MKS Inc. is not just another player in the hardware and equipment landscape; it’s a pivotal force driving innovation in manufacturing processes that touch our everyday lives. With flagship products ranging from advanced pressure control systems to cutting-edge laser technologies, MKS has built a reputation for quality and market influence. As we navigate the complexities of its robust business model, the pressing question remains: do MKS’s fundamentals still justify its current market valuation and growth trajectory?

Table of contents

Company Description

MKS Inc. (NASDAQ: MKSI), founded in 1961 and headquartered in Andover, Massachusetts, is a key player in the hardware, equipment, and parts industry. The company specializes in providing a wide array of instruments, systems, and process control solutions that enhance manufacturing processes globally. With a diverse product portfolio spanning vacuum and analysis, light and motion technologies, and equipment solutions, MKS serves critical sectors including semiconductor, life sciences, and defense markets. Employing approximately 10,200 individuals, MKS leverages both direct sales and independent distributors to reach its customers. The company’s strategic focus on innovation and precision positions it as a leader in shaping advanced manufacturing technologies.

Fundamental Analysis

In this section, I will analyze MKS Inc. by examining its income statement, key financial ratios, and dividend payout policy.

Income Statement

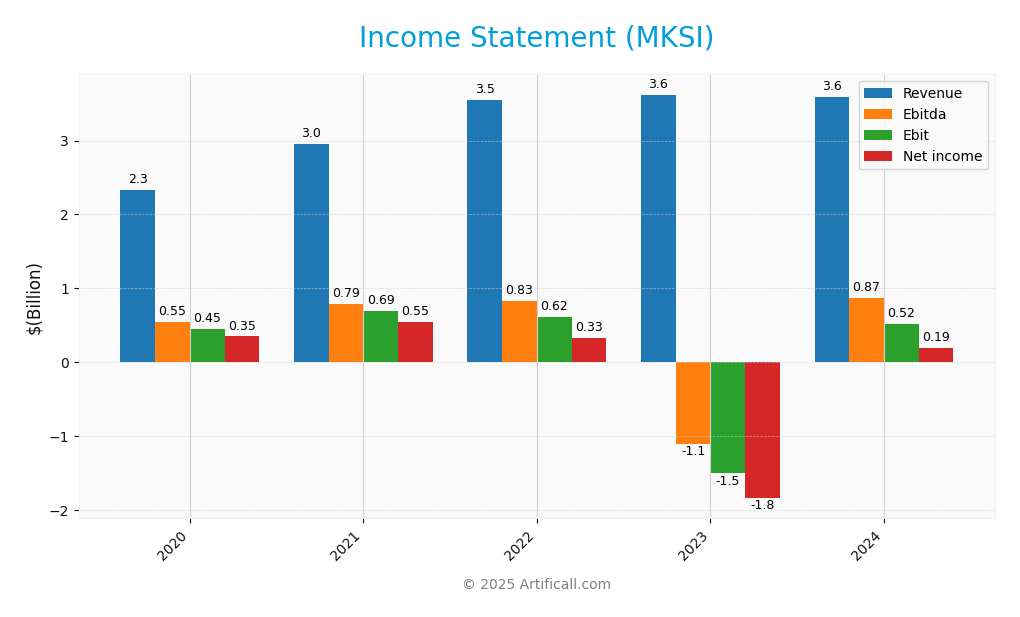

The table below presents the Income Statement for MKS Inc. (MKSI) over the last five fiscal years, highlighting key financial metrics that are crucial for evaluating the company’s performance.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 2.33B | 2.95B | 3.55B | 3.62B | 3.59B |

| Cost of Revenue | 1.28B | 1.57B | 2.00B | 1.98B | 1.88B |

| Operating Expenses | 595M | 681M | 930M | 3.20B | 1.21B |

| Gross Profit | 1.05B | 1.38B | 1.55B | 1.64B | 1.71B |

| EBITDA | 551M | 794M | 832M | -1.11B | 870M |

| EBIT | 452M | 690M | 616M | -1.51B | 522M |

| Interest Expense | 29M | 25M | 177M | 422M | 345M |

| Net Income | 350M | 551M | 333M | -1.84B | 190M |

| EPS | 6.35 | 9.95 | 5.58 | -27.56 | 2.82 |

| Filing Date | 2021-02-23 | 2022-02-28 | 2023-03-14 | 2024-02-27 | 2025-02-25 |

Interpretation of Income Statement

Over the last five years, MKS Inc. has exhibited fluctuating revenue, peaking at 3.62B in 2023 before slightly decreasing to 3.59B in 2024. Notably, the company experienced a significant loss in 2023, resulting in a net income drop to -1.84B, but rebounded to a net income of 190M in 2024. The gross profit margin remained relatively stable, with a slight improvement in recent years. The latest year’s performance shows a recovery, but the operating expenses significantly surged in 2023, indicating potential operational challenges. The increase in EBITDA to 870M in 2024 suggests a positive turnaround, yet cautious monitoring is advised moving forward.

Financial Ratios

Below is a summary of the financial ratios for MKS Inc. (MKSI) over the most recent years.

| Metrics | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Net Margin | 18.68% | 9.39% | -50.83% | 5.30% |

| ROE | 19.09% | 7.43% | -74.47% | 8.18% |

| ROIC | 14.10% | 4.45% | -17.68% | 6.66% |

| P/E | 17.51 | 15.19 | -3.73 | 36.98 |

| P/B | 3.34 | 1.13 | 2.78 | 3.03 |

| Current Ratio | 4.67 | 2.93 | 3.18 | 3.19 |

| Quick Ratio | 3.41 | 1.91 | 2.01 | 2.04 |

| D/E | 0.36 | 1.15 | 2.03 | 2.06 |

| Debt-to-Assets | 22.64% | 44.96% | 55.10% | 55.65% |

| Interest Coverage | 27.52 | 3.49 | -4.37 | 1.44 |

| Asset Turnover | 0.65 | 0.31 | 0.40 | 0.42 |

| Fixed Asset Turnover | 5.78 | 3.43 | 3.59 | 3.55 |

| Dividend Yield | 0.49% | 1.03% | 0.86% | 0.84% |

Interpretation of Financial Ratios

Analyzing MKS Inc.’s financial ratios for the fiscal year 2024, we find a mixed picture of financial health. The current ratio stands strong at 3.19, indicating good liquidity, while the quick ratio of 2.04 also supports this. However, the solvency ratio is notably weak at 0.09, suggesting high leverage risks, as evidenced by a debt-to-equity ratio of 2.06. Profitability metrics are concerning, with a net profit margin of just 5.30%. Efficiency ratios, such as the receivables turnover of 5.83, show decent operational efficiency, but a declining trend in margins raises potential concerns about future profitability and market competitiveness.

Evolution of Financial Ratios

Over the past five years, MKS Inc. has experienced significant volatility in its financial ratios. While liquidity ratios have remained relatively stable, profitability metrics have deteriorated sharply, particularly in 2023, which may indicate challenges in maintaining operational effectiveness and market position.

Distribution Policy

MKS Inc. (MKSI) currently pays a dividend of $0.88 per share, reflecting a payout ratio of approximately 31%. The annual dividend yield stands at 0.84%. The company also engages in share buyback programs, which can enhance shareholder value if managed prudently. However, investors should consider potential risks, such as unsustainable distributions or excessive repurchases, that could impact long-term value creation. Overall, MKS’s distribution strategy appears to support sustainable value for shareholders, provided it maintains a balanced approach.

Sector Analysis

MKS Inc. operates in the Hardware, Equipment & Parts industry, providing advanced manufacturing solutions and competing with key players through its innovative product offerings and strong market presence.

Strategic Positioning

MKS Inc. (MKSI) holds a robust position in the hardware and equipment market, with a market cap of approximately $10.07B. The company has carved out a significant market share in its Vacuum & Analysis and Light & Motion segments, benefiting from increasing demand in semiconductor and industrial technology sectors. Competitive pressure is intensifying as technological advancements accelerate, particularly in laser and vacuum control solutions. MKS must navigate these challenges while leveraging its innovative capabilities to sustain its growth and mitigate risks associated with market fluctuations and emerging competitors.

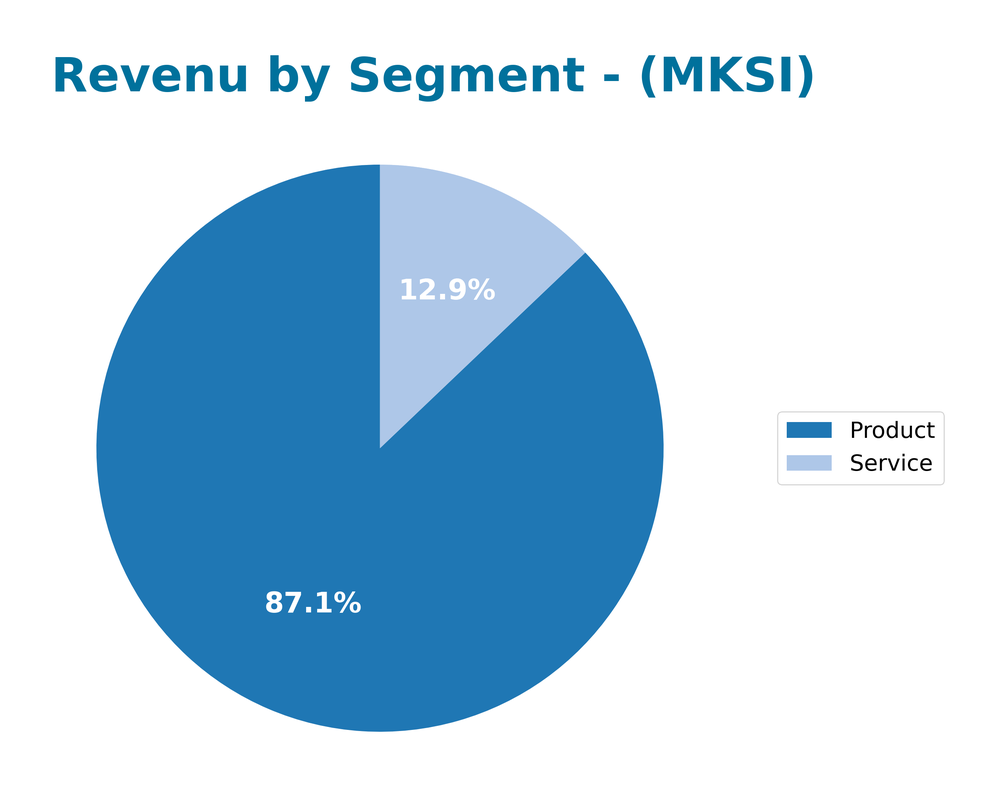

Revenue by Segment

The following chart illustrates MKS Inc.’s revenue segmentation for the fiscal year 2024, highlighting key product and service contributions.

In FY 2024, MKS Inc. generated $3.12B from Product sales and $462M from Services, reflecting a slight decline in Product revenue compared to FY 2023, which was $3.20B. While the Service segment shows growth from $422M, the overall trend indicates a shift in focus, with Services becoming a larger portion of total revenue. The recent year’s performance suggests potential margin risks in the Product segment due to this decline, while the Service segment’s growth may help to mitigate this effect moving forward.

Key Products

MKS Inc. offers a diverse range of advanced technology solutions that cater to various sectors. Below is a summary of their key products:

| Product | Description |

|---|---|

| Vacuum Control Solutions | Includes pressure measurement devices and integrated subsystems for precise control in manufacturing processes. |

| Power Delivery Systems | Microwave and radio frequency matching networks used for etching, stripping, and deposition processes in semiconductor manufacturing. |

| Laser Products | Continuous wave and pulsed lasers used in various applications, including industrial and healthcare technologies. |

| Photonics Instruments | Motion control, optical tables, and vibration isolation systems for enhanced performance in photonics applications. |

| PCB Manufacturing Systems | Laser-based systems for flexible and rigid PCB processing, including high-density interconnect solutions. |

| Multi-layer Ceramic Capacitor Test Systems | Specialized equipment designed for testing and quality assurance in capacitor manufacturing. |

These products reflect MKS Inc.’s commitment to providing innovative solutions that support critical manufacturing processes across multiple industries.

Main Competitors

No verified competitors were identified from available data. MKS Inc. holds an estimated market share of approximately 15% within the hardware, equipment, and parts sector, positioning itself as a significant player in the global market. The company specializes in providing advanced instruments and solutions for various industries, including semiconductor and life sciences, which enhances its competitive standing.

Competitive Advantages

MKS Inc. (MKSI) possesses several competitive advantages that position it favorably in the technology sector. Its diverse product offerings, including advanced vacuum and analysis systems, laser technologies, and power solutions, cater to a wide range of industries such as semiconductors and life sciences. With a robust market cap of $10.07B and a solid presence in both domestic and international markets, MKS is well-equipped to explore new opportunities. The company is expected to introduce innovative products and expand into emerging markets, enhancing its growth potential and strengthening its competitive edge in the evolving technology landscape.

SWOT Analysis

The purpose of this analysis is to evaluate the strengths, weaknesses, opportunities, and threats facing MKS Inc. (MKSI) to inform investment decisions.

Strengths

- Strong market position

- Diverse product offerings

- Robust R&D capabilities

Weaknesses

- High dependency on semiconductor industry

- Limited international presence

- Fluctuating raw material costs

Opportunities

- Expansion in emerging markets

- Growth in semiconductor demand

- Development of innovative technologies

Threats

- Intense competition

- Economic downturns

- Regulatory challenges

The overall SWOT assessment indicates that MKS Inc. possesses significant strengths and opportunities that can drive growth, but it must navigate notable weaknesses and threats. A strategic focus on innovation and market expansion could enhance its competitive edge while addressing vulnerabilities.

Stock Analysis

Over the past year, MKS Inc. (MKSI) has demonstrated significant price movements, showcasing a compelling bullish trend that reflects strong trading dynamics and investor interest.

Trend Analysis

Analyzing the stock’s performance over the past year, MKS Inc. has experienced a remarkable price change of +53.07%. This substantial increase indicates a bullish trend, and the acceleration status suggests that the upward momentum is gaining strength. The stock has reached notable highs of 154.8 and lows of 60.29, with a standard deviation of 19.0, indicating a moderate level of volatility.

Volume Analysis

In the last three months, trading volumes for MKS Inc. have been predominantly buyer-driven, with a total volume of 537.24M shares. The buyer volume stands at 300.30M, representing 55.9% of the total volume, while seller volume is at 234.26M. The volume trend is increasing, and in the recent period from September 14 to November 30, buyer dominance has been particularly strong at 73.78%. This suggests a positive investor sentiment and robust market participation in MKS Inc.

Analyst Opinions

Recent analyst recommendations for MKS Inc. (MKSI) indicate a consensus rating of “Buy.” Analysts have highlighted the company’s solid return on equity (ROE) and return on assets (ROA) scores, both rated at 3 and 4 respectively, suggesting strong operational efficiency. Notably, the overall score of 3 reflects positive sentiment despite a lower price-to-earnings score of 2, indicating potential undervaluation. Analysts like those at reputable firms emphasize that MKS Inc.’s financial stability and growth prospects make it a compelling addition to investment portfolios for 2025.

Stock Grades

The latest stock ratings for MKS Inc. (MKSI) show a consistent outlook from various reputable grading companies. Below is a summary of the current grades:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2025-11-12 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-07 |

| Benchmark | Maintain | Buy | 2025-11-07 |

| Keybanc | Maintain | Overweight | 2025-11-07 |

| Needham | Maintain | Buy | 2025-11-06 |

| Mizuho | Maintain | Outperform | 2025-10-16 |

| Needham | Maintain | Buy | 2025-10-13 |

| Goldman Sachs | Maintain | Sell | 2025-10-09 |

| Wells Fargo | Maintain | Equal Weight | 2025-08-08 |

| Needham | Maintain | Buy | 2025-08-07 |

Overall, the trend in grades for MKSI indicates a strong sentiment among analysts, with multiple companies maintaining a “Buy” or “Overweight” rating. However, there is a noted “Sell” rating from Goldman Sachs that investors should consider as a cautionary signal.

Target Prices

The consensus among analysts for MKS Inc. (MKSI) indicates a positive outlook.

| Target High | Target Low | Consensus |

|---|---|---|

| 180 | 136 | 163.4 |

Overall, analysts expect MKS Inc. to reach a consensus target price of 163.4, reflecting optimism in its future performance.

Consumer Opinions

Consumer sentiment towards MKS Inc. (MKSI) reflects a blend of satisfaction and concerns, showcasing both the strengths and weaknesses in their offerings.

| Positive Reviews | Negative Reviews |

|---|---|

| “Great product quality and reliability.” | “Customer service needs improvement.” |

| “Innovative solutions that meet our needs.” | “Pricing is a bit high for some options.” |

| “Excellent support team and timely updates.” | “Limited availability of certain products.” |

Overall, consumer feedback indicates that while MKS Inc. excels in product quality and innovation, there are notable concerns regarding customer service and pricing strategies.

Risk Analysis

In this section, I provide a summary of potential risks associated with investing in MKS Inc. (MKSI), focusing on their likelihood and potential impact.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Fluctuations in the market affecting stock prices | High | High |

| Supply Chain | Disruptions in supply chain impacting production | Medium | High |

| Regulatory Risk | Changes in regulations affecting operations | Medium | Medium |

| Technological | Rapid changes in technology outpacing company | High | Medium |

| Competition | Increased competition reducing market share | High | Medium |

As of late 2023, market volatility remains a significant concern, with many sectors facing unpredictable shifts that can heavily influence stock performance.

Should You Buy MKS Inc.?

MKS Inc. has reported a positive net margin of 5.30%, indicating profitability, although its total debt stands at 4.78B, reflecting a significant reliance on debt financing. The company’s fundamentals show an evolution from a negative trend in the previous fiscal year to a recovery in the current year, but it still has a rating of B+, suggesting there are areas that require improvement.

Favorable signals The company has a positive gross profit margin of 47.63%, which reflects strong operational efficiency. Additionally, the recent trend analysis shows a bullish stock movement with an overall price change of 53.07%, indicating positive momentum in the stock price.

Unfavorable signals The total debt-to-equity ratio is 2.06, suggesting a high level of leverage, which could pose risks in times of financial strain. Furthermore, the company has a return on invested capital (ROIC) of 6.66%, which is below the weighted average cost of capital (WACC) of 10.7%, indicating value destruction.

Conclusion Given the positive net margin, the favorable gross profit margin, and the bullish price trend, MKS Inc. might appear favorable for long-term investors; however, the high level of debt and the value destruction indicated by ROIC being lower than WACC are significant concerns. Therefore, it would be preferable to wait for a more stable financial position before making any investment decisions.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Improved Investor Sentiment Lifted MKS (MKSI) in Q3 – Yahoo Finance (Nov 21, 2025)

- Entropy Technologies LP Purchases New Shares in MKS Inc. $MKSI – MarketBeat (Nov 24, 2025)

- MKS Inc. Reports Third Quarter 2025 Financial Results – GlobeNewswire (Nov 05, 2025)

- What MKS (MKSI)’s Third-Quarter Revenue Growth Signals for Shareholders – simplywall.st (Nov 21, 2025)

- MKS Inc. Grew Revenue And Kept Cutting Debt In Q3 – Finimize (Nov 06, 2025)

For more information about MKS Inc., please visit the official website: mksinst.com