Home > Comparison > Technology > NOW vs DOCU

The competitive dynamic between ServiceNow, Inc. and DocuSign, Inc. shapes the evolution of the technology sector’s software application landscape. ServiceNow operates as a comprehensive enterprise cloud platform focusing on workflow automation and IT service management. DocuSign specializes in high-margin electronic signature and contract lifecycle management solutions. This analysis evaluates their divergent growth strategies to identify which offers superior risk-adjusted returns for a diversified investment portfolio.

Table of contents

Companies Overview

ServiceNow and DocuSign represent pivotal players in the enterprise software market with distinct value propositions.

ServiceNow, Inc.: Enterprise Cloud Workflow Leader

ServiceNow dominates the enterprise cloud computing space by automating workflows through its Now platform. It generates revenue primarily from IT service management, security operations, and business process automation products. In 2026, the company’s strategic focus emphasizes expanding AI-driven automation and strengthening partnerships, notably with Celonis, to optimize process efficiencies across industries.

DocuSign, Inc.: Digital Agreement Pioneer

DocuSign leads in electronic signature software and contract lifecycle management. Its core revenue stems from enabling businesses to prepare, sign, and manage agreements digitally, supported by AI-powered tools like Insights and Analyzer. The company prioritizes enhancing AI capabilities and broadening industry-specific cloud offerings to deepen customer engagement and streamline agreements in 2026.

Strategic Collision: Similarities & Divergences

Both companies focus on workflow automation but diverge in scope and approach. ServiceNow targets comprehensive enterprise IT and business processes with a broad platform, while DocuSign specializes in digital agreements and contract management. Their primary battleground lies in automating enterprise workflows, but they serve complementary niches. ServiceNow offers a vast ecosystem; DocuSign provides specialized legal-tech solutions, defining distinct investment profiles.

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | ServiceNow, Inc. (NOW) | DocuSign, Inc. (DOCU) |

|---|---|---|

| Revenue | 13.3B | 3.0B |

| Cost of Revenue | 3.0B | 622M |

| Operating Expenses | 8.5B | 2.2B |

| Gross Profit | 10.3B | 2.4B |

| EBITDA | 3.0B | 357M |

| EBIT | 2.3B | 249M |

| Interest Expense | 0 | 1.6M |

| Net Income | 1.7B | 1.1B |

| EPS | 1.69 | 5.23 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company operates with superior efficiency and sustainable profitability in a competitive market landscape.

ServiceNow, Inc. Analysis

ServiceNow’s revenue rose sharply from 5.9B in 2021 to 13.3B in 2025, with net income surging from 230M to 1.75B. Its gross margin remains robust at 77.5%, reflecting strong cost control. The net margin of 13.2% signals consistent profitability, while a 21.9% EPS growth in 2025 highlights accelerating earnings momentum.

DocuSign, Inc. Analysis

DocuSign’s revenue climbed steadily from 1.45B in 2021 to 3.0B in 2025, with net income recovering from a 243M loss to 1.07B profit. The company boasts a high gross margin of 79.1% and an impressive net margin of 35.9%, driven by operational improvements. Its 148% EBIT growth and 1311% EPS growth in 2025 underscore strong efficiency gains after earlier losses.

Margin Power vs. Revenue Scale

ServiceNow commands a larger revenue base and steady margin expansion, while DocuSign shows explosive margin recovery and profitability on a smaller scale. The clear fundamental leader is ServiceNow, given its scale, consistent margin growth, and strong earnings momentum. Investors seeking a blend of scale and sustainable profit will find ServiceNow’s profile more compelling.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | ServiceNow, Inc. (NOW) | DocuSign, Inc. (DOCU) |

|---|---|---|

| ROE | 13.5% | 53.3% |

| ROIC | 9.0% | 9.1% |

| P/E | 90.9 | 18.5 |

| P/B | 12.3 | 9.9 |

| Current Ratio | 0.95 | 0.81 |

| Quick Ratio | 0.95 | 0.81 |

| D/E (Debt-to-Equity) | 0.25 | 0.06 |

| Debt-to-Assets | 12.3% | 3.1% |

| Interest Coverage | 0 | 129 |

| Asset Turnover | 0.51 | 0.74 |

| Fixed Asset Turnover | 4.29 | 7.28 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as the company’s DNA, unveiling hidden risks and operational excellence that shape investor confidence and valuation.

