Alibaba Group Holding Limited and Genuine Parts Company stand as prominent players in the specialty retail industry, yet they operate in distinct market segments with unique innovation approaches. Alibaba drives growth through advanced e-commerce platforms and digital infrastructure, while Genuine Parts focuses on automotive and industrial replacement parts distribution. This comparison explores their strategies and market positions to help you identify which company offers the most compelling investment opportunity today.

Table of contents

Companies Overview

I will begin the comparison between Alibaba Group Holding Limited and Genuine Parts Company by providing an overview of these two companies and their main differences.

Alibaba Group Holding Limited Overview

Alibaba Group Holding Limited operates as a technology infrastructure and marketing company, supporting merchants, brands, and retailers in China and internationally. Its diverse business model spans e-commerce platforms like Taobao and Tmall, logistics via Cainiao Network, cloud services, digital media, and local consumer services. Founded in 1999 and headquartered in Hangzhou, Alibaba’s market cap stands at 350B USD, reflecting its dominant position in specialty retail and technology sectors.

Genuine Parts Company Overview

Genuine Parts Company distributes automotive and industrial replacement parts across various vehicle types and industries. Operating through its Automotive Parts and Industrial Parts segments, GPC serves customers such as repair shops, fleet operators, and manufacturers across multiple countries. Founded in 1928 and based in Atlanta, Georgia, GPC has a market cap of 17.9B USD and offers value-added services alongside its broad parts distribution network within the specialty retail industry.

Key similarities and differences

Both Alibaba and Genuine Parts operate in the specialty retail sector but differ substantially in scope and business models. Alibaba emphasizes technology-driven e-commerce, cloud computing, and digital media services globally, while Genuine Parts focuses on physical distribution of automotive and industrial parts primarily in North America and select international markets. Alibaba’s business is more diversified and tech-centric, whereas GPC relies heavily on traditional distribution channels and aftermarket parts services.

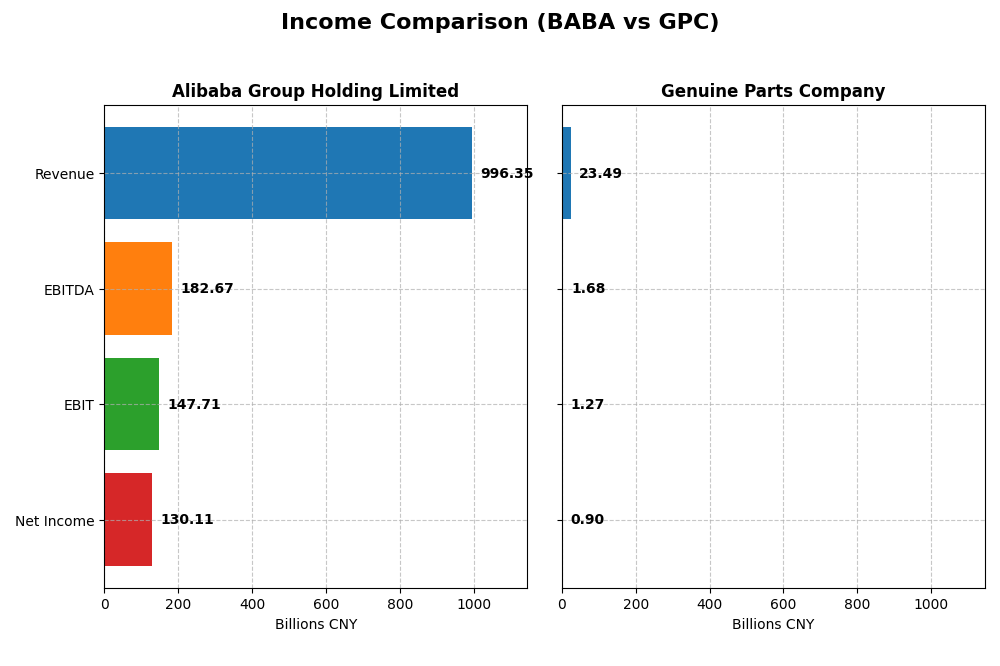

Income Statement Comparison

Below is a side-by-side comparison of the most recent fiscal year income statement metrics for Alibaba Group Holding Limited and Genuine Parts Company.

| Metric | Alibaba Group Holding Limited (BABA) | Genuine Parts Company (GPC) |

|---|---|---|

| Market Cap | 350B CNY | 17.9B USD |

| Revenue | 996B CNY | 23.5B USD |

| EBITDA | 183B CNY | 1.68B USD |

| EBIT | 148B CNY | 1.27B USD |

| Net Income | 130B CNY | 904M USD |

| EPS | 55.12 CNY | 6.49 USD |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Alibaba Group Holding Limited

Alibaba’s revenue showed a favorable growth trend, increasing by 38.9% over 2021-2025, with a slight 5.86% rise in the most recent year. Net income, however, declined by 13.6% overall, despite a strong rebound of 53.6% in the last year. Margins improved notably, with gross margin at 39.95% and net margin rising 13.06% in 2025, reflecting enhanced profitability.

Genuine Parts Company

Genuine Parts Company’s revenue grew 42.0% over the 2020-2024 period but slowed to a 1.71% increase in the latest year. Net income and net margin showed strong overall gains of 3206.6% and 2287.4%, respectively, yet both contracted significantly last year. Gross margin remained favorable at 36.29%, while EBIT and net margins were more moderate, showing mixed stability.

Which one has the stronger fundamentals?

Alibaba demonstrates stronger fundamentals with more consistent margin improvements and robust recent net income growth, despite an overall net income decline. Genuine Parts shows remarkable long-term net income growth but faces recent margin contraction and weaker EBIT performance. Both companies have favorable evaluations, though Alibaba’s margin and profitability trends appear more solid.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Alibaba Group Holding Limited (BABA) and Genuine Parts Company (GPC) based on their most recent fiscal year data.

| Ratios | Alibaba Group Holding Limited (BABA) | Genuine Parts Company (GPC) |

|---|---|---|

| ROE | 12.86% | 20.84% |

| ROIC | 7.87% | 9.82% |

| P/E | 17.32 | 17.98 |

| P/B | 2.23 | 3.75 |

| Current Ratio | 1.54 | 1.16 |

| Quick Ratio | 1.49 | 0.51 |

| D/E (Debt-to-Equity) | 0.25 | 1.32 |

| Debt-to-Assets | 13.75% | 29.78% |

| Interest Coverage | 14.68 | 14.90 |

| Asset Turnover | 0.55 | 1.22 |

| Fixed Asset Turnover | 3.99 | 6.31 |

| Payout Ratio | 22.35% | 61.38% |

| Dividend Yield | 1.29% | 3.41% |

Interpretation of the Ratios

Alibaba Group Holding Limited

Alibaba presents a favorable overall ratio profile, with strong liquidity evidenced by current and quick ratios above 1.5 and low leverage reflected in a debt-to-equity ratio of 0.25. Profitability is decent, with a net margin of 13.06% and return on equity near 13%, though some ratios remain neutral. The dividend yield is moderate at 1.29%, supported by sustainable payout metrics and no signs of excessive repurchases.

Genuine Parts Company

Genuine Parts shows mixed ratio strengths; it has a high return on equity of 20.84% and strong asset turnover ratios, but its net margin is relatively weak at 3.85%. Liquidity ratios are less robust, with a quick ratio below 1 and debt leverage higher than Alibaba. The company offers a favorable dividend yield of 3.41%, consistent with solid coverage and manageable risk from interest expenses.

Which one has the best ratios?

Alibaba’s ratios lean more favorable overall, particularly in liquidity, leverage, and profitability consistency, with no unfavorable metrics reported. Genuine Parts delivers strong equity returns and dividend yield but faces concerns in profitability margins and liquidity. Thus, Alibaba holds a more balanced and robust ratio set compared to Genuine Parts’ slightly favorable yet riskier profile.

Strategic Positioning

This section compares the strategic positioning of Alibaba Group Holding Limited and Genuine Parts Company, including market position, key segments, and exposure to technological disruption:

Alibaba Group Holding Limited

- Leading global e-commerce and technology platform with strong market presence, facing competitive pressure from international and local players.

- Diverse business segments including e-commerce, cloud services, logistics, digital media, and innovation initiatives driving growth.

- High exposure to technological disruption through cloud computing, AI, e-commerce innovations, and digital marketing platforms.

Genuine Parts Company

- Established distributor in automotive and industrial parts, competing in mature markets with steady demand and moderate pressure.

- Focused on automotive and industrial parts distribution, supported by value-added repair and assembly services.

- Limited exposure to technological disruption, operating mainly in traditional parts distribution and related services.

Alibaba Group Holding Limited vs Genuine Parts Company Positioning

Alibaba has a diversified strategic approach spanning e-commerce, cloud, and digital services, offering multiple growth drivers. Genuine Parts is more concentrated in automotive and industrial parts distribution, relying on established markets and service offerings. Diversification versus focused specialization differentiates their market strategies.

Which has the best competitive advantage?

Both companies demonstrate a very favorable moat with growing ROIC above WACC, indicating durable competitive advantages. Alibaba’s advantage stems from technology-driven innovation, while Genuine Parts benefits from consistent value creation in stable distribution markets.

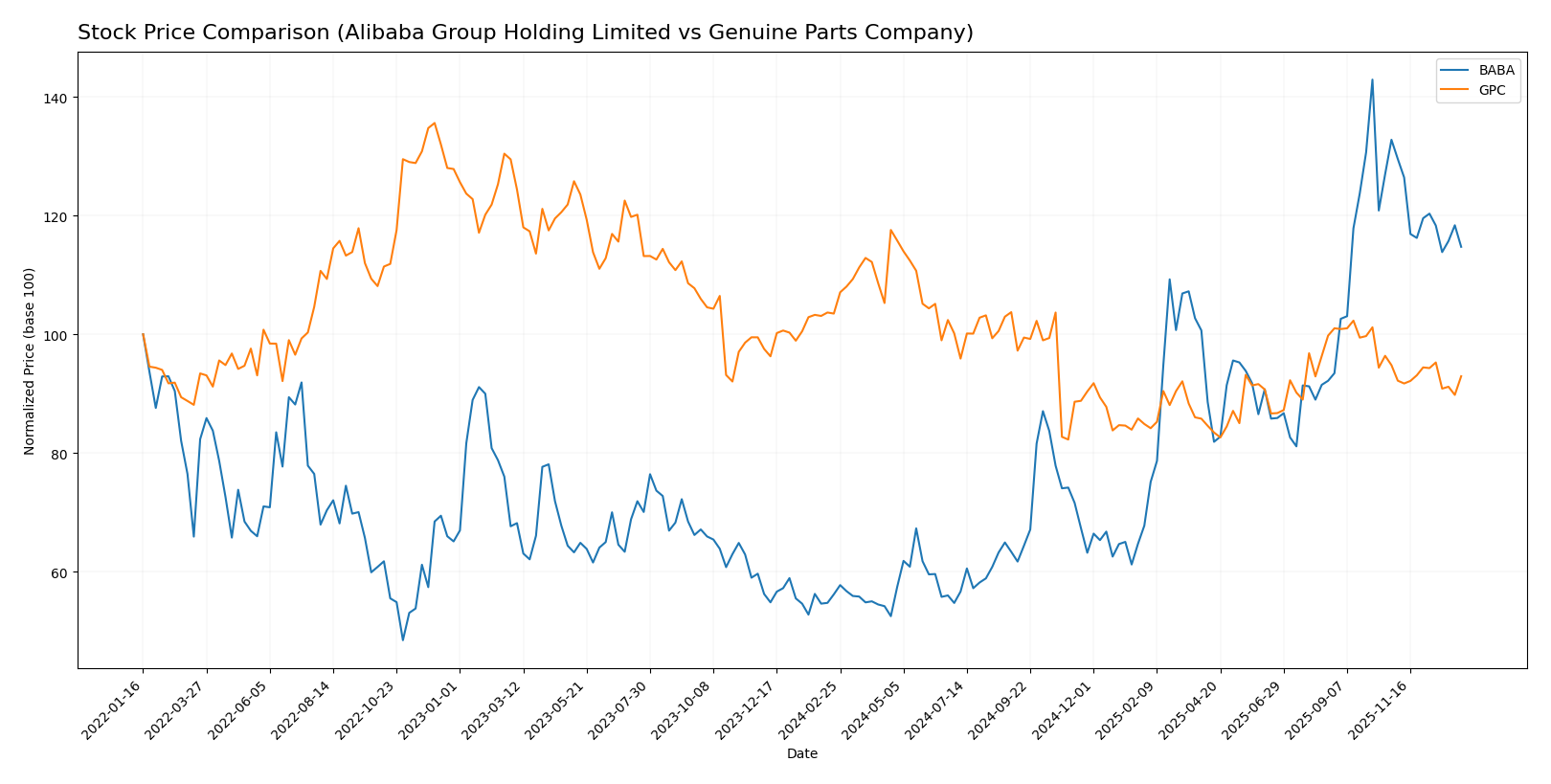

Stock Comparison

The stock prices of Alibaba Group Holding Limited (BABA) and Genuine Parts Company (GPC) exhibited contrasting dynamics over the past 12 months, with BABA showing substantial gains despite recent pullbacks, while GPC faced a consistent decline amid accelerating bearish momentum.

Trend Analysis

Alibaba’s stock price increased by 104.25% over the past year, indicating a strong bullish trend with decelerating momentum. The price ranged from 69.07 to a high of 188.03, with notable recent weakness.

Genuine Parts Company’s stock price declined by 10.21% over the same period, reflecting a bearish trend with accelerating downward movement. The price fluctuated between 113.61 and 162.39, showing persistent weakness.

Comparing the two, Alibaba delivered the highest market performance with a significant positive return, while Genuine Parts Company experienced a moderate loss, confirming a clear divergence in their stock trajectories.

Target Prices

The current analyst consensus presents a balanced outlook with notable upside potential for both Alibaba Group Holding Limited and Genuine Parts Company.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Alibaba Group Holding Limited | 225 | 140 | 186.98 |

| Genuine Parts Company | 150 | 140 | 145.33 |

Analysts expect Alibaba’s stock to rise from its current price of $150.96 toward the consensus target near $187, indicating moderate growth potential. Genuine Parts Company’s target consensus at $145.33 also suggests upside from its current $128.34, reflecting positive market sentiment.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Alibaba Group Holding Limited (BABA) and Genuine Parts Company (GPC):

Rating Comparison

BABA Rating

- Rating: B+ indicating a very favorable overall assessment of financial health.

- Discounted Cash Flow Score: Moderate at 3, suggesting average valuation outlook.

- ROE Score: Favorable at 4, showing efficient profit generation from equity.

- ROA Score: Favorable at 4, reflecting effective asset utilization.

- Debt To Equity Score: Moderate at 3, implying balanced financial risk exposure.

- Overall Score: Moderate at 3 summarizing average overall financial strength.

GPC Rating

- Rating: B also reflecting a very favorable overall financial standing.

- Discounted Cash Flow Score: Favorable at 4, indicating better valuation.

- ROE Score: Favorable at 4, similarly efficient in generating shareholder returns.

- ROA Score: Moderate at 3, indicating slightly less efficient asset use.

- Debt To Equity Score: Very Unfavorable at 1, suggesting higher financial risk.

- Overall Score: Moderate at 3, also indicating average overall financial strength.

Which one is the best rated?

Based strictly on the data, BABA holds a slightly higher rating (B+) compared to GPC’s B. While GPC scores better on discounted cash flow, BABA outperforms in return on assets and debt management, making BABA marginally better rated overall.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Alibaba and Genuine Parts Company:

Alibaba Scores

- Altman Z-Score: 1.72, in the distress zone indicating higher bankruptcy risk.

- Piotroski Score: 8, very strong financial health indication.

Genuine Parts Company Scores

- Altman Z-Score: 2.44, in the grey zone indicating moderate bankruptcy risk.

- Piotroski Score: 6, indicating average financial strength.

Which company has the best scores?

Alibaba shows a very strong Piotroski Score of 8 compared to Genuine Parts Company’s 6, but it has a lower Altman Z-Score in the distress zone. Genuine Parts Company has a higher Altman Z-Score in the grey zone, indicating moderate risk.

Grades Comparison

The following is a comparison of recent grades assigned to Alibaba Group Holding Limited and Genuine Parts Company by reputable grading firms:

Alibaba Group Holding Limited Grades

This table summarizes recent grades from notable financial institutions for Alibaba:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Jefferies | Maintain | Buy | 2026-01-08 |

| Freedom Capital Markets | Downgrade | Hold | 2026-01-06 |

| Benchmark | Maintain | Buy | 2025-11-26 |

| Bernstein | Maintain | Outperform | 2025-11-26 |

| Citigroup | Maintain | Buy | 2025-11-26 |

| JP Morgan | Maintain | Overweight | 2025-11-26 |

| Barclays | Maintain | Overweight | 2025-11-26 |

| Bernstein | Maintain | Outperform | 2025-10-10 |

| JP Morgan | Maintain | Overweight | 2025-10-09 |

| JP Morgan | Maintain | Overweight | 2025-10-01 |

Alibaba’s grades predominantly indicate a stable Buy or Outperform consensus with only one recent downgrade to Hold, reflecting general confidence from major analysts.

Genuine Parts Company Grades

This table presents the latest grades from respected financial firms for Genuine Parts Company:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Goldman Sachs | Upgrade | Neutral | 2025-11-13 |

| JP Morgan | Maintain | Overweight | 2025-10-23 |

| Truist Securities | Maintain | Buy | 2025-10-22 |

| UBS | Maintain | Neutral | 2025-10-10 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-01 |

| Evercore ISI Group | Maintain | Outperform | 2025-08-26 |

| Loop Capital | Maintain | Buy | 2025-07-24 |

| JP Morgan | Maintain | Overweight | 2025-07-23 |

| Truist Securities | Maintain | Buy | 2025-07-23 |

| UBS | Maintain | Neutral | 2025-07-23 |

Genuine Parts Company shows a mix of Buy, Neutral, Overweight, and Outperform grades with one recent upgrade from Sell to Neutral, indicating a cautious but generally positive outlook.

Which company has the best grades?

Alibaba Group Holding Limited has received a stronger consensus with numerous Buy and Outperform ratings, whereas Genuine Parts Company features more Neutral and Hold grades. This difference suggests Alibaba currently enjoys higher analyst confidence, which may influence investor sentiment and portfolio allocation.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Alibaba Group Holding Limited (BABA) and Genuine Parts Company (GPC) based on the most recent financial and operational data.

| Criterion | Alibaba Group Holding Limited (BABA) | Genuine Parts Company (GPC) |

|---|---|---|

| Diversification | Highly diversified with strong segments in Customer Management Services (425B CNY), Logistics (123B CNY), Cloud Services (85B CNY), and Sales of Goods (274B CNY) | Moderately diversified; main revenue from Automotive Parts (14.8B USD) and Industrial Parts (8.7B USD) |

| Profitability | Net margin favorable at 13.06%, ROIC neutral at 7.87%, creating value with ROIC > WACC (4.5%) | Lower net margin at 3.85% (unfavorable), but strong ROE (20.84%) and ROIC (9.82%), also creating value |

| Innovation | Strong innovation presence through cloud and digital services, growing ROIC trend (40.8%) | Innovation reflected in efficient asset turnover and growing ROIC trend (80.8%), but less tech-driven |

| Global presence | Very strong global footprint, especially in Asia and expanding cloud markets | Primarily North American focus with expanding industrial reach |

| Market Share | Large market share in e-commerce and cloud services in China and Asia | Leading position in automotive parts distribution in the US and industrial supply chains |

Key takeaways: Alibaba demonstrates robust diversification and profitability with a very favorable economic moat, driven by innovation and global scale. Genuine Parts shows a durable competitive advantage with strong capital efficiency but faces challenges in net margin and liquidity ratios. Both companies create value but appeal to different investor risk profiles.

Risk Analysis

Below is a comparative risk table for Alibaba Group Holding Limited (BABA) and Genuine Parts Company (GPC) based on the most recent financial and operational data.

| Metric | Alibaba Group Holding Limited (BABA) | Genuine Parts Company (GPC) |

|---|---|---|

| Market Risk | Low beta (0.36) suggests lower volatility | Moderate beta (0.75) indicates medium volatility |

| Debt level | Low debt-to-equity ratio (0.25) favorable | High debt-to-equity ratio (1.32) unfavorable |

| Regulatory Risk | Elevated due to China’s evolving tech and e-commerce regulations | Moderate, mainly US and global trade compliance |

| Operational Risk | Moderate; diverse segments and global logistics complexity | Moderate; supply chain and industrial distribution risks |

| Environmental Risk | Moderate; increasing scrutiny on ESG in China and global markets | Low to moderate; industrial parts distribution with environmental considerations |

| Geopolitical Risk | High; exposure to China-US tensions and international trade barriers | Moderate; mostly US and allied countries exposure |

In synthesis, Alibaba faces significant geopolitical and regulatory risks due to its Chinese base and global operations, despite strong financial health and low debt. Genuine Parts Company has a higher debt burden and moderate operational risks but benefits from stable markets with less geopolitical tension. Investors should weigh Alibaba’s regulatory and geopolitical challenges against its strong profitability and growth potential, while GPC warrants caution on leverage but offers steadier market conditions.

Which Stock to Choose?

Alibaba Group Holding Limited (BABA) shows a favorable income evolution with a 5.86% revenue growth last year and strong profitability metrics, including a 13.06% net margin. Its financial ratios are mostly favorable, reflecting solid liquidity and manageable debt levels, supported by a very favorable rating and a durable competitive advantage.

Genuine Parts Company (GPC) presents a more mixed income evolution with modest recent revenue growth of 1.71% and neutral net margin at 3.85%. Its financial ratios are slightly favorable overall but include some unfavorable points such as high debt-to-equity. The company holds a very favorable rating with a durable competitive advantage, though its financial risk is higher.

For investors, BABA might appear more suitable for those prioritizing growth and stronger profitability, given its favorable income and ratio evaluations. In contrast, GPC could be seen as appealing to those seeking value in a company with a durable moat but with higher leverage and mixed recent income performance.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Alibaba Group Holding Limited and Genuine Parts Company to enhance your investment decisions: