Imagine a world where cars communicate with each other and navigate roads autonomously, enhancing safety and efficiency. Mobileye Global Inc. is at the forefront of this automotive revolution, pioneering advanced driver assistance systems (ADAS) and autonomous driving technologies. With a reputation for innovation and quality, Mobileye’s flagship products redefine how we experience mobility. As I analyze the company’s fundamentals, I invite you to consider whether its current market valuation aligns with its growth potential in this rapidly evolving industry.

Table of contents

Company Description

Mobileye Global Inc. is a leading player in the development and deployment of advanced driver assistance systems (ADAS) and autonomous driving technologies. Founded in 1999 and headquartered in Jerusalem, Israel, the company offers a suite of innovative products, including real-time safety alerts, cloud-enhanced driver assistance, and autonomous driving solutions. Operating primarily in the auto parts industry, Mobileye has carved out a significant presence in the global market, supported by a robust workforce of approximately 3,900 employees. As a subsidiary of Intel, Mobileye is strategically positioned to shape the future of transportation through its commitment to safety, innovation, and the seamless integration of technology into the driving experience.

Fundamental Analysis

In this section, I will analyze Mobileye Global Inc.’s income statement, financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

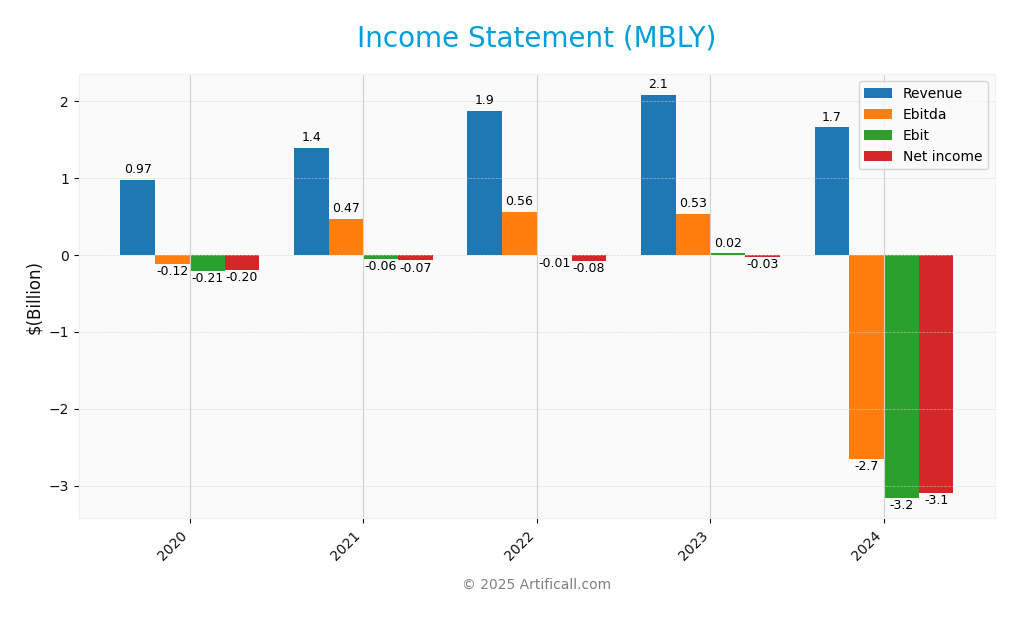

The following table outlines the income statement for Mobileye Global Inc. (MBLY) over the past five fiscal years, providing insight into the company’s financial performance.

| Item | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 967M | 1.39B | 1.87B | 2.08B | 1.65B |

| Cost of Revenue | 591M | 731M | 947M | 1.03B | 913M |

| Operating Expenses | 589M | 712M | 959M | 1.08B | 3.97B |

| Gross Profit | 376M | 655M | 922M | 1.05B | 741M |

| EBITDA | -118M | 469M | 559M | 529M | -2.66B |

| EBIT | -213M | -57M | -8M | 16M | -3.16B |

| Interest Expense | 0 | 0 | 24M | 0 | 0 |

| Net Income | -196M | -75M | -82M | -27M | -3.09B |

| EPS | -0.25 | -0.0942 | -0.1 | -0.0335 | -3.82 |

| Filing Date | N/A | 2021-12-31 | 2023-03-09 | 2024-02-23 | 2025-02-13 |

Interpretation of Income Statement

Over the five-year period, Mobileye’s revenue peaked in 2023 at 2.08B but dropped significantly to 1.65B in 2024. This decline in revenue coincided with a drastic increase in operating expenses, leading to a substantial negative EBITDA of -2.66B in the latest year. The company’s net income also worsened, with a loss of -3.09B in 2024 compared to -27M in 2023. This sharp decline indicates that the company faced significant operational challenges, raising concerns about sustainability and profitability moving forward. Investors should exercise caution as the latest performance suggests potential volatility ahead.

Financial Ratios

The following table summarizes the financial ratios for Mobileye Global Inc. (MBLY) over the last few fiscal years.

| Metrics | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -20.27% | -5.41% | -4.39% | -1.30% | -1.87% |

| ROE | -1.24% | -0.47% | -0.55% | -0.18% | -25.56% |

| ROIC | -1.22% | -0.46% | -0.63% | 0.37% | -25.70% |

| P/E | -117.69 | -307.57 | -342.87 | -1291.58 | -5.24 |

| P/B | 1.46 | 1.45 | 1.90 | 2.34 | 1.34 |

| Current Ratio | 5.46 | 4.79 | 3.95 | 5.13 | 6.53 |

| Quick Ratio | 5.05 | 4.58 | 3.65 | 4.16 | 5.28 |

| D/E | 0 | 0 | 0 | 0.0034 | 0.0041 |

| Debt-to-Assets | 0 | 0 | 0.0038 | 0.0033 | 0.0039 |

| Interest Coverage | 0 | 0 | -1.54 | 0 | 0 |

| Asset Turnover | 0.0587 | 0.0832 | 0.1210 | 0.1335 | 0.1315 |

| Fixed Asset Turnover | 5.17 | 4.56 | 4.87 | 4.65 | 3.61 |

| Dividend Yield | 0 | 0 | 0.012 | 0 | 0 |

Interpretation of Financial Ratios

Analyzing Mobileye Global Inc.’s financial ratios for FY 2024 reveals a mix of strengths and weaknesses. The liquidity ratios are strong, with a current ratio of 6.53 and a quick ratio of 5.28, indicating ample short-term assets to cover liabilities. However, profitability ratios are concerning, as the net profit margin stands at -1.87, reflecting ongoing losses. The solvency ratio is negative at -5.25, signaling potential issues with long-term financial stability. Efficiency metrics, such as receivables turnover of 7.80 and inventory turnover of 2.20, demonstrate decent asset management but highlight the need for improvement in profitability. Overall, while liquidity is solid, the negative profitability and solvency ratios are red flags for investors.

Evolution of Financial Ratios

Over the past five years, Mobileye’s financial ratios have shown significant variability. The current ratio has improved from 4.79 in 2021 to 6.53 in 2024, reflecting better liquidity management. However, profitability ratios have generally trended negatively, with persistent losses impacting the net profit margin, which remains a concern for investors.

Distribution Policy

Mobileye Global Inc. (MBLY) does not currently pay dividends, reflecting a strategic focus on reinvesting profits into growth and innovation during its high-growth phase. With a negative net income and ongoing investments in research and development, this approach aims to enhance long-term shareholder value. The company does engage in share buybacks, signaling confidence in its valuation. Overall, this distribution strategy aligns with sustainable long-term value creation for shareholders, albeit with inherent risks.

Sector Analysis

Mobileye Global Inc. operates in the Auto – Parts industry, focusing on advanced driver assistance systems (ADAS) and autonomous driving technologies. Its competitive advantages include innovation, strong partnerships, and a comprehensive product suite.

Strategic Positioning

Mobileye Global Inc. (MBLY) holds a significant position in the advanced driver assistance systems (ADAS) and autonomous driving technologies market. Currently valued at approximately $8.98B, the company continues to innovate in a competitive landscape marked by rapid technological disruption. With a beta of 0.498, MBLY exhibits lower volatility compared to the market, allowing for a more stable investment. The company’s offerings, including Mobileye SuperVision and Mobileye Drive, are well-benchmarked against competitors, though they face increasing pressure from emerging players in the autonomous vehicle sector. As the industry evolves, Mobileye’s focus on integrating cloud-enhanced features will be critical to maintaining its market share.

