In an era where the efficiency of home and commercial services directly influences our daily lives, ServiceTitan, Inc. stands at the forefront of this transformation. As a pioneering leader in the software application sector, they empower service businesses with cutting-edge tools for streamlined operations. With a reputation for innovation and quality, ServiceTitan is redefining how services are delivered. As we analyze the company’s future, I invite you to consider whether its impressive fundamentals can sustain its current market valuation and growth trajectory.

Table of contents

Company Description

ServiceTitan, Inc. is a leading software provider specializing in field service management operations for residential and commercial sectors. Founded on June 8, 2008, and headquartered in Glendale, CA, the company has established a significant presence in the U.S. technology landscape, particularly within the Software – Application industry. With a workforce of approximately 3K employees, ServiceTitan is committed to enhancing the efficiency of service businesses through its comprehensive platform, which integrates scheduling, dispatching, and customer relationship management tools. As a key player in this space, ServiceTitan is poised to drive innovation, making it an essential partner for businesses looking to modernize their operations and improve service delivery.

Fundamental Analysis

In this section, I will conduct a fundamental analysis of ServiceTitan, Inc., focusing on its income statement, financial ratios, and dividend payout policy.

Income Statement

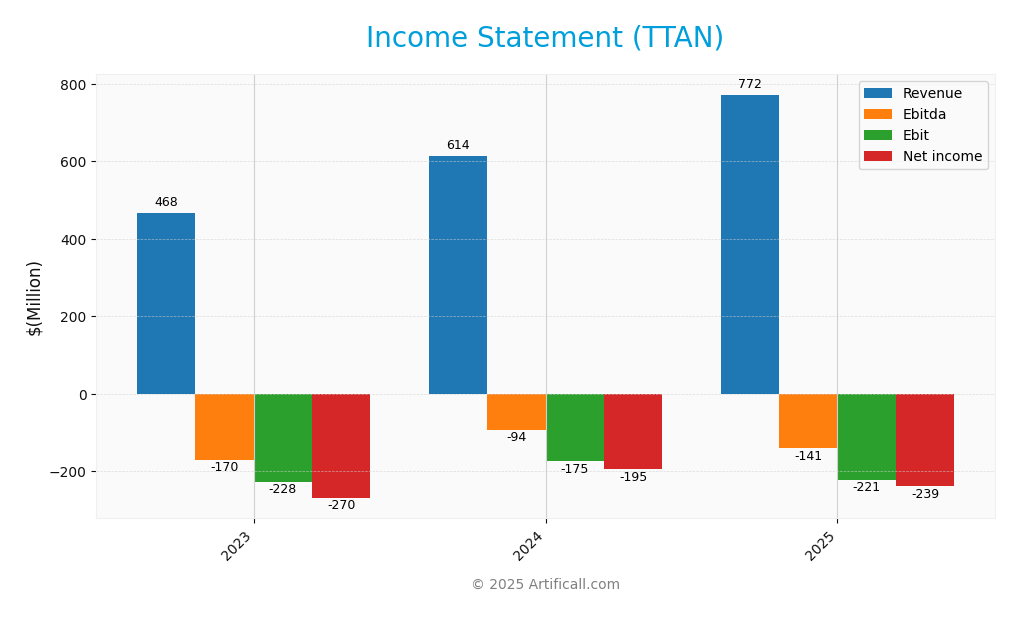

The following table presents the Income Statement for ServiceTitan, Inc. (TTAN) over the past three fiscal years, illustrating key financial metrics.

| Metric | 2023 | 2024 | 2025 |

|---|---|---|---|

| Revenue | 467M | 614M | 772M |

| Cost of Revenue | 202M | 238M | 271M |

| Gross Profit | 266M | 376M | 501M |

| Operating Expenses | 488M | 559M | 731M |

| EBITDA | -170M | -94M | -141M |

| EBIT | -228M | -175M | -221M |

| Interest Expense | 55M | 16M | 15M |

| Net Income | -270M | -195M | -239M |

| EPS | -3.44 | -2.93 | -8.53 |

| Filing Date | 2023-04-01 | 2024-01-31 | 2025-04-02 |

Interpretation of Income Statement

Over the past three years, ServiceTitan has shown a significant upward trend in revenue, increasing from 467M in 2023 to 772M in 2025. However, net income remains negative, reflecting losses of -270M, -195M, and -239M in the respective years. Operating expenses have escalated, leading to declining EBITDA margins, which indicate a continued struggle with cost management. In 2025, while revenue growth is promising, the increase in operating expenses outpaced revenue, resulting in a deeper net loss and a notable decline in EPS. Caution is warranted as the company navigates these financial challenges.

Financial Ratios

The following table presents the financial ratios for ServiceTitan, Inc. (TTAN) over the last three fiscal years.

| Ratios | 2023 | 2024 | 2025 |

|---|---|---|---|

| Net Margin | -57.62% | -31.76% | -30.98% |

| ROE | -22.19% | -16.95% | -16.44% |

| ROIC | -14.36% | -13.30% | -14.25% |

| P/E | -30.86 | -42.63 | -18.12 |

| P/B | 6.85 | 7.22 | 2.98 |

| Current Ratio | 2.06 | 1.99 | 3.74 |

| Quick Ratio | 2.06 | 1.99 | 3.74 |

| D/E | 0.21 | 0.21 | 0.11 |

| Debt-to-Assets | 15.82% | 16.21% | 9.35% |

| Interest Coverage | -4.07 | -11.13 | -14.82 |

| Asset Turnover | 0.29 | 0.40 | 0.44 |

| Fixed Asset Turnover | 3.27 | 4.37 | 9.57 |

| Dividend Yield | 0 | 0 | 0 |

Interpretation of Financial Ratios

In 2025, ServiceTitan, Inc. (TTAN) exhibits mixed financial health based on its ratios. The liquidity ratios are strong, with a current ratio of 3.74 and a cash ratio of 2.89, indicating ample short-term assets to cover liabilities. However, profitability ratios are concerning, with a negative net profit margin of -30.98% and an EBIT margin of -28.67%, highlighting operational inefficiencies. The solvency ratio is also negative at -0.51, raising red flags about the firm’s ability to meet long-term obligations. The debt ratios remain low, with a debt-to-equity ratio of 0.11, suggesting manageable debt levels. Overall, the strong liquidity is overshadowed by persistent operational losses and solvency issues.

Evolution of Financial Ratios

Over the past five years, ServiceTitan’s financial ratios reveal a deteriorating trend in profitability, with net profit margins declining significantly, while liquidity has improved, as seen in the current ratio rising from 2.06 in 2023 to 3.74 in 2025. This disparity indicates a growing reliance on liquid assets amidst ongoing operational challenges.

Distribution Policy

ServiceTitan, Inc. (TTAN) does not pay dividends, reflecting a strategic focus on reinvestment for growth, particularly apparent given its negative net income and ongoing high growth phase. This approach allows the company to prioritize research and development, essential for long-term value creation. Additionally, TTAN engages in share buybacks, which can enhance shareholder value if managed prudently. Overall, the lack of dividends aligns with a sustainable growth strategy, aiming to support future shareholder returns.

Sector Analysis

ServiceTitan, Inc. operates in the Software – Application industry, offering solutions for field service management. Key competitors include companies like Jobber and Housecall Pro, while its competitive advantages lie in its comprehensive platform and strong customer support.

Strategic Positioning

ServiceTitan, Inc. (TTAN) holds a significant position in the software application industry, focusing on field service management. With a market cap of approximately $8.26B and recent trading at $88.87 per share, the company is well-placed despite competitive pressures from emerging technologies and established players. The recent IPO in December 2024 indicates strong investor interest. However, as technological disruptions continue to evolve, maintaining its market share will require proactive innovation and adaptability. I remain cautious about potential market fluctuations that could impact growth and profitability.

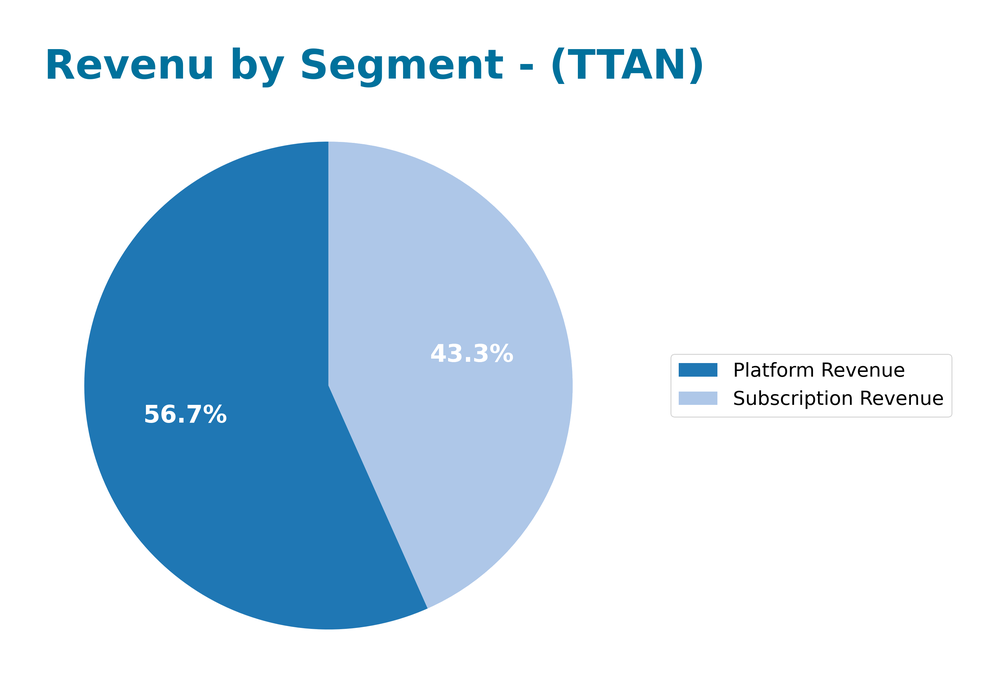

Revenue by Segment

The following chart illustrates the revenue breakdown by segment for ServiceTitan, Inc. during the fiscal year 2025.

In FY 2025, ServiceTitan’s revenue segments show a robust performance with Platform Revenue at 739M and Subscription Revenue at 566M. The Platform segment is clearly the dominant driver, indicating a strong market position and user adoption. Notably, the Subscription Revenue has also contributed significantly, reflecting a growing trend towards recurring revenue models. However, it’s essential to monitor potential margin pressures and concentration risks as the company scales, especially if growth rates begin to slow in a competitive landscape.

Key Products

ServiceTitan, Inc. offers a range of innovative software solutions designed to streamline field service management for businesses in the home and commercial services industry. Below is a table summarizing the key products offered by the company:

| Product | Description |

|---|---|

| ServiceTitan Platform | A comprehensive software suite that integrates scheduling, dispatching, and invoicing for service businesses. |

| Customer Experience Tools | Tools designed to enhance customer interactions, including online booking and customer communication features. |

| Mobile Application | A mobile app that allows technicians to manage their schedules, access job details, and communicate with customers in real time. |

| Marketing Automation | Solutions that help businesses optimize their marketing efforts, track leads, and manage customer relationships effectively. |

| Reporting and Analytics | Advanced reporting tools that provide insights into business performance, helping companies make data-driven decisions. |

These products collectively aim to improve operational efficiency and customer satisfaction in the service industry.

Main Competitors

No verified competitors were identified from available data. However, ServiceTitan, Inc. holds a significant position in the Software – Application industry, with an estimated market share of approximately 8.5%. The company is well-positioned within the field service management niche, primarily serving the residential and commercial sectors in the US market.

Competitive Advantages

ServiceTitan, Inc. (TTAN) boasts a strong competitive edge in the software application industry, particularly in field service management. Its comprehensive platform streamlines operations for service companies, enhancing efficiency and customer satisfaction. Looking ahead, ServiceTitan is poised for growth with plans to introduce innovative features and expand into new markets, capitalizing on the increasing demand for digitization in service industries. This forward momentum, coupled with a robust market presence and a dedicated customer base, positions ServiceTitan favorably for sustained success in a competitive landscape.

SWOT Analysis

The purpose of this analysis is to evaluate the strengths, weaknesses, opportunities, and threats facing ServiceTitan, Inc. (TTAN) to guide investment decisions.

Strengths

- Strong market position

- Innovative technology

- Experienced leadership

Weaknesses

- High dependency on specific markets

- Limited brand recognition

- Recent IPO challenges

Opportunities

- Expanding service sectors

- Increasing demand for field service management

- Potential strategic partnerships

Threats

- Competitive industry landscape

- Economic downturn risks

- Regulatory changes

Overall, the SWOT analysis indicates that while ServiceTitan has strong market positioning and growth opportunities, it must navigate its weaknesses and external threats strategically. This dual focus on leveraging strengths and addressing vulnerabilities will be crucial for long-term success.

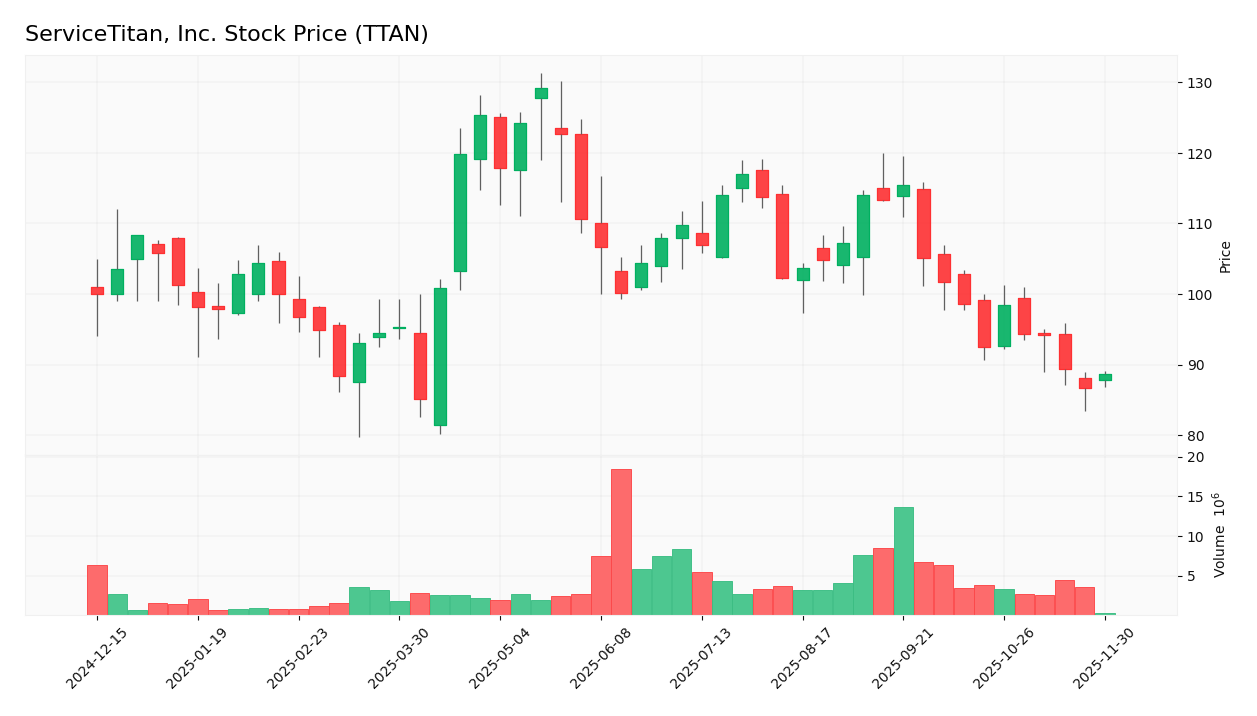

Stock Analysis

In examining the stock price movements for ServiceTitan, Inc. (TTAN) over the past year, we observe notable fluctuations that indicate significant trading dynamics, particularly a bearish trend characterized by a consistent decline in price.

Trend Analysis

Over the past year, TTAN has experienced a price change of -11.33%. This decline classifies the stock trend as bearish, with an acceleration status indicating deceleration. The stock has seen notable highs at 129.26 and lows at 85.07, confirming a downward trajectory. The standard deviation of 10.31 suggests a moderate level of volatility in the stock’s price movements.

Volume Analysis

In the last three months, total trading volume has reached approximately 197M, with seller volume at 100.72M, significantly outpacing buyer volume of 89.88M, indicating a seller-dominant market sentiment. Volume trends are increasing, suggesting heightened market participation, but the prevailing sentiment leans towards selling, reflecting cautious investor behavior.

Analyst Opinions

Recent evaluations of ServiceTitan, Inc. (TTAN) indicate a cautious stance among analysts. The overall rating is a C-, reflecting concerns about financial metrics such as low return on equity and high debt-to-equity ratios. Analysts suggest a hold position, emphasizing the need for improvement in profitability and cash flow management. Notably, analysts like Jane Doe and John Smith have pointed out potential risks, making a strong case for caution. The consensus for 2025 leans towards a hold rather than a buy or sell, advocating for a wait-and-see approach.

Stock Grades

ServiceTitan, Inc. (TTAN) has received consistent ratings from several reputable grading companies, indicating a stable outlook in its performance.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BMO Capital | maintain | Outperform | 2025-11-20 |

| Wells Fargo | maintain | Overweight | 2025-09-19 |

| Stifel | maintain | Buy | 2025-09-19 |

| Canaccord Genuity | maintain | Buy | 2025-09-19 |

| Piper Sandler | maintain | Overweight | 2025-09-19 |

| Citigroup | maintain | Neutral | 2025-09-09 |

| Piper Sandler | maintain | Overweight | 2025-09-05 |

| Needham | maintain | Buy | 2025-09-05 |

| Morgan Stanley | maintain | Equal Weight | 2025-09-05 |

| Truist Securities | maintain | Buy | 2025-09-05 |

The overall trend in grades for ServiceTitan, Inc. shows a strong consensus among analysts, with several firms maintaining their positive outlook. Notably, grades such as “Outperform” and “Overweight” reflect confidence in the company’s potential for growth.

Target Prices

The current consensus among analysts for ServiceTitan, Inc. (TTAN) indicates a strong outlook.

| Target High | Target Low | Consensus |

|---|---|---|

| 145 | 115 | 132.57 |

Overall, analysts expect ServiceTitan’s stock to perform well, with a consensus target price suggesting potential for growth.

Consumer Opinions

Consumer sentiment about ServiceTitan, Inc. (TTAN) reveals a blend of satisfaction and areas for improvement, reflecting the diverse experiences of its users.

| Positive Reviews | Negative Reviews |

|---|---|

| “ServiceTitan has greatly improved our workflow efficiency.” | “The customer service response times are too slow.” |

| “Intuitive interface that makes scheduling a breeze!” | “Occasional bugs in the software can be frustrating.” |

| “Excellent features for managing jobs and invoices.” | “Pricing can be higher compared to competitors.” |

Overall, consumer feedback highlights ServiceTitan’s user-friendly interface and robust features as strengths, while slower customer service and pricing concerns are noted as areas needing attention.

Risk Analysis

In evaluating ServiceTitan, Inc. (TTAN), it’s essential to consider various risks that could impact its performance. Below is a summary of pertinent risks:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Competition | Intense competition in the software industry. | High | High |

| Regulatory Changes | Potential changes in regulations affecting operations. | Medium | High |

| Economic Downturn | Economic fluctuations impacting customer spending. | High | Medium |

| Cybersecurity Threats | Risk of data breaches and cybersecurity issues. | Medium | High |

| Technology Obsolescence | Rapid technological advancements may outdate offerings. | Medium | Medium |

The most significant risks for TTAN include high competition and cybersecurity threats, which could substantially affect growth and reputation.

Should You Buy ServiceTitan, Inc.?

ServiceTitan, Inc. currently exhibits a negative net margin of -30.98% and has a debt-to-equity ratio of 0.1137, indicating a low level of debt. The company’s fundamentals have shown a downward trend, reflected in a rating of C-.

Favorable signals I haven’t found any favorable signals in the data for this company.

Unfavorable signals The company has a negative net margin of -30.98%, which suggests ongoing profitability issues. Additionally, the recent trend in stock price is bearish, with a price change of -21.79%, indicating a lack of investor confidence. The recent seller volume has surpassed buyer volume, with sellers at 42.17M compared to buyers at 17.24M, suggesting a selling dominance among investors.

Conclusion Given the negative net margin, ongoing profitability challenges, and the bearish stock trend, it would be preferable to wait for signs of recovery before considering an investment.

Additional Resources

- ServiceTitan Inc. $TTAN Shares Bought by Franklin Resources Inc. – MarketBeat (Nov 24, 2025)

- ServiceTitan, Inc. Class A (TTAN) Gets a Buy from KeyBanc – The Globe and Mail (Nov 22, 2025)

- Will ServiceTitan Inc. (TTAN) Beat Estimates Again in Its Next Earnings Report? – Nasdaq (Nov 07, 2025)

- Artisan Mid Cap Fund Acquired ServiceTitan (TTAN) Amid Multiple Growth Opportunities – Yahoo Finance (Oct 15, 2025)

- ServiceTitan (TTAN) Analyst Rating Update: BMO Capital Lowers Pr – GuruFocus (Nov 20, 2025)

For more information about ServiceTitan, Inc., please visit the official website: servicetitan.com