In today’s evolving energy landscape, two innovative companies, NuScale Power Corporation (SMR) and Oklo Inc. (OKLO), are at the forefront of nuclear energy solutions. Both operate within the utilities sector, with a focus on sustainable energy generation through advanced nuclear technology. Their distinct approaches and market strategies present an intriguing comparison for investors looking to capitalize on the future of energy. Join me as we explore which of these companies holds the most promise for your investment portfolio.

Table of contents

Company Overview

NuScale Power Corporation Overview

NuScale Power Corporation (ticker: SMR), founded in 2007 and headquartered in Portland, Oregon, is at the forefront of the nuclear energy sector. The company’s mission revolves around developing innovative modular light water reactors to produce clean, reliable energy. With a market capitalization of approximately $5.57B, NuScale is focused on offering various configurations of its power modules, including the VOYGR-12 plant, which can generate 924 MWe. This strategic positioning allows NuScale to cater to diverse energy needs, including district heating and hydrogen production.

Oklo Inc. Overview

Oklo Inc. (ticker: OKLO), established in 2013 and based in Santa Clara, California, aims to revolutionize energy production through its compact fission power plants. The company not only designs and develops these facilities to provide reliable energy but also offers used nuclear fuel recycling services. With a market capitalization of about $13.29B, Oklo is well-positioned in the regulated electric industry, emphasizing sustainability and efficiency in its operations.

Key similarities and differences in their business models include their focus on nuclear energy and clean technology. While both companies aim to provide innovative energy solutions, NuScale emphasizes modular reactors and diverse applications, whereas Oklo highlights compact fission technology and recycling services.

Income Statement Comparison

Below is a comparative analysis of the most recent income statements for NuScale Power Corporation (SMR) and Oklo Inc. (OKLO), highlighting key financial metrics.

| Metric | NuScale Power Corporation (SMR) | Oklo Inc. (OKLO) |

|---|---|---|

| Revenue | 37M | 0 |

| EBITDA | -134M | -53M |

| EBIT | -135M | -53M |

| Net Income | -137M | -74M |

| EPS | -1.47 | -0.74 |

Interpretation of Income Statement

In the latest fiscal year, NuScale Power Corporation (SMR) reported a significant increase in revenue to 37M, up from 23M in the previous year. However, it still faced substantial net losses, totaling 137M. Oklo Inc. (OKLO) reported no revenue, maintaining consistent losses, with net income at -74M. Both companies show negative EBITDA, indicating challenges in operational efficiency. SMR’s revenue growth is promising, yet the elevated costs and losses raise caution for potential investors. Meanwhile, OKLO’s lack of revenue highlights its pre-revenue status, which could present a higher-risk investment scenario.

Financial Ratios Comparison

The following table provides a comparative analysis of the most recent financial metrics for NuScale Power Corporation (SMR) and Oklo Inc. (OKLO), focusing on key revenue ratios.

| Metric | NuScale Power (SMR) | Oklo Inc. (OKLO) |

|---|---|---|

| ROE | -22.08% | -29.35% |

| ROIC | -30.66% | -19.23% |

| P/E | -12.24 | -31.76 |

| P/B | 2.70 | -29.73 |

| Current Ratio | 5.25 | 43.47 |

| Quick Ratio | 5.25 | 43.47 |

| D/E | 0.00 | 0.01 |

| Debt-to-Assets | 0.00 | 0.02 |

| Interest Coverage | 0.00 | 0.00 |

| Asset Turnover | 0.068 | 0.00 |

| Fixed Asset Turnover | 15.30 | 0.00 |

| Payout Ratio | 0.00 | 0.00 |

| Dividend Yield | 0.00 | 0.00 |

Interpretation of Financial Ratios

Both companies exhibit weak profitability indicators, with negative ROE and ROIC values, indicating that they are currently unprofitable. While NuScale has a stronger current and quick ratio compared to Oklo, suggesting better liquidity, Oklo’s significantly high current ratio indicates it can cover its short-term liabilities comfortably. However, both companies face concerns due to their hefty negative P/E ratios, reflecting a lack of earnings, which may deter potential investors.

Dividend and Shareholder Returns

NuScale Power Corporation (SMR) does not pay dividends, with a dividend payout ratio of 0%. Instead, it focuses on reinvesting capital to fund growth and R&D, which is typical for companies in high-growth sectors. Oklo Inc. (OKLO) also refrains from dividends, prioritizing cash for operational sustainability and innovation. Both companies actively conduct share buybacks, indicating a commitment to enhancing shareholder value. This strategy, while not immediate, aligns with long-term value creation potential.

Strategic Positioning

In the competitive landscape of renewable energy, NuScale Power Corporation (SMR) and Oklo Inc. (OKLO) are key players. NuScale holds a significant market share in modular nuclear reactors, leveraging its advanced VOYGR technology to meet growing energy demands. Meanwhile, Oklo focuses on fission power plants and offers used fuel recycling, which positions it uniquely in the market. Both companies face technological disruptions and increased competitive pressure, necessitating strategic agility to maintain their positions.

Stock Comparison

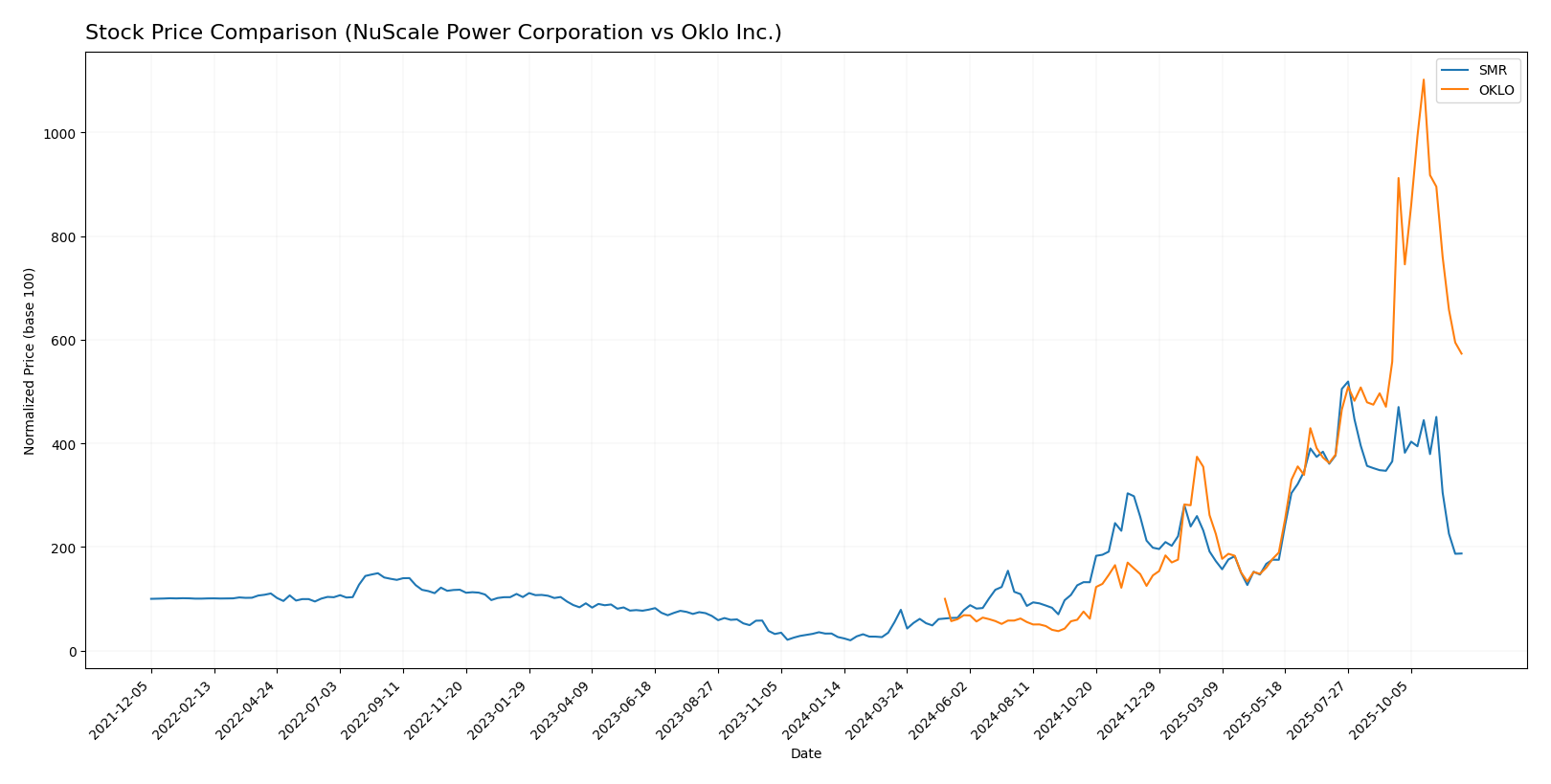

In this section, I will analyze the stock price movements and trading dynamics of NuScale Power Corporation (SMR) and Oklo Inc. (OKLO) over the past year, highlighting key trends and fluctuations.

Trend Analysis

NuScale Power Corporation (SMR) Over the past year, SMR’s stock has experienced a remarkable price change of +611.83%, indicating a bullish trend overall. However, in the recent period from September 14, 2025, to November 30, 2025, the stock showed a decline of -48.68%, suggesting a deceleration in the recent trend despite its substantial growth over the longer term. The highest price reached was 51.67, while the lowest was 1.99. The standard deviation of 13.08 indicates a moderate level of volatility.

Oklo Inc. (OKLO) For OKLO, the stock saw an impressive increase of +473.1% over the past year, also reflecting a bullish trend. In the short term, from September 14 to November 30, 2025, there was a slight increase of +2.76%, which, although positive, indicates a neutral trend when considering the percentage change. The stock hit a high of 163.39 and a low of 5.59, with a standard deviation of 38.3 pointing to relatively high volatility.

In summary, both companies show strong year-over-year performance with significant long-term gains, while recent trends for SMR indicate a bearish shift, contrasting with OKLO’s neutral movement.

Analyst Opinions

Recent analyst recommendations for NuScale Power Corporation (SMR) indicate a cautious stance, with a rating of D+. Analysts highlight concerns over low scores in key financial metrics, suggesting potential risks in profitability and debt management. In contrast, Oklo Inc. (OKLO) received a more favorable C rating, with analysts noting a better outlook on discounted cash flow and debt-to-equity ratios. However, overall consensus remains cautious, with a preference to hold both stocks for the current year, reflecting mixed sentiments about their future performance.

Stock Grades

In this section, I will present the latest stock grades for NuScale Power Corporation (SMR) and Oklo Inc. (OKLO) based on reliable grading data from established firms.

NuScale Power Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | downgrade | Sell | 2025-10-21 |

| B of A Securities | downgrade | Underperform | 2025-09-30 |

| RBC Capital | maintain | Sector Perform | 2025-11-10 |

| Canaccord Genuity | maintain | Buy | 2025-09-03 |

| UBS | maintain | Neutral | 2025-08-11 |

| CLSA | maintain | Outperform | 2025-05-27 |

Oklo Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wedbush | maintain | Outperform | 2025-11-12 |

| B of A Securities | maintain | Neutral | 2025-11-12 |

| B. Riley Securities | maintain | Buy | 2025-11-12 |

| B of A Securities | downgrade | Neutral | 2025-09-30 |

| Seaport Global | downgrade | Neutral | 2025-09-23 |

Overall, the grades for NuScale Power Corporation indicate a mix of downgrades and maintained grades, reflecting a cautious sentiment among analysts. In contrast, Oklo Inc. shows a more stable outlook with multiple maintain ratings, suggesting confidence in its performance despite some downgrades earlier in the year.

Target Prices

The consensus target prices for NuScale Power Corporation (SMR) and Oklo Inc. (OKLO) show significant growth potential based on analyst expectations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| NuScale Power Corporation (SMR) | 55 | 20 | 36.57 |

| Oklo Inc. (OKLO) | 175 | 75 | 129.5 |

For NuScale Power Corporation, the current stock price of 18.67 is well below the consensus target of 36.57, suggesting considerable upside potential. Similarly, Oklo Inc. is currently priced at 85.06, significantly lower than the consensus target of 129.5, indicating strong analyst optimism for both stocks.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of NuScale Power Corporation (SMR) and Oklo Inc. (OKLO) based on the most recent financial data.

| Criterion | NuScale Power Corporation (SMR) | Oklo Inc. (OKLO) |

|---|---|---|

| Diversification | Limited product offerings | Niche market focus |

| Profitability | Negative profit margins | No profitability |

| Innovation | Advanced reactor technology | Innovative design |

| Global presence | Primarily US-based | Focused on US market |

| Market Share | Emerging player | Start-up phase |

| Debt level | Minimal debt | Very low debt |

Key takeaways include that both companies are in growing sectors but face challenges in profitability. NuScale has a slight edge in technology innovation, while Oklo’s focus is more niche, which could be a double-edged sword in terms of market reach.

Risk Analysis

In this section, I will outline the key risks associated with two companies, NuScale Power Corporation (SMR) and Oklo Inc. (OKLO), to provide you with a clearer picture for investment decisions.

| Metric | NuScale Power Corporation (SMR) | Oklo Inc. (OKLO) |

|---|---|---|

| Market Risk | High, due to volatility in energy prices and demand fluctuations. | Moderate, as the market for nuclear energy is niche but growing. |

| Regulatory Risk | Significant, influenced by changes in energy regulations and nuclear policies. | High, as nuclear energy is heavily regulated and subject to public scrutiny. |

| Operational Risk | Moderate, given the complexities of nuclear reactor operations. | High, due to the technical challenges in developing fission power plants. |

| Environmental Risk | Moderate, focusing on waste management and emissions. | High, associated with nuclear waste disposal and regulatory compliance. |

| Geopolitical Risk | Moderate, affected by geopolitical tensions impacting energy supply chains. | Low, primarily domestic operations reduce exposure to geopolitical events. |

The most impactful risks for both companies stem from regulatory challenges and operational complexities inherent in the nuclear energy sector. With energy prices fluctuating and regulatory scrutiny increasing, these factors could significantly affect future performance.

Which one to choose?

In comparing NuScale Power Corporation (SMR) and Oklo Inc. (OKLO), both companies exhibit significant challenges in profitability, with negative margins and substantial operating losses. SMR has shown a higher market capitalization of approximately $3.72B, but its financial ratios reflect serious concerns, including a D+ rating and a price-to-earnings ratio of -12.24. In contrast, OKLO, with a market cap of about $2.10B, carries a slightly better rating of C, indicating comparatively better fundamentals despite its own challenges.

While SMR’s stock trend has been bullish, it has faced a recent decline of 48.68%, suggesting volatility. OKLO’s trend is also bullish but has seen a modest increase of only 2.76%. Investors focused on potential growth may prefer OKLO for its marginally better financial metrics, while those prioritizing stability might lean towards SMR, with its larger market presence.

Both companies face risks related to intense competition and reliance on a nascent market for their technologies.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of NuScale Power Corporation and Oklo Inc. to enhance your investment decisions: