In the competitive landscape of the non-alcoholic beverage industry, two giants stand out: Coca-Cola Europacific Partners PLC (CCEP) and PepsiCo, Inc. (PEP). Both companies dominate the market, sharing similar product offerings and strategies that revolve around innovation and consumer engagement. This article will delve into their financial health, market strategies, and growth prospects to help you, the investor, determine which company presents the more compelling opportunity for your portfolio.

Table of contents

Company Overview

Coca-Cola Europacific Partners PLC Overview

Coca-Cola Europacific Partners PLC (CCEP) is a leading beverage company that focuses on producing, distributing, and selling a wide variety of non-alcoholic ready-to-drink beverages. With a market capitalization of approximately $42.1B, CCEP operates under renowned brands such as Coca-Cola, Fanta, Sprite, and Monster Energy, among others. The company serves around 600 million consumers, emphasizing innovation and sustainability in its product offerings. CCEP, headquartered in Uxbridge, UK, employs approximately 41,000 individuals and aims to deliver quality beverages that meet the diverse needs of customers while also driving strong financial performance.

PepsiCo, Inc. Overview

PepsiCo, Inc. is a global leader in the food and beverage industry, boasting a market cap of about $203.4B. The company manufactures and markets a vast array of products, including beverages and convenient foods, across multiple segments such as Frito-Lay, Quaker Foods, and PepsiCo Beverages. Founded in 1898 and headquartered in Purchase, NY, PepsiCo employs around 319,000 people. The company’s mission centers on delivering sustainable growth while providing consumers with a wide selection of nutritious and enjoyable products. PepsiCo continues to innovate and expand its portfolio to meet evolving consumer preferences.

Key similarities and differences

Both CCEP and PepsiCo operate within the non-alcoholic beverage sector, focusing on delivering a diverse range of products to consumers. However, CCEP primarily concentrates on beverage distribution, while PepsiCo has a broader portfolio that includes snacks and foods alongside its beverage offerings. This diversification allows PepsiCo to capture a larger share of the consumer market compared to CCEP’s more specialized focus.

Income Statement Comparison

The following table provides a detailed comparison of the most recent income statements for Coca-Cola Europacific Partners PLC (CCEP) and PepsiCo, Inc. (PEP), highlighting key financial metrics for the fiscal year 2024.

| Metric | CCEP | PEP |

|---|---|---|

| Market Cap | 42.13B | 203.38B |

| Revenue | 20.44B | 91.85B |

| EBITDA | 3.27B | 16.68B |

| EBIT | 2.34B | 12.87B |

| Net Income | 1.42B | 9.58B |

| EPS | 3.08 | 6.98 |

| Fiscal Year | 2024 | 2024 |

Interpretation of Income Statement

In 2024, both CCEP and PEP reported solid revenue figures, with CCEP achieving 20.44B and PEP at 91.85B. CCEP experienced a revenue growth of approximately 12.6% year-over-year, reflecting stable demand in the non-alcoholic beverage market. Meanwhile, PEP’s revenue growth was marginally positive, indicating a potential slowing in expansion. Net income for CCEP decreased to 1.42B from 1.67B in the previous year, suggesting increased operational costs. In contrast, PEP’s net income rose to 9.58B, benefiting from efficient cost management and robust sales across its segments. Overall, CCEP faces challenges in margin stability, while PEP demonstrates resilience in its profitability and market position.

Financial Ratios Comparison

Below is a comparative analysis of key financial ratios for Coca-Cola Europacific Partners PLC (CCEP) and PepsiCo, Inc. (PEP) based on the most recent data available.

| Metric | CCEP | PEP |

|---|---|---|

| ROE | 16.70% | 53.09% |

| ROIC | 6.53% | 13.73% |

| P/E | 24.08 | 21.80 |

| P/B | 4.02 | 12.63 |

| Current Ratio | 0.81 | 0.82 |

| Quick Ratio | 0.62 | 0.65 |

| D/E | 1.33 | 2.49 |

| Debt-to-Assets | 36.43% | 45.19% |

| Interest Coverage | 8.81 | 14.02 |

| Asset Turnover | 0.66 | 0.92 |

| Fixed Asset Turnover | 3.18 | 2.93 |

| Payout Ratio | 64.17% | 73.64% |

| Dividend Yield | 2.66% | 3.46% |

Interpretation of Financial Ratios

Coca-Cola Europacific Partners (CCEP) shows a solid but lower return on equity (ROE) compared to PepsiCo (PEP), indicating less profitability relative to shareholder equity. PEP’s higher asset turnover ratio suggests better efficiency in utilizing assets to generate revenue. However, CCEP has a slightly better debt-to-equity (D/E) ratio, indicating lower financial leverage. Both companies maintain current ratios below 1, raising concerns about short-term liquidity. Therefore, while both companies exhibit strengths, PEP generally demonstrates stronger profitability metrics and asset management.

Dividend and Shareholder Returns

Coca-Cola Europacific Partners PLC (CCEP) and PepsiCo, Inc. (PEP) both engage in dividend payments, supporting shareholder returns. CCEP’s dividend payout ratio stands at 64%, with a yield of 2.66%, while PEP’s is 74% and offers a yield of 3.46%. Both companies also participate in share buyback programs, enhancing shareholder value. However, the sustainability of these distributions may be challenged by market volatility and economic conditions, warranting careful consideration for long-term value creation.

Strategic Positioning

Coca-Cola Europacific Partners PLC (CCEP) holds a significant market share in the non-alcoholic beverage sector, primarily through its diverse product range under the Coca-Cola brand. Meanwhile, PepsiCo, Inc. (PEP) dominates with a more expansive portfolio that includes snacks and beverages, giving it a competitive edge in total revenue. Both companies face technological disruptions, particularly in e-commerce and health-conscious product trends, which could intensify competitive pressures in the coming years.

Stock Comparison

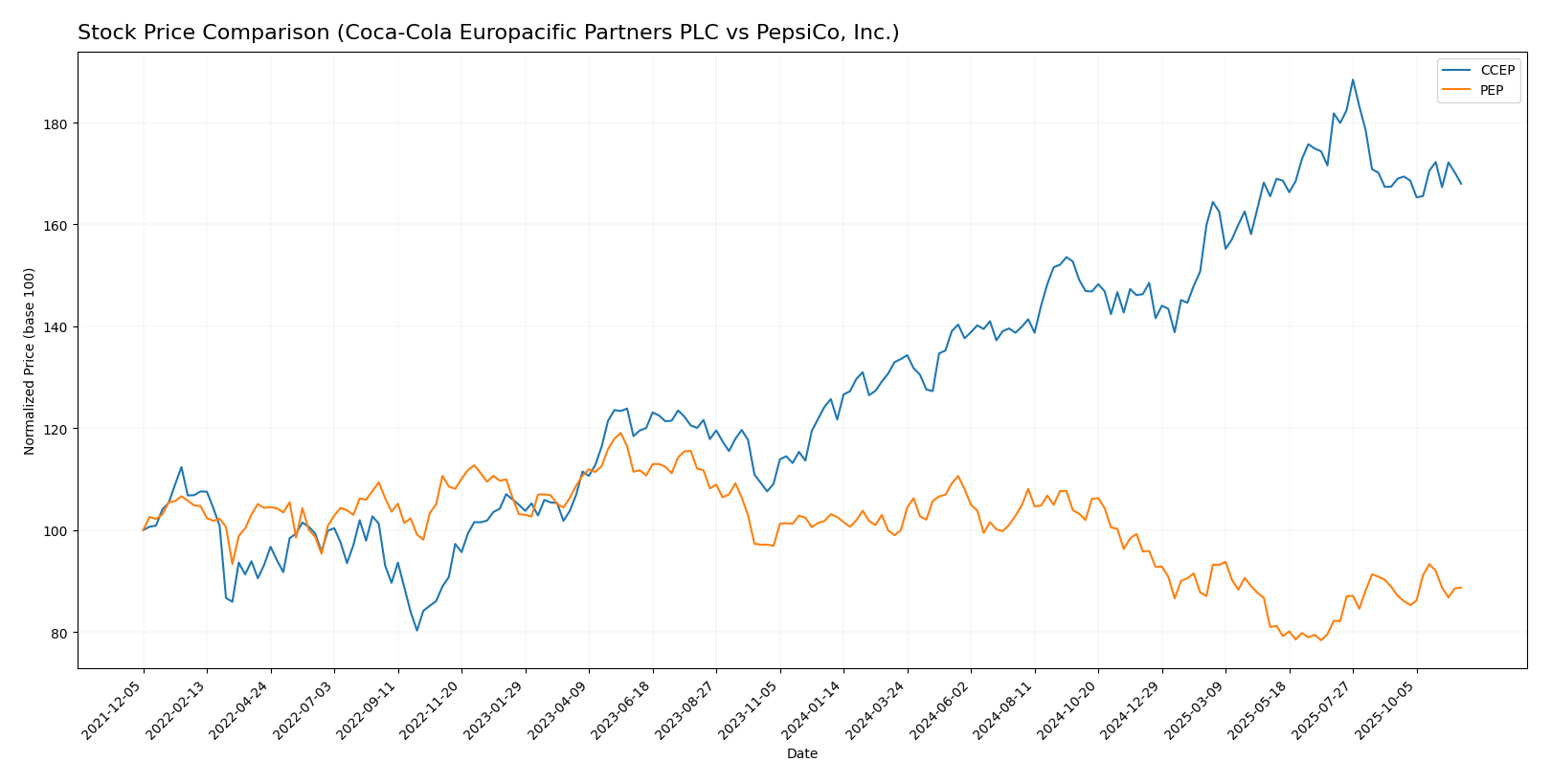

In this section, I will analyze the weekly stock price movements of Coca-Cola Europacific Partners PLC (CCEP) and PepsiCo, Inc. (PEP) over the past year, focusing on key price dynamics and trading patterns.

Trend Analysis

Coca-Cola Europacific Partners PLC (CCEP) Over the past year, CCEP has experienced a significant price change of +41.91%, indicating a bullish trend. However, the trend is showing signs of deceleration. The stock reached a notable high of 100.04 and a low of 64.61, with a standard deviation of 8.79 suggesting moderate volatility. Recently, from September 14, 2025, to November 30, 2025, the price increased by 2.21%, indicating stability within a neutral range.

PepsiCo, Inc. (PEP) PEP, on the other hand, has seen a price decline of -11.96% over the past year, marking a bearish trend with an acceleration status. The stock fluctuated between 182.19 at its highest and 129.07 at its lowest, with a standard deviation of 14.71, denoting higher volatility. In the recent analysis period from September 14, 2025, to November 30, 2025, PEP’s price increased by 3.63%, which is a positive shift but not enough to alter its overall bearish assessment.

Analyst Opinions

Recent recommendations for Coca-Cola Europacific Partners PLC (CCEP) and PepsiCo, Inc. (PEP) show a consensus rating of B+, indicating a moderate buy. Analysts highlight CCEP’s strong discounted cash flow and return on equity as key strengths, while cautioning about its debt-to-equity ratio. For PEP, analysts praise its robust return on assets and equity, though they note a weaker price-to-book score. Overall, the consensus for 2025 leans towards a buy for both companies, reflecting positive growth prospects despite existing risks.

Stock Grades

In this section, I present the latest stock grades for Coca-Cola Europacific Partners PLC (CCEP) and PepsiCo, Inc. (PEP) based on reliable data from recognized grading companies.

Coca-Cola Europacific Partners PLC Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | maintain | Overweight | 2025-08-08 |

| Barclays | maintain | Overweight | 2025-07-15 |

| UBS | maintain | Buy | 2025-07-02 |

| Barclays | maintain | Overweight | 2025-05-01 |

| UBS | maintain | Buy | 2025-04-30 |

| Barclays | maintain | Overweight | 2025-04-11 |

| Barclays | maintain | Overweight | 2025-03-27 |

| Barclays | maintain | Overweight | 2025-03-06 |

| Evercore ISI Group | maintain | Outperform | 2025-02-18 |

| UBS | maintain | Buy | 2025-02-17 |

PepsiCo, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | maintain | Overweight | 2025-11-21 |

| Freedom Capital Markets | downgrade | Hold | 2025-10-23 |

| Wells Fargo | maintain | Equal Weight | 2025-10-10 |

| JP Morgan | maintain | Neutral | 2025-10-06 |

| Barclays | maintain | Equal Weight | 2025-10-03 |

| Wells Fargo | maintain | Equal Weight | 2025-09-25 |

| Citigroup | maintain | Buy | 2025-09-25 |

| UBS | maintain | Buy | 2025-09-11 |

| RBC Capital | maintain | Sector Perform | 2025-09-03 |

| Barclays | maintain | Equal Weight | 2025-07-21 |

Overall, the grades for CCEP indicate a strong support for the stock with the majority of ratings at “Overweight” or “Buy.” Meanwhile, PEP shows a mixed sentiment with some downgrades, particularly from Freedom Capital Markets, suggesting caution for investors considering this stock.

Target Prices

The current target consensus for Coca-Cola Europacific Partners PLC (CCEP) and PepsiCo, Inc. (PEP) reflects a generally positive outlook among analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Coca-Cola Europacific Partners PLC (CCEP) | 98 | 46.22 | 74.69 |

| PepsiCo, Inc. (PEP) | 164 | 140 | 152.6 |

For CCEP, analysts expect a target price of approximately 74.69, while the stock is currently trading at 91.69, suggesting an upside potential. In contrast, PEP has a consensus target of 152.6 against its current price of 148.74, indicating a slightly favorable outlook.

Strengths and Weaknesses

In this section, I will present a concise comparison of the strengths and weaknesses of Coca-Cola Europacific Partners PLC (CCEP) and PepsiCo, Inc. (PEP) based on the most recent financial data.

| Criterion | CCEP | PEP |

|---|---|---|

| Diversification | Moderate | High |

| Profitability | Moderate | High |

| Innovation | Moderate | High |

| Global presence | Strong | Very Strong |

| Market Share | 10.5% | 24.9% |

| Debt level | High | Moderate |

Key takeaways from this comparison indicate that while CCEP displays a solid global presence and moderate profitability, PEP excels in diversification, innovation, and overall market share, suggesting a more robust competitive position in the beverage industry.

Risk Analysis

The following table outlines the key risks associated with Coca-Cola Europacific Partners PLC (CCEP) and PepsiCo, Inc. (PEP):

| Metric | CCEP | PEP |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Moderate | Moderate |

| Operational Risk | High | Moderate |

| Environmental Risk | High | High |

| Geopolitical Risk | Moderate | High |

Both companies face significant market and operational risks due to increasing competition and changing consumer preferences. Environmental and geopolitical risks are also notable, especially as sustainability becomes a focal point for investors and consumers alike.

Which one to choose?

When comparing Coca-Cola Europacific Partners PLC (CCEP) and PepsiCo, Inc. (PEP), both companies exhibit solid fundamentals. CCEP shows a market cap of €34.15B and a dividend yield of 2.66%, with a net profit margin of 6.94%. In contrast, PEP has a larger market cap of $208.78B, a higher net profit margin of 10.43%, and a dividend yield of 3.46%.

However, the stock trends diverge significantly: CCEP’s price has risen by 41.91% recently, indicating a bullish outlook, while PEP has experienced a decline of 11.96%, suggesting a bearish trend. Analysts rate both companies equally at B+, but CCEP’s recent performance may appeal to growth-focused investors, while PEP could attract those seeking stability and dividend income.

Investors should consider the competitive landscape and potential supply chain risks inherent in the beverage industry.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Coca-Cola Europacific Partners PLC and PepsiCo, Inc. to enhance your investment decisions: