Home > Comparison > Technology > MSFT vs CRWD

The strategic rivalry between Microsoft Corporation and CrowdStrike Holdings defines the evolution of the software infrastructure sector. Microsoft operates as a diversified technology behemoth spanning cloud, productivity, and personal computing, while CrowdStrike focuses on agile, cloud-native cybersecurity solutions. This head-to-head contrasts scale and breadth against innovation and specialization. This analysis aims to identify which corporate trajectory delivers superior risk-adjusted returns for a diversified portfolio in an increasingly digital economy.

Table of contents

Companies Overview

Microsoft Corporation and CrowdStrike Holdings, Inc. shape the forefront of the software infrastructure market.

Microsoft Corporation: The Diversified Tech Titan

Microsoft dominates as a global technology leader with a vast ecosystem spanning productivity software, cloud computing, and personal computing devices. Its core revenue springs from subscription services like Office 365, cloud platform Azure, and Windows licensing. In 2026, Microsoft sharpens its strategic focus on expanding Azure’s cloud infrastructure and integrating AI-driven enterprise solutions to sustain its competitive advantage.

CrowdStrike Holdings, Inc.: The Cloud Security Specialist

CrowdStrike stands out as a pioneer in cloud-delivered cybersecurity, specializing in endpoint protection and threat intelligence. Its revenue is primarily subscription-based, driven by the Falcon platform and cloud security modules sold directly and via channel partners. In 2026, CrowdStrike intensifies efforts on Zero Trust identity protection and expanding its managed security services to capture growing enterprise demand for advanced cyber defense.

Strategic Collision: Similarities & Divergences

Both companies operate in software infrastructure, yet Microsoft pursues a broad, integrated ecosystem while CrowdStrike focuses narrowly on cloud security solutions. Their primary battleground lies in enterprise cloud adoption, where security and productivity intersect. Investors face a contrast: Microsoft offers scale and diversification, whereas CrowdStrike delivers specialized growth potential in cybersecurity’s evolving landscape.

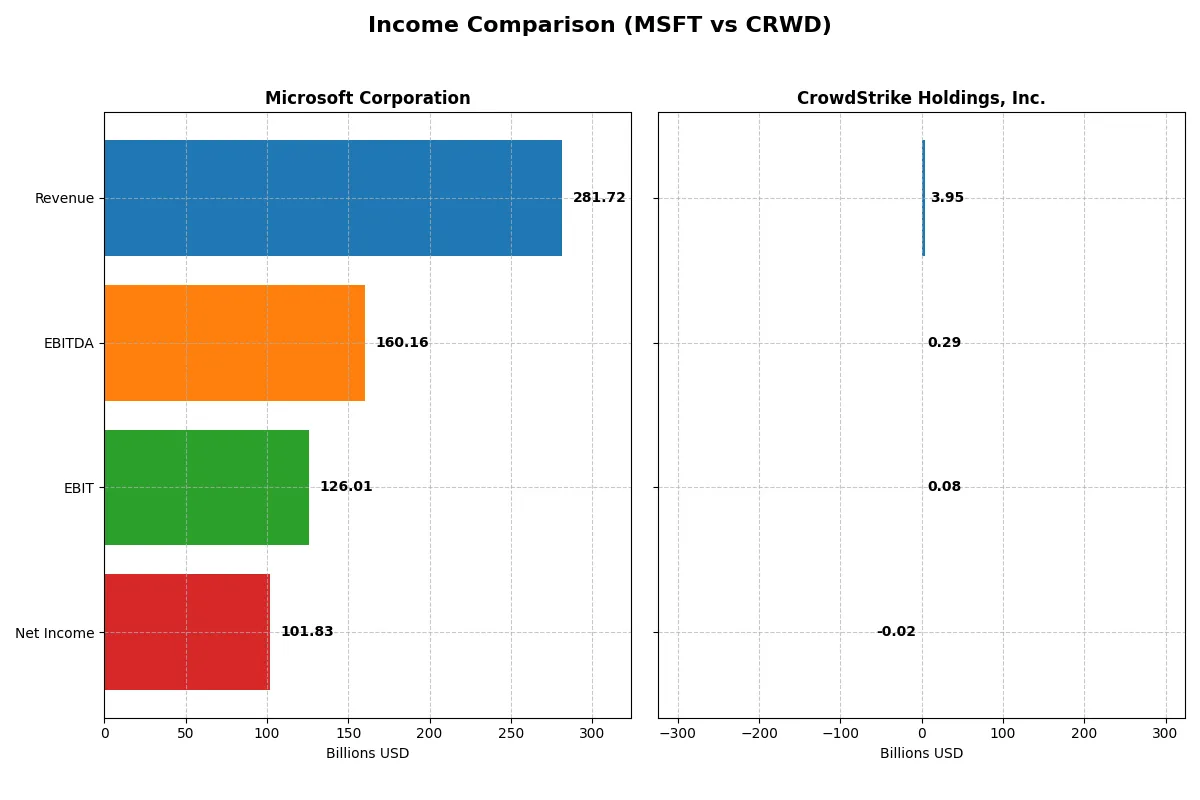

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Microsoft Corporation (MSFT) | CrowdStrike Holdings, Inc. (CRWD) |

|---|---|---|

| Revenue | 282B | 3.95B |

| Cost of Revenue | 87.8B | 991M |

| Operating Expenses | 65.4B | 3.08B |

| Gross Profit | 194B | 2.96B |

| EBITDA | 160B | 295M |

| EBIT | 126B | 81M |

| Interest Expense | 2.39B | 26.3M |

| Net Income | 102B | -19.3M |

| EPS | 13.7 | -0.0787 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals the true efficiency and profitability of two distinct corporate engines powering their growth and margins.

Microsoft Corporation Analysis

Microsoft’s revenue surged from 168B in 2021 to 282B in 2025, with net income climbing from 61B to 102B. Its gross margin remains robust at 68.8%, while net margin stabilizes around 36.2%. In 2025, Microsoft demonstrated strong operating leverage, growing revenue and earnings simultaneously with disciplined expense control.

CrowdStrike Holdings, Inc. Analysis

CrowdStrike’s revenue expanded rapidly from 874M in 2021 to 3.95B in 2025, yet it posted a slight net loss of 19M in 2025 despite a strong gross margin of 74.9%. The company struggles with thin EBIT margins at 2%, reflecting heavy operating expenses. Recent growth shows momentum but limited profitability and margin compression.

Verdict: Scale and Margin Strength vs. Growth at a Cost

Microsoft balances scale and margin power, delivering consistent profitability with 36% net margins and healthy EPS growth. CrowdStrike offers impressive revenue growth but at the expense of profitability and margin stability. For investors prioritizing fundamental strength and efficiency, Microsoft’s profile presents a clearer, more attractive investment foundation.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Microsoft Corporation (MSFT) | CrowdStrike Holdings, Inc. (CRWD) |

|---|---|---|

| ROE | 29.6% | -0.6% |

| ROIC | 22.0% | 0.7% |

| P/E | 36.3 | -5055.7 |

| P/B | 10.8 | 29.7 |

| Current Ratio | 1.35 | 1.67 |

| Quick Ratio | 1.35 | 1.67 |

| D/E (Debt-to-Equity) | 0.18 | 0.24 |

| Debt-to-Assets | 9.8% | 9.1% |

| Interest Coverage | 53.9 | -4.6 |

| Asset Turnover | 0.46 | 0.45 |

| Fixed Asset Turnover | 1.23 | 4.76 |

| Payout Ratio | 23.6% | 0% |

| Dividend Yield | 0.65% | 0% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Ratios serve as a company’s DNA, exposing hidden risks and operational strengths that shape investment decisions.

Microsoft Corporation

Microsoft demonstrates robust profitability with a 29.65% ROE and a strong 36.15% net margin, reflecting efficient operations. Despite these strengths, its P/E ratio at 36.31 signals an expensive valuation, while a modest 0.65% dividend yield suggests limited shareholder income. The firm prioritizes reinvestment in R&D, boosting long-term growth.

CrowdStrike Holdings, Inc.

CrowdStrike posts weak profitability, with a negative ROE of -0.59% and a slight net margin loss at -0.49%, indicating operational challenges. Its P/E ratio is anomalous at -5055.66 due to losses, but a high P/B at 29.71 marks a stretched valuation. The company does not pay dividends, focusing heavily on growth investments instead.

