In today’s rapidly evolving market, understanding the nuances between leading companies is crucial for investors. This article compares ServiceNow, Inc. (NOW) and Roper Technologies, Inc. (ROP), two prominent players in the software and industrial sectors, respectively. Both firms are known for their innovative strategies and strong market presence, yet they operate in distinctly different industries. By evaluating their growth potential and risk profiles, I will help you determine which company might be the most intriguing addition to your investment portfolio.

Table of contents

Company Overview

ServiceNow, Inc. Overview

ServiceNow, Inc. is a leading provider of enterprise cloud computing solutions, focusing on streamlining and automating workflows for businesses globally. With a market cap of approximately 171B, ServiceNow is positioned at the forefront of the software application industry. The company offers a wide range of services, including IT service management, governance, risk, compliance, and human resources management, all powered by advanced technologies like artificial intelligence and machine learning. Founded in 2004 and headquartered in Santa Clara, California, ServiceNow aims to transform how organizations manage their services and operations, making them more efficient and responsive.

Roper Technologies, Inc. Overview

Roper Technologies, Inc. is a diversified technology company specializing in software and engineered products across various sectors, including industrial machinery and healthcare. With a market cap of about 48B, Roper designs innovative solutions that cater to industries such as insurance, transportation, and financial analytics. The company, incorporated in 1981 and based in Sarasota, Florida, combines advanced technology with practical applications to enhance operational efficiency and productivity. Roper’s extensive product portfolio includes cloud-based software, diagnostic tools, and precision instruments, showcasing its commitment to quality and innovation.

Key similarities between ServiceNow and Roper Technologies include their focus on technology-driven solutions and commitment to enhancing operational efficiency across various sectors. However, they differ in their primary markets, with ServiceNow specializing in IT and workflow automation, while Roper spans multiple industries, including healthcare and industrial machinery.

Income Statement Comparison

The following table presents a comparison of the most recent income statements for ServiceNow, Inc. (NOW) and Roper Technologies, Inc. (ROP), highlighting key financial metrics.

| Metric | ServiceNow, Inc. | Roper Technologies, Inc. |

|---|---|---|

| Revenue | 10.98B | 7.04B |

| EBITDA | 2.23B | 3.04B |

| EBIT | 1.76B | 2.23B |

| Net Income | 1.43B | 1.55B |

| EPS | 6.92 | 14.47 |

Interpretation of Income Statement

In the most recent year, ServiceNow, Inc. experienced significant growth, with revenue increasing from 8.97B to 10.98B, reflecting a strong performance. However, net income decreased from 1.73B to 1.43B, indicating margin compression, primarily due to rising costs. Conversely, Roper Technologies, Inc. also showed robust revenue growth from 6.18B to 7.04B, coupled with steady net income growth from 1.36B to 1.55B. Overall, both companies demonstrated resilience, but ServiceNow’s declining net income highlights potential challenges in managing operational costs effectively.

Financial Ratios Comparison

The following table provides a comparative analysis of key financial ratios for ServiceNow, Inc. (NOW) and Roper Technologies, Inc. (ROP) based on the most recent data available.

| Metric | NOW | ROP |

|---|---|---|

| ROE | 14.83% | 8.21% |

| ROIC | 9.22% | 5.50% |

| P/E | 153.13 | 42.60 |

| P/B | 22.71 | 3.33 |

| Current Ratio | 1.10 | 0.40 |

| Quick Ratio | 1.10 | 0.37 |

| D/E | 0.24 | 0.41 |

| Debt-to-Assets | 11.18% | 22.63% |

| Interest Coverage | 59.30 | 10.60 |

| Asset Turnover | 0.54 | 0.22 |

| Fixed Asset Turnover | 4.47 | 47.02 |

| Payout ratio | 0% | 21% |

| Dividend yield | 0% | 0.58% |

Interpretation of Financial Ratios

ServiceNow shows a strong return on equity (ROE) and return on invested capital (ROIC), indicating effective use of capital. However, its high P/E ratio suggests that the stock is potentially overvalued. Roper Technologies, while having lower ratios, maintains a solid interest coverage ratio, indicating it can comfortably meet its debt obligations. The current and quick ratios for ROP are concerning, as they indicate liquidity issues. Overall, NOW appears stronger in growth metrics, while ROP shows resilience in managing debt.

Dividend and Shareholder Returns

ServiceNow, Inc. (NOW) does not currently pay dividends, opting instead to reinvest profits for growth, which aligns with its high-growth strategy. However, it engages in share buybacks, indicating a commitment to returning capital to shareholders.

In contrast, Roper Technologies, Inc. (ROP) has a dividend payout ratio of 21% and a dividend yield of 0.58%, reflecting a balanced approach to shareholder returns while maintaining sufficient cash flow for growth initiatives. Both companies exhibit strategies that could support long-term value creation, though ROP provides immediate returns through dividends.

Strategic Positioning

ServiceNow, Inc. (NOW) holds a significant market share in the enterprise cloud computing space, focusing on workflow automation and IT service management. Its competitive edge lies in its advanced AI and machine learning capabilities, which can be vulnerable to technological disruption but also provide a robust defense against competitors. Roper Technologies, Inc. (ROP), positioned in industrial machinery, faces intense competitive pressure, but its diverse software solutions and focus on cloud-based analytics allow it to maintain a strong market presence. Both companies must navigate the evolving landscape while managing risks effectively.

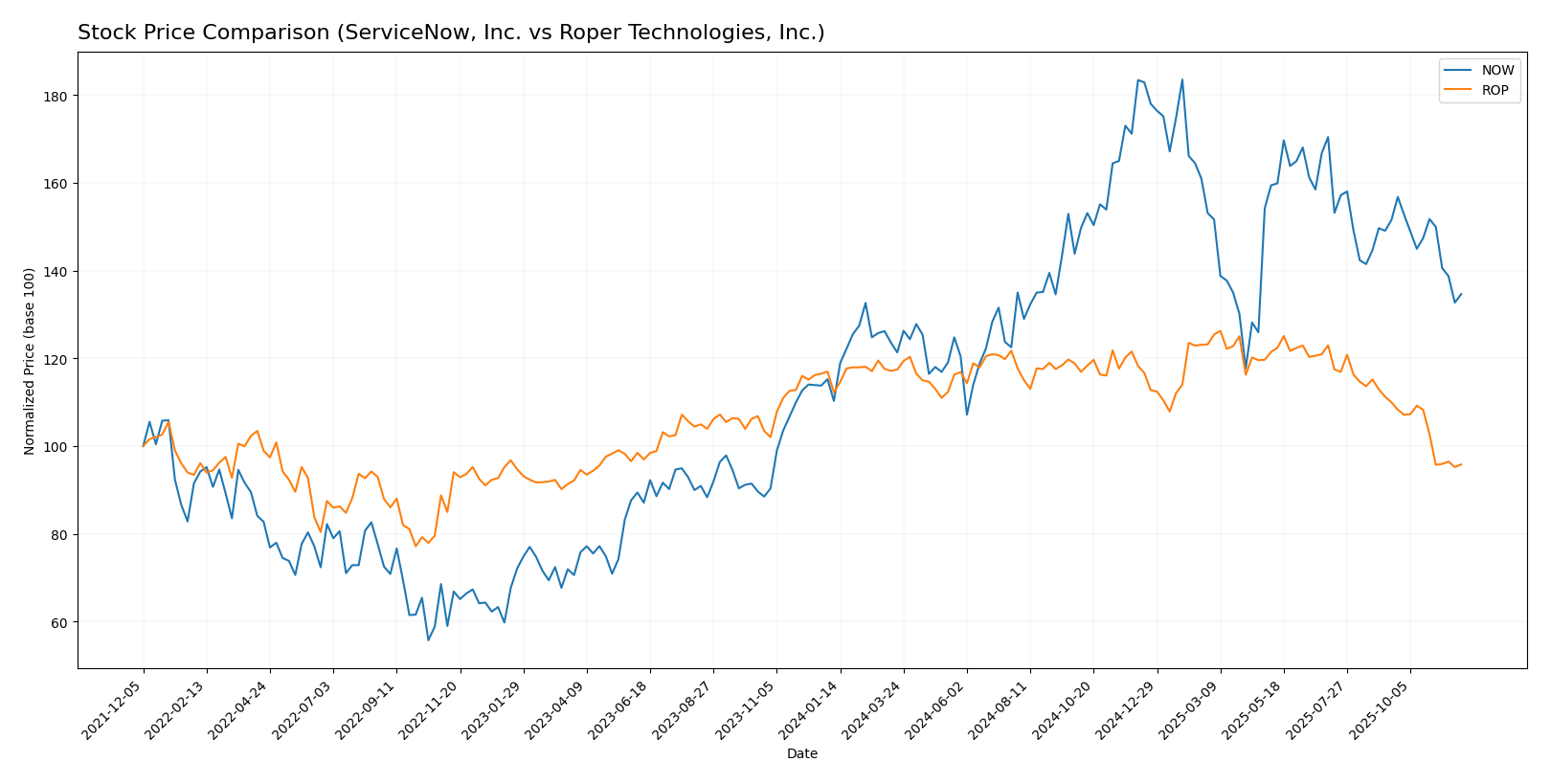

Stock Comparison

In analyzing the stock prices of ServiceNow, Inc. (NOW) and Roper Technologies, Inc. (ROP) over the past year, we observe significant price movements and trading dynamics that warrant closer examination.

Trend Analysis

ServiceNow, Inc. (NOW) has experienced a percentage change of +22.06% over the past year. This indicates a bullish trend, although the stock has shown signs of deceleration in its price acceleration. The highest price reached was 1,124.98, while the lowest was 656.93. Despite the overall positive trend, the recent analysis from September 14, 2025, to November 30, 2025, reveals a decline of -11.16%, suggesting short-term weakening.

Roper Technologies, Inc. (ROP), on the other hand, has faced a percentage change of -14.66% over the past year, categorizing it as a bearish trend. Similar to NOW, ROP is also experiencing deceleration in its price movement. The stock’s highest price was 588.38, with a low of 443.75. Recently, from September 14, 2025, to November 30, 2025, ROP has further declined by -12.9%, indicating continued short-term challenges.

In summary, while NOW shows potential for recovery in the long term, ROP is currently under pressure, and investors should exercise caution when considering their positions in either stock.

Analyst Opinions

Recent analyses indicate a bullish sentiment towards both ServiceNow, Inc. (NOW) and Roper Technologies, Inc. (ROP). Analysts have assigned a “B” rating to NOW, with strong scores in discounted cash flow and return metrics, though concerns linger regarding its price-to-earnings ratio. Conversely, ROP received a “B+” rating, benefiting from solid performance in asset returns and cash flow. The consensus for both companies leans towards a “buy” for 2025, reflecting optimism about their growth potential amidst market volatility.

Stock Grades

We have reliable stock grades from recognized grading companies for both ServiceNow, Inc. (NOW) and Roper Technologies, Inc. (ROP). Let’s explore the current ratings for these companies.

ServiceNow, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | maintain | Overweight | 2025-10-30 |

| Canaccord Genuity | maintain | Buy | 2025-10-30 |

| TD Cowen | maintain | Buy | 2025-10-30 |

| UBS | maintain | Buy | 2025-10-30 |

| Wells Fargo | maintain | Overweight | 2025-10-30 |

| Barclays | maintain | Overweight | 2025-10-30 |

| Citigroup | maintain | Buy | 2025-10-30 |

| UBS | maintain | Buy | 2025-10-14 |

| Morgan Stanley | upgrade | Overweight | 2025-09-24 |

| JMP Securities | maintain | Market Outperform | 2025-08-04 |

Roper Technologies, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | downgrade | Sector Perform | 2025-10-27 |

| Barclays | maintain | Underweight | 2025-10-27 |

| TD Cowen | maintain | Buy | 2025-10-24 |

| Raymond James | maintain | Strong Buy | 2025-10-24 |

| RBC Capital | maintain | Outperform | 2025-10-24 |

| Jefferies | maintain | Buy | 2025-10-24 |

| Mizuho | maintain | Neutral | 2025-10-17 |

| JP Morgan | downgrade | Underweight | 2025-10-15 |

| Barclays | maintain | Underweight | 2025-10-01 |

| Truist Securities | maintain | Buy | 2025-07-22 |

Overall, ServiceNow, Inc. maintains a strong position with consistent “Buy” and “Overweight” ratings, indicating solid investor confidence. In contrast, Roper Technologies, Inc. shows mixed signals with recent downgrades, suggesting a more cautious approach may be warranted for potential investors.

Target Prices

The current consensus target prices for the selected companies are as follows:

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| ServiceNow, Inc. | 1,315 | 860 | 1,172.71 |

| Roper Technologies, Inc. | 650 | 506 | 574.2 |

For ServiceNow, Inc. (NOW), the target consensus of 1,172.71 is significantly higher than its current price of 825.31, indicating positive expectations from analysts. Similarly, Roper Technologies, Inc. (ROP) has a consensus target of 574.2, above its current price of 446.41, suggesting room for growth as well.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of ServiceNow, Inc. (NOW) and Roper Technologies, Inc. (ROP) based on the most recent data available.

| Criterion | ServiceNow, Inc. (NOW) | Roper Technologies, Inc. (ROP) |

|---|---|---|

| Diversification | Moderate | High |

| Profitability | High (Net Margin: 12.97%) | High (Net Margin: 22.01%) |

| Innovation | Strong | Moderate |

| Global presence | Strong | Moderate |

| Market Share | Growing | Stable |

| Debt level | Low (Debt/Equity: 0.24) | Moderate (Debt/Equity: 0.41) |

Key takeaways indicate that while both companies have strong profitability, Roper Technologies leads in innovation and debt management. ServiceNow has a growing market share, which may present investment opportunities.

Risk Analysis

In this section, I provide a concise overview of the key risks associated with two companies, ServiceNow, Inc. and Roper Technologies, Inc.

| Metric | ServiceNow, Inc. | Roper Technologies, Inc. |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | Moderate |

| Operational Risk | Low | Moderate |

| Environmental Risk | Low | High |

| Geopolitical Risk | Moderate | High |

Both companies face notable market and geopolitical risks, particularly due to fluctuating demand and global instability. Additionally, Roper’s exposure to environmental risks is higher, reflecting potential regulatory changes and sustainability concerns.

Which one to choose?

When comparing ServiceNow, Inc. (NOW) and Roper Technologies, Inc. (ROP), I observe distinct financial profiles. NOW boasts a robust revenue growth trajectory with a net profit margin of 12.97% in FY 2024 and a high return on equity (RoE) of 14.83%. However, it carries a lofty price-to-earnings ratio of 153, indicating potential overvaluation risks. Conversely, ROP presents a more stable financial picture with a net profit margin of 22% and an attractive price-to-earnings ratio of 35.94, suggesting it may be undervalued relative to its earnings.

Analyst ratings for both companies are solid, with NOW rated B and ROP rated B+, indicating a preference for the latter based on overall financial health and risk management.

For growth-oriented investors, NOW is appealing due to its rapid expansion, while conservative investors may prefer ROP for its stability and consistent returns.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of ServiceNow, Inc. and Roper Technologies, Inc. to enhance your investment decisions: