In the rapidly evolving landscape of technology, two companies stand out for their innovative approaches to software solutions: ServiceNow, Inc. (NOW) and PagerDuty, Inc. (PD). Both operate in the Software – Application industry, focusing on enhancing enterprise operations through automation and digital management. Their overlapping markets provide intriguing insights into their distinct strategies and growth potentials. In this article, I will analyze these companies to determine which one might be the more compelling investment opportunity for you.

Table of contents

Company Overview

ServiceNow, Inc. Overview

ServiceNow, Inc. is a leading provider of enterprise cloud computing solutions, specializing in workflow automation and digital transformation for various industries. Founded in 2004 and headquartered in Santa Clara, California, the company operates the Now platform, which integrates artificial intelligence, machine learning, and robotic process automation to streamline IT service management and operational efficiency. With a market capitalization of approximately $171.3B, ServiceNow serves a diverse clientele, including government, healthcare, telecommunications, and financial services, emphasizing its commitment to enhancing organizational productivity and resilience.

PagerDuty, Inc. Overview

PagerDuty, Inc. operates a digital operations management platform that empowers businesses to manage incidents and optimize performance through real-time data analytics. Established in 2009 and based in San Francisco, California, PagerDuty leverages machine learning to interpret data signals across various software systems. With a market cap of around $1.4B, it caters to multiple sectors such as retail, telecommunications, and media, providing comprehensive solutions to improve operational reliability and customer satisfaction.

Both companies operate within the software application industry, focusing on enhancing operational efficiencies through innovative technology. However, while ServiceNow emphasizes IT service management across diverse sectors, PagerDuty concentrates on incident management and operational performance optimization, showcasing distinct yet complementary business models.

Income Statement Comparison

In the following table, I present a comparison of the most recent Income Statements for ServiceNow, Inc. and PagerDuty, Inc., highlighting key financial metrics.

| Metric | ServiceNow, Inc. | PagerDuty, Inc. |

|---|---|---|

| Revenue | 10.98B | 467.5M |

| EBITDA | 2.23B | -11.89M |

| EBIT | 1.76B | -32.50M |

| Net Income | 1.43B | -42.74M |

| EPS | 6.92 | -0.59 |

Interpretation of Income Statement

ServiceNow, Inc. exhibits robust growth, with a significant increase in revenue from 8.97B in 2023 to 10.98B in 2024, alongside a stable net income of 1.43B. The EBITDA margin improved, reflecting efficient cost management. In contrast, PagerDuty, Inc. continues to struggle, with revenues increasing slightly but still posting a net loss of 42.74M. The negative EBITDA indicates ongoing operational challenges. Overall, while ServiceNow demonstrates positive trends, PagerDuty’s performance suggests a need for strategic adjustments to enhance profitability.

Financial Ratios Comparison

The table below presents a comparative analysis of key financial ratios for ServiceNow, Inc. (NOW) and PagerDuty, Inc. (PD) based on the most recent data.

| Metric | NOW | PD |

|---|---|---|

| ROE | 14.83% | -32.92% |

| ROIC | 9.22% | -10.07% |

| P/E | 153.13 | -39.87 |

| P/B | 22.71 | 13.12 |

| Current Ratio | 1.10 | 1.87 |

| Quick Ratio | 1.10 | 1.87 |

| D/E | 0.24 | 3.57 |

| Debt-to-Assets | 0.11 | 0.50 |

| Interest Coverage | 59.30 | -6.46 |

| Asset Turnover | 0.54 | 0.50 |

| Fixed Asset Turnover | 4.47 | 16.61 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

ServiceNow shows solid financial health with a strong ROE and low debt levels, indicating effective management and profitability. Conversely, PagerDuty’s negative ratios highlight significant financial challenges, particularly in profitability and debt management. The high debt-to-equity ratio and lack of coverage for interest expenses raise red flags regarding its financial stability and risk profile. Investors should exercise caution when considering positions in these stocks.

Dividend and Shareholder Returns

Both ServiceNow, Inc. (NOW) and PagerDuty, Inc. (PD) do not pay dividends, reflecting their focus on reinvesting for growth and innovation. ServiceNow has a robust cash flow, allowing for significant share buybacks, which can enhance shareholder value. Conversely, PagerDuty’s negative net income and high debt levels raise concerns about its financial stability. Overall, the lack of dividends for both companies aligns with a growth strategy, but caution is warranted regarding their long-term value creation potential.

Strategic Positioning

ServiceNow, Inc. (NOW) holds a significant market share in the enterprise cloud computing landscape, driven by its robust Now platform that streamlines workflow automation. With a market cap of $171.3B, it faces competitive pressure from players like PagerDuty, Inc. (PD), which operates a digital operations management platform with a market cap of $1.4B. Both companies are navigating technological disruptions, emphasizing the need for continuous innovation to maintain their positions in a rapidly evolving market.

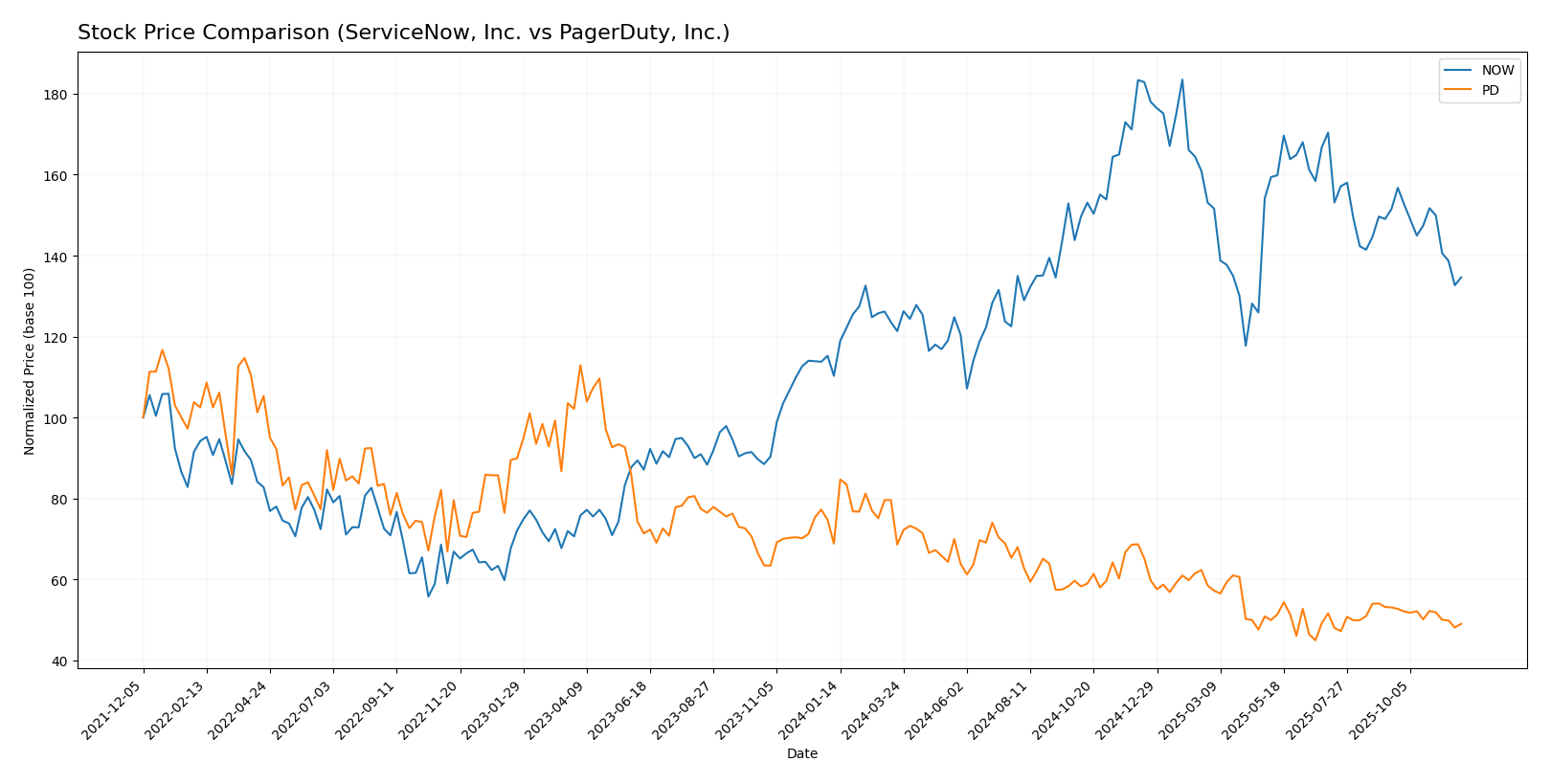

Stock Comparison

In the past year, the stock prices of ServiceNow, Inc. (NOW) and PagerDuty, Inc. (PD) have exhibited significant movements, highlighting contrasting trading dynamics that warrant close examination.

Trend Analysis

ServiceNow, Inc. (NOW) has experienced a price change of +22.06% over the past year, indicating a bullish trend despite recent declines of -11.16% from mid-September to the end of November 2025. The stock reached a notable high of $1124.98 and a low of $656.93. The trend is currently decelerating, with a standard deviation of 116.38, suggesting some volatility in its price movements.

In contrast, PagerDuty, Inc. (PD) has faced a price decline of -28.8% over the same period, marking a bearish trend. Recently, the stock has also seen a decrease of -7.66% from September to November 2025. The highest recorded price was $26.23, while the lowest was $13.92. The acceleration status is also decelerating, with a much lower standard deviation of 2.91, indicating less volatility compared to NOW.

In summary, while NOW remains in a bullish phase overall, its recent performance suggests caution, and PD continues to struggle in a bearish market.

Analyst Opinions

Recent analyst recommendations indicate a mixed outlook for ServiceNow, Inc. (NOW) and PagerDuty, Inc. (PD). Analysts have rated ServiceNow with a “B,” highlighting concerns over its price-to-earnings and price-to-book ratios, while its discounted cash flow and return metrics remain strong. In contrast, PagerDuty received an “A-” rating, praised for its robust return on equity and assets, despite a lower debt-to-equity ratio. The consensus for PagerDuty is a “buy,” while ServiceNow is regarded as a “hold” for the current year.

Stock Grades

As we assess the current stock ratings, we find reliable grades for two companies: ServiceNow, Inc. and PagerDuty, Inc.

ServiceNow, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | maintain | Overweight | 2025-10-30 |

| Canaccord Genuity | maintain | Buy | 2025-10-30 |

| TD Cowen | maintain | Buy | 2025-10-30 |

| UBS | maintain | Buy | 2025-10-30 |

| Wells Fargo | maintain | Overweight | 2025-10-30 |

| Barclays | maintain | Overweight | 2025-10-30 |

| Citigroup | maintain | Buy | 2025-10-30 |

| UBS | maintain | Buy | 2025-10-14 |

| Morgan Stanley | upgrade | Overweight | 2025-09-24 |

| JMP Securities | maintain | Market Outperform | 2025-08-04 |

PagerDuty, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | maintain | Buy | 2025-11-19 |

| Canaccord Genuity | maintain | Buy | 2025-09-04 |

| Baird | maintain | Neutral | 2025-09-04 |

| RBC Capital | maintain | Outperform | 2025-09-04 |

| Canaccord Genuity | maintain | Buy | 2025-06-02 |

| Truist Securities | maintain | Buy | 2025-05-30 |

| JP Morgan | maintain | Underweight | 2025-05-30 |

| RBC Capital | maintain | Outperform | 2025-05-30 |

| TD Securities | maintain | Hold | 2025-05-21 |

| Morgan Stanley | maintain | Equal Weight | 2025-04-16 |

Overall, the trend for ServiceNow shows a consistent positive outlook with multiple “Overweight” and “Buy” ratings, indicating strong investor confidence. PagerDuty also maintains a generally positive sentiment, although it features a mix of “Buy,” “Neutral,” and “Underweight” grades, suggesting a more cautious approach may be warranted.

Target Prices

The consensus target prices for ServiceNow, Inc. and PagerDuty, Inc. indicate positive growth expectations from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| ServiceNow, Inc. | 1315 | 860 | 1172.71 |

| PagerDuty, Inc. | 52 | 18 | 30.13 |

The analysts’ consensus target prices suggest that ServiceNow, Inc. has significant upside potential compared to its current price of 825.31, while PagerDuty, Inc. also presents an attractive growth outlook relative to its current price of 15.18.

Strengths and Weaknesses

Below is a comparative analysis of the strengths and weaknesses of ServiceNow, Inc. and PagerDuty, Inc.

| Criterion | ServiceNow, Inc. | PagerDuty, Inc. |

|---|---|---|

| Diversification | Strong | Moderate |

| Profitability | High (Net Profit Margin: 12.97%) | Negative (Net Profit Margin: -9.14%) |

| Innovation | High (Focus on AI and automation) | Moderate (Growing digital operations platform) |

| Global presence | Extensive (Serves multiple sectors globally) | Moderate (Primary focus in US and Japan) |

| Market Share | Significant | Small |

| Debt level | Low (Debt to Equity Ratio: 0.24) | High (Debt to Equity Ratio: 3.57) |

Key takeaways from this analysis indicate that ServiceNow, Inc. demonstrates strong profitability and low debt levels, making it a more stable investment choice. In contrast, PagerDuty, Inc. faces challenges with profitability and high debt, which may pose risks for investors.

Risk Analysis

Below is a summary of the potential risks associated with investing in ServiceNow, Inc. (NOW) and PagerDuty, Inc. (PD):

| Metric | ServiceNow, Inc. (NOW) | PagerDuty, Inc. (PD) |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Low | Moderate |

| Operational Risk | Moderate | High |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Low | Moderate |

In my analysis, the most pressing risks appear to be market volatility for PagerDuty, which can significantly impact its financial performance, alongside operational risks due to the company’s current financial struggles. Monitoring these factors is essential for informed investment decisions.

Which one to choose?

When comparing ServiceNow, Inc. (NOW) and PagerDuty, Inc. (PD), the choice largely depends on investor goals. NOW exhibits strong fundamentals, with a market cap of 218B, a gross profit margin of 79.2%, and a bullish stock trend, despite a recent 11.16% decline. Analysts rate it a ‘B’ overall, reflecting solid profitability metrics like a return on equity of 14.83%. In contrast, PD struggles with negative margins and a bearish trend, showing a 28.8% price decline recently. However, it holds a higher overall score of ‘A-‘ due to its better return metrics.

For growth-focused investors, NOW appears favorable, whereas those prioritizing value might consider PD, albeit with caution due to its volatility and operational challenges. Both companies face risks from competition and market dependence, which could affect future performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of ServiceNow, Inc. and PagerDuty, Inc. to enhance your investment decisions: