Quantum technology is reshaping the future of computing and cybersecurity, making companies in this space highly intriguing for investors. D-Wave Quantum Inc. (QBTS) pioneers in quantum computing hardware and software, while Arqit Quantum Inc. (ARQQ) focuses on quantum-enhanced cybersecurity solutions. Despite their different specialties, both operate at the cutting edge of quantum innovation. In this article, I will analyze their potential to determine which offers the most compelling investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between D-Wave Quantum Inc. and Arqit Quantum Inc. by providing an overview of these two companies and their main differences.

D-Wave Quantum Inc. Overview

D-Wave Quantum Inc. develops and delivers quantum computing systems, software, and services globally. Its offerings include the fifth-generation quantum computer Advantage, quantum onboarding services, open-source programming tools, and cloud-based access to live quantum computers. The company serves diverse sectors such as manufacturing, logistics, financial services, and life sciences, positioning itself as a leader in quantum computing hardware and software.

Arqit Quantum Inc. Overview

Arqit Quantum Inc. specializes in cybersecurity services via satellite and terrestrial platforms, primarily in the United Kingdom. Its core product, QuantumCloud, enables devices to generate encryption keys through a lightweight software agent. With a focus on software infrastructure, Arqit targets advanced encryption solutions, distinguishing itself within the cybersecurity segment of the technology sector.

Key similarities and differences

Both companies operate in the technology sector with a focus on quantum-related innovations. D-Wave emphasizes quantum computing hardware and software for a broad range of industries, while Arqit concentrates on quantum-enabled cybersecurity solutions through software. D-Wave has a significantly larger market cap and workforce, reflecting its broader product portfolio and global reach compared to Arqit’s niche focus in encryption technology.

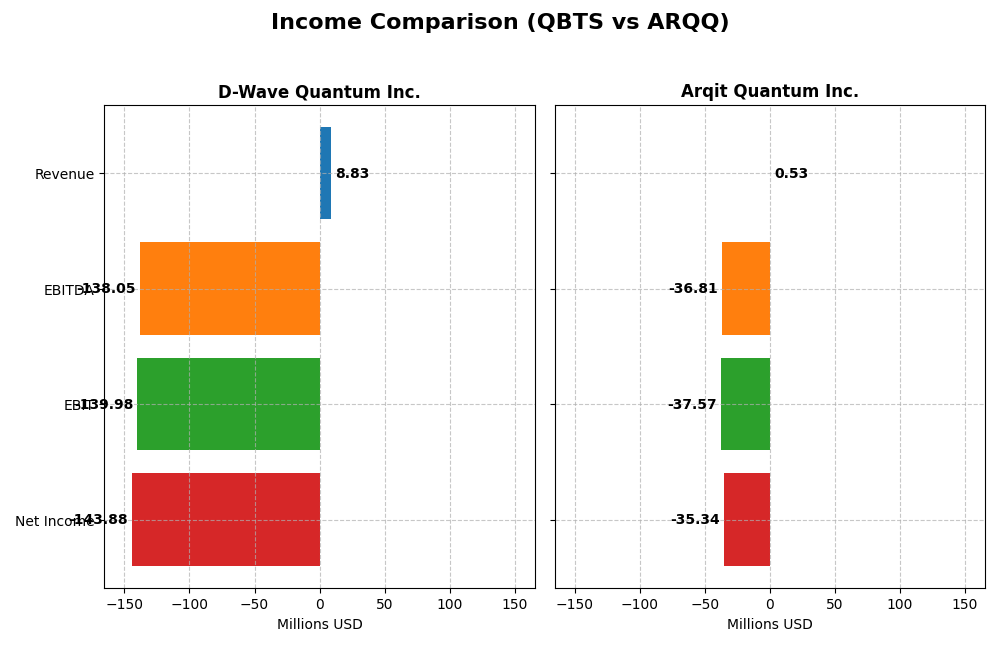

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for D-Wave Quantum Inc. and Arqit Quantum Inc. for their most recent fiscal years.

| Metric | D-Wave Quantum Inc. (QBTS) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| Market Cap | 9.75B | 384M |

| Revenue | 8.83M | 530K |

| EBITDA | -138.1M | -36.8M |

| EBIT | -140.0M | -37.6M |

| Net Income | -143.9M | -35.3M |

| EPS | -0.75 | -2.56 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

D-Wave Quantum Inc.

D-Wave Quantum Inc. showed a 71.07% revenue growth from 2020 to 2024, but net income declined sharply by 555%, reflecting deepening losses. Gross margin remained favorable at 63%, indicating strong product profitability, though EBIT and net margins were significantly negative. The 2024 year showed slight revenue growth of 0.79% but worsening margins and a 69% EBIT decline.

Arqit Quantum Inc.

Arqit Quantum Inc. experienced rapid revenue growth, surging 1006% overall to 2025, with a 80.9% increase from 2024 to 2025. Net income improved by 87% over the period, supported by favorable net margin growth of nearly 99%. However, gross margin remained negative at -43%, and EBIT margin was deeply negative. The most recent year showed strong top-line growth but continuing operating losses.

Which one has the stronger fundamentals?

Arqit Quantum’s fundamentals appear stronger, supported by significant revenue and net income growth and mostly favorable margin trends despite negative gross and EBIT margins. Conversely, D-Wave Quantum shows stable gross margin but deteriorating profitability and unfavorable margin trends. Arqit’s higher proportion of favorable income statement metrics (64% vs 29%) suggests better operational momentum.

Financial Ratios Comparison

The following table compares the most recent key financial ratios for D-Wave Quantum Inc. (QBTS) and Arqit Quantum Inc. (ARQQ) based on their fiscal year 2024 and latest available data.

| Ratios | D-Wave Quantum Inc. (QBTS) 2024 | Arqit Quantum Inc. (ARQQ) 2025 |

|---|---|---|

| ROE | -2.30 | -1.30 |

| ROIC | -0.45 | -1.27 |

| P/E | -11.22 | -15.12 |

| P/B | 25.76 | 19.62 |

| Current Ratio | 6.14 | 2.69 |

| Quick Ratio | 6.08 | 2.69 |

| D/E (Debt-to-Equity) | 0.61 | 0.03 |

| Debt-to-Assets | 0.19 | 0.02 |

| Interest Coverage | -19.82 | -802.90 |

| Asset Turnover | 0.04 | 0.01 |

| Fixed Asset Turnover | 0.77 | 0.74 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

D-Wave Quantum Inc.

D-Wave Quantum displays predominantly unfavorable financial ratios, including a deeply negative net margin (-1630%) and return on equity (-230%), indicating weak profitability and efficiency. The company shows a high current ratio (6.14) but it is flagged unfavorable, suggesting potential liquidity management concerns. D-Wave does not pay dividends, reflecting either a reinvestment strategy or ongoing development phase without shareholder payouts.

Arqit Quantum Inc.

Arqit Quantum shows a mix of strengths and weaknesses, with favorable liquidity ratios such as a current ratio and quick ratio at 2.69, and low debt to assets (1.68%), indicating solid balance sheet health. However, profitability remains negative with a net margin of -6668% and return on equity of -130%. Arqit also does not pay dividends, likely prioritizing growth and R&D investments over distributions to shareholders.

Which one has the best ratios?

Both companies face unfavorable overall ratio evaluations; however, Arqit Quantum has a higher proportion of favorable ratios (36% vs. D-Wave’s 21%), particularly in liquidity and leverage metrics. Despite both showing negative profitability and no dividends, Arqit’s stronger balance sheet ratios suggest relatively better financial stability compared to D-Wave Quantum’s broader challenges.

Strategic Positioning

This section compares the strategic positioning of D-Wave Quantum Inc. and Arqit Quantum Inc. regarding Market position, Key segments, and Exposure to technological disruption:

D-Wave Quantum Inc.

- Large market cap (~9.7B USD) with moderate competitive pressure in computer hardware.

- Focus on quantum computing systems, software, and professional services targeting AI, drug discovery, cybersecurity, and financial modeling.

- Positioned in emerging quantum computing hardware and software; faces disruption from rapid quantum technology advancements.

Arqit Quantum Inc.

- Small market cap (~384M USD) with higher beta, indicating higher volatility and competitive pressure in software infrastructure.

- Specializes in cybersecurity services via satellite and terrestrial platforms, offering QuantumCloud encryption software.

- Exposure to disruption in cybersecurity quantum encryption, relying on innovative satellite-based technology delivery.

D-Wave Quantum Inc. vs Arqit Quantum Inc. Positioning

D-Wave presents a diversified approach across hardware, software, and services in multiple industries, while Arqit concentrates on cybersecurity software via satellite platforms. D-Wave’s broader market presence contrasts with Arqit’s niche focus and smaller scale.

Which has the best competitive advantage?

Both companies show slightly unfavorable MOAT evaluations, shedding value despite growing ROIC trends. D-Wave’s larger scale and diversified offerings contrast with Arqit’s narrower focus and smaller capital base, reflecting different stages in value creation and competitive sustainability.

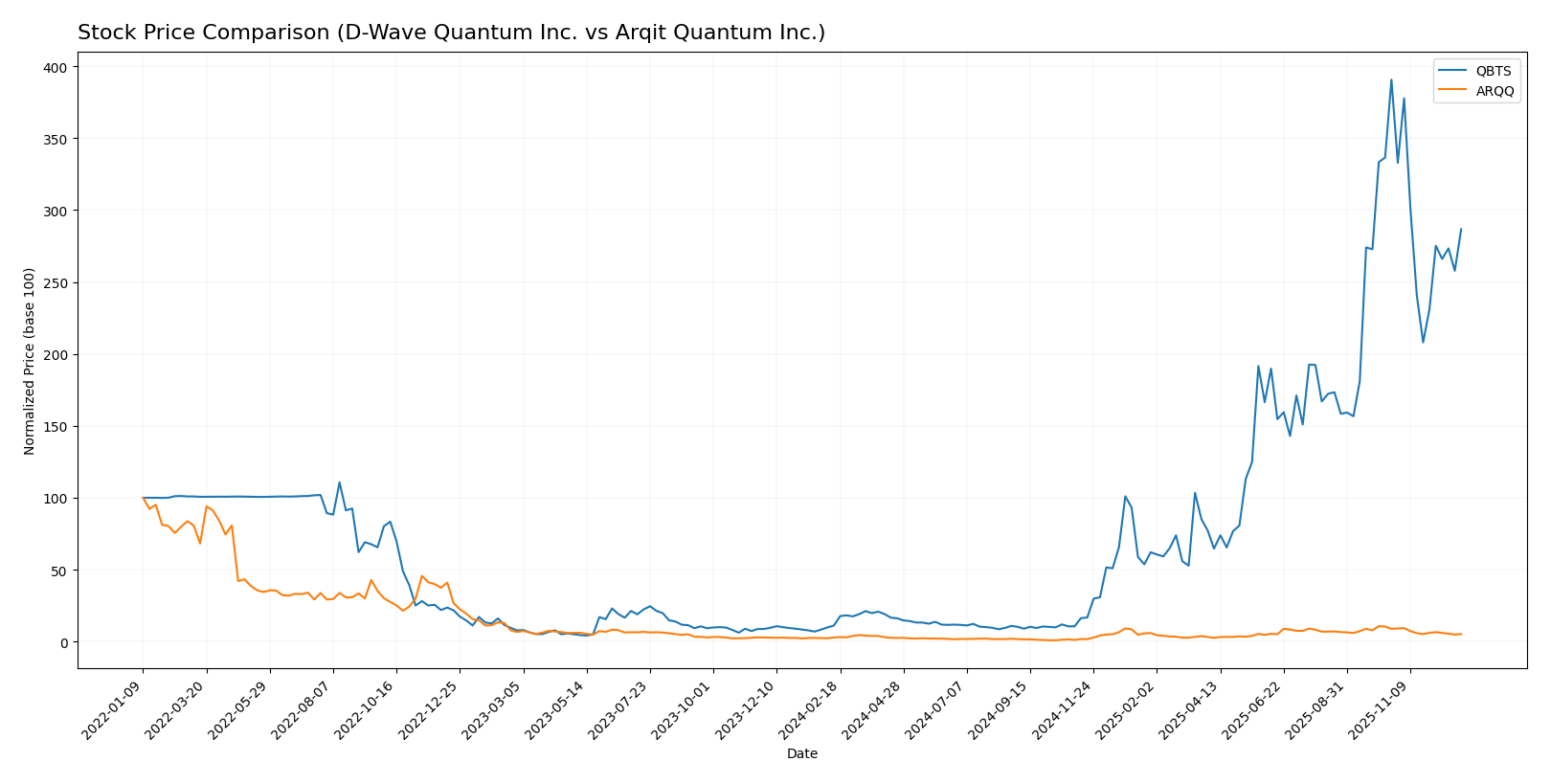

Stock Comparison

The past year showed markedly divergent price movements for D-Wave Quantum Inc. and Arqit Quantum Inc., with both stocks experiencing strong long-term gains but recent declines signaling shifting trading dynamics.

Trend Analysis

D-Wave Quantum Inc. (QBTS) exhibited a strong bullish trend over the past 12 months with a 2480.73% price increase, though recent months show a deceleration phase and a 26.61% decline. Volatility is moderate with a 10.07 standard deviation.

Arqit Quantum Inc. (ARQQ) also demonstrated a bullish trend with an 85.21% rise over the year, followed by a sharper recent decline of 40.85% and decelerating momentum. Volatility is higher, reflected in an 11.75 standard deviation.

Comparing both, QBTS outperformed ARQQ substantially in market performance over the year, despite both stocks facing recent downward pressure.

Target Prices

The current analyst consensus shows promising upside potential for both D-Wave Quantum Inc. and Arqit Quantum Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| D-Wave Quantum Inc. | 46 | 26 | 38.88 |

| Arqit Quantum Inc. | 60 | 60 | 60 |

Analysts expect D-Wave Quantum’s shares to rise significantly from the current price of $28.12, while Arqit Quantum’s target consensus at $60 indicates a strong bullish outlook compared to its current price of $24.54.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for D-Wave Quantum Inc. and Arqit Quantum Inc.:

Rating Comparison

D-Wave Quantum Inc. Rating

- Rating: C- indicating a very favorable overall rating status.

- Discounted Cash Flow Score: 1, very unfavorable valuation score.

- ROE Score: 1, very unfavorable efficiency in profit generation.

- ROA Score: 1, very unfavorable asset utilization.

- Debt To Equity Score: 4, favorable financial stability.

- Overall Score: 1, very unfavorable summary financial standing.

Arqit Quantum Inc. Rating

- Rating: C indicating a very favorable overall rating status.

- Discounted Cash Flow Score: 2, moderate valuation score.

- ROE Score: 1, very unfavorable efficiency in profit generation.

- ROA Score: 1, very unfavorable asset utilization.

- Debt To Equity Score: 4, favorable financial stability.

- Overall Score: 2, moderate summary financial standing.

Which one is the best rated?

Based strictly on the provided data, Arqit Quantum Inc. holds higher overall and discounted cash flow scores, indicating a moderately better financial standing than D-Wave Quantum Inc., which shows very unfavorable overall and cash flow scores.

Scores Comparison

Here is a comparison of the financial scores for D-Wave Quantum Inc. and Arqit Quantum Inc.:

D-Wave Quantum Inc. Scores

- Altman Z-Score: 28.11, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 4, reflecting average financial strength.

Arqit Quantum Inc. Scores

- Altman Z-Score: -1.46, indicating distress zone and high bankruptcy risk.

- Piotroski Score: 2, reflecting very weak financial strength.

Which company has the best scores?

Based strictly on the provided data, D-Wave Quantum Inc. has better scores, with a significantly higher Altman Z-Score in the safe zone and a stronger Piotroski Score than Arqit Quantum Inc., which is in financial distress and has very weak financial strength.

Grades Comparison

Here is a comparison of the latest grades assigned by reliable grading companies for both companies:

D-Wave Quantum Inc. Grades

This table shows recent grades and rating actions from recognized grading firms for D-Wave Quantum Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Benchmark | Maintain | Buy | 2025-11-10 |

| Rosenblatt | Maintain | Buy | 2025-11-07 |

| Canaccord Genuity | Maintain | Buy | 2025-11-07 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-11-07 |

| B. Riley Securities | Maintain | Buy | 2025-09-22 |

| Piper Sandler | Maintain | Overweight | 2025-08-08 |

| Benchmark | Maintain | Buy | 2025-08-04 |

| B. Riley Securities | Maintain | Buy | 2025-07-23 |

| B. Riley Securities | Maintain | Buy | 2025-06-18 |

| Benchmark | Maintain | Buy | 2025-06-18 |

Grades for D-Wave Quantum Inc. consistently remain positive, with multiple Buy and Overweight ratings maintained over recent months.

Arqit Quantum Inc. Grades

Below are recent grading actions from a recognized grading company for Arqit Quantum Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2025-10-13 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-18 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-31 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-06 |

| HC Wainwright & Co. | Maintain | Buy | 2024-07-11 |

| HC Wainwright & Co. | Maintain | Buy | 2024-05-29 |

| HC Wainwright & Co. | Maintain | Buy | 2024-05-15 |

| HC Wainwright & Co. | Maintain | Buy | 2023-11-22 |

| HC Wainwright & Co. | Maintain | Buy | 2023-09-27 |

| HC Wainwright & Co. | Maintain | Buy | 2023-09-26 |

The grades for Arqit Quantum Inc. have been uniformly positive, with a consistent Buy rating maintained by HC Wainwright & Co. over several years.

Which company has the best grades?

Both companies hold consistently positive grades, but D-Wave Quantum Inc.’s ratings include multiple Buy and Overweight assessments from several grading firms, indicating a broader analyst coverage. Arqit Quantum Inc.’s grades come from a single grading company but show unwavering Buy ratings. This suggests D-Wave Quantum Inc. may have slightly more diverse analyst confidence, potentially impacting investor perception of stability and market support.

Strengths and Weaknesses

Below is a comparison table highlighting key strengths and weaknesses of D-Wave Quantum Inc. (QBTS) and Arqit Quantum Inc. (ARQQ) based on the most recent financial and operational data.

| Criterion | D-Wave Quantum Inc. (QBTS) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| Diversification | Moderate: Revenue mainly from professional services (1.94M USD in 2024) with limited product sales (144K USD) | Low: No reported revenue segmentation; likely early-stage or narrow focus |

| Profitability | Poor profitability: Negative net margin (-1630%) and ROIC (-45%), but improving ROIC trend (+47%) | Very poor profitability: More severe negative net margin (-6668%) and ROIC (-127%), but ROIC improving (+29%) |

| Innovation | Strong focus on quantum computing services with gradually increasing returns | Focused on quantum encryption technology, still in investment phase with negative returns |

| Global presence | Established presence with professional services globally | Less established; smaller scale and limited disclosures |

| Market Share | Niche player in quantum computing services | Emerging player in quantum security with limited market penetration |

Key takeaways: Both companies are currently unprofitable and destroying value, yet they show improving profitability trends. D-Wave Quantum has more diversification and a stronger presence, while Arqit Quantum remains an early-stage innovator with higher risk but potential for growth. Caution and close monitoring of financial improvements are advised before investing.

Risk Analysis

Below is a comparative table outlining key risks for D-Wave Quantum Inc. (QBTS) and Arqit Quantum Inc. (ARQQ) based on the most recent data from 2025-2026:

| Metric | D-Wave Quantum Inc. (QBTS) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| Market Risk | Beta 1.56; moderate volatility | Beta 2.38; high volatility |

| Debt Level | Debt-to-Equity 0.61; moderate debt | Debt-to-Equity 0.03; very low debt |

| Regulatory Risk | Moderate, tech industry regulations in Canada/US | Moderate, cybersecurity regulations in UK/EU |

| Operational Risk | Medium; reliance on quantum hardware innovation | Medium; dependency on cybersecurity platform adoption |

| Environmental Risk | Low; primarily software and hardware development | Low; software-focused with minimal environmental impact |

| Geopolitical Risk | Moderate; US-Canada tech collaboration stable | Moderate-high; UK regulatory changes and Brexit aftermath |

The most impactful risks are ARQQ’s high market volatility (beta 2.38) and financial distress signals, including a distress zone Altman Z-Score and very weak Piotroski Score, indicating elevated bankruptcy risk. QBTS shows moderate market risk but better financial stability with a safe zone Altman Z-Score, though operational risks remain due to heavy R&D demands in quantum computing. Investors should weigh volatility and financial health carefully.

Which Stock to Choose?

D-Wave Quantum Inc. (QBTS) shows modest revenue growth of 0.79% in 2024, but suffers from unfavorable profitability and financial ratios, including a negative net margin of -1629.99% and ROE of -229.67%. The company carries moderate debt (debt-to-equity 0.61) with a favorable debt-to-assets ratio of 19.2%, yet overall financial health and profitability remain weak. Its rating is very favorable (C-), despite the global ratios evaluation being unfavorable.

Arqit Quantum Inc. (ARQQ) exhibits strong revenue growth of 80.89% in 2025 and favorable improvements in net margin growth (64.2%) and EPS growth (76.27%). However, profitability ratios remain unfavorable with a net margin of -6668.49% and ROE of -129.77%. The company has low leverage, reflected in a debt-to-equity of 0.03 and favorable liquidity ratios. The rating is very favorable (C), but the overall ratios evaluation is unfavorable.

Investors focused on growth might find ARQQ more aligned with their strategy due to its rapid revenue and earnings growth despite profitability challenges. Conversely, those prioritizing a stronger balance sheet and lower leverage could view QBTS as more favorable, given its moderate debt levels and slightly better financial stability metrics. Both companies show unfavorable profitability and financial ratios, suggesting a cautious approach might be more prudent.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of D-Wave Quantum Inc. and Arqit Quantum Inc. to enhance your investment decisions: