Mesa Laboratories, Inc. crafts the very tools that safeguard our health and enhance the quality of life, making it an indispensable player in the life sciences and quality control sectors. Known for its innovative products ranging from sterilization indicators to genetic analysis tools, Mesa Labs continuously sets high standards in technology and reliability. As I analyze its current market position, I question whether its robust fundamentals can sustain its valuation and growth trajectory in an ever-evolving industry landscape.

Table of contents

Company Description

Mesa Laboratories, Inc. (NASDAQ: MLAB), founded in 1982 and headquartered in Lakewood, Colorado, operates within the hardware, equipment, and parts industry, specializing in life sciences tools and quality control products. The company offers a diverse range of services across multiple segments, including sterilization and disinfection control, biopharmaceutical development, calibration solutions, and clinical genomics. With a global reach spanning the U.S., Europe, and the Asia Pacific, Mesa Labs plays a vital role in supporting sectors such as healthcare, pharmaceuticals, and research. Its commitment to innovation and quality positions it as a key player in shaping industry standards and enhancing safety in various applications.

Fundamental Analysis

In this section, I will conduct a fundamental analysis of Mesa Laboratories, Inc., focusing on its income statement, financial ratios, and dividend payout policy.

Income Statement

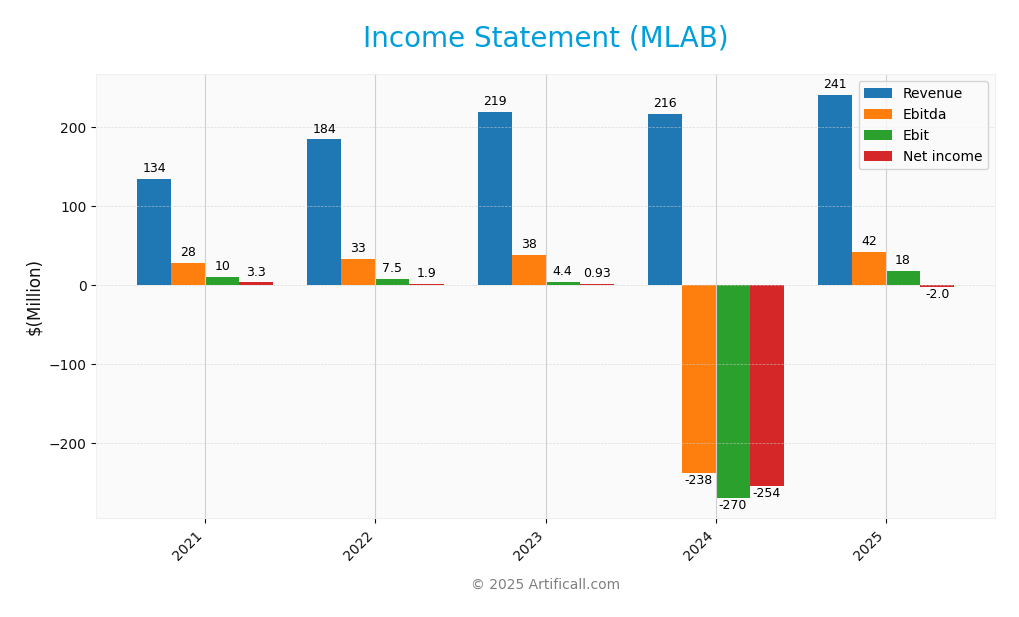

Below is the Income Statement for Mesa Laboratories, Inc. (MLAB) over the last five fiscal years, providing insights into revenue, expenses, and net income.

| Year | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Revenue | 134M | 184M | 219M | 216M | 241M |

| Cost of Revenue | 47M | 75M | 85M | 83M | 90M |

| Operating Expenses | 75M | 104M | 130M | 405M | 135M |

| Gross Profit | 87M | 109M | 134M | 133M | 151M |

| EBITDA | 28M | 33M | 38M | -238M | 42M |

| EBIT | 10M | 7M | 4M | -270M | 18M |

| Interest Expense | 8M | 4M | 5M | 6M | 12M |

| Net Income | 3M | 2M | 1M | -254M | -2M |

| EPS | 0.66 | 0.36 | 0.17 | -47.2 | -0.36 |

| Filing Date | 2021-06-01 | 2022-05-31 | 2023-05-30 | 2024-06-28 | 2025-05-28 |

Interpretation of Income Statement

Over the reported period, MLAB has experienced a generally upward trend in revenue, increasing from 134M in 2021 to 241M in 2025. However, the company faced significant volatility in net income, with a drastic decline to -254M in 2024 and a slight recovery to -2M in 2025. The operating expenses were exceptionally high in 2024, adversely affecting margins. In the latest fiscal year, while revenue improved, the net income remained negative, highlighting ongoing challenges in cost management and operational efficiency. The significant interest expense also suggests a need for careful debt management moving forward.

Financial Ratios

The following table summarizes the financial ratios for Mesa Laboratories, Inc. (MLAB) over the years.

| Metric | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 2.44% | 1.01% | 0.42% | -1.18% | -0.82% |

| ROE | 0.81% | 0.48% | 0.24% | -1.75% | -1.24% |

| ROIC | -0.12% | -0.03% | -0.05% | -0.62% | -1.45% |

| P/E | 370.01 | 710.01 | 999.72 | -2.37 | -326.35 |

| P/B | 2.98 | 3.37 | 4.24 | 4.15 | 4.03 |

| Current Ratio | 9.30 | 2.59 | 2.74 | 2.47 | 0.63 |

| Quick Ratio | 8.96 | 2.07 | 1.94 | 1.73 | 0.47 |

| D/E | 0.36 | 0.56 | 0.43 | 1.59 | 1.14 |

| Debt-to-Assets | 24.44% | 31.26% | 25.73% | 51.77% | 41.88% |

| Interest Coverage | -0.66 | -5.24 | -6.39 | -47.76 | 1.38 |

| Asset Turnover | 0.22 | 0.26 | 0.33 | 0.48 | 0.56 |

| Fixed Asset Turnover | 6.09 | 6.44 | 7.78 | 5.22 | 7.45 |

| Dividend Yield | 0.26% | 0.25% | 0.37% | 0.57% | 0.54% |

Interpretation of Financial Ratios

Analyzing Mesa Laboratories, Inc. (MLAB) for FY 2025 reveals concerning financial metrics. The liquidity ratios are weak, with a current ratio of 0.63 and a quick ratio of 0.47, indicating potential difficulties in covering short-term liabilities. Solvency is a concern, reflected by a solvency ratio of 0.08 and a debt-to-equity ratio of 1.14, suggesting high leverage. Profitability is under pressure, as evidenced by a negative net profit margin of -0.82%. Efficiency ratios are mixed; while receivables turnover is relatively strong at 5.74, the overall profitability and cash flow generation remain weak. Investors should approach this stock with caution, particularly due to the negative earnings and low profitability margins.

Evolution of Financial Ratios

Over the past five years, MLAB’s financial ratios have shown a concerning downward trend. Liquidity ratios have decreased significantly, and profitability metrics have turned negative, reflecting a deteriorating financial condition and increasing operational challenges.

Distribution Policy

Mesa Laboratories, Inc. does not currently pay dividends, as evidenced by a negative net income margin of -0.82% in FY2025. The company appears to prioritize reinvestment in growth opportunities, aligning with a strategy focused on R&D and potential acquisitions. However, it does engage in share buybacks, which can help support share prices. This approach, while aimed at long-term shareholder value creation, carries risks, particularly if profitability does not improve.

Sector Analysis

Mesa Laboratories, Inc. operates in the Hardware, Equipment & Parts industry, specializing in life sciences tools and quality control products, facing competition from established players while leveraging unique technological advantages.

Strategic Positioning

Mesa Laboratories, Inc. (MLAB) operates in the competitive hardware and life sciences sector, holding a market cap of $406M. The company has carved a niche in sterilization and disinfection control, with its products being essential in healthcare settings. However, it faces increasing competitive pressure from emerging technologies and innovative startups focusing on automation and efficiency in laboratory services. With significant investments in R&D, Mesa is positioned to mitigate technological disruptions, ensuring its solutions remain relevant and effective in a rapidly evolving market.

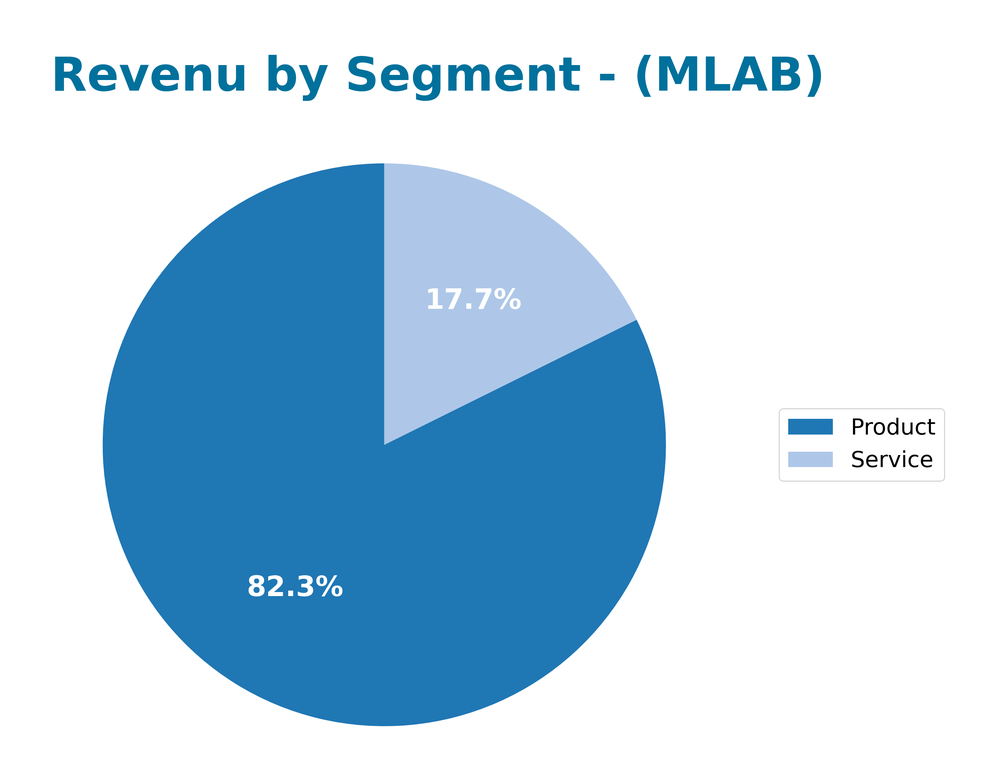

Revenue by Segment

The following chart illustrates Mesa Laboratories, Inc.’s revenue segmentation for the fiscal year 2025, highlighting contributions from product and service segments.

In FY 2025, Mesa Laboratories reported revenues of $198.4M from Product and $42.6M from Service segments. The Product segment continues to be the primary revenue driver, reflecting a growth trend from $180.5M in FY 2023. Although the Service segment has seen some increase, it remains significantly smaller. The overall growth trajectory appears solid; however, I recommend monitoring potential margin pressures as the company scales its service offerings.

Key Products

Mesa Laboratories, Inc. offers a diverse range of products designed to enhance quality control in various sectors, particularly in life sciences and healthcare. Below is a summary of their key products:

| Product | Description |

|---|---|

| Biological Indicators | Used to assess the effectiveness of sterilization processes in hospitals and medical devices. |

| Automated Protein Analysis Systems | Solutions for immunoassays that streamline protein analysis in biopharmaceutical research and development. |

| Calibration Equipment | Products to measure and calibrate parameters such as temperature and pressure, essential for health and safety. |

| Continuous Monitoring Systems | Designed for real-time monitoring of critical parameters in healthcare environments, ensuring compliance and safety. |

| MassARRAY System | A genetic analysis tool that enables clinical laboratories to perform genomic testing for various therapeutic areas. |

| Peptide Synthesizers | Automates the synthesis of peptides used in drug development, cosmetics, and research applications. |

These products illustrate Mesa Laboratories’ commitment to providing innovative solutions that support quality assurance in critical industries.

Main Competitors

No verified competitors were identified from available data. Mesa Laboratories, Inc. holds a market capitalization of approximately $406M, operating primarily within the life sciences tools and quality control products sector. Given its specialized offerings, the company maintains a competitive position focused on niche markets, particularly in sterilization and disinfection control, as well as biopharmaceutical development.

Competitive Advantages

Mesa Laboratories, Inc. (MLAB) enjoys a strong competitive edge through its diverse range of life sciences tools and quality control products. Its segments—Sterilization and Disinfection Control, Biopharmaceutical Development, Calibration Solutions, and Clinical Genomics—cater to critical industries such as healthcare and pharmaceuticals. As the demand for automation and advanced testing solutions grows, MLAB is well-positioned to capitalize on emerging markets and develop innovative products. Future opportunities include expanding its offerings in genetic analysis and enhancing its automated systems to meet the increasing needs of personalized medicine.

SWOT Analysis

This SWOT analysis aims to evaluate Mesa Laboratories, Inc. and its strategic positioning in the market.

Strengths

- Established brand in life sciences

- Diverse product offerings

- Strong market presence in multiple regions

Weaknesses

- Dependence on healthcare sector

- Limited brand recognition outside core markets

- Vulnerability to regulatory changes

Opportunities

- Expansion into emerging markets

- Growing demand for quality control products

- Advancements in genetic analysis technologies

Threats

- Intense competition in the industry

- Economic downturns affecting healthcare spending

- Rapid technological changes

Overall, the SWOT assessment indicates that while Mesa Laboratories has solid strengths and opportunities for growth, it must remain vigilant against industry threats and weaknesses. Strategic investments in emerging markets and technology can enhance its competitive edge.

Stock Analysis

Over the past year, Mesa Laboratories, Inc. (MLAB) has experienced significant price fluctuations, culminating in a notable bearish trend characterized by a sharp decline in stock value.

Trend Analysis

Analyzing the stock’s performance over the past year, MLAB has recorded a percentage change of -26.2%. This decline indicates a bearish trend, further supported by an acceleration in the downturn as evidenced by a standard deviation of 22.54. The stock reached a high of 147.79 and a low of 61.66 during this period, illustrating substantial volatility in its price movements.

Volume Analysis

In the last three months, MLAB’s trading volume has shown an increasing trend, with total activity amounting to 38.16M shares. The volume breakdown reveals that buyers accounted for 47.59% of the trades, with buyer activity at 18.16M compared to seller activity at 19.88M. This suggests that the market sentiment is relatively neutral, as neither buyers nor sellers dominate the trading landscape.

Analyst Opinions

Recent analyst recommendations for Mesa Laboratories, Inc. (MLAB) indicate a cautious stance, with a consensus rating of “Hold.” Analysts emphasize the company’s modest C+ rating, highlighting concerns over low return on equity and high debt-to-equity ratios. While the discounted cash flow score is more favorable at 5, the overall performance metrics suggest a need for strategic adjustments. Notably, analysts are divided, but the prevailing sentiment leans towards holding rather than buying or selling, reflecting a wait-and-see approach amidst market uncertainties.

Stock Grades

Mesa Laboratories, Inc. (MLAB) has recently seen updates in its stock ratings, reflecting a mix of assessments from recognized grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Upgrade | Equal Weight | 2025-08-08 |

| Wells Fargo | Maintain | Underweight | 2025-05-30 |

| Evercore ISI Group | Maintain | Outperform | 2024-10-01 |

| Evercore ISI Group | Maintain | Outperform | 2024-08-06 |

| Evercore ISI Group | Maintain | Outperform | 2024-07-02 |

| Evercore ISI Group | Maintain | Outperform | 2024-04-04 |

| Evercore ISI Group | Upgrade | Outperform | 2024-01-04 |

| Evercore ISI Group | Downgrade | In Line | 2021-01-04 |

| Evercore ISI Group | Downgrade | In Line | 2021-01-03 |

| Keybanc | Maintain | Equal Weight | 2020-11-10 |

Overall, the trend indicates a recent upgrade from Wells Fargo, while Evercore ISI Group has consistently rated MLAB as “Outperform” in multiple assessments, showing a stable outlook despite some fluctuations. This mix of grades suggests a cautious but optimistic perspective on MLAB’s performance moving forward.

Target Prices

The consensus target price for Mesa Laboratories, Inc. (MLAB) is strongly defined.

| Target High | Target Low | Consensus |

|---|---|---|

| 120 | 120 | 120 |

Analysts expect MLAB to maintain a stable outlook with a consensus target price of 120, indicating confidence in the stock’s performance.

Consumer Opinions

Consumer sentiment about Mesa Laboratories, Inc. (MLAB) reflects a mix of satisfaction and concern, showcasing the diverse experiences of its clientele.

| Positive Reviews | Negative Reviews |

|---|---|

| “Exceptional customer service and support.” | “Product pricing is on the higher side.” |

| “Reliable and accurate testing equipment.” | “Long wait times for product delivery.” |

| “Innovative solutions that meet our needs.” | “Some products lack user-friendly manuals.” |

Overall, consumer feedback indicates that while MLAB is praised for its customer service and product reliability, concerns about pricing and delivery times are recurring themes that the company may need to address.

Risk Analysis

In evaluating Mesa Laboratories, Inc. (MLAB), it is essential to consider various risks that could affect its performance and investor returns.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in demand for laboratory instruments. | High | High |

| Regulatory Risk | Changes in healthcare regulations affecting sales. | Medium | High |

| Technology Risk | Rapid advancements may outdate current products. | Medium | Medium |

| Operational Risk | Disruptions in supply chain affecting production. | Medium | Medium |

| Competitive Risk | Increased competition in laboratory services market. | High | Medium |

Among these risks, market and regulatory risks are the most likely and impactful for MLAB, given the current healthcare landscape and ongoing demand for innovative laboratory solutions.

Should You Buy Mesa Laboratories, Inc.?

Mesa Laboratories, Inc. is currently experiencing a challenging profitability situation, as indicated by a negative net margin of -0.0082. The company carries significant debt, with a debt-to-equity ratio of 1.135, suggesting potential risk in its capital structure. Over recent fiscal periods, the company’s fundamentals have evolved negatively, with a continuous decline in net income. The company holds a rating of C+, reflecting a cautious outlook.

Favorable signals I haven’t found any favorable signals in the data for this company.

Unfavorable signals The company has a negative net margin of -0.0082, indicating lack of profitability. Its debt-to-equity ratio stands at 1.135, which is relatively high and may raise concerns about leverage. Additionally, the overall trend analysis shows a bearish stock trend with a price change of -26.2%, suggesting a significant downward movement in its stock price. Lastly, the recent seller volume exceeds the buyer volume, indicating selling pressure.

Conclusion Given the negative net margin and unfavorable signals, it would be preferable to wait for improvement in the company’s financial health and market conditions before considering any potential investment.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Mesa Laboratories, Inc. (NASDAQ:MLAB) is a favorite amongst institutional investors who own 87% – Yahoo Finance (Nov 07, 2025)

- Mesa Laboratories (NASDAQ: MLAB) to join Jefferies chat; live webcast Nov 20, 12:00 GMT – Stock Titan (Nov 12, 2025)

- Mesa Labs: Fiscal Q2 Earnings Snapshot – Connecticut Post (Nov 06, 2025)

- Mesa Laboratories (NASDAQ:MLAB) Has Announced A Dividend Of $0.16 – Sahm (Nov 07, 2025)

- It’s Down 27% But Mesa Laboratories, Inc. (NASDAQ:MLAB) Could Be Riskier Than It Looks – simplywall.st (Jul 20, 2025)

For more information about Mesa Laboratories, Inc., please visit the official website: mesalabs.com