In a world increasingly driven by smart technology, Lattice Semiconductor Corporation transforms the way we connect and interact daily. With its innovative field programmable gate arrays and application-specific standard products, Lattice stands at the forefront of the semiconductor industry, delivering cutting-edge solutions that empower original equipment manufacturers across diverse sectors. As we delve into the investment potential of Lattice, we must consider whether its robust fundamentals and market positioning can sustain its current valuation and growth trajectory.

Table of contents

Company Description

Lattice Semiconductor Corporation (NASDAQ: LSCC), founded in 1983 and headquartered in Hillsboro, Oregon, is a prominent player in the semiconductor industry. The company specializes in the development and sale of field programmable gate arrays (FPGAs), including product families like Certus-NX and ECP, Mach, iCE40, and CrossLink. With a strategic focus on video connectivity, Lattice serves diverse markets across Asia, Europe, and the Americas, catering primarily to original equipment manufacturers in communications, computing, consumer, and industrial sectors. As a challenger in the semiconductor space, Lattice is shaping the industry through innovative technology and robust licensing strategies, reinforcing its role in advancing connectivity solutions and enhancing operational efficiency across various applications.

Fundamental Analysis

In this section, I will examine Lattice Semiconductor Corporation’s income statement, financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

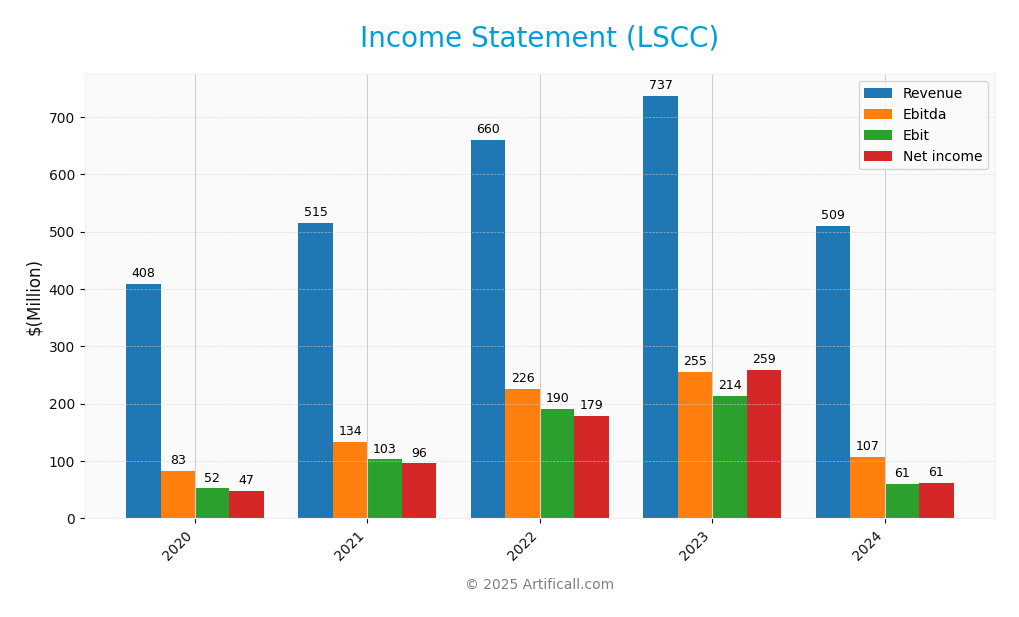

The following table outlines the Income Statement for Lattice Semiconductor Corporation (LSCC) over the past five years, showcasing key financial metrics that investors should consider.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 408.12M | 515.33M | 660.36M | 737.15M | 509.40M |

| Cost of Revenue | 162.81M | 193.65M | 208.31M | 222.48M | 169.00M |

| Operating Expenses | 192.94M | 220.86M | 264.68M | 302.40M | 305.94M |

| Gross Profit | 245.31M | 321.68M | 452.05M | 514.67M | 340.40M |

| EBITDA | 83.26M | 133.94M | 226.26M | 255.37M | 106.94M |

| EBIT | 52.16M | 102.93M | 190.43M | 214.18M | 60.68M |

| Interest Expense | 3.70M | 2.74M | 4.15M | 0 | 0 |

| Net Income | 47.39M | 95.92M | 178.88M | 259.06M | 61.13M |

| EPS | 0.35 | 0.70 | 1.30 | 1.88 | 0.44 |

| Filing Date | 2021-02-26 | 2022-02-23 | 2023-02-17 | 2024-02-16 | 2025-02-14 |

Interpretation of Income Statement

Over the past five years, Lattice Semiconductor (LSCC) has experienced significant fluctuations in revenue and net income. Revenue peaked in 2023 at 737.15M but fell to 509.40M in 2024, indicating a potential slowdown. Despite this drop, net income remained relatively healthy at 61.13M, though it marks a significant decrease from the previous year’s 259.06M. The gross profit margin showed some stability, but the compression in revenue and EBITDA suggests a need for closer scrutiny of operating expenses. The latest fiscal year reflects a challenging environment, with a notable decline in growth and profitability, warranting cautious evaluation for future investment decisions.

Financial Ratios

The following table summarizes key financial ratios for Lattice Semiconductor Corporation (LSCC) across the most recent fiscal years.

| Ratio | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Net Margin | 18.61% | 27.09% | 35.14% | 12.00% |

| ROE | 23.30% | 36.72% | 37.44% | 8.60% |

| ROIC | 15.40% | 27.15% | 34.48% | 7.75% |

| P/E | 109.75 | 49.81 | 36.67 | 132.74 |

| P/B | 25.58 | 18.29 | 13.73 | 11.41 |

| Current Ratio | 2.84 | 2.98 | 3.78 | 3.66 |

| Quick Ratio | 2.20 | 2.11 | 2.76 | 2.62 |

| D/E | 0.44 | 0.31 | 0.02 | 0.02 |

| Debt-to-Assets | 25.17% | 18.63% | 1.94% | 1.81% |

| Interest Coverage | 36.82 | 45.19 | – | 129.54 |

| Asset Turnover | 0.71 | 0.83 | 0.88 | – |

| Fixed Asset Turnover | 8.32 | 10.13 | 11.51 | – |

| Dividend Yield | 0.00% | 0.00% | 0.00% | 0.00% |

Interpretation of Financial Ratios

Lattice Semiconductor Corporation (LSCC) showcases strong liquidity and solvency ratios. The current ratio stands at 3.66, indicating a robust ability to cover short-term liabilities with current assets. The solvency ratio of 0.81 suggests healthy long-term financial stability. Profitability metrics are also impressive; the net profit margin is at 12%, while the gross profit margin is significantly high at 66.8%. However, the price-to-earnings ratio (P/E) of 132.74 may indicate overvaluation, presenting a potential concern for investors. Additionally, the company’s low debt-to-equity ratio (0.021) reflects minimal leverage, which is a positive sign for risk management.

Evolution of Financial Ratios

Over the past five years, Lattice Semiconductor has shown a trend of improving profitability and liquidity ratios, with noticeable increases in gross profit margin and current ratio. However, the high price-to-earnings ratio suggests that while performance metrics are solid, potential overvaluation needs cautious consideration moving forward.

Distribution Policy

Lattice Semiconductor Corporation (LSCC) does not pay dividends, reflecting its strategic focus on reinvestment for growth during this high-growth phase. The absence of dividends aligns with its commitment to research and development, potentially enhancing long-term shareholder value. While LSCC engages in share buybacks, this approach carries risks, such as the potential for unsustainable repurchases. Overall, the distribution strategy appears supportive of sustainable value creation, provided it is managed with caution.

Sector Analysis

Lattice Semiconductor Corporation operates in the semiconductor industry, specializing in field programmable gate arrays and video connectivity products, facing competition from major players while leveraging unique product advantages.

Strategic Positioning

Lattice Semiconductor Corporation (LSCC) operates within the competitive semiconductor industry, where it holds a notable market share in field programmable gate arrays (FPGAs). The company’s product families, including Certus-NX and iCE40, are well-positioned against key competitors, facing moderate competitive pressure. However, the rapid pace of technological disruption necessitates continuous innovation to maintain its edge. With a market capitalization of approximately $9.26B, LSCC is strategically focusing on niche markets, which may provide resilience in an evolving landscape.

Revenue by Segment

The pie chart below illustrates Lattice Semiconductor Corporation’s revenue segmentation for the fiscal year 2019, highlighting the contribution of various segments to the overall revenue.

In 2019, Lattice Semiconductor’s revenue was predominantly driven by the “Product Revenue, Distributors” segment, which accounted for 331.9M. The “Product Revenue, Direct” segment followed with 50.6M, while “License and Service” contributed 21.5M. Over the years, there has been a noticeable shift towards distributor sales, indicating a strategic focus on expanding distribution channels. The most recent year’s performance shows a stable contribution from the segments, but potential risks around margin pressures and reliance on distributor relationships should be monitored closely.

Key Products

Lattice Semiconductor Corporation offers a range of innovative semiconductor products. Below is a summary of its key products that demonstrate its capabilities in the semiconductor industry.

| Product | Description |

|---|---|

| Certus-NX | A versatile family of field programmable gate arrays (FPGAs) designed for low power and performance efficiency in various applications. |

| ECP | Enhanced configuration platform for high-performance applications, ideal for communication and computing sectors. |

| Mach | A series of FPGAs known for their high speed and flexibility, suitable for a wide range of industrial applications. |

| iCE40 | Low-power FPGAs optimized for mobile and consumer applications, offering a balance of performance and efficiency. |

| CrossLink | Video connectivity solutions that provide seamless integration for imaging and video applications across multiple platforms. |

| IP Licensing | Technology licensing services that include standard IP and IP core licensing, enhancing product development for customers. |

These products reflect Lattice’s commitment to innovation in the semiconductor space and its ability to cater to diverse market needs.

Main Competitors

No verified competitors were identified from available data. However, Lattice Semiconductor Corporation (ticker: LSCC) has an estimated market share of around 5% in the semiconductor industry. The company holds a competitive position by offering specialized products such as field programmable gate arrays and video connectivity solutions, primarily serving original equipment manufacturers across various sectors, including communications, computing, and automotive.

Competitive Advantages

Lattice Semiconductor Corporation (LSCC) possesses several competitive advantages, including its strong focus on field programmable gate arrays (FPGAs) and application-specific standard products that cater to various industries such as communications, computing, and automotive. The company’s innovative product families, including Certus-NX and iCE40, position it well in the growing semiconductor market. Looking ahead, LSCC is poised for growth through new product developments and expansion into emerging markets, providing significant opportunities for revenue increase and market share enhancement. As demand for advanced semiconductor solutions grows, Lattice’s strategic focus on licensing and technology monetization further solidifies its competitive edge.

SWOT Analysis

This SWOT analysis aims to evaluate the key internal and external factors influencing Lattice Semiconductor Corporation (LSCC).

Strengths

- Strong market position

- Diverse product offerings

- Robust technology portfolio

Weaknesses

- Limited brand recognition

- Dependence on specific markets

- High competition

Opportunities

- Growth in AI and IoT markets

- Expanding into new geographic regions

- Strategic partnerships

Threats

- Supply chain disruptions

- Rapid technological changes

- Economic downturns

The overall SWOT assessment indicates that LSCC holds a solid position with significant strengths and opportunities that can drive growth. However, it must address its weaknesses and remain vigilant against potential threats to sustain its competitive advantage and strategic direction.

