Nordson Corporation is redefining efficiency in the industrial machinery sector, seamlessly integrating innovation with everyday applications. Their advanced systems for dispensing adhesives and coatings not only enhance manufacturing processes but also elevate product quality across various industries. With a robust reputation for excellence and a commitment to technological advancement, Nordson stands at the forefront of market trends. As we delve into this analysis, I invite you to consider whether Nordson’s impressive fundamentals still align with its current market valuation and growth outlook.

Table of contents

Company Description

Nordson Corporation (NASDAQ: NDSN), founded in 1935 and headquartered in Westlake, Ohio, specializes in the engineering, manufacturing, and marketing of systems that dispense, apply, and control adhesives, coatings, and other fluids globally. Operating through two segments—Industrial Precision Solutions (IPS) and Advanced Technology Solutions (ATS)—Nordson serves various industries, including packaging, consumer goods, and electronics. With a market cap of approximately $13.13B, the company is recognized as a leader in the industrial machinery sector, offering innovative solutions that enhance manufacturing efficiency. Nordson’s commitment to precision and technology positions it as a pivotal player in shaping industry standards and driving advancements in automated dispensing systems.

Fundamental Analysis

In this section, I will analyze Nordson Corporation’s income statement, financial ratios, and dividend payout policy to provide insights for informed investment decisions.

Income Statement

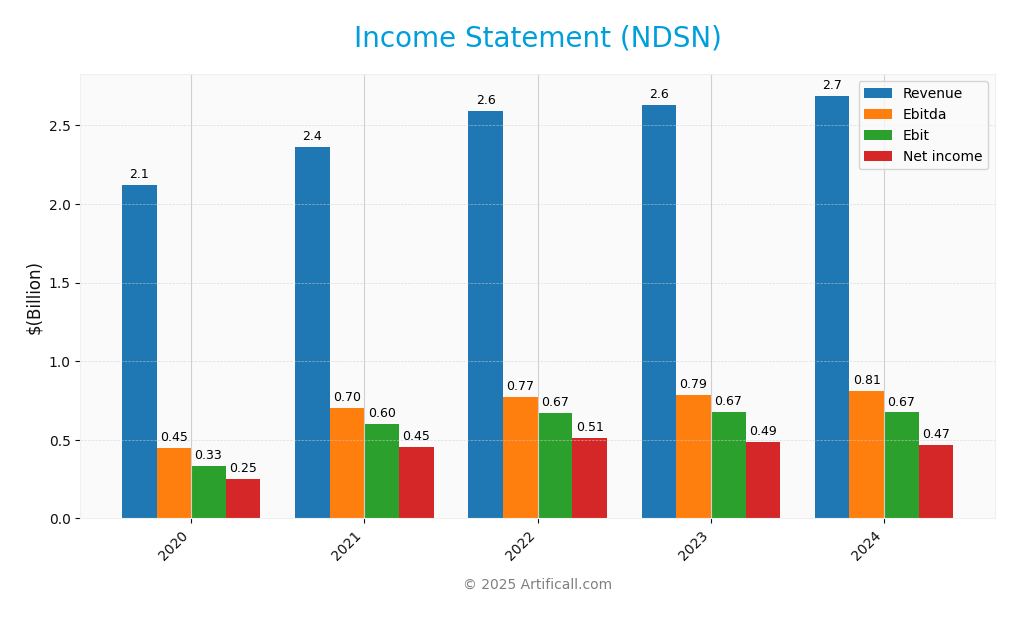

The table below presents the Income Statement for Nordson Corporation, detailing its financial performance over the last five fiscal years.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 2.12B | 2.36B | 2.59B | 2.63B | 2.69B |

| Cost of Revenue | 990M | 1.04B | 1.16B | 1.20B | 1.20B |

| Operating Expenses | 781M | 709M | 724M | 753M | 812M |

| Gross Profit | 1.13B | 1.32B | 1.43B | 1.43B | 1.49B |

| EBITDA | 447M | 704M | 772M | 787M | 811M |

| EBIT | 334M | 600M | 672M | 675M | 674M |

| Interest Expense | 32M | 25M | 22M | 60M | 89M |

| Net Income | 250M | 454M | 513M | 487M | 467M |

| EPS | 4.32 | 7.82 | 8.90 | 8.54 | 8.17 |

| Filing Date | 2020-12-18 | 2021-12-17 | 2022-12-19 | 2023-12-20 | 2024-12-18 |

Interpretation of Income Statement

Over the past five years, Nordson Corporation has shown a steady increase in revenue, culminating in 2.69B in 2024, reflecting a modest growth trend. However, net income has experienced slight fluctuations, peaking at 513M in 2022 before declining to 467M in 2024. Despite the increase in operating expenses, gross profit margins have remained stable, indicating efficient cost management. In 2024, while revenue growth was positive, the decline in net income suggests potential challenges in maintaining profitability amidst rising costs. This scenario warrants cautious observation moving forward, particularly regarding interest expenses and overall cost control.

Financial Ratios

The table below summarizes the key financial ratios for Nordson Corporation (NDSN) across the most recent fiscal years.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 11.76% | 19.23% | 19.81% | 18.55% | 17.37% |

| ROE | 14.19% | 21.04% | 22.36% | 18.76% | 15.94% |

| ROIC | 8.58% | 14.31% | 16.33% | 11.09% | 9.65% |

| P/E | 44.77 | 33.08 | 25.27 | 24.90 | 30.56 |

| P/B | 6.35 | 6.96 | 5.65 | 4.67 | 4.87 |

| Current Ratio | 2.81 | 2.62 | 1.36 | 2.11 | 2.41 |

| Quick Ratio | 2.05 | 1.88 | 0.90 | 1.33 | 1.51 |

| D/E | 0.63 | 0.38 | 0.32 | 0.72 | 0.79 |

| Debt-to-Assets | 30.10% | 21.52% | 19.31% | 35.47% | 38.67% |

| Interest Coverage | 10.87 | 24.13 | 31.34 | 11.31 | 7.58 |

| Asset Turnover | 0.58 | 0.62 | 0.68 | 0.50 | 0.45 |

| Fixed Asset Turnover | 5.91 | 6.64 | 7.33 | 5.27 | 4.21 |

| Dividend Yield | 0.79% | 0.65% | 0.97% | 1.24% | 1.13% |

Interpretation of Financial Ratios

Analyzing Nordson Corporation’s financial health reveals a mixed picture. The liquidity ratios are strong, with a current ratio of 2.41 and a quick ratio of 1.51, indicating good short-term financial stability. However, the solvency ratio of 0.20 suggests potential long-term debt concerns, as it indicates a higher reliance on debt. Profitability ratios show a net profit margin of 17.37%, demonstrating effective cost management, yet the relatively high price-to-earnings ratio of 30.56 could indicate overvaluation. Efficiency ratios, such as a receivables turnover of 4.52, suggest effective management of accounts receivable, but the inventory turnover of 2.52 raises questions about inventory management efficiency.

Evolution of Financial Ratios

Over the past five years, Nordson’s financial ratios have shown both stability and fluctuation. The current ratio has improved from 1.36 in 2022 to 2.41 in 2024, reflecting enhanced liquidity, while the solvency ratio has declined from 0.40 in 2022 to 0.20 in 2024, indicating growing long-term debt concerns.

Distribution Policy

Nordson Corporation (NDSN) maintains a dividend payout ratio of approximately 34.5%, reflecting a steady commitment to returning value to shareholders. The annual dividend yield stands at 1.13%, supported by a consistent trend in dividends, which have seen a gradual increase over recent years. Additionally, the company engages in share buyback programs, enhancing shareholder value further. However, investors should remain cautious of potential risks related to unsustainable distributions or excessive repurchases, which could affect long-term value creation. Overall, the current distribution strategy appears to support sustainable long-term value for shareholders.

Sector Analysis

Nordson Corporation operates in the Industrial Machinery sector, specializing in the engineering and manufacturing of precision dispensing systems for various fluids, with strong competitive positioning and a diverse product range.

Strategic Positioning

Nordson Corporation (NDSN) holds a significant position in the industrial machinery sector, with a market capitalization of approximately $13.13B. The company has established a robust market share in the dispensing and coating systems industry, catering to diverse applications ranging from adhesives to biomedical devices. Competitive pressure is considerable, as advancements in technology and automation continue to disrupt traditional manufacturing processes. Nordson’s focus on innovation, particularly in its Advanced Technology Solutions segment, allows it to effectively benchmark against peers, although maintaining its market edge requires ongoing adaptation to emerging trends and client needs.

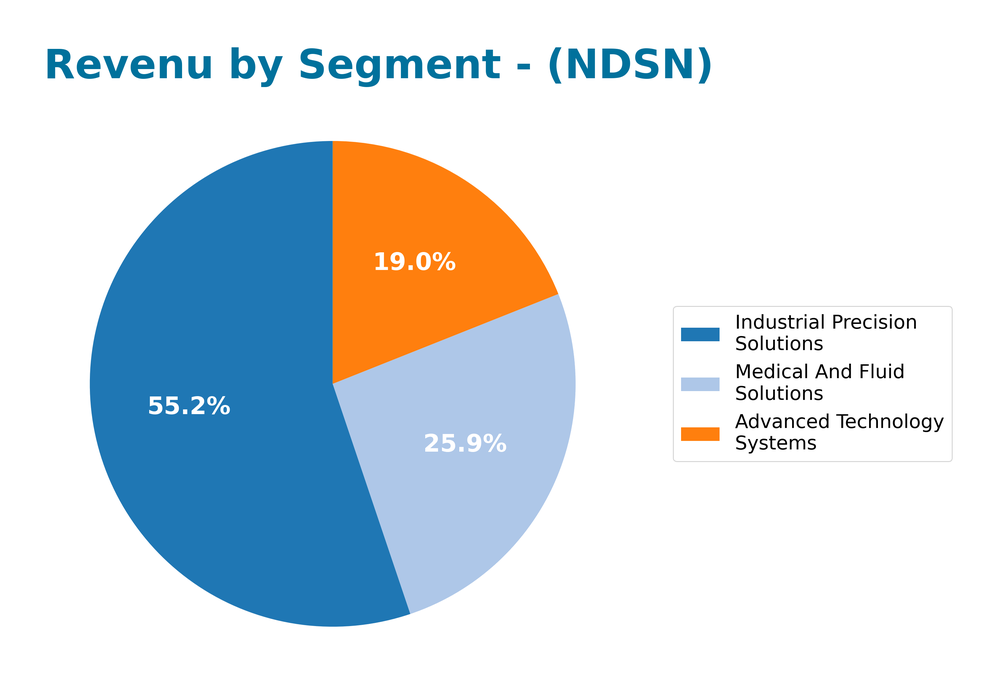

Revenue by Segment

The following chart illustrates Nordson Corporation’s revenue distribution across its main segments for the fiscal year 2024.

In fiscal year 2024, Nordson’s revenue demonstrated a notable performance across its segments. The Industrial Precision Solutions segment led with $1.48B, reflecting a steady growth trajectory. Meanwhile, the Medical and Fluid Solutions segment increased to $695M, indicating a positive trend. However, the Advanced Technology Systems segment saw a decline to $510M, suggesting possible market saturation or increased competition. Overall, while the Industrial Precision Solutions segment continues to drive significant revenue, the recent year’s performance shows mixed results, highlighting potential margin risks for the Advanced Technology Systems segment.

Key Products

Nordson Corporation offers a diverse range of products designed to meet various industrial needs. Below is a summary of their key products:

| Product | Description |

|---|---|

| Adhesive Dispensing Systems | Automated systems designed for precise application of adhesives in various industries, including packaging and assembly. |

| Coating and Laminating Systems | Equipment for applying coatings to surfaces, including liquid paints and powder coatings, suitable for both consumer and industrial products. |

| Interventional Delivery Devices | Minimally invasive devices for medical applications, including syringes, catheters, and balloon systems. |

| Bond Testing Systems | Advanced systems for testing the quality of bonds in semiconductor and printed circuit board applications, utilizing optical and x-ray inspection. |

| Gas Plasma Treatment Systems | Equipment for cleaning and conditioning surfaces prior to coating, ensuring optimal adhesion and performance. |

These products reflect Nordson’s commitment to innovation and quality in the industrial machinery sector, serving a wide array of applications globally.

Main Competitors

No verified competitors were identified from available data. Nordson Corporation holds a significant position in the industrial machinery sector, with an estimated market share of approximately 3.5% in its niche. The company is recognized for its advanced dispensing and coating systems, which positions it as a strong player in the global market, particularly in the adhesive and fluid management solutions domain.

Competitive Advantages

Nordson Corporation (NDSN) boasts a strong position in the industrial machinery sector, driven by its innovative product offerings in adhesive and coating systems. The company’s competitive edge lies in its advanced technology solutions that cater to diverse industries, from packaging to semiconductor manufacturing. With a focus on automation and precision, Nordson is well-positioned to capture emerging market opportunities. Looking ahead, the introduction of new products and expansion into untapped markets could further enhance its growth trajectory, solidifying its status as a leader in the industrial space.

SWOT Analysis

This SWOT analysis evaluates Nordson Corporation’s strengths, weaknesses, opportunities, and threats to inform strategic decisions.

Strengths

- Strong market position

- Innovative product offerings

- Diverse customer base

Weaknesses

- High dependency on specific industries

- Limited geographic presence

- Vulnerability to supply chain disruptions

Opportunities

- Growth in automation trends

- Expansion into emerging markets

- Increasing demand for sustainable solutions

Threats

- Intense competition

- Economic downturns affecting demand

- Regulatory changes impacting operations

Overall, Nordson Corporation’s strengths position it well for growth, especially in automation and sustainability. However, it must address its weaknesses and remain vigilant against external threats to enhance its market resilience.

Stock Analysis

Over the past year, Nordson Corporation’s stock (NDSN) has experienced notable price movements, characterized by fluctuations that reflect shifting market dynamics.

Trend Analysis

Analyzing the stock’s performance over the last two years, I observe a percentage change of -6.51%, indicating a bearish trend. The highest price recorded was 278.89, while the lowest reached 176.73. The trend displays acceleration, suggesting that the downward movement is gaining momentum. With a standard deviation of 23.83, the stock has exhibited significant volatility during this period.

Volume Analysis

In the last three months, total trading volume reached approximately 164.21M shares, with buyer-driven activity accounting for 51.34% of the volume. This suggests that market participation is leaning towards buyers, and the volume trend is increasing. Recently, buyer dominance has strengthened, with buyers making up 62.84% of the activity, indicating positive investor sentiment amidst the prevailing bearish trend.

Analyst Opinions

Recent analyst recommendations for Nordson Corporation (NDSN) indicate a cautious yet positive outlook. Analysts have rated the stock as “B+” based on strong return on assets (5) and return on equity (4), highlighting its solid fundamentals. However, the price-to-earnings (2) and price-to-book (2) scores suggest some valuation concerns. Despite this, the overall consensus leans towards “buy” for 2025, reflecting confidence in Nordson’s growth potential and stability in its financial metrics.

Stock Grades

Here are the most recent stock ratings for Nordson Corporation (NDSN), reflecting the consensus among recognized grading firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Oppenheimer | Maintain | Outperform | 2025-08-25 |

| Baird | Maintain | Neutral | 2025-08-22 |

| Keybanc | Maintain | Overweight | 2025-07-15 |

| Oppenheimer | Upgrade | Outperform | 2025-05-30 |

| Baird | Maintain | Neutral | 2025-05-30 |

| Keybanc | Maintain | Overweight | 2025-04-08 |

| Keybanc | Upgrade | Overweight | 2025-03-04 |

| Baird | Maintain | Neutral | 2025-02-21 |

| Loop Capital | Upgrade | Buy | 2025-01-22 |

| Seaport Global | Upgrade | Buy | 2024-12-17 |

The overall trend indicates a stable outlook for Nordson Corporation, with multiple firms maintaining or upgrading their ratings, particularly emphasizing an “Outperform” and “Overweight” stance. This reflects a positive sentiment among analysts, suggesting potential for growth in the stock’s performance.

Target Prices

The consensus target price for Nordson Corporation (NDSN) reflects a positive outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 285 | 240 | 263 |

Overall, analysts anticipate a target price around 263, indicating a balanced expectation between the high and low estimates.

Consumer Opinions

Consumer sentiment surrounding Nordson Corporation (NDSN) reveals both enthusiasm and concerns among its clientele.

| Positive Reviews | Negative Reviews |

|---|---|

| “Excellent product quality and reliability.” | “Customer service could be improved.” |

| “Innovative solutions that meet our needs.” | “Pricing is on the higher side.” |

| “Consistent performance across various applications.” | “Delivery times are often delayed.” |

Overall, consumer feedback highlights Nordson’s strong product quality and innovative solutions as key strengths, while concerns about customer service and pricing remain recurring weaknesses.

Risk Analysis

In evaluating Nordson Corporation (NDSN), it’s essential to understand the potential risks that may affect its performance. Below is a summary of key risks:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Fluctuations in market demand affecting sales. | High | High |

| Supply Chain Disruptions | Dependence on global suppliers may lead to delays. | Medium | High |

| Regulatory Changes | Changes in regulations impacting manufacturing processes. | Medium | Medium |

| Technological Risks | Rapid technological advancements could outpace NDSN’s innovation. | Medium | High |

| Economic Downturn | Economic recessions can significantly reduce capital spending. | High | High |

The most pressing risks for NDSN are market volatility and economic downturns, both of which have historically proven to be highly impactful on revenue streams.

Should You Buy Nordson Corporation?

Nordson Corporation demonstrates a positive net margin of 17.37% and shows a return on invested capital (ROIC) of 9.65%, which exceeds the weighted average cost of capital (WACC) of 7.64%, indicating value creation. However, the company has a high total debt of 2.32B, which contributes to a debt-to-equity ratio of 0.79, suggesting a significant reliance on debt financing.

Favorable signals The company has a positive net margin of 17.37%, indicating strong profitability. Furthermore, its ROIC is 9.65%, which is above the WACC of 7.64%, confirming that it is creating value for shareholders. Additionally, Nordson Corporation has a favorable rating of B+, reflecting solid overall performance.

Unfavorable signals Nordson Corporation carries a high total debt of 2.32B, which may pose financial risk. The debt-to-equity ratio of 0.79 suggests a significant leverage position. Moreover, the stock is currently in a bearish trend, with an overall price change of -6.51% over the analyzed period, indicating potential volatility.

Conclusion Given the positive net margin, value creation through ROIC exceeding WACC, and a favorable rating, the company might appear favorable for long-term investors. However, considering the high debt levels and bearish price trend, it could be prudent to wait for more favorable market conditions before making an investment decision.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Nordson Corporation $NDSN Shares Purchased by Vanguard Group Inc. – MarketBeat (Nov 24, 2025)

- Nordson Corporation: Modest Return Potential, Mixed Signals Limit Conviction (NASDAQ:NDSN) – Seeking Alpha (Nov 18, 2025)

- Cynosure Group LLC Invests $1.40 Million in Nordson Corporation $NDSN – MarketBeat (Nov 24, 2025)

- Nordson Corporation Announces Earnings Release and Webcast for Fourth Quarter and Fiscal Year 2025 – Business Wire (Nov 06, 2025)

- Innovation and Global Reach Drive Nordson (NDSN) Corporation’s Long-Term Strength – Yahoo Finance (Oct 28, 2025)

For more information about Nordson Corporation, please visit the official website: nordson.com