ServiceNow, Inc.

ServiceNow shows solid profitability with a 13.5% ROE and a favorable 13.2% net margin. However, its valuation appears stretched, trading at a high P/E of 90.9 and a P/B of 12.3. The company does not offer dividends, instead reinvesting heavily in R&D for growth. Its balance sheet shows some liquidity pressure with a current ratio below 1.

DocuSign, Inc.

DocuSign impresses with a robust 53.3% ROE and a strong 35.9% net margin, indicating operational efficiency. Its valuation is more reasonable, with a P/E of 18.5, although the P/B at 9.9 remains elevated. Like ServiceNow, it pays no dividend, focusing on growth investments. DocuSign’s current ratio is weaker at 0.81, signaling tighter liquidity.

Premium Valuation vs. Operational Efficiency

ServiceNow’s premium multiple reflects strong market confidence but entails valuation risk. DocuSign offers superior profitability and a more balanced valuation profile. Investors prioritizing growth at any cost may lean toward ServiceNow, while those seeking operational efficiency with moderate valuation risk might prefer DocuSign.

Which one offers the Superior Shareholder Reward?

I observe that neither ServiceNow (NOW) nor DocuSign (DOCU) pays dividends, focusing instead on reinvestment and buybacks. ServiceNow’s free cash flow per share stands at $4.4B with a payout ratio of zero, indicating full reinvestment into growth. Its buyback program is moderate but consistent. DocuSign also reinvests fully, boasting a free cash flow per share of $4.5B and a more aggressive buyback, given its lower valuation multiples (P/FCF ~21 vs. NOW’s ~35). DocuSign’s lower price-to-earnings ratio (18.5 vs. NOW’s 90.9) signals better valuation. However, NOW’s higher margins and stronger cash flow coverage ratios suggest a more sustainable distribution model. I conclude that for 2026, DocuSign offers a more attractive total return profile due to its blend of efficient capital allocation, lower valuation, and aggressive buybacks driving shareholder value.

Comparative Score Analysis: The Strategic Profile

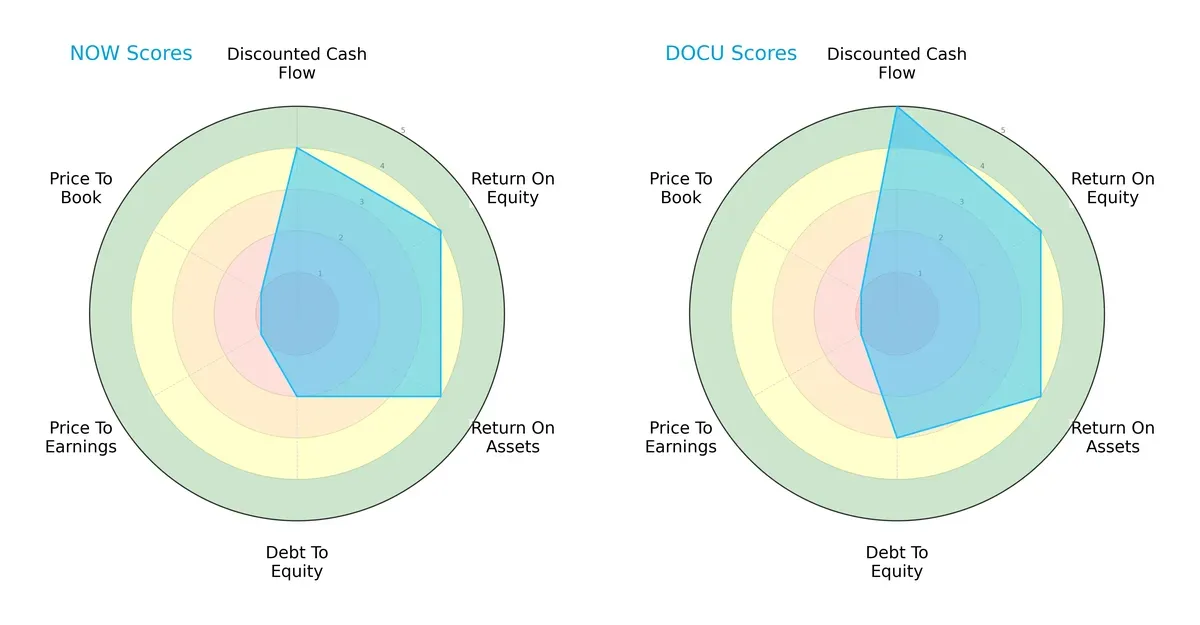

The radar chart reveals the fundamental DNA and trade-offs of ServiceNow, Inc. and DocuSign, Inc., highlighting their financial strengths and valuation challenges:

Both companies share strong operational efficiency with identical ROE and ROA scores of 4. DocuSign edges ServiceNow on discounted cash flow valuation (5 vs. 4), indicating better future cash flow prospects. ServiceNow, however, shows a slightly weaker debt position (2 vs. 3), reflecting higher leverage risk. Both firms face valuation headwinds with very unfavorable P/E and P/B scores. Overall, DocuSign presents a more balanced profile, while ServiceNow relies more heavily on operational efficiency amid capital structure constraints.

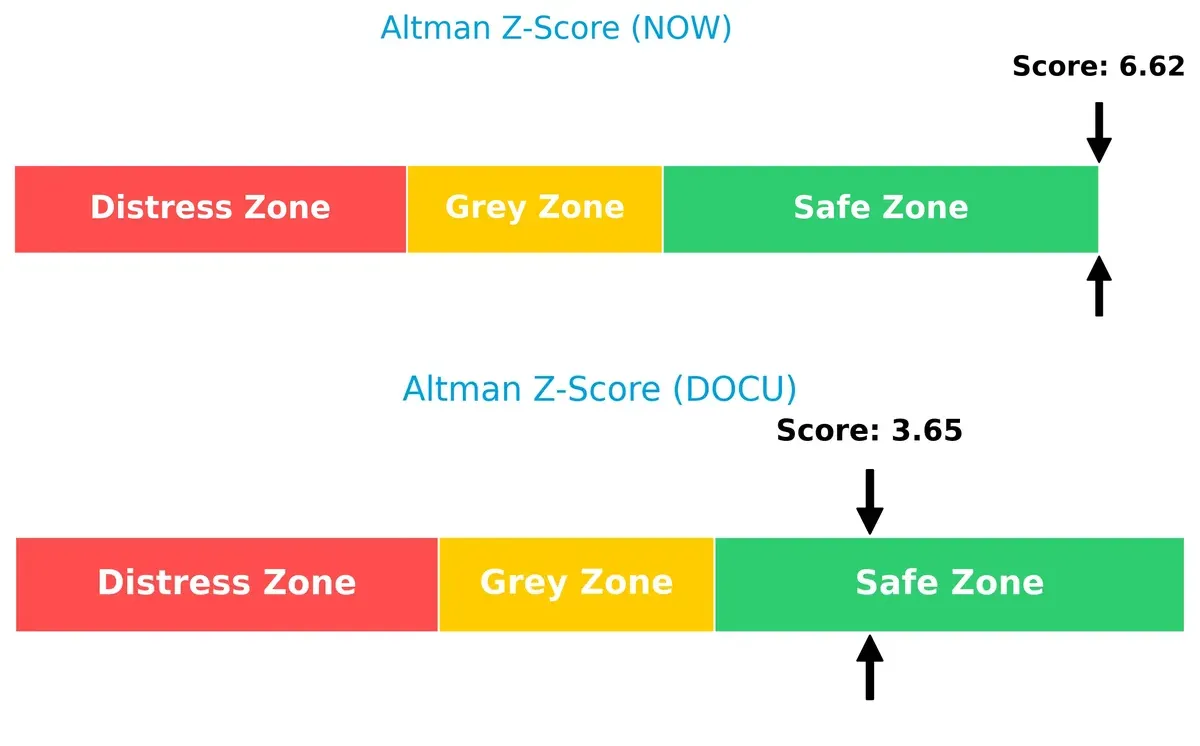

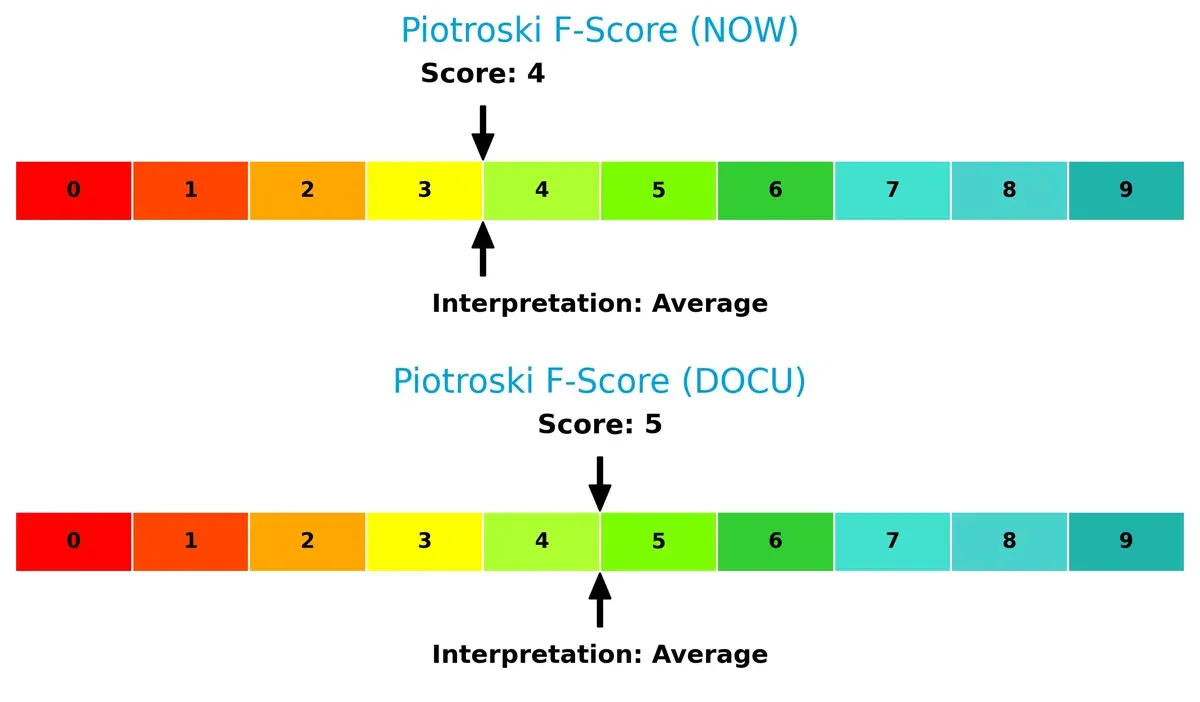

Bankruptcy Risk: Solvency Showdown

ServiceNow’s Altman Z-Score of 6.62 significantly surpasses DocuSign’s 3.65, indicating superior long-term solvency and a safer financial position in this cycle:

Financial Health: Quality of Operations

DocuSign’s Piotroski F-Score of 5 slightly outpaces ServiceNow’s 4, suggesting marginally better internal financial health. Neither company exhibits strong red flags, but both remain in the average range:

How are the two companies positioned?

This section dissects the operational DNA of ServiceNow and DocuSign by analyzing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats to reveal which business model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how ServiceNow and DocuSign diversify their income streams and reveals where their primary sector bets lie:

ServiceNow anchors revenue in “License and Service” with $12.9B in 2025, dwarfing its $414M “Technology Service” line, signaling a strong focus on digital workflow dominance. DocuSign pivots heavily on “Subscription and Circulation,” generating $2.9B, with minimal contribution from “Professional Services.” ServiceNow’s concentrated digital workflow bets suggest ecosystem lock-in, while DocuSign’s reliance on subscription models highlights customer retention but poses concentration risks.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of ServiceNow and DocuSign:

ServiceNow Strengths

- Strong revenue growth in License and Service segment

- Favorable debt-to-equity and interest coverage ratios

- Large global presence with significant North America and EMEA sales

DocuSign Strengths

- High profitability with strong net margin and ROE

- Favorable debt levels and interest coverage

- Higher fixed asset turnover showing efficient asset use

ServiceNow Weaknesses

- Unfavorable valuation multiples (PE and PB)

- Current ratio below 1 indicating liquidity risk

- No dividend yield

DocuSign Weaknesses

- Lower current ratio signaling liquidity concerns

- Unfavorable price-to-book ratio

- No dividend yield

ServiceNow exhibits solid global diversification and moderate profitability but faces valuation and liquidity challenges. DocuSign shows superior profitability and asset efficiency but shares similar liquidity and valuation weaknesses. Both companies maintain slightly favorable overall financial health with balanced risks.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competitive erosion. Let’s dissect the moats of two leading software firms:

ServiceNow, Inc.: Workflow Automation with Expanding Scale Advantage

ServiceNow’s moat stems from high switching costs embedded in its workflow automation platform. Its 77.5% gross margin and rising profitability reflect pricing power and customer retention. Expansion into AI and global markets in 2026 should deepen this advantage but margin pressure looms from new entrants.

DocuSign, Inc.: Digital Signature with Efficiency and Brand Recognition

DocuSign leverages brand recognition and network effects in e-signature adoption, contrasting ServiceNow’s platform lock-in. It commands a 79% gross margin but a thinner EBIT margin signals operational challenges. Growth in AI-driven contract management tools offers upside amid intensifying competition.

The Moat Verdict: Switching Costs vs. Network Effects

Both firms show growing ROIC trends but remain below WACC, signaling no dominant moat yet. ServiceNow’s sticky enterprise workflows build a wider moat than DocuSign’s brand-driven network effects. I see ServiceNow better positioned to defend and expand market share in 2026.

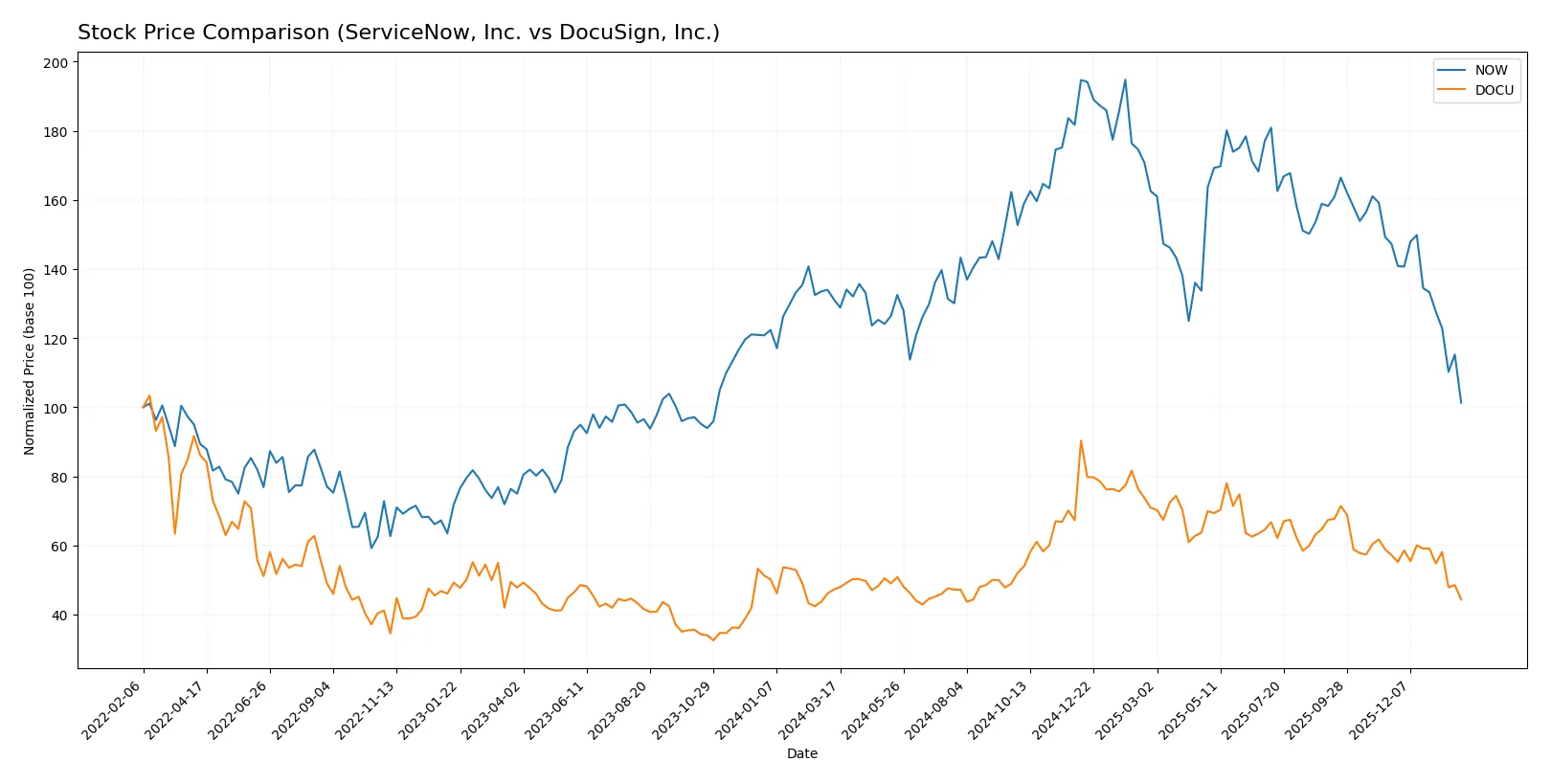

Which stock offers better returns?

The past year shows both stocks on a downward trajectory, with ServiceNow experiencing sharper declines and more volatile trading than DocuSign.

Trend Comparison

ServiceNow’s stock fell 22.79% over the past 12 months, marking a bearish trend with decelerating losses. The price ranged from a high of 225 to a low near 117.

DocuSign’s stock declined 6.13% in the same period, also bearish but with less volatility and a smoother deceleration. Its price fluctuated between 107 and 51.

ServiceNow underperformed DocuSign with a larger percentage drop and higher volatility, delivering the weaker market performance over the last year.

Target Prices

Analysts present a wide target price range for ServiceNow, Inc. and a narrower, more conservative outlook for DocuSign, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| ServiceNow, Inc. | 115 | 1315 | 440.14 |

| DocuSign, Inc. | 70 | 88 | 76.86 |

ServiceNow’s target consensus at 440.14 significantly exceeds its current price of 117.01, implying strong long-term growth expectations. DocuSign’s consensus target of 76.86 also surpasses its current 52.54 price, suggesting moderate upside potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here are the recent institutional grades assigned to ServiceNow, Inc. and DocuSign, Inc.:

ServiceNow, Inc. Grades

The following table lists recent grades from leading financial institutions for ServiceNow, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-30 |

| BTIG | Maintain | Buy | 2026-01-29 |

| Stifel | Maintain | Buy | 2026-01-29 |

| RBC Capital | Maintain | Outperform | 2026-01-29 |

| Macquarie | Maintain | Neutral | 2026-01-29 |

| DA Davidson | Maintain | Buy | 2026-01-29 |

| Needham | Maintain | Buy | 2026-01-29 |

| Keybanc | Maintain | Underweight | 2026-01-29 |

| Evercore ISI Group | Maintain | Outperform | 2026-01-29 |

| Cantor Fitzgerald | Maintain | Overweight | 2026-01-29 |

DocuSign, Inc. Grades

The following table lists recent grades from leading financial institutions for DocuSign, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| Piper Sandler | Maintain | Neutral | 2025-12-05 |

| Evercore ISI Group | Maintain | In Line | 2025-12-05 |

| UBS | Maintain | Neutral | 2025-12-05 |

| Needham | Maintain | Hold | 2025-12-05 |

| Wedbush | Maintain | Neutral | 2025-12-05 |

| B of A Securities | Maintain | Neutral | 2025-12-05 |

| JP Morgan | Maintain | Neutral | 2025-12-05 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-05 |

Which company has the best grades?

ServiceNow, Inc. consistently receives higher grades like Buy and Outperform from multiple institutions, signaling stronger analyst confidence. DocuSign, Inc. mostly holds Neutral or Sector Perform ratings, indicating more cautious sentiment. Investors may view ServiceNow’s grades as reflecting a more favorable outlook.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

ServiceNow, Inc.

- Operates in a highly competitive enterprise cloud software sector with rising demand for workflow automation. Faces strong rivals like Salesforce and Microsoft.

DocuSign, Inc.

- Competes in electronic signature and contract management, with pressure from Adobe and emerging AI-powered platforms. Market growth is robust but crowded.

2. Capital Structure & Debt

ServiceNow, Inc.

- Maintains low leverage with debt-to-equity at 0.25 and strong interest coverage. Conservative capital structure supports financial stability.

DocuSign, Inc.

- Exhibits even lower leverage at 0.06 and excellent interest coverage, indicating very low financial risk and strong balance sheet discipline.

3. Stock Volatility

ServiceNow, Inc.

- Beta near 0.98 suggests stock moves closely with market, moderate volatility aligning with technology sector norms.

DocuSign, Inc.

- Beta close to 0.99 indicates similar market sensitivity and volatility, consistent with tech industry peers.

4. Regulatory & Legal

ServiceNow, Inc.

- Faces typical software industry regulations, including data privacy and security compliance, with limited regulatory disruptions.

DocuSign, Inc.

- Encounters regulatory scrutiny around digital signatures, data protection, and cross-border compliance, which could increase operational complexity.

5. Supply Chain & Operations

ServiceNow, Inc.

- Relies on cloud infrastructure partners and global IT services. Potential risks from service disruptions or cyber threats remain manageable.

DocuSign, Inc.

- Dependent on cloud service providers and digital infrastructure. Vulnerable to tech outages but benefits from scalable SaaS model.

6. ESG & Climate Transition

ServiceNow, Inc.

- Increasing focus on ESG initiatives and sustainable IT practices. Risk of reputational damage if ESG targets are missed.

DocuSign, Inc.

- Committed to reducing carbon footprint via digital solutions. Faces pressure to enhance transparency and ESG reporting standards.

7. Geopolitical Exposure

ServiceNow, Inc.

- Exposed to U.S.-China tech tensions and global data sovereignty laws, which could impact international sales and partnerships.

DocuSign, Inc.

- Similar geopolitical risks with added sensitivity due to global contract execution and cross-border legal frameworks.

Which company shows a better risk-adjusted profile?

ServiceNow’s primary risk lies in market competition and stretched valuation metrics, which could pressure future returns. DocuSign faces its biggest threat from regulatory complexities in global digital agreements. Despite these, DocuSign’s lower leverage and stronger profitability metrics suggest a superior risk-adjusted profile. Notably, DocuSign’s Altman Z-score remains safely above distress levels, reflecting robust financial health despite market headwinds.

Final Verdict: Which stock to choose?

ServiceNow’s superpower lies in its unmatched operational efficiency and consistent income growth, making it a robust cash machine. However, its below-par current ratio signals liquidity pressure, a point of vigilance amid market volatility. It suits aggressive growth portfolios that tolerate short-term risks for long-term rewards.

DocuSign’s strategic moat is its strong recurring revenue and impressive return on equity, reflecting effective capital use and scalability. It offers better financial safety compared to ServiceNow, with a healthier debt profile. This aligns well with GARP portfolios seeking growth with reasonable valuation discipline.

If you prioritize aggressive growth fueled by operational excellence, ServiceNow is the compelling choice due to its strong income momentum despite liquidity concerns. However, if you seek balanced growth with superior financial stability, DocuSign offers better risk management and a durable recurring revenue base. Both present slightly favorable moats but cater to distinct investor profiles.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of ServiceNow, Inc. and DocuSign, Inc. to enhance your investment decisions: