Gen Digital Inc. and CCC Intelligent Solutions Holdings Inc. both operate in the software infrastructure industry, yet they serve distinct but overlapping markets with innovative technology solutions. Gen Digital focuses on cybersecurity and digital privacy, while CCC leverages AI and cloud platforms for the insurance economy. This comparison explores their growth strategies and market positions to help you identify which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Gen Digital Inc. and CCC Intelligent Solutions Holdings Inc. by providing an overview of these two companies and their main differences.

Gen Digital Inc. Overview

Gen Digital Inc. provides cyber safety solutions for consumers globally, offering products such as Norton 360, LifeLock identity theft protection, and Avira Security. The company focuses on protecting PCs, Macs, and mobile devices against a wide range of online threats. Founded in 1982 and based in Tempe, Arizona, Gen Digital operates in the software infrastructure industry with a market cap of approximately 16.1B USD.

CCC Intelligent Solutions Holdings Inc. Overview

CCC Intelligent Solutions Holdings Inc. delivers cloud, AI, telematics, and hyperscale technology solutions for the property and casualty insurance economy. Its SaaS platform supports insurance carriers, repairers, parts suppliers, and automotive manufacturers. Founded in 1980 and headquartered in Chicago, Illinois, CCC operates in the software infrastructure sector with a market capitalization near 5.6B USD.

Key similarities and differences

Both companies operate in the technology sector within the software infrastructure industry, emphasizing software solutions. Gen Digital focuses on cybersecurity and consumer protection, while CCC specializes in AI-driven workflows and digital commerce for insurance and automotive sectors. Gen Digital has a significantly larger market cap and global consumer reach, whereas CCC targets business-to-business solutions within a specific industry niche.

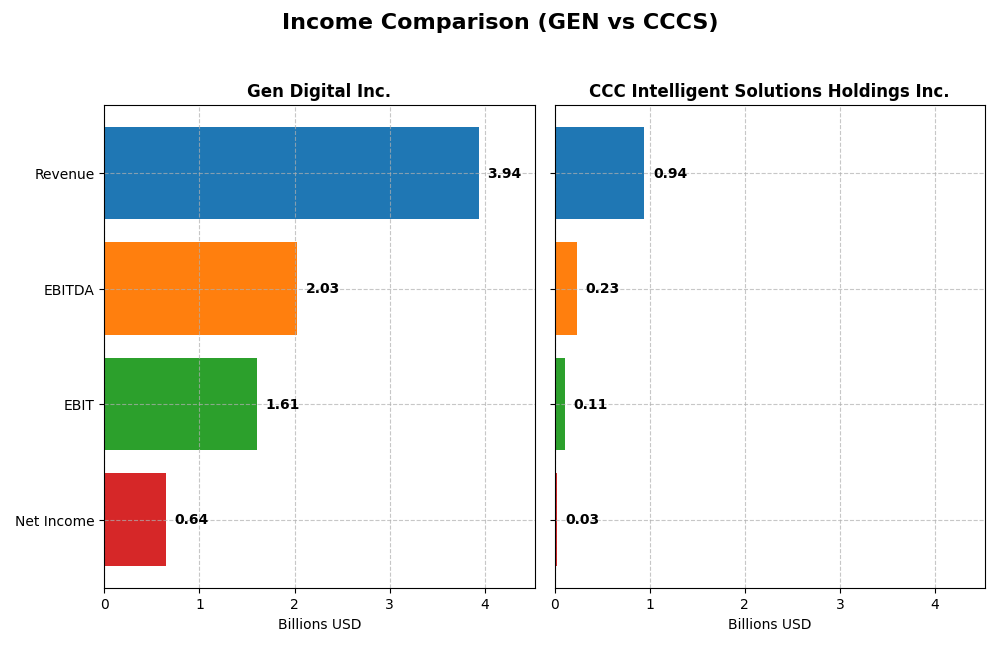

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for Gen Digital Inc. and CCC Intelligent Solutions Holdings Inc. for their most recent fiscal years.

| Metric | Gen Digital Inc. (2025) | CCC Intelligent Solutions Holdings Inc. (2024) |

|---|---|---|

| Market Cap | 16.1B | 5.6B |

| Revenue | 3.94B | 945M |

| EBITDA | 2.03B | 233M |

| EBIT | 1.61B | 109M |

| Net Income | 643M | 26.1M |

| EPS | 1.04 | 0.043 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Gen Digital Inc.

Gen Digital Inc. showed steady revenue growth from $2.55B in 2021 to $3.94B in 2025, a 54.25% increase over five years. Net income rose moderately to $643M in 2025, though net margin declined overall. The company improved EBIT margin to 40.84% in 2025, with a slight revenue growth slowdown to 3.55%. Operating expenses grew in line with revenue, indicating controlled cost management.

CCC Intelligent Solutions Holdings Inc.

CCC Intelligent Solutions Holdings reported revenue growth from $633M in 2020 to $945M in 2024, a 49.24% increase. Net income turned positive at $26M in 2024 after losses in prior years, reflecting a strong 254.92% growth overall. Margins improved significantly, with net margin rising to 2.77% and EBIT margin to 11.53%. The company saw robust profitability gains and operational efficiency in the latest year.

Which one has the stronger fundamentals?

Gen Digital has a higher revenue base and superior margins, especially EBIT and gross margins, but faces higher interest expenses and a declining net margin trend. CCC Intelligent Solutions exhibits strong margin improvements and net income growth from a lower base, with a more favorable interest expense profile. Both show favorable income statement trends, with CCC demonstrating more pronounced recent profitability gains.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Gen Digital Inc. (GEN) and CCC Intelligent Solutions Holdings Inc. (CCCS) for their most recent fiscal years, providing a snapshot of profitability, liquidity, valuation, leverage, and efficiency metrics.

| Ratios | Gen Digital Inc. (GEN) 2025 | CCC Intelligent Solutions Holdings Inc. (CCCS) 2024 |

|---|---|---|

| ROE | 28.3% | 1.31% |

| ROIC | 7.77% | 1.86% |

| P/E | 25.4 | 274.0 |

| P/B | 7.19 | 3.59 |

| Current Ratio | 0.51 | 3.65 |

| Quick Ratio | 0.51 | 3.65 |

| D/E (Debt-to-Equity) | 3.66 | 0.42 |

| Debt-to-Assets | 53.7% | 26.7% |

| Interest Coverage | 2.79 | 1.24 |

| Asset Turnover | 0.25 | 0.30 |

| Fixed Asset Turnover | 36.1 | 4.68 |

| Payout ratio | 48.7% | 0% |

| Dividend yield | 1.92% | 0% |

Interpretation of the Ratios

Gen Digital Inc.

Gen Digital shows strong profitability with a favorable net margin of 16.34% and a high return on equity of 28.34%. However, liquidity ratios are weak, with a current ratio of 0.51, and leverage is high, with a debt-to-equity ratio of 3.66 and debt-to-assets at 53.66%. The dividend yield is moderate at 1.92%, supported by a payout that appears sustainable but warrants monitoring due to elevated debt levels.

CCC Intelligent Solutions Holdings Inc.

There is insufficient data available to evaluate CCC Intelligent Solutions Holdings Inc.’s financial ratios comprehensively. Key metrics, including profitability, liquidity, leverage, and dividend information, are missing, preventing a thorough assessment of the company’s financial health or shareholder returns.

Which one has the best ratios?

Based on the available data, Gen Digital Inc. presents a clearer financial picture with several favorable profitability ratios despite some weaknesses in liquidity and leverage. CCC Intelligent Solutions Holdings Inc. cannot be compared due to missing ratio data, making Gen Digital the only company with a measurable ratio profile for analysis.

Strategic Positioning

This section compares the strategic positioning of Gen Digital Inc. and CCC Intelligent Solutions Holdings Inc. based on Market position, Key segments, and Exposure to technological disruption:

Gen Digital Inc.

- Leading cybersecurity provider with $16B market cap, facing moderate competition.

- Focuses on consumer cyber safety, identity protection, VPN, and privacy tools.

- Positioned in cybersecurity with evolving threats but no explicit disruption data.

CCC Intelligent Solutions Holdings Inc.

- Mid-sized player with $5.6B market cap, operating in insurance software.

- Specializes in AI-enabled SaaS for property and casualty insurance workflows.

- Uses AI and cloud technologies, exposed to rapid tech changes in insurance.

Gen Digital Inc. vs CCC Intelligent Solutions Holdings Inc. Positioning

Gen Digital pursues a diversified cybersecurity portfolio spanning consumer protection and privacy, while CCC concentrates on AI-driven SaaS for insurance. Gen’s broader segment base may offer risk distribution; CCC’s focused niche leverages specialized technology for insurance ecosystems.

Which has the best competitive advantage?

Gen Digital shows a very unfavorable MOAT with declining ROIC and value destruction, while CCC lacks sufficient data for MOAT assessment, leaving Gen’s competitive advantage weak and CCC’s advantage undetermined.

Stock Comparison

The stock prices of Gen Digital Inc. (GEN) and CCC Intelligent Solutions Holdings Inc. (CCCS) exhibited contrasting movements over the past 12 months, with GEN showing a bullish but decelerating trend and CCCS facing a pronounced bearish trend.

Trend Analysis

Gen Digital Inc. (GEN) experienced a 17.89% price increase over the past year, indicating a bullish trend with decelerating momentum and price fluctuations reflected by a 2.59 standard deviation. The recent period shows a slight negative change of -0.99%, signaling near-neutral short-term behavior.

CCC Intelligent Solutions Holdings Inc. (CCCS) recorded a 31.78% price decline over the last 12 months, confirming a bearish trend with deceleration. Volatility is lower than GEN’s, at 1.24 standard deviation, while recent losses accelerated with a -25.15% drop.

Comparing both, GEN delivered the highest market performance by a wide margin, maintaining positive gains while CCCS suffered significant value erosion during the same timeframe.

Target Prices

Here is the current target price consensus for the selected companies based on verified analyst data.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Gen Digital Inc. | 32 | 31 | 31.5 |

| CCC Intelligent Solutions Holdings Inc. | 11 | 11 | 11 |

Analysts expect Gen Digital’s stock to appreciate moderately, with a consensus target about 20.7% above its current price of $26.1. CCC Intelligent Solutions shows a consensus target significantly above the current price of $8.75, indicating potential upside.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Gen Digital Inc. and CCC Intelligent Solutions Holdings Inc.:

Rating Comparison

Gen Digital Inc. Rating

- Rating: B, classified as Very Favorable by analysts.

- Discounted Cash Flow Score: 5, indicating a very favorable valuation.

- ROE Score: 5, showing very efficient profit generation from equity.

- ROA Score: 3, reflecting moderate asset utilization effectiveness.

- Debt To Equity Score: 1, considered very unfavorable due to high financial risk.

- Overall Score: 3, representing a moderate overall financial standing.

CCC Intelligent Solutions Holdings Inc. Rating

- No rating data available.

- No Discounted Cash Flow score provided.

- No Return on Equity score available.

- No Return on Assets score provided.

- No Debt To Equity score available.

- No overall score data available.

Which one is the best rated?

Based strictly on the available data, Gen Digital Inc. is the better-rated company with a clear “B” rating and several detailed financial scores, while CCC Intelligent Solutions Holdings Inc. lacks any rating or scoring information.

Scores Comparison

Here is a comparison of the financial scores for Gen Digital Inc. and CCC Intelligent Solutions Holdings Inc.:

Gen Scores

- Altman Z-Score: 1.25, indicating financial distress.

- Piotroski Score: 6, reflecting average financial health.

CCC Scores

- Altman Z-Score: 2.18, placing it in the grey zone.

- Piotroski Score: 3, indicating very weak financial health.

Which company has the best scores?

Based strictly on the provided data, CCC has a better Altman Z-Score, signaling lower bankruptcy risk than Gen. However, Gen’s Piotroski Score is higher, implying stronger financial strength compared to CCC.

Grades Comparison

Here is the comparison of grades from leading grading companies for the two companies:

Gen Digital Inc. Grades

The following table summarizes recent grades and recommendations for Gen Digital Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Sector Perform | 2025-11-07 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-07 |

| Morgan Stanley | Maintain | Equal Weight | 2025-09-02 |

| Barclays | Maintain | Equal Weight | 2025-08-08 |

| Wells Fargo | Maintain | Overweight | 2025-08-08 |

| RBC Capital | Maintain | Sector Perform | 2025-08-08 |

| Barclays | Maintain | Equal Weight | 2025-07-14 |

| RBC Capital | Maintain | Sector Perform | 2025-05-07 |

| Morgan Stanley | Maintain | Equal Weight | 2025-04-16 |

| RBC Capital | Maintain | Sector Perform | 2025-01-31 |

Overall, Gen Digital Inc.’s grades show a consistent pattern of moderate confidence with mostly “Sector Perform” and “Equal Weight” ratings, alongside some “Outperform” and “Overweight” recommendations.

No reliable grades are available for CCC Intelligent Solutions Holdings Inc. The lack of grading data means investors should consider the stock’s inherent risk profile carefully.

Which company has the best grades?

Gen Digital Inc. has received more comprehensive and moderately positive grades, including several “Outperform” and “Overweight” ratings. In contrast, CCC Intelligent Solutions Holdings Inc. lacks verifiable grading data, which may leave investors with less clarity on its outlook. This contrast could influence investor confidence and perceived risk.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Gen Digital Inc. (GEN) and CCC Intelligent Solutions Holdings Inc. (CCCS) based on the most recent available data.

| Criterion | Gen Digital Inc. (GEN) | CCC Intelligent Solutions Holdings Inc. (CCCS) |

|---|---|---|

| Diversification | High diversification with strong Cyber Safety segment ($3.89B in 2025) and Legacy products | Focused mainly on Software Subscriptions ($906M in 2024) and Other Services |

| Profitability | Moderate profitability: Net margin 16.34%, ROE 28.34%, ROIC 7.77% (neutral) but declining ROIC trend | Data unavailable for profitability evaluation |

| Innovation | Moderate innovation with ongoing Cyber Safety growth, but declining ROIC indicates challenges | Data unavailable for innovation assessment |

| Global presence | Established global footprint in consumer cybersecurity | Primarily US-focused with niche market presence |

| Market Share | Large market share in consumer security and identity protection | Smaller, specialized market share in intelligent solutions |

Key takeaways: Gen Digital shows strong diversification and profitability metrics, but a worrying declining ROIC trend signals potential value destruction. CCC Intelligent Solutions lacks detailed financial data but maintains steady revenue growth in software subscriptions, indicating a focused but smaller scale operation. Investors should weigh GEN’s scale against its financial warning signs and consider CCCS’s growth potential with caution due to missing data.

Risk Analysis

Below is a comparison of key risks for Gen Digital Inc. (GEN) and CCC Intelligent Solutions Holdings Inc. (CCCS) based on the most recent data available in 2026.

| Metric | Gen Digital Inc. (GEN) | CCC Intelligent Solutions Holdings Inc. (CCCS) |

|---|---|---|

| Market Risk | Moderate (Beta 1.08) | Lower (Beta 0.72) |

| Debt Level | High (Debt-to-Equity 3.66, Debt to Assets 53.66%) | Data unavailable |

| Regulatory Risk | Moderate (Operating in cybersecurity with privacy laws impact) | Moderate (Insurance tech sector, regulated environment) |

| Operational Risk | Moderate (Cybersecurity product complexity and evolving threats) | Moderate (Cloud and AI tech, dependence on insurance ecosystem) |

| Environmental Risk | Low (Software sector with limited direct environmental impact) | Low (Software sector with limited direct environmental impact) |

| Geopolitical Risk | Moderate (Global presence across multiple regions) | Moderate (US-based but with international clients) |

The most impactful risks for Gen Digital are its high leverage and moderate market risk, combined with regulatory pressures in cybersecurity. CCCS faces moderate operational and regulatory risks but lacks detailed financial risk data. Investors should monitor GEN’s debt levels closely and consider CCCS’s weaker financial transparency as a caution.

Which Stock to Choose?

Gen Digital Inc. (GEN) shows steady income growth with a favorable gross margin of 80.28% and net margin of 16.34%. Its profitability is strong with a 28.34% ROE, though debt levels are high (debt-to-equity 3.66) and liquidity ratios are low. The overall rating is very favorable despite some unfavorable financial ratios and a declining ROIC trend.

CCC Intelligent Solutions Holdings Inc. (CCCS) reports favorable income growth and margins, including a 75.55% gross margin and 2.77% net margin. Its liquidity is strong with a current ratio above 3, and debt is moderate. However, financial ratio details and comprehensive rating data are unavailable, and stock price trends have been bearish recently.

For investors focused on financial strength and profitability, GEN’s strong income statement and very favorable rating might appear more attractive, though its high debt and declining ROIC suggest caution. CCCS could appeal to those seeking companies with better liquidity and recent income growth, but the lack of detailed financial ratio data and weaker stock performance may signal higher risk or uncertainty.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Gen Digital Inc. and CCC Intelligent Solutions Holdings Inc. to enhance your investment decisions: