In a world where collaboration drives success, monday.com Ltd. transforms how teams operate, bridging gaps and fostering productivity across industries. This innovative software provider has redefined work management with its cloud-based Work OS, empowering organizations to streamline tasks and enhance communication. With a reputation for quality and adaptability, monday.com has carved a niche in the software application market. As we delve into an investment analysis, I invite you to consider whether its strong fundamentals still align with its current market valuation and growth trajectory.

Table of contents

Company Description

monday.com Ltd. is a prominent player in the software application industry, specializing in cloud-based work management solutions. Founded in 2012 and headquartered in Tel Aviv-Yafo, Israel, the company offers a versatile Work OS platform that enables organizations to create customized software applications tailored to their specific needs. With a diverse product lineup covering areas such as marketing, CRM, project management, and software development, monday.com serves a wide range of clients, including businesses, educational institutions, and government entities across the globe. Since its rebranding from DaPulse Labs Ltd. in 2017, monday.com has positioned itself as a leader in innovation, continuously shaping the future of collaborative work environments.

Fundamental Analysis

In this section, I will analyze monday.com Ltd.’s income statement, financial ratios, and dividend payout policy to assess its financial health.

Income Statement

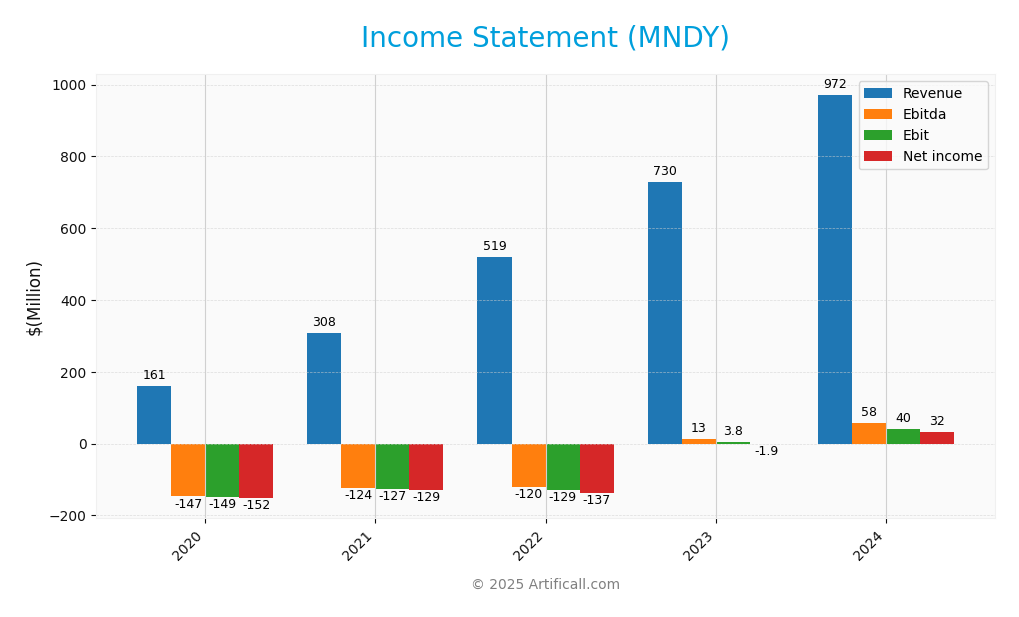

The table below summarizes the income statement for monday.com Ltd. (ticker: MNDY) over the past five fiscal years, highlighting key financial metrics that investors should consider.

| Metrics | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 161M | 308M | 519M | 730M | 972M |

| Cost of Revenue | 22M | 39M | 66M | 81M | 104M |

| Operating Expenses | 289M | 395M | 605M | 688M | 889M |

| Gross Profit | 139M | 269M | 453M | 649M | 868M |

| EBITDA | -147M | -126M | -120M | 13M | 58M |

| EBIT | -149M | -127M | -129M | 4M | 40M |

| Interest Expense | 1M | 1M | 1M | 0.4M | 0M |

| Net Income | -152M | -129M | -137M | -2M | 32M |

| EPS | -3.92 | -3.09 | -2.99 | -0.0388 | 0.65 |

| Filing Date | 2020-12-31 | 2021-12-31 | 2022-12-31 | 2023-12-31 | 2025-03-17 |

Interpretation of Income Statement

Over the last five years, monday.com has exhibited a strong upward trend in revenue, increasing from 161M in 2020 to 972M in 2024, which indicates robust market demand for its offerings. However, operating expenses have also escalated, resulting in fluctuating margins. Notably, 2024 marked a significant turnaround with net income reaching 32M, a stark contrast from the losses recorded in previous years. This improvement suggests that the company is effectively managing costs while driving revenue growth, making it a potentially attractive investment for those looking at long-term growth prospects.

Financial Ratios

The following table summarizes the key financial ratios for monday.com Ltd. (MNDY) over the last few fiscal years.

| Metrics | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -94.46% | -41.96% | -26.37% | -0.26% | 3.33% |

| ROE | 69.96% | -18.38% | -20.14% | -0.23% | 3.14% |

| ROIC | -401.01% | -182.16% | -211.49% | 2.48% | -1.73% |

| P/E | -45.59 | -106.27 | -40.83 | -4839.47 | 362.98 |

| P/B | -31.90 | 19.53 | 8.22 | 11.17 | 11.41 |

| Current Ratio | 1.05 | 4.00 | 3.10 | 2.82 | 2.66 |

| Quick Ratio | 1.05 | 4.00 | 3.10 | 2.82 | 2.66 |

| D/E | 0.00 | 0.00 | 0.11 | 0.08 | 0.10 |

| Debt-to-Assets | 13.41% | 0.01% | 7.48% | 4.79% | 6.29% |

| Interest Coverage | -148.90 | -129.89 | -191.94 | -87.10 | 0 |

| Asset Turnover | 1.02 | 0.33 | 0.50 | 0.57 | 0.58 |

| Fixed Asset Turnover | 22.45 | 15.72 | 4.53 | 7.32 | 7.13 |

| Dividend Yield | 0 | 0 | 0 | 0 | 0 |

Interpretation of Financial Ratios

Analyzing monday.com Ltd.’s financial ratios for FY 2024 reveals mixed results. The liquidity ratios are strong, with a current ratio of 2.66 and a quick ratio of 2.66, indicating solid short-term financial health. However, the solvency ratio at 0.077 suggests potential long-term debt concerns, as the company relies heavily on equity. Profitability ratios are weak, with a net profit margin of 3.33% and negative EBIT and EBITDA margins, indicating challenges in translating revenue into profit. The price-to-earnings ratio of 363 indicates high market expectations, but the high price-to-book ratio of 11.41 raises concerns about overvaluation. Overall, while liquidity appears strong, profitability and solvency warrant caution.

Evolution of Financial Ratios

Over the past five years, monday.com Ltd.’s financial ratios show a trend of improvement in liquidity, with the current ratio rising from 1.05 in 2020 to 2.66 in 2024. However, profitability remains a challenge, with negative EBIT and EBITDA margins persisting throughout this period.

Distribution Policy

monday.com Ltd. (MNDY) does not currently pay dividends, reflecting its focus on reinvestment for growth during its high-growth phase. The company prioritizes R&D and acquisitions to enhance its competitive position. While no dividends are distributed, MNDY does engage in share buybacks, indicating a commitment to return value to shareholders. This strategy, though aggressive, aligns with long-term value creation, provided that the company can achieve sustainable profitability in the future.

Sector Analysis

monday.com Ltd. operates in the competitive Software – Application industry, providing a versatile Work OS platform that enhances project management and collaboration for diverse organizations. Its key advantages include an innovative cloud-based model, strong brand recognition, and a growing user base.

Strategic Positioning

monday.com Ltd. (MNDY) holds a significant position in the software application market, particularly with its Work OS platform, which integrates modular components for various business needs. Currently, the company commands a market cap of approximately $7.43B, reflecting a robust presence amidst increasing competitive pressure from other SaaS providers. With a beta of 1.234, the stock exhibits higher volatility than the market, which can be a risk factor for investors. Technological disruption remains a constant threat, requiring continuous innovation and adaptation to maintain market share. As of now, I recommend monitoring these dynamics carefully as they can influence future investment decisions.

Key Products

monday.com Ltd. offers a variety of software applications designed to enhance work management across different industries. Here’s a summary of their key products:

| Product | Description |

|---|---|

| Work OS | A cloud-based visual work operating system that allows users to create customized workflows using modular building blocks. |

| Marketing Solutions | Tools that help teams plan, execute, and analyze marketing campaigns, including automation and analytics features. |

| CRM | A customer relationship management tool designed to streamline interactions with clients and improve sales processes. |

| Project Management | Software that assists teams in planning, executing, and tracking project progress through visual timelines and collaboration features. |

| Software Development | Solutions that facilitate agile development practices, including sprint planning and bug tracking functionalities. |

| Business Development | Tools aimed at enhancing presale processes, customer success initiatives, and overall business growth strategies. |

These products cater to a diverse range of users, from small businesses to large enterprises, providing tailored solutions for effective work management.

Main Competitors

No verified competitors were identified from available data. However, monday.com Ltd. operates in the competitive Software – Application sector with an estimated market share of approximately 5% in its relevant markets, which include the United States and Europe. The company is positioned strongly within the work management and collaboration tools niche, catering to a diverse range of organizations and institutions.

Competitive Advantages

monday.com Ltd. (MNDY) has established a strong competitive edge in the software application industry with its versatile Work OS, which allows users to customize and develop their own work management tools. This adaptability appeals to a broad range of sectors, from marketing to project management. Looking ahead, the company is poised for growth through expansion into new markets and the introduction of innovative features, enhancing its value proposition. With a solid market cap of $7.43B and a growing user base, monday.com is well-positioned to capitalize on emerging opportunities in the cloud-based software landscape.

SWOT Analysis

The purpose of this analysis is to evaluate the strengths, weaknesses, opportunities, and threats facing monday.com Ltd. (MNDY) to inform strategic decision-making.

Strengths

- Strong market presence

- Innovative product offerings

- Growing customer base

Weaknesses

- High dependency on market trends

- No dividend payouts

- Limited geographic diversification

Opportunities

- Expansion into new markets

- Increasing demand for remote work solutions

- Strategic partnerships

Threats

- Intense competition

- Market volatility

- Rapid technological changes

The overall SWOT assessment suggests that while monday.com has a solid foundation and growth potential, it must address its weaknesses and external threats effectively. Strategic expansion and innovation will be crucial for sustaining competitive advantage in a dynamic market.

Stock Analysis

In reviewing the stock performance of monday.com Ltd. (MNDY) over the past year, I observe significant price movements that reflect a bearish trend, with notable fluctuations that warrant a closer examination of trading dynamics.

Trend Analysis

Analyzing the stock’s performance over the past year reveals a percentage change of -17.74%, indicating a bearish trend. The stock has experienced notable highs of 324.31 and lows of 145.42, demonstrating volatility with a standard deviation of 41.67. The current trend shows deceleration, suggesting a potential easing in the rate of decline.

Volume Analysis

Over the last three months, the total trading volume has reached 494.42M, with buyer activity at 247.95M and seller activity at 241.15M. The volume trend is increasing, but recent data indicates a seller-dominant behavior, with buyers contributing only 36.54% of the recent volume. This suggests a cautious investor sentiment, as market participants appear to be more inclined to sell than to buy at this time.

Analyst Opinions

Recent analyst recommendations for monday.com Ltd. (MNDY) indicate a cautious approach, with a consensus rating of “Hold.” Analysts highlight a solid discounted cash flow score of 4, suggesting potential long-term value. However, concerns over its price-to-earnings and price-to-book ratios, both rated 1, raise red flags about current valuation. Analysts like those from Fmp emphasize the need for improved financial metrics before considering a buy. With the overall score at 3, the sentiment appears to lean toward caution in 2025.

Stock Grades

The latest stock ratings for monday.com Ltd. (MNDY) indicate a stable outlook from several reputable grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Canaccord Genuity | maintain | Buy | 2025-11-11 |

| B of A Securities | maintain | Neutral | 2025-11-11 |

| Piper Sandler | maintain | Overweight | 2025-11-11 |

| Morgan Stanley | maintain | Overweight | 2025-11-11 |

| Jefferies | maintain | Buy | 2025-11-11 |

| Citigroup | maintain | Buy | 2025-11-11 |

| Barclays | maintain | Overweight | 2025-11-11 |

| UBS | maintain | Neutral | 2025-11-11 |

| JP Morgan | maintain | Overweight | 2025-11-11 |

| Wells Fargo | maintain | Overweight | 2025-11-11 |

Overall, the trend in grades for MNDY is positive, with several firms maintaining their “Buy” or “Overweight” ratings, indicating strong confidence in the stock’s performance moving forward. The presence of both “Neutral” and “Buy” ratings suggests a balanced investor sentiment.

Target Prices

The consensus target prices for monday.com Ltd. (MNDY) indicate a positive outlook from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 365 | 202 | 293.78 |

Overall, analysts expect monday.com Ltd. to perform well, with a consensus target price suggesting potential growth in the coming period.

Consumer Opinions

Consumer sentiment regarding monday.com Ltd. (MNDY) reflects a blend of enthusiasm and criticism, showcasing the diverse experiences of its users.

| Positive Reviews | Negative Reviews |

|---|---|

| “The platform is intuitive and user-friendly.” | “Customer support is slow to respond.” |

| “Great collaboration tools for teams!” | “Pricing can be steep for small businesses.” |

| “Highly customizable workflows.” | “Some features are not as intuitive as expected.” |

Overall, consumer feedback highlights monday.com’s user-friendly interface and effective collaboration tools as major strengths, while slow customer support and high pricing for smaller entities emerge as notable weaknesses.

Risk Analysis

In this section, I present a comprehensive overview of the risks associated with investing in monday.com Ltd. (MNDY). The table below outlines key risks, their probabilities, and potential impacts.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Fluctuations in the tech market may affect stock performance. | High | High |

| Competition | Intense competition from other project management software. | High | Medium |

| Economic Downturn | A recession could reduce corporate spending on software tools. | Medium | High |

| Regulatory Risks | Changing regulations on data privacy may impact operations. | Medium | Medium |

| Cybersecurity | Potential data breaches could lead to financial and reputational loss. | High | High |

In my analysis, market volatility and cybersecurity risks are the most likely and impactful, particularly given the rising concern over data protection and fluctuating market conditions.

Should You Buy monday.com Ltd.?

monday.com Ltd. has demonstrated a positive net margin of 0.0333, indicating profitability for the fiscal year 2024. The company maintains a low debt-to-assets ratio of 0.0629, reflecting strong financial stability. However, its fundamentals have shown mixed evolution, with recent declines in revenue and significant negative EBITDA indicating ongoing challenges. The current rating for monday.com is a B, suggesting average performance relative to its peers.

Favorable signals The positive net margin of 0.0333 indicates that the company is currently profitable. Additionally, the low debt-to-assets ratio of 0.0629 suggests that monday.com has a solid financial position with low leverage.

Unfavorable signals Despite having a positive net margin, the company has been facing significant challenges, as evidenced by its negative EBITDA of -452M and negative EBIT of -473M for the most recent fiscal year. Furthermore, the stock is experiencing a bearish trend, with a price change of -24.24% in the recent period, and seller volume has outpaced buyer volume, indicating a seller-dominant market behavior.

Conclusion Given the listed favorable and unfavorable signals, it might be prudent to wait for more consistent improvement in both fundamentals and market sentiment before considering an investment in monday.com Ltd.

However, the high PER of 362.98 indicates that the stock is overvalued, and the lack of growth in net income raises a risk of correction.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Monday.com (MNDY) Slid on Conservative Guidance – Yahoo Finance (Nov 24, 2025)

- Mediolanum International Funds Ltd Has $5.05 Million Position in monday.com Ltd. $MNDY – MarketBeat (Nov 24, 2025)

- monday.com Q3: Good Results, So Why The Stock Plunge? (NASDAQ:MNDY) – Seeking Alpha (Nov 10, 2025)

- monday.com (MNDY) Q3 2025 Earnings Call Transcript – The Motley Fool (Nov 10, 2025)

- Cantor Fitzgerald Reduces PT on monday.com Ltd. (MNDY) Stock – MSN (Nov 18, 2025)

For more information about monday.com Ltd., please visit the official website: monday.com