Premium Valuation vs. Operational Safety

Microsoft offers a superior balance of profitability and operational efficiency despite a premium valuation. CrowdStrike’s stretched metrics and negative returns entail higher risk. Investors seeking stability and steady returns find Microsoft’s profile more fitting, while growth-oriented investors must weigh CrowdStrike’s risk carefully.

Which one offers the Superior Shareholder Reward?

Microsoft offers a balanced distribution strategy with a 0.65% dividend yield and a sustainable 24% payout ratio, supported by strong free cash flow coverage above 1.5x. Its consistent buyback program amplifies total returns. CrowdStrike pays no dividends but reinvests heavily in growth, with free cash flow reinvestment and moderate buybacks. However, CrowdStrike’s negative net margins and volatile earnings raise concerns about long-term distribution sustainability. I conclude Microsoft provides a more attractive and reliable shareholder reward in 2026.

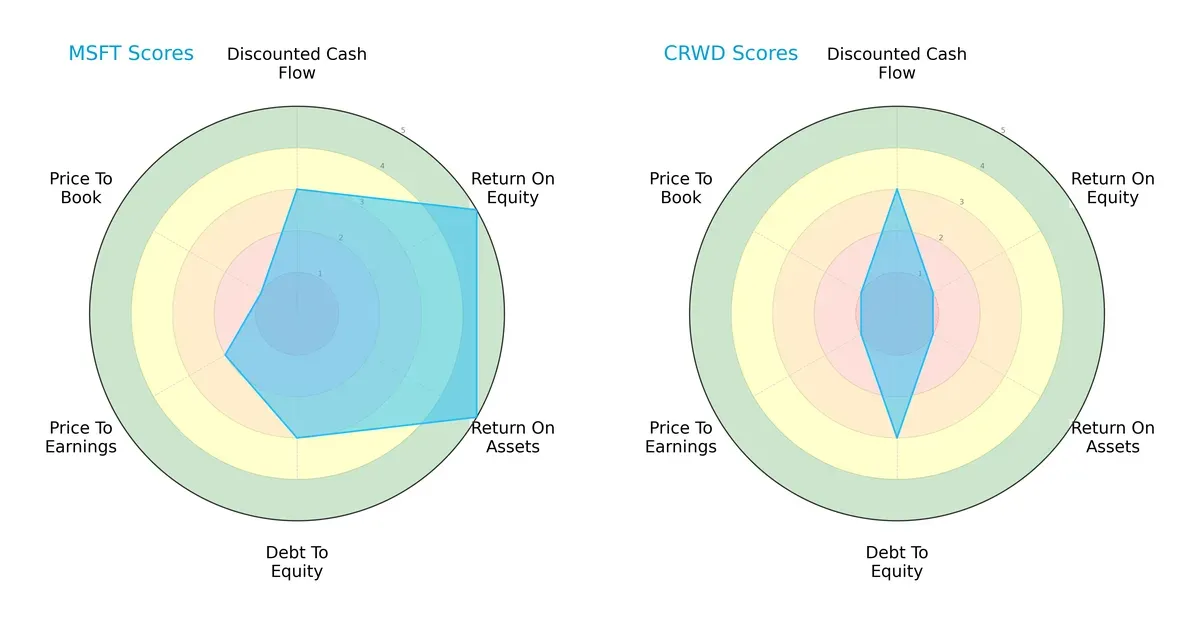

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of both firms, highlighting their core financial strengths and valuation differences:

Microsoft dominates in profitability metrics with very favorable ROE and ROA scores of 5 each, while CrowdStrike lags significantly at 1 in both. Both share moderate DCF and debt-to-equity scores, indicating similar cash flow and leverage profiles. Microsoft’s valuation scores (PE/PB) are weaker, suggesting a premium market price, while CrowdStrike’s low valuation scores hint at undervaluation but also reflect risk. Overall, Microsoft presents a more balanced and robust financial profile, whereas CrowdStrike relies on a cheaper valuation but lacks operational efficiency.

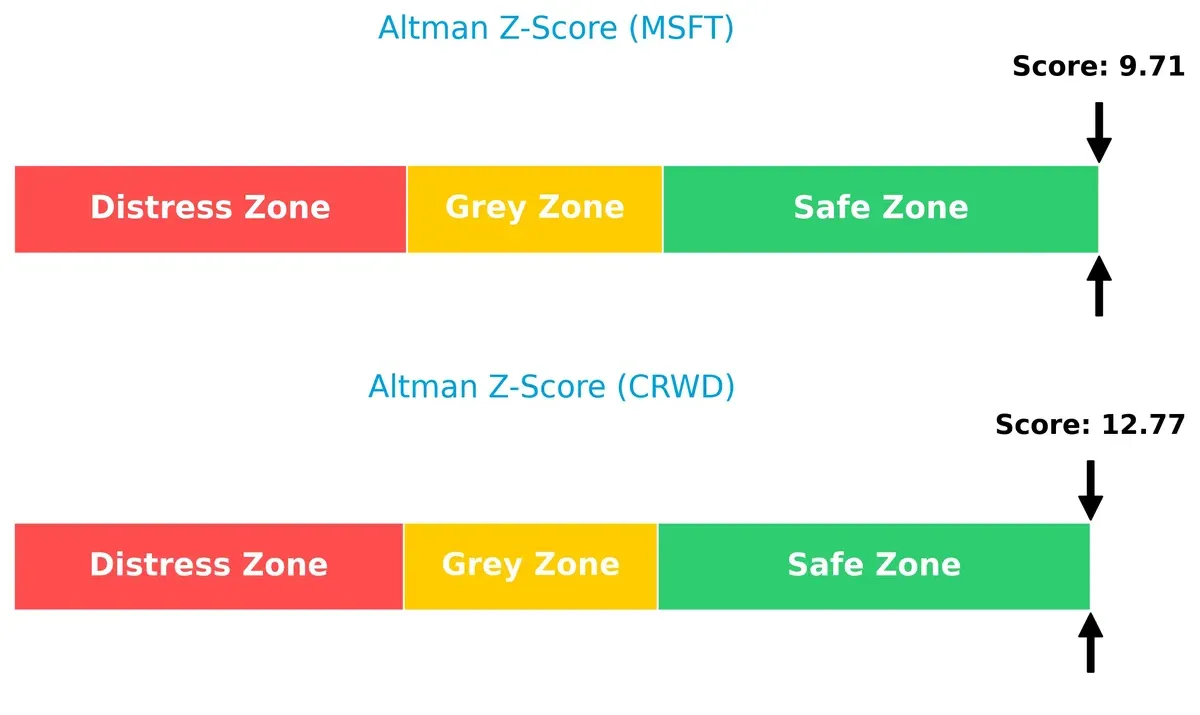

Bankruptcy Risk: Solvency Showdown

Microsoft’s Altman Z-Score of 9.7 and CrowdStrike’s 12.8 confirm both firms sit comfortably in the safe zone, signaling strong solvency and a low bankruptcy risk in the current economic cycle:

Financial Health: Quality of Operations

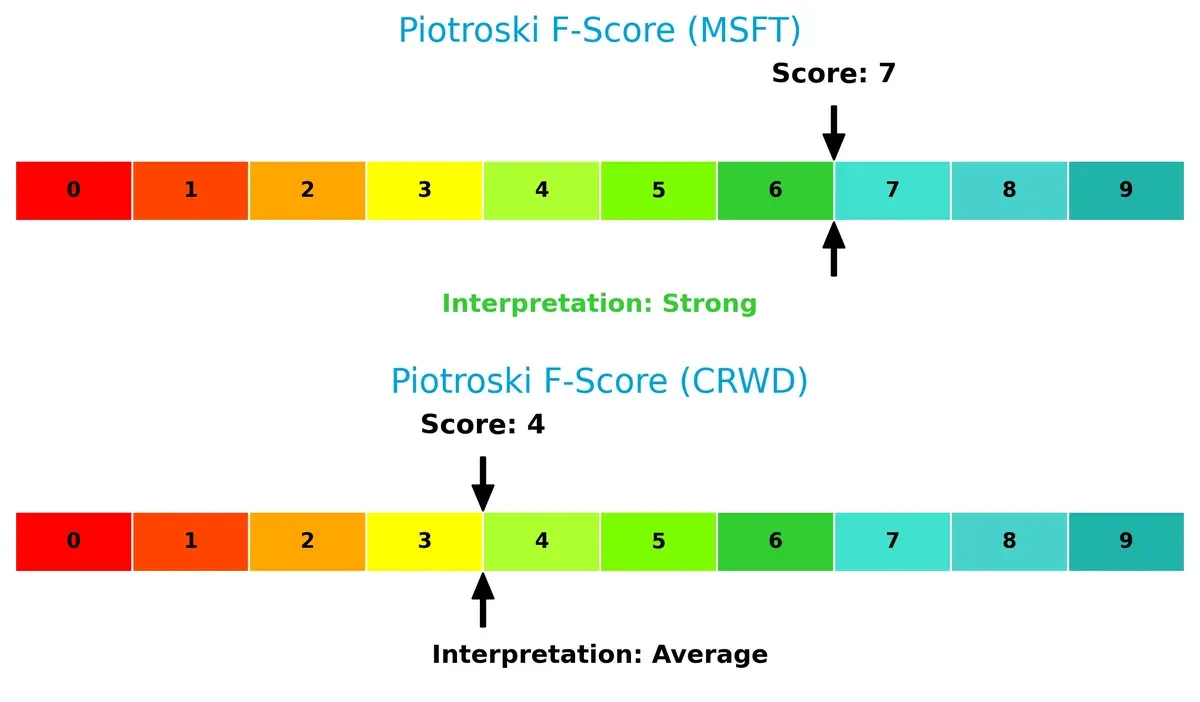

Microsoft’s Piotroski F-Score of 7 indicates strong financial health, reflecting solid profitability, liquidity, and operational efficiency. CrowdStrike’s score of 4 is average, raising caution about internal weaknesses and less consistent financial quality:

How are the two companies positioned?

This section dissects Microsoft and CrowdStrike’s operational DNA by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats and identify which business model delivers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

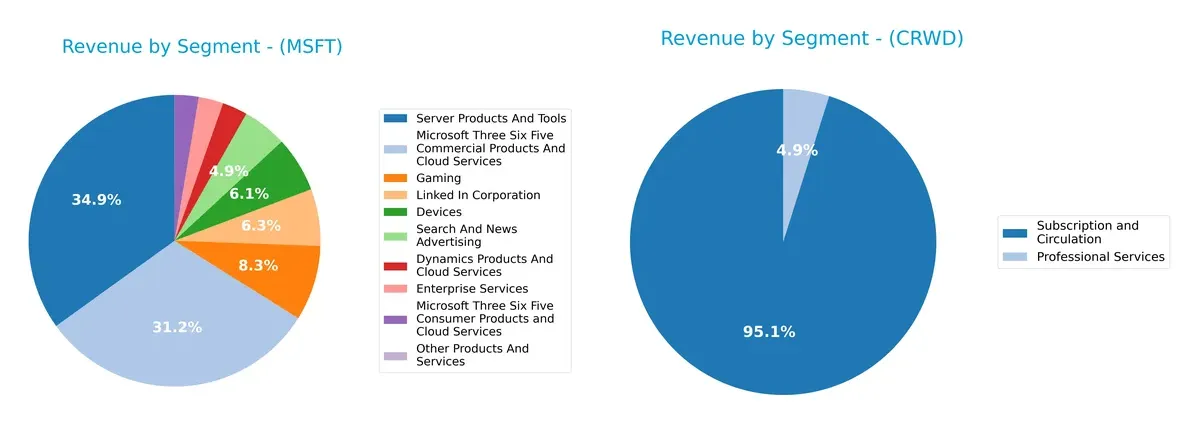

This comparison dissects how Microsoft Corporation and CrowdStrike Holdings diversify income streams and identifies their primary sector bets:

Microsoft dwarfs CrowdStrike in absolute revenue, anchored by its Server Products And Tools at $98B and Microsoft 365 Commercial at $87.8B. Microsoft’s mix spans gaming ($23.5B), LinkedIn ($17.8B), and devices ($17.3B), showing broad ecosystem lock-in. CrowdStrike relies heavily on Subscription and Circulation at $3.76B, with minimal Professional Services at $192M, indicating concentration risk but a focused growth strategy in cybersecurity SaaS.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Microsoft Corporation and CrowdStrike Holdings, Inc.:

Microsoft Strengths

- Highly diversified revenue streams across cloud, gaming, devices, and enterprise services

- Strong profitability with 36.15% net margin and 29.65% ROE

- Solid global presence with nearly equal US and Non-US revenue

- Favorable debt levels and interest coverage ratios

- Innovation supported by strong cloud and server products

CrowdStrike Strengths

- Growing subscription revenue indicates scalable business model

- Favorable capital structure with low debt ratios

- Strong liquidity ratios suggest good short-term financial health

- High fixed asset turnover implies efficient use of assets

- Expansion in Asia Pacific and EMEA markets shows geographic growth

Microsoft Weaknesses

- High P/E and P/B ratios indicate potentially overvalued stock

- Unfavorable asset turnover suggests room for operational efficiency improvement

- Low dividend yield may deter income-focused investors

- Neutral current ratio points to moderate liquidity risks

CrowdStrike Weaknesses

- Negative net margin and ROE reveal unprofitable operations

- Low ROIC compared to WACC signals weak capital return

- High P/B ratio suggests expensive valuation

- No dividend yield limits income appeal

- Moderate interest coverage ratio may constrain debt servicing

Microsoft’s broad diversification and strong profitability contrast with CrowdStrike’s early-stage financial challenges and growth focus. These differences highlight Microsoft’s mature, stable model versus CrowdStrike’s investment in expansion and innovation.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat safeguards long-term profits from relentless competitive pressure. It’s the key to sustainable economic value creation:

Microsoft Corporation: Ecosystem Lock-in and Intangible Assets

Microsoft’s moat stems from its vast ecosystem and intangible assets like Office 365 and Azure. This drives high ROIC (~13% above WACC), bolstering margin stability. In 2026, cloud growth and AI integration could deepen Microsoft’s advantage, though ROIC shows slight decline.

CrowdStrike Holdings, Inc.: Network Effects in Cybersecurity

CrowdStrike’s primary moat is its cloud-native Falcon platform’s network effects, enhancing threat intelligence. Unlike Microsoft, CrowdStrike’s ROIC lags below WACC but shows rapid improvement. Expansion into identity and Zero Trust markets fuels future growth potential amid fierce competition.

Ecosystem Lock-in vs. Network Effects: The Moat Showdown

Microsoft boasts a deeper moat with consistent value creation and scale. CrowdStrike’s improving ROIC signals promise but remains a value destroyer. Microsoft is better positioned to defend market share in 2026’s evolving tech landscape.

Which stock offers better returns?

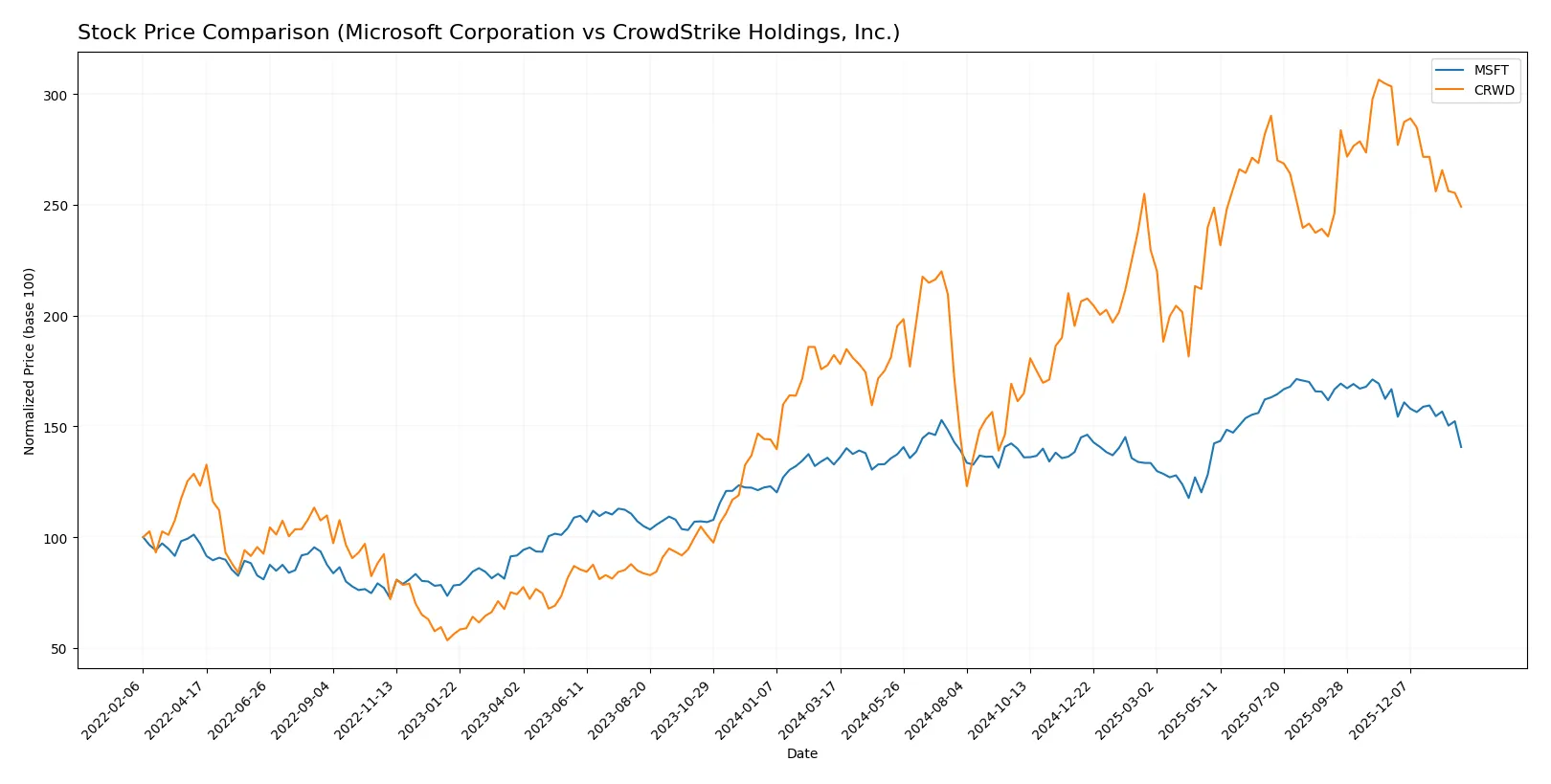

Both Microsoft Corporation and CrowdStrike Holdings, Inc. display notable price movements over the past year, with distinct trading volumes and recent downward momentum shaping their trajectories.

Trend Comparison

Microsoft’s stock rose 5.93% over the past 12 months, indicating a bullish trend with decelerating momentum. The price ranged between 359.84 and 524.11, showing moderate volatility (std dev 41.93).

CrowdStrike’s stock gained 36.72% over the same period, signaling a strong bullish trend but with deceleration. Prices fluctuated widely from 217.89 to 543.01, reflecting high volatility (std dev 80.24).

CrowdStrike outperformed Microsoft in market returns over the year, delivering a higher overall price appreciation despite both showing recent declines.

Target Prices

Analysts set confident targets for Microsoft Corporation and CrowdStrike Holdings, reflecting strong growth outlooks.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Microsoft Corporation | 450 | 675 | 600.04 |

| CrowdStrike Holdings, Inc. | 353 | 706 | 551.26 |

Microsoft’s consensus target at 600.04 suggests a 40% upside from current 430.29. CrowdStrike’s 551.26 target implies a 25% gain above its 441.41 price.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following tables summarize the latest institutional grades for Microsoft Corporation and CrowdStrike Holdings, Inc.:

Microsoft Corporation Grades

The table below lists recent grades assigned by major financial institutions to Microsoft:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-30 |

| Wells Fargo | Maintain | Overweight | 2026-01-29 |

| Wedbush | Maintain | Outperform | 2026-01-29 |

| Scotiabank | Maintain | Sector Outperform | 2026-01-29 |

| RBC Capital | Maintain | Outperform | 2026-01-29 |

| Stifel | Maintain | Buy | 2026-01-29 |

| Evercore ISI Group | Maintain | Outperform | 2026-01-29 |

| Keybanc | Maintain | Overweight | 2026-01-29 |

| Piper Sandler | Maintain | Overweight | 2026-01-29 |

| Cantor Fitzgerald | Maintain | Overweight | 2026-01-29 |

CrowdStrike Holdings, Inc. Grades

Below are recent institutional grades assigned to CrowdStrike Holdings, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Macquarie | Maintain | Neutral | 2026-01-27 |

| BTIG | Maintain | Buy | 2026-01-13 |

| Citigroup | Maintain | Buy | 2026-01-13 |

| Keybanc | Downgrade | Sector Weight | 2026-01-12 |

| Berenberg | Upgrade | Buy | 2026-01-09 |

| Stephens & Co. | Maintain | Overweight | 2025-12-18 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-18 |

| Freedom Capital Markets | Upgrade | Buy | 2025-12-11 |

| Citigroup | Maintain | Buy | 2025-12-04 |

| Goldman Sachs | Maintain | Buy | 2025-12-04 |

Which company has the best grades?

Microsoft consistently holds above-market grades, mostly Buy, Outperform, and Overweight, reflecting strong institutional confidence. CrowdStrike’s grades vary more, with a mix of Buy, Neutral, and some downgrades. Investors may view Microsoft’s steadier and higher grades as a sign of greater stability and broader analyst support.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Microsoft Corporation

- Dominates with diversified software and cloud services, facing intense competition from tech giants.

CrowdStrike Holdings, Inc.

- Faces fierce competition in cybersecurity with rapid innovation demands and evolving threat landscape.

2. Capital Structure & Debt

Microsoft Corporation

- Maintains low debt-to-equity (0.18) and strong interest coverage (52.84), signaling financial stability.

CrowdStrike Holdings, Inc.

- Moderate debt levels (0.24) with lower interest coverage (3.07) pose higher financial risk.

3. Stock Volatility

Microsoft Corporation

- Beta of 1.073 indicates moderate volatility, aligned with tech sector norms.

CrowdStrike Holdings, Inc.

- Slightly lower beta at 1.029 suggests marginally less volatility but still sensitive to market swings.

4. Regulatory & Legal

Microsoft Corporation

- Faces ongoing antitrust scrutiny and data privacy regulation risks globally.

CrowdStrike Holdings, Inc.

- Cybersecurity regulations and data protection laws impose compliance costs and operational risks.

5. Supply Chain & Operations

Microsoft Corporation

- Complex global supply chain for hardware and cloud infrastructure with potential disruption risks.

CrowdStrike Holdings, Inc.

- Cloud-based service model less reliant on physical supply chains but dependent on robust data centers.

6. ESG & Climate Transition

Microsoft Corporation

- Strong ESG initiatives with carbon neutrality goals; transition risks managed proactively.

CrowdStrike Holdings, Inc.

- Emerging ESG focus amid growing investor scrutiny; must enhance climate-related disclosures.

7. Geopolitical Exposure

Microsoft Corporation

- Significant global footprint exposes it to geopolitical tensions and trade restrictions.

CrowdStrike Holdings, Inc.

- Global client base subjects it to cross-border regulatory and geopolitical instability risks.

Which company shows a better risk-adjusted profile?

Microsoft’s dominant market position and strong financial stability outweigh CrowdStrike’s higher operational risks and weaker profitability. Microsoft’s Altman Z-score (9.7, safe zone) and Piotroski score (7, strong) reinforce its solid risk management. CrowdStrike, despite a safe Altman Z-score (12.7), has a middling Piotroski score (4), reflecting moderate financial health concerns. The critical risk for Microsoft is regulatory/legal scrutiny, while CrowdStrike’s largest threat is its persistent unprofitability and capital structure vulnerability. Overall, Microsoft exhibits a superior risk-adjusted profile supported by robust cash flows and balanced leverage.

Final Verdict: Which stock to choose?

Microsoft’s superpower lies in its unmatched ability to generate robust returns on invested capital well above its cost of capital, signaling consistent value creation. Its slight decline in profitability and premium valuation serve as points of vigilance. It fits well in portfolios seeking reliable, steady growth with a strong competitive moat.

CrowdStrike commands a strategic moat through rapid revenue growth fueled by its cloud security dominance and recurring revenue model. While it shows improving profitability trends, it remains a riskier play with negative net margins and value destruction historically. It suits investors targeting high-growth opportunities with tolerance for volatility.

If you prioritize stable value creation and proven profitability, Microsoft is the compelling choice due to its strong economic moat and financial resilience. However, if you seek aggressive growth with potential for outsized returns and accept elevated risk, CrowdStrike offers superior growth momentum despite its current challenges. Both scenarios demand careful risk management aligned with your investment horizon.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Microsoft Corporation and CrowdStrike Holdings, Inc. to enhance your investment decisions: