Inc.

TEM experienced rapid revenue growth, rising from $188M in 2020 to $693M in 2024, a 268.82% increase. Despite this, net income remained negative each year, worsening to a loss of $705.8M in 2024. Gross margin was strong at 54.96%, but EBIT and net margins were deeply negative, reflecting ongoing operational losses. The latest year showed a sharp increase in revenue but deteriorating profitability and EPS decline.

Which one has the stronger fundamentals?

GEHC presents stronger fundamentals with consistent revenue growth, positive net income, and stable, favorable margins, particularly in EBIT and net margin. In contrast, TEM’s impressive revenue expansion is offset by persistent and deep net losses, negative EBIT, and unfavorable profitability metrics. GEHC’s overall income statement evaluation is favorable, whereas TEM’s remains unfavorable due to ongoing losses and margin challenges.

Financial Ratios Comparison

The following table presents a side-by-side comparison of key financial ratios for GE HealthCare Technologies Inc. and Tempus AI, Inc. based on the latest fiscal year data from 2024.

| Ratios | GE HealthCare Technologies Inc. | Tempus AI, Inc. |

|---|---|---|

| ROE | 23.6% | -1253% |

| ROIC | 8.3% | -108% |

| P/E | 17.9 | -7.75 |

| P/B | 4.22 | 97.1 |

| Current Ratio | 1.00 | 2.29 |

| Quick Ratio | 0.79 | 2.16 |

| D/E (Debt-to-Equity) | 1.11 | 8.31 |

| Debt-to-Assets | 28.3% | 50.5% |

| Interest Coverage | 5.20 | -12.9 |

| Asset Turnover | 0.59 | 0.75 |

| Fixed Asset Turnover | 7.71 | 9.52 |

| Payout ratio | 2.76% | -0.80% |

| Dividend yield | 0.15% | 0.10% |

Interpretation of the Ratios

GE HealthCare Technologies Inc.

GEHC presents a mixed financial profile with strong net margin (10.13%) and return on equity (23.59%), but weaker liquidity ratios such as a current ratio around 1.0 and a quick ratio below 0.8, signaling potential short-term solvency concerns. Debt levels appear moderate, with favorable debt-to-assets at 28.34%. The company pays a modest dividend with a 0.15% yield, reflecting a cautious payout approach supported by free cash flow, minimizing risks of unsustainable returns.

Tempus AI, Inc.

TEM’s ratios indicate significant challenges: negative net margin (-101.79%) and return on equity (-1252.79%) highlight operational losses and weak profitability. The balance sheet shows strong liquidity, with a current ratio of 2.29 and quick ratio of 2.16, but high leverage is concerning, with debt-to-equity at 8.31 and debt-to-assets exceeding 50%. The company does not pay dividends, consistent with its negative earnings and focus on growth and R&D investments.

Which one has the best ratios?

GEHC displays a more balanced financial position with several favorable profitability and leverage ratios, despite liquidity weaknesses. TEM’s ratios largely reflect financial distress and high leverage, though it maintains strong liquidity. Overall, GEHC’s ratios are more favorable, while TEM’s profile suggests higher financial risk and instability in 2024.

Strategic Positioning

This section compares the strategic positioning of GEHC and TEM, including Market position, Key segments, and Exposure to technological disruption:

GEHC

- Large market cap of 39.9B, facing moderate competitive pressure in global healthcare imaging.

- Operates four segments: Imaging, Ultrasound, Patient Care Solutions, and Pharmaceutical Diagnostics.

- Exposure to technological disruption through digital healthcare solutions and advanced imaging.

TEM

- Smaller market cap of 11.4B, operating in a niche healthcare technology segment with high beta.

- Focuses on healthcare technology with sequencing diagnostics, molecular profiling, and analytics.

- High exposure to disruption via AI-driven diagnostics, data analytics, and clinical trial platforms.

GEHC vs TEM Positioning

GEHC follows a diversified business model with multiple healthcare segments, offering broad exposure but facing complex operational demands. TEM is more concentrated on innovative AI and molecular diagnostics, emphasizing technology but with higher risk from market volatility and competition.

Which has the best competitive advantage?

Both companies show very unfavorable MOAT evaluations with declining ROIC and value destruction. Neither currently demonstrates a sustainable competitive advantage based on capital efficiency and profitability trends.

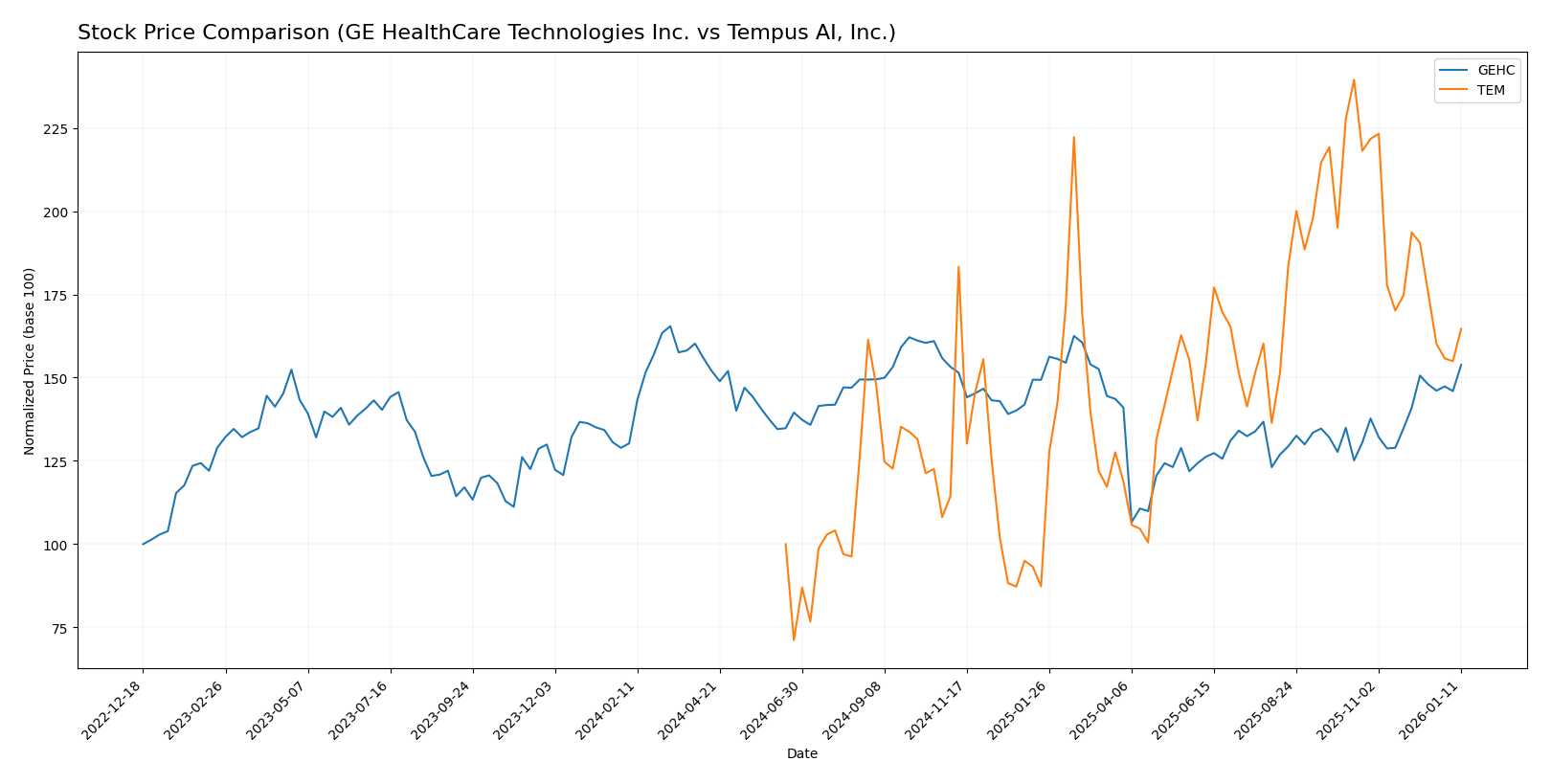

Stock Comparison

The stock price chart highlights significant price movements and trading dynamics over the past year, with GE HealthCare Technologies Inc. showing moderate growth and Tempus AI, Inc. experiencing a strong overall uptrend despite recent declines.

Trend Analysis

GE HealthCare Technologies Inc. recorded a 1.46% price increase over the past 12 months, indicating a neutral to mildly bullish trend with accelerating momentum and moderate volatility (std dev 7.23). The stock ranged between 60.51 and 93.87.

Tempus AI, Inc. exhibited a strong 64.65% price increase over the same period, signaling a bullish trend with decelerating momentum and higher volatility (std dev 16.07). The stock showed a wide range from 28.64 to 96.39 but declined by 25.73% recently.

Comparing both stocks, Tempus AI, Inc. delivered the highest market performance overall despite recent weakness, while GE HealthCare Technologies Inc. maintained steadier, less volatile gains.

Target Prices

The consensus target prices from verified analysts indicate a moderate upside potential for both companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| GE HealthCare Technologies Inc. | 105 | 74 | 90.88 |

| Tempus AI, Inc. | 105 | 70 | 90 |

Analysts expect GE HealthCare’s stock to appreciate modestly from its current price of $87.28, while Tempus AI’s consensus target of $90 suggests a significant potential increase from its current price of $66.27.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for GE HealthCare Technologies Inc. and Tempus AI, Inc.:

Rating Comparison

GEHC Rating

- Rating: B+, classified as Very Favorable overall rating by analysts.

- Discounted Cash Flow Score: 4, indicating a Favorable evaluation of cash flows.

- ROE Score: 5, rated Very Favorable for efficient profit generation.

- ROA Score: 4, Favorable for effective asset utilization.

- Debt To Equity Score: 1, Very Unfavorable, indicating higher financial risk.

TEM Rating

- Rating: D+, classified as Very Unfavorable overall rating by analysts.

- Discounted Cash Flow Score: 1, indicating a Very Unfavorable evaluation.

- ROE Score: 1, rated Very Unfavorable for profit generation efficiency.

- ROA Score: 1, Very Unfavorable for asset utilization.

- Debt To Equity Score: 1, Very Unfavorable, similarly indicating financial risk.

Which one is the best rated?

Based on provided data, GEHC holds significantly better ratings and scores across all key financial metrics compared to TEM. GEHC shows favorable to very favorable performance, while TEM’s ratings are very unfavorable throughout.

Scores Comparison

The scores comparison for GEHC and TEM highlights their financial stability and strength based on Altman Z-Score and Piotroski Score:

GEHC Scores

- Altman Z-Score: 1.98, in the grey zone indicating moderate bankruptcy risk.

- Piotroski Score: 5, average financial strength.

TEM Scores

- Altman Z-Score: 3.54, in the safe zone indicating low bankruptcy risk.

- Piotroski Score: 2, very weak financial strength.

Which company has the best scores?

TEM has a stronger Altman Z-Score placing it in the safe zone, while GEHC is in the grey zone. However, GEHC’s Piotroski Score is higher, indicating better financial strength than TEM’s very weak score.

Grades Comparison

Here is a comparison of the recent grades issued by reputable grading companies for the two companies:

GE HealthCare Technologies Inc. Grades

This table summarizes the latest grades assigned by major financial institutions to GE HealthCare Technologies Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | Maintain | Buy | 2026-01-07 |

| B of A Securities | Maintain | Neutral | 2026-01-05 |

| Citigroup | Maintain | Neutral | 2025-12-11 |

| Jefferies | Maintain | Buy | 2025-12-11 |

| BTIG | Maintain | Buy | 2025-11-21 |

| Wells Fargo | Maintain | Overweight | 2025-10-30 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-30 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-30 |

| BTIG | Maintain | Buy | 2025-10-13 |

| Citigroup | Downgrade | Neutral | 2025-10-07 |

The overall grades for GE HealthCare Technologies Inc. show a mixed but predominantly positive sentiment, with several “Buy” and “Outperform” ratings complemented by neutral and equal weight positions.

Tempus AI, Inc. Grades

Below is a summary of recent grades from recognized financial firms for Tempus AI, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Canaccord Genuity | Maintain | Buy | 2025-12-22 |

| JP Morgan | Maintain | Neutral | 2025-12-15 |

| Morgan Stanley | Maintain | Overweight | 2025-12-02 |

| BTIG | Maintain | Buy | 2025-11-25 |

| Piper Sandler | Maintain | Neutral | 2025-11-11 |

| Morgan Stanley | Maintain | Overweight | 2025-11-11 |

| HC Wainwright & Co. | Maintain | Buy | 2025-11-07 |

| Needham | Maintain | Buy | 2025-11-05 |

| BTIG | Maintain | Buy | 2025-11-05 |

| Canaccord Genuity | Maintain | Buy | 2025-11-05 |

Tempus AI, Inc. grades display a consistently positive outlook, dominated by “Buy” and “Overweight” ratings with no downgrades reported.

Which company has the best grades?

Both GE HealthCare Technologies Inc. and Tempus AI, Inc. hold a consensus rating of “Buy” with strong support from multiple financial institutions. However, Tempus AI exhibits a more uniform “Buy” and “Overweight” profile, while GE HealthCare has a wider spread including neutral and equal weight ratings. This difference may influence investors seeking either stronger positive conviction or a more cautious stance.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for GE HealthCare Technologies Inc. (GEHC) and Tempus AI, Inc. (TEM), based on the most recent financial and operational data.

| Criterion | GE HealthCare Technologies Inc. (GEHC) | Tempus AI, Inc. (TEM) |

|---|---|---|

| Diversification | Moderate diversification with multiple segments: Imaging ($8.9B), PCS ($3.1B), PDx ($2.5B) | Limited diversification; primarily focused on AI-driven healthcare solutions |

| Profitability | Favorable net margin (10.13%), positive ROE (23.59%), neutral ROIC (8.29%) | Unfavorable profitability; negative net margin (-101.79%), negative ROE (-1252.79%), negative ROIC (-107.77%) |

| Innovation | Solid innovation in medical imaging and diagnostics | High innovation potential in AI but currently unprofitable and value-destructive |

| Global presence | Established global footprint through healthcare technologies | Emerging global presence; growth phase with limited scale |

| Market Share | Strong presence in medical imaging and diagnostic segments | Small market share; competing in a highly dynamic AI healthcare niche |

Key takeaways: GEHC shows moderate diversification with stable profitability and a global footprint, but faces challenges in maintaining ROIC above WACC. TEM demonstrates high innovation potential in AI healthcare but struggles with significant value destruction and unprofitable operations, posing high risk for investors.

Risk Analysis

Below is a comparative table highlighting key risks for GE HealthCare Technologies Inc. (GEHC) and Tempus AI, Inc. (TEM) based on the most recent data from 2024.

| Metric | GE HealthCare Technologies Inc. (GEHC) | Tempus AI, Inc. (TEM) |

|---|---|---|

| Market Risk | Moderate (Beta 1.23) | High (Beta 5.23) |

| Debt Level | Moderate (Debt-to-Equity 1.11, Debt-to-Assets 28.3%) | High (Debt-to-Equity 8.31, Debt-to-Assets 50.5%) |

| Regulatory Risk | Moderate (Healthcare sector, global presence) | Moderate to High (Healthcare technology, rapid innovation) |

| Operational Risk | Moderate (Large scale, complex segments) | High (Smaller size, tech-dependent operations) |

| Environmental Risk | Low to Moderate (Healthcare manufacturing) | Low to Moderate (Data center energy use) |

| Geopolitical Risk | Moderate (Global markets exposure) | Moderate (Primarily US-based but global partnerships) |

GEHC faces moderate market and operational risks with manageable debt levels, while TEM has a significantly higher market risk due to its elevated beta and higher leverage, indicating more financial vulnerability. TEM’s negative profitability and weak financial scores further emphasize its operational and financial risks. Investors should weigh TEM’s growth potential against its higher risk profile and GEHC’s more stable but moderately leveraged position.

Which Stock to Choose?

GE HealthCare Technologies Inc. (GEHC) shows a mostly favorable income evolution with stable gross and EBIT margins, positive net margin growth, and solid profitability metrics. Financial ratios reveal a mixed picture: favorable returns and interest coverage contrast with weaker liquidity and leverage indicators. Its rating is very favorable (B+) but with moderate overall scores.

Tempus AI, Inc. (TEM) exhibits strong revenue growth but struggles with negative profitability and unfavorable income statement metrics overall. Financial ratios are largely unfavorable, marked by high debt, negative returns, and weak interest coverage, despite good liquidity ratios. Its overall rating is very unfavorable (D+), reflecting significant financial challenges.

For investors, GEHC might appear more favorable given its stronger rating and overall income statement quality, despite some financial ratio concerns. TEM’s profile could suggest potential for growth but with elevated risk and weaker financial stability. Therefore, risk-averse investors may find GEHC more aligned with their priorities, while risk-tolerant investors focused on growth might consider TEM’s prospects with caution.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of GE HealthCare Technologies Inc. and Tempus AI, Inc. to enhance your investment decisions: