Lincoln Electric Holdings, Inc. doesn’t just manufacture welding products; it shapes the very fabric of manufacturing industries worldwide. With a legacy dating back to 1895, this company has established itself as a powerhouse in the industrial sector, renowned for its innovative welding solutions and commitment to quality. As I analyze Lincoln Electric’s current market position and growth trajectory, I am compelled to ask: do the company’s fundamentals still justify its robust market valuation amidst evolving industry dynamics?

Table of contents

Company Description

Lincoln Electric Holdings, Inc. (NASDAQ: LECO), founded in 1895 and headquartered in Cleveland, Ohio, is a leading global manufacturer in the welding, cutting, and brazing products industry. With a market capitalization of approximately $12.7B, the company operates through three segments: Americas Welding, International Welding, and The Harris Products Group. Its extensive product range includes arc welding power sources, plasma cutters, robotic welding systems, and various consumables. Lincoln Electric serves diverse markets such as automotive, construction, and heavy fabrication, selling directly to end-users and through distributors. The company’s commitment to innovation and quality solidifies its position as a key player in shaping industry standards and practices.

Fundamental Analysis

This section will analyze Lincoln Electric Holdings, Inc. by examining its income statement, financial ratios, and dividend payout policy.

Income Statement

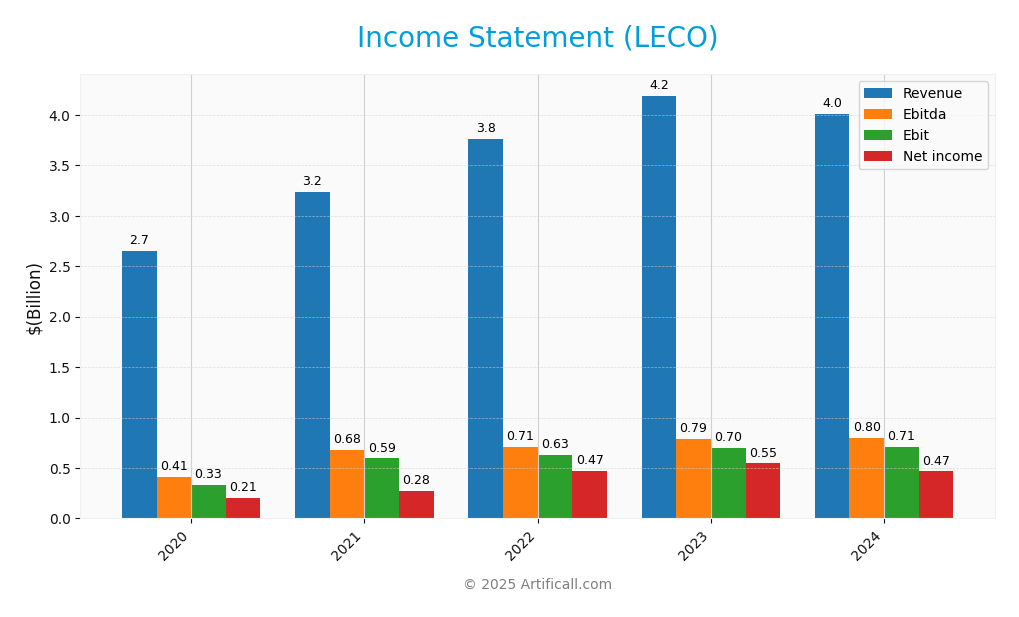

The following table presents the Income Statement for Lincoln Electric Holdings, Inc., highlighting key financial metrics over the past five fiscal years.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 2.66B | 3.23B | 3.76B | 4.19B | 4.01B |

| Cost of Revenue | 1.78B | 2.17B | 2.48B | 2.71B | 2.53B |

| Operating Expenses | 589M | 607M | 668M | 760M | 841M |

| Gross Profit | 871M | 1.07B | 1.28B | 1.48B | 1.48B |

| EBITDA | 410M | 675M | 708M | 789M | 801M |

| EBIT | 330M | 594M | 630M | 703M | 712M |

| Interest Expense | 22M | 22M | 30M | 44M | 43M |

| Net Income | 206M | 277M | 472M | 545M | 466M |

| EPS | 3.46 | 4.66 | 8.14 | 9.51 | 8.23 |

| Filing Date | N/A | 2022-02-18 | 2023-02-21 | 2024-02-27 | 2025-02-26 |

Interpretation of Income Statement

Over the past five fiscal years, Lincoln Electric has demonstrated stable revenue growth, peaking in 2023 before a slight decline in 2024 to 4.01B. Net income followed a similar trajectory, with a notable dip in 2024 to 466M, reflecting tightening margins and increased operating expenses. The gross profit margin remained consistent, indicating effective cost control. However, the decrease in net income suggests potential challenges in maintaining profitability amidst rising costs. The most recent year’s performance indicates a slight slowdown in growth, warranting cautious monitoring of operational efficiency and market conditions moving forward.

Financial Ratios

Here is a summary of the financial ratios for Lincoln Electric Holdings, Inc. (LECO) over the past five fiscal years.

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 7.76% | 8.55% | 12.55% | 13.01% | 11.63% |

| ROE | 26.08% | 32.01% | 45.67% | 41.66% | 35.11% |

| ROIC | 12.38% | 20.69% | 20.06% | 21.60% | 18.06% |

| P/E | 33.63 | 29.91 | 17.76 | 22.88 | 22.78 |

| P/B | 8.77 | 9.57 | 8.11 | 9.53 | 8.00 |

| Current Ratio | 2.02 | 1.71 | 1.83 | 2.24 | 1.87 |

| Quick Ratio | 1.33 | 0.99 | 1.05 | 1.50 | 1.25 |

| D/E | 0.97 | 0.95 | 1.21 | 0.89 | 0.99 |

| Debt-to-Assets | 32.99% | 31.59% | 39.31% | 34.34% | 37.39% |

| Interest Coverage | 12.84 | 20.78 | 20.76 | 16.18 | 14.88 |

| Asset Turnover | 1.15 | 1.25 | 1.18 | 1.24 | 1.14 |

| Fixed Asset Turnover | 5.09 | 6.32 | 6.90 | 6.67 | 6.47 |

| Dividend Yield | 1.70% | 1.47% | 1.56% | 1.19% | 1.53% |

Interpretation of Financial Ratios

Lincoln Electric Holdings, Inc. (LECO) exhibits a solid financial profile based on the latest ratios. The liquidity position is strong, with a current ratio of 1.87 and a quick ratio of 1.25, indicating good short-term financial health. The solvency ratio at 0.25 suggests a moderate level of debt relative to assets, while the debt-to-equity ratio of 0.99 indicates a balanced capital structure. Profitability is also robust, with a net profit margin of 11.63% and an operating profit margin of 15.88%, although the price-to-earnings ratio (22.78) indicates that the stock might be overvalued relative to earnings. Efficiency ratios, such as inventory turnover at 4.65, are adequate but could be improved. Overall, while the ratios are generally strong, the relatively high price-to-earnings ratio may warrant caution for potential investors.

Evolution of Financial Ratios

Over the past five years, Lincoln Electric’s financial ratios show a positive trend in profitability and liquidity. The current ratio has improved from 1.71 in 2021 to 1.87 in 2024, reflecting enhanced short-term financial stability. However, the net profit margin has fluctuated, indicating some variability in profitability.

Distribution Policy

Lincoln Electric Holdings, Inc. (LECO) maintains a robust dividend policy, currently offering a dividend per share of 2.86 and a yield of 1.53%. The payout ratio stands at 34.79%, indicating a sustainable distribution level supported by strong free cash flow. Additionally, the company engages in share buybacks, which can enhance shareholder value. However, investors should remain cautious about potential risks associated with unsustainable dividends and excessive repurchases. Overall, LECO’s distribution approach appears to support long-term value creation for shareholders.

Sector Analysis

Lincoln Electric Holdings, Inc. is a leader in the manufacturing tools and accessories industry, specializing in welding and cutting products while facing competition from other major players in the sector.

Strategic Positioning

Lincoln Electric Holdings, Inc. (LECO) operates in the highly competitive manufacturing sector, specifically within the welding, cutting, and brazing products market. The company holds a notable market share, driven by its diverse product range and strong brand reputation. However, competitive pressure remains significant, particularly from emerging technologies and innovative companies that are disrupting traditional manufacturing practices. Benchmarking against peers, Lincoln Electric’s focus on quality and customer service positions it strategically; yet, it must continuously adapt to technological advancements to maintain its competitive edge.

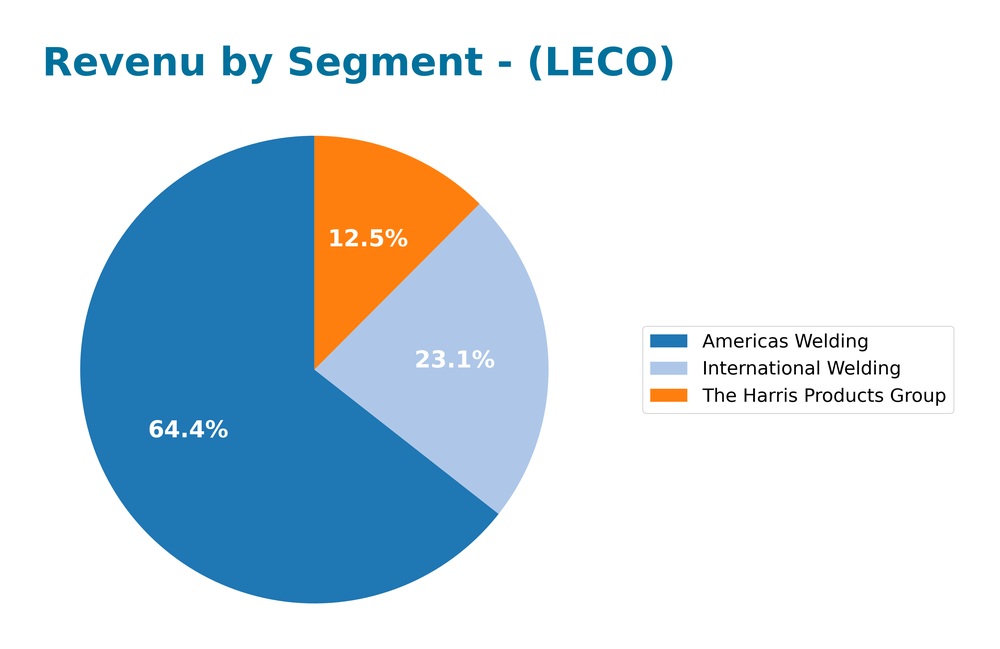

Revenue by Segment

The following chart illustrates Lincoln Electric’s revenue segmentation for the fiscal year 2024, highlighting contributions from various business segments.

In FY 2024, Lincoln Electric’s revenue saw the Americas Welding segment leading with $2.7B, followed by International Welding at $970M and The Harris Products Group at $522M. While the Americas Welding segment remains a significant driver, it experienced a slight decline from $2.78B in FY 2023. The International Welding segment also showed a decrease, down from $1.07B. This trend indicates potential market saturation or increased competition in key areas, while the Harris Products Group maintained a stable growth trajectory. Overall, while Lincoln Electric’s revenue diversification is commendable, the slowdown in growth raises concerns about margin risks and sector concentration.

Key Products

Lincoln Electric Holdings, Inc. offers a range of innovative products designed for various welding and cutting applications. Below is a table highlighting some of their key products:

| Product | Description |

|---|---|

| Arc Welding Power Sources | Equipment that provides electric power for arc welding processes, essential for various applications. |

| Plasma Cutters | Tools used for cutting metal through the use of a high-velocity jet of ionized gas (plasma). |

| Wire Feeding Systems | Mechanisms that supply welding wire to the welding arc, enhancing productivity and efficiency. |

| Robotic Welding Packages | Integrated systems that automate welding processes, improving precision and reducing labor costs. |

| Fume Extraction Equipment | Systems designed to capture and filter harmful fumes produced during welding operations. |

| Specialty Welding Consumables | High-performance materials used in specific welding applications, enhancing quality and durability. |

| Computer Numeric Controlled Systems | Advanced cutting systems that utilize CNC technology for precision cutting of various materials. |

| Oxy-Fuel Cutting Equipment | Tools that use a combination of oxygen and fuel gas for cutting metal, widely used in fabrication. |

These products reflect Lincoln Electric’s commitment to providing high-quality solutions for the manufacturing and industrial sectors.

Main Competitors

Currently, I do not have access to specific competitor data for Lincoln Electric Holdings, Inc. (LECO). As such, I am unable to provide a table of competitors or their market shares.

However, based on my analysis, Lincoln Electric occupies a strong position in the manufacturing sector, particularly in welding and cutting products. The company is recognized for its extensive product range and global reach, which enhances its competitive advantage within the industry.

Competitive Advantages

Lincoln Electric Holdings, Inc. (LECO) boasts several competitive advantages that position it well for future growth. Its extensive product portfolio in welding, cutting, and brazing, coupled with a strong presence in diverse industries such as automotive, construction, and energy, enhances its market resilience. Looking ahead, the company is focused on expanding its international footprint and advancing automation technologies, which are vital in meeting rising demand for efficient manufacturing solutions. This strategic direction opens up new markets and opportunities, reinforcing Lincoln Electric’s strong competitive edge.

SWOT Analysis

The following SWOT analysis provides insights into Lincoln Electric Holdings, Inc. (LECO) to guide potential investors in their decision-making.

Strengths

- Strong market position

- Diverse product portfolio

- Global presence

Weaknesses

- High dependence on industrial sectors

- Potential supply chain disruptions

- Limited exposure to emerging markets

Opportunities

- Growth in automation and robotics

- Expansion in renewable energy sectors

- Increasing demand for welding solutions

Threats

- Intense competition

- Fluctuating raw material prices

- Economic downturns affecting industrial spending

Overall, Lincoln Electric demonstrates solid strengths and opportunities that can support long-term growth; however, investors should remain cautious of its weaknesses and external threats that could impact performance. A balanced approach focusing on risk management is essential for a successful investment strategy.

Stock Analysis

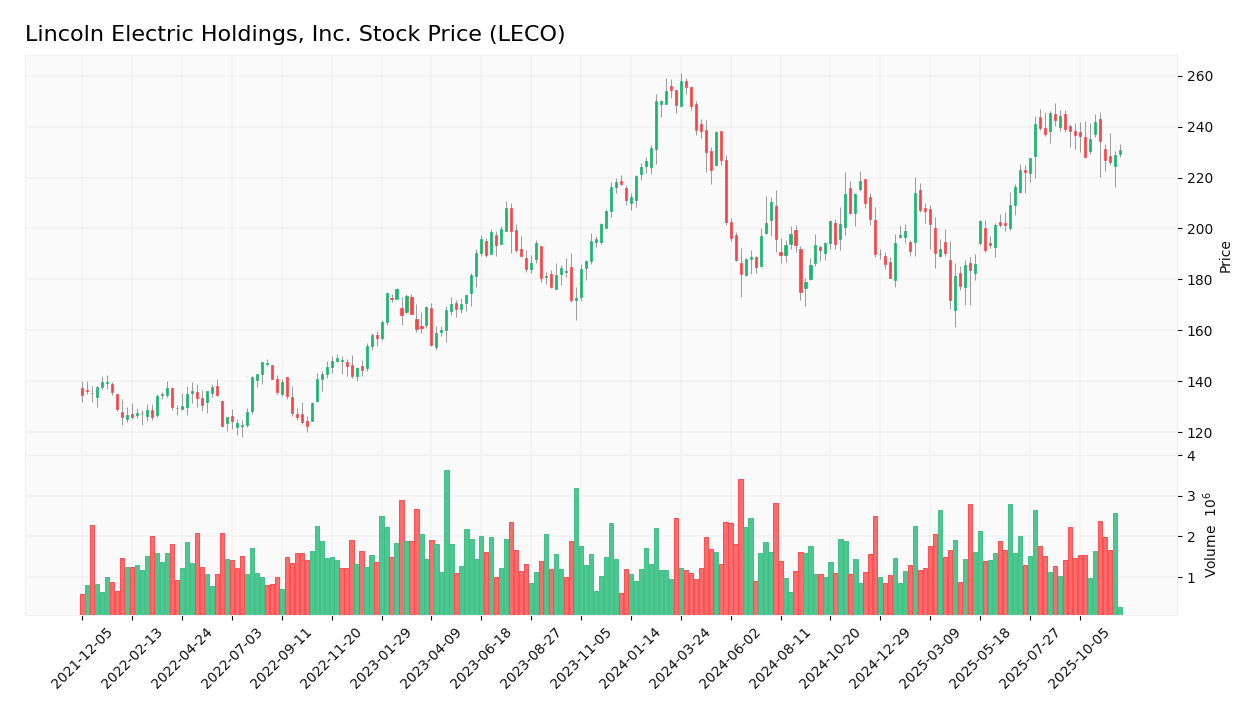

Over the past year, Lincoln Electric Holdings, Inc. (LECO) has exhibited significant price movements, characterized by a bullish trend despite recent volatility.

Trend Analysis

The stock has experienced a percentage change of +9.31% over the past two years. This indicates a bullish trend, although the acceleration status is currently in deceleration. Notably, LECO reached a high of 258.04 and a low of 172.02 during this period. The standard deviation of 22.66 suggests some volatility in the stock price, yet the overall trend remains positive.

In the recent period from September 14, 2025, to November 30, 2025, the stock saw a price change of -3.44%, indicating a slight bearish movement in the short term, with a trend slope of -0.95.

Volume Analysis

In the last three months, the total trading volume for LECO reached 186.09M shares, with buyer volume at 98.09M and seller volume at 86.68M, resulting in a buyer percentage of 52.71%. The volume trend is increasing, suggesting that investor participation is on the rise. However, recent activity indicates a seller-dominant market, with buyer volume only at 5.45M against seller volume of 14.25M in the recent period. This seller-dominant behavior may reflect cautious sentiment among investors.

Analyst Opinions

Recent analyst recommendations for Lincoln Electric Holdings, Inc. (LECO) indicate a consensus rating of “Buy.” Analysts highlight the company’s strong return on equity (5) and return on assets (5), which suggest robust operational efficiency. The discounted cash flow score (3) further supports growth potential, making it an appealing choice for investors. However, the price-to-earnings (2) and price-to-book (1) scores indicate some valuation concerns. Analysts like those from Fmp note that while the stock is currently attractive, investors should remain cautious due to market fluctuations.

Stock Grades

Lincoln Electric Holdings, Inc. (LECO) has received various stock ratings from reputable grading companies. Below is a summary of the most recent grades:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | maintain | Hold | 2025-10-31 |

| Barclays | maintain | Overweight | 2025-10-20 |

| Keybanc | maintain | Overweight | 2025-08-01 |

| Stifel | maintain | Hold | 2025-08-01 |

| Stifel | maintain | Hold | 2025-07-21 |

| Keybanc | maintain | Overweight | 2025-07-15 |

| Morgan Stanley | maintain | Underweight | 2025-05-06 |

| Keybanc | maintain | Overweight | 2025-05-01 |

| Baird | maintain | Outperform | 2025-05-01 |

| Stifel | maintain | Hold | 2025-05-01 |

The overall trend in grades indicates a stable outlook for Lincoln Electric, with several firms maintaining their ratings. Notably, Keybanc and Barclays have consistently rated the stock as Overweight, suggesting a positive sentiment, while Stifel’s repeated “Hold” rating indicates a more cautious stance.

Target Prices

The consensus target price for Lincoln Electric Holdings, Inc. (LECO) indicates a positive outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 285 | 260 | 272.5 |

Overall, analysts expect Lincoln Electric’s stock to reach a consensus of 272.5, suggesting a favorable investment potential within the projected range.

Consumer Opinions

Consumer sentiment towards Lincoln Electric Holdings, Inc. (LECO) reflects a mix of satisfaction and concerns, showcasing the company’s strengths and areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “Outstanding product quality, consistently reliable.” | “Customer service could use significant improvement.” |

| “Innovative solutions that meet our needs.” | “Pricing is higher compared to competitors.” |

| “Strong reputation in the welding industry.” | “Delivery times are often longer than expected.” |

Overall, consumer feedback highlights Lincoln Electric’s exceptional product quality and innovation, while also pointing out challenges with customer service and pricing competitiveness.

Risk Analysis

In evaluating Lincoln Electric Holdings, Inc. (LECO), it is essential to consider the various risks that could impact the company’s performance. Below is a summary of potential risks.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in demand for welding products. | High | High |

| Supply Chain Risk | Disruptions in raw material supply. | Medium | High |

| Regulatory Risk | Changes in trade policies affecting exports. | Medium | Medium |

| Competition Risk | Increased competition from low-cost providers. | High | Medium |

| Currency Risk | Adverse currency exchange rate movements. | Medium | Medium |

The most significant risks for LECO include high market and competition risks, given the current economic climate and rising global competition. Recent increases in material costs also heighten supply chain risk, emphasizing the need for robust risk management strategies.

Should You Buy Lincoln Electric Holdings, Inc.?

Lincoln Electric Holdings, Inc. has demonstrated a positive net profit margin of 11.63%, indicating solid profitability. The company carries a total debt of 1.32B, resulting in a debt-to-equity ratio of approximately 0.99, which suggests a moderate level of debt. The fundamentals have evolved positively, though the recent trend indicates some caution with a seller-dominant market. The company’s rating stands at B, reflecting a decent overall performance.

Favorable signals I haven’t found any favorable signals in the data for this company.

Unfavorable signals The company has a debt-to-equity ratio of 0.99, which indicates a relatively high level of debt compared to equity. Additionally, there is a recent trend of seller dominance in the market, suggesting potential volatility. The recent seller volume has exceeded the buyer volume, indicating a lack of immediate demand.

Conclusion Given the unfavorable signals present, it may be more prudent to wait for a more favorable market environment before considering an investment in Lincoln Electric Holdings, Inc.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Vanguard Group Inc. Cuts Holdings in Lincoln Electric Holdings, Inc. $LECO – MarketBeat (Nov 24, 2025)

- What Is Lincoln Electric Holdings, Inc.’s (NASDAQ:LECO) Share Price Doing? – simplywall.st (Nov 20, 2025)

- Lincoln Electric Holdings, Inc. (NASDAQ:LECO) is largely controlled by institutional shareholders who own 82% of the company – Yahoo Finance (Nov 15, 2025)

- How Is The Market Feeling About Lincoln Electric Holdings Inc? – Benzinga (Nov 19, 2025)

- Hillsdale Investment Management Inc. Increases Stock Position in Lincoln Electric Holdings, Inc. $LECO – MarketBeat (Nov 24, 2025)

For more information about Lincoln Electric Holdings, Inc., please visit the official website: lincolnelectric.com