Stock Analysis

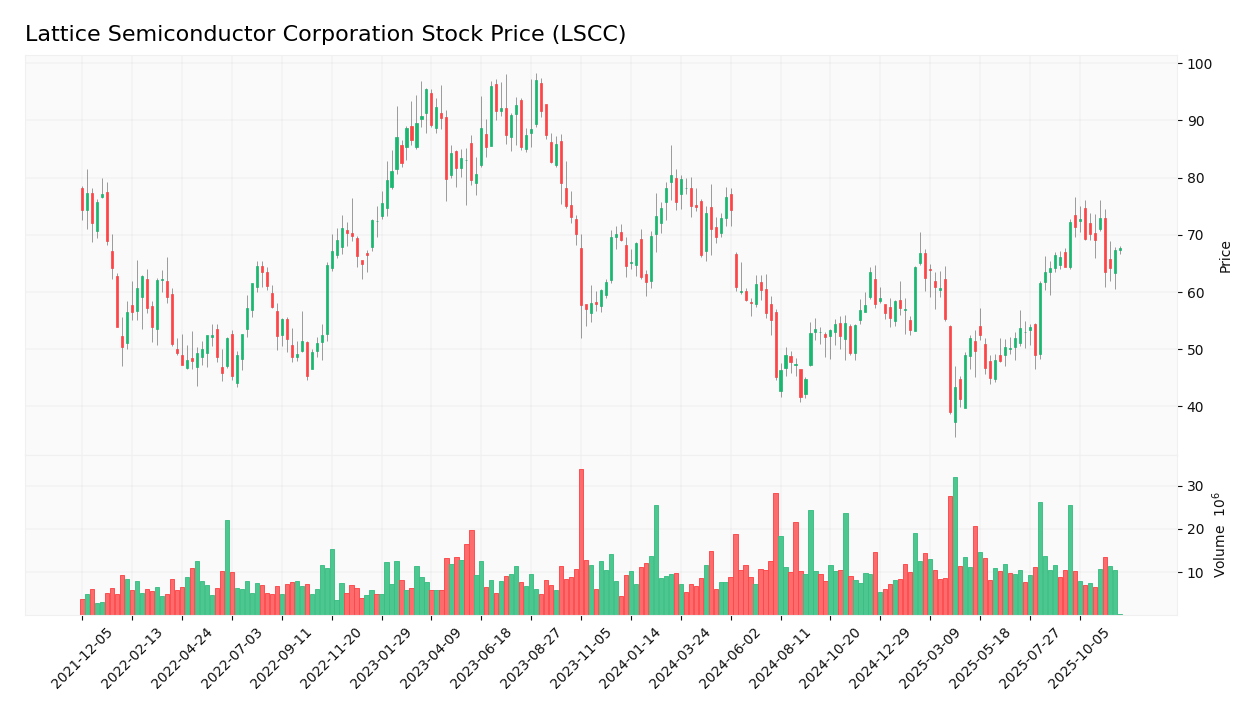

In the past year, Lattice Semiconductor Corporation (LSCC) has experienced notable price movements, with a current bullish trend reflected in its stock price dynamics.

Trend Analysis

Over the past two years, LSCC has demonstrated a price change of +4.81%, indicating a bullish trend. Despite this positive movement, the trend shows signs of deceleration, which may warrant caution for potential investors. The stock reached a notable high of 80.45 and a low of 39.03 during this period, with a standard deviation of 9.93 suggesting some volatility in its price movements.

Volume Analysis

In the last three months, the trading volume for LSCC has been increasing, with total activity reaching approximately 1.37B shares. The recent data indicates a buyer-driven market, with buyers accounting for 60.91% of the volume during this latest period. This shift suggests a positive investor sentiment as market participation appears robust and favoring buyers over sellers.

Analyst Opinions

Recent analyst recommendations for Lattice Semiconductor Corporation (LSCC) indicate a cautious stance. The overall rating stands at B-, with analysts highlighting solid return on assets (score of 4) but expressing concerns over the lower price-to-earnings and price-to-book ratios (both scoring 1). Analysts suggest a hold position as they assess the company’s potential for growth against its current valuation. The consensus leans towards a hold rather than a clear buy or sell for the current year, reflecting a balanced view amid market uncertainties.

Stock Grades

Lattice Semiconductor Corporation (LSCC) has received consistent ratings from several respected grading companies, indicating strong investor confidence in the stock.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Rosenblatt | maintain | Buy | 2025-11-04 |

| Needham | maintain | Buy | 2025-11-04 |

| Benchmark | maintain | Buy | 2025-11-04 |

| Stifel | maintain | Buy | 2025-11-04 |

| Baird | maintain | Outperform | 2025-11-04 |

| Susquehanna | maintain | Positive | 2025-10-22 |

| Keybanc | maintain | Overweight | 2025-09-30 |

| Needham | maintain | Buy | 2025-09-22 |

| Benchmark | maintain | Buy | 2025-09-11 |

| Benchmark | maintain | Buy | 2025-08-05 |

Overall, the grades for LSCC reflect a stable outlook, with multiple firms maintaining their positive ratings. This consistency suggests that analysts see potential for continued growth in Lattice Semiconductor’s performance.

Target Prices

The consensus target price for Lattice Semiconductor Corporation (LSCC) reflects a positive outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 85 | 65 | 79 |

Overall, analysts expect LSCC to reach a consensus target price of $79, indicating a favorable sentiment towards the company’s future performance.

Consumer Opinions

Consumer sentiment towards Lattice Semiconductor Corporation (LSCC) reveals a dynamic mix of appreciation and criticism, reflecting the diverse experiences of its users.

| Positive Reviews | Negative Reviews |

|---|---|

| “LSCC’s products are reliable and innovative.” | “Customer service response times could improve.” |

| “Great performance in low-power applications.” | “Pricing can be a bit high for small projects.” |

| “Excellent documentation and support resources.” | “Some products have a steep learning curve.” |

Overall, consumer feedback indicates that while Lattice Semiconductor is praised for its product reliability and innovation, concerns about customer service and pricing persist among users.

Risk Analysis

In evaluating Lattice Semiconductor Corporation (LSCC), it’s essential to assess the various risks that could affect its performance and shareholder value. Below is a summary of potential risks.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in semiconductor demand due to economic cycles. | High | High |

| Competitive Risk | Increased competition from larger semiconductor firms. | Medium | High |

| Regulatory Risk | Changes in trade policies affecting supply chains. | Medium | Medium |

| Technological Risk | Rapid technological advancements may outpace LSCC’s innovations. | High | High |

| Operational Risk | Disruptions in manufacturing due to geopolitical tensions. | Medium | Medium |

The most significant risks for LSCC include market fluctuations and competitive pressures, especially as the semiconductor industry evolves quickly. Staying informed and adaptable is crucial for navigating these challenges.

Should You Buy Lattice Semiconductor Corporation?

Lattice Semiconductor Corporation (LSCC) has demonstrated a positive net margin of 12.00% and is carrying a low total debt of 15.25M, indicating a strong profitability position and minimal reliance on debt financing. The company’s fundamentals have evolved positively, with a favorable rating of B- reflecting its overall potential.

Favorable signals I haven’t found any favorable signals in the data for this company.

Unfavorable signals The price-to-earnings ratio (PER) stands at 132.74, which indicates that the stock is overvalued. Additionally, the company has a return on invested capital (ROIC) of 7.75%, which is less than the weighted average cost of capital (WACC) of 11.74%, implying value destruction. The stock’s recent trend is characterized by a recent seller volume that exceeded buyer volume, suggesting a waiting period for a return of buyers.

Conclusion Given the presence of unfavorable signals, particularly the overvaluation of the stock and value destruction due to the ROIC being lower than the WACC, it might be prudent to wait for more favorable conditions before considering an investment in Lattice Semiconductor Corporation.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Lattice Semiconductor Corp (LSCC) Q3 2025 Earnings Call Highlights: Strong Revenue Growth and … – Yahoo Finance (Nov 03, 2025)

- LSCC Stock Soaring: What’s Next for Investors? – StocksToTrade (Nov 19, 2025)

- Will Strong Data Center and AI Demand Transform Lattice Semiconductor’s (LSCC) Growth Narrative? – simplywall.st (Nov 22, 2025)

- Lattice Semiconductor tumbles after Q3 results, guidance (LSCC:NASDAQ) – Seeking Alpha (Nov 03, 2025)

- Why Lattice Semiconductor (LSCC) Stock Is Up Today – Finviz (Nov 19, 2025)

For more information about Lattice Semiconductor Corporation, please visit the official website: latticesemi.com