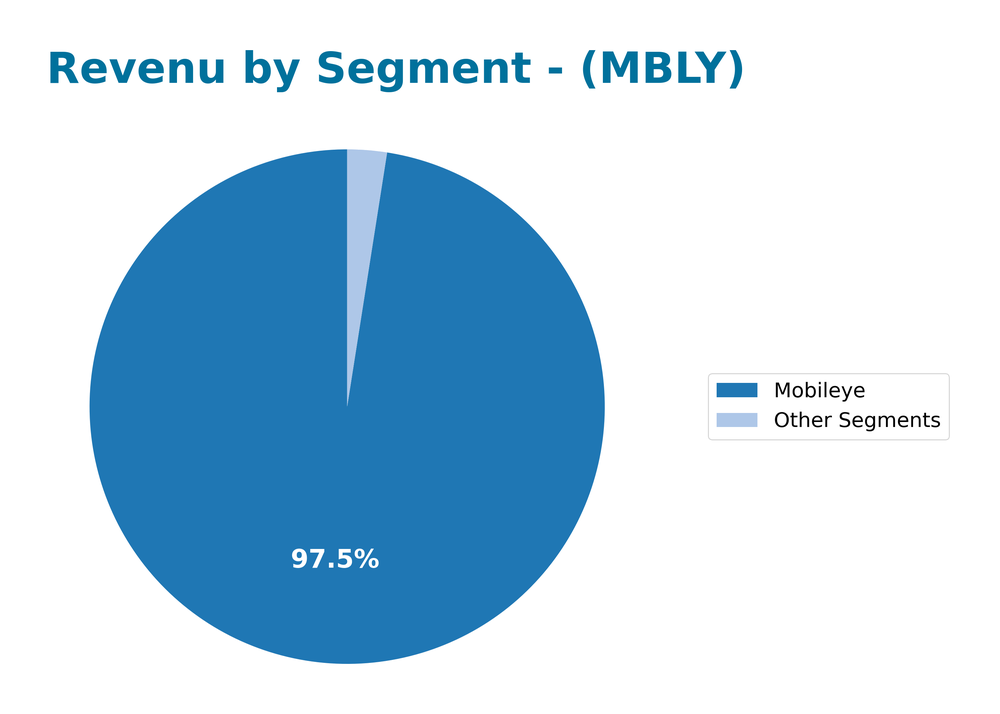

Revenue by Segment

The chart illustrates the revenue distribution by segment for Mobileye Global Inc. during the fiscal years 2022 to 2024.

Over the observed period, Mobileye has been the dominant revenue driver, showing fluctuations in performance with a notable decline from 2023 to 2024, dropping from $2.045B to $1.613B. The “Other Segments” category contributed modestly but showed a slight increase in revenue. The significant drop in Mobileye’s revenue may indicate emerging competitive pressures or market challenges, raising potential concerns about margin sustainability and dependency on a singular revenue stream.

Key Products

Below is a summary of Mobileye Global Inc.’s key products, showcasing their advancements in driver assistance and autonomous driving technologies.

| Product | Description |

|---|---|

| Driver Assist | A suite of advanced driver assistance systems (ADAS) that includes safety features like real-time detection of road users, geometry, semantics, and markings for alerts and interventions. |

| Cloud-Enhanced Driver Assist | This solution enhances the driving experience by providing real-time scene interpretations, benefiting drivers through improved situational awareness. |

| Mobileye SuperVision Lite | A driver assist solution designed for everyday driving scenarios, providing essential features for enhanced safety and navigation. |

| Mobileye SuperVision | An operational point-to-point assisted driving navigation system that adapts to various road types, incorporating cloud-based enhancements and over-the-air updates. |

| Mobileye Chauffeur | A next-generation autonomous driving solution aimed at providing a fully automated driving experience for users. |

| Mobileye Drive | A Level 4 autonomous driving technology suite that encompasses self-driving systems and vehicles, including solutions for autonomous mobility as a service (MaaS). |

These products illustrate Mobileye’s commitment to innovating in the automotive technology sector, focusing on safety and the future of autonomous driving.

Main Competitors

No verified competitors were identified from available data. Mobileye Global Inc. (ticker: MBLY) is currently positioned in the advanced driver assistance systems (ADAS) and autonomous driving technology sector. The company holds a significant market share within its niche, leveraging innovative solutions to enhance vehicle safety and automation.

Competitive Advantages

Mobileye Global Inc. (MBLY) holds a strong competitive edge in the advanced driver assistance systems (ADAS) and autonomous driving technology market. With a robust portfolio that includes innovative products like Mobileye SuperVision and Mobileye Drive, the company is well-positioned to capitalize on the growing demand for safety and autonomous solutions in the automotive industry. Looking ahead, Mobileye’s focus on cloud-enhanced features and over-the-air updates presents significant growth opportunities as it expands into new markets and enhances its product offerings, ensuring it remains a leader in this rapidly evolving sector.

SWOT Analysis

The SWOT analysis evaluates Mobileye Global Inc.’s internal and external factors impacting its business position and strategic planning.

Strengths

- Strong market positioning in ADAS

- Innovative technology in autonomous driving

- Backing from Intel Corporation

Weaknesses

- Dependence on automotive industry cycles

- Limited dividend payout

- High competition in tech sector

Opportunities

- Growing demand for autonomous vehicles

- Expansion into new markets

- Partnerships with automotive manufacturers

Threats

- Regulatory challenges

- Rapid technological changes

- Economic downturns affecting automotive sales

Overall, the SWOT analysis indicates that Mobileye has robust strengths and significant opportunities, but it must navigate competitive pressures and regulatory challenges effectively. This assessment suggests that the company should leverage its innovative capabilities while exploring strategic partnerships to enhance market resilience.

Stock Analysis

In analyzing Mobileye Global Inc. (MBLY), the stock has exhibited significant price movements over the past year, characterized by a pronounced bearish trend. The dynamics of trading have reflected broad market challenges, impacting investor sentiment and engagement.

Trend Analysis

Over the past year, Mobileye’s stock price has experienced a substantial decline, with a total percentage change of -63.78%. This indicates a bearish trend strictly based on the significant loss in value. Notable price fluctuations include a high of 32.15 and a low of 10.91. The trend shows signs of deceleration, suggesting that while the stock continues to decline, the rate of that decline is slowing down. The standard deviation of 6.39 indicates a moderate level of volatility during this period.

Volume Analysis

In the last three months, the trading volumes for MBLY indicate a seller-driven market, with seller volume at 1.63B compared to buyer volume of 1.03B, resulting in a buyer percentage of 37.91. The volume trend has been increasing, reflecting heightened market participation. However, the recent data shows a stark contrast, with buyer volume at 62.75M and seller volume at 232.66M, indicating a seller-dominant environment with a buyer dominance percentage of only 21.24. This suggests a prevailing negative sentiment among investors, as sellers remain more active in the market.

Analyst Opinions

Recent recommendations for Mobileye Global Inc. (MBLY) indicate a cautious stance, with a consensus rating of “hold.” Analysts like those from FMP have assigned a C+ rating, reflecting concerns over the company’s return on equity and assets, both scoring low at 1. However, the price-to-book ratio shows some promise with a score of 4. This suggests that while there are growth opportunities, potential investors should be cautious given the current financial metrics. Overall, the sentiment leans towards holding rather than buying or selling.

Stock Grades

Mobileye Global Inc. (MBLY) has recently received several ratings from reputable grading companies, reflecting a consistent outlook on its performance.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Tigress Financial | Maintain | Buy | 2025-10-30 |

| TD Cowen | Maintain | Buy | 2025-10-24 |

| Mizuho | Maintain | Neutral | 2025-10-24 |

| Barclays | Maintain | Equal Weight | 2025-10-10 |

| Goldman Sachs | Maintain | Neutral | 2025-09-29 |

| B of A Securities | Maintain | Neutral | 2025-09-10 |

| Baird | Maintain | Outperform | 2025-09-03 |

| RBC Capital | Maintain | Sector Perform | 2025-07-29 |

| Mizuho | Maintain | Neutral | 2025-07-25 |

| Baird | Maintain | Outperform | 2025-07-25 |

Overall, the trend in grades for Mobileye shows a stable outlook, with a significant number of firms maintaining their positions. Notably, the majority continue to express a favorable view, with “Buy” and “Outperform” ratings indicating confidence in the company’s future performance.

Target Prices

The consensus target price for Mobileye Global Inc. (MBLY) indicates a range reflecting the analysts’ expectations for the stock’s performance.

| Target High | Target Low | Consensus |

|---|---|---|

| 25 | 15 | 18.67 |

Analysts generally expect Mobileye’s stock to reach an average target of approximately 18.67, suggesting a moderate outlook amidst varying expectations.

Consumer Opinions

Consumer sentiment about Mobileye Global Inc. (MBLY) reflects a dynamic landscape, showcasing both enthusiasm and concerns among its users.

| Positive Reviews | Negative Reviews |

|---|---|

| “Exceptional technology and reliability!” | “Customer service needs significant improvement.” |

| “Innovative solutions for autonomous driving.” | “High price point for the average consumer.” |

| “Impressive safety features.” | “Some software glitches reported.” |

Overall, consumer feedback indicates that while Mobileye excels in technology and innovation, issues with customer service and pricing remain prominent concerns.

Risk Analysis

In evaluating Mobileye Global Inc. (MBLY), I’ve identified key risks that could impact the company’s performance. Below is a summary of these risks:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in the automotive and tech markets can affect demand for autonomous vehicle technology. | High | High |

| Regulatory Risk | Changes in government regulations regarding autonomous driving could impose restrictions. | Medium | High |

| Technological Risk | Rapid advancements by competitors in AI and automotive technology may outpace Mobileye’s innovations. | High | Medium |

| Supply Chain Risk | Disruptions in the supply chain can delay product launches and increase costs. | Medium | Medium |

| Cybersecurity Risk | Increasing threats of cyberattacks on technology firms may compromise data integrity. | High | High |

Mobileye faces significant market and regulatory risks, particularly as the demand for autonomous technology evolves. Market volatility and regulatory changes can substantially influence its operational landscape.

Should You Buy Mobileye Global Inc.?

Mobileye Global Inc. has shown a negative net margin of -1.87% and is currently facing significant losses, with a recent net income of -3.09B. The company maintains a very low total debt of 50M, indicating a strong debt position. Despite recent revenue growth of 17.24%, the company continues to struggle with profitability and has received a rating of C+.

Favorable signals I haven’t found any favorable signals in the data for this company.

Unfavorable signals The company has a negative net margin of -1.87%, indicating unprofitability. The long-term trend for the stock has been bearish, with a price change of -63.78% over the overall duration examined. Recent seller volume exceeds buyer volume, signaling a lack of demand for the stock. Additionally, the company has a low return on invested capital (ROIC) of -0.26%, which is less than its weighted average cost of capital (WACC) of 5.95%, suggesting value destruction.

Conclusion Given the negative net margin, the bearish long-term trend, and the recent seller volume exceeding buyer volume, it might be prudent to wait for a more favorable market condition before considering any investment in Mobileye Global Inc.

Additional Resources

- 131,301 Shares in Mobileye Global Inc. $MBLY Bought by Covalis Capital LLP – MarketBeat (Nov 24, 2025)

- Mobileye: ADAS Thrives While Advanced Products Stuck In Neutral, Still Undervalued (MBLY) – Seeking Alpha (Nov 21, 2025)

- Mobileye Global’s Shares Decline 10% Since Q3 Earnings Beat – Yahoo Finance (Oct 31, 2025)

- Oversold Conditions For Mobileye Global (MBLY) – Nasdaq (Nov 19, 2025)

- Mobileye Announces Participation in Upcoming Fourth Quarter 2025 Investor Conferences – Business Wire (Nov 07, 2025)

For more information about Mobileye Global Inc., please visit the official website: mobileye.com