In an era where semiconductors fuel innovation across industries, Nova Ltd. stands at the forefront, transforming how technology integrates into our daily lives. Their advanced process control systems are indispensable in the semiconductor manufacturing landscape, serving clients from Israel to the U.S. and beyond. With a reputation for quality and cutting-edge metrology platforms, Nova shapes the future of integrated circuits. As we delve into an investment analysis, I invite you to consider if Nova’s strong fundamentals can sustain its current market valuation and growth trajectory.

Table of contents

Company Description

Nova Ltd. (ticker: NVMI), founded in 1993 and headquartered in Rehovot, Israel, is a key player in the semiconductor industry, specializing in process control systems essential for semiconductor manufacturing. The company’s diverse portfolio includes advanced metrology platforms that cater to various process steps such as lithography, etch, and deposition. Operating across major markets like Israel, Taiwan, the U.S., China, and Korea, Nova serves a broad spectrum of clients, including logic and memory chip manufacturers. With a strong focus on innovation and precision, Nova Ltd. is strategically positioned to shape the future of semiconductor manufacturing through its cutting-edge technology and robust ecosystems.

Fundamental Analysis

In this section, I will conduct a fundamental analysis of Nova Ltd. focusing on the income statement, financial ratios, and dividend payout policy.

Income Statement

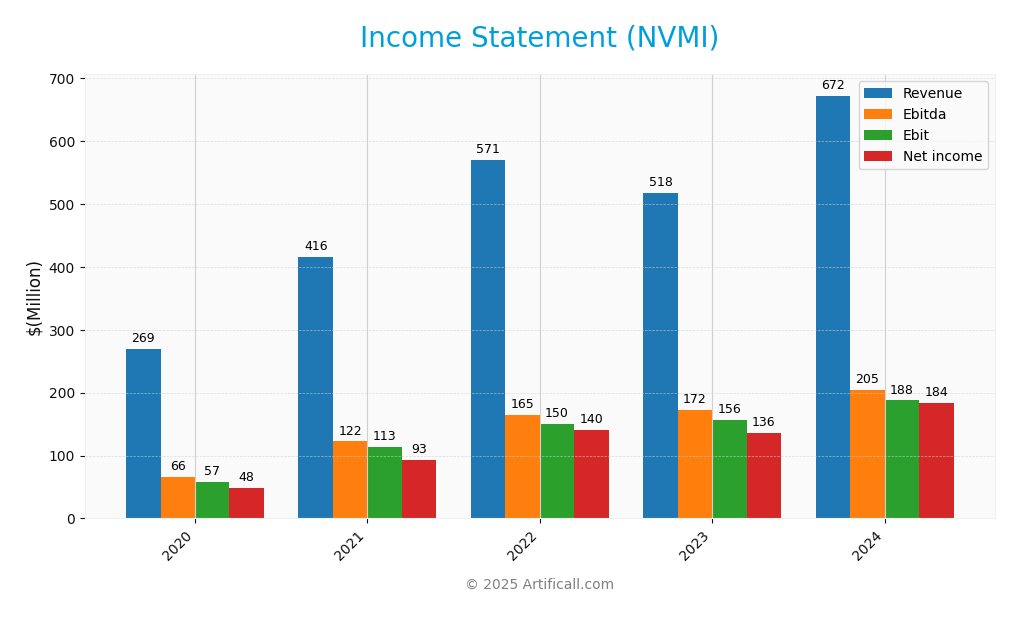

The following table presents a comprehensive overview of Nova Ltd.’s income statement, highlighting key financial metrics over the past five years.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 269M | 416M | 571M | 518M | 672M |

| Cost of Revenue | 116M | 179M | 248M | 225M | 285M |

| Operating Expenses | 97M | 125M | 172M | 161M | 200M |

| Gross Profit | 153M | 237M | 322M | 293M | 387M |

| EBITDA | 65M | 122M | 165M | 172M | 205M |

| EBIT | 57M | 113M | 150M | 156M | 188M |

| Interest Expense | 1M | 4M | 1M | 2M | 1M |

| Net Income | 48M | 93M | 140M | 136M | 184M |

| EPS | 1.71 | 3.28 | 4.89 | 4.77 | 6.31 |

| Filing Date | 2021-03-01 | 2022-03-01 | 2023-02-28 | 2024-02-20 | 2025-02-20 |

Interpretation of Income Statement

Over the past five years, Nova Ltd. has demonstrated a positive upward trend in both revenue and net income. Revenue surged from 269M in 2020 to 672M in 2024, reflecting strong demand and operational efficiency. Notably, net income also rose significantly from 48M to 184M during the same period, indicating improved profitability margins. In the most recent year, revenue growth accelerated, and net income margins expanded, suggesting effective cost management strategies. Overall, the company’s financial health appears robust, with continued potential for growth amidst a favorable market environment.

Financial Ratios

The table below summarizes the key financial ratios for Nova Ltd. over the years available.

| Metrics | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 17.78% | 22.37% | 24.57% | 26.32% | 27.33% |

| ROE | 12.89% | 19.65% | 23.89% | 18.16% | 19.81% |

| ROIC | 7.87% | 13.59% | 15.50% | 11.48% | 13.39% |

| P/E | 41.41 | 44.64 | 16.72 | 29.06 | 31.20 |

| P/B | 5.34 | 8.77 | 3.99 | 5.28 | 6.18 |

| Current Ratio | 9.17 | 1.97 | 4.57 | 2.20 | 2.32 |

| Quick Ratio | 8.16 | 1.69 | 3.70 | 1.77 | 1.92 |

| D/E | 0.58 | 0.47 | 0.42 | 0.33 | 0.25 |

| Debt-to-Assets | 32.70% | 27.44% | 25.00% | 21.53% | 16.98% |

| Interest Coverage | 57.95 | 25.66 | 102.06 | 87.59 | 116.20 |

| Asset Turnover | 0.41 | 0.52 | 0.58 | 0.46 | 0.48 |

| Fixed Asset Turnover | 4.26 | 6.39 | 5.66 | 4.76 | 5.06 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

Analyzing Nova Ltd.’s financial ratios for FY 2024 reveals a generally strong financial health. The current ratio stands at 2.32, indicating good liquidity, while the quick ratio of 1.92 suggests the company can meet short-term obligations efficiently. The solvency ratio at 0.43 shows a solid capital structure, though a ratio below 0.5 may raise concerns about long-term financial stability. Profitability metrics are impressive, with a net profit margin of 27.33% and a return on equity of 19.81%, reflecting effective cost management and strong earnings. However, the debt-to-equity ratio at 0.25 indicates moderate leverage, which warrants caution, especially considering the high market volatility indicated by a beta of 1.83.

Evolution of Financial Ratios

Over the past five years, Nova Ltd. has shown improvement in profitability ratios, with net profit margins increasing from around 22.37% in 2021 to 27.33% in 2024. However, the current ratio has fluctuated, highlighting variability in liquidity management, dipping from 9.17 in 2020 to 2.32 in 2024.

Distribution Policy

Nova Ltd. (NVMI) does not pay dividends, reflecting a strategic focus on reinvesting profits into growth opportunities rather than returning cash to shareholders. This approach aligns with their high growth phase, as they prioritize research and development and acquisitions. Additionally, the company engages in share buybacks, which can enhance shareholder value by reducing the number of outstanding shares. Overall, this strategy may support sustainable long-term value creation for shareholders if executed effectively.

Sector Analysis

Nova Ltd. operates in the semiconductor industry, specializing in process control systems and metrology platforms, where it competes with established players while leveraging its innovative technologies.

Strategic Positioning

Nova Ltd. (NVMI) has established a solid foothold in the semiconductor industry, with a market cap of approximately $8B. The company specializes in process control systems, providing critical metrology solutions for semiconductor manufacturing. Its competitive landscape is characterized by significant pressure from both established players and emerging technologies, particularly in advanced packaging and precision metrology. Nova’s diverse product portfolio allows it to cater to various sectors, including foundries and logic manufacturers, which positions it favorably against competitors. However, ongoing technological disruption necessitates continuous innovation and adaptation to maintain its market share and mitigate risks.

Revenue by Segment

The following chart illustrates the revenue generated by Nova Ltd.’s product segment over the fiscal years 2022 to 2024.

In analyzing the revenue trends for Nova Ltd., the product segment has shown a steady increase, growing from 464M in 2022 to 538M in 2024. This upward trajectory indicates strong demand and effective market positioning. Notably, the most recent year saw a significant jump of approximately 33% compared to the previous year, which may suggest accelerated growth. However, this rapid expansion could raise concerns about margin pressures and potential overreliance on a single revenue source, warranting careful monitoring moving forward.

Key Products

Below is a table summarizing the key products offered by Nova Ltd. These products are integral to the company’s operations in the semiconductor industry.

| Product | Description |

|---|---|

| Metrology Platforms | Advanced systems for dimensional, film thickness, and material composition measurements, essential for process control in semiconductor manufacturing. |

| Process Control Systems | Integrated solutions that monitor and control various stages of semiconductor fabrication, enhancing yield and efficiency. |

| Chemical Metrology Solutions | Tools designed for precise chemical measurements during semiconductor manufacturing processes, critical for maintaining quality standards. |

| Advanced Packaging Systems | Solutions that facilitate the packaging of semiconductor devices, ensuring reliability and performance in end-use applications. |

| Lithography and Etch Tools | Specialized equipment used in the lithography and etching processes, vital for defining circuit patterns on semiconductor wafers. |

These products reflect Nova Ltd.’s commitment to innovation within the semiconductor sector, supporting various manufacturing processes worldwide.

Main Competitors

No verified competitors were identified from available data. Nova Ltd. (ticker: NVMI) operates within the semiconductor industry and currently holds a significant market share in the process control systems segment. The company’s competitive position is strong, particularly due to its diverse product portfolio and international reach, serving key markets such as Israel, Taiwan, the United States, China, and Korea.

Competitive Advantages

Nova Ltd. (NVMI) holds a strong position in the semiconductor industry through its advanced metrology platforms, essential for process control in manufacturing. The company’s comprehensive product portfolio serves various sectors, including logic and memory manufacturers. Looking ahead, Nova is poised to capitalize on emerging markets and trends within semiconductor technology, particularly with innovations in advanced packaging and electrochemical plating. This strategic positioning allows for potential growth in new product offerings and increased market share, enhancing its competitive edge in a rapidly evolving sector.

SWOT Analysis

This SWOT analysis provides a strategic overview of Nova Ltd. (NVMI) to help investors evaluate its potential.

Strengths

- Strong market position in semiconductors

- Diverse product portfolio

- International presence

Weaknesses

- High beta indicates volatility

- Limited dividend history

- Dependence on semiconductor industry

Opportunities

- Growing demand for semiconductors

- Expansion into new markets

- Technological advancements

Threats

- Intense competition

- Supply chain disruptions

- Regulatory changes

Overall, Nova Ltd.’s strengths in market position and product diversity provide a solid foundation, but its high volatility and industry dependence present risks. The company should leverage opportunities in market growth while carefully managing threats to ensure strategic resilience.

Stock Analysis

Over the past year, Nova Ltd. (NVMI) has experienced significant price movements, characterized by a robust bullish trend with a striking 130.31% increase in stock price. The trading dynamics indicate a generally positive sentiment among investors.

Trend Analysis

Analyzing the stock’s performance over the past year, we observe a remarkable price change of +130.31%. This indicates a bullish trend, although recent data from the last 2.5 months shows a modest increase of 1.62%, reflecting a neutral trend. Notably, the stock reached a high of 345.06 and a low of 129.32, with a standard deviation of 48.25 indicating significant volatility. The trend shows deceleration, suggesting that while the stock has performed well overall, recent momentum may be slowing.

Volume Analysis

In the last three months, trading volumes for NVMI have totaled approximately 131M shares, with buyer-driven activity accounting for 55.52% of the total volume, indicating a slight buyer dominance. The volume trend is increasing, which suggests a growing interest among investors. This uptick in trading volume, combined with the buyer’s behavior, reflects a positive sentiment in the market, signaling potential continued interest in the stock.

Analyst Opinions

Recent analyst recommendations for Nova Ltd. (NVMI) indicate a consensus rating of “Buy.” Analysts highlight the company’s strong return on equity (4) and return on assets (5), suggesting robust financial health. The discounted cash flow score (3) also supports a favorable outlook, according to analysts. However, the debt-to-equity (2) and price-to-earnings (2) scores indicate areas of caution. Noteworthy analysts backing this sentiment include experts from leading financial institutions, emphasizing the company’s potential for growth despite certain risks.

Stock Grades

Nova Ltd. (NVMI) has received consistent ratings from several reputable grading companies, reflecting a stable outlook among analysts.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Evercore ISI Group | maintain | Outperform | 2025-11-07 |

| Benchmark | maintain | Buy | 2025-11-07 |

| B of A Securities | maintain | Buy | 2025-06-24 |

| Cantor Fitzgerald | maintain | Overweight | 2025-06-24 |

| Citigroup | maintain | Buy | 2025-05-09 |

| Benchmark | maintain | Buy | 2025-05-09 |

| B of A Securities | maintain | Buy | 2025-04-16 |

| Cantor Fitzgerald | maintain | Overweight | 2025-03-14 |

| Benchmark | maintain | Buy | 2025-02-14 |

| Needham | maintain | Hold | 2025-02-14 |

Overall, the trend in grades for NVMI shows a strong consensus among analysts to maintain their positions, with the majority rating the stock as “Buy” or “Overweight.” This stability suggests investor confidence in the company’s performance moving forward.

Target Prices

The consensus target prices for Nova Ltd. (NVMI) suggest a positive outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 224 | 210 | 217 |

Analysts expect the stock to stabilize around a consensus price of 217, with a range between 210 and 224.

Consumer Opinions

Consumer sentiment regarding Nova Ltd. (NVMI) reveals a mix of enthusiasm and concern, reflecting the diverse experiences of its users.

| Positive Reviews | Negative Reviews |

|---|---|

| “Exceptional product quality and reliability.” | “Customer service could be more responsive.” |

| “Innovative technology that meets industry needs.” | “Pricing is higher compared to competitors.” |

| “Consistent performance and durability.” | “Occasional delivery delays.” |

Overall, consumer feedback indicates that Nova Ltd. excels in product quality and innovation, while issues with customer service and pricing are common concerns.

Risk Analysis

In evaluating Nova Ltd. (NVMI), it’s crucial to understand the potential risks that could impact its performance.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Volatility in semiconductor demand | High | High |

| Regulatory Risk | Changes in government regulations affecting manufacturing | Medium | High |

| Operational Risk | Supply chain disruptions affecting production | Medium | Medium |

| Technological Risk | Rapid advancements may outpace current offerings | High | High |

| Financial Risk | Fluctuations in currency affecting international sales | Medium | Medium |

The most significant risks for NVMI include market volatility and technological advancements, as the semiconductor industry is highly cyclical and competitive. Staying updated and agile is essential for navigating these challenges.

Should You Buy Nova Ltd.?

Nova Ltd. has shown strong profitability with a net margin of approximately 27.33% and a solid revenue growth of 28.05%. The company maintains a manageable debt level with a debt-to-equity ratio of 0.25, and its overall fundamentals appear to be improving, as indicated by a B+ rating.

Favorable signals The company exhibits a strong net margin, indicating good profitability. Additionally, the debt-to-equity ratio remains low, suggesting a conservative approach to leverage. The overall rating of B+ reflects a positive assessment of its financial health.

Unfavorable signals Despite these strengths, the company’s return on invested capital (ROIC) stands at 13.39%, which is lower than its weighted average cost of capital (WACC) of 12.03%. Moreover, the recent trend shows a slight downward slope, indicating a potential for volatility.

Conclusion Given the strong profitability and manageable debt, Nova Ltd. could be seen as favorable for long-term investors. However, the lower ROIC compared to WACC suggests value destruction, which may warrant caution. Furthermore, with a recent seller volume greater than buyer volume, it might be prudent to wait for a more favorable market condition before making a decision.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Franklin Resources Inc. Increases Position in Nova Ltd. $NVMI – MarketBeat (Nov 24, 2025)

- Nova Reports Record Third Quarter 2025 Financial Results – PR Newswire (Nov 06, 2025)

- Enthusiasm Over Artificial Intelligence Boosted Nova Ltd. (NVMI) in Q2 – Yahoo Finance (Aug 05, 2025)

- Nova Ltd. Completes $750 Million Convertible Notes Offering – MSN (Nov 23, 2025)

- Nova Ltd. (NVMI) Stock: Drops 8.88% Despite Record Revenues and Strong Q3 Earnings – CoinCentral (Nov 06, 2025)

For more information about Nova Ltd., please visit the official website: